The Christmas tree is the ultimate destination for most projects; the real competitive edge lies in rejuvenating old trees

TechFlow Selected TechFlow Selected

The Christmas tree is the ultimate destination for most projects; the real competitive edge lies in rejuvenating old trees

To avoid becoming a Christmas tree exit, projects can only keep splitting and creating spin-offs, which essentially means building an ecosystem—but it must be a self-sustaining ecosystem, not a parasitic one.

Author: Zixi.eth

TLDR:

The ultimate fate of 99.99% of blockchain projects is becoming a Christmas tree. Whether it's a VC coin or a Meme coin, the destiny is the same—the only difference is that Meme Christmas trees progress at an accelerated pace compared to VC Christmas trees. However, this doesn't prevent people from making money within them; you just need to believe early and exit early.

To avoid ending up as a Christmas tree, projects must continuously create spin-offs, which essentially means building ecosystems—but they must be ecosystems that are "self-sustaining" rather than parasitic. This places significant demands on tokenomics design.

When I first started reading and when I joined Matrix Partners, I was highly results-driven, believing that anything leading to poor outcomes was a waste of time. When I first entered the crypto space, I held the same view: if a project eventually went to zero, it was trash. But after seeing countless Christmas tree projects, I gradually realized that the process truly matters more than the outcome. If you refrain from participating in certain projects early simply because you believe they'll eventually go to zero, you'll miss out on enormous wealth opportunities.

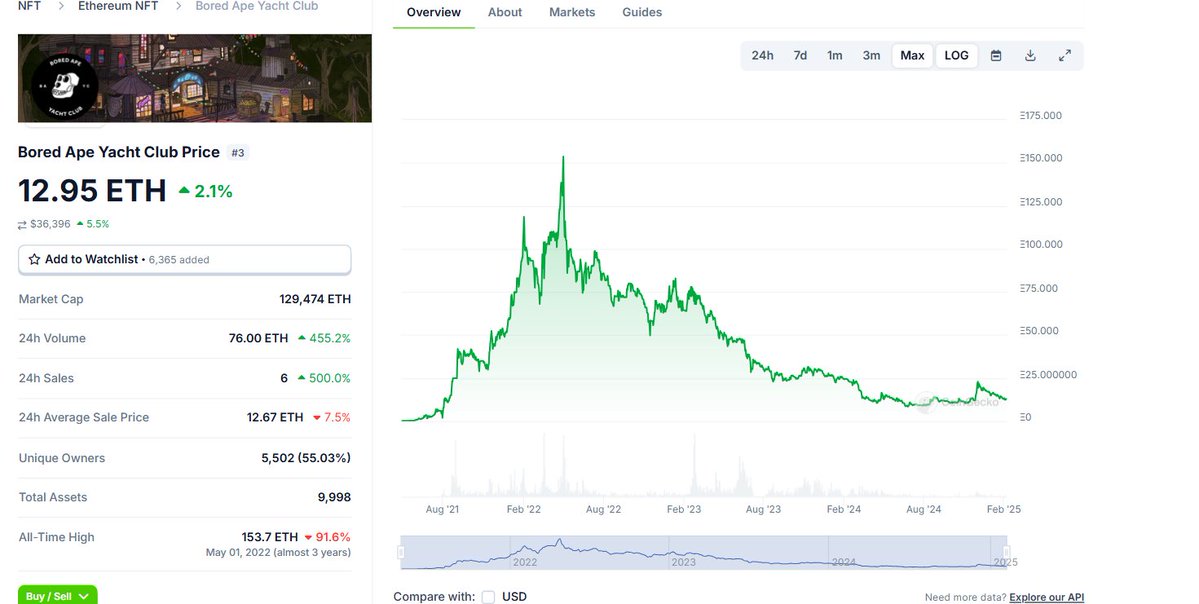

When I first entered crypto in 2021, I absolutely refused to buy animal-themed MEMEs or NFTs because I didn't understand them, viewing them as Ponzi schemes and completely failing to grasp the mechanics behind those rapid price surges. As a result, I completely missed projects like Bored Ape, Moonbirds, penguins, and Azuki. Even if these NFTs eventually go to zero four years later, early participants still made profits—Bored Apes, for example, airdropped Baby Apes /kernel/ape tokens.

