SEC Roundtable: Successes, Failures, and What’s Next

TechFlow Selected TechFlow Selected

SEC Roundtable: Successes, Failures, and What’s Next

Four days after the roundtable meeting ended, the industry began to wonder whether it would pave the way for a new era of crypto regulation or merely redefine the same old challenges.

Article by: Prathik Desai, Nameet Potnis, Thejaswini M A

Translation: Block unicorn

Last Friday, the U.S. Securities and Exchange Commission (SEC) took its first step toward easing tensions with the cryptocurrency industry—but fell short of delivering all the answers the sector had hoped for.

After years of "enforcement-by-regulation," the securities regulator convened a crypto roundtable with key industry figures for the first time, branding it a "Spring Sprint toward Crypto Clarity."

Despite the hopeful title, much of the two-hour session was spent debating the decades-old Howey Test rather than charting a clear regulatory path forward.

The meeting did yield some outcomes—but were they enough? This article explores what this regulatory shift means for the crypto industry:

-

How the SEC acknowledged past failures but still struggles to define a future direction

-

What the proposed DART tracking system means for transparency

-

Why NFTs could be the next area to receive regulatory guidance

-

What critical elements were missing from the dialogue that the industry urgently needs

New leadership, new regulatory mindset

The SEC’s governance style before and after Trump’s second presidential term stands in stark contrast. Former Chair Gary Gensler claimed most cryptocurrencies were securities and relied heavily on enforcement actions. In contrast, Acting Chair Mark Uyeda and Commissioner Hester Peirce opened the meeting by acknowledging the need for collaboration to rebuild the regulatory framework.

“I think we’re ready for our sprint into the future,” Peirce told attendees, referencing the working group’s ambitious “Spring Sprint toward Crypto Clarity” initiative.

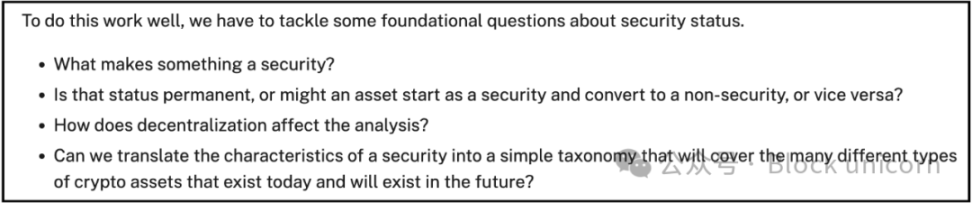

“Can we transform the characteristics of a security into a clear classification system that covers both existing and future types of crypto assets?” This was one of the questions Peirce raised when addressing the challenge of treating crypto assets as securities.

This open invitation to dialogue marks a shift in the SEC’s stance.

The roundtable brought together over a dozen securities lawyers and crypto experts, including Miles Jennings, A16z's Head of Crypto Policy and General Counsel—a prominent industry supporter—and former SEC lawyer John Reed Stark, a well-known critic.

Most notably, the SEC candidly admitted that its previous approach had failed.

Miles Jennings spoke bluntly. “The prior administration’s regulatory approach failed to achieve any of the SEC’s stated goals—not protecting investors, nor fostering capital formation or market efficiency. Clearly, the current approach has failed, and we must do better.” More surprisingly: the SEC seemed to agree.

Old problems, limited progress

Though the faces were new and the tone cordial, the roundtable quickly devolved into a familiar debate: how to apply the 1946 Howey Test to determine whether a digital asset is a security?

Participants spent much of the discussion debating how an almost 80-year-old citrus orchard framework applies to tokens, decentralized exchanges, and other crypto innovations.

For an industry hoping to move beyond the past, focusing on refining old tools instead of building new ones left many disappointed.

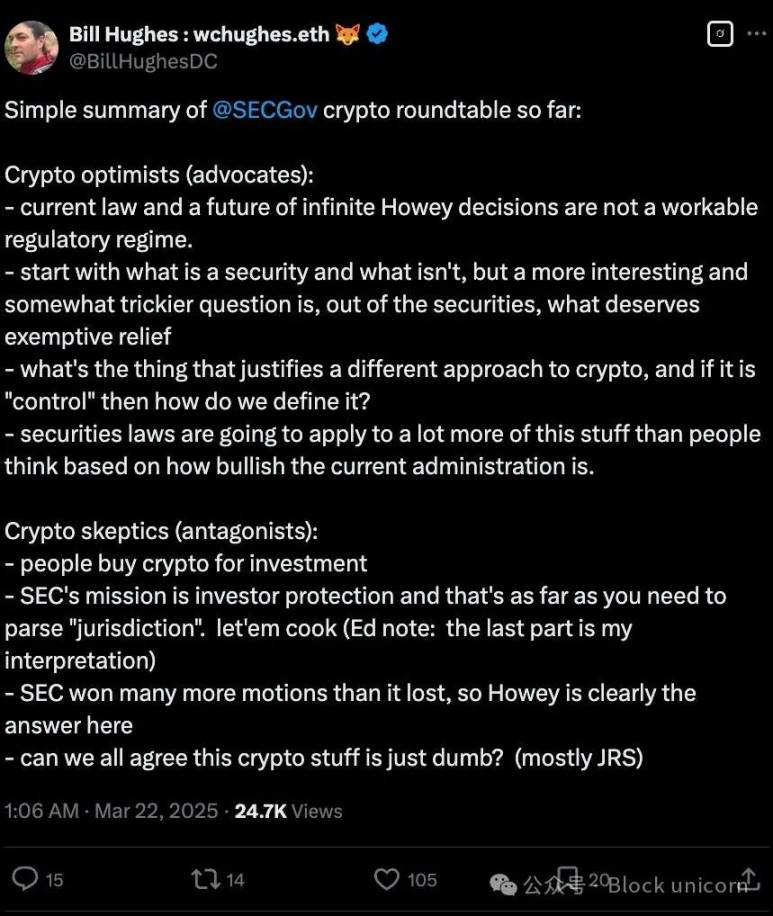

“Crypto optimists believe that relying on current laws and endless Howey Test rulings does not constitute a viable regulatory regime,” wrote crypto attorney Bill Hughes in a post on X.

