Crypto Graveyard: 10,000 Ways to Zero

TechFlow Selected TechFlow Selected

Crypto Graveyard: 10,000 Ways to Zero

"If I knew where I was going to die, I would never go there." —Charlie Munger

By kokii.eth

The market has gone wild recently: rate cuts, relaxed regulations, Trump launching a token, Bitcoin hitting new highs—once again, crypto proves itself as one of the best options in this polarized era. Yes, as long as you stay in the game, we’ll all eventually get rich. —— But the problem is, it’s way too easy to get knocked out.

Half fire, half water. This industry creates overnight millionaires every day, while others fall into irreversible ruin just the same. Before the next violent bull run begins, let’s review some cautionary tales from those who lost everything—so that when the next big opportunity comes, you can protect your precious principal.

Wallet Security

-

Lost private keys: Paper backups burned (e.g., Los Angeles wildfires), hard drives containing wallets thrown away (one British guy still searching trash heaps for his BTC), multi-sig threshold failures (lost keys or sudden death permanently locking funds)

-

Stolen wallets: Private key leaks (stored on hacked cloud storage, carelessly copied and pasted), connecting to phishing websites, downloading malicious fake wallet apps (common scams on Twitter and Telegram), falling victim to social engineering attacks (beware of people close to you)

Operational Mistakes

-

Deposit/withdrawal errors: Wrong token selected, wrong chain used, sending to incorrect addresses, depositing to testnets, sending to black hole addresses (no recovery possible)

-

Market order shock: Accidentally triggering market orders resulting in extreme slippage (a needle piercing straight into the sky)

Personal Safety

-

Information leakage: Leading to real-life tracking or threats (especially true for those who wear exchange-branded T-shirts or carry exchange luggage everywhere)

-

Emotional breakdown: Losing control after major losses, leading to dangerous decisions (going downstairs for a pack of cigarettes, not taking elevators or stairs)

-

Severe burnout: Chronic sleep deprivation and poor lifestyle causing serious health issues or even sudden death (from farming airdrops or sitting endlessly trading memecoins)

Trading & Investing

-

Futures liquidation: High leverage + holding losing positions + continuously adding margin until blown out in a single day (the inevitable end for perpetual contract gamblers)

-

Gambler mentality: Treating trading like gambling, blindly going all-in on low-quality tokens based on hype, refusing to cut losses and keep averaging down hoping for a miracle (altcoins, memes)

-

Wrong all-in moves: Putting more money than you can afford (borrowed funds, house down payments, emergency savings) into a single asset or sector (e.g., Luna)

-

Falling for scams: Getting rekt by vaporware projects, local mining schemes, Ponzi-like "Pilots" (貔貅盘), insider trading pools, blindly trusting project teams (your counterparty is the token issuer—how do you expect to win?)

Exchanges

-

Exchange collapse: Exchange runs away with funds, users unable to withdraw (e.g., FTX)

-

Withdrawal trapped: Triggering exchange risk controls, accounts frozen (even major exchanges do this)

-

Bank card freeze: Triggering anti-money laundering checks, personal bank cards frozen ("for your own protection")

-

USDT OTC scam: Unreliable OTC dealers disappearing after receiving payment (common in offline peer-to-peer transactions)

On-chain Interactions

-

Smart contract vulnerabilities: Exploits in protocols interacted with—bridges getting hacked, flash loan attacks, oracle manipulation (in lending), malicious approvals draining wallets

