Trump's "Ascension" Shakes Up Crypto: Exclusive Interviews with Insiders, A Complete Portrait of Web3's Ecosystem

TechFlow Selected TechFlow Selected

Trump's "Ascension" Shakes Up Crypto: Exclusive Interviews with Insiders, A Complete Portrait of Web3's Ecosystem

As the original logic of financial investment is gradually unraveling, who is truly celebrating Bitcoin amid this wave?

Author: Cora Xu

Editor: Manman Zhou, Evan

No one expected that on his first day in office, U.S. President-elect Trump would not utter a single word about cryptocurrency.

The president stayed silent—but he did go straight to minting coins. On January 18 (Beijing time), Trump announced the launch of his personal meme coin $TRUMP via social media. Within half a day, the market cap of this meme coin had nearly reached $30 billion.

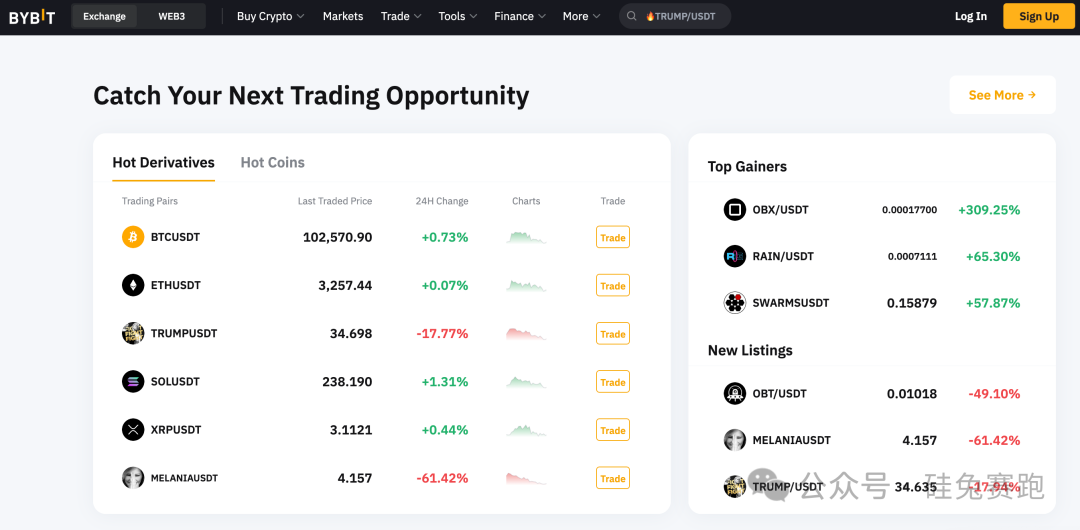

Two days later, Melania Trump also announced her own meme coin $MELANIA on X, quickly pushing its valuation past $5 billion. The Trump family's crypto project World Liberty spent $9.29 million purchasing 88.02 WBTC via Cow Protocol shortly after the inauguration ceremony began.

Just as people anticipated Trump would unveil new crypto policies during his inaugural speech to further ignite the market, he instead remained unusually silent on cryptocurrency.

