Trump revived the market with just one sentence, but have you made any money?

TechFlow Selected TechFlow Selected

Trump revived the market with just one sentence, but have you made any money?

Let go of that heart which is both greedy and fearful, impulsive yet hesitant.

By TechFlow

Good morning, esteemed holders of BTC, ETH, SOL, XRP, and ADA.

Has the one-month-long crypto bear market ended?

From enduring the waterfall dump to an abrupt market recovery—things really can change overnight.

Last night, former U.S. President Donald Trump posted life-changing news on Truth Social: the United States will elevate the status of the cryptocurrency industry through a "Crypto Strategic Reserve," explicitly naming XRP, SOL, and ADA as assets to be included in this strategic reserve.

In the post, the former president once again declared his vision of “ensuring America becomes the capital of the crypto world.” This promise—enough to excite any crypto insider—seems to have reignited market enthusiasm.

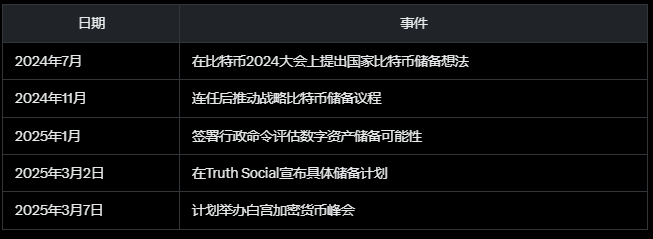

Notably, Trump’s interest in a crypto reserve isn’t new. Let us remind you of his series of actions:

In July 2024, he first proposed creating a national Bitcoin reserve at the Bitcoin 2024 Conference. After winning re-election in November 2024, he continued advancing this agenda.

In January 2025, he signed an executive order directing an assessment of establishing a national digital asset reserve. Today’s announcement can thus be seen as a continuation and further specification of that long-term plan.

This time, while he didn’t explicitly reaffirm support for Bitcoin and Ethereum (already obvious), he notably included XRP, SOL, and ADA in the strategic reserve for the first time.

The news triggered an immediate market frenzy. According to CMC data, the prices of relevant cryptocurrencies surged within minutes:

Ripple (XRP) rose 33%, Solana (SOL) climbed 22%, and Cardano (ADA) skyrocketed by over 60%. Meanwhile, Bitcoin (BTC) and Ethereum (ETH) also gained 8% and 11% respectively.

The total market cap of the entire cryptocurrency market surged by $300 billion within hours. This rally not only reversed recent losses but also revived hopes that the so-called “Crypto President” might indeed come to crypto’s rescue.

Fleeting Speculators, Everlasting Inner Circle

But here's the real question: did you actually make money?

Trump speaks, and instantly ADA goes parabolic—XRP’s FDV even surpasses ETH’s.

But before Trump dropped the news, were you brave enough to heavily load up on these established altcoins like ADA or XRP amid a brutal bear market and sinking morale?

For retail speculators, the classic scenario likely unfolded like this:

-

Futures traders: Prices are back, but your position is gone. The wild swings during the bear market probably liquidated your leveraged positions long ago, leaving only the bitter regret: “If only I’d held on a bit longer.”

-

Spot investors: Prices are back, but your cost basis isn’t recovered. If you sold low during the downturn, you may now lack the funds to re-enter. Or if you HODLed, your unrealized losses still remain. For you, this “recovery” is just a paper consolation.

In crypto, no force rivals the power of information—but only the inner circle truly captures the opportunity.

Just because you didn’t profit doesn’t mean no one did. Those close to the core were likely already positioned to win before the news broke.

For example, just before Trump announced the positive development, a whale on Hyperliquid made an uncannily well-timed, highly unusual 50x leveraged long bet on BTC and ETH.

Prior to the announcement, the whale was nearly liquidated due to falling prices, suffering significant floating losses. Yet, even then, they added to their position—and ultimately exited with a profit of $6.83 million.

Such nerves of steel may stem from asymmetric information access. No wonder some on social media sarcastically suggested—or outright implied—that the Hyperliquid whale might be part of the Trump family or closely affiliated.

