Redstone's Pre-Launch Hype and Controversy: Accusations of Airdrop PUA and Price Volatility

TechFlow Selected TechFlow Selected

Redstone's Pre-Launch Hype and Controversy: Accusations of Airdrop PUA and Price Volatility

A clash of red and black, a test of community trust and market rules.

“Red and black—the intertwining of ambition and reality, the collision of passion and coldness.” — *The Red and the Black*

In the crypto market, price fluctuations are an endless game of博弈; a project’s success or failure resembles repeated contests between trust and skepticism.

Much like in the classic novel *The Red and the Black*, where red symbolizes passion and hope, and black represents shadow and crisis,

when we turn our attention to RedStone, recently launched on Binance Launchpool, this contrast of “red and black” becomes especially evident:

As a new representative of cross-chain oracles, RedStone previously attracted market attention with its innovative multi-chain architecture and strong backing from investors such as Coinbase Ventures and Blockchain Capital.

Over the past week, this “Red Stone” briefly became a bright spot amid a sluggish market, with its token RED showing bullish momentum in Binance’s pre-market trading.

However, as hype grew, controversies around its airdrop and unusual pre-market price movements have gradually surfaced, causing the perception of this “Red Stone” to darken among some community members.

A tale of red and black—a test of community trust versus market rules.

RedStone in the Price-Cap Experiment

In the crypto market, innovation is often key to capturing attention.

And Binance’s introduction of a “price cap mechanism” for RedStone (RED) has become the centerpiece of this latest experiment.

On February 25, 2025, Binance announced it would test this mechanism during pre-market trading on Launchpool, aiming to limit price volatility by capping gains—preventing the kind of extreme “Christmas tree” price spikes that have become all too common during early token launches.

Since RED debuted in pre-market trading, the mechanism has ignited significant market interest.

For three consecutive days, RED repeatedly hit the upper price limit. After temporary caps were lifted, the price surged to as high as $1.40, making it the focal point of pre-market trading.

As of now, RED trades at $0.83, with a market cap of $33 million and a fully diluted valuation of $830 million. For a project launching during a bear market, this initial performance is impressive—giving the impression that even price caps can’t contain its upward momentum.

When there’s money to be made, people naturally take notice.

While the price cap mechanism has undoubtedly boosted RED’s visibility, the sustainability of this “red” heat remains to be seen.

Sustained price increases attract attention but may also mask underlying issues brewing within the community.

The Dark Spots in the Airdrop Controversy

Once again, the flashpoint lies in the airdrop.

Previously, RedStone ran three “expedition campaigns” via Zealy and Discord, asking community members to complete various tasks—reading technical documents, writing analyses, creating visual content, and even posting consistently during the Lunar New Year holiday.

These efforts were marketed as opportunities to “co-build the ecosystem.” Participants earned RSG points, which RedStone promised would be key to qualifying for future RED token airdrops.

Put simply, farming these rewards required serious grind.

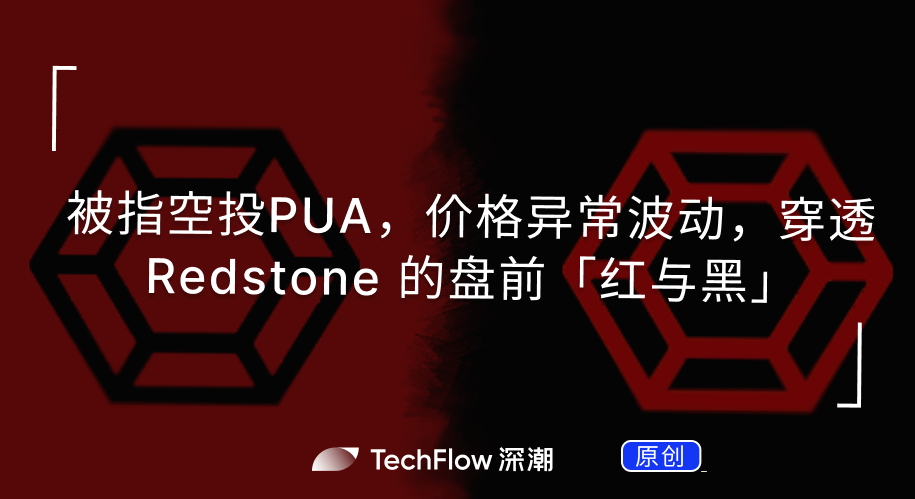

According to its tokenomics (RED Tokenomics), RedStone planned to allocate 48.3% of tokens to the ecosystem and community, with 10% reserved for initial community claims—raising high expectations among participants.