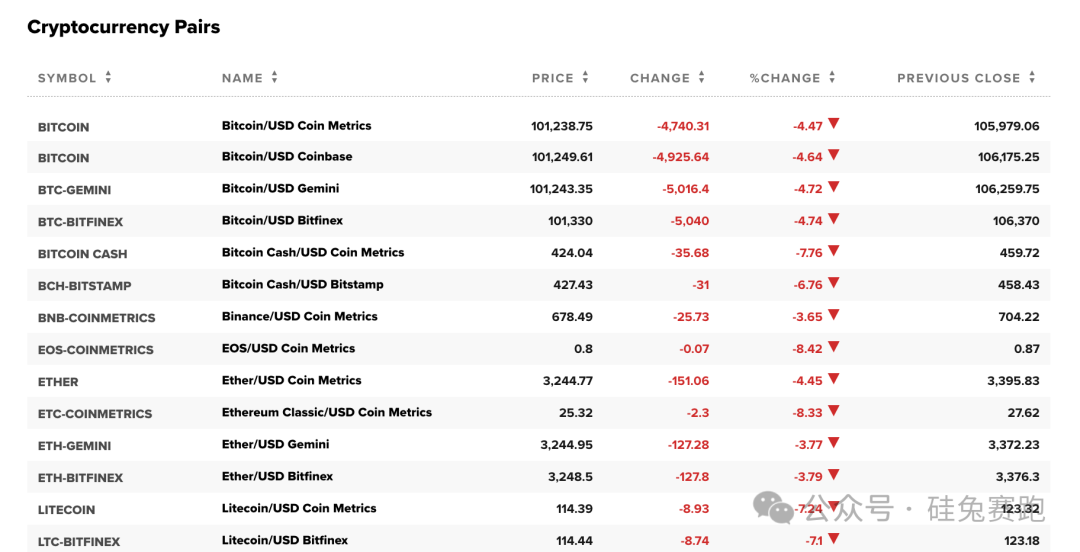

This silence triggered a full-scale crash across the crypto sector this morning. According to CNBC data, Bitcoin plunged 4.47%, Ethereum dropped 4.45%, and SOLANA saw an even steeper decline of 14.32%.

Beneath the Bitcoin frenzy lies a volatile mix of political signals, well-positioned whales, rampant greed, and hesitant newcomers lingering at the gate.

Even now, when a single Bitcoin is worth hundreds of millions of times its initial value, there are still investors loudly questioning its legitimacy. Yet simultaneously, a group of early adopters stand firmly within the river of cryptocurrency, holding their faith and awaiting a new era.

As traditional financial logic gradually unravels, who exactly is celebrating Bitcoin’s rise? And who among the greed has managed to preserve their true self?

In this tug-of-war between skeptics and believers, TechFlow spoke with professionals across various sectors of Silicon Valley's Web3 ecosystem to understand the diverse landscape of the industry.

#01 SuSu: "The best time to invest is when you're young—and that applies to Bitcoin too"

Three years in Web3 | Firm believer in Bitcoin

Currently working in Web3 operations

To SuSu, Bitcoin and Ethereum are the definitive "orthodox" representatives of cryptocurrency.

As the first official cryptocurrency, Bitcoin once defined the entire crypto market. Though over 12,000 new cryptocurrencies have since emerged—reducing Bitcoin’s dominance—it still commands around 60% of the market share.

Unlike traditional finance, 24/7 exchanges, decentralization, and peer-to-peer transactions have branded crypto with the label of “freedom.” Over time, Bitcoin has experienced three pivotal turning points.

Initially, Bitcoin was seen as a symbol of support for cryptographic technology—a recognition of value. In 2021, when Bitcoin futures ETFs were approved by the U.S. Securities and Exchange Commission (SEC), it leapt from being a “niche asset” into mainstream investment portfolios.

SuSu entered the space during this wave. At the time, she was preparing for graduate school exams while juggling a part-time job offer from a former boss requiring her to handle operations. With curiosity and hesitation, she stepped into the world of Web3.

Looking back, SuSu says Web3 transformed her life entirely. “Now I clearly see how financial behaviors aren’t distant from daily life—NFTs, blind boxes, they’re essentially financial products.” After navigating the crypto industry, she began to demystify finance.

This allows her to stay calm amid the industry’s inherent volatility. Many dream of becoming the next overnight millionaire, but escaping human greed once seated at the table is no easy feat.

“I rode the last bull market—I bought low at $10K–$20K and confidently added more at $70K–$80K. Price swings brought excitement, anxiety over dips, and moments of self-doubt,” she recalls. After growing through these experiences, she chose to become a “HODLer”—buying long-term and trading opportunistically. Reflecting on her journey, she believes the experience shaped her deeply: “The best investment is made when you’re young. Even if you lose money, it’s a small amount that won’t disrupt your life—and you gain valuable perspectives.”

If volatility defines the crypto industry, then faith is its core pillar. SuSu firmly believes Bitcoin is a long-term investment, potentially the next “digital gold.” “Newcomers rarely possess such conviction initially. But after going through multiple cycles, you get drawn in. Your understanding evolves through validation until belief takes root. What fascinates me most is meeting people of all styles—the emotional shifts are intense, yet many remain captivated.”

#02 Alexis: Exchanges hire aggressively; Bitcoin becomes a new settlement unit

About three years in Web3

Web3 designer | Senior exchange employee

Like SuSu, Alexis joined Bybit, a Web3 company, around 2021, gaining deep exposure to Bitcoin and blockchain for the first time and gradually becoming part of the crypto community. At that time, Bitcoin hovered around $40,000.

Working at a Web3 firm differs significantly from traditional enterprises. Some companies pay bonuses or performance incentives not in fiat currency, but in niché stablecoins or Bitcoin. Alexis remembers receiving USDT—crypto pegged to the U.S. dollar—as her first project bonus. As Bitcoin rose, so did the value of her USDT. In 2022, she converted her USDT to RMB, making a substantial profit.

