Post-TRUMP Era: Where Is Crypto's Next Hot Narrative?

TechFlow Selected TechFlow Selected

Post-TRUMP Era: Where Is Crypto's Next Hot Narrative?

Has Trumpcoin become the peak of the memecoin craze? Should we now turn our attention to SocialFi?

Author: Tulip King

Translation: TechFlow

Alpha First

-

The overall market is healthy but shows signs of overextension, with the next major investment trend yet to emerge clearly.

-

Trumpcoin may have marked the peak of the Memecoin frenzy—should we now shift focus to SocialFi?

-

Emerging trends: SocialFi, AI, and Dinocoins are competing for market attention.

Market Overview

Despite recent volatility, I believe the market remains fundamentally healthy. The three core indicators of the crypto market all show strong positive signals.

-

Bitcoin Holds Strong at High Levels

Bitcoin continues consolidating near its upper range, signaling bullish sentiment rather than weakness. At this stage, approximately $105,000 appears to be a key psychological level for Bitcoin. This price point reflects confidence in the long-term trajectory of cryptocurrencies while avoiding excessive optimism.

Bitcoin’s consolidation at elevated levels sends a healthy market signal.

While we haven’t seen major catalysts—such as a Strategic Bitcoin Reserve (BSR) or comprehensive tax incentives for crypto—there have been subtle developments. For instance, Ross Ulbricht’s pardon was a quiet but meaningful signal that the Trump administration hasn’t abandoned pro-crypto policies. Regulatory clarity is advancing slowly, but the direction remains positive.

-

Stablecoin Supply Shows Steady Growth

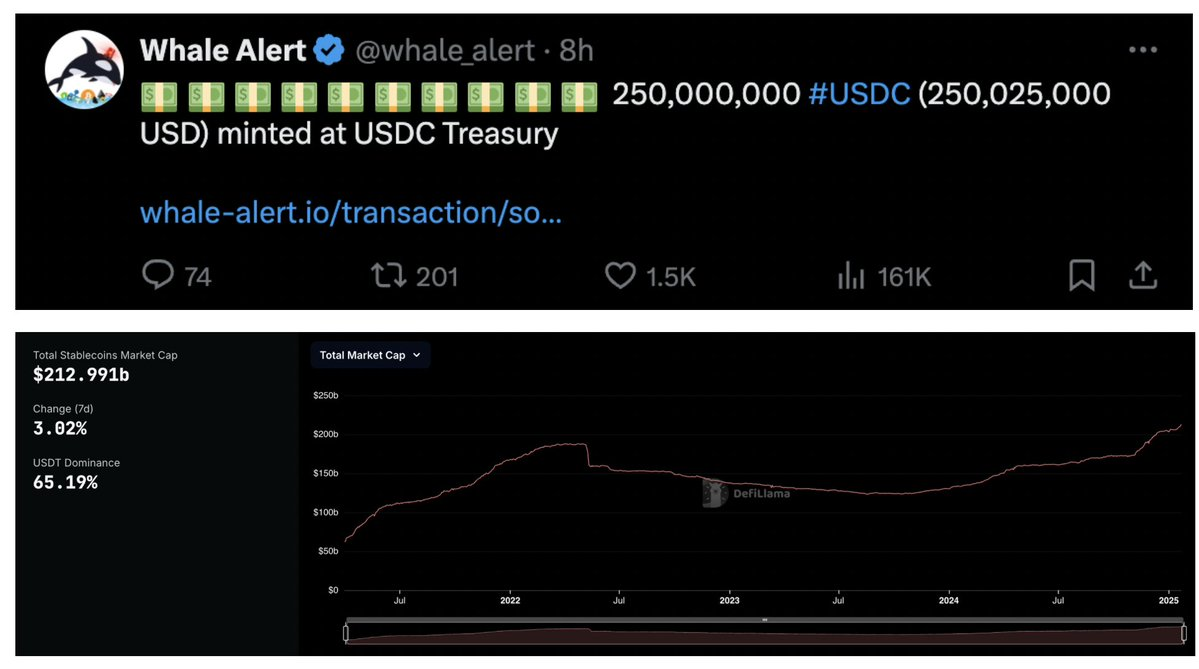

Another encouraging sign is the sustained increase in stablecoin supply. Historically, rising stablecoin issuance has reliably preceded growing institutional interest and enhanced market liquidity. A key question arises: Who is minting these stablecoins at such scale?

