Keeta Network: The Return of the "Ripple Killer"? Even VC Coins Are No Longer Playing Marketing Games

TechFlow Selected TechFlow Selected

Keeta Network: The Return of the "Ripple Killer"? Even VC Coins Are No Longer Playing Marketing Games

"Sexy" L1 public chain surges online with "contrasting" pump.

By Bright, Foresight News

Recently, payment-focused blockchain Keeta Network announced its TGE (Token Generation Event) on Base. After a brief pullback to a $6 million FDV, its token $KTA experienced a "value discovery," surging 1000% over the past week. On March 19, $KTA reached an all-time high FDV of $160 million, with the price climbing from $0.006 to $0.16.

Such gains aren't unusual for memecoins, but Keeta Network—previously obscure and shrouded in FUD—turns out to be a legitimate Silicon Valley-backed Layer 1 payment chain.

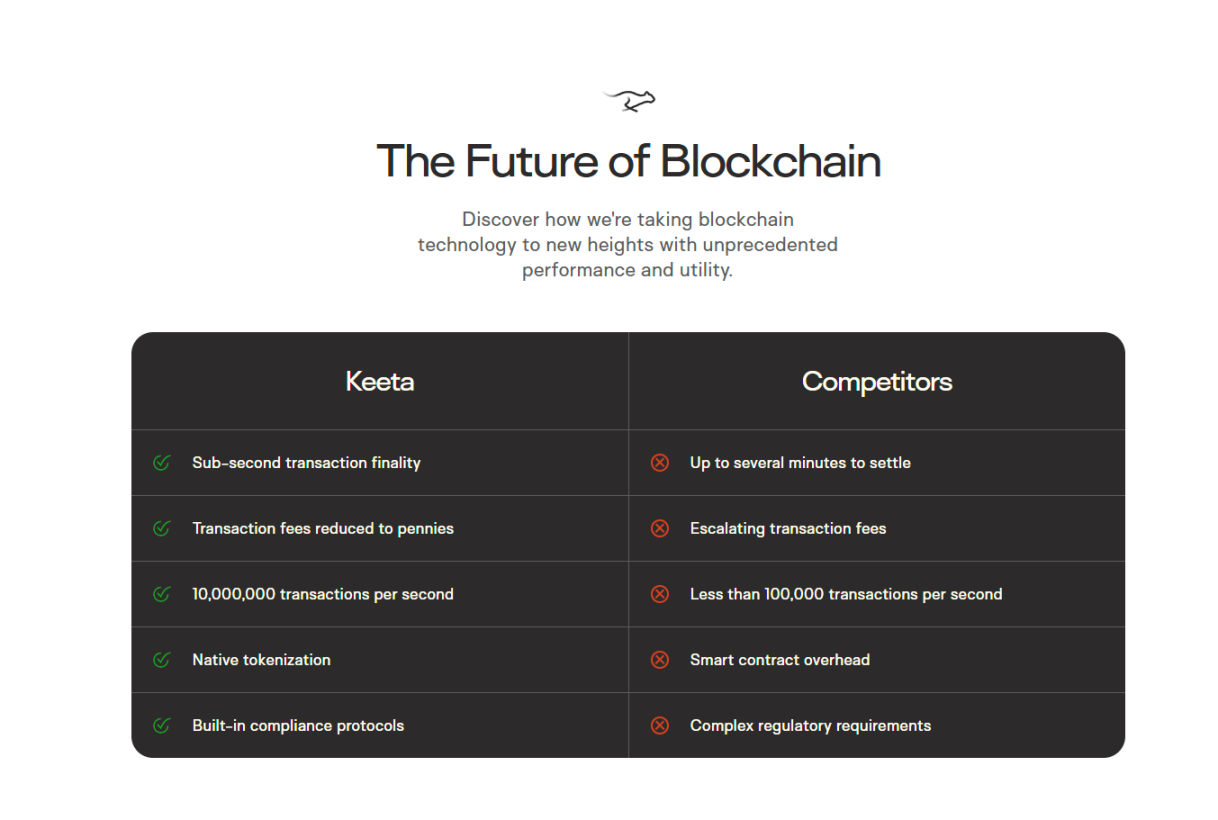