Beyond bonuses, Web3 firms run creative campaigns encouraging employees to trade or play with crypto. “Early on, we had bug-hunting events—find a bug on the platform, get rewarded in crypto.” Alexis notes that several colleagues have now achieved financial freedom just from bug bounty rewards.

Financial freedom seems attainable in Web3, where stories of overnight wealth constantly stimulate the senses. Alexis has witnessed numerous paths to riches—one acquaintance’s friend, a Gen Z girl, launched her own token, earned a fortune, and promptly retired.

Yet on the flip side, one misstep can lead to ruin. On December 5, 2024, Bitcoin plummeted over 10% in a single day, triggering over $1.087 billion in liquidations and wiping out 210,000 investor accounts. Earlier, bankruptcies of exchanges like Hotbit and Bittrex left many empty-handed. Among Alexis’s circle, relatives lost significant sums investing in scam tokens promoted by influencers, only for the issuers to vanish.

Despite repeated high-risk warnings, many continue flocking to crypto—some even accepting pay cuts to join Web3. P8/P9-level executives from major tech firms have switched industries for the promise of decentralization and the potential of the next internet revolution.

“But most still think in traditional Web2 terms and don’t actively engage in Web3 trading, so truly qualified talent remains scarce,” Alexis observes. Today, most Web3 companies require candidates to have crypto wallets and trading experience. A quick look at recruitment platforms like Boss Zhipin or Maimai reveals that many roles explicitly require crypto trading experience, with salaries often several times higher than comparable positions in traditional consumer sectors.

When asked why big-tech professionals choose Web3, Alexis learned that many believe decentralization and internet transformation represent the future—and possibly the next wave of opportunity.

#03 Project Founder May Wong: Building a professional investment insights platform, 80k+ millionaires invested over $100M in Bitcoin

