Did Zuckerberg's $46 billion go down the drain? What happened to the metaverse race

TechFlow Selected TechFlow Selected

Did Zuckerberg's $46 billion go down the drain? What happened to the metaverse race

The billions of dollars that once flooded into the metaverse have dried up, and public interest has sharply declined, leaving the concept now regarded as one of the biggest failures in the tech industry in recent years.

Author: Jeffrey Gogo, Cryptonews

Translation: Tim, PANews

Key Takeaways

- Four years after Mark Zuckerberg's full-scale bet on the metaverse, the concept is now considered one of the biggest flops in recent tech history.

- One major reason for the metaverse’s decline lies in the rise of generative artificial intelligence (AI).

- Despite overall industry downturns, some projects remain strong. Experts point out that the field is undergoing a process of separating genuine innovators from pretenders, gradually eliminating unsustainable players.

When Mark Zuckerberg unveiled his vision for the metaverse in October 2021, the idea of a digital utopia where people could connect and interact within immersive virtual environments sounded achievable.

The billionaire founder saw the metaverse as the next frontier of the internet, prompting his company to invest billions of dollars into developing technologies needed to realize this strategic vision.

Zuckerberg even rebranded Facebook as Meta to reflect its new ambition of building the metaverse—a virtual world powered by virtual reality (VR) and augmented reality (AR), where people can interact, work, and create.

Given the massive investments made by Meta—around $46 billion since 2021—and other competitors, it's hard to imagine why the metaverse failed to take off.

At one time, artists like Sir Elton John and Travis Scott hosted concerts in the metaverse, while users explored cities and visited art exhibitions in virtual spaces.

Yet four years after CEO Zuckerberg’s strategic pivot, the metaverse has become one of the most significant failures in recent tech history. With its grand promises unfulfilled, the flood of billions of dollars into the space has receded, and public interest has plummeted.

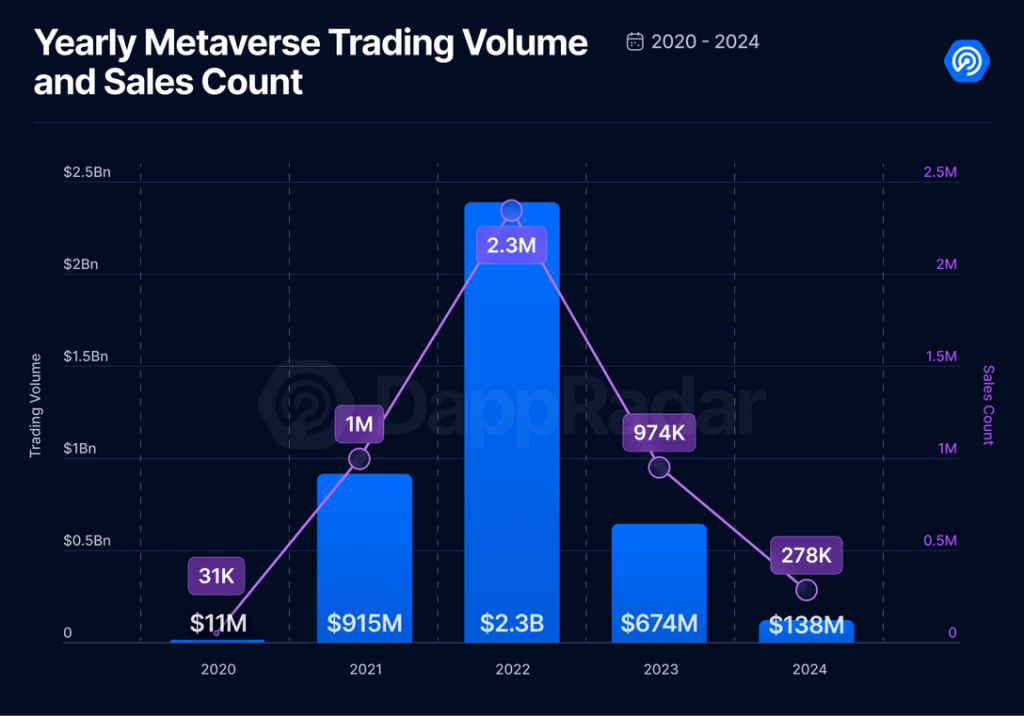

According to DappRadar data, transaction volumes and sales numbers for metaverse NFT projects in 2024 have dropped to their lowest levels since 2020, with trading volume down 80% year-on-year and sales falling 71% compared to the previous year.

