Ethereum at a Crossroads: Prices and Fundamentals Under Pressure

TechFlow Selected TechFlow Selected

Ethereum at a Crossroads: Prices and Fundamentals Under Pressure

The price of ETH is not only a reflection of market sentiment but also a key factor in whether Ethereum can unify its community vision, balance decentralization and performance, and solidify its position as the leading smart contract platform.

Author: Jiawei @IOSG

Preface

▲ Source: Jon Charbonneau

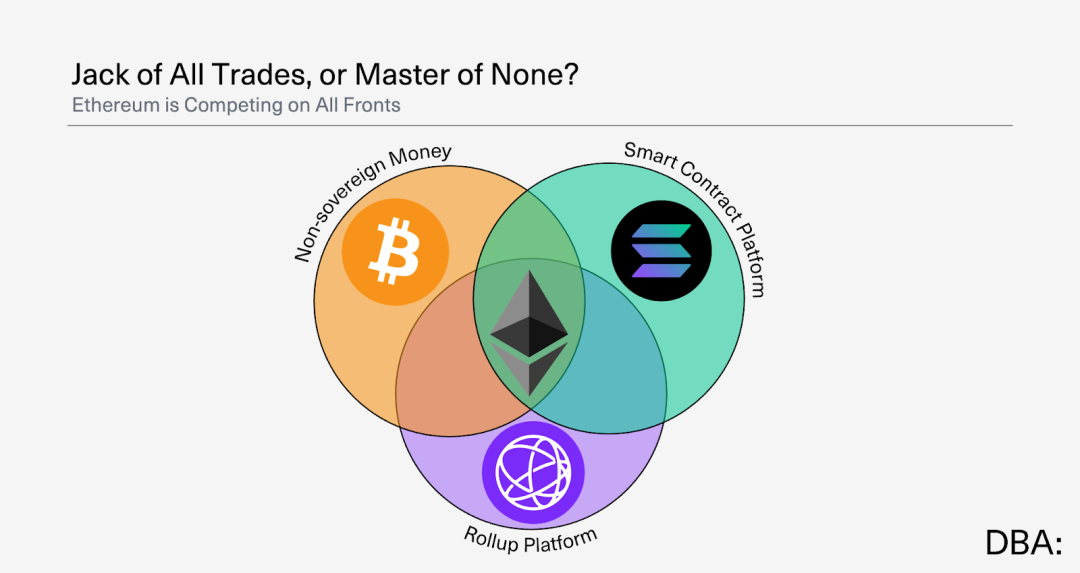

Jon Charbonneau, co-founder of dba, published an article titled "Ethereum's North Star" at the end of last year, pointing out that Ethereum lacks a clear "North Star" goal. In earlier tweets, Jon also noted that even within the Ethereum community, there is no consensus on its core product.

Since this cycle began, discussions about ETH's underwhelming price performance have been ongoing. Overall, ETH's price reflects not just market sentiment but also whether Ethereum can unify its community vision, balance decentralization with performance, and solidify its position as the leading smart contract platform.

Inspired by the above article, this piece will discuss what I perceive as some emerging issues for Ethereum.

ETH Price – It Does Mean Something

In this cycle, we've seen the ETH/BTC exchange rate hit multi-year lows, while SOL/ETH continues to reach new highs—becoming a major point of criticism from the community toward Ethereum.

Technical enthusiasts at the Ethereum Foundation (EF) are dismissive of community concerns over ETH’s price, often labeling critics as short-term speculators. While it's true that protocol design shouldn't be driven solely by price, completely avoiding price discussion is equally problematic. This section explores why ETH's price matters.

#ETH price directly impacts EF's runway

According to EF’s 2024 report, as of October 2024, EF held approximately $970.2 million in total assets, including $788.7 million in cryptocurrency (99.45% in ETH) and $181.5 million in non-crypto assets.

Assuming a burn rate of $130 million per year and stable ETH prices, the current treasury could sustain operations for about 7.5 years. A drop in ETH price would shorten this runway; conversely, a rise would extend it.

The $130 million burn rate is considered high. The community has previously criticized EF for staffing bloat (around 200 people), with only 35% being technical staff. Stani Kulechov, founder of Aave, suggested reducing the burn rate to $30 million and cutting headcount to 80.

#Protocol Security

ETH price directly affects the cost of attacks under PoS consensus. While real-world attacks must also consider geographically distributed validators and slashing mechanisms, price remains a key factor.

