Dragonfly Partner: How I Missed the Opportunity to Invest in Solana's Seed Round?

TechFlow Selected TechFlow Selected

Dragonfly Partner: How I Missed the Opportunity to Invest in Solana's Seed Round?

Missed 3,250x returns: one of the most expensive investment memos in crypto history.

Original author: @hosseeb

Translation: TechFlow

TechFlow Note: On the occasion of Solana's fifth anniversary, Hosseeb, a partner at Dragonfly Capital, shared a thread today reflecting on how he missed the opportunity to invest in Solana’s seed round back in 2018 at $0.04 per token—and with it, a return of over 3,000x. He attached the original investment memo as a nostalgic keepsake. We’ve also included selected exchanges between Solana co-founder Toly and Hosseeb under that tweet.

Here is the full original post:

I passed on the chance to invest in @solana's seed round at $0.04 in early 2018.

At current prices, that’s a 3,250x return I’ve missed out on.

Solana was one of the first projects I evaluated as a junior VC. Back then, I was adorably naive and confident—writing detailed memos for every deal I passed on.

Re-reading this memo now is pure "peak junior VC cringe." We were all obsessed with finding the “Ethereum killer,” analyzing consensus protocols, and debating which tech would replace EVM / eWASM.

So here’s the unedited memo—the worst investment miss of my career.

Happy birthday, Solana! 🎂

Memo Content

-

My quick notes after reading the whitepaper:

-

Their key innovation is Proof of History (PoH). Essentially, it’s a verifiable time-delay function using sequential hashing, similar to sequential proof-of-work. In short, a designated timekeeper continuously iterates hash operations on a value and publishes all intermediate hashes. Since this process must be executed serially on a single core and can’t be parallelized, nodes should be able to predict the elapsed time between consecutive hashes (probably based on their understanding of hardware performance?).

-

PoH nodes also mix in any current state (e.g., transactions to be committed) into these hashes, enabling a reliably timestamped history of events.

-

If the PoH node fails or goes offline, they propose a mechanism where multiple PoH nodes periodically mix their states with each other.

-

A set of validator nodes replay and verify the PoH node’s operations (with verification potentially parallelized efficiently via a MapReduce-like architecture). These validators reach consensus using a PoS protocol similar to Casper. If a PoH node is found to be Byzantine or misbehaving, validators can elect a new one.

-

They plan to build payment and smart contract functionality.

-

They claim up to 710,000 TPS and achieved 35,000 TPS on a single-node testnet.

-

My thoughts:

-

Their numbers are completely bullshit. 710,000 TPS is laughable—Google doesn’t even do 100,000 searches per second. The fact that this number is front and center on their website makes me deeply suspicious.

-

Take back what I said earlier about the whitepaper being well-written. High-level content is decent, but technical details are severely lacking and vague. As a description of a consensus protocol, the rigor is disappointing.

-

The team consists mostly of low-level engineers from Qualcomm. The CEO and CTO have backgrounds in operating systems, embedded systems, GPU optimization, and compilers. Their experience in distributed systems and cryptography is clearly weak—and it shows in the paper. Poor handling of Byzantine fault tolerance. Reminds me of the Raiblocks/Nano whitepaper (also written by low-level engineers).

-

And things like this in the whitepaper raise red flags:

[Excerpt from Solana Whitepaper, Section 5.12]

"PoH allows network validators to observe past events and their timing with a degree of certainty. When the PoH generator produces a stream of messages, all validators are required to submit signatures of their state within 500ms. This value can be further reduced based on network conditions. Since each validation is fed into the stream, everyone on the network can verify whether all validators submitted their votes within the timeout, without directly observing the voting process."

-

This is not a consensus protocol. Assuming a 500ms message delivery limit as part of consensus is highly problematic and does not meaningfully achieve Byzantine fault tolerance. Also, how do they measure 500ms? Given they estimate time passage based on the number of iterative hashes executed, how do other nodes in the system agree on when 500ms has elapsed? Furthermore, how will they handle clock speed drift over time due to hardware improvements, failures, or noise? Time in distributed systems is extremely complex, and I don't think they realize how hard it is.

-

Besides, who cares about time? Is timing really a major problem in blockchain? Are people really dissatisfied with 15-second or 1-second block times (like DFINITY and others)? I don’t think this is a meaningful problem, and the complexity and messiness they introduce into the protocol don’t seem to deliver much value.

-

They have a section dedicated to attacks and incentive misalignment. Their responses to potential attacks are entirely unconvincing and again lack rigor or detail.

-

They devote an entire chapter to Proof of Replication, just like Filecoin. What the hell? Tell me about your consensus protocol, how you handle transactions and accounts, and what properties your blockchain will have. I don’t care about data storage proofs.

-

There’s a long section starting to describe smart contracts, but it only says they’ll use LLVM as a backend to support multiple platforms. That’s it—nothing else.

-

A lot of emphasis on GPUs and parallelization. This reveals a strange obsession—if they need to build a BFT consensus protocol and a functional smart contract platform, they shouldn’t be fixated on parallelizing their packet formats. I remember their presentation was the same—spending most of the time discussing node processing optimizations and barely any time actually describing their consensus protocol.

Conclusion: I would absolutely not invest in this project.

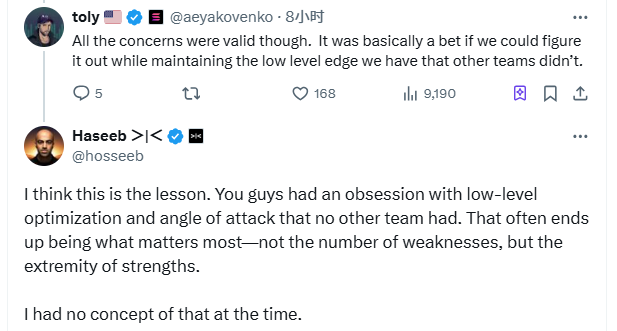

Interestingly, five years later, when Haseeb @hosseeb tweeted his congratulations to Solana for securing its place in crypto—and poked fun at his younger self for missing such a massive opportunity—Solana co-founder Toly @aeyakovenko replied to the tweet: “All your concerns were valid back then. At its core, it was a bet—that we could solve all those problems while maintaining low-level advantages no other team had.”

Haseeb then replied to Toly: “I guess that’s the lesson. Your team’s relentless focus on low-level optimizations and unique attack vectors was something no other team possessed. That extreme emphasis on playing to your strengths—and ignoring weaknesses—is what mattered most. I completely failed to see that at the time.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News