Trump's tariff game: "using tariffs to promote talks," a power play amid market volatility

TechFlow Selected TechFlow Selected

Trump's tariff game: "using tariffs to promote talks," a power play amid market volatility

The sharp market fluctuations, the strong rebound of the U.S. dollar, and the stock market's reaction reveal how Trump has used power and information to influence the global economic landscape.

Author: YBB Capital Researcher Ac-Core

1. Trade War Escalation, 24-Hour Cross-Market Flash Crash Relay

Image source: forbes

1.1 Global Financial Markets Collapse!

On the morning of April 7, amid escalating fears over "reciprocal tariffs" and worsening trade tensions, global financial markets saw a synchronized crash across equities, crude oil, precious metals, and even cryptocurrencies. In early Asian trading, U.S. stock index futures extended last week’s losses, with Nasdaq 100 futures plunging 5%, while S&P 500 and Dow Jones futures both dropping over 4%. European markets were equally bleak—Germany’s DAX futures fell nearly 5%, and STOXX 50 Europe and UK FTSE futures both breached the 4% decline threshold.

Asian markets opened with a stampede: South Korea's KOSPI 200 futures plunged 5% at the open, triggering circuit breakers that halted trading; Australia's benchmark index expanded its intraday loss from 2.75% to 6% within two hours; Singapore’s Straits Times Index crashed 7.29% in a single day, setting a record drop. The Middle East pre-emptively experienced a “Black Sunday,” with Saudi Arabia’s Tadawul Index plummeting 6.1% in one session, while Qatar, Kuwait, and other oil-producing nations all saw equity indices fall over 5.5%.

Commodities markets were devastated: WTI crude broke below the psychological $60 level, hitting a two-year low with a 4% daily drop; gold unexpectedly lost support at $3,010, while silver extended weekly losses to 13%; in crypto, Bitcoin broke key support levels, and Ethereum dropped 10% intra-day—shattering the myth of digital assets as safe-haven instruments.

1.2 Impact on the Crypto Market

Short-Term Market Shock

Recent policies under the Trump administration have significantly increased volatility in the cryptocurrency market. In January this year, when Trump signed an executive order mandating the establishment of a crypto regulatory framework and studying a national cryptocurrency reserve, market sentiment responded positively, pushing total crypto market capitalization to $3.65 trillion by month-end—an accumulated gain of 9.14%. However, the announcement of new tariff hikes in February swiftly reversed this trend. Particularly after imposing long-term import tariffs on China, Canada, and Mexico on February 3, the crypto market moved in tandem with equities into sharp decline: Bitcoin dropped 8% within 24 hours, Ethereum plunged over 10%, triggering $900 million in liquidations and forced closures for 310,000 investors.

From a transmission mechanism perspective, tariff policies affect the crypto market through multiple channels: first, intensified trade friction increases global market volatility, strengthening the U.S. dollar as a safe-haven asset and prompting capital repatriation to U.S. markets; second, institutional investors may liquidate crypto holdings to cover losses elsewhere in their portfolios; third, inflationary pressures triggered by tariffs could weaken consumer spending power, thereby reducing overall risk appetite—especially in high-volatility markets like crypto.

Long-Term Structural Opportunities

Despite significant short-term shocks, tariff policies may create structural opportunities for the crypto market:

-

Liquidity Expansion Expectations: The Trump administration may pursue expansionary fiscal policies such as tax cuts and infrastructure investment. To finance resulting deficits, debt monetization measures could increase market liquidity. Historical precedent shows that during the period when the Federal Reserve expanded its balance sheet by $3 trillion in 2020, Bitcoin’s price rose over 300%, suggesting that renewed liquidity injections could provide strong support for crypto assets.

-

Enhanced Anti-Inflation Properties: As Eugene Epstein, Head of Trading and Structured Products at Moneycorp, pointed out, if trade wars lead to U.S. dollar depreciation, Bitcoin—with its fixed supply cap—could become a hedge instrument. Competitive currency devaluations potentially triggered by tariff policies might drive more investors toward cryptocurrencies as alternative vehicles for cross-border capital flows.

2. "Businessman + Dictator = Market Manipulation"

Image source: marketwatch

2.1 Starting the Tariff War Over Trade Deficits

In Trump’s businessman mindset, the so-called “trade deficit” isn’t a complex economic concept—it resembles more an unequal pricing relationship between buyer and supplier in a procurement negotiation. As explained by economist Fu Peng: imagine a buyer calling all potential suppliers to the table and saying, “We need to renegotiate cooperation terms.” Doesn't this sound similar to centralized bidding in the pharmaceutical industry? Indeed, Trump’s approach mirrors classic tender-bidding tactics.

