A Guide to Understanding Solana's New Launch Platforms: Time.fun and Super.exchange

TechFlow Selected TechFlow Selected

A Guide to Understanding Solana's New Launch Platforms: Time.fun and Super.exchange

Innovation persists even in a downturn cycle—could new projects present fresh opportunities amid market panic?

Written by: TechFlow

Bitcoin dropped to $86,000, triggering widespread panic across the market.

When fear and anxiety from falling prices take over, the market often turns its attention toward new asset issuance models.

Yes, despite $SOL briefly dropping to around $130, enthusiasm for innovation within the Solana ecosystem remains strong. Yesterday, two new asset launch platforms—Time.fun and Super.exchange—gained significant traction and hype.

1. Time.fun: Is your time really that valuable?

Solana leadership pushes adoption

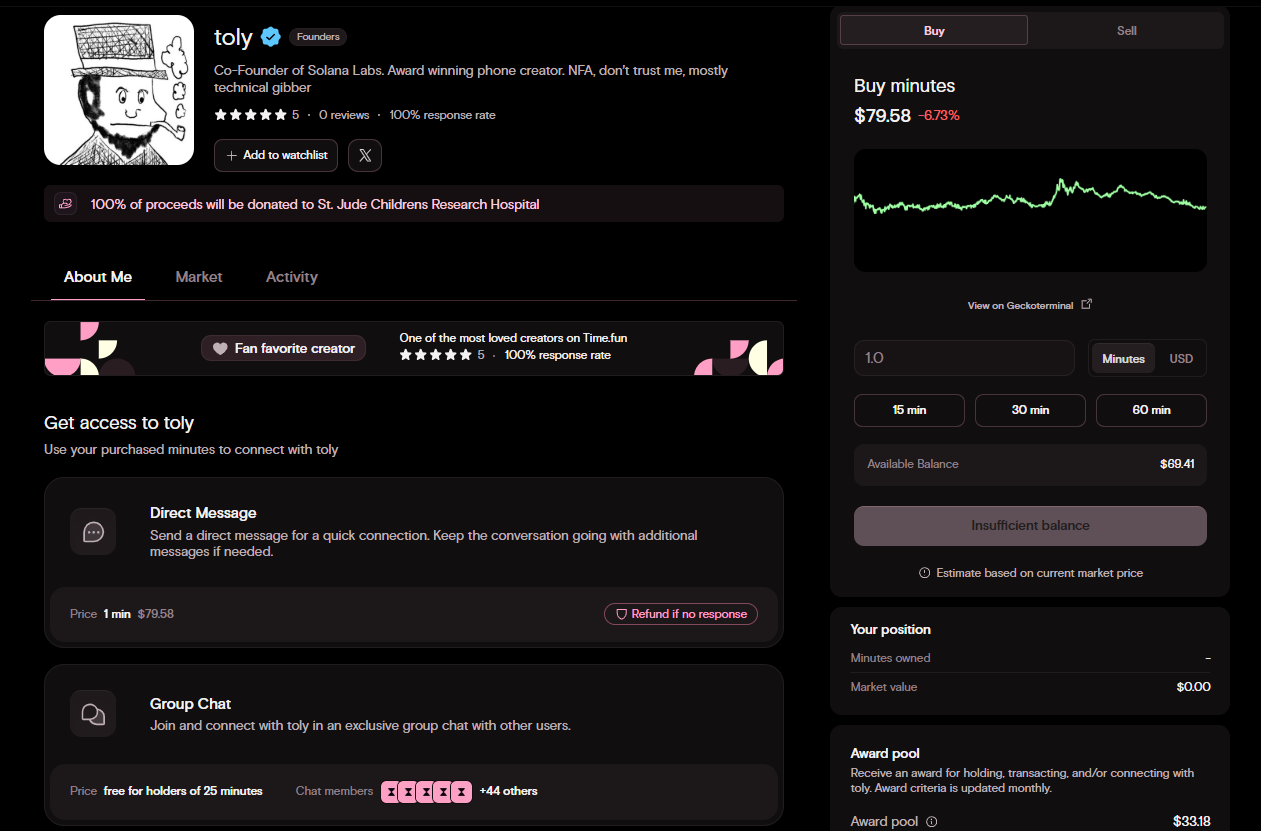

Yesterday, Solana co-founder Toly (@aeyakovenko) "launched a token," but unlike previous celebrity coins on pump.fun, this time Toly chose Time.fun, a SocialFi platform where users can sell their time.

