Coinbase CEO: Cryptocurrency is the key to economic freedom in the new era

TechFlow Selected TechFlow Selected

Coinbase CEO: Cryptocurrency is the key to economic freedom in the new era

Economic freedom creates prosperity for everyone.

Author: Brian Armstrong

Translation: TechFlow

In 2024, the American people expressed their support for economic freedom and free markets by electing Donald Trump as president once again. Canada appears to be moving in a similar direction under conservative politician Pierre Poilievre. In 2023, President Milei of Argentina and President Bukele of Latin America further advanced this trend. In the UK, Starmer is attempting to attract more voters through policies supporting technology and innovation; meanwhile, in Germany, Scholz is likely to be voted out soon due to fiscal mismanagement that has slowed the economy.

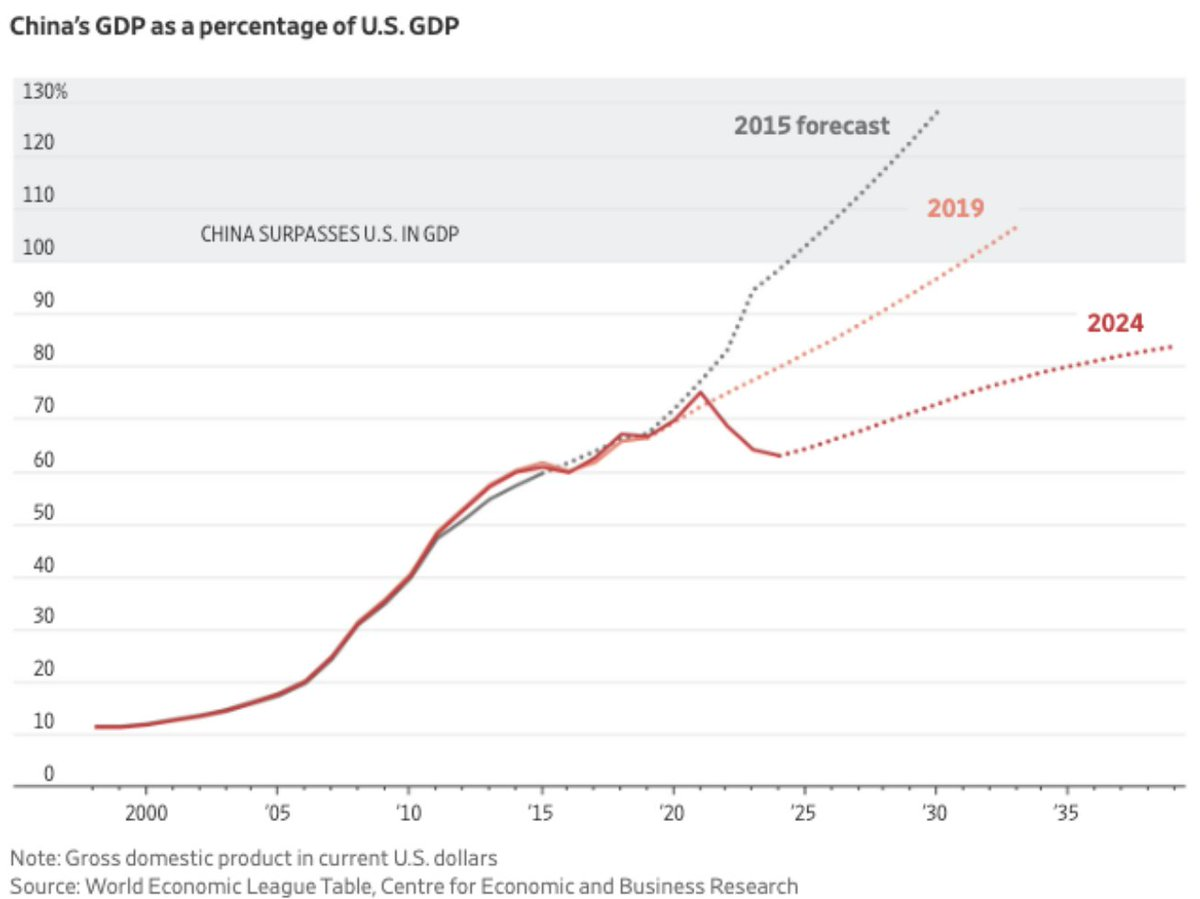

We are at a pivotal moment in history: The world is gradually recognizing the problems associated with certain social models—ideologies that end up harming the very groups they claim to protect and have rarely succeeded in practice. Yet, some countries continue to move in the wrong direction.