After transitioning to PoS, ETH price directly influences stakers' returns. Falling ETH prices reduce real yields, potentially causing validator exits and weakening network security. Lido’s TVL is now around $20 billion, nearly 50% lower than its peak of $40 billion in December last year. During the same period, the SOL/ETH trading pair surged over 3x, with SOL staking yields roughly double those of ETH—this may drive many stakers to shift from Ethereum to Solana in the next cycle.

#Confidence of ecosystem participants

No explanation needed—price is the result of ecosystem participants (developers, users, investors, etc.) voting with their feet. In a cycle where mainstream sentiment is generally bearish on Ethereum, poor price performance risks triggering a negative feedback loop.

Early Ethereum developer and EIP-1559 co-author eric.eth recently wrote that as Vitalik steps back, EF is increasingly disconnected from the community, with growing opacity. Faced with Solana's expansion and EF's "anti-competition" stance, he has received numerous questions from early Ethereum builders asking, “Why stay in this ecosystem?”

ETH’s price is a mirror—it deserves attention and respect from EF.

Decentralization is a Spectrum, So Is Competition

Different people, standing in different positions, naturally understand decentralization differently. A memecoin trader on Solana doesn’t need a blockchain capable of resisting nation-state attacks; for them, it’s enough that memecoin token distribution, dev runs, and insider wallets are visible on-chain.

▲ Source: dba

Likewise, competition and non-competition are relative concepts. I believe Ethereum faces two main competitive pressures.

As a store of value asset

In my previous Ethereum staking report, I argued that ETH serves as a reserve asset in various protocol DAO treasuries, collateral in CeFi and DeFi, and a unit of account and medium of exchange in NFT trading, MEV pricing, and token pairs—persisting across time and space—which qualifies it as a store of value.

But this applies mainly within the Ethereum ecosystem. Broadly speaking, outside its own ecosystem, ETH's store-of-value properties still lag significantly behind Bitcoin.

For example, from inception, Bitcoin has been framed around narratives like “digital gold” and “scarce asset resistant to inflation.” Its core function is clearly defined as value storage, making it easier for mainstream markets and the public to understand.

Ethereum, as a smart contract platform, derives value from gas fees, staking rewards, and the ecosystem built on-chain. This complexity dilutes its perception as a pure store of value, leading the public to see it more as a “tech token” or “utility token” rather than a dedicated store of value.

In terms of supply, Bitcoin has a fixed cap of 21 million coins, with halving events gradually reducing inflation to zero. After EIP-1559 and the shift to PoS, ETH’s actual inflation rate may fall below Bitcoin’s. However, due to recent low network activity, ETH has gradually returned to inflationary status, fluctuating with network usage.

Compared to Bitcoin, Ethereum’s complex functions and mechanisms require higher cognitive load. Additionally, institutional investors (like MicroStrategy and Tesla) publicly holding Bitcoin as reserves further legitimizes its role as a store of value.

Therefore, ETH currently struggles to compete with Bitcoin in terms of value storage. Ethereum’s core identity lies more accurately in being a smart contract platform.

As a smart contract platform

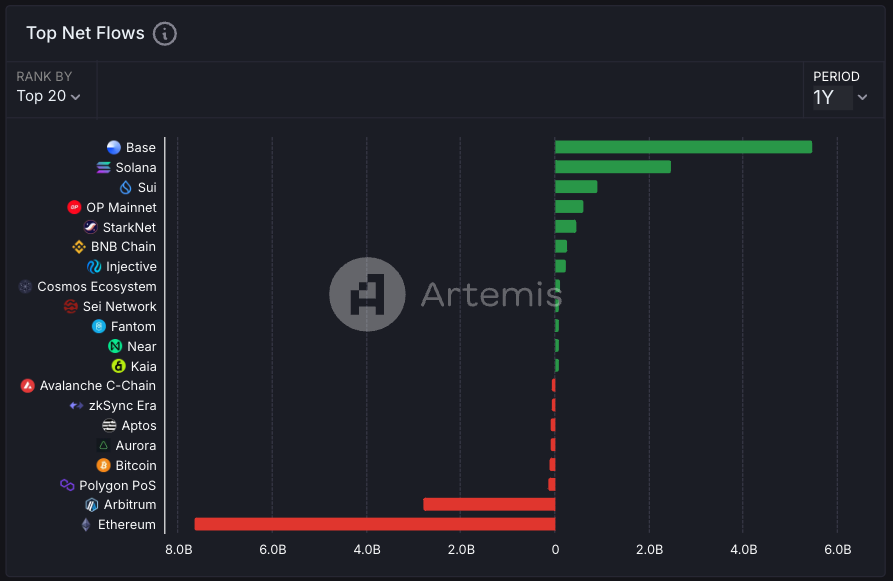

As a smart contract platform, Ethereum is facing intense competition from Layer 1s like Solana and Sui. On the data front, although Ethereum dominates in stablecoin issuance and TVL, key metrics such as daily transactions, active addresses, and transaction counts show signs of weakness.

