Rumors swirl: Can Trump's proposed elimination of the crypto gains tax be realized?

TechFlow Selected TechFlow Selected

Rumors swirl: Can Trump's proposed elimination of the crypto gains tax be realized?

Dreams are good, but maybe we'll have to wait a bit longer.

Written by: TechFlow

The market is a giant Christmas tree.

Yesterday, the market was still basking in the positive sentiment sparked by Trump’s support for cryptocurrency. But before the celebration could even last a full day, Bitcoin plunged back to where it started, wiping out all gains driven by Trump's comments and drawing an uncomfortable door-shaped pattern on the charts.

Yet the market, having finally grasped what feels like a lifeline, isn’t ready to let go of the possibility of extracting more favorable developments from Trump.

On the morning of March 4, Mike Alfred, founder of Alpine Fox LP, tweeted that the Trump administration may announce a zero capital gains tax policy on cryptocurrencies at Friday’s crypto summit.

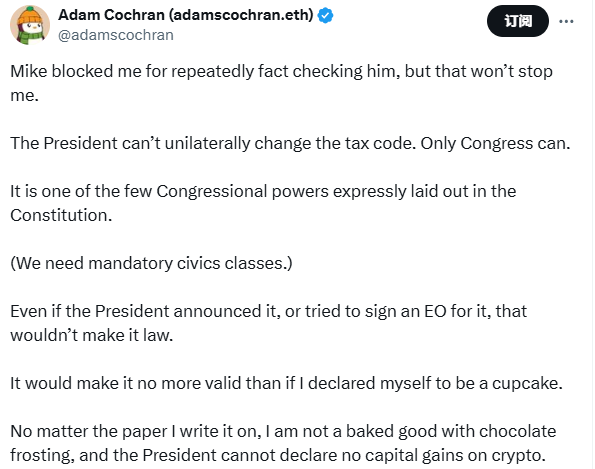

Regarding Mike Alfred’s claim about Trump preparing to announce zero taxation on crypto, Adam Cochran, partner at Cinneamhain Ventures, fired back sharply: "Mike blocked me for repeatedly fact-checking him, but that won’t stop me. The president cannot unilaterally change tax law. Only Congress can. This is one of the few powers explicitly granted to Congress under the Constitution. Even if the president announces such a decision or attempts to sign an executive order, it won’t become law. It’s no more effective than me declaring myself a cupcake."

Eliminating capital gains taxes on cryptocurrency would be a major move—for the crypto market itself, for market participants, and for the U.S. government.

Naturally, social media has been abuzz with debate over whether this rumor holds any truth.

Beyond the market noise, let’s examine: if such a tax exemption were to happen, what impact would it have? And if not, what factors are holding it back?

How are cryptocurrencies taxed today?

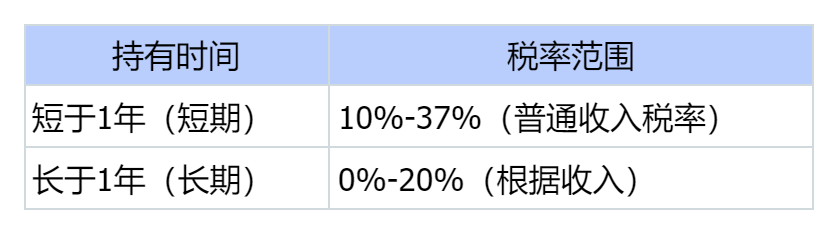

To start, here’s the current situation: according to Coinbase’s tax guide, in the United States, cryptocurrency is not considered “currency.” The IRS (Internal Revenue Service) classifies it as “property.” If you buy Bitcoin and later sell it at a higher price, the profit is subject to capital gains tax. The tax rate depends on how long you held the asset:

In other words, if an American citizen buys $10,000 worth of Bitcoin and sells it three months later for $20,000, the $10,000 profit will be taxed at ordinary income tax rates (10%–37%), potentially costing several thousand dollars. If they hold it for over a year before selling, the rate is lower—perhaps only a few hundred or even zero if their income is low enough. But regardless, taxes are unavoidable.

And it’s not just trading: ordinary income tax applies to mining, staking, salary payments, airdrops, and any activity involving receiving cryptocurrency. Individuals must report the fair market value at the time of receipt and pay income tax accordingly (10%–37%).

What if capital gains tax really were eliminated?

Suppose Trump actually did eliminate capital gains tax on crypto assets—what would happen? Let’s set aside lofty analysis and talk plainly about how markets and ordinary people might be affected.