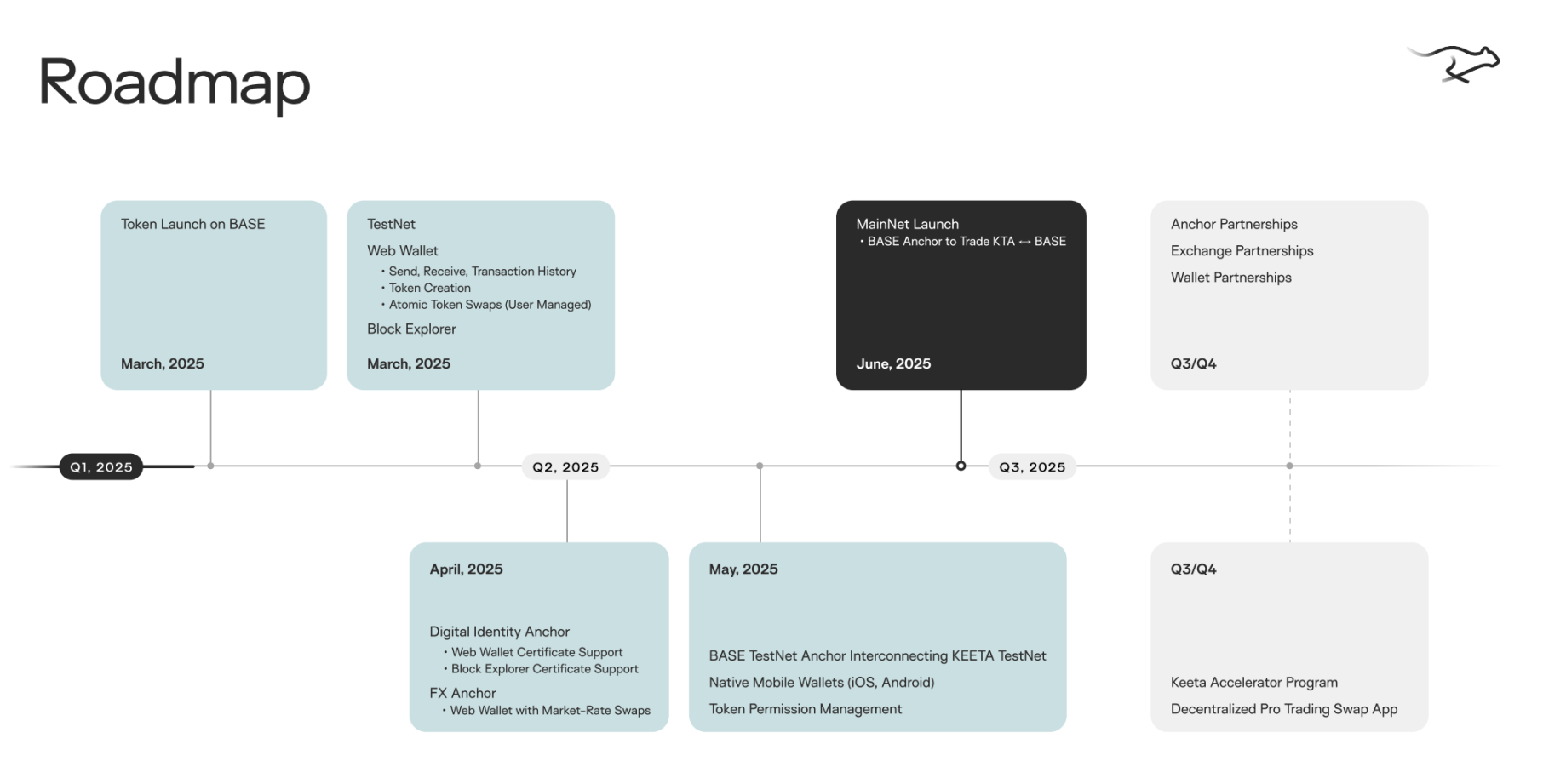

A Payment L1 That Sudden-Dropped Its Token on Base—Zero Marketing Sparks FUD

According to its official whitepaper, Keeta Network is a delegated Proof-of-Stake (dPoS) blockchain system powering global blockchain banking and serving as an ideal bridge between TradFi and DeFi. It claims its electronic ledger can process over 50 million transactions per second. Financial institutions can connect via API or custom integration, leveraging Keeta’s real-time payment rail network to settle cross-border remittances within minutes at fees 50–70% lower than traditional channels. As of now, Keeta has announced that its L1 supports 10M TPS and 400ms settlement. Starting in early June 2023, Keeta officially launched services in the U.S., Canada, Mexico, Brazil, the UK, and the EU, adopting an invite-only pilot model for B2B payments.