Their token $toly (toly's minutes) reached a peak market cap of $20 million upon listing, currently sitting around $8 million, priced at $80 per token—or in other words, $80 per minute.

This time-based pricing mechanism is the core innovation of Time.fun.

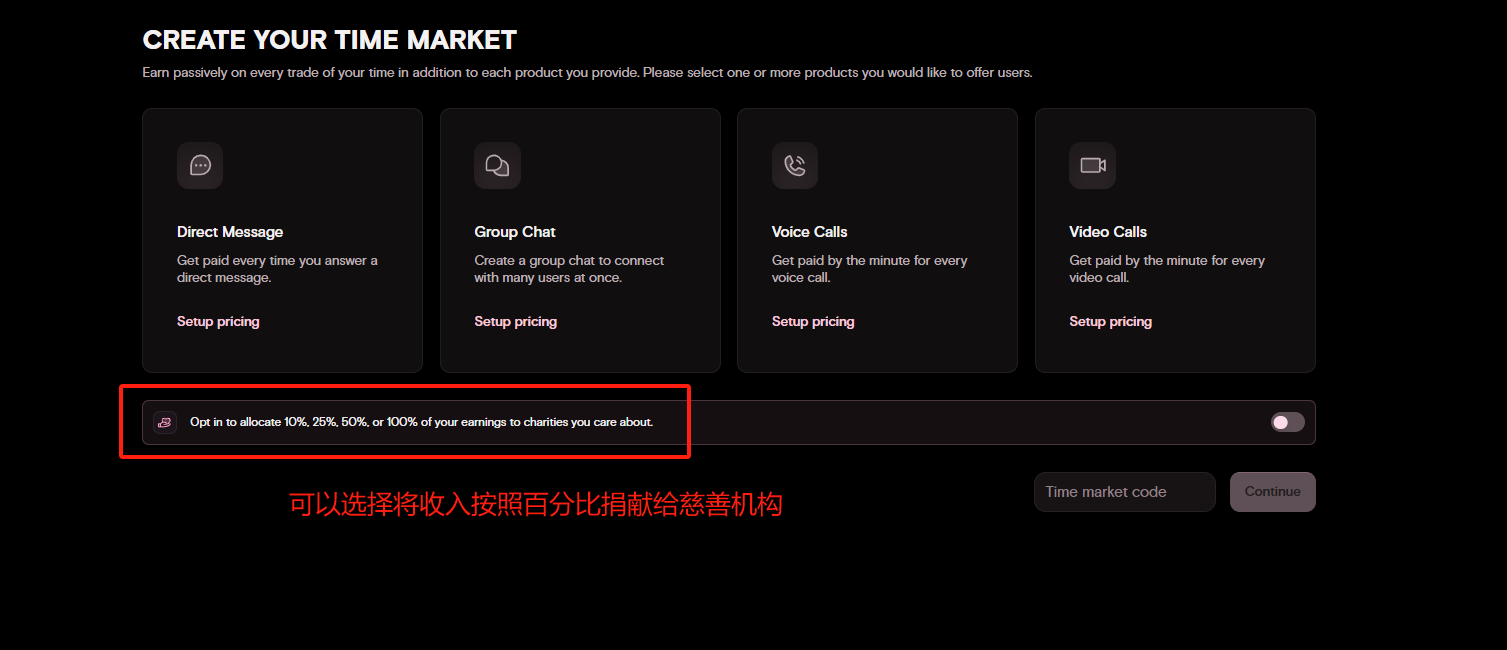

Similar to the previously popular Friendtech, Time.fun allows creators to tokenize access to their social presence, but now priced per minute. Fans purchase these time tokens to gain interaction opportunities such as direct messages or group chats. Future plans include richer interactions like voice/video calls and auctions. Creators earn fees from every transaction, maximizing the value of their time.

