312 Fifth Anniversary: If we've made it through 312, what is there left to fear?

TechFlow Selected TechFlow Selected

312 Fifth Anniversary: If we've made it through 312, what is there left to fear?

What doesn't kill me, will make me stronger.

By TechFlow

It's March 12 again—a number that still sends shivers down the spine of countless crypto investors.

March 12, 2020, Thursday. I was lounging in my rental apartment after work, casually browsing the web, when after 6:30 PM my phone began constantly alerting—like a horror story unfolding:

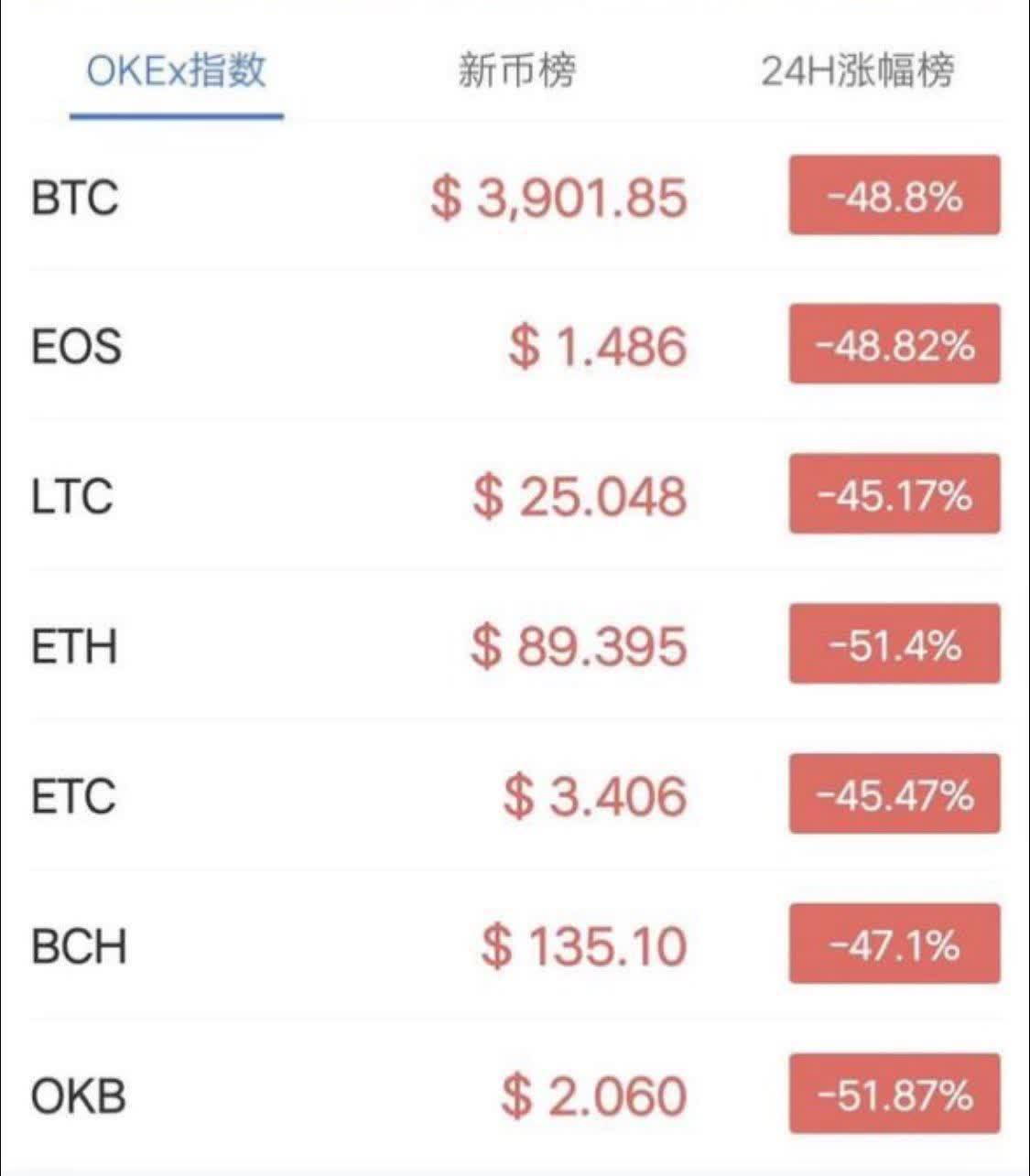

Bitcoin plunged from around $7,000 in free fall, with no resistance, hitting a low of $3,800—the largest single-day drop in Bitcoin’s history at the time.