Continued growth in stablecoin supply signals bullish momentum.

The scale of minting suggests real institutional participation. If you're skeptical, check data from @whale_alert and other on-chain monitoring tools. While this capital inflow isn't yet reflected in altcoin performance, money is clearly entering the ecosystem.

-

Expansion of Total Crypto Market Cap

Total cryptocurrency market capitalization continues to grow.

Finally, the total market cap of the crypto market keeps expanding. Combined with Bitcoin’s strength and rising stablecoin supply, this indicates the market is far from collapse. Instead, it is consolidating and preparing for the next phase of growth—whatever form that may take. The current environment hardly resembles an impending doomsday scenario.

Narrative Risk: Loss of Market Direction

A major reason for the lack of significant movement in the altcoin market is the absence of a clear narrative direction. This is what we call “narrative risk”—when markets lose their sense of direction, capital may flow into suboptimal themes, increasing systemic risk.

Take the recent Memecoin surge. Despite no announcement of a Strategic Bitcoin Reserve (BSR) or other major policy shifts, Trump launched a Memecoin. Melania followed with her own token, and rumors suggest Barron might join too. Traders, myself included, responded enthusiastically to these opportunities.

Yet this sudden Memecoin wave introduced more uncertainty than clarity. Is this the supercycle for Memecoins—or a top? Should we refocus on AI tokens? Why is XRP’s chart looking so strong? Even the market itself seems unable to identify where capital should be allocated next.

