After the AI Agent bubble bursts, where will the next trend and projects emerge?

TechFlow Selected TechFlow Selected

After the AI Agent bubble bursts, where will the next trend and projects emerge?

Infrastructure, decentralized AI, and real-world applications are taking over.

Author: 0xJeff

Translation: TechFlow

Overview

AI agents surged to over $20 billion in just a few months—only to collapse just as quickly. Yet, the space is maturing. Infrastructure, decentralized AI (DeAI), and real-world use cases are taking over. Here's how the next wave is forming, and why it matters.

In Q4 last year, we witnessed the rapid rise of the "AI agent" sector—from zero to over $20 billion in a matter of months. This ranged from fun, charming, entertaining, almost absurd “agents” to financial agents promising to change the world through trading and investing, making you extremely wealthy. And not just wealth-generating agents—there were also investment DAOs…DAOs made up of people (or agents) that invest in other agents (3,3).

From Hype to Infrastructure

We all know that in a new industry fueled by fresh catalysts—such as Web2 AI or Trump’s election and his pro-crypto/AI stance—fundamentals take a backseat. Anything generating buzz, appearing flashy, with slick demos, could easily surpass a $100 million valuation.

@virtuals_io emerged as the standout player in this ecosystem, dominating marketing, capturing builder attention, telling the best stories, and crafting compelling narratives. This drew builders to launch projects on Virtuals and attracted retail traders eager to speculate.

Then came @elizaOS, taking a different approach—open-sourcing AI tools for any developer wanting to build “gold rush” agents. A massive movement formed around this idea, adoption grew at an astonishing pace, and GitHub stars and forks skyrocketed (and continue to grow).

Top Virtuals projects reached valuations exceeding $5 billion. At its peak, Eliza was worth roughly half that, while many other notable agents hit 8- to 9-digit highs—AIXBT even touched a billion-dollar valuation. Of course, things look very different now. Newly launched agents typically trade at $3–10 million on average, while older, well-performing ones trade between $10–50 million. Valuations have compressed, and total market cap has shrunk from $200 billion to the $40–60 billion range.

Infrastructure Momentum and Web2 Acceleration

The market is now focused on “pure fundamentals.” There’s growing interest in infrastructure and decentralized AI—especially as Web2 AI models continue accelerating at breakneck speed. Meta’s Llama, OpenAI’s GPT, Grok, DeepSeek, Alibaba’s Qwen—all roll out new improvements and optimizations every month. You can see how ChatGPT’s image generation model immediately sparked a viral “Studio Ghibli-fication” trend upon release.

Beyond that, enhanced AI capabilities are pushing consumer applications forward faster than ever. Things once impossible are now achievable. Tools like Lovable, Bolt, Cursor, and Windsurf allow developers to ship more products at greater speed. Agent workflows and AI agents are everywhere. Entry barriers are lower, and user switching costs are nearly zero. If you don’t like one app, you can easily switch to a competitor with better pricing or superior UI/UX.

The Awakening of Data Ownership

Amid all this, many began asking: “With so many agent apps relying on centralized tech, who owns my data? Where does it go? If I discuss something personal with an AI, will it stay private—or leak elsewhere?” This concern is especially pressing given @OpenAI's recent update allowing ChatGPT to reference all your past conversations for more personalized responses.

Dude… that sounds cool—and could spark waves of personalized AI agents: co-pilots, private secretaries, therapists, companions. But imagine the implications when your data is owned or controlled by someone else.

The Rise of Decentralized AI (DeAI)

Last year, I made a prediction: decentralized AI would emerge in Q2 2025, with infrastructure enhancing privacy, transparency, verifiability, and ownership—leading to greater adoption and attention due to rising demand for these features.

