How can DeFi effectively respond to market turmoil after the Bybit hack?

TechFlow Selected TechFlow Selected

How can DeFi effectively respond to market turmoil after the Bybit hack?

A deep dive into the impact of this attack on Aave, Ethena, and USDe.

Author: Omer Goldberg, Founder of Chaos Labs

Translation: Yuliya, PANews

Following Bybit's $1.4 billion hack, the cryptocurrency market has suffered a severe shock. How DeFi (decentralized finance) platforms respond to this largest-ever cyberattack—along with potential contagion risks and USDe price volatility—has become a focal point in the crypto space. This article examines the impact of the attack on Aave, Ethena, and USDe, analyzes how DeFi systems are responding, and explores whether Proof of Reserves could prevent over $20 million in liquidations.

After the attack, the Chaos Labs team formed an emergency response group together with bgdlabs, AaveChan, and LlamaRisk to assess potential risks to Aave and systemic risks.

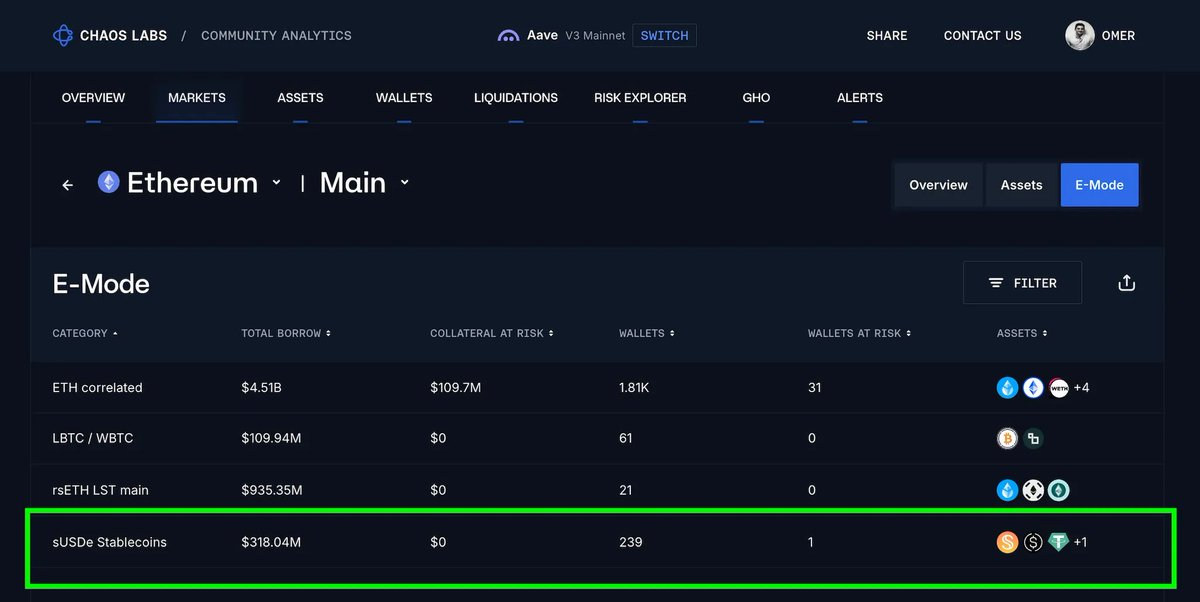

The emergency group focused on several key issues: Bybit’s solvency status, the possibility of a broader-scale attack, and the potential impact on Aave given its exposure to sUSDe.

