Dou Bao can't bring out the rations

TechFlow Selected TechFlow Selected

Dou Bao can't bring out the rations

The self-developed large inference model remains nowhere to be seen despite high expectations.

Author: Ma Shuye, Zimu Bang

Image source: Generated by Wujie AI

Tencent's Yuanbao, which later surpassed others by integrating DeepSeek, is now putting greater pressure on ByteDance.

Since February 22, ten days after integrating DeepSeek, Tencent's AI application "Tencent Yuanbao" has overtaken Douyin-owned Doulit (BeanPack), rising to second place on the free app download chart of China's Apple App Store, and has maintained this position ever since.

Caption: Tencent Yuanbao’s downloads surpass ByteDance’s Doulit

Source: Screenshot from Zimu Bang

"Right after coming back from the New Year holiday, we heard all Tencent’s C-end product managers were switching to become AI product managers. We just didn’t expect Tencent to move so fast," Chen Ming (pseudonym), an employee from a large model team at ByteDance, told Zimu Bang (ID: wujicaijing). Amid internal overtime development of their reasoning large model, no one expected Tencent—once seen as laid-back—to act so aggressively this time.

However, compared to the intense discussions sparked by DeepSeek R1 within ByteDance, Tencent's T1 reasoning large model seems to be “not impressive enough.” Tencent barely comes up in casual break-room conversations. They firmly believe that "if a domestic reasoning large model emerges capable of catching up with or even surpassing DeepSeek R1, it will definitely be from ByteDance."

ByteDance's goal is simply to “surpass.”

Insiders have revealed to Zimu Bang that ByteDance’s self-developed reasoning large model is expected to launch by the end of March. Meanwhile, Doulit, which previously drained traffic from Douyin and shifted its ad spending en masse to platforms like Bilibili, has decided to pause投放.

In response, Zimu Bang reached out to ByteDance for confirmation. ByteDance declined to comment on the specific release date of its self-developed reasoning model but denied claims that Doulit had exhausted Douyin’s traffic.

On the other hand, Tencent’s entire ecosystem is progressively integrating DeepSeek. Even WeChat, typically restrained, has frequently promoted Tencent Yuanbao. Ads for Yuanbao appear on WeChat Moments, Bilibili’s splash screen, and even the main page of Tencent Meeting.

"The best DeepSeek experience under Tencent is right here in Tencent Yuanbao"—this has now become the new slogan for Tencent’s consumer-facing large model business. According to DataEye, before February 15, Doulit and Kimi each produced 2–3 times more ad creatives than Tencent Yuanbao. Then, between February 18 and 23, Yuanbao’s volume of ad creatives surged by 345.1% week-on-week. Tencent has replaced ByteDance as the next big tech spender rushing into aggressive advertising campaigns.

ByteDance is being increasingly cornered by Tencent, which is rapidly embracing DeepSeek. Before DeepSeek’s rise, Doulit was unquestionably the star consumer-facing app over the past year. But now, the latecomer Yuanbao is capturing some of Doulit’s former spotlight.

If earlier being overtaken in rankings by DeepSeek could still be dismissed by ByteDance as an isolated incident, now that Tencent has again overtaken Doulit by leveraging DeepSeek’s momentum, the narrative of large model competition has officially escalated into a battle between major tech giants at the application level. Since the mobile internet era began, Tencent and ByteDance—both companies known for breakout products—have repeatedly clashed in the app space.

It’s easy to imagine that news of Tencent Yuanbao overtaking Doulit will continue to reverberate and impact ByteDance internally for some time.

DeepSeek’s emergence is akin to jolting Zhang Yiming and ByteDance awake from their year-long dream of Doulit’s success. Now, with Liang Wenfeng supporting Ma Huateng, Zhang Yiming is fully backed into a corner—ByteDance may have reached a point where action is unavoidable.

One

The most direct and effective countermeasure available to ByteDance against Tencent Yuanbao’s offensive is to quickly launch a new self-developed reasoning large model.

"Tencent Yuanbao iterated five versions in one week, shifting from passive following to rapid advancement. Tencent isn't just trying to capture overflow traffic from WeChat AI search—it's betting that ByteDance can't produce a new reasoning large model in the short term," a senior algorithm engineer at a leading internet company told Zimu Bang. Tencent clearly identified the gap before ByteDance’s self-developed reasoning model launches. Now is the time to spend heavily promoting Yuanbao and pushing its own T1 reasoning model—this is all about exploiting timing.

Judging by results, Tencent’s timing strategy has achieved some success.