Originally launched as Circle.tech on Base, Time.fun recently migrated to the Solana ecosystem. Toly not only joined immediately but also praised the project: "Business communication is my favorite crypto use case."

Likewise, Mert Mumtaz (@0xMert_), a key figure in the Solana ecosystem, expressed support for Time.fun and launched his own token $mert on the platform.

How to participate?

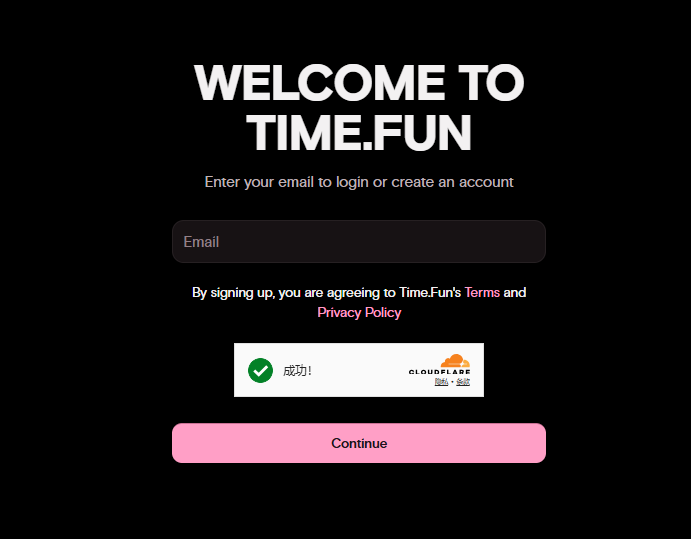

Visit the Time.fun website: https://time.fun/login and register using your email.

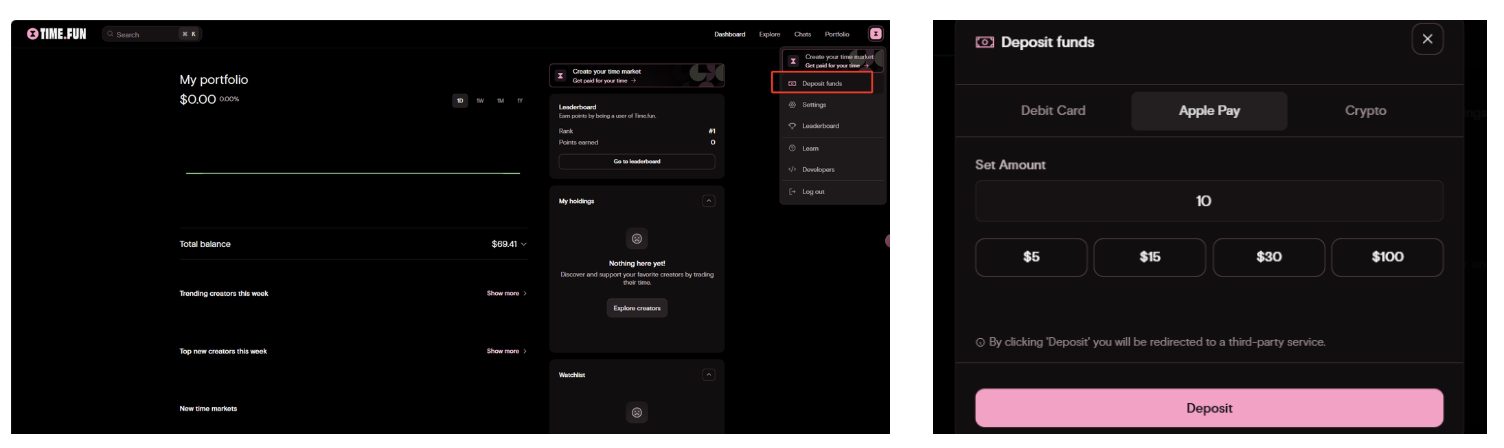

All transactions on the platform are priced in USDC. There’s no need to connect an external wallet—Time.fun generates a dedicated wallet account. Deposit USDC on the Solana network via credit card, Apple Pay, or cryptocurrency transfer.