Web3 entrepreneur | Founder of SoSoValue

Veteran investor

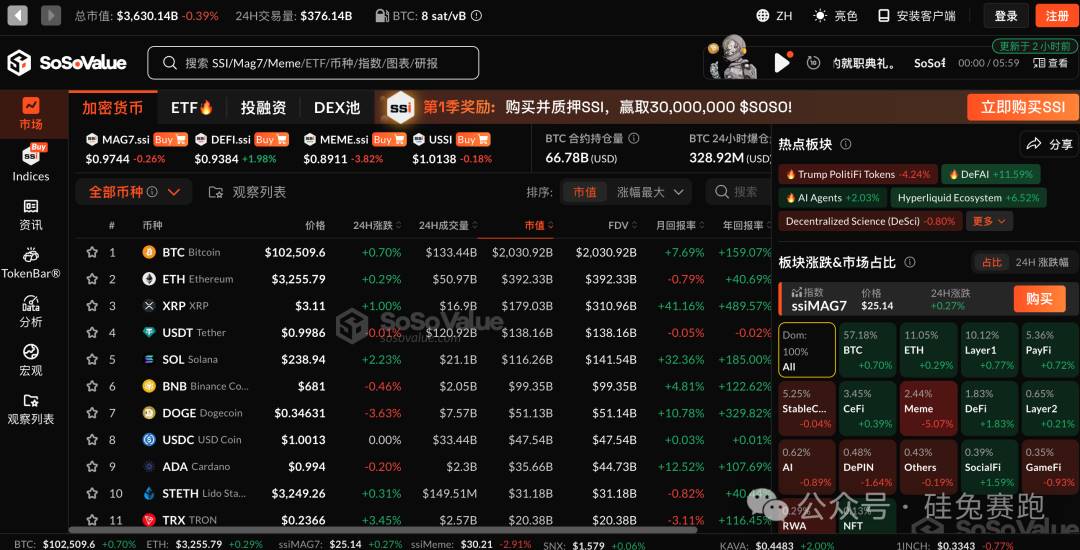

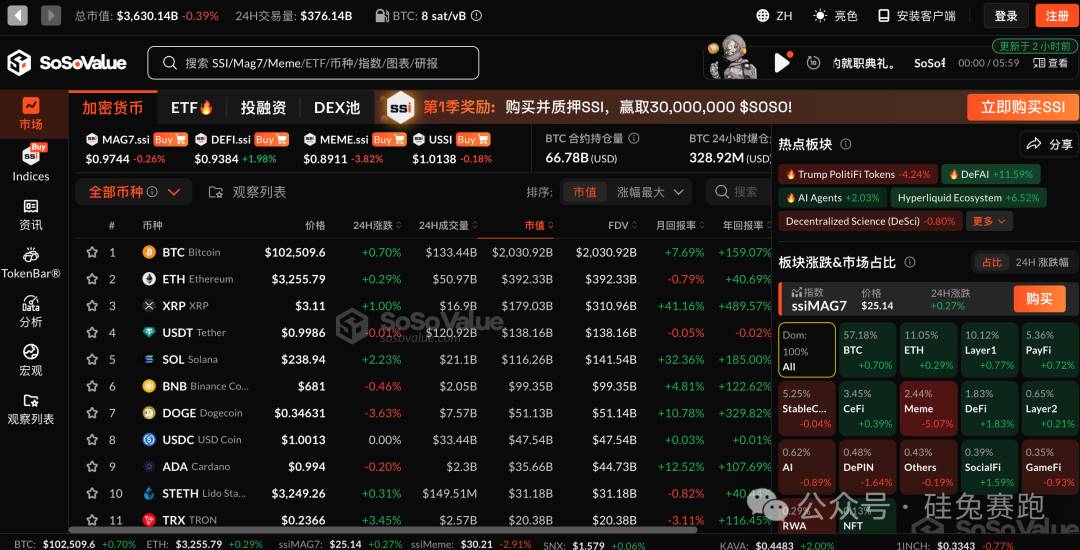

Unlike those merely observing the Bitcoin trend, May Wong recognized Web3’s potential early and seized the moment. By late 2022, she launched her Web3 venture—SoSoValue, an information platform serving professional crypto investors.

May sees finance undergoing a new revolution, lacking third-party platforms to continuously track financial data. SoSoValue fills this gap by offering real-time intelligence to investors. Explaining the name, she says it stands for “most of the crypto, nowadays no value, just so-so”—referring to how today’s gains concentrate in top-tier assets like Bitcoin and Ethereum, while others lag—hence, SoSoValue.

Today, SoSoValue boasts 200,000 daily active users, primarily from North America, Singapore, Japan, and Southeast Asia—including fast-growing markets like Vietnam. Registered active users exceed 8 million. On January 8, SoSoValue announced an additional $15 million in funding led by Hongshan, SmallSpark, Mirana Ventures, and Safepal, valuing the company at $200 million.

According to May, user growth has accelerated recently, with most new sign-ups transitioning from traditional finance to crypto. However, many VC institutions remain unfamiliar with secondary markets, making intuitive data platforms essential for faster decision-making.

She notes that financial systems follow a “top-down” principle—prioritizing key information upfront—a consistency shared with traditional industries. But Web3 has a unique trait: exchanges operate 24/7, demanding constant attention to real-time updates.

New token listings on SoSoValue integrate comprehensive details—TokenBar, official websites, whitepapers—enabling users to access full insights instantly. “In TokenBar groups alone, we have over 3 million users, with over 30,000 daily actives,” she shares. Users closely monitor sector performance, and emerging markets like Vietnam, Russia, and Turkey show rapid adoption, especially among tech-savvy youth.

Prior to 2024, Web3 existed largely in a “Crypto Native” state—dominated by die-hard believers in the Bitcoin ecosystem, with market cycles tied closely to mining halvings. But with milestones like stablecoin integration and ETF approvals, Bitcoin has steadily gained mainstream credibility. “At least in the North American market, Bitcoin is now widely accepted by investors,” she affirms.

Industry research supports this. According to a joint report by New World Wealth and Henley & Partners, global cryptocurrency millionaires surged 95% year-on-year by August 2024, reaching 172,300 individuals. Those holding over $1 million in Bitcoin grew 103% to 85,400. Notably, 325 individuals hold crypto assets exceeding $100 million.

“Once, only a few nurtured this seed of crypto, watering it obsessively. Now we can see it sprouting. We hope it grows into a vast forest,” says May, who believes the ecosystem is still in its early stages—with no final market structure yet formed.

Given this uncertainty, opinions diverge on Web3’s next steps—particularly regarding the coexistence of centralized and decentralized exchanges. May views centralized exchanges (CEXs) as similar to traditional markets—lower learning curves, easier entry for new investors. Decentralized exchanges (DEXs), however, represent an idealistic vision—what many in crypto ultimately aspire to achieve.

“Those paying attention to crypto right now are lucky. The key is to stay in the game,” May emphasizes. She acknowledges many still view crypto as gambling. “First, learn to distinguish scams, casinos, and legitimate finance. Finance creates societal value; the other two do not. We believe crypto will form the foundation of a new financial system in the digital age. Second, actively participate in crypto and become a believer. Third, ensure you survive the industry’s volatility over the next 20 years. Then, your new era will arrive.”