If tariffs are seen as a form of “price ceiling,” then Trump’s high tariff rates function much like a preset psychological price point in procurement tenders—any supplier wanting to win the bid must compete below this threshold. This setup may seem crude or even arbitrary, but it is common in real-world procurement negotiations, especially large-scale government-led centralized purchasing projects.

Some question whether these decisions are made impulsively via Excel spreadsheets—but they’re not. His strategy is simple: set an artificial “entry price” barrier to force suppliers to the negotiating table. The immediate effect? Any country refusing to negotiate is effectively disqualified—if you don’t accept this upper limit, you face maximum taxation, essentially forfeiting market access.

Thus, countries wishing to remain in the game have no choice but to sit down with the U.S.—to discuss tariff reductions, product quotas, and rule changes. While appearing as trade confrontation, it’s actually a series of strategic business negotiations. As Mohamed Apabhai, Citigroup’s Asia trading strategy head, clearly stated in his report: what Trump is using is a textbook negotiation tactic.

For smaller suppliers, room to maneuver is limited—they lack bargaining power individually. So the buyer (i.e., the U.S.) leverages concessions from minor players to pressure larger ones. This is a classic “weaken the periphery, encircle the core” strategy—using peripheral concessions to force central players into submission.

In essence, Trump’s so-called “tariff war” isn’t truly about warfare—it’s about creating a “negotiate-or-exit” dilemma. Will you come to the table, or will you be pushed out? That’s the real game he’s playing.

2.2 The "Dictator"

Although the United States boasts a robust constitutional system and democratic traditions, Donald Trump’s conduct during his presidency was widely criticized as exhibiting authoritarian tendencies. This assessment is not baseless, but grounded in repeated violations of institutional norms, democratic mechanisms, media freedom, and checks and balances. While Trump failed to dismantle America’s institutional framework entirely, his actions displayed hallmark traits of authoritarianism—breaking institutional boundaries, suppressing dissent, and consolidating personal authority.

Undermining Institutional Checks, Bypassing Congress to Centralize Power

Throughout his term, Trump frequently used executive orders to advance policy goals—including building the U.S.-Mexico border wall, implementing the “Muslim ban,” and rolling back environmental regulations. When Congress refused to fund the border wall, he declared a national emergency to redirect military funds, bypassing legislative oversight. Such actions eroded the constitutional principle of separation of powers, enabling unprecedented expansion of executive authority—a clear sign of autocratic inclination.

Attacking Press Freedom, Manufacturing an “Enemy” Media Narrative

Trump repeatedly labeled critical media outlets as “fake news,” even referring to major institutions like CNN and The New York Times as “the enemy of the people.” He routinely attacked journalists, TV hosts, and commentators on Twitter, inciting supporters to distrust mainstream media. In political communication theory, this tactic of delegitimizing the press is a common tool among authoritarian leaders aimed at weakening public trust in diverse information sources and establishing informational monopolies.

Interfering with Judicial Independence, Prioritizing Loyalty Over Expertise

Trump openly attacked the judiciary, especially when courts ruled against his policies. He personally criticized judges, once calling a judge who opposed his immigration policy a “Mexican”—implying bias. Moreover, he prioritized loyalty over professional competence in key appointments, frequently replacing the Attorney General, FBI Director, and other critical roles, severely undermining judicial independence.

Rejecting Election Results, Disrupting Peaceful Transfer of Power

After losing the 2020 presidential election, Trump refused to concede, claiming the election had been “stolen,” demanding recounts or invalidation of results in various states. More alarmingly, his rhetoric culminated in the January 6, 2021 Capitol riot, where supporters stormed Congress attempting to block certification of Joe Biden’s victory. This event was widely condemned internationally as a “dark day for American democracy” and represented a direct assault on the tradition of peaceful transition of power—an act bearing the hallmarks of authoritarian behavior.

Promoting Personality Cult, Creating a "Leader-Only" Political Narrative

Trump cultivated a highly personalized leadership style within his party and government, demanding absolute loyalty. He constantly praised himself at rallies, calling himself “the greatest president in history” and implying national collapse without him. This rhetoric fostered a “savior” mythos, diminishing the role of collective governance and institutional norms, paving the way for populism and personality cults.