One thing is certain: this whale knew something you didn’t—knowledge that gave them conviction you could not possess.

If whales operate in the shadows, others execute open strategies in plain sight.

Take David Sacks, the so-called “Crypto Czar,” who two years ago said on a podcast:

“SOL was $9 at the start of the year; now it’s up more than tenfold… Critics online claim we bought SOL at a discount and then dumped it on retail. That’s nonsense. Let me put it this way: those of us who still hold Solana are absolutely thrilled.”

Now serving as White House lead on AI and cryptocurrency, he sits at the epicenter of power—with theoretically unlimited room to maneuver.

After all, if the president himself has effectively launched a coin, couldn’t Sacks quietly offload his SOL holdings after the monthly unlock, timed perfectly with the upcoming March 7th crypto summit?

Unprovable. But also unrefutable.

Still, one thing is clear: his odds of profiting are far higher than yours.

Browsing Chinese CT spaces, you’ll often find a popular form of self-mockery:

“I totally knew Trump would announce ETH as part of the strategic reserve—I’m glad I bought in at $4,000.”

Fleeting speculators, everlasting inner circle. If you don’t know where the returns come from, you are the return—whether the market is bearish or bullish.

When Market Moves Depend on One Sentence: Winners and Losers

When the entire market hinges on a single sentence from President Trump, crypto becomes unavoidably Americanized—and politicized.

The president and his team represent, to some extent, centralization and dominance. And the subtext of centralization is simple: we will do what we want, and the market merely obeys.

Doubt centralization, understand centralization, become centralization.

Who wouldn’t want to embody that supreme power capable of moving asset prices? Who still genuinely remembers the fiery ideals of decades past—when cypherpunks championed decentralization and dreamed of financial freedom?

Driven by reality, both industry insiders and outsiders have shifted focus from ideology to profit—recovering portfolio value and growing personal wealth have become the primary concerns. Idealism may once have been faith, but today it appears pale and powerless amid the tides of market volatility.

To be blunt, people care about their positions and personal gains.

Shortly after the news broke, Tomasz K. Stańczak, co-executive director of Ethereum, tweeted that the crypto reserve initiative presents a brief window of opportunity to showcase the Ethereum ecosystem.

If Ethereum’s progress depends on begging for a fleeting moment granted by a presidential tweet, clearly its prior efforts fell short.

Arthur Hayes, meanwhile, stated that the crypto reserve remains mere talk—the U.S. government lacks the budget to accumulate Bitcoin or altcoins. He remains bullish long-term but won’t buy at current levels.

When the entire market dances to the tune of one person, one sentence, and one document, this so-called “rally” cannot be seen as a broad industry win, but rather a zero-sum game: some celebrate, while others enter a bloodbath.

For retail participants downstream, policy shifts rarely improve their actual situation. Ask yourself:

How is your portfolio doing? Are you sitting on unrealized gains, or still trapped in loss?

Has your status improved? Are you closer to the inner circle?

If most answers are “no,” then even if the market recovers, your profits may remain fleeting and unrealized.

When the next black swan hits and the scythe falls again, erasing your gains, you may once again fail to outperform the market. History repeatedly shows that human greed, fear, and indecision prevent us from learning from past mistakes.

From my own losing experiences, I’ve learned that instead of chasing illusory dreams of overnight riches amid an avalanche of information, it’s better to accept our limitations—let go of that mind torn between greed and fear, impulse and hesitation.

Admitting that you’re easily swayed by influencers and prone to FOMO is the first step toward maturity.

If you can’t precisely time the market, holding BTC (Bitcoin) may be the safer choice: while it won’t deliver the 10x-100x paper gains of altcoins, one solid doubling of your investment can at least keep you standing through market storms.

After all, in this uncertain industry, stability often triumphs over risk.

What about you?

In this market frenzy sparked by a single presidential tweet, are you among the winners celebrating—or just another bystander caught in the slaughter? Perhaps the answer already lies in your attitude toward your portfolio, the market, and yourself.

The allure of the crypto world lies in its uncertainty—but precisely because of that, it tests the wisdom and discipline of every participant.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News