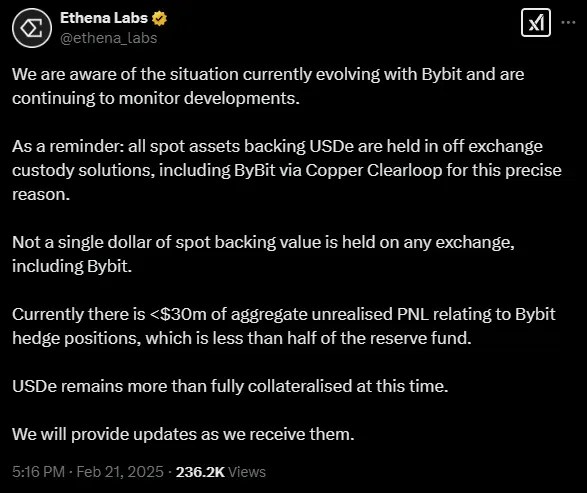

Ethena Labs confirmed that its funds were custodied via Copper.co, but market concerns remain about potential ripple effects if Bybit cannot settle P&L obligations, and whether USDe might face deeper depegging risks.

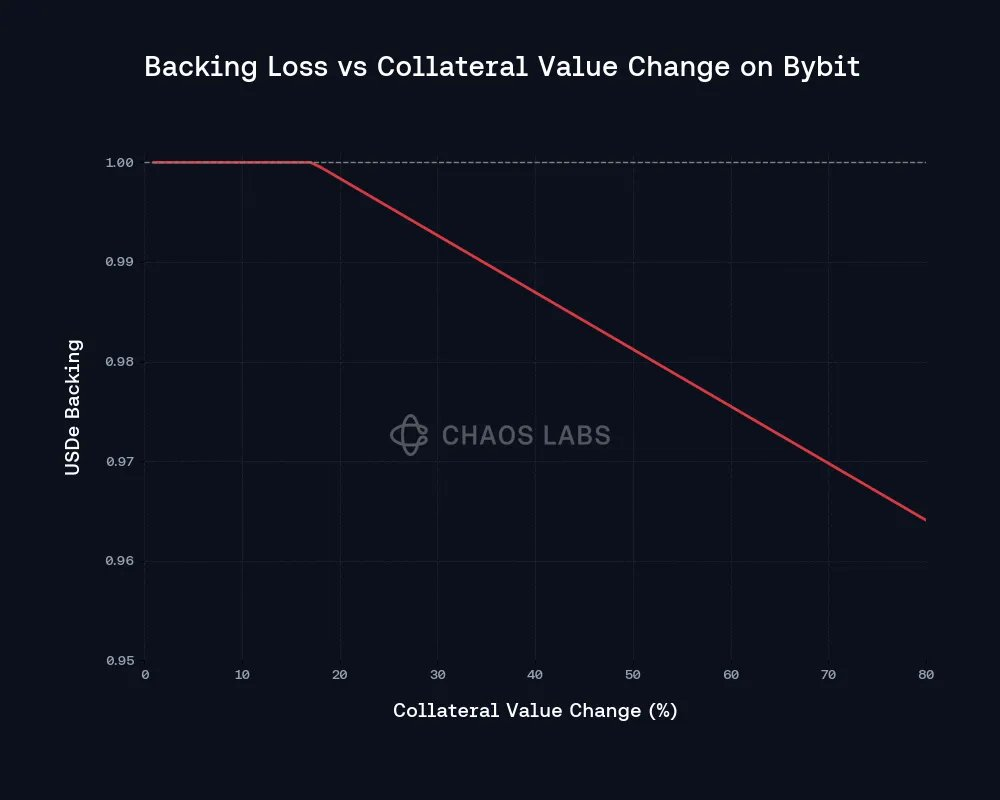

Analysis of Bybit’s bankruptcy risk highlights three main vulnerabilities: exposure from failed USDe hedging, cascading liquidation risks triggered by ETH price declines, and potential DeFi contagion.

This prompted stakeholders to accurately quantify losses to determine whether measures such as freezing the sUSDe market should be taken. Transparency dashboards show Ethena’s ETH positions on Bybit, while Ethena Labs’ collateral is securely held off-exchange at Copper.co. This custody solution and off-exchange settlement mechanism effectively shield Ethena and USDe from risks similar to those of the FTX exchange collapse.