Ethereum tumbled even more dramatically, falling from around $200 to just $90, a decline exceeding 50%.

Crypto faced its darkest day. Communities echoed with despair. Shocked and heartbroken, I couldn’t help but wonder: Is this industry gone? Should I switch careers?

My pessimism wasn't unfounded. Panic spread like wildfire. That night, even PayPal co-founder Max Levchin reportedly told his team: "This industry is dead."

Bitcoin fell in a cascade—from $7,000 to $6,000, then $5,000—each drop triggering a chain reaction of leveraged liquidations. Over 100,000 positions were wiped out—even those using only 2x or 3x leverage weren’t spared. Ethereum kept dropping; DeFi protocol MakerDAO suffered liquidations and faced bad debt risks...

Exchanges were overloaded. Multiple platforms crashed. It felt like the end of the world.

In that crisis moment, BitMEX—the largest derivatives platform at the time—went offline. Later, many across the industry widely believed that BitMEX going dark (pulling the plug) saved the market; had they not, Bitcoin would have faced an even deeper price collapse.

The March 12 crash wasn’t an isolated incident—it was a perfect storm fueled by multiple factors:

Global pandemic outbreak: COVID-19 rapidly spread worldwide, triggering widespread market panic;

Traditional financial markets crashed: U.S. stocks experienced two circuit breakers within a single week—an unprecedented event. Nasdaq dropped 8.4% in one day, while the Dow Jones recorded its worst single-day fall since 1987;

Oil price crisis: The oil price war between Saudi Arabia and Russia intensified market fears. Oil prices plummeted—later even turning negative.

These were external macro forces. Internally, excessive leverage built up over time was suddenly triggered, leading to panic selling, liquidity drought, and further accelerating price declines.

In summary, the global financial meltdown caused by the pandemic, combined with the crypto market’s early structural flaws of “high leverage + low liquidity,” together created this crisis.

Yet it was precisely this crisis that became a turning point for the maturation of the crypto market.

After March 12, Bitcoin embarked on a long and steady recovery.

From its March 2020 low of $3,800, it reached nearly $69,000 in November 2021, and by January 20, 2025, briefly broke through $108,000—a gain of over 28x.

Ethereum rose from its $90 low to a peak of $4,800—an increase of more than 53x.

SOL dropped as low as $0.50 before surging to a high of $293—a staggering rise of over 580x.

More importantly, the March 12 crisis catalyzed multiple innovations across the crypto industry:

Explosive growth of DeFi: Following March 12 came the "DeFi Summer," launching the most spectacular wealth creation era in crypto history.

Accelerated institutional adoption: Major players like MicroStrategy and Tesla began adding Bitcoin to their balance sheets; El Salvador adopted Bitcoin as legal tender.

Improved market structure: The crypto derivatives market matured, and liquidity provision mechanisms became more robust.

Every veteran who lived through March 12 likely looks back with both fear and regret—fear of experiencing such turmoil again, and regret for not going all-in at the bottom. In crypto, brutality and opportunity often go hand in hand.

Those projects and investors who survived March 12 all endured extreme trials.

No matter how the market evolves in the future, we’ve already witnessed the worst-case scenario. We can now say confidently: If we survived March 12, what do we have to fear?

Since its inception, Bitcoin has been declared “dead” over 400 times. From the first major crash in 2011, to the Mt. Gox disaster in 2014, the bear market depths of 2018, to the March 12, 2020 plunge—Bitcoin has weathered countless brutal drawdowns of 80% or even 90%.

Yet each time, it rose from the ashes, setting new all-time highs. This extraordinary resilience perfectly embodies Nietzsche’s words: "What does not destroy me makes me stronger."

Bitcoin’s history teaches us that in this highly uncertain market, what matters most isn’t short-term gains or losses—but long-term survival. As long as you stay alive, you’ll have the chance to create new miracles.

As Warren Buffett said: "The first rule of investing is don’t lose money. The second rule is don’t forget the first rule." In crypto, this wisdom becomes: "The first rule is to survive. The second rule is never forget the first rule."

Finally, let’s repeat it once more: If we survived March 12, what do we have to fear?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News