The industry wants a clean slate—clear definitions of what is and isn’t a security—rather than endless applications of outdated precedents.

The tension played out in real time, as some participants tried to steer the conversation toward more forward-looking approaches. Rodrigo Seira, special adviser at Cooley LLP, questioned the fundamental premise that investment intent automatically creates a security. “We must understand that just because there’s investment intent behind a purchase doesn’t mean the transaction automatically becomes a security,” said Seira, citing art purchases that have both aesthetic and investment value. While the main discussion remained stuck on defining securities, subtle hints of more practical progress emerged on the sidelines.

Commissioner Peirce told reporters off the record that following recent staff statements on meme coins and proof-of-work mining, non-fungible tokens (NFTs) might be the next category to receive SEC guidance. “I think we’ll see guidance come out for the NFT space as well,” she said.

This offhand comment could significantly impact projects like Stoner Cats and Flyfish Club, which previously faced SEC lawsuits for raising funds through NFT sales. Formal clarification could open the door for creators to use NFTs as legitimate fundraising tools without requiring securities registration.

DART System: A Quiet Transparency Revolution

Beyond the roundtable itself, another development may prove even more impactful—an emerging parallel initiative that could fundamentally reshape how crypto trading is reported.

The SEC’s recently announced Digital Asset Reporting and Tracking (DART) system could transform how regulators monitor the crypto market. Unlike philosophical debates over the Howey Test, DART represents a practical solution to one of the SEC’s core challenges: transparency.

The proposed system would track not only public blockchain transactions but also private off-chain trades, providing a comprehensive view of digital asset ownership across platforms. This addresses a long-standing regulatory blind spot—while DeFi protocol transactions are publicly visible on-chain, centralized exchanges often process trades internally without recording them on a blockchain.

As the SEC stated: “Trading in digital asset securities—whether ‘on-chain’ or ‘off-chain’—should be subject to the same trade reporting requirements as traditional securities.”

DART is particularly significant because it is being developed jointly with the Commodity Futures Trading Commission (CFTC)—a sharp contrast to the roundtable, which notably excluded CFTC representatives despite their shared jurisdiction over digital assets.

This inter-agency collaboration suggests that beneath the surface of public debate, regulators are quietly advancing a more unified framework. For an industry long plagued by fragmented oversight, such pragmatic cooperation may ultimately deliver the regulatory coherence that roundtables and speeches cannot.

However, DART also raises serious privacy concerns. By aggregating both public blockchain data and private off-chain trading activity, the system grants regulators unprecedented surveillance capabilities over the crypto market. For traders who value the anonymity inherent in blockchain transactions, this level of monitoring signals a major shift toward traditional financial surveillance models.

Industry observers are closely watching how DART will balance its transparency goals with privacy protections—and whether it will spark a new wave of innovation in privacy-preserving technologies.

Final thoughts

Four days after the roundtable ended, the industry is left wondering: will this pave the way for a new era of crypto regulation, or merely reframe the same old challenges?

The SEC’s Crypto 2.0 initiative, led by Commissioner Peirce, has already shifted the tone. Staff statements on meme coins and mining, potential upcoming NFT guidance, and the agency’s willingness to engage directly with the industry all indicate a tangible change in approach.

The timing is especially critical—the U.S. Congress is advancing legislative efforts similar to last year’s FIT21 Act, which would establish a completely new framework for classifying digital assets. Prominent lawyer Renato Mariotti noted: “Friday’s roundtable was a missed opportunity” to shape that legislative process by nurturing innovative ideas with long-term regulatory value.

While Peirce’s “Spring Sprint” signals a move away from an enforcement-first posture toward a more open stance, Friday’s discussion remained trapped within decades-old frameworks rather than building systems fit for a new era.

Given institutional constraints, this compromise is not surprising.

The SEC is currently operating with only three commissioners and is awaiting Paul Atkins’ confirmation hearing this Thursday. As a result, the agency lacks both the statutory authority and procedural capacity to drive comprehensive reform. For now, it can only implement limited measures, such as issuing non-binding staff statements on meme coins and mining activities.

The proposed DART system represents the most substantive advancement—through collaboration with the CFTC, it could establish an unprecedented transparency mechanism in the crypto market. Yet at its core, it remains an application of traditional financial regulatory paradigms to emerging financial technologies.

The most critical shortcoming of the current regulatory system is speed. Blockchain innovation evolves at the pace of code deployment, while SEC decision-making is constrained by the slow process of committee consensus. This widening “regulatory innovation deficit” has become the industry’s unspoken central conflict.

Crypto firms navigating this regulatory fog must recognize the strategic reality: real transformative momentum comes from congressional legislation, not roundtable discussions. Compared to endless debates over how the Howey Test applies to digital assets, the FIT21 Act clearly offers a far more constructive regulatory framework.

For now, this so-called “Spring Sprint” feels less like a sprint and more like a cautious walk—better than standing still, perhaps, but ultimately unable to keep pace with an industry moving at full speed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News