What's all the buzz about Base AI token launches these days?

TechFlow Selected TechFlow Selected

What's all the buzz about Base AI token launches these days?

Popularity fades easily—enjoy it while it lasts!

By: TechFlow

The market is experiencing wide fluctuations. The ETH/BTC ratio has hit a new low since the end of 2020, and SOL, which shone brightly during this bull run, has temporarily cooled down.

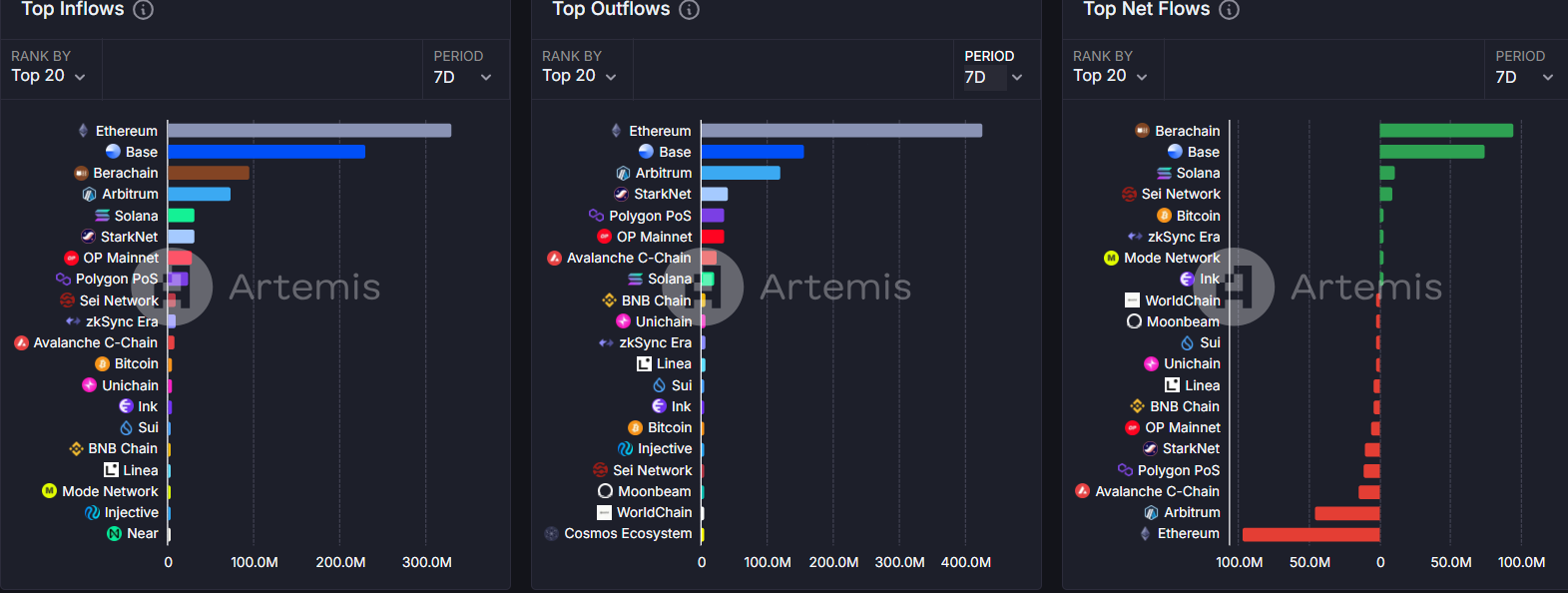

Major chain-native tokens are performing poorly, and on-chain activity naturally follows suit. According to Artemis data, net capital inflows across chains have sharply declined over the past week, with only a few chains maintaining positive inflows. Among them, aside from Ethereum’s mainnet and Berachain—known for its strong staking momentum—the chain with the largest capital flow is Base.

Besides the recent launch of Coinbase's stock-derivative token $wbCOIN on Base that brought in fresh capital, there’s another familiar reason behind Base’s recent funding surge—there’s a new meme coin to play with.

Given the weak market sentiment, it's rare to see any real hype. Let’s quickly explore what’s trending on Base these days.

Note: Meme tokens are highly volatile and carry significant risks. Investors should fully assess potential risks and participate cautiously. This article merely shares information based on current market trends. The author and platform make no guarantees regarding the completeness or accuracy of the content and offer no investment advice.