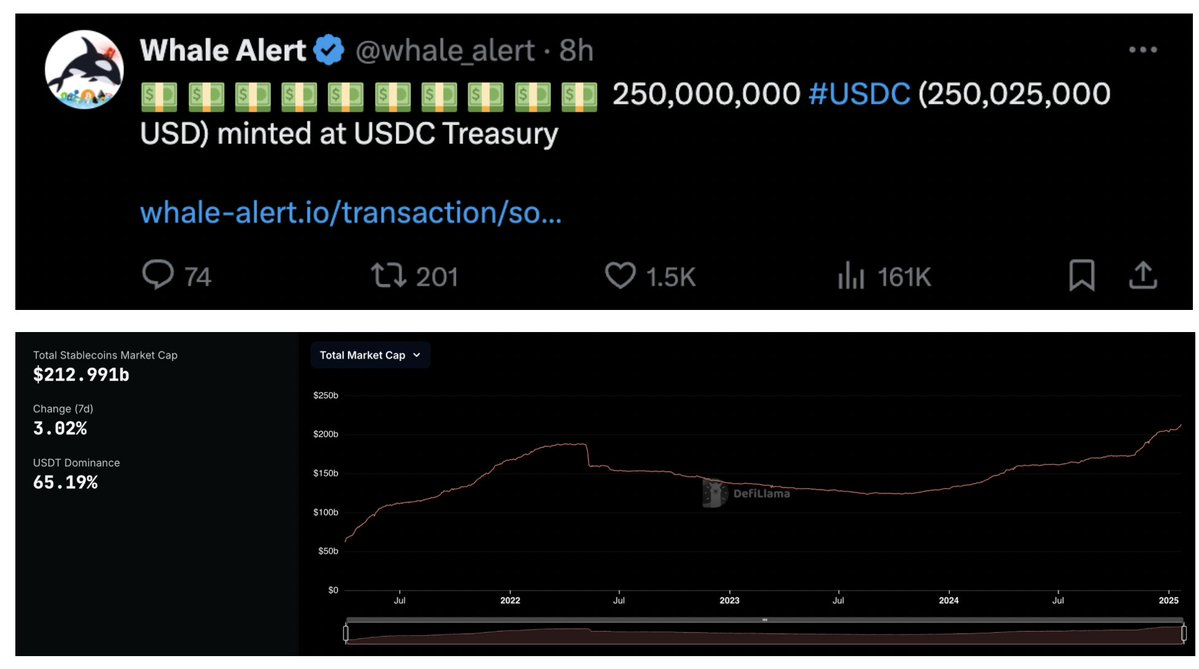

Memecoins: The End of the Frenzy?

Unfortunately, Memecoin trading may already be entering its final act. Trump’s entry has captured an overwhelming share of attention and market dominance—an impact difficult to overstate. Now the question is: Who else can launch a Memecoin at a comparable scale? The likely answer is “no one.”

In Kel’s words, we’ve exhausted our “attention resources.”

Memecoins fundamentally convert public attention into tokenized assets. They thrive by capturing attention and channeling it into speculative capital. This model has driven explosive growth in the Memecoin space for years. But with Trump’s entry, it may have reached its apex. Trump isn’t just another celebrity or influencer—he commands the majority of global media and cultural attention. No other figure or event can match his dominance.

Therefore, Memecoins as an asset class may have peaked. The potential for attention-to-token conversion has been fully tapped. Sure, Trumpcoin might rally further, possibly pulling other Memecoins into one last parabolic move. But this feels like an epilogue, not the beginning of a new chapter.

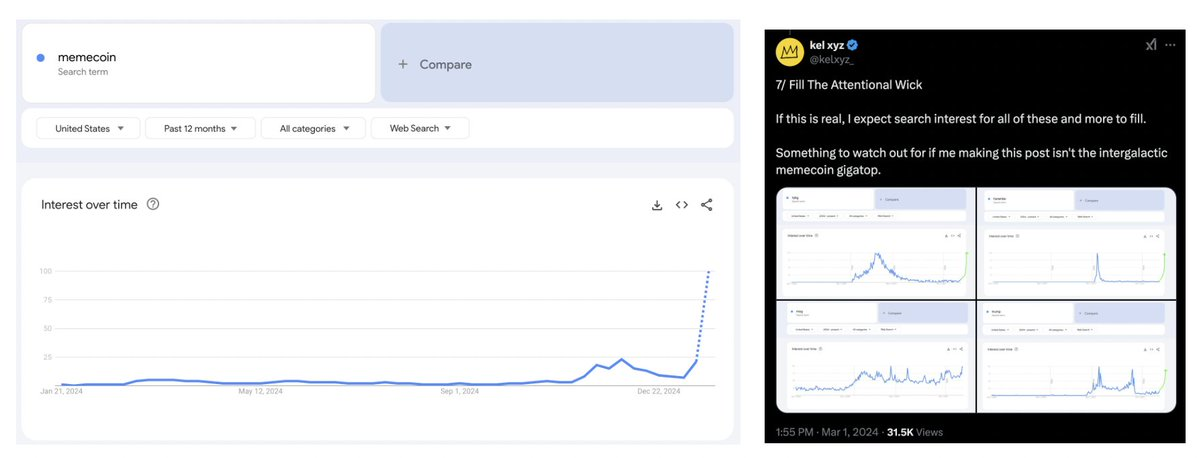

SocialFi (Clout & Yapster)

If the Memecoin narrative is to continue evolving, it needs a more sustainable and scalable model. This is where SocialFi comes in. By combining speculation with deeper, more personal engagement, SocialFi could extend the Memecoin story. Rather than betting on cultural moments or celebrity tokens, SocialFi offers investment in personal relationships and community dynamics. In this sense, it represents a natural evolution—from mere attention extraction toward meaningful interaction and long-term value creation.