Keeta's founder and CEO Ty Schenk stated, “Keeta aims to make international money transfers as simple and fast as Venmo payments, eliminating concerns about fund security for both senders and receivers.” Schenk added that while SWIFT is better suited for large transfers exceeding $1 million, Keeta holds a clear advantage in instant, small-value payments.

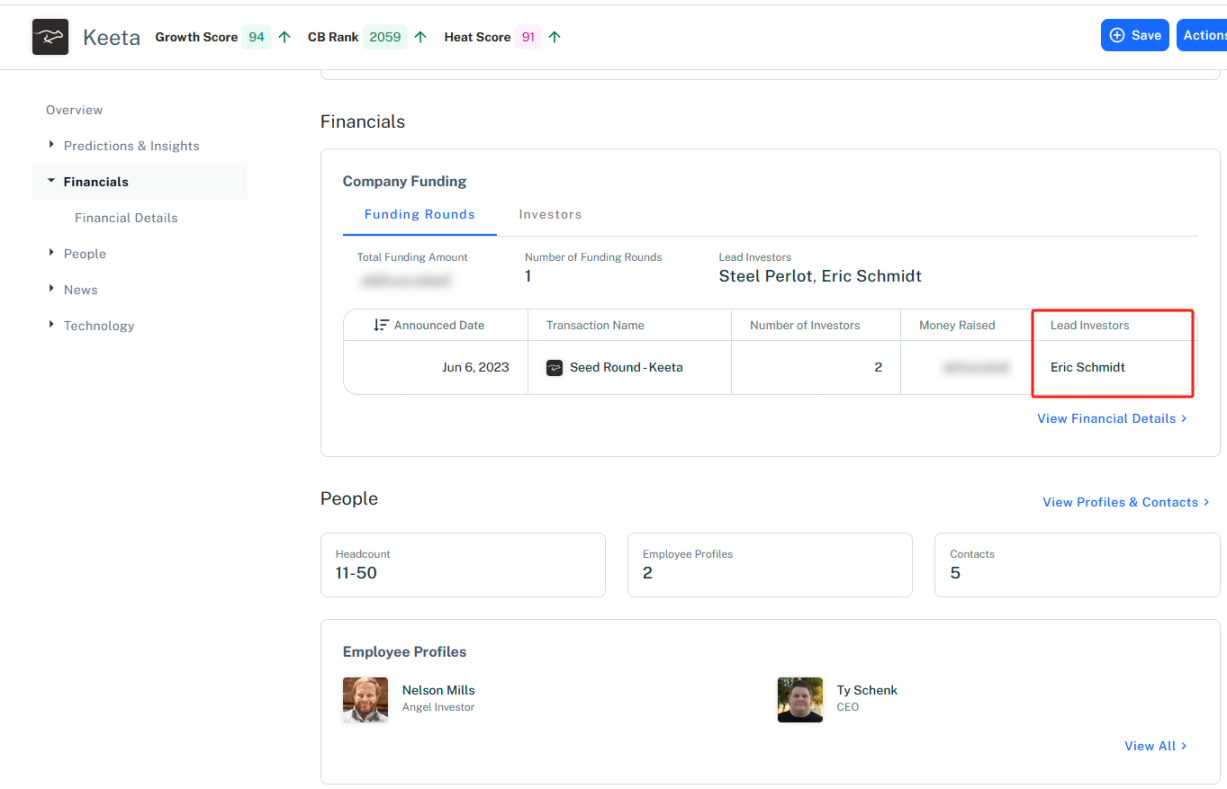

Judging by technical expertise and funding history, Keeta Network is far from a casual project. The CTO of Keeta Network is Roy Keene, former lead developer at Nano, who left the company aiming to reform Nano’s incentive mechanisms and institutional adoption. In June 2023, Keeta Network announced a $17 million funding round led by Eric Schmidt, former CEO of Google. Ty Schenk revealed that the investment valued the company at $75 million.