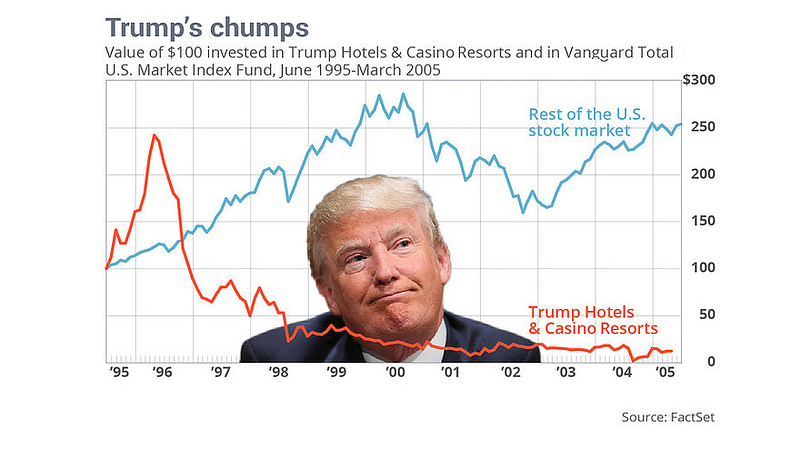

2.3 Trump’s Dual Chessboard: Not President, But a "Market Wizard"

Donald Trump, the billionaire real estate tycoon who ascended to the world’s most powerful office in 2016, surprised many as a “non-traditional politician.” Analyzing his governing style and political behavior—and considering the earlier framing of Trump as both “businessman” and “dictator”—it becomes plausible to argue that Trump was never truly a conventional “president,” but rather a “super trader” who treated power, public opinion, and financial markets as tools. He transformed the White House into a Wall Street trading floor—a “market wizard” profiting from volatility. Viewing Trump through the lens of a “market operator” makes his seemingly erratic moves suddenly logical.

Business Instinct: Treating the Presidency as a 'Super Trading Platform'

Trump embodies the archetype of a businessman-politician. With decades in business, he mastered agenda-setting, narrative control, and speculative profit-taking. He doesn’t govern according to political logic, but views domestic and global affairs through a “business lens.” His governance isn’t aimed at institutional improvement or global leadership, but transactional outcomes—“America First” is, fundamentally, “Profit First.”

Moreover, Trump exhibits strong “dictator-like” characteristics in managing discourse and concentrating power. He controls the information cycle, often using Twitter to release statements that shock markets—such as “We’re close to a major deal with China” or “The Fed should cut rates”—routinely causing sharp fluctuations in financial markets. For a traditional president, such remarks might be diplomatic signaling; for a leader operating with a “market manipulation mindset,” they are precision instruments for controlling market momentum.

Authoritarian Communication Tactics: Using Information to Manipulate Market Sentiment

If a defining trait of dictators is “control and exploitation of information,” then Trump is a master of using information to “shake markets” in the modern era. He doesn’t need censorship or media shutdowns—instead, by generating uncertainty and conflict, he positions himself as the dominant source of market-moving intelligence.

In the age of Twitter, he operated almost like a financial news anchor, releasing “market-impacting statements” daily:

-

“China is going to sign a huge trade deal”;

-

“If the Fed doesn’t cut rates, America will lose competitiveness”;

-

“Oil prices are too high—that’s OPEC’s fault”;

-

“The border wall will be built—markets should feel reassured.”

These statements carry no formal policy weight, yet consistently trigger violent swings in the Dow Jones, S&P 500, gold, and crude oil markets. The timing, tone, and phrasing all bear the marks of deliberate market manipulation.

More strikingly, he constantly reverses positions—praising progress in China talks one day, announcing new tariffs the next; urging rate cuts in the morning, warning about a weak dollar by afternoon. This isn’t political inconsistency—it’s precise emotional engineering, turning volatility into controllable profit opportunities.

Family Capital Network: Arbitrage Channels Built on Power and Information

Trump’s business network did not cease upon taking office—in fact, it gained greater legitimacy and influence. Family members like Kushner and Ivanka remained deeply involved in political and commercial affairs, wielding direct influence over Middle East policy, tech investments, and real estate. Reports persistently surface about family trusts and allied investment groups leveraging policy foresight for financial arbitrage:

-

Before Trump’s sweeping tax cuts, certain closely-linked funds had already taken large positions in U.S. equities;

-

Whenever Trump hinted at releasing strategic petroleum reserves or launching military action, energy markets showed suspicious pre-trade activity;

-

During phases of the China trade war, market reactions to Trump’s “deal reached” comments were extremely sensitive, with repeated short-term spikes.

While insider trading cannot be directly proven, the concentration of information control and policy-making power creates highly valuable arbitrage channels. The presidency ceases to represent institutions and instead functions as a “trader” with privileged access to forward-looking intelligence and unmatched public influence.