In a scenario where a notional $400 million ETH position remains unhedgeable and ETH prices drop 25% before Copper.co releases funds, Ethena could face $100 million in unhedged losses. However, considering a $60 million insurance fund, the total support loss for USDe is expected to be only 0.5%.

Given the relatively manageable risk level, Aave has prepared contingency plans and continues to monitor developments.

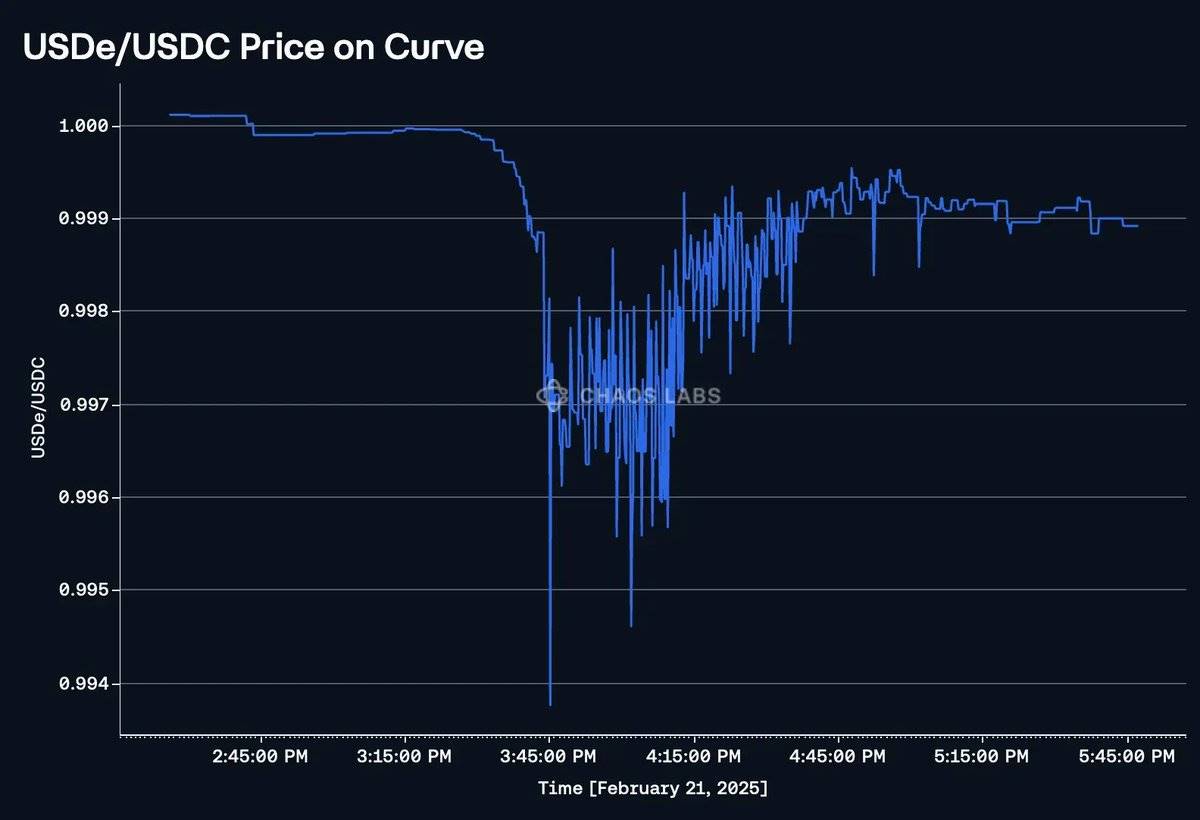

