Trump Remains Firm: Tariffs Are the Only Solution to Save America, Over 50 Countries Rush to Start Negotiations

TechFlow Selected TechFlow Selected

Trump Remains Firm: Tariffs Are the Only Solution to Save America, Over 50 Countries Rush to Start Negotiations

"I didn't intend to crash the stock market, but sometimes you have to take medicine to get better."

By Natalia Wu, BlockTempo

Following market turmoil in U.S. and global equities triggered by tariff policies, nationwide anti-Trump protests erupted across the United States last week, drawing 500,000 people onto the streets. Nevertheless, Trump remains steadfast in his stance on tariffs. On Monday, Trump responded: "I didn't intend to crash the stock market, but sometimes you need medicine to cure the disease."

After President Donald Trump announced plans last week to impose reciprocal tariffs on multiple countries and regions, global financial markets plunged sharply. This morning, U.S. stock index futures tumbled at open—Dow Jones futures dropped as much as 1,822 points (4.7%); S&P 500 and Nasdaq 100 futures both fell over 5%. The CBOE Volatility Index (VIX) surged past 45, reaching its third-highest level since the 2008 financial crisis and the 2020 pandemic.

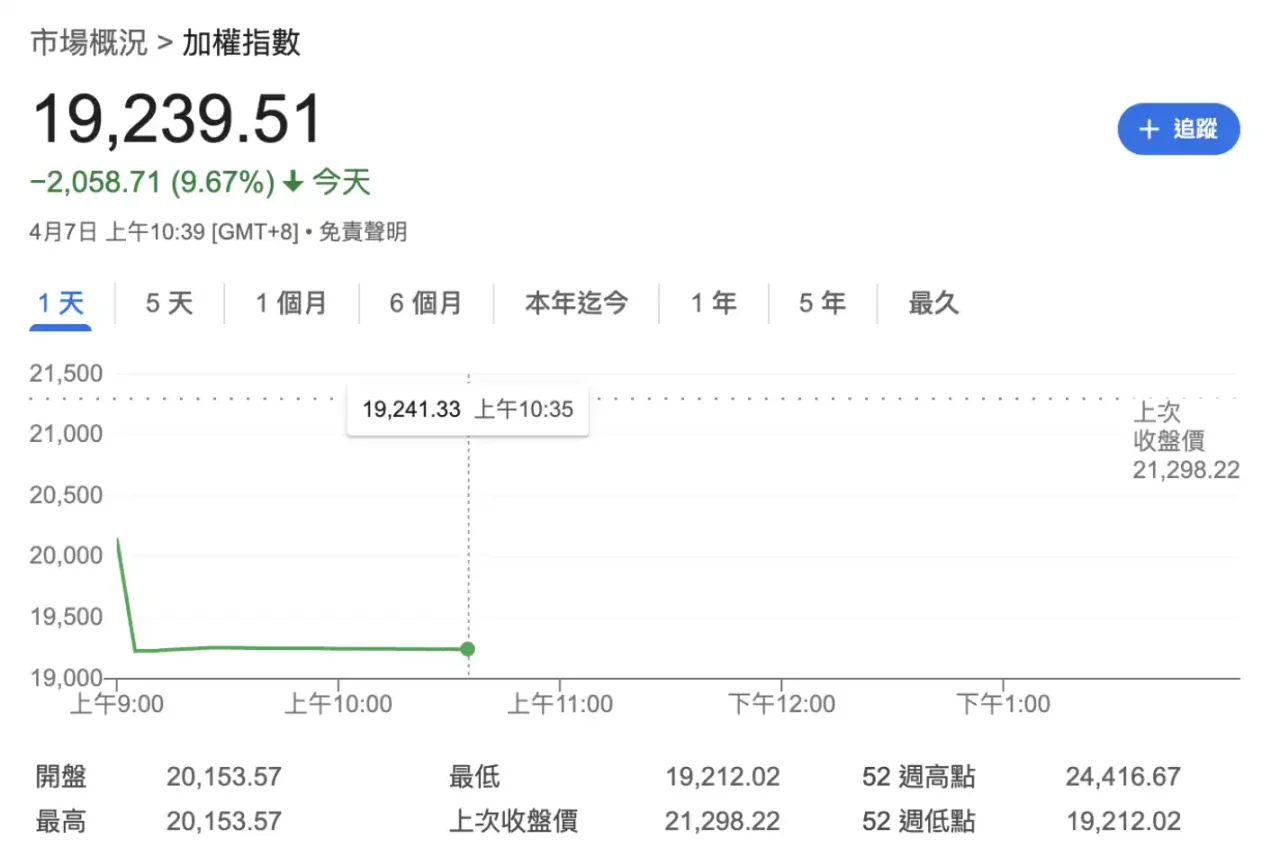

Taiwan's stock market, spared last week due to a holiday, opened sharply lower today, plunging as much as 2,085 points to an intraday low of 19,212 (down 9.8%)—the largest intraday percentage drop in its history. Other Asian markets, including Japan, mainland China, and South Korea, also suffered heavy losses during early trading, briefly triggering circuit breakers.

Current performance of Taiwan’s stock market

In the crypto market, Bitcoin briefly crashed to $77,000 this morning. Over the past 24 hours, total liquidations across the cryptocurrency market exceeded $890 million, with more than 299,000 traders forcibly liquidated. Meanwhile, even gold—a traditional safe-haven asset—was not spared; spot gold briefly dipped below $3,000 per ounce.

Heightened investor risk aversion boosted demand for safe-haven currencies such as the Japanese yen and Swiss franc. The yen surged nearly 2.27% over the past five days to 146.584 JPY/USD, while the Swiss franc rose more than 3% over the same period.

Trump: I Didn’t Mean to Crash the Stock Market…

As tariff-driven turmoil rattled U.S. and global markets, anti-Trump sentiment swept the nation, with over 500,000 Americans participating in approximately 1,200 protest rallies last week under the slogan “Hands Off.”

