Tokenized Gold and Yield Opportunities

TechFlow Selected TechFlow Selected

Tokenized Gold and Yield Opportunities

Investors can gain exposure to gold through cryptocurrencies, and new opportunities have emerged to earn yield on tokenized gold assets.

By 0xEdwardyw

Why Gold Still Matters

In 2025, gold is back in the headlines, hitting record highs driven by surging safe-haven demand. For the first time, gold prices surpassed $3,000 per ounce, marking a strong comeback for the "king of precious metals." Amid renewed concerns over fiat currency devaluation and global instability, investors are flocking back to gold.

Bitcoin, often dubbed “digital gold,” has led many to question whether physical gold still holds relevance. Yet, the latest data tells a clear story: gold remains vital for portfolio diversification and stability. As of March 2025, gold delivered a 36% annualized return—outperforming major stock indices and even Bitcoin.

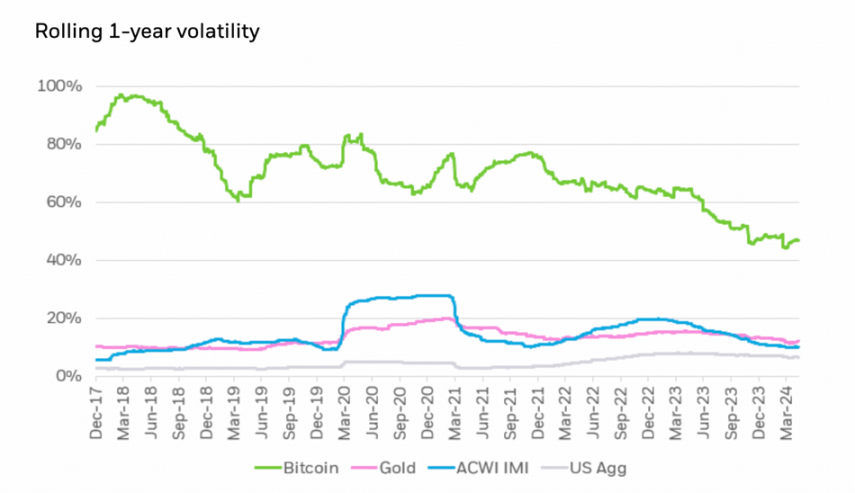

Lower Volatility Than Bitcoin

Compared to Bitcoin’s wild price swings, gold exhibits far milder volatility. For instance, as of 2024, Bitcoin’s annualized volatility was around 47%, while gold’s stood at just 12%. This means Bitcoin's price fluctuates nearly four times more on average than gold. For risk-conscious investors, this difference is critical.

We saw this play out in early 2025: when tech stocks (Nasdaq) dropped nearly 15% over several weeks, gold remained relatively flat (up ~1%), while Bitcoin fell about 20%, closely tracking equity markets. Gold’s low volatility makes it a valuable asset for capital preservation during market turmoil, whereas Bitcoin behaves more like a high-beta risk asset.

Source: https://www.ishares.com/us/insights/bitcoin-volatility-trends#:~:text=,deviation%20of%20annualized%20daily%20returns

Low Correlation With Bitcoin

In the most recent market cycle, gold and Bitcoin have moved in divergent directions. Over the past year, gold has steadily climbed to new highs amid inflation fears and geopolitical tensions, while Bitcoin has oscillated within a wide range, driven more by shifts in investor risk appetite. Notably, gold has low—or even negative—correlation with traditional assets, making it ideal for portfolio diversification. In fact, gold has also shown a negative correlation with Bitcoin, meaning holding both assets can further enhance portfolio resilience.

Tokenized Gold in 2025

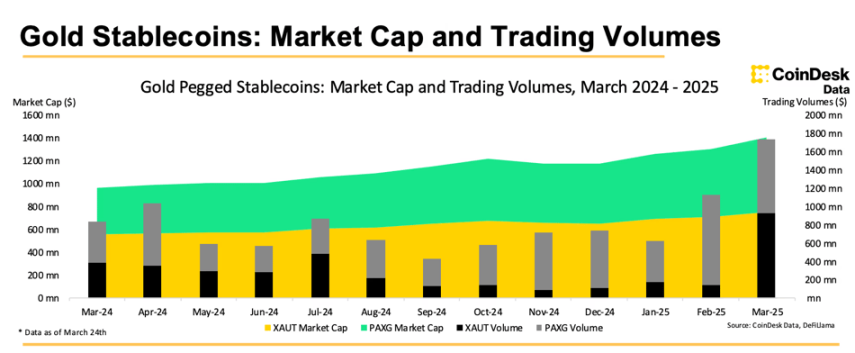

One of the most exciting developments is that gold itself has joined the blockchain revolution. "Tokenized gold"—digital tokens fully backed by physical gold—is experiencing rapid growth. In March 2025, the market cap of gold-backed crypto tokens hit a record $1.4 billion. This space is primarily dominated by two tokens: PAX Gold (PAXG) and Tether Gold (XAUt). These tokens allow investors to hold gold digitally, combining gold’s stability with the flexibility of crypto assets.