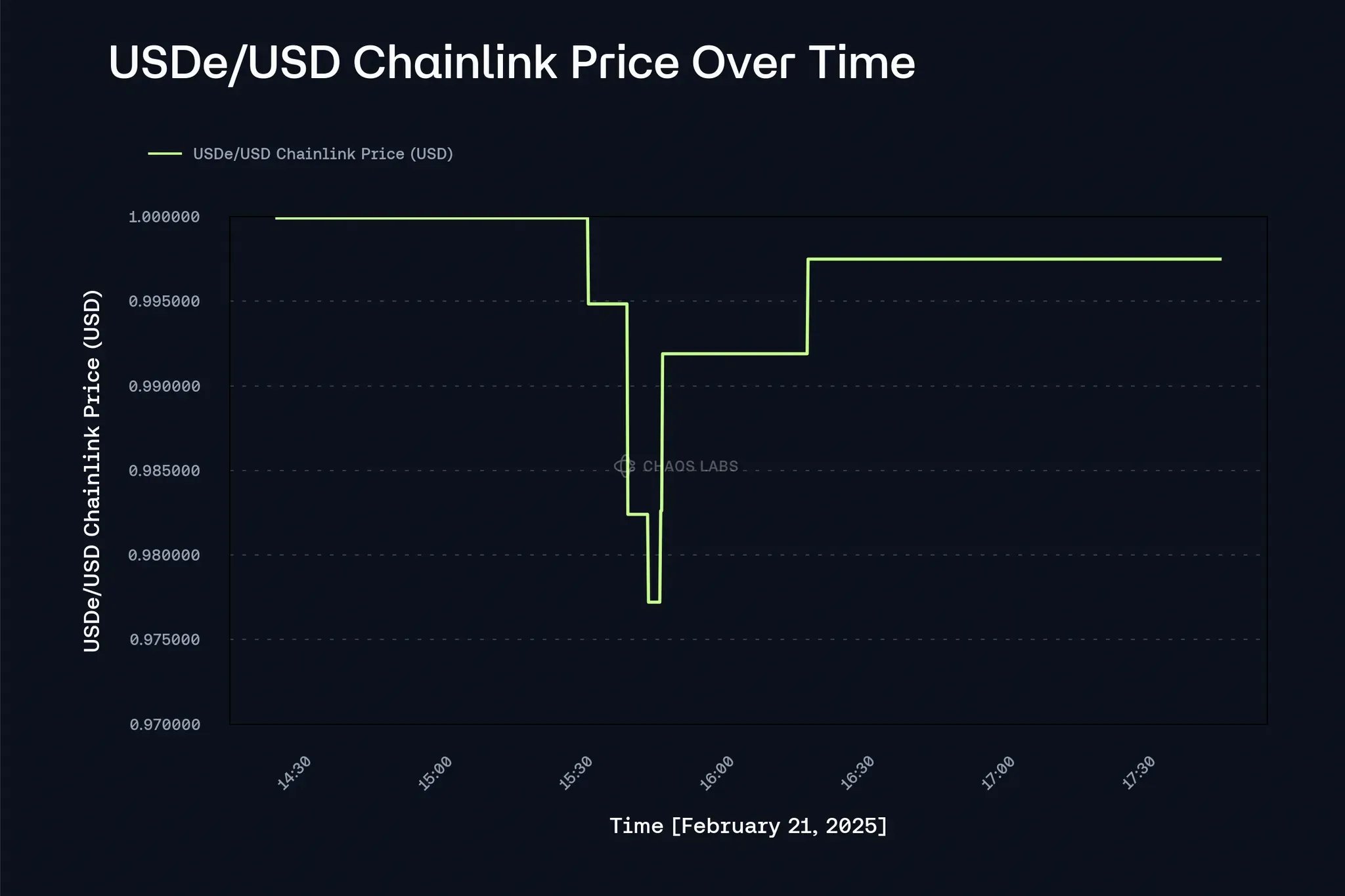

In terms of pricing, USDe showed significant deviations across different trading venues. On Bybit, due to panic selling and lack of immediate arbitrage, USDe/USDT briefly dropped to $0.96.

In contrast, on-chain pricing remained more stable, experiencing only a brief dip to $0.994 before quickly recovering through arbitrage. This divergence primarily stems from differences in redemption mechanisms and oracle functions.