For the market, removing tax barriers would naturally encourage more U.S. speculative capital to enter, increasing short-term trading activity due to the lack of tax constraints, thereby amplifying short-term volatility. More crypto project teams would also be drawn by the zero-tax policy, relocating major projects to the U.S., turning it into the “crypto capital” Trump has promised.

But favoring the market essentially means cutting government revenue. Losing tens of billions annually from crypto-related taxes would force a recalibration of public budgets, squeezing spending on infrastructure, healthcare, and other areas. For average taxpayers who don’t touch crypto, learning that wealthy traders enjoy tax-free profits while they continue paying income tax could easily breed resentment.

In short, if current U.S. crypto capital gains tax doesn’t affect you, then the potential impact of a tax exemption on your personal crypto earnings would vary case by case. Labeling it simply as bullish or bearish isn't appropriate.

Rumors fly—but will it actually happen?

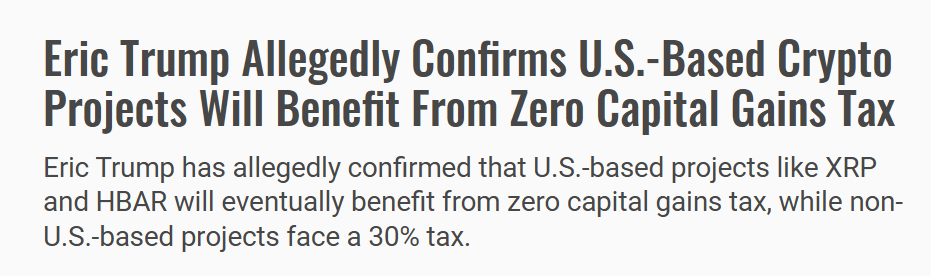

There have been persistent rumors about changes to crypto taxation. In January, The Street reported that Eric Trump, known for his involvement in crypto events, confirmed top U.S.-based crypto projects like XRP and HBAR would receive preferential treatment with zero capital gains tax, while non-U.S. projects would face capital gains taxes of up to 30%.

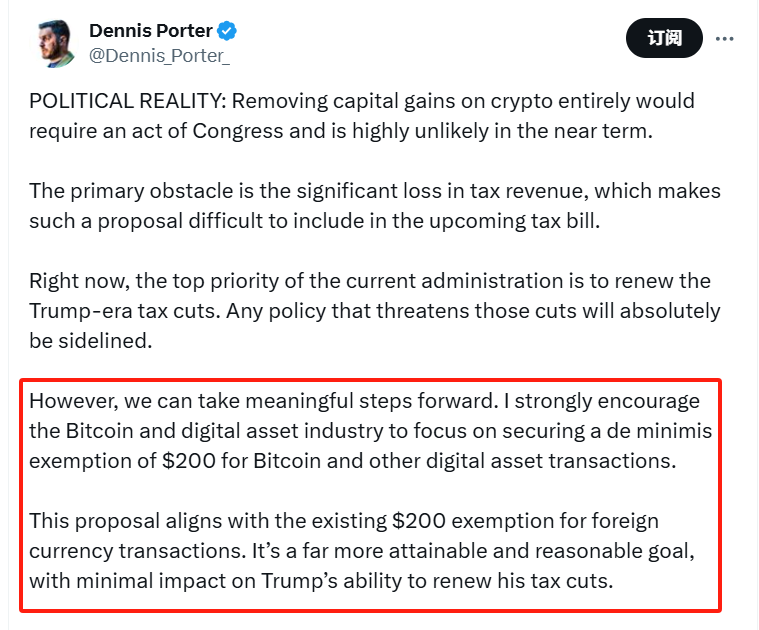

Dennis Porter, co-founder of Satoshi Action Fund, noted that completely eliminating crypto taxes is unrealistic in the short term, though changes like a “minimum exemption threshold” could be achievable.

So no matter how loudly the口号 are shouted, tax law isn’t something Trump can decide alone.

The U.S. Constitution mandates that changes to tax policy require Congressional approval. Even if Republicans support it, Democrats may oppose it.

Moreover, the U.S. state-level tax system is highly complex, with varying policies across states—achieving consensus would be a lengthy and difficult process.

Conclusion: The dream is nice—but we may have to wait

Viewed in isolation, eliminating capital gains tax on crypto is an incredibly appealing prospect for most market participants. If realized, it could certainly revive the struggling market for another round. But in reality, the market shifts and broader societal implications following such a move are hurdles policymakers cannot ignore. Thus, this aspiration may remain just a hope—at least in the near term.

In my view, this is just another oversized promise dangled in front of the crypto market—tempting to look at, but whether we’ll ever get to taste it depends entirely on Congress’s mood. For retail investors like us, it’s fine to dream—but keep your wallets secure. Don’t go all-in on every rumor you hear.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News