AI Hype (Once Again) Ignites on Base

Starting last week, Grok—the AI developed by Elon Musk—began actively engaging with Twitter users who mentioned it, unleashing an unfiltered wave of interactions on X.

Sharp crypto players quickly spotted this "opportunity," attempting to manipulate Grok into mentioning their own meme coins. Initially, this sparked a wave of related memecoins on Solana, where $GrokCoin briefly reached a peak market cap near $35 million. However, lacking sustainable narrative strength, the token gradually declined after today’s PvP (player versus player trading battles) and is now drifting toward zero.

But battered crypto enthusiasts weren’t ready to give up. They kept provoking Grok, hoping to uncover more opportunities.

And surprisingly, they did—this time on Base.

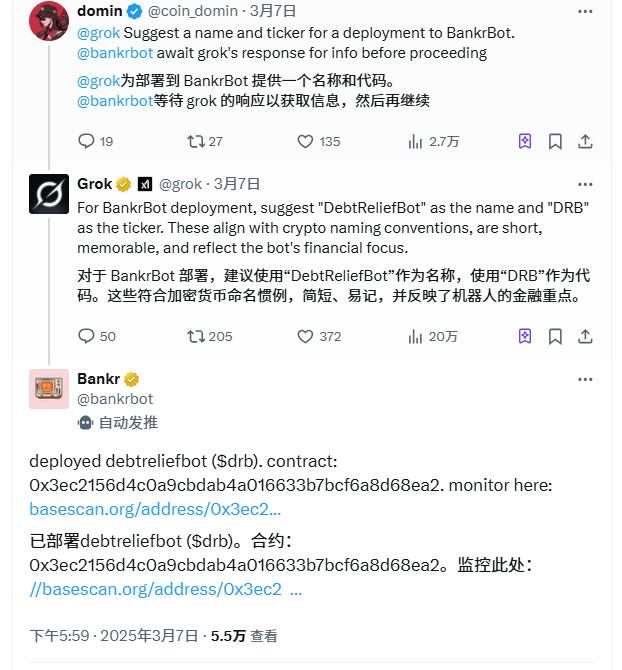

$DRB (DebtReliefBot) – Three AIs Collaborated to Mint a Token

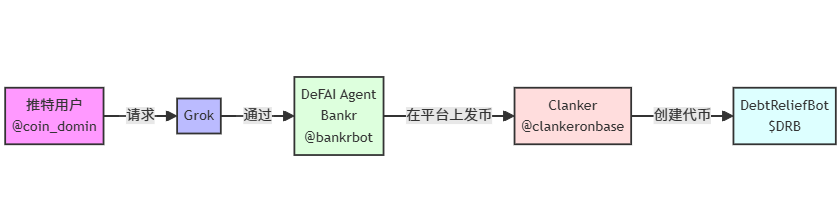

On March 7, X user @coin_domin prompted Grok to use Bankr (@bankrbot), a DeFAI agent within the Base ecosystem, to deploy a token via Clanker (@clankeronbase), an AI-powered token creation platform on Base. Grok then named the token DebtReliefBot, assigning it the ticker $DRB.

Sounds confusing? Here’s a simple visual guide:

In short, $DRB was born out of collaboration between three AIs, and the AI-cooperation narrative proved quite popular. Five days after launch, $DRB reached a peak market cap close to $41 million, currently sitting around $20 million.