Yet despite its impressive pedigree, Keeta Network launched a surprise attack on March 5, conducting its TGE directly on Base with zero prior announcement. Several hours later, it finally published its tokenomics and Telegram group link on X—but the previous post on Keeta’s account was a lone “hello world” from October 22, 2022.

FUD quickly followed. Some questioned whether Keeta had been hacked and a fake contract deployed; others suspected the team was orchestrating a pump-and-dump scheme. Most criticism centered on the non-transparent TGE enabling widespread pre-mining. Unsurprisingly, $KTA’s price began a steady decline.

The Keeta team immediately hosted a Space session to prove legitimacy. However, seemingly oblivious to crypto marketing norms, Keeta Network barely engaged with community concerns through official posts. Its social presence—meager follower count and near-zero Twitter activity—appeared stuck in a "very early" stage. Soon, the official account was left tweeting alone about being the “fastest payment chain,” “decentralized,” and “fully compliant,” with few comments other than confusion and anger. In the short term, Keeta found itself trapped in a dual crisis of falling price and spreading FUD.

Just Drop Good News—Can a “Contrast Effect” Fuel a Massive Pump?

But precisely because of this unconventional approach, Keeta’s “value discovery” was merely delayed—not denied.

During the prolonged price slump, Keeta took repeated steps to prove legitimacy: publishing the contract address (CA) on its website, having the founder repeatedly confirm on Twitter that the TGE was indeed official. Then, amid lingering skepticism, they executed a lock-up consistent with their roadmap. Founder Ty Schenk interacted with Aerodrome (Base’s DEX), and frequently posted videos on his personal Twitter showing progress on the Keeta Testnet, easing doubts among on-chain degens. As of March 19, the top eight individual addresses collectively held 6.48% of $KTA, with a net inflow of $460,800 and net outflow of $112,100 over the past week—indicating growing bullish sentiment among whales.