Source: https://www.coindesk.com/markets/2025/03/27/tokenized-gold-hits-new-record-market-cap-as-trading-volumes-soar-in-march

PAXG (Paxos Gold)

PAX Gold (PAXG) is issued by Paxos Trust Company, a regulated financial institution based in New York. Each PAXG token represents one troy ounce of refined gold stored in LBMA-certified vaults in London. Crucially, Paxos operates under strict regulatory oversight—the token is fully backed 1:1 by physical gold and undergoes monthly third-party audits to verify reserves. Authorized by the New York State Department of Financial Services (NYDFS), Paxos offers strong compliance and confidence to holders.

In 2025, PAXG’s popularity has steadily increased. It currently boasts a market cap of approximately $680 million, capturing roughly half of the tokenized gold market. Daily trading volumes regularly reach tens of millions of dollars. Thanks to its regulatory credibility, PAXG has continued operating smoothly even as scrutiny over stablecoins intensifies in the U.S.

New financial products tied to PAXG are emerging: for example, in late 2024, derivatives exchange Deribit launched futures and options contracts on PAXG, signaling growing institutional interest in tokenized gold as a tradable asset.

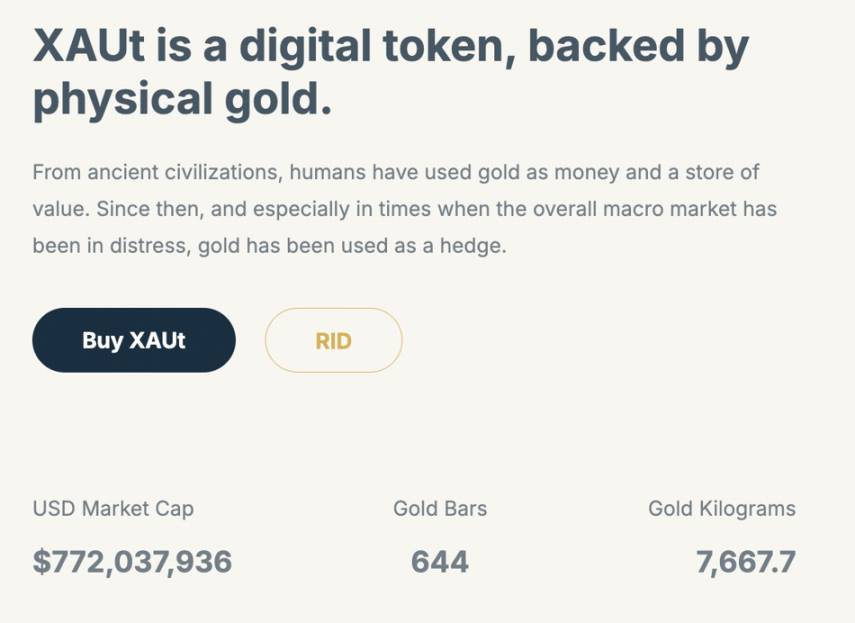

XAUt (Tether Gold)

Tether Gold (XAUt) is another major gold-backed token, issued by TG Commodities, a company affiliated with Tether. Each XAUt token represents one troy ounce of gold stored in Swiss vaults compliant with the London Good Delivery standard. As of 2025, XAUt has a market cap of approximately $770 million.

However, XAUt’s regulatory framework differs from PAXG’s. In 2023, Tether migrated its gold token operations to El Salvador, where TG Commodities obtained a stablecoin issuance license and now operates under Salvadoran regulation. Tether Gold publishes regular gold reserve reports and claims full physical backing, but unlike Paxos, it has not yet undergone comprehensive independent audits of its reserves. This has raised some market concerns regarding transparency.

Tether executives have stated that conducting a full audit by one of the Big Four accounting firms has become a top priority, especially given evolving regulatory requirements in the stablecoin sector. The market widely hopes that XAUt’s gold reserves will soon meet the same audit and transparency standards as PAXG.

Yield Opportunities in DeFi

Beyond simple buying and holding, tokenized gold is unlocking new use cases in decentralized finance (DeFi). Crypto investors can now deploy gold-backed tokens into various yield-generating strategies, transforming gold into a source of passive income. Historically, gold sat idle in vaults, generating little to no return. Now, through DeFi protocols, gold can generate returns—all without moving the underlying physical metal.