Three distinct trend segments are forming, with significant overlap and convergence:

-

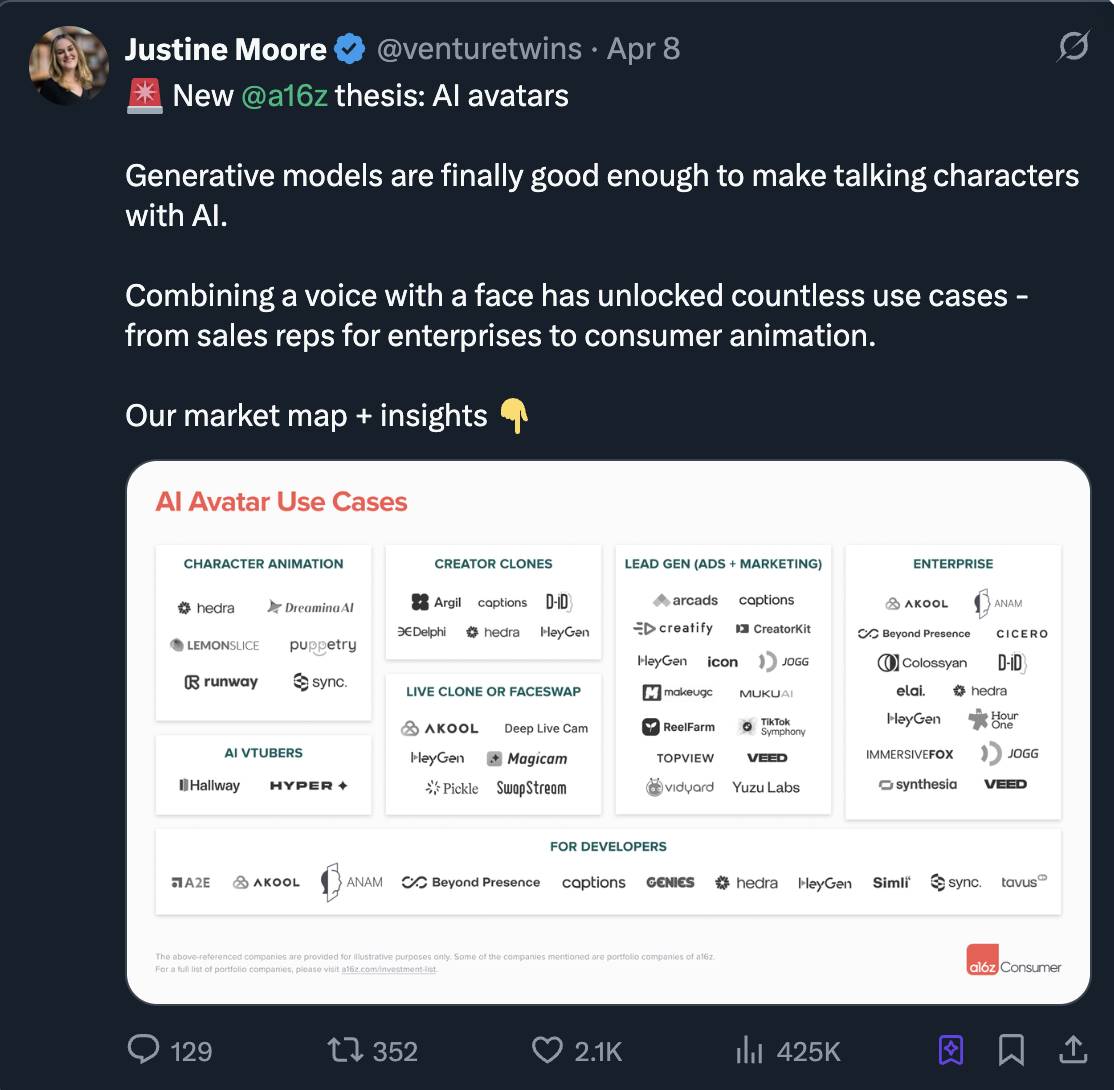

Web2 AI Venture Trends (YC startups launching vertical agents, a16z positioning future consumer trends, Perplexity launching its AI fund)

-

Web3 AI Venture Trends (DeAI infrastructure investments, distributed training, inference networks, etc.)