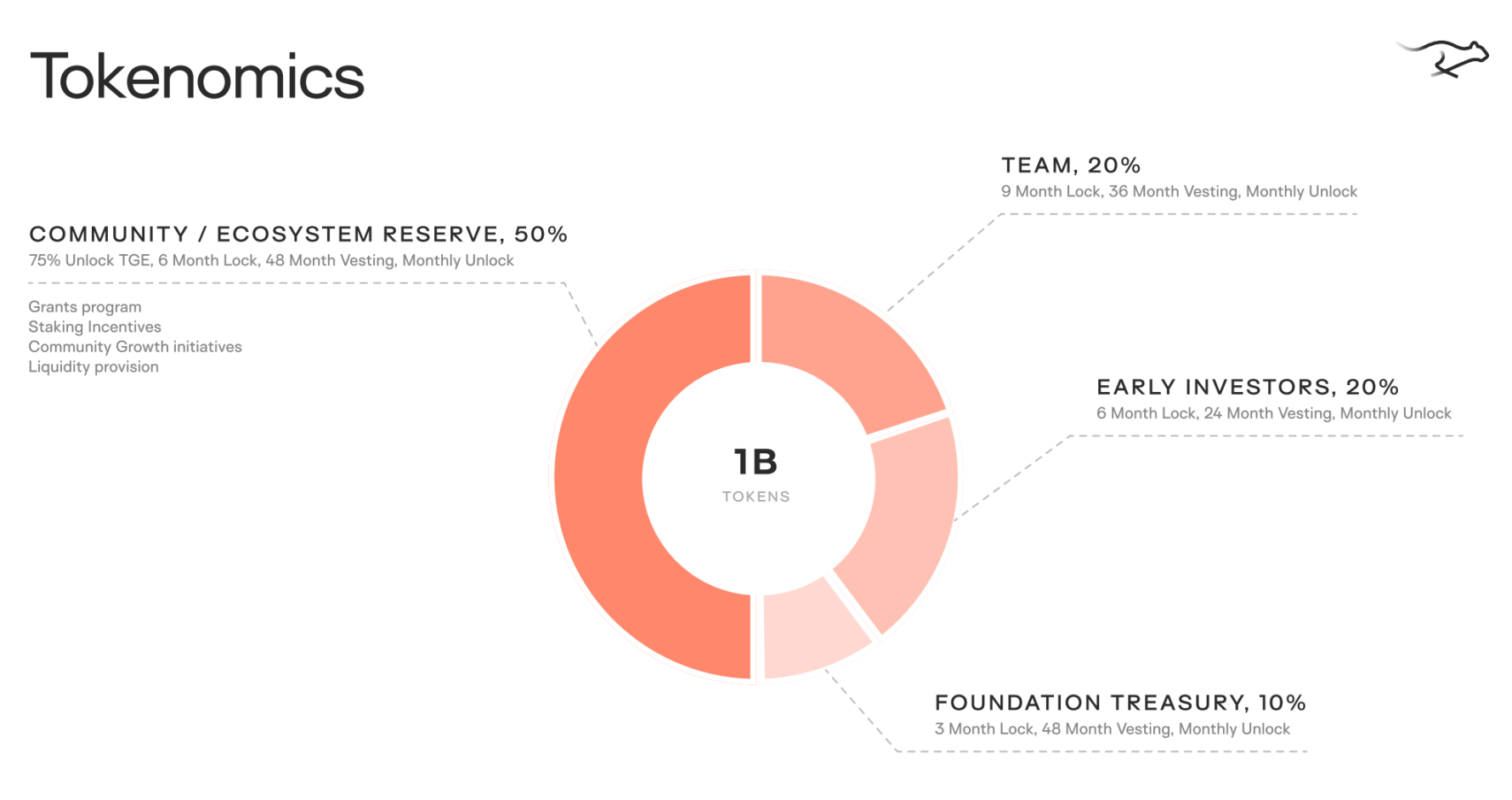

Moreover, Keeta’s tokenomics are strikingly simple and aggressive. Team allocation: 20%, locked for 9 months, then linearly unlocked over 36 months with monthly distributions. Early investors: 20%, locked for 6 months, then linearly unlocked over 24 months. Foundation: 10%, locked for 3 months, then linearly unlocked over 48 months. Community/Ecosystem: 50%, with 75% unlocked at TGE and the remainder locked for 6 months before linear unlocking over 48 months. Relatively low circulating supply gives ample room for future price appreciation.

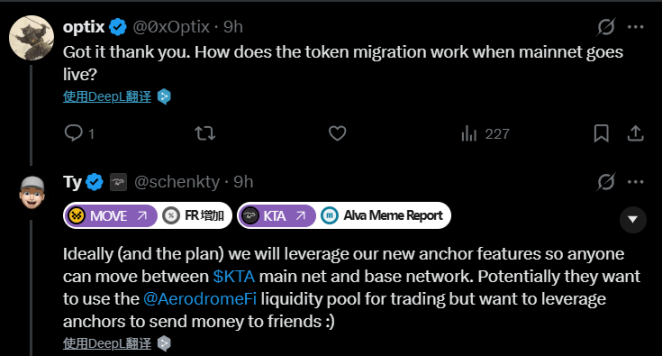

When asked by the community why Keeta Network, as an L1, chose to launch its token on Base (an L2), Ty Schenk clarified: Base offers significantly lower fees than the Ethereum mainnet, and Keeta did not want to be lumped in with memecoins. Ideally—and as part of Keeta’s plan—the new bridging functionality would allow $KTA to move from Base to the mainnet.

As the founder continued engaging directly with the community and addressing concerns transparently, $KTA carved out a unique trajectory—defying the typical "same-day dump" fate of most memecoins and instead performing like a well-backed VC gem. This rare success underscores once again the importance of DYOR. Could this offer a blueprint for other VC-funded projects struggling after listing on CEXs only to crash 90%?

In an era ruled by hype and speculation, even the mere appearance of innocence—a “white flower” amidst chaos—can rekindle crypto’s geek culture and decentralized ideals, prompting the market to hit buy. When every project follows the same playbook—marketing, user acquisition, conversion—chanting “something big is coming,” perhaps a shift in market sentiment is already underway. Whether Keeta stumbled into brilliance or played it smart remains unclear—but reality has undeniably favored Keeta.

When marketing fades and FOMO cools, how should we assess value? Perhaps it’s time to sharpen our vision through dull markets and cultivate true discernment.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News