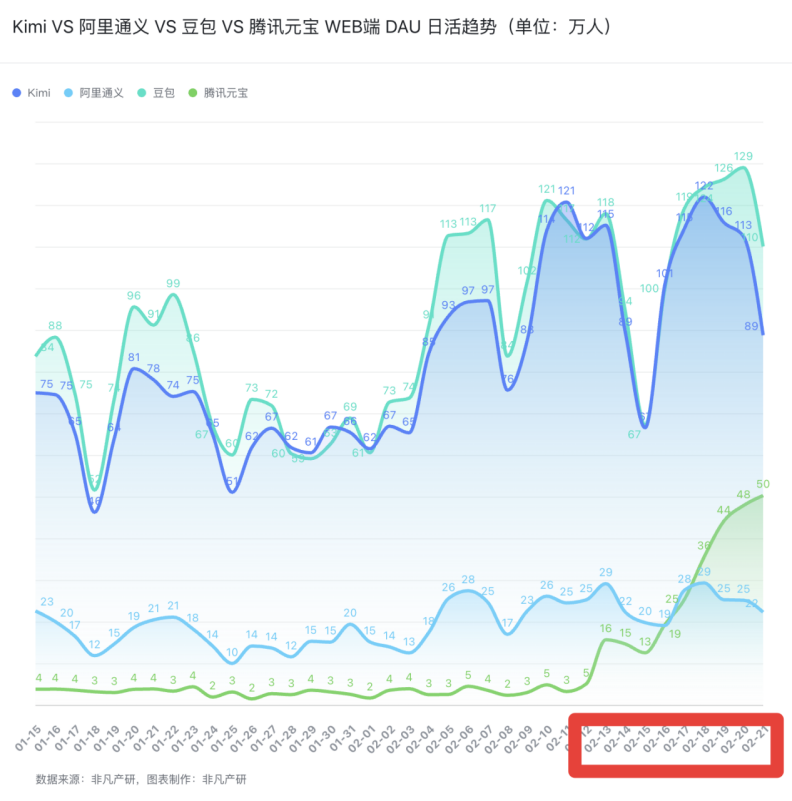

According to Feifan Industry Research data, from February 13 when Tencent Yuanbao announced integration with DeepSeek to February 21, its web version daily active users steadily increased. On February 21, Yuanbao reached 500,000 DAUs—nearly half of Doulit’s average DAU—in less than ten days. It also successfully surpassed Doulit on the Apple free app download ranking, climbing to second place.

Caption: Daily Active User Trends – Doulit vs. Tencent Yuanbao (Web)

Source: Feifan Industry Research

While Tencent’s T1 reasoning large model is already in internal testing and Tencent Yuanbao rapidly acquires users via DeepSeek integration, Baidu has announced plans to launch a new large model within the next 4–5 months, while Alibaba publicly committed to investing over 380 billion yuan in the next three years toward achieving AGI.

A new arms race among tech giants has begun, leaving only ByteDance without any new plans announced yet.

"We’ve been working overtime since returning from Spring Festival to develop our reasoning large model," said Chen Ming. The ByteDance office in Beijing’s Dazhong Temple hosts key teams including Douyin and Volcano Engine. Even on weekend nights past 10 PM, the entire building remains brightly lit.

Regarding the expected capabilities of ByteDance’s self-developed reasoning large model, one thing is clear: internally, the requirement is to match or even exceed DeepSeek R1.

Recently, ByteDance’s Doulit large model team has taken timely action.

Rumors indicate that Seed—the core department within ByteDance focused on cutting-edge research—is rapidly adjusting its direction and has just brought in Wu Yonghui, a prominent figure from Google who contributed to Gemini’s development. Wu Yonghui will become Seed’s new technical lead, while Zhu Wenjia, former head of Seed, will oversee application-side operations. Beyond restructuring responsibilities, ByteDance has also introduced a novel sparse model architecture called UltraMem.

According to public data, Doulit team’s latest architecture achieves 2–6x faster inference speed than MoE-based models, reducing inference costs by up to 83%. Faster and cheaper—ByteDance appears to be targeting DeepSeek’s comfort zone.

Still, while launching a new self-developed reasoning model as quickly as Musk might is ByteDance’s optimal strategy, beyond technological innovation for user acquisition, ByteDance has another path to catch up with Yuanbao: continuing to spend heavily on ad投放.

Previously, Doulit relied solely on Douyin’s ad placements and dominated the market for nearly half a year. Through relentless investment, ByteDance successfully turned Doulit into a top domestic AI app with 70 million monthly active users.

Yet, whether such high-intensity投放 can continue into 2025 is certainly questionable.

After all, while ads bring quick results, they burn cash. According to AppGrowing data, Kimi—the most aggressive advertiser last year—spent over 500 million yuan cumulatively, exceeding 200 million yuan in October alone. Close behind was Doulit, spending over 400 million yuan during the same period. Even for deep-pocketed ByteDance, growth bottlenecks loom and ad costs keep rising.

