Coincall ranks among top five crypto options exchanges, launches "Earn While Trading" feature

TechFlow Selected TechFlow Selected

Coincall ranks among top five crypto options exchanges, launches "Earn While Trading" feature

"Trade & Earn" enables users to generate returns from idle capital without giving up active trading.

Cryptocurrency exchange Coincall has officially become one of the top five largest crypto options exchanges by trading volume globally—a major milestone for the platform just 18 months after its founding. This achievement also highlights Coincall’s rapidly growing attention and adoption among both institutional and retail traders in the options trading space.

According to internal data and third-party analysis, Coincall's surge in performance is tied to its first-quarter strategy, which included partnerships with prominent crypto players such as SignalPlus, DWF, and Big Candle Capital, high-impact marketing campaigns, and new product launches.

Crypto Options: From Niche Strategy to Core Market Component

Options, once tools reserved for quantitative analysts and hedge funds, are now becoming the go-to instruments for native crypto investors. These contracts grant traders the right—but not the obligation—to buy or sell assets at a fixed price, enabling sophisticated hedging, volatility plays, and directional speculation.

As digital asset markets mature, crypto options are increasingly seen as a critical component of the financial stack. Earlier this month, reports emerged that Coinbase is engaged in advanced talks to acquire Deribit, a leading BTC and ETH options trading platform, at a rumored price tag of $4–5 billion. Although details have since quieted, the market signal is clear: crypto derivatives are no longer supporting actors—they’re center stage.

Coincall: The Youngest Member Among Top 5 Crypto Options Exchanges

Coincall stands out not only for its growth velocity but also for its relative youth. Founded in late 2023, Coincall is already among the leading options exchanges in the crypto space, currently operating at 9–10% of Deribit’s scale.

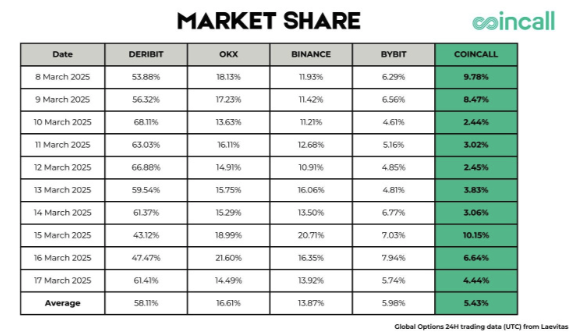

Data from Laevitas shows that Coincall held an average market share of 5.43% between March 8 and March 17, 2025, peaking at 10.15% on March 15. Its daily market share was particularly notable, reaching 9.78% on March 8 and 6.64% on March 16—indicating both strong growth and an increasingly competitive global crypto options market.

Coincall’s relative market share and growth trajectory make it the youngest exchange ever to enter the top five rankings in crypto options—and potentially the most viable acquisition or institutional partnership candidate among emerging players. As attention shifts from established giants to agile market challengers, Coincall has emerged as one of the most promising contenders, with a market share nearly on par with industry leader Bybit.

Visionary Leadership

In January this year, Coincall appointed Daryl Teo, former strategist at Alibaba Group (NASDAQ: BABA) and long-time crypto investor, as Chief Operating Officer and minority shareholder. He joined CEO Jimmy’s executive team, whose members previously worked at major firms including OKX, Paradigm, and ByteDance.

"We’re witnessing cryptocurrency gaining legitimacy as a store of value at the consensus level," said Teo. "Options are the next wave—they offer leverage, flexibility, and strategic depth. Coincall’s mission is simple: make investing fast, intuitive, and secure for everyone."

“Earn While You Trade”: Unlocking Yield + Capital Efficiency

Coincall’s latest innovation is the “Earn While You Trade (EWYT)” feature, designed to eliminate the trade-off between liquidity mining and active trading.

With EWYT, users can:

-

Earn up to 6.4% annualized yield on USDT holdings;

-

Use 90% of staked funds as trading margin;

-

Withdraw funds anytime—no lock-up periods;

-

Enhance capital efficiency for active traders.

The feature allows users to earn yield on idle capital without sacrificing trading activity, significantly improving capital efficiency. For more product details, users can click here to explore.

Macro Momentum: A Return to Crypto Infrastructure

Coincall’s rise reflects a broader tailwind for crypto infrastructure. According to PitchBook, in 2024, $11.5 billion in venture capital was deployed across 2,153 deals into crypto and blockchain startups—the strongest rebound in funding activity since the bear market cycle.

"The next phase of the crypto industry will be defined by real infrastructure," said Teo. "Platforms that consciously build with both capital efficiency and user accessibility in mind will shape the next decade."

About Coincall

Coincall is a next-generation cryptocurrency options exchange founded in 2023, focused on accessibility, capital efficiency, and seamless trading experiences. With deep liquidity, fast execution, and innovative features like “Earn While You Trade,” Coincall is building the future of digital asset derivatives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News