Source: DappRadar

AI Steals the Spotlight from the Metaverse

Experts cite the emergence of generative AI chatbots—such as OpenAI’s ChatGPT and Google’s Gemini—as a primary factor behind the metaverse’s decline.

Irina Karagyaur, co-founder and CEO of BQ9 ecosystem growth agency, told Cryptonews: "Generative AI delivers immediate and scalable business impact."

Karagyaur, also an expert member of the ITU (International Telecommunication Union) Focus Group on the Metaverse, added:

Unlike the metaverse, which requires expensive infrastructure investment, AI tools like ChatGPT, MidJourney, and DALL·E offer instant usability. Businesses and consumers are shifting toward AI due to automation benefits and enhanced content creation efficiency. Venture capital has shifted dramatically—funding is flooding into AI startups while metaverse projects face downgrades.

Herman Narula, CEO of metaverse venture builder Improbable, told Cryptonews that AI played a significant role in the metaverse’s downfall.

He said AI captured industry attention as the “next disruptive technology,” diverting focus away from the metaverse. However, he noted this evolution involved multiple additional factors.

"The term 'metaverse' was criticized for being tied to speculative crypto hype, with companies raising large sums, selling assets, and making promises they ultimately couldn’t deliver," Narula explained.

"More importantly, early versions or prototype metaverses fell short of expectations, offering closed and limited environments that severely restricted user activities."

After Meta (formerly Facebook) announced its entry into the metaverse space, related tokens such as Decentraland (MANA), The Sandbox (SAND), and Axie Infinity (AXS) surged in price.

Now, amid growing skepticism about Meta’s metaverse ambitions, these token prices have crashed despite extremely low daily active user counts.

Since peaking in November 2021, SAND, MANA, and AXS have all dropped more than 95% from their highs. MANA once reached $6.96, SAND surpassed $5.20, and Axie Infinity’s AXS briefly hit around $153.