#04 Investment Manager Kevin: Bitcoin ecosystem grows; meme coins surge

Web3 investment manager | Focused on ecosystem development

Contrary to the heated secondary market, Kevin finds investing in primary-market Web3 projects increasingly difficult. “Overall sentiment? Neither good nor bad,” he adds. “But Web3 is moving forward.”

As an investment manager, while retail investors focus on Bitcoin price swings, Kevin observes rising market interest driven by price movements—but notes no substantial progress in Bitcoin’s ecosystem development. “A richer ecosystem means higher liquidity and more diverse use cases for Bitcoin.”

Market trends show certain tokens gaining broader utility. Meanwhile, communities built around innovations like Bitcoin-based runes and inscriptions are thriving, blending technological advancement with grassroots growth—indicating remaining opportunities in Web3.

Meme coins—often humorous, community-driven tokens—are surging. Examples include Dogecoin (DOGE) and PNUT. Dogecoin alone has reached a market cap of $55 billion.

Additionally, the runes and inscription market tied to Bitcoin is booming. DOG•GO•TO•THE•MOON (shortened to DOG), one of the most popular rune tokens, already exceeds $300 million in market cap. According to OKX data, DOG has over 73,000 holders.

With these new markets, crypto玩法 diversify—but identifying strong projects remains challenging.

Similar to Web2, Web3 investment logic focuses on backing exceptional teams, building outstanding projects, and creating clean, user-friendly applications.

Kevin currently focuses on two areas: projects deeply integrated with public chains, and those capable of bringing traditional Web2 applications into Web3, expanding real-world use cases. However, with top tech talent shifting toward AI, Web3 faces severe brain drain—quality projects are rare.

“Right now, the most important factor in Web3 investments is reasonable valuation,” Kevin stresses. He notes that since late 2024, Web3 has entered a vicious cycle: hot money inflates project valuations; inflated prices create bubbles; excessive bubbles deter future funding rounds and reduce trader participation. This cycle makes sustainable growth extremely difficult for most projects.

“We haven’t truly reached the ‘Web3 moment’ yet. The current state feels more like a hybrid—somewhere between Web2 and Web3, maybe Web2.5,” he concludes.

#05 Investment Manager Sam: Crypto hasn't broken out of financial circles; top projects yield 10x returns

Web2-to-Web3 investment manager

Focused on nurturing promising Web3 ventures

After two years in the Web3 investment space, Sam finds the waves growing larger, drawing more participants—but truly great projects are dwindling, with almost no innovative newcomers emerging.

He cites two main reasons: First, as exchanges grow more regulated, listing new tokens on major platforms has become far harder than before. Early-stage projects struggle to get listed, face stricter unlock terms, and make fund exits difficult—resulting in lower returns and tougher investment conditions. Second, overall funding has tightened. More capital flows into trending AI ventures and BTC ETFs, meaning less money reaches the Web3 ecosystem compared to the last bull run.

Sam transitioned into Web3 investing around 2022 and has backed several solid projects since.

Compared to traditional Web2 investing, early Web3 investors prioritize technical innovation. “While academic credentials matter less now, emphasis remains on team quality, resources, and execution capability.”

In terms of direction, innovation in this cycle has been limited. Despite talk of internet transformation, trends increasingly converge on upgrading decentralized financial payments—making Web3 resemble on-chain fintech. Other applications like gaming and social networking still lag behind Web2 counterparts. Expanding use cases requires stronger, more stable underlying infrastructure.

“The industry is progressing—underlying technologies improve incrementally—but no breakthrough products or technologies have emerged. Investment momentum is slowing,” Sam says. During the last bull market, he encountered several standout projects where top investments delivered up to 10x returns.

#Conclusion

What will become of long-standing regulatory uncertainty in crypto under President-elect Trump? “The best outcome? If Trump does absolutely nothing,” many respondents agreed. Conversations reveal widespread concern over the risks accompanying his presidency.

From interviews, a consensus emerges: most expect Bitcoin to stabilize around $100,000 this year. Many echo the same advice: “Whether rich or poor, everyone should hold some Bitcoin.” There’s broad agreement that Bitcoin is digital gold.

“Money in the bank isn’t really yours. Only money in your decentralized wallet belongs to you,” they say in unison. For most Bitcoin holders, the baseline expectation is simply outpacing inflation.

Currently, most Web3 investments concentrate in Southeast Asia and North America. China’s advanced payment systems have also attracted early investors toward Chinese entrepreneurs—many quietly accumulating wealth beneath the surface.

Though many still see Web3 as a distant future, every prior internet shift was preceded by fragmented visions. Where the tide of technology will flow next—perhaps time will give these aspiring dreamers a new answer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News