Liquidity Pools and Automated Market Makers (AMMs)

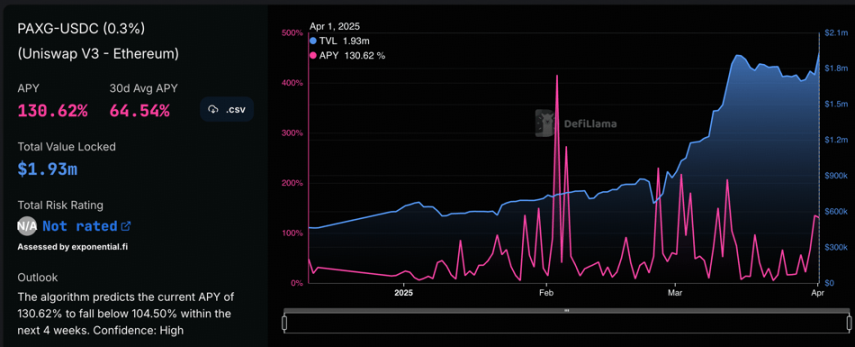

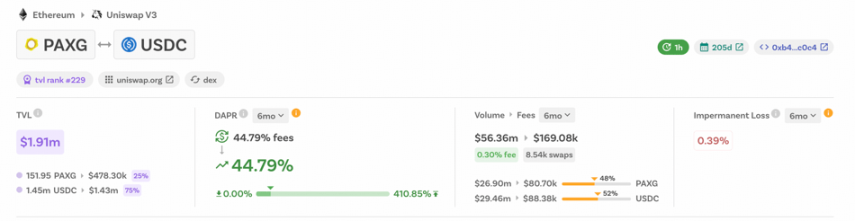

For example, the PAXG/USDC pool on Uniswap enables trading between tokenized gold and USD. Liquidity providers (LPs) to this pool earn transaction fees as passive income.

This mechanism allows LPs to earn yield while maintaining exposure to gold—an especially attractive option during periods of heightened gold demand and active trading.

Source: https://defillama.com/yields/pool/459e731e-60a0-45fa-8b49-092468ab14f5

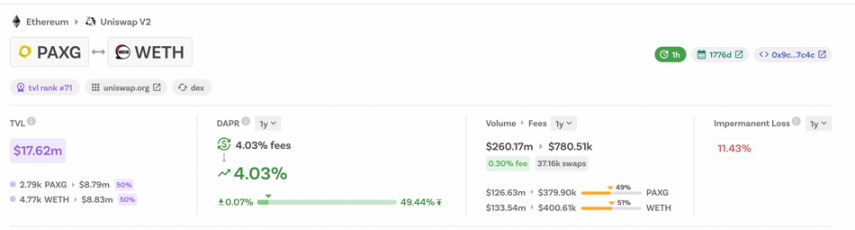

Another option is the PAXG/WETH liquidity pool, which facilitates swaps between gold and Ethereum. This pool typically has higher liquidity but also carries greater risk of "impermanent loss" (IL), since PAXG (which tracks gold prices) is relatively stable, while WETH (which tracks ETH) is highly volatile. When ETH prices swing dramatically, the relative value of the two assets can diverge rapidly, increasing the risk of significant impermanent loss.

Both pools offer yield opportunities, but their risk-return profiles differ based on the volatility of the paired assets.

Source: https://defillama.com/yields/pool/40ac1aaf-26f1-4a04-b908-539f37672ef2

Impermanent Loss (IL)

Impermanent loss (IL) is a core concept in DeFi, especially for users providing liquidity to automated market makers (AMMs) like Uniswap. IL occurs when the value of assets in a liquidity pool changes relative to simply holding them. If the prices of the two tokens diverge after depositing, LPs may end up with less value than if they had held the assets separately. The loss is called "impermanent" because it could reverse if prices return to their original ratio; however, withdrawing liquidity while prices remain unbalanced turns the loss into a permanent one.

The magnitude of IL depends mainly on two factors: the volatility and correlation of the paired assets.

In the PAXG/USDC pool, one side is PAXG—a token pegged to gold prices—and the other is USDC, a stablecoin pegged to the U.S. dollar. Since gold is far less volatile than crypto assets and USDC maintains a stable $1 value, the price ratio between the two remains relatively steady, significantly reducing the risk of impermanent loss.

In contrast, the PAXG/WETH pool pairs PAXG with WETH. PAXG is relatively stable, while ETH markets are highly volatile, sometimes surging or dropping 20–50% in short periods. Such sharp movements trigger the AMM’s “constant product” algorithm, rebalancing the pool by reducing the share of the outperforming asset (e.g., rising PAXG) and increasing the share of the underperforming one (e.g., falling ETH). As a result, LPs end up with fewer high-value assets than if they had simply held them, leading to larger impermanent losses.

Yield Samurai's Impermanent Loss Estimation Charts

Source: Samurai

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News