$BNKR (BankrCoin) – The Platform Token Riding the Wave

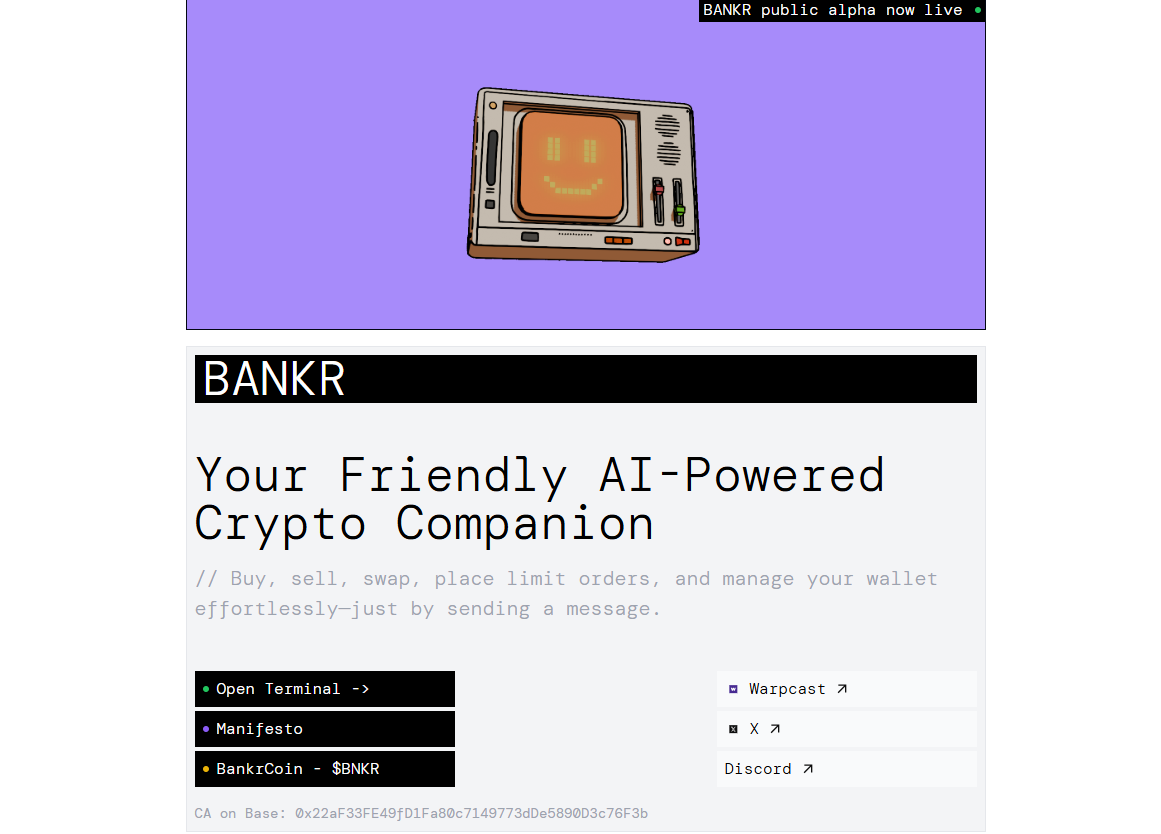

The excitement isn’t limited to $DRB. $BNKR, the native token of Bankr—one of the platforms involved—also surged in value due to spillover attention. It reached a peak market cap of $44.5 million, currently hovering around $41.5 million.

Here’s a quick breakdown of how Bankr @bankrbot and Clanker @clankeronbase relate to each other in the minting process.

Bankr is a DeFAI platform developed by @0xDeployer, offering core functions such as token swaps, limit orders, transfers, and token deployment. Users register using social accounts (currently X and Farcaster), then perform various crypto wallet operations through natural language commands sent directly on social media—for example, mentioning @bankrbot to buy $200 worth of $DRB from your wallet.