-

Web3 AI Retail Trends (AI agent ecosystems, consumer agents, AI consumer apps)

Web2 vs Web3 AI: Radically Different Energies

For Web2, the total addressable market (TAM) is vastly larger than Web3. Countless businesses want to leverage AI to transform or optimize operations, improve workflows, generate more leads, boost conversions, increase sales, retain customers, reduce overhead, and operate at higher efficiency. These enterprises seek highly specific solutions tailored to their niche pain points.

This demand for optimization attracts young startup founders looking for better ways to integrate AI agents into workflows. Compared to traditional SaaS, AI agents offer capital savings or lead generation at scale—enabling agent-based startups to charge premium subscription fees (which explains why many achieved 7- to 8-figure annual recurring revenue within months).

For Web3 ventures, the trend is entirely different. Blockchain provides the ideal layer for decentralized AI (DeAI): verifiable and immutable transaction trails, trustless environments, decentralized compute, and trust-minimized AI inference and training. In short, the future is about knowing how your data is used, understanding AI reasoning, owning your data, owning models, owning use cases, and being incentivized to share freely (without censorship). Web3 VCs are actively investing in this future.

Why Retail Loves Agents (Even Without Understanding DeAI)

For Web3 retail users, decentralized AI (DeAI) is hard to grasp—it requires learning complex terminology and concepts that often feel like alien language. That’s why retail gravitates toward the most accessible entry point: “Web3 AI agents” that chat, crack jokes, and perform entertaining tasks.

As retail participants stay longer in the space, they gradually realize such agents fail to deliver sustainable value (yes, many are useless and uncreative). This realization—combined with market volatility—drives consolidation: useless agents die off, while useful ones survive (albeit at much lower valuations).

People begin recognizing the need for core AI products with real utility. This shift pushes teams to either build genuine AI products or partner with technically robust AI companies like @AlloraNetwork and @opentensor (Bittensor).

This transition brings two key benefits:

-

Increases awareness of underlying infrastructure previously overlooked.

-

Provides AI agents with tangible use cases to showcase to communities.

Before this shift: agents had basic skills/use cases (chatting, post analysis)

After: agents gain advanced, practical capabilities (AI-driven betting, trading, liquidity provision, mining, etc.)

Agents like @AskBillyBets and @thedkingdao become ideal showcases for Bittensor subnets, bringing cutting-edge tech into the mainstream.

The Bittensor Ecosystem

What makes the Bittensor ecosystem fascinating is that it’s a decentralized AI (DeAI) ecosystem anyone can invest in. Today, most DeAI projects are only accessible to VCs or strategic insiders, as they’re still early and haven’t issued tokens.

But Bittensor allows anyone to hold $TAO and stake it into subnets they support—receiving subnet-specific alpha tokens in return (essentially investing directly in DeAI projects).

I’ve publicly shared my fatigue with cross-chain complexity and trading UX—but the tech, product, and community energy, especially around @rayon_labs, are impressive.

What I love about Rayon Labs is their focus on consumer-friendly UI/UX. Given dTAO’s nature—where markets determine each subnet’s emissions and pricing—it’s increasingly vital for subnets to build intuitive, easy-to-grasp products.

Rayon hosts several exciting subnets (Gradients, an automated machine learning platform where you can easily train models, might be the coolest). Even cooler is their latest flagship: Squad, an AI agent platform where you can create agents via drag-and-drop blocks—think Figma-style agent building for node creators.

Final Thoughts

My journey into Bittensor is still in early stages. I’ll publish a dedicated piece later sharing interesting findings and how to capitalize on opportunities within it. For other trends and shifts in the market, check out this thread.

Personal note: Thanks for reading! If you’re a Bittensor subnet owner or researcher building or exploring cool things in the Bittensor ecosystem, I’d love to connect and learn more.

Disclaimer: This document is for informational and entertainment purposes only. The views expressed herein are not, and should not be construed as, investment advice or recommendations. Recipients of this document should conduct their own due diligence and consider their individual financial circumstances, investment objectives, and risk tolerance (none of which are considered herein) before making any investment decisions. This document does not constitute an offer or solicitation to buy or sell any assets mentioned herein.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News