Economic growth is driven by free markets, deregulation, small government, and technological innovation. These forces not only lower prices but also create more jobs, increase tax revenue, and improve healthcare, among other benefits. The evidence shows that the proven path out of poverty and toward broad-based prosperity isn’t socialism—it’s free-market capitalism. If other G20 nations wish to share in this prosperity, they should embrace the growing global trend toward economic freedom and free markets.

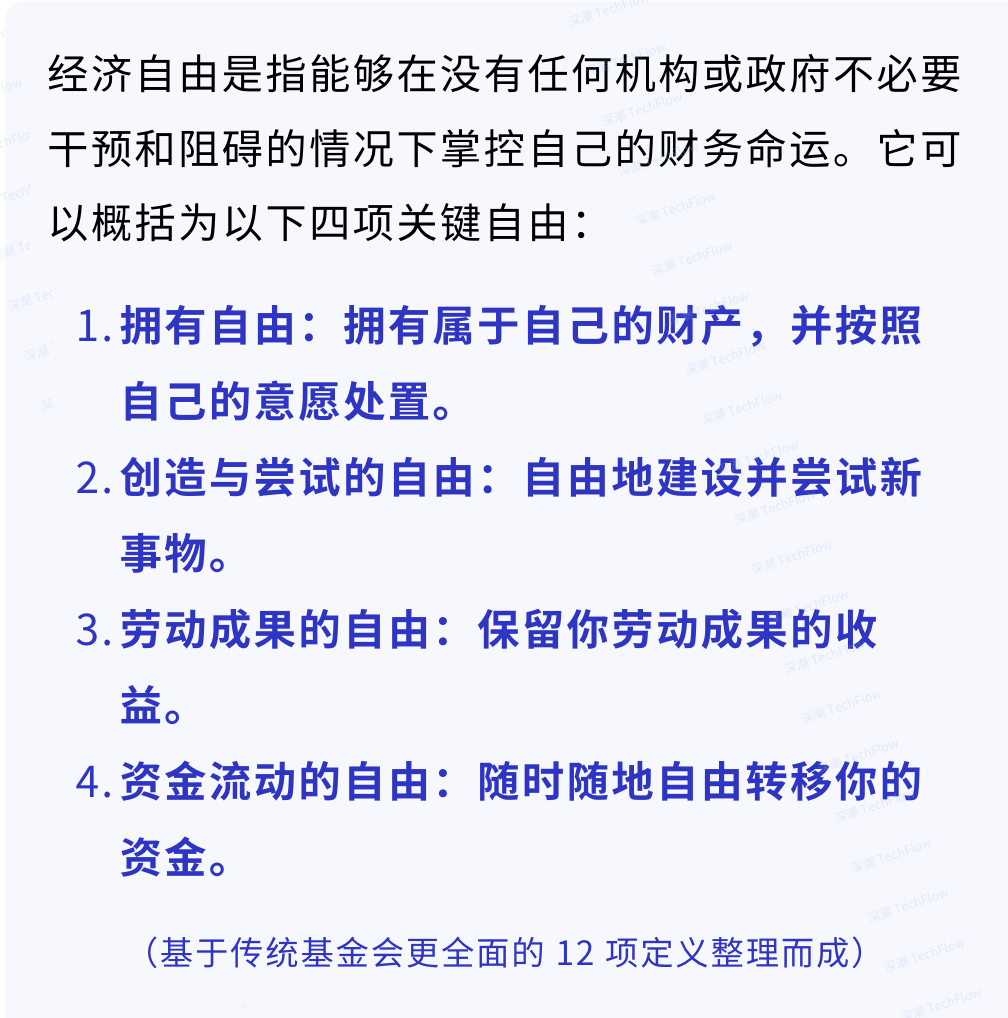

At Coinbase, we are committed to advancing global economic freedom. Just like freedom of speech or religious liberty, economic freedom is foundational to a thriving society and human progress. And we believe cryptocurrency is the key technology enabling greater global economic freedom.

Original image by Brian Armstrong, translated by TechFlow

According to our research, over three-quarters of adults worldwide say they want more economic freedom. This is unsurprising, as studies show economic freedom correlates with higher levels of happiness, improved literacy rates, better environmental protection, and many other social indicators (supported by data from the World Bank, Pew Research Center, and World Economic Forum).