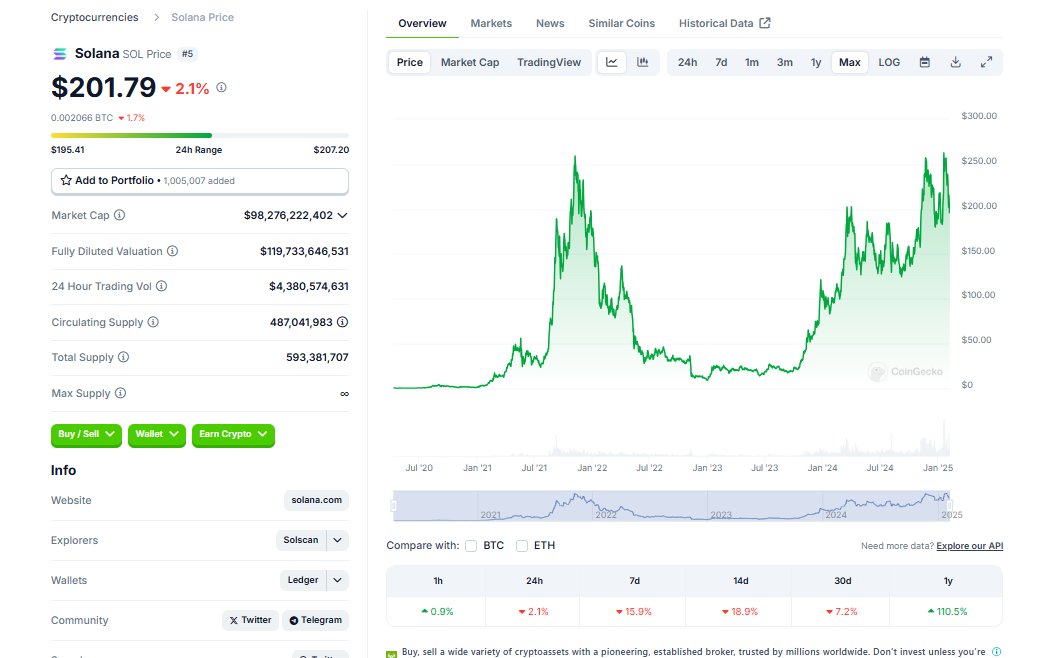

For a period in 2021, I was extremely focused on top-tier VC-backed coins, particularly Luna and Solana, and made some profits myself on these. However, after Luna collapsed, the entire crypto market began to crash. Luna, Solana, and many so-called "valuable VC coins" all turned into Christmas trees. From that point on, I kept questioning what being a so-called "top project" in crypto really meant, and what could possibly escape the fate of becoming a Christmas tree.

By 2024, the Meme craze took off and Solana began to revive. Watching meme coins like BOME, GIGA, and SPX6900 skyrocket overnight, I still felt internal resistance but chose to participate anyway, because I began to realize that riding the primary bullish wave would allow me to profit—as long as I exited quickly enough, I wouldn't be the one left holding the bag. Believe early, exit early.

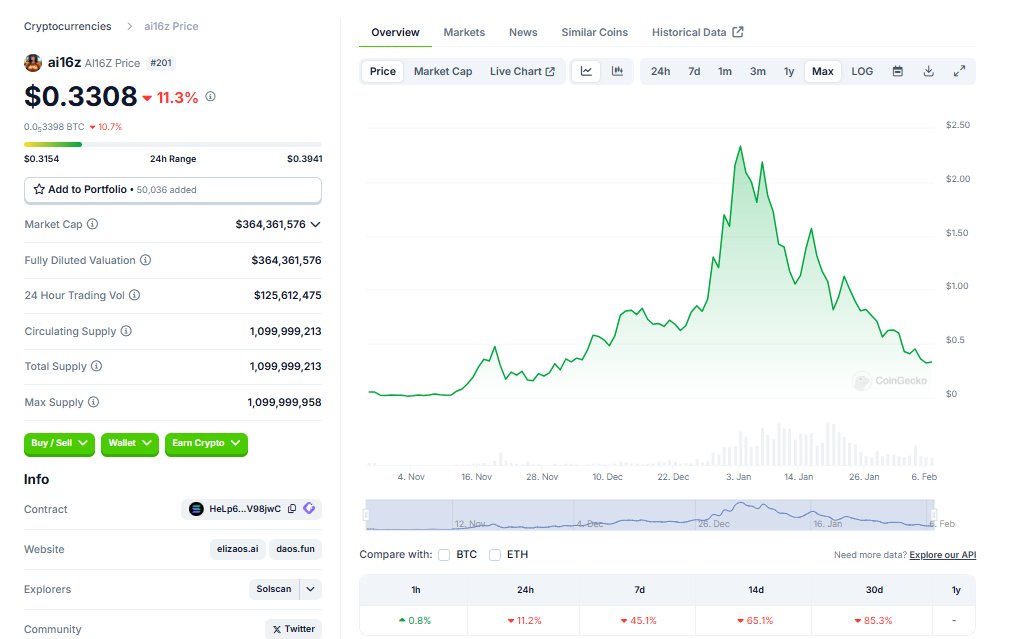

In November 2024, while on a business trip in Bangkok, I discovered ai16z. After researching it, I bought a large amount. As AI Agents surged in popularity from December to January, countless crypto developers and retail investors who previously knew nothing about AI started flocking to this sector. Shaw's visit to China further convinced me that bottom-up community power could truly turn a grassroots project into a B2B company. Unfortunately, by February 2025, ai16z’s price had nearly returned to where I first saw it. It took two months to rise from $200 million to $2 billion market cap, but only one month to fall back to $200 million. Those three months felt like I'd experienced everything, yet also nothing at all.

These experiences led me to realize that the lifecycle of top Meme projects starting in 2024 has become a highly accelerated version of the 2021 VC value coin cycle. A top VC coin might take 1–2 years to grow from $0 to $2 billion market cap and another 1–2 years to collapse to zero. But for Memes, value discovery from $0 to $2 billion takes just 1–2 months, and once the tide recedes, collapsing back to zero also takes only 1–2 months.

The fundamental nature of this industry hasn't changed in years—every meme or ecosystem project is essentially a spin-off of major blockchains. Most spin-offs will likely end up at zero. But how can one escape this zero-fate?

Currently, my answer is to build a "self-sustaining" ecosystem. The essence of building an ecosystem is still creating more spin-offs. Solana stands as the best example of phoenix-like rebirth. On the verge of dying and reaching zero in 2023, @SolanaFndn clearly defined its next steps, launching memes to generate wealth effects and promoting narratives around DePIN, PayFi, and AI Agents—constantly spinning new stories to drive buying pressure. At the same time, its ecosystem projects performed exceptionally well: Raydium, Jupiter, Jito, and others were self-sustaining and attracted real users, helping Solana retain users and capital, thereby genuinely avoiding the Christmas tree fate.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News