Yet, when RedStone revealed the airdrop results on March 5, 2025, community enthusiasm quickly cooled.

Only 2.19% of participants (4,386 people) received RED tokens. The vast majority found their hard-earned RSG points invalidated—dedicated grinders seemingly left with nothing.

It's not scarcity that angers people, but inequality: grinding yields nothing, while status grants rewards.

According to RedStone’s official post, Discord roles became the deciding factor for eligibility. Qualifying roles included Vein Master, Deep Miner, Professor, and IRL (those who attended offline events). Public data shows only about 2% of the Discord group held these roles.

With approximately 230,000 total community members, this means only around 4,000 ultimately qualified—matching the announced figure.

Unsurprisingly, frustration spread rapidly across social media platforms.

Some users joked: “If you didn’t get the RED airdrop, don’t worry—you’re not alone.”

More angry users began outright accusations. Critical posts circulated quickly in both Chinese and English communities, accusing RedStone of exploiting free labor under the guise of community building.

As a neutral observer, I cannot verify every claim in these posts—but the depth of community resentment cannot be ignored. After all, in crypto, “the people support you, or they sink you,” is a recurring theme.

At its core, the anger boils down to: “I worked hard, but wasn’t eligible.”

Many users accumulated millions of points only to be excluded, labeled as “invalid labor.” With only 2.19% receiving rewards, this highlights the persistent issue of “airdrop PUA”—where projects drive intensive user engagement before launch but fail to honor implicit promises.

When contributors feel reduced to “digital indentured labor,” exploited for free marketing, only to see rewards go to those with insider status, disillusionment is inevitable.

Pre-Market Price Anomalies

Amid growing dissatisfaction over the airdrop, any irregularity in token pricing further fuels distrust.