After funding your account, select the creator ticker you want to trade. There’s no minimum buy-in; pricing can be displayed either per minute or in USD.

Besides buying others’ time, you can also sell your own. Notably, all users issuing time tokens must undergo identity verification, ensuring authenticity of the creators on Time.fun.

2. Super.exchange: Trade first, buy token later—earlier entry, bigger advantage?

Super.exchange resembles a hybrid of Pump.fun and Hyperliquid, improving two core aspects of current asset launch platforms: the bonding curve and the points incentive system.

Below is a brief explanation of how it works from both technical and user participation perspectives.

Super Curve: An improved model based on Pump.fun

Unlike Pump.fun’s dual-pool mechanism, Super Exchange uses a Super Curve composed of seven different curves:

(xⁿ * y = k, where n values are 32, 16, 8, 4, 3, 2, and 1 respectively)

These curves divide a token’s lifecycle into multiple stages:

-

Low market cap phase (high n value): The curve is flatter, allowing slow price increases and preventing early investors from hoarding large amounts before dumping aggressively.

-

Mid-to-high market cap phase (low n value): The slope gradually increases, ensuring sufficient liquidity supports price growth.

In simple terms, this design prevents whales from accumulating excessive supply early on, reducing the risk of large dumps disrupting price momentum.

Points Incentive System

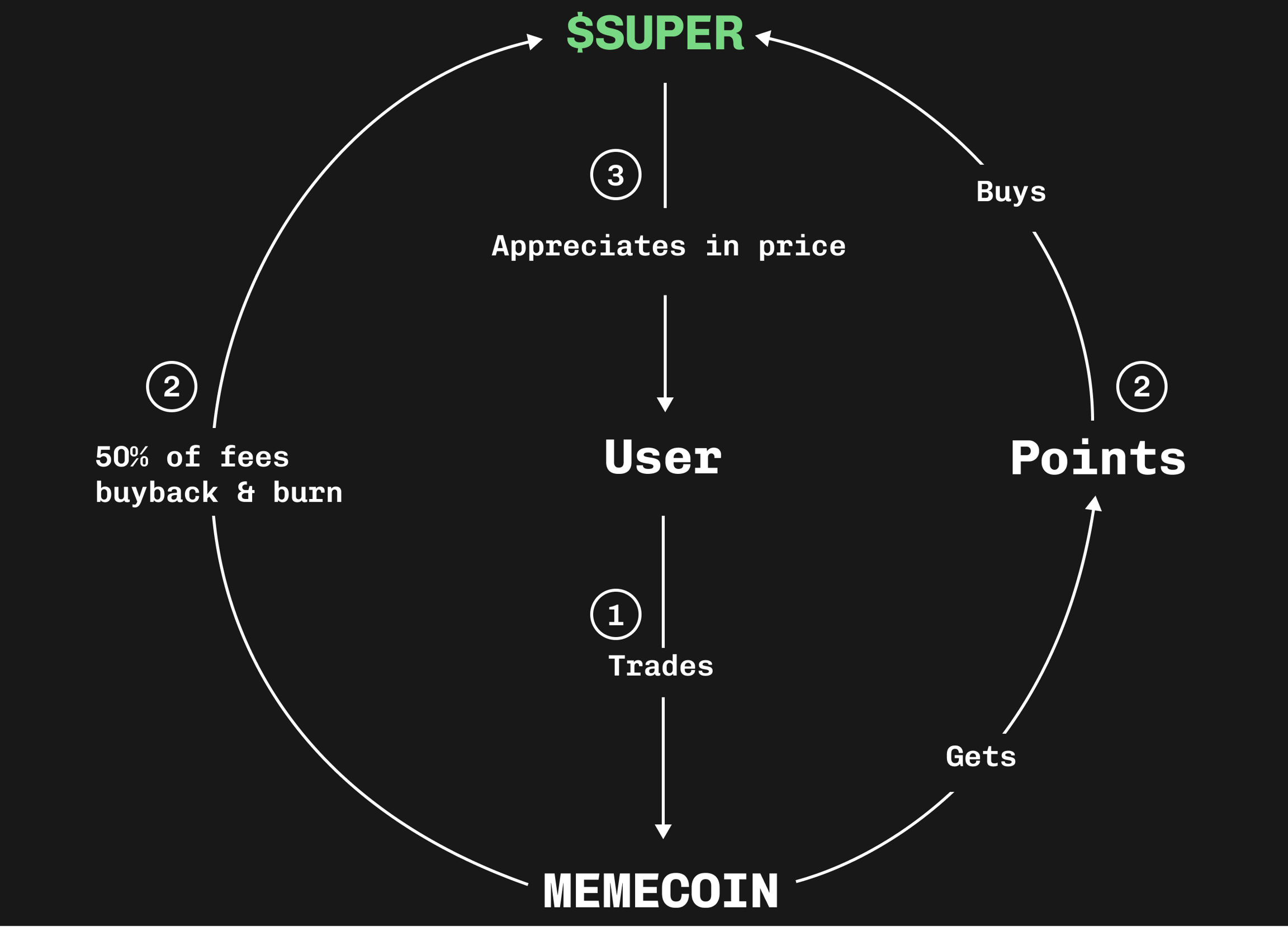

Beyond the improved bonding curve, the main draw for users is the incentive system allowing them to use platform points to purchase the platform token $SUPER at a fixed price.

-

Points Distribution Rules

-

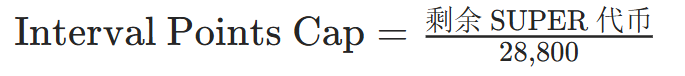

Points are distributed every 5 minutes, with total issuance dynamically calculated using the following formula:

As the total supply of $SUPER decreases, points issued per cycle decline—meaning earlier participants receive higher rewards.

-

80% of points go to traders, with allocation based on trading activity and token quality: the higher the trading volume, and the better the liquidity and user base of the traded token, the more points earned.