-

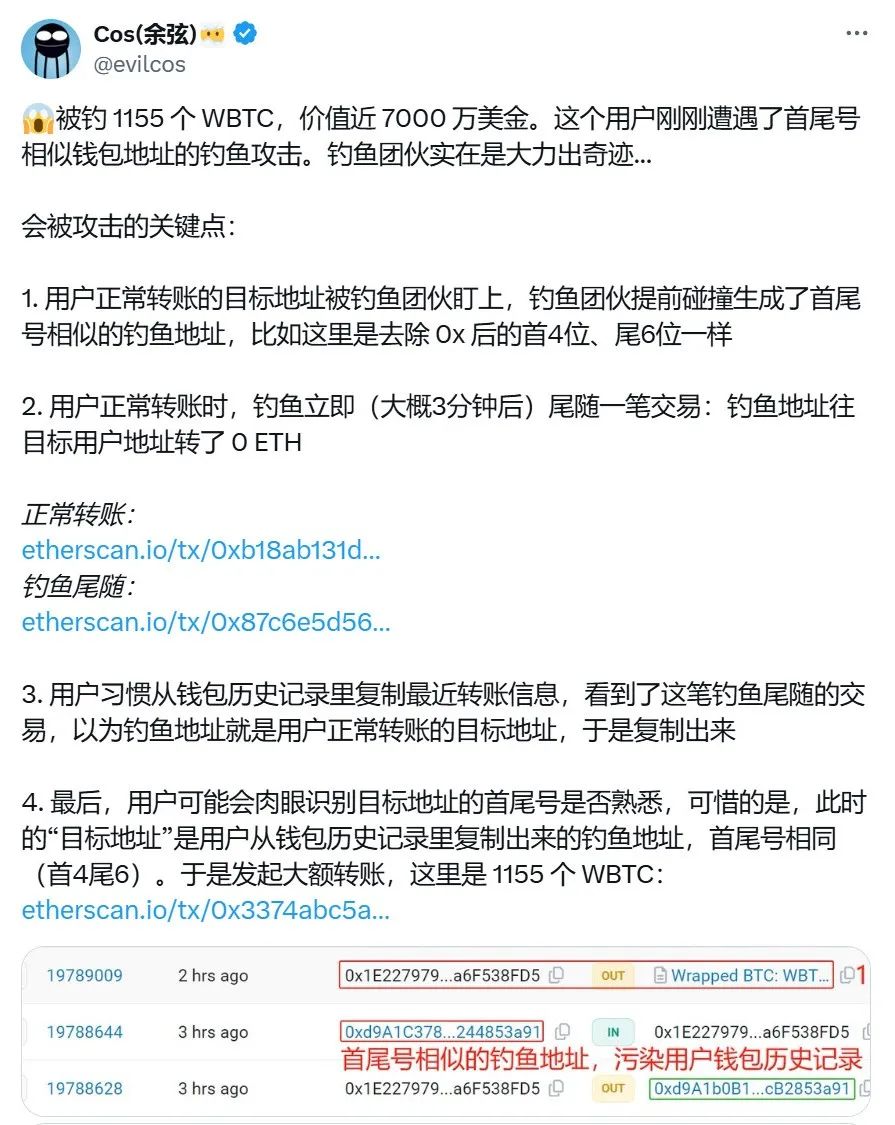

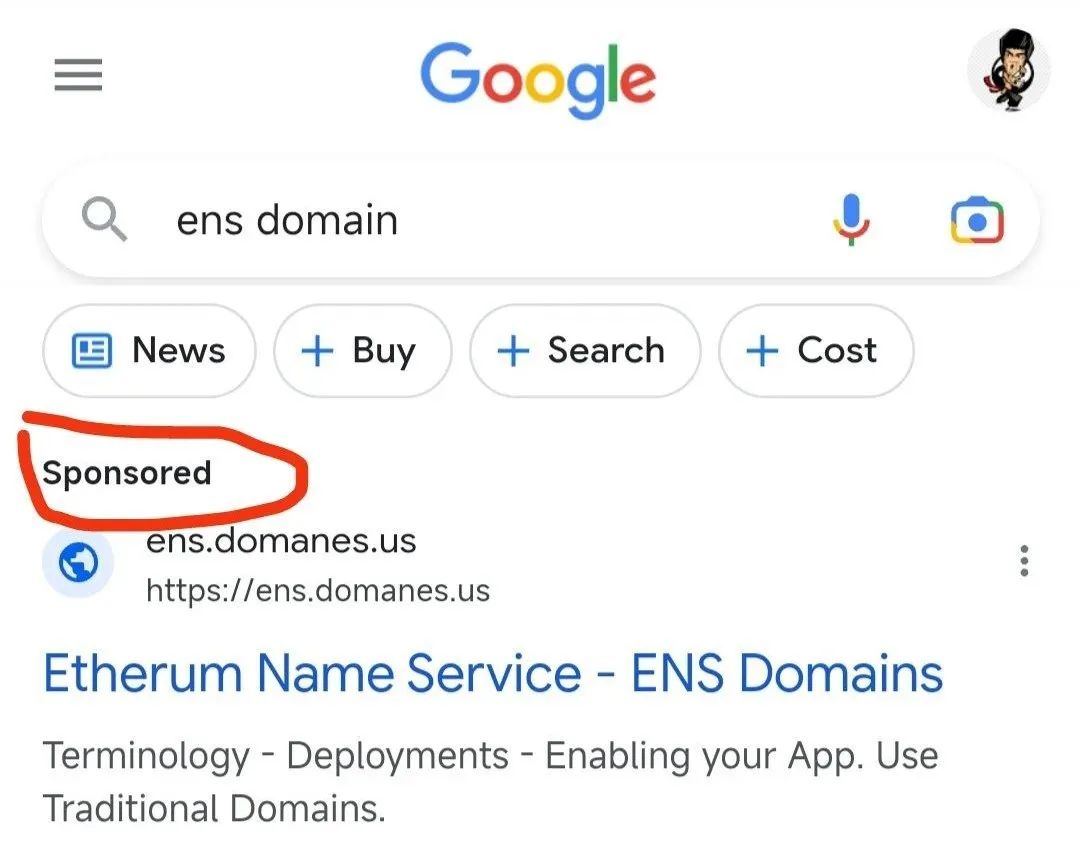

Cloned websites: Frontend frauds, paid search ads, fake domains, fake customer support (Discord, Telegram)

-

Rug pulls: Project teams vanish after presale funding, or dump immediately upon launch (last words: “we will never rug”)

-

MEV (Miner Extractable Value): Being frontrun, sandwiched, or arbitraged (humans can’t compete with machines)

Launching Your Own Project

-

Wrong direction: Spending massive resources solving non-existent problems, failing to raise funds, project dies (metaverse, GameFi, Polkadot ecosystem)

-

Regulatory nightmares: Targeted by regulators or law enforcement across jurisdictions (e.g., Multichain, offshore dragnets)

There are countless ways to fail—what other stories have you heard? Feel free to share. Behind every abyss lies boundless treasure. Wishing everyone avoids every pitfall and stays in the game.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News