▲ Source: Artemis

Looking at capital flows over the past year, protocols like Base, Solana, and Sui have captured large inflows, while Ethereum has seen nearly $8 billion in outflows. Most of Ethereum’s on-chain activity is now concentrated on Base and Arbitrum. While this aligns with the rollup-centric roadmap,低迷 L1 activity inevitably affects how the market prices ETH.

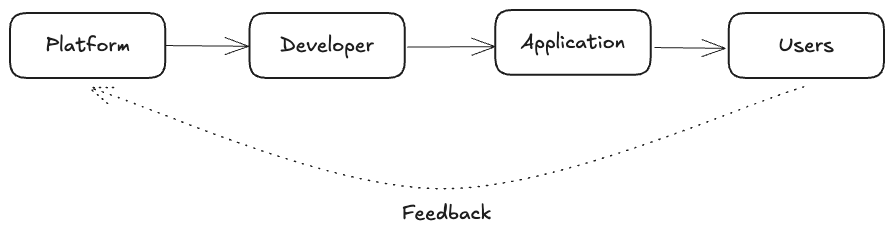

▲ Source: IOSG

A feedback loop generally forms among platforms, developers, applications, and users: strong platforms attract top developers, who build great apps, which in turn draw users, fueling platform growth.

Due to differing technical development paths between Ethereum and Solana, developers often have to choose one over the other. Thus, at the level of “smart contract platforms,” they are inherently in competition.

▲ Source: Solana

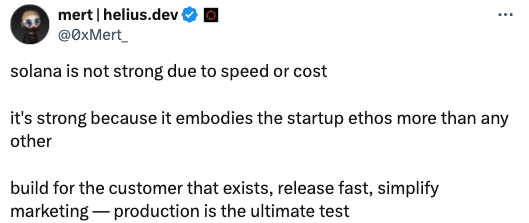

The solanaroadmap.com webpage contains only four words, abbreviated as IBRL. But today’s Solana is not just about high performance. Beyond technical IBRL, Solana’s culture and attention capture offer distinct competitive advantages.

▲ Source: mert

I once asked on X, “Why not launch memecoins on Ethereum L2s?” given that L2s also offer low cost and high throughput. The answer was “culture.” Broadly speaking, user demographics suggest Ethereum users are often seen as “old money” mining DeFi, while Solana represents fresh capital, rapid movement, and redistribution.

New often captures attention better than old. Among many founders I’ve spoken with this cycle, most chose to build consumer-facing apps on Solana—not just for technical reasons, but because they repeatedly mentioned “attention”: more users are focusing on Solana this cycle.

In a market flooded with projects and extremely scarce attention, founders go to great lengths to increase exposure and get their products noticed. Solana also has more hot money and smoother user experience—because every additional step when getting someone to use your product becomes friction and a barrier.

Lost in the Game – The Ethereum Foundation’s Choices

Is laissez-faire governance suitable for Ethereum in a highly competitive environment?

Community reactions to Aya Miyaguchi stepping down as Executive Director of the Ethereum Foundation were mixed: critics pointed to slow development progress during her seven-year tenure, insufficient developer support, and weak token performance, attributing these directly to her leadership. Her advocated “philosophy of subtraction” and decentralized governance were criticized as “laissez-faire,” resulting in EF failing to actively coordinate ecosystem resources—especially when contrasted with the efficient operations of the Solana Foundation.

These evaluations are difficult to untangle quickly and aren’t the focus of this article, but they reflect underlying community dissatisfaction—a release valve for accumulated frustration.