Why SocialFi Matters

SocialFi is a promising emerging trend. Successful projects here could merge social media and online gaming into a compelling, monetizable hybrid platform. Think of it as the convergence of “social networking and digital entertainment,” with massive scalability potential.

Two projects stand out:

-

Clout: Clout focuses on tokenizing social influence, allowing users with large followings (10K+) to create personal tokens. Built on Solana, it combines the monetization features of Friend.tech, simplifies token issuance, and integrates with decentralized exchanges like Raydium. Clout has seen early success—its first token, $PASTERNAK, reached an $80 million market cap within hours. Seamless registration via credit card and Apple Pay significantly lowers the barrier for Web2 users. However, its open structure spreads liquidity across many influencers, potentially weakening community cohesion.

-

Yapster: Yapster is another innovative SocialFi project, blending social media, gaming, and crypto, also built on Solana. Its approach is more centralized, uniting communities around shared goals rather than fragmenting liquidity across numerous influencers. Users participate in daily game shows, paying a 0.25 SOL entry fee to create and vote on memes. Winning memes can be minted as tokens, with distribution tied to user scores. This model concentrates liquidity around single memes instead of multiple personalities, creating stronger, unified capital flows. Yapster’s invite-only beta fosters a tightly-knit, highly engaged community. Notably, its first token hit a $25 million market cap in just 10 minutes—demonstrating powerful user engagement and value creation.

@yapsterxyz: We’re aware many users experienced lag and technical issues during gameplay! Our team is working around the clock to fix them. Thank you all for your understanding and patience during the beta.

Stability issues due to excess demand are often bullish signals.

While Clout offers advantages in scalability and ease of use for influencers, I’m more drawn to Yapster’s centralized mechanism and community-driven design. Its focus on converting mass attention into tangible value—rather than scattering liquidity across individuals—is more sustainable and compelling.

Dinocoins (XRP, HBAR, XLM)

-

“What is dead may never die, but rises again harder and stronger.” — George R.R. Martin

Dinocoins (including XRP, HBAR, and XLM) represent the classic “unloved trade” of this crypto cycle. These trades work precisely because they expose emotional biases in the market. Widespread skepticism and dismissal mean under-allocation—and thus significant dry powder waiting on the sidelines. When these assets start moving, investors are often forced to buy in, fueling further upside.

Bitcoin vs. XRP price charts.

For years, crypto Twitter has dismissed Dinocoins as outdated relics, irrelevant in the face of newer, shinier narratives. Yet this very disdain creates fertile ground for unexpected resurgence.

Why pay attention now?

Despite poor reputation on Twitter, Dinocoins are showing strong price action and institutional adoption. Here’s why they matter:

-

Institutional Recognition: These tokens are positioning themselves as “more formal” players in crypto, focusing on real-world use cases and partnerships. Ripple’s new stablecoin RLUSD signals serious intent to integrate with mainstream finance. XRP’s collaboration with Santander and HBAR’s partnership with the World Gemological Institute underscore their commitment to institutional adoption.

(Not a typical XRP Army account—an excellent research team sharing a bullish view)

-

Regulatory Positioning: With expectations of friendlier crypto regulations, these tokens are well-positioned. XRP and XLM’s compliance with ISO 20022—a standard closely tied to traditional financial systems—boosts credibility. Moreover, rumors of ETFs for XRP and HBAR add another layer of appeal, even as Bitcoin ETFs dominate headlines.

The contrast is striking: while many crypto enthusiasts sneer at them, institutions may quietly embrace these assets. Whether you love them or hate them, Dinocoins are making moves that could redefine their market role. Their focus on compliance, partnerships, and real-world utility may ultimately prove to be the winning strategy—especially if they gain favor with regulators.

Hedge Fund Liquidity Token Plays

If you still believe in the idea of a “fair launch,” it’s time to face reality: most tokens’ life cycles aren’t as democratic as they appear.