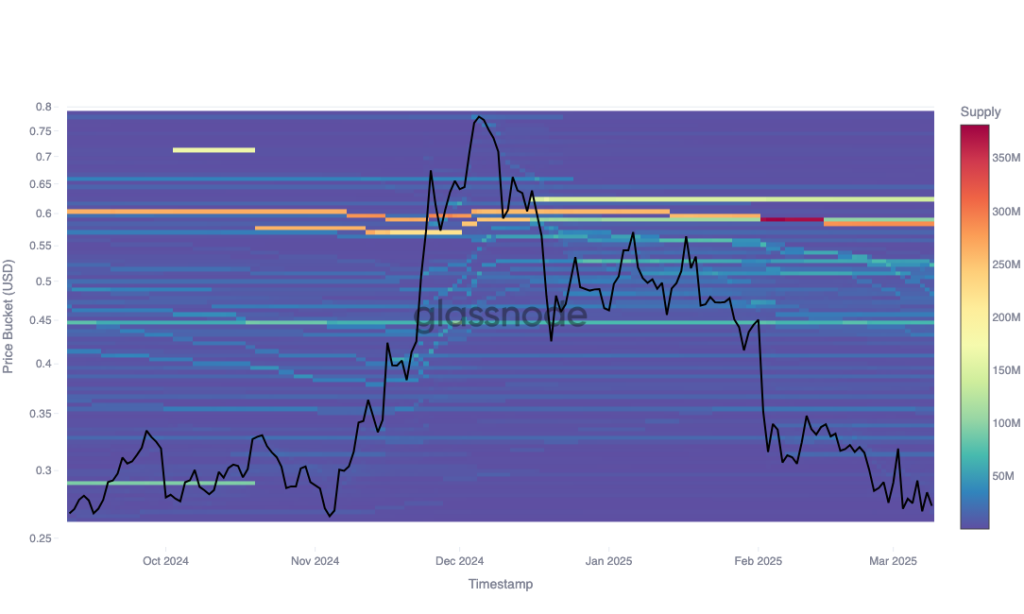

However, a recent on-chain analysis by crypto research firm Glassnode shows that despite extreme price volatility, “true believers” in these three projects are steadily accumulating positions.

Glassnode noted that MANA formed a significant accumulation zone around $0.60, reflecting increased buying activity following price declines. Similar accumulation patterns were observed for SAND and AXS.

Glassnode stated: "Ongoing accumulation of major metaverse tokens suggests many investors see these projects as undervalued opportunities rather than failures."

CoinGecko data shows that at the time of writing, Decentraland’s native token MANA trades at $0.27, down 2%; The Sandbox’s SAND falls 3.2% to $0.28; and Axie Infinity’s AXS drops over 1% to $3.43.

Hardware Barriers Hinder Adoption

Charu Sethi, a Web3 expert and Polkadot’s Chief Ambassador, told Cryptonews that the metaverse business model wasn’t fully mature when the concept gained popularity.

"Brands rushed to launch NFTs and high-priced virtual land projects, but few users received lasting value," she said. "For example, despite attracting millions in investment, both Decentraland and The Sandbox have long struggled to maintain daily active users above 5,000."

Sethi also pointed to the high cost of premium VR and AR headsets and “complex login processes” as further barriers to mainstream adoption.

Hardware is critical to enhancing the metaverse experience.

"As a result, funding and attention have shifted to AI, which offers immediate ROI," she emphasized. "For many businesses, the fast returns from AI make the metaverse look underwhelming."

As part of the metaverse race, Meta and Apple launched VR headsets enabling users to immerse themselves in virtual spaces.

With these devices, users can do various things in the metaverse via avatars—gaming, socializing, even virtual office work. But these headsets come at a steep price.

Apple’s Vision Pro costs $3,500, while Meta Quest 3 starts at $500. In contrast, AI tools like ChatGPT offer limited free services, with a $20/month premium version providing unlimited access—no extra hardware required.

Karagyaur, a metaverse expert at the International Telecommunication Union (ITU), noted that VR headset market growth has stalled because devices like Apple Vision Pro and Meta Quest 3 “only appeal to niche audiences and haven't broken into the mass consumer market.”

She said: "Without sustainable monetization models, the high-cost, high-risk nature of the metaverse is increasingly difficult to justify."

Kim Currier, Marketing Director at the Decentraland Foundation, stressed that the metaverse isn’t just about VR/AR hardware. "It creates shared virtual spaces where humans collaborate, socialize, explore, and build together," she emphasized.

Currier added: "While Apple Vision Pro and Meta Quest 3 have sparked innovation waves, there remains a fundamental truth for consumers: wearing headsets all day isn’t practical."

Currier is more interested in how AI and the metaverse can benefit real people—whom she calls “core metaverse users.”

The Decentraland executive does not view the rise of generative AI as “competition,” but rather as an “opportunity,” stating:

"AI tools can accelerate virtual world-building, help track real-time dynamics in virtual spaces, and make experiences more dynamic and personalized. AI will help virtual worlds evolve in ways we’re only beginning to explore."

Industry Shakeout

Decentraland Foundation’s Kim Currier attributes the metaverse slowdown to “overinflated expectations creating a bubble, technological bottlenecks, and structural shifts in the tech industry.”

Currier told Cryptonews that the current cooling phase represents a restructuring of industry value, with this shakeout filtering out true builders:

"Like every bear market cycle, this is an industry purge—clearing space for committed builders who understand the boundaries of the metaverse and will focus on products users actually need."