-

20% of points are awarded to referrers, who receive 25% of the points earned by users they invite.

-

Points Redemption for Tokens

Accumulated points can be used to purchase $SUPER at a fixed price, at a 1:1 ratio. The team commits to using 50% of trading fees to repurchase and burn $SUPER.

Therefore, early users purchasing $SUPER at a fixed price will acquire it below the future market price driven by ongoing buybacks and burns. Currently, $SUPER has a market cap of approximately $210,000, and early participants have already realized profits based on price trends.

Summary

Overall, while the two platforms differ significantly in model, both aim to explore new paths in asset issuance through mechanism design:

Time.fun slices creators’ time into tradable tokens, essentially experimenting with new ways to monetize social influence on-chain. Its success heavily depends on individual creators’ popularity. It may gain short-term momentum due to endorsements from Solana figures, but long-term sustainability hinges on sustained user willingness to pay and creator engagement.

Super.Exchange leverages an innovative bonding curve combined with token purchase restrictions and buyback mechanics to attract retail capital. However, in the long run, constant small-scale trading among retail users could devolve into short-term PVP games. The points incentive relies heavily on positive price expectations for $SUPER; if the market remains weak, the model’s appeal may diminish.

Unfortunately, amid current negative market sentiment, whether it’s selling time on Time.fun or farming points on Super.exchange, the current excitement might simply reflect retail investors’ desperate moves amid falling prices. Whether short-term hype can translate into lasting value largely depends on the teams’ commitment to continuous development.

As users, cautiously trying new opportunities may be a viable path to discovering value during uncertain times. Still, remain mindful of risks, participate carefully, and always DYOR.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News