Fed's Dovish Turn at March Meeting: Is This the Turning Point for Crypto Markets?

TechFlow Selected TechFlow Selected

Fed's Dovish Turn at March Meeting: Is This the Turning Point for Crypto Markets?

Is the crypto market rebounding or reversing?

Author: Bright, Foresight News

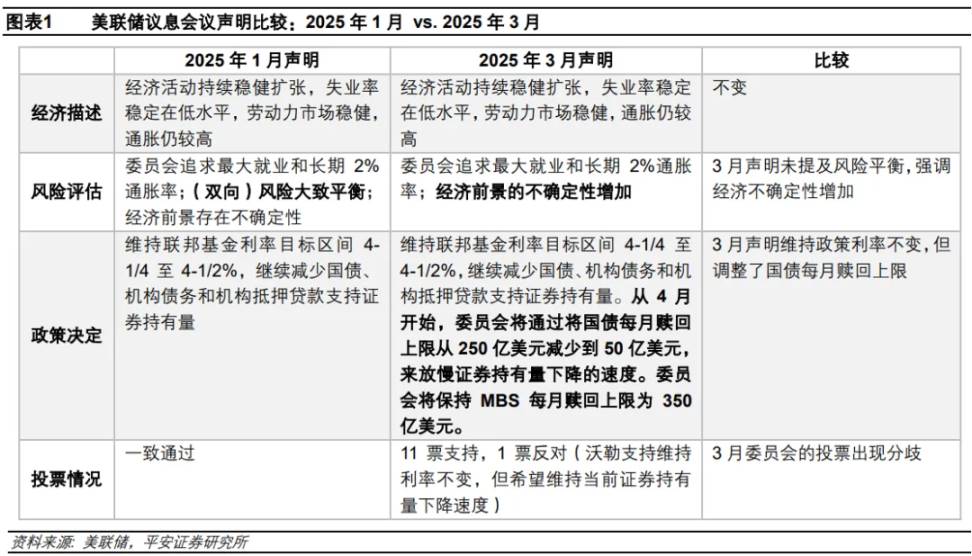

On March 19, the U.S. Federal Reserve concluded its two-day monetary policy meeting and announced that it would maintain the federal funds rate target range at 4.25% to 4.50%, in line with market expectations.

The cryptocurrency market responded positively, with Bitcoin posting a "nine consecutive green candles" pattern on the four-hour chart, reaching a high of $87,453.67. Ethereum broke strongly out of its consolidation range, surpassing the $2,000 mark and peaking at $2,069.90. Market liquidity outlook improved relatively.

As of 13:00 on March 20, total liquidations across the entire market reached $355 million over the past 24 hours, including $257 million in short liquidations and $97.74 million in long liquidations, primarily shorts being liquidated. Notably, prior to the Fed’s FOMC meeting, Ethereum’s breakout surge briefly caused its network-wide liquidation amount to exceed Bitcoin’s.

Powell: The Fed Needs “Technical Adjustments”

The Fed held rates steady as expected, but sent numerous dovish signals. In his press conference at the White House, Fed Chair Jerome Powell mentioned the word “uncertainty” 16 times within an hour, repeatedly emphasizing the uncertain outlook for the U.S. economy.

Compared to the January meeting, the Fed removed the statement that “risks to achieving employment and inflation objectives are roughly balanced” from its release, while raising its 2025 core PCE inflation forecast to 2.8%. This adjustment may signal weakening confidence in a soft landing for the economy, prompting global markets to begin pricing in future rate cuts.

Meanwhile, starting in April, the monthly cap on U.S. Treasury securities runoff will sharply decline from $25 billion to $5 billion, while the MBS runoff cap remains unchanged at $35 billion. Although Powell described this move as a “technical adjustment,” markets interpreted the Fed’s significant slowdown in balance sheet reduction as a sign that Quantitative Tightening (QT) is entering its final phase. As a result, U.S. Treasury yields immediately dropped by 8–11 basis points, gold surged past $3,050 per ounce to hit a new all-time high, and both the Nasdaq and Dow Jones indices rose.

Trump: Cut Rates Immediately!

Following the FOMC meeting, Trump posted on Truth Social: “With U.S. tariffs beginning to transition into the economy (loosening!), the Fed had better cut interest rates. April 2nd is American Liberation Day!!”

Trump forcefully demanded that the Fed “immediately cut rates,” blaming high interest rates as a continuation of “Biden inflation.” Last month, he posted on Truth Social: “Interest rates should be lowered—they will go hand-in-hand with upcoming tariffs!!” His core logic appears clear: rate cuts would reduce the cost of servicing the government’s $36 trillion debt, while complementing tariff policies to drive manufacturing repatriation.

Previously, Trump’s chief economic advisor Kevin Hassett publicly stated that the White House forecasts 2025 GDP growth at 2.5%, significantly higher than the Fed’s latest projection of 1.7%. This divergence stems from Trump’s optimism about tariff policies—he believes protectionist measures can “revive manufacturing,” though economists warn they could trigger a global trade war and push U.S. inflation above 2.5%. Fitch Ratings noted that Trump’s proposed tariffs and the “huge uncertainty” surrounding them are two key drivers behind potential economic slowdown and near-term price increases. This uncertainty could freeze any Fed rate-cutting action, widening the rift between Trump and the central bank.

Crypto Seasonal Shift: Gradual Recovery

In the native crypto market, recent regulatory tailwinds have driven early recovery in certain tokens, potentially accelerating broader market回暖 under a looser macroeconomic backdrop.

On March 12, the Abu Dhabi sovereign fund’s $2 billion investment in Binance directly boosted BNB and the BSC ecosystem, leading the charge in blockchain recovery and spawning viral BSC meme coin phenomena such as MUBARAK, which surpassed a $200 million market cap. On March 19, according to DeFiLlama data, BSC’s DEX 24-hour trading volume reached $2.664 billion, exceeding Ethereum’s $1.356 billion and ranking first globally.

On the evening of March 19, positive news that “the U.S. SEC will drop its appeal in the Ripple case” directly triggered a 11.46% spike in XRP, reaching a high of $2.59. On March 20, Ripple CEO Brad Garlinghouse told Bloomberg that an XRP ETF is expected to launch by the end of 2025, and added that an IPO for Ripple Labs is not out of the question.

Regarding future market trends, Arthur Hayes, co-founder of BitMEX, tweeted on X: “Powell has delivered on his promise—Quantitative Tightening (QT) essentially ends on April 1. To truly ignite a bull market, either the Supplemental Leverage Ratio (SLR) exemption must be reinstated, or Quantitative Easing (QE) restarted. $77,000 may be Bitcoin’s bottom, but equities might need further turbulence before Jay (Powell) fully aligns with Team Trump.”

Wall Street traders have already begun pricing in rate cuts for June and July. However, in the short term, participants in the crypto space should remain agile—after all, the “sword of Damocles” of April 2 tariff implementation still looms overhead. Perhaps, as Arthur Hayes suggested, it’s time to “keep cash ready in hand.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News