'Create Chaos → Guide Direction → Harvest Gains': Classic Market Manipulation Strategy

Traditional presidents seek stability and continuity, but Trump appears to thrive on manufacturing chaos. He excels at triggering market panic, then calming nerves with reassuring statements—the entire process resembling a swing trade:

-

Threaten Iran → market panic → next-day peace signals → market rebound;

-

Announce new China tariffs → tech stocks crash → days later claim “China has good attitude” → recovery;

-

During pandemic, declare virus “under control” → brief stock rally → subsequent data reversal → renewed sell-off.

Behind these seemingly random statements lies a sophisticated alignment of emotional triggers and market timing. He understands public expectations and investor psychology, acting as a supreme market manipulator orchestrating the collective psyche of global investors.

Post-Trump Era: Personal Brand Continues to Influence Markets

Even after leaving office, Trump retains the ability to sway market rhythms. A casual remark about “possibly running again” instantly moves stocks tied to energy, defense, social media, and conservative tech. Take Trump Media & Technology Group (Truth Social), which went public via SPAC: despite lacking real profitability, its stock surged dramatically—proving that “Trump” itself has become a tradable asset, reflecting the full financialization and branding of his persona.

3. The Cryptocurrency Market Orchestrated by the U.S.: Collusion Between Capital and Power

Image source: Al Jazeera

3.1 Power Reconfiguration: What Trump Wants Isn’t Bitcoin, But a ‘Americanized’ Bitcoin

Today’s cryptocurrency market is no longer a haven for decentralization ideals, but a new frontier of financial colonization jointly orchestrated by U.S. capital and political power. Since the approval of Bitcoin spot ETFs, Wall Street giants like BlackRock, Fidelity, and MicroStrategy have rapidly accumulated physical BTC holdings, locking what was once a technology community’s asset into Wall Street vaults. Financialization and politicization have become dominant forces—crypto prices are no longer determined by organic market dynamics, but by Federal Reserve rate hints, SEC regulatory updates, or even a presidential candidate’s offhand comment supporting crypto.

This “Wall Street-ification” means re-embedding decentralized assets back into a centralized system—the U.S. financial hegemony. ETFs have tethered crypto markets to U.S. equities, rising and falling together. Behind every price chart now pulses the rhythm of U.S. Treasury yields and CPI data. Bitcoin, once a symbol of freedom, increasingly resembles “an alternative Nasdaq component stock that lags behind Fed intentions.”

3.2 Bitcoin’s Strategic Value: Not a Sovereign-Free Reserve Asset, But a Gray Backup for Dollar Hegemony

The Trump era laid the groundwork for Bitcoin’s strategic financial positioning. Rather than openly endorsing it like traditional politicians, Trump quietly integrated Bitcoin into America’s strategic financial arsenal by allowing mining power migration, loosening regulatory gray zones, and supporting mining infrastructure. Amid growing concerns over weakening dollar credibility, Bitcoin is gradually assuming the role of a “non-sovereign reserve asset,” being molded into an alternative safe-haven during financial turmoil.

This approach is quintessentially American: undeclared, silent absorption. The U.S. dominates key Bitcoin financial infrastructure (Coinbase, CME, BlackRock ETF) and further strengthens on-chain settlement dominance through dollar-pegged stablecoins like USDC. When global instability arises and capital seeks refuge, the U.S. already quietly possesses this “dollar-alternative within de-dollarization.”

Trump may see further ahead: he doesn’t care about Bitcoin’s ideology, only about taming its financial attributes into another “monetary sovereignty tool” for the U.S. In scenarios where the dollar is restricted, SWIFT is inaccessible, or fiat currencies depreciate, Bitcoin becomes a contingency plan for maintaining power.

3.3 The Truth of Market Manipulation? Trump Is Not Just President, But a 'Super Dealer' in the Battlefield of Financialized Attention

First, understand one truth: 90% of any financial market consists of range-bound consolidation—only “big volatility generates big profits.”

Therefore, synthesizing all previous points, Trump may appear to be a president, but in reality functions more like a traffic-driven super trader—his sole objective being to create and control market volatility to profit from it.

Trump is a speculator adept at manipulating market direction through information, attention, and influence to harvest volatility gains. Simultaneously advocating Bitcoin as a “U.S. strategic reserve” while launching meme tokens like $TRUMP to siphon market liquidity represents a dual strategy of “information manipulation + liquidity vampirism.”

Even more starkly, crypto market movements are increasingly dependent on U.S. political gamesmanship: Fed statements, SEC announcements, presidential candidates’ remarks, congressional hearing sentiments… A system meant to be decentralized is now deeply entangled with U.S. monetary policy, stock market structures, and the logic of American mega-capital—effectively becoming an extension battlefield of the American financial system.

We are witnessing a harsh reality: markets may appear free, but are already pre-scripted; prices may seem volatile, but behind them lie orchestrated schemes designed by those who control information and attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News