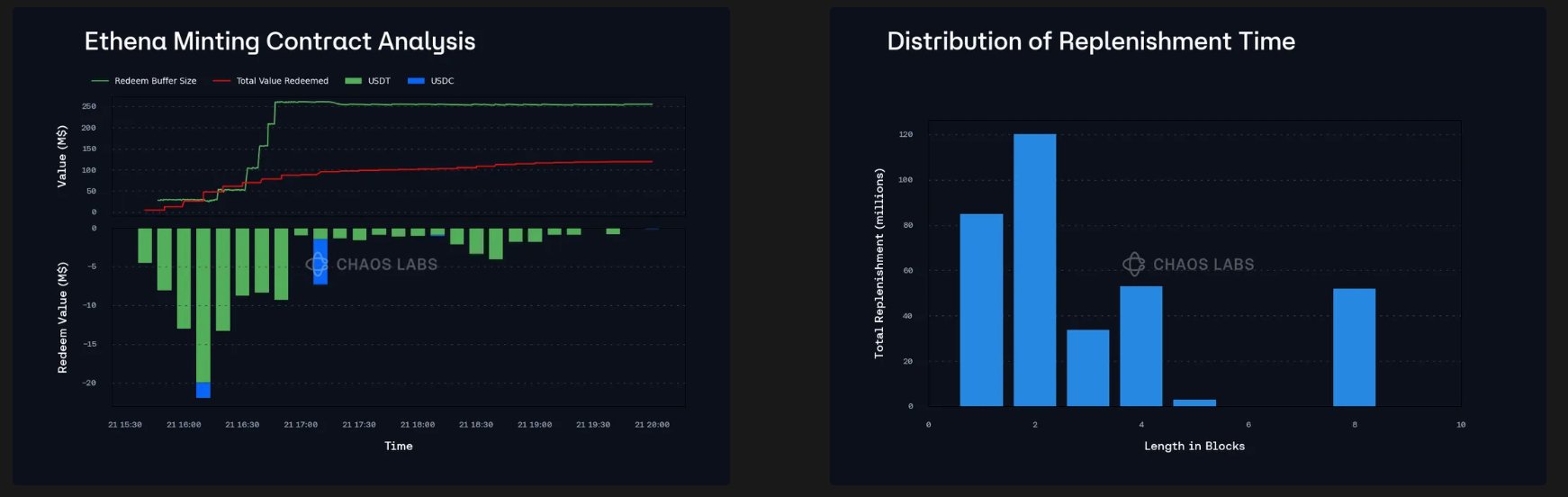

Unlike CeFi, USDe redemptions can occur continuously and atomically on-chain via the Mint and Redeem contract. The on-chain redemption mechanism operated smoothly, processing $117 million in redemptions within hours. Ethena Labs also increased its redemption buffer to $250 million and continuously replenished it to maintain price stability until USDe re-pegged. Due to the atomic nature of USDe redemptions, whitelisted redeemers quickly closed the price gap on Curve.

However, oracle anomalies amplified market risk. Chainlink’s USDe/USD price feed deviated from on-chain prices, falling to $0.977 despite the redemption mechanism functioning normally.

