One-Day Plunge of 60%: Unveiling the Whale's Secret Manipulation Tactics Behind AUCTION

TechFlow Selected TechFlow Selected

One-Day Plunge of 60%: Unveiling the Whale's Secret Manipulation Tactics Behind AUCTION

How do "market manipulators" carry out large-scale distribution under a situation that "appears to favor the bulls"?

Author: Fairy, ChainCatcher

A covert and highly efficient manipulation game unfolded over the weekend.

Within just a few weeks, an unknown entity accumulated over 20% of the total AUCTION supply, driving trading volume spikes, growing open interest, and a continuously rising CVD—appearing at first glance to be a strongly bullish market. Yet behind this façade, the "whale" was quietly and precisely offloading their holdings.

The token price formed a "Christmas tree" pattern—seemingly climbing higher, but in reality concealing deadly traps. What kind of manipulation scheme was this? How did the "whale" manage to distribute such a large position under the guise of a bull-run? This article will uncover the truth behind this orchestrated market play.

AUCTION Market Anomalies: Whale Manipulation Emerges

AUCTION is the governance token of Bounce Brand, a decentralized auction platform integrating liquidity mining, decentralized governance, and staking mechanisms.

Last night, Bounce Brand issued a statement clarifying that the team had not participated in any price manipulation of AUCTION, while disclosing several unusual market activities:

In recent weeks, an unidentified entity has acquired more than 20% of the total AUCTION supply.

Trading volume for AUCTION surged across major exchanges. On Binance, the AUCTION futures pair became the third-largest trading pair after BTC and ETH. On Upbit, AUCTION spot trading volume surpassed BTC for multiple consecutive days.

A significant premium emerged in AUCTION’s trading price on Upbit, with large amounts of AUCTION being withdrawn from major exchanges for arbitrage opportunities.

Moreover, market liquidity showed clear imbalances, reflecting a series of unhealthy conditions:

Binance’s hot wallet holdings dropped sharply, now holding less than 10% of the total AUCTION supply.

Lending rates exceeded 80% annualized, and funding rates remained negative at around -2% over multiple cycles.

Major exchanges adjusted position limits and risk controls for AUCTION perpetual contracts.

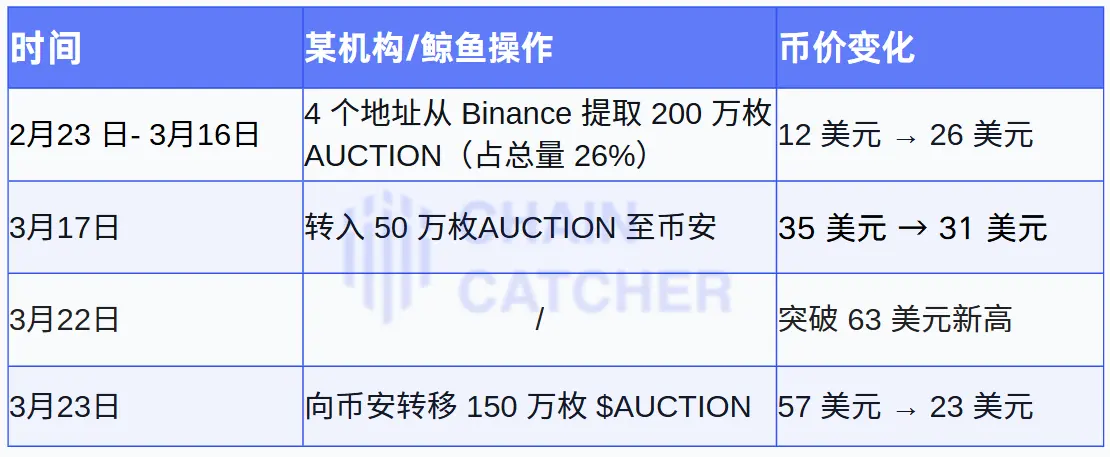

Based on monitoring data from Yujin, we have compiled the key movements of the AUCTION whale alongside price changes:

Given the whale's capital flows and the observed market anomalies, AUCTION’s price action cannot be explained by simple buying pressure—it reveals a far more complex manipulation strategy.

Covert Distribution: The “Passive Sell Order” Manipulation Strategy

During AUCTION’s sharp decline, market data displayed seemingly contradictory signals: CVD (Cumulative Volume Delta) continued to rise, funding rates climbed, and open interest increased. Under normal logic, rising CVD and increasing open interest suggest strong inflows of aggressive buy orders, which should push prices upward. However, AUCTION’s price kept falling—a clear case of market divergence.

According to analysis by crypto KOL Biupa-TZC, the "whale" behind AUCTION employed a highly concealed "passive sell order" distribution strategy, successfully dumping a massive position while maintaining the illusion of a bullish market.

1. Placing Large Passive Sell Orders

The whale placed massive passive sell orders near the current market price, allowing aggressive buy orders to hit these bids and execute trades.

Since spot supply was largely controlled by the whale, there were almost no aggressive sell orders in the market. CVD is calculated as aggressive buy volume minus aggressive sell volume. With minimal aggressive selling, CVD kept rising—even as price remained suppressed.

2. Creating the Illusion of Price Strength

The whale avoided aggressively dumping, instead making it appear as though only buy-side activity existed, creating a false impression of upward momentum.

With CVD steadily climbing and open interest increasing, retail traders mistakenly believed institutional capital was flooding in, prompting them to go long or attempt to catch the falling knife.

3. Gradually Absorbing Buy-Side Liquidity to Distribute Holdings

The whale continuously posted new passive sell orders, systematically absorbing incoming buy-side liquidity.

Each time aggressive buyers hit these passive sell walls, temporary liquidity vacuums emerged. The whale then slightly lowered the next layer of sell orders, gradually pushing the price down.

Because of the high volume involved, these weren’t merely suppressive orders—they represented actual selling, ultimately leading to a sharp collapse in AUCTION’s price.

The End of the Game: A Wake-Up Call for the Market

The dramatic surge and crash of AUCTION was a carefully orchestrated capital reallocation and market manipulation operation. Although Bounce Brand has stepped in to stabilize market liquidity—providing support across multiple exchanges and locking up approximately 1.5 million AUCTION tokens—this incident still exposes the hidden risks and complexities lurking within the crypto markets.

For ordinary investors, this serves as a profound lesson: blindly following market signals when trading high-volatility assets can easily turn one into fodder for whales. Only through vigilance and deep analysis of market dynamics can traders hope to survive—and thrive—in the ever-changing landscape of digital asset trading.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News