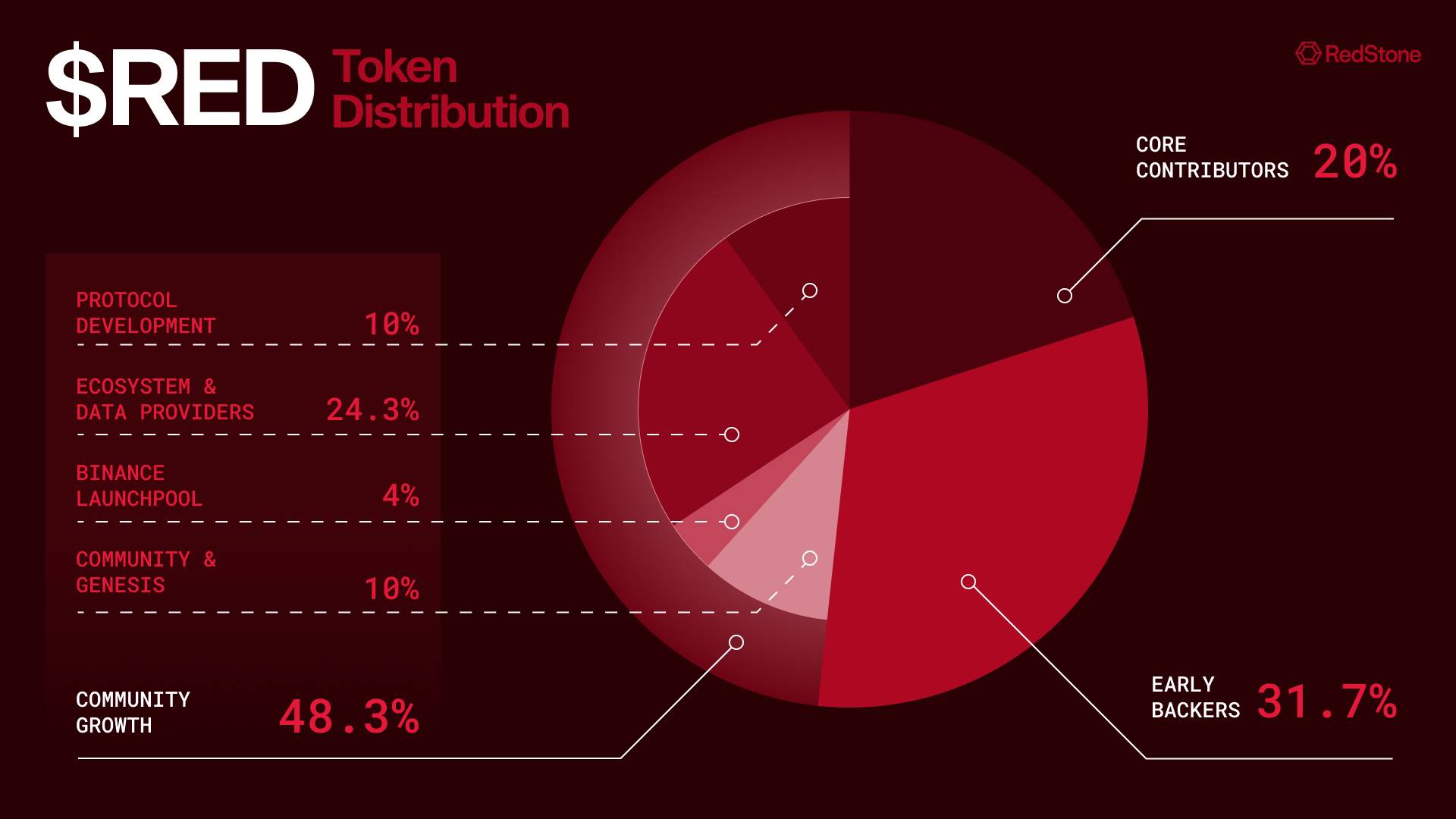

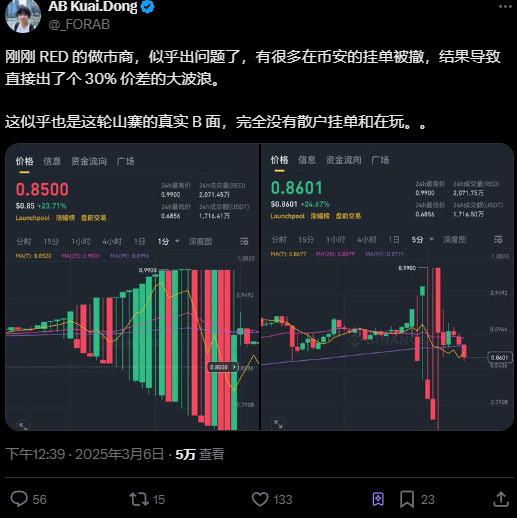

This afternoon, several community members shared screenshots showing extremely erratic price movements for RED in pre-market trading—far from normal market behavior.

Shortly after, well-known KOL @_FORAB noted similar anomalies, speculating that market makers might be malfunctioning—large orders were pulled, resulting in wild spreads and artificial-looking waves.

Such patterns easily fuel suspicion: market makers manipulating prices without balanced retail participation.

However, Stephen, RedStone’s community manager for the Chinese region, clarified in comments that no market makers were involved in the pre-market phase. The price swings stemmed from the design rule limiting each user to trade only 5,000 RED tokens.

Later, Binance officially confirmed that the limit-order function for RED/USDT was temporarily faulty between 11:39 and 12:09 on March 6, 2025, though market orders remained functional. The platform has since resolved the issue.

While the incident wasn’t due to manipulation, in an already tense community environment, such volatility allowed conspiracy theories to spread rapidly.

Even with clarifications from both RedStone and Binance, retail investors in crypto often favor conspiracy theories over technical explanations. This narrative effect further deepened community distrust.

Conclusion

Where profit is involved, the relationship between project teams and communities in crypto is always delicate: mutually dependent, yet sometimes feeling mutually betrayed.

From its innovative multi-chain design and Binance’s price cap mechanism, to the airdrop backlash and price anomalies, RedStone has experienced intense spotlight—and equally severe tests of community trust—in a short time.

The airdrop outcome disappointed most participants and sparked accusations of exploitative “PUA” practices. Such sentiment is highly contagious in crypto, especially in communities deeply sensitive to fairness.

For RedStone, the road ahead hinges on rebuilding community trust and establishing more transparent, robust mechanisms in both technology and operations.

Perhaps more broadly, this cycle of crypto projects demands not just technical innovation, but also deep empathy for community sentiment and comprehensive optimization of market rules.

Win the community, win the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News