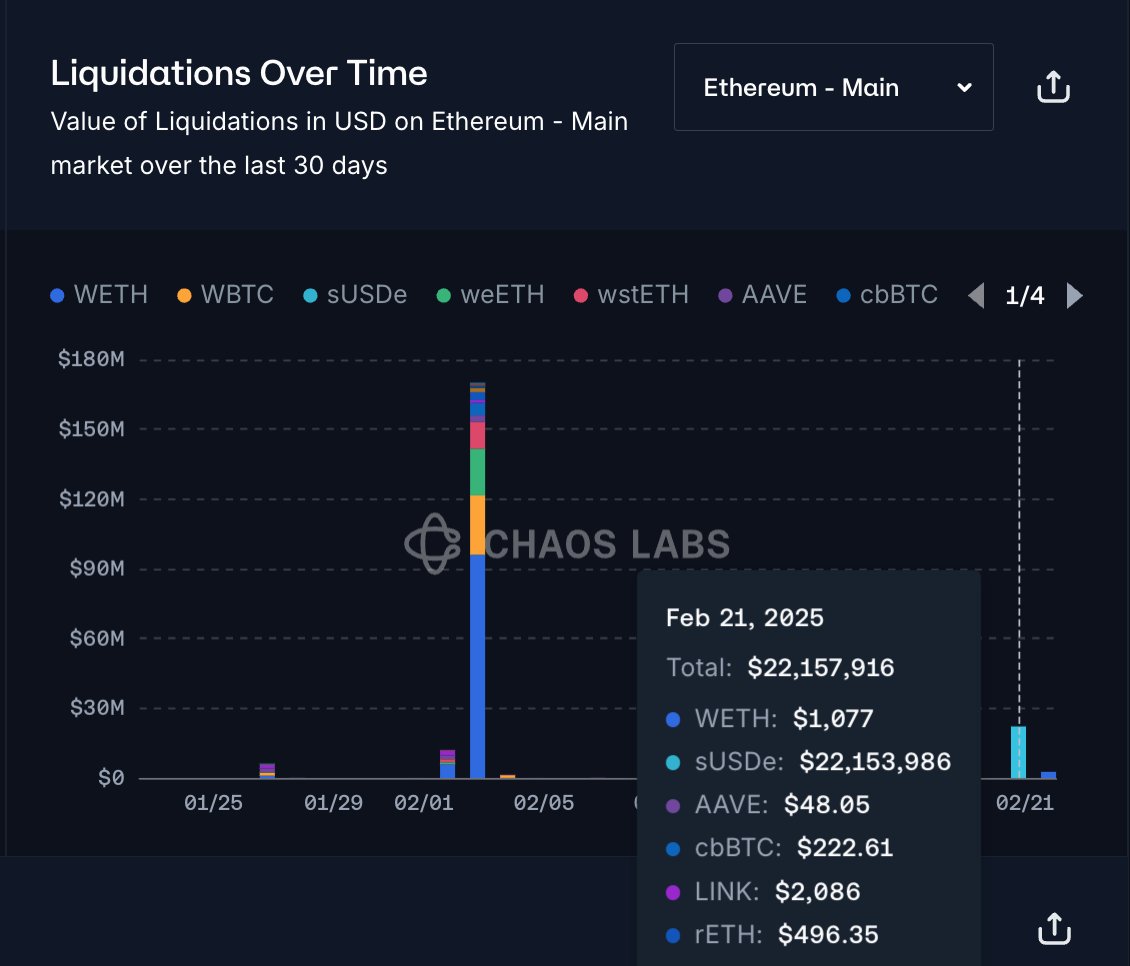

This discrepancy triggered $22 million in liquidations on Aave, where traders were liquidated due to secondary market price fluctuations, even though their USDe collateral remained sound.

This highlights room for improvement in oracle mechanisms—an intelligent data source integrating Proof of Reserves could provide more accurate USDe valuations and prevent unnecessary liquidations by factoring in real-time redemption capacity instead of relying solely on weighted average trading prices. Such a smart oracle could:

-

Prevent unnecessary liquidations;

-

Maintain capital efficiency;

-

Reduce market pressure

Where Can Improvements Be Made?

Risk, price, and Proof of Reserves data must work together rather than in isolation to preserve value and maintain DeFi system resilience under stress. Price oracles should reflect actual collateral backing, not just secondary market prices.

Overall, the DeFi ecosystem has withstood this stress test. The Bybit team stabilized markets through transparent communication, the Ethena Labs team swiftly eliminated exposure and ensured smooth redemptions, and Aave effectively contained risks without incurring bad debt.

This event shows that to build more resilient systems, the industry needs smarter oracles and risk-aware infrastructure that enhances capital efficiency while ensuring security. The next major stress test is only a matter of time—the industry must prepare ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News