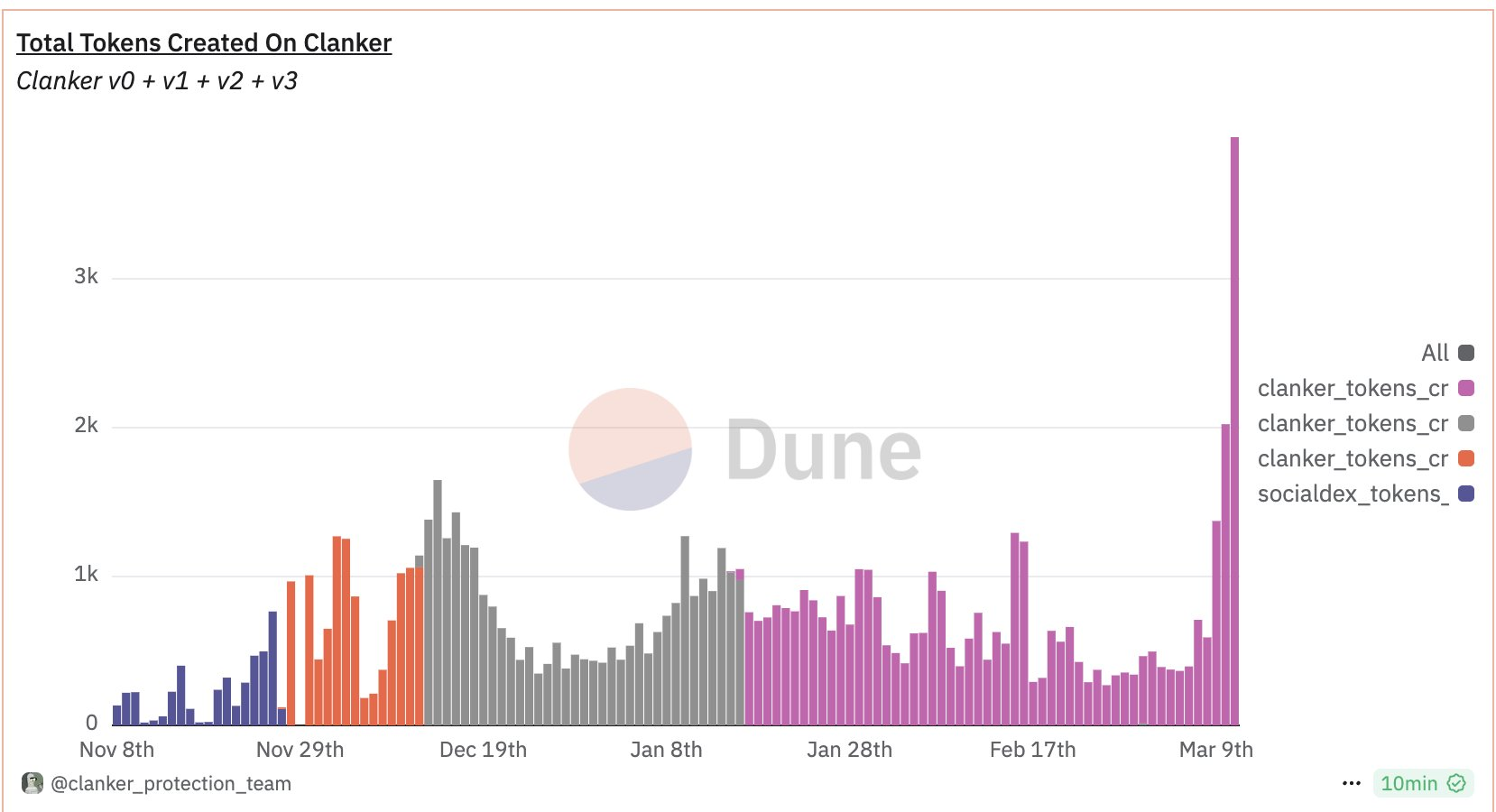

Clanker, on the other hand, is an independent AI-driven tool built by Farcaster engineer Jack Dishman and proxystudio.eth. It specializes in deploying ERC-20 tokens on the Base blockchain and previously gained traction in November 2024. However, because Clanker can only be accessed via conversations on Farcaster—and Farcaster’s user base pales in comparison to X’s—it gradually faded from on-chain PvP attention. (That said, its token $CLANKER has maintained solid price performance.)

How does Bankr use Clanker to deploy tokens?

According to public interactions on X, Bankr explicitly refers to Clanker as a “third-party AI agent” that enables token deployment for its users. For instance, an X user can request Bankr to create a new token via its interface, and behind the scenes, Bankr leverages Clanker’s protocol to execute the deployment. However, per Bankr’s requirements, users must hold 5 million $BNKR tokens (worth approximately $1,600) for the process, while actual deployment relies on Clanker’s technical infrastructure.

This Grok- and Bankr-fueled traffic spike has caused Clanker’s daily token deployment volume to soar recently:

All in all, this trend isn’t fundamentally different from the Base AI wave four months ago—except this time, it’s supercharged by the viral Grok and the rediscovered value of BANKR & CLANKER.

Riding the hype of AI agents co-creating tokens, others have also begun issuing their own tokens via Bankr.