-

Team develops project: Founders build a project—often around DeFi or infrastructure—and create a token as part of the ecosystem.

-

VCs fund in exchange for locked tokens: Venture capitalists provide funding in return for locked or vesting tokens. This theoretically aligns VCs with long-term success, since tokens can’t be sold immediately.

-

VCs OTC-sell unlocked tokens to liquidity providers: As tokens begin unlocking, VCs typically sell them off-chain (OTC) to liquidity providers—well-capitalized institutions that buy in bulk at a discount.

-

Liquidity providers dump during high-volume market activity (you're in this phase now): After acquiring these tokens, liquidity providers seek to create or exploit market hype. They promote narratives via platforms like Twitter, drive up volume and attention, then sell at high prices when conditions are favorable.

Reality Check

Take Raydium, for example—its tokens appear largely unlocked.

Between 2021 and 2023, venture capital flooded into the crypto market, especially DeFi and infrastructure projects. Investments were typically made in exchange for locked or vesting tokens. Now, as most of these tokens unlock, VCs need to liquidate to deliver returns to their limited partners (LPs). Starting mid-2024, many prominent VCs began calling for increased liquidity raising. These liquidity providers purchase illiquid unlocked tokens via OTC deals, giving VCs an exit route.

Rather than blaming participants, understand the system itself. VCs are pushing for liquidity raises to offload their tokens via OTC, enabling profit distribution to LPs from the previous cycle.

The relationship between VCs, liquidity providers, and the market isn’t malicious—it’s a natural part of capital flow in the crypto ecosystem. VCs rely on well-funded liquidity providers to absorb their tokens, which, due to low liquidity, are often sold at a discount. In turn, liquidity providers amplify narratives on platforms like Twitter to generate attention and volume, aiming to dump tokens at a premium when market conditions allow.

Alignment of market narratives and timing.

This isn’t necessarily malicious—I’m even buying some of these tokens myself. But you must know your counterparty and understand the full lifecycle of a token.

AI Agents & DeFAI

DeFAI could replace many existing crypto tools. With sufficient integration, a DeFAI router could function simultaneously as a yield aggregator, DEX and perpetual contract aggregator, portfolio manager, and more.

That said, I remain skeptical of AI agents that claim to “make you money.” Market dynamics ensure that alpha decays over time. Nevertheless, DeFAI could still empower individual investors by simplifying trading strategies and portfolio management.

Currently, AI stands at a critical juncture. The AI narrative has evolved through several phases: first infrastructure projects like Bittensor, then agent-focused plays like AIXBT, followed by agent launchpads (e.g., Virtuals) and frameworks (e.g., AI16Z). Now, the latest frontier is DeFAI.

An Emerging Key Trend

AI is undoubtedly one of the most important themes of this cycle, but its long-term trajectory remains unclear. The rise of DeFAI is particularly noteworthy—not because it promises magical “money-making AI,” but because it emphasizes practical functionality: streamlining yield optimization, trading, and portfolio management.

DeFAI’s uniqueness lies in its potential to unify today’s fragmented crypto tooling landscape. Imagine a router that seamlessly integrates multiple financial tools—this could drastically reduce user friction. While the idea of a “profit-generating AI agent” sounds unrealistic, DeFAI’s real value is helping users execute their own strategies more efficiently.

Evolving Market Trends

Like all major market themes, AI is rapidly evolving through hype and experimentation. From early promises of financial freedom to today’s focus on functional DeFAI tools, this shift reflects a broader transition from fantasy to real-world utility. AI will remain a central theme, but the ultimate winners will be those that meet actual needs and avoid overpromising.

The crypto market remains full of unknowns. Trends shift quickly, and future winners will be those who anticipate where mass attention will flow next. Stay sharp, stay flexible, and keep the big picture in mind—don’t get distracted by short-term noise.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News