Reports suggest Moonshot AI recently decided to drastically cut Kimi’s product投放 budget. Whether to continue burning money recklessly or adjust投放 policies, ByteDance—urgently needing to strike back—now faces a critical strategic decision.

Two

Compared to Tencent’s current glory boosted by DeepSeek, ByteDance’s past achievements have now become shackles when it comes to integrating DeepSeek—the more emphasis they previously placed on Doulit, the harder it becomes to adopt DeepSeek now.

As Tencent integrates DeepSeek across its full suite of apps, ByteDance appears to favor embracing DeepSeek primarily in B-end services.

Recently, ByteDance’s Volcano Engine announced a giveaway campaign for R1 API—acting as a provider of DeepSeek R1 model APIs, encouraging users to invite friends to register and offering vouchers worth up to 145 yuan, redeemable for 36.25 million tokens for free.

Yet despite ByteDance’s willingness to spend on B-end user acquisition, there has been no news of integrating DeepSeek into its flagship C-end products—neither Douyin nor Doulit.

Unlike Tencent, which previously remained uninvolved in consumer AI apps and never promoted any C-end app within WeChat’s traffic pool, ByteDance has adopted a highly aggressive stance in going all-in on AI—in other words, ByteDance carries too much baggage.

Earlier, to seize early advantage in the large model race, ByteDance both poached talent aggressively and invested heavily in promoting Doulit.

Take Wu Yonghui, rumored to soon join Seed, ByteDance’s core AI division. Although the recruitment package hasn’t been disclosed, given his role, “his annual compensation must exceed tens of millions, with a significant portion in stock,” said Xing Ze, founder of Jiaming, a headhunting firm serving major tech firms.

Additionally, to feed Doulit, ByteDance essentially turned Douyin into Doulit’s exclusive traffic source.

On March 18 last year, Douyin’s Giant Quantity Advertising announced restrictions on AIGC software投放; from April 2 through year-end, non-ByteDance products were barred from accessing Douyin and Toutiao’s massive traffic pools. Since August last year, although Doulit’s投放 scale was smaller than Kimi, Zhipu, or Xingye, its average monthly downloads approached 6 million, rapidly turning it into a top-tier app with 70 million MAUs.

In e-commerce, Douyin can simultaneously support its own businesses while earning revenue from competitors. But to help Doulit leap ahead, ByteDance’s Giant Quantity became the first platform to restrict投放 for rival products.

With such massive investments, it has become harder for ByteDance—a giant elephant—to pivot directions swiftly.

Now that Baidu—a fellow tech giant committed to self-research and rarely investing in other large model companies—has begun integrating DeepSeek into its main consumer applications, ByteDance’s continued refusal to do so is drawing increasing external skepticism. Meanwhile, mounting pressure builds on both ByteDance and Zhang Yiming.

Three

Nonetheless, it should be noted that this AGI battle is far from over. Temporary leads cannot determine final outcomes—both Tencent and ByteDance face their own unique opportunities and challenges.

Although Tencent demonstrates catching-up momentum in competing for C-end users by binding with DeepSeek, attention should be paid to ByteDance’s existing lead in multimodal technology布局.

As Tencent’s first AI product to integrate DeepSeek R1, Yuanbao offers features including AI search, smart document processing, AI music recommendations, AI map navigation, and intelligent assistant functions.

In contrast, ByteDance has spent a year deeply developing text-to-video capabilities. Not only did it launch JiMeng AI to compete with Kuaishou’s Keli, but it recently released VideoWorld—an open-source video large model capable of performing tasks without relying on reinforcement learning search or reward function mechanisms, such as achieving professional 5-dan level performance in 9x9 Go.

Not to mention, ByteDance has already solidified its position in the B-end market through CapCut. For newcomers like DeepSeek and Tencent, ByteDance retains a time advantage.

Meanwhile, according to a Bloomberg report on February 21, considering Doulit’s potential, SoftBank’s Vision Fund raised ByteDance’s valuation to over $400 billion in December 2024. Rising from a $300 billion valuation last year to $400 billion this year, despite disruptions from new entrants like DeepSeek, external parties clearly remain confident in ByteDance’s profit potential in the AI era.

For Tencent, which itself develops multimodal large models, retaining the traffic overflow from DeepSeek ultimately requires accelerating its own R&D pace to catch up with ByteDance and matching DeepSeek’s model performance.

This war centered around cognitive revolution has no absolute winner yet, but it will undoubtedly redefine the next decade for major tech giants. For Douyin’s 800 million daily active users, what lies ahead may be the most dramatic paradigm shift in history.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News