Nonetheless, Trump continues to defend his tariff policy. Earlier today, he posted on his social media platform Truth Social, calling tariffs “a beautiful thing,” claiming they are generating tens of billions of dollars in revenue for the U.S., aiming to eliminate massive trade deficits with China, the European Union, and many other nations. He insists tariffs are the only solution to fixing trade imbalances.

According to Bloomberg’s report on Monday, Trump told reporters aboard Air Force One:

“I didn’t mean to crash the stock market, but sometimes you have to take medicine to get better.”

Trump also said he has spoken with several unnamed foreign leaders. He reiterated that the purpose of imposing tariffs is to completely eliminate America’s trade deficit.

“They’re eager to make a deal, and I say, ‘We won’t run a trade deficit with your country.’ We won’t do it because, to me, a trade deficit is a loss. We will achieve a surplus, or at worst, balance. That’s what we’re going to have.”

“We must fix our trade deficit, especially with China. I won’t make any deal unless it reduces the U.S. goods trade deficit with China. I want this issue resolved. Right now, China is suffering greatly because everyone knows we are right.”

Trump also turned his criticism toward Europe, even suggesting he wants not just balanced trade—but compensation:

“We’ve imposed high tariffs on Europe. They’ve come to the negotiating table, wanting to talk. But talks won’t proceed unless they pay us substantial sums every year.”

When asked about public concerns that tariffs could reignite inflation, Trump simply replied: “I don’t think inflation will be a big problem.”

Trump Vows to Reverse Trade Deficits Through Tariffs

White House economic officials revealed that more than 50 countries have called the White House seeking negotiations to mitigate the impact. However, Commerce Secretary Lutnick emphasized on CBS’s *Face the Nation* that Trump is “not joking”—his tariff plan will take effect on April 9 without delay and “will absolutely remain in place for days, if not weeks.”

Lutnick expressed optimism that tariffs would spur manufacturing reshoring. In a March 3 interview with CNBC, he noted semiconductors are currently excluded from the new tariffs, but Trump intends to bring chip manufacturing back from Taiwan to the U.S., potentially imposing targeted tariffs in the future.

More than 50 countries are racing against time to convince Trump to ease up—but Trump remains resolute, stating flatly: “No negotiations until the trade deficit is gone.” Experts warn this tariff war may trigger cascading effects, dragging down global growth, with little relief expected in the near term.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News