BQ9’s CEO Karagyaur stressed that the metaverse is not dying, but evolving through a technological paradigm shift—the sector is “transforming into AI-powered vertical application clusters guided by public demand.”

"While the initial hype may have faded, what remains is something far more meaningful: a shift from corporate-controlled virtual worlds to human-centered, community-driven ecosystems," she elaborated, adding:

"Industrial applications—like Siemens and NVIDIA’s collaboration in digital twins—continue advancing, but real momentum has shifted to platforms like Roblox, Fortnite, and Life Beyond. Here, user communities—not corporations—shape the experience. These platforms don’t sell escapism—they empower creation, connection, and collaboration."

Sethi, representing the Polkadot blockchain project, cited industry data showing that gaming platform Roblox surpassed 80 million daily active users in 2024, hitting a peak of 4 million concurrent users this year, leading in metaverse user engagement metrics.

Epic Games’ phenomenon Fortnite maintains strong growth—with recent operational data indicating that single-event reach consistently exceeds tens of millions, solidifying its position as a top-tier metaverse social entertainment platform.

Sethi provided a deep dive into Fortnite’s ecosystem empowerment model—through strategic collaborations with luxury brands like Balenciaga and blockbuster IPs like Star Wars, the platform has built a commercial loop with over one million daily retained users, proving the sustained value-creation potential of metaverse IP operations.

Hope in the Darkness

Experts say Zuckerberg’s bold metaverse gamble has turned into a full-blown disaster. In 2024, Meta’s Reality Labs—the division responsible for metaverse development—reported a record $17.7 billion operating loss.

Meta’s official financial reports show that Reality Labs has accumulated nearly $70 billion in losses over the past six years. While Zuckerberg’s metaverse dream appears shattered, several projects within the ecosystem continue to grow against the odds.