EF’s role has never been to control or own all domains in Ethereum. Instead, our responsibility—our accountability—lies in upholding Ethereum’s values. Through both our actions and our non-actions, we are accountable for ensuring that Ethereum remains resilient, not just as a network, but as a broader ecosystem of people, ideas, and values—never reduced to a single organization’s product. ——Aya Miyaguchi

On her final day, Aya published “A New Chapter in the Infinite Garden,” positioning the Foundation as a “gardener” rather than a “controller,” supporting the ecosystem through fostering client diversity, coordinating R&D, and organizing community events. She advocated adaptive growth, decentralized leadership, opposed corporate-style expansion, and emphasized preserving Ethereum’s original vision as the “world computer.”

I believe discussing values and ideals is beneficial during growth phases. But if the system is in decline and unable to generate new value, such lofty talk appears hollow and fails to convince.

The prerequisite for becoming a “world computer” and the foundation for practicing and spreading values is having people building on the ecosystem who are willing to adopt and promote these values. Ecosystem prosperity is a necessary condition.

Han Feizi, in “The Five Vermin,” pointed out that Confucianism’s essence of “using literature to disrupt law” lies in empty talk about benevolence while ignoring real contradictions. When resources are limited, talking idealistically leads to detachment from practical needs, requiring concrete tools like “law, technique, power” instead. When Confucius traveled across states, only relatively prosperous Wei briefly accepted his idealism; in war-torn states like Song, Chen, and Cai, his ideals were ignored due to lack of material foundation.

Recently, amid community criticism that EF continuously sells ETH without using staking or other financial tools to preserve runway, EF sold another small batch of ETH. Amid rising discontent, this move appeared tone-deaf. Vitalik responded that if EF stakes ETH, it might be forced into making an “official choice” during contentious hard forks, violating Ethereum’s decentralization principles. Yet this argument feels abstract and unconvincing, failing to address the community’s core concerns.

Based on the above, whether looking at weakening metrics as a “smart contract platform” or the sluggish price performance of ETH as a “store of value,” Ethereum appears stretched thin. Choosing to stick with laissez-faire governance at this moment may not be wise.

“Ethereum is an Ecosystem, Not a Company”

Vitalik emphasized in a Chinese AMA on February 27 that Ethereum is not a company, but an ecosystem.

I think Ethereum is a decentralized ecosystem, not a company. If Ethereum became a company, we’d lose much of its purpose. Running companies is for companies to do. ——Vitalik Buterin

I fully agree Ethereum should not become a company, as corporate operations imply profit-driven motives, conflicting with Ethereum’s long-standing ethos. However, the consequence of non-corporate governance is difficulty setting measurable KPIs to assess efficiency, and system goals become diffuse rather than optimized toward specific objectives.

The irony is, even though EF insists Ethereum isn’t a company, public valuation of Ethereum still leans toward corporate-style metrics—such as active addresses, transaction volume, and protocol revenue—making it hard to achieve the kind of symbolic simplicity enjoyed by Bitcoin.

From fundamental data like protocol revenue, Ethereum no longer shows strong momentum. For instance, due to低迷 L1 activity, ETH burn rates have dropped sharply, ending nearly two years of deflation and returning to inflation, with an annual inflation rate now at 0.72%.

▲ Source: Dankrad

On the technical development side, Aya wrote: “Instead of controlling, we steward All Core Dev calls to create space for technical decisions to emerge through community wisdom.” Coordination over dominance is well-intentioned in principle, but arguably too idealistic. A coordination-first approach encounters many real-world problems—inefficiency and high friction. With everyone having their own opinions and no centralized decision-making, execution becomes difficult.

Of course, this article does not claim who is right or wrong, nor does it condemn EF’s approach. Rather, it aims to present my perspective and logic, highlighting potential implications. In summary, I believe EF needs to focus on substance over theory, face reality, identify problems, listen to the community, and take action.

Conclusion

Crypto has different themes across cycles. In a cycle dominated by Bitcoin ETF narratives and Solana memecoin mania, Ethereum is clearly not favored by the market. Ethereum holds strong values and idealism, but these superstructures need real use cases and active communities to support them.

While maintaining these values, what can Ethereum do today?

Accelerate development, prioritize scaling and solve cross-L2 interoperability issues to make Ethereum technically viable. Attract long-term developers.

Education. ethereum.org has excellent multilingual support. While Ethereum may not engage in political lobbying, global education is essential.

EF needs reform—greater governance transparency, community oversight, and a balance between idealism and market demands.

As a long-time Ethereum supporter, I feel regret about the current state—but I’m also excited to see challengers like Solana pushing Ethereum’s dominance. In crypto, the story of newcomers challenging established “winners” keeps repeating—and that’s inspiring.

Hope we can make Ethereum great again.

Milady.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News