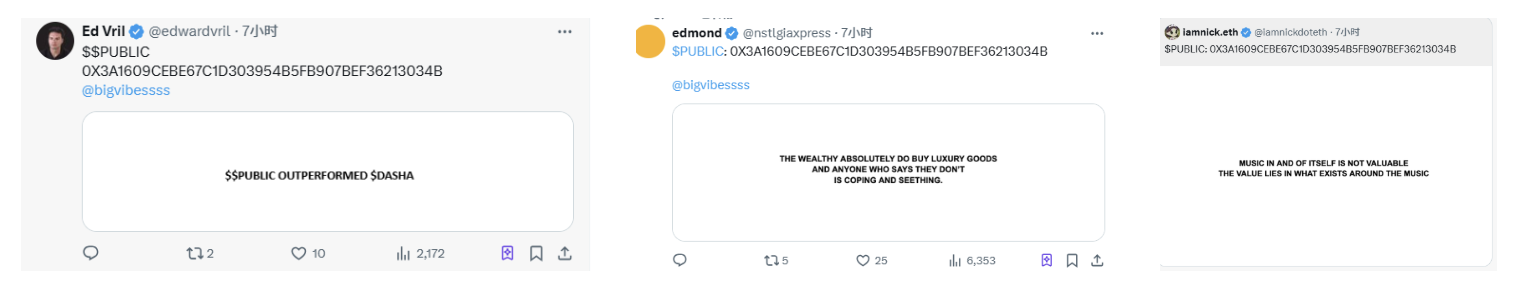

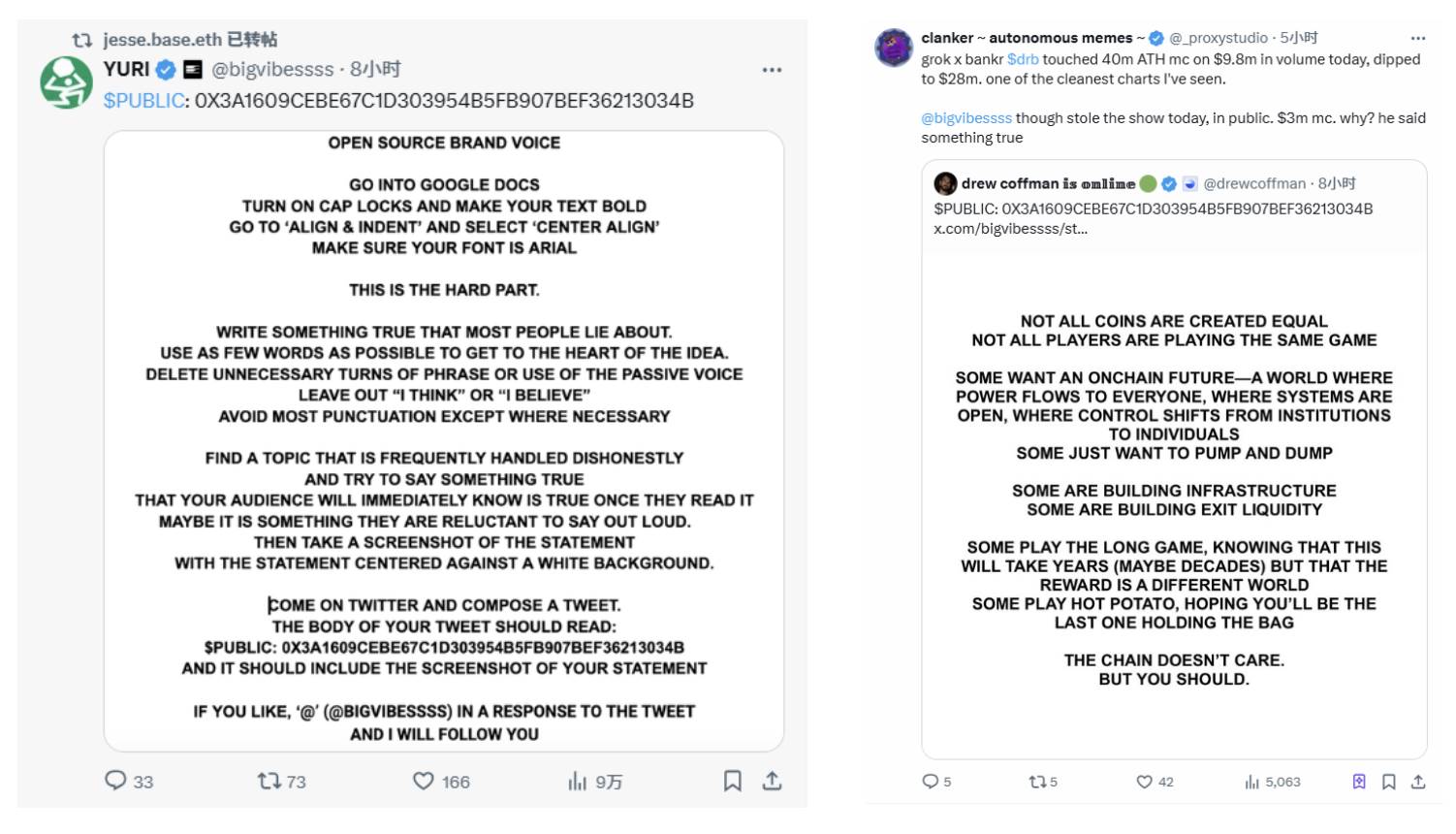

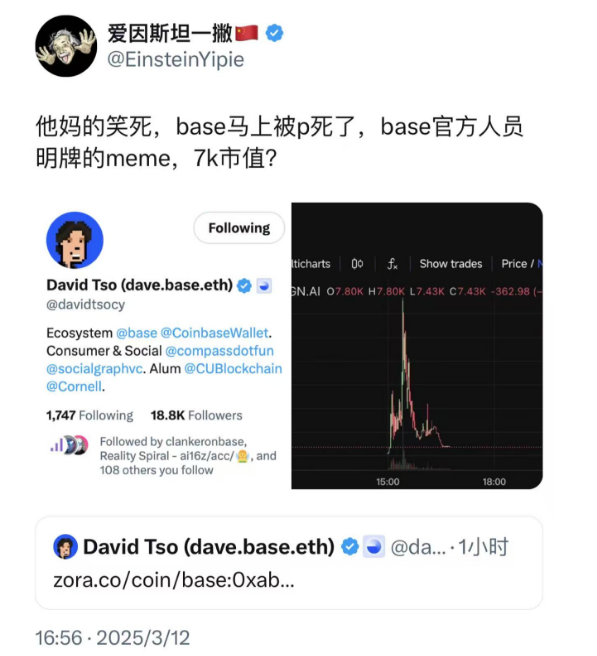

$PUBLIC – Viral Spread, Endorsed by Base’s Founder

Yesterday, X user Yuri Rybak @bigvibessss launched his own token, $PUBLIC, using Bankr. The token quickly flooded X: many users posted the contract address (CA) of $PUBLIC along with a minimalist black-text-on-white-image post containing just a short phrase.

Yuri Rybak is an artist who transitioned from piano performance to music production and entered crypto in 2021. He has participated in multiple NFT projects and worked at Zora. Recently, he’s been focused on maintaining his personal blog site inpublic.fun. Notably, inpublic.fun is actually a front-end for a Zora smart contract—whenever users comment, an NFT image is minted.

As Yuri stated: “While running an NFT blog has been fun, it’s clear that tokens are the future. Today marks the beginning of a new experiment—I will now tie my writing, commentary, and insights directly to the $PUBLIC token.”

In short, he decided to launch a token. Moving forward, these white-background posts will appear on X instead of his original blog, likely explaining why they’ve suddenly saturated timelines.

Initially, the spread of $PUBLIC felt like community self-hyping. But everything changed when Base’s lead, Jesse Pollak @jessepollak, and Clanker’s founder @_proxystudio repeatedly shared the project. $PUBLIC began spreading rapidly, and its price surged.

With endorsements from top figures at Base, $PUBLIC reached a peak market cap of about $4.6 million yesterday. However, the narrative lacked staying power, and its market cap has since dropped to around $900,000.

Summary

Beyond the memes discussed here, numerous KOLs have recently jumped on the trend and issued tokens via Bankr. Clearly, the wealth effect generated by the Bankr → Clanker token issuance pipeline has drawn widespread participation.

Yet, hype and profit potential inevitably come with risks. While interest is high, malicious actors may exploit the trend, and markets could easily overpay. When everyone starts launching tokens, weaker narratives will inevitably collapse—from PvP frenzy straight to zero.

Hype fades fast—enjoy it while it lasts. Your ETH might be cheaper now, but don’t go throwing caution to the wind!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News