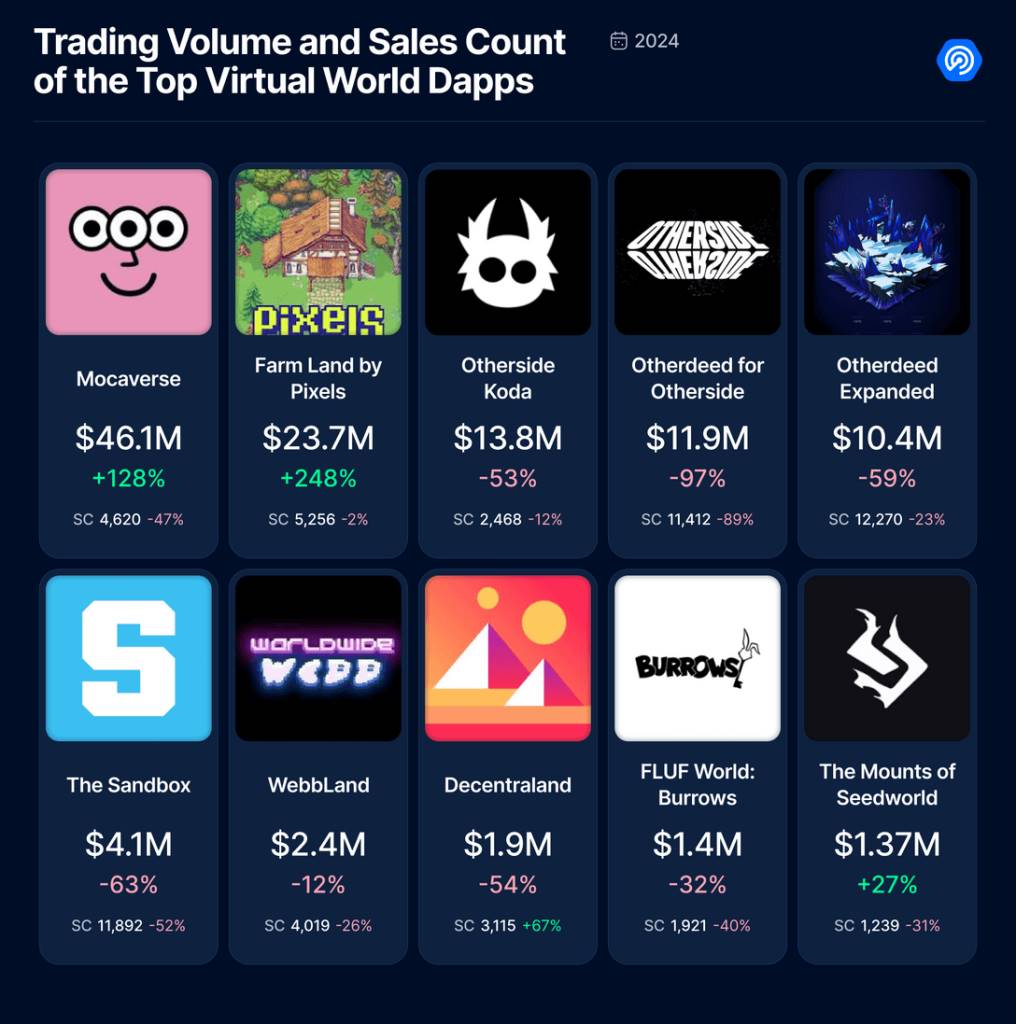

DappRadar’s Blockchain Analytics Agency released its 2024 Gaming Industry Report, spotlighting two standout metaverse projects that achieved dual breakthroughs in user scale and commercial value through differentiated ecosystem strategies: identity protocol Mocaverse and blockchain gaming platform Pixels.

Source: DappRadar

Launched by Animoca Brands, the Mocaverse project introduced its MOCA token and Moca ID—a decentralized on-chain identity solution—quickly attracting 1.79 million registered users and integrating with 160 Web3 applications.

The report noted the project secured $20 million in funding to expand its ecosystem and launched Realm Network, aimed at “enabling interoperability across gaming, music, and education.”

Pixels first launched in 2022. Last year, this browser-based multiplayer farming game “gained massive traction,” surpassing one million daily active users.

The Pixels project migrated from Polygon to Ronin Network and integrated its “farm land NFT” assets into the Mavis Marketplace.

DappRadar also highlighted key developments from Yuga Labs’ Otherside metaverse, The Sandbox, and Decentraland. Notably, Decentraland launched a new desktop client, reportedly “enhancing performance and optimizing visuals.”

The report emphasized that Decentraland’s creator-centric economy is a “defining feature”—creators retain 97.5% of their sales revenue and earn a 2.5% royalty on secondary transactions, setting an industry-high benchmark for revenue distribution.

Nonetheless, significant shortcomings persist. According to DappRadar:

"Due to the lack of a 'killer app' capable of driving mass adoption, media attention has waned, and companies that previously invested heavily in virtual worlds have redirected their focus elsewhere."

Is the Metaverse Fading Away?

Karagyaur, ITU metaverse expert, told Cryptonews that the success of the metaverse will “depend on integration, not isolation.” She explained:

"It will only thrive where it complements existing industries, not where it tries to replace them. The next stage of digital technology won’t aim for escapism—it will focus on improving reality itself."

Narula, founder and CEO of Improbable—the company behind Yuga Labs’ The Otherside metaverse—stated that value-driven innovation will save the metaverse. Beyond flashy visuals, utility is essential for users.

"The metaverse has always been a deeper, more grounded concept rooted in fulfilling fundamental human needs for self-expression and identity," he said.

"While the flashy, Meta Investor Day-style metaverse is fading, the technically sound, pragmatically focused version we’re building remains resilient."

Narula also noted that teenagers and younger users “spend substantial time on platforms like Minecraft, Roblox, and Fortnite, engaging in increasingly complex virtual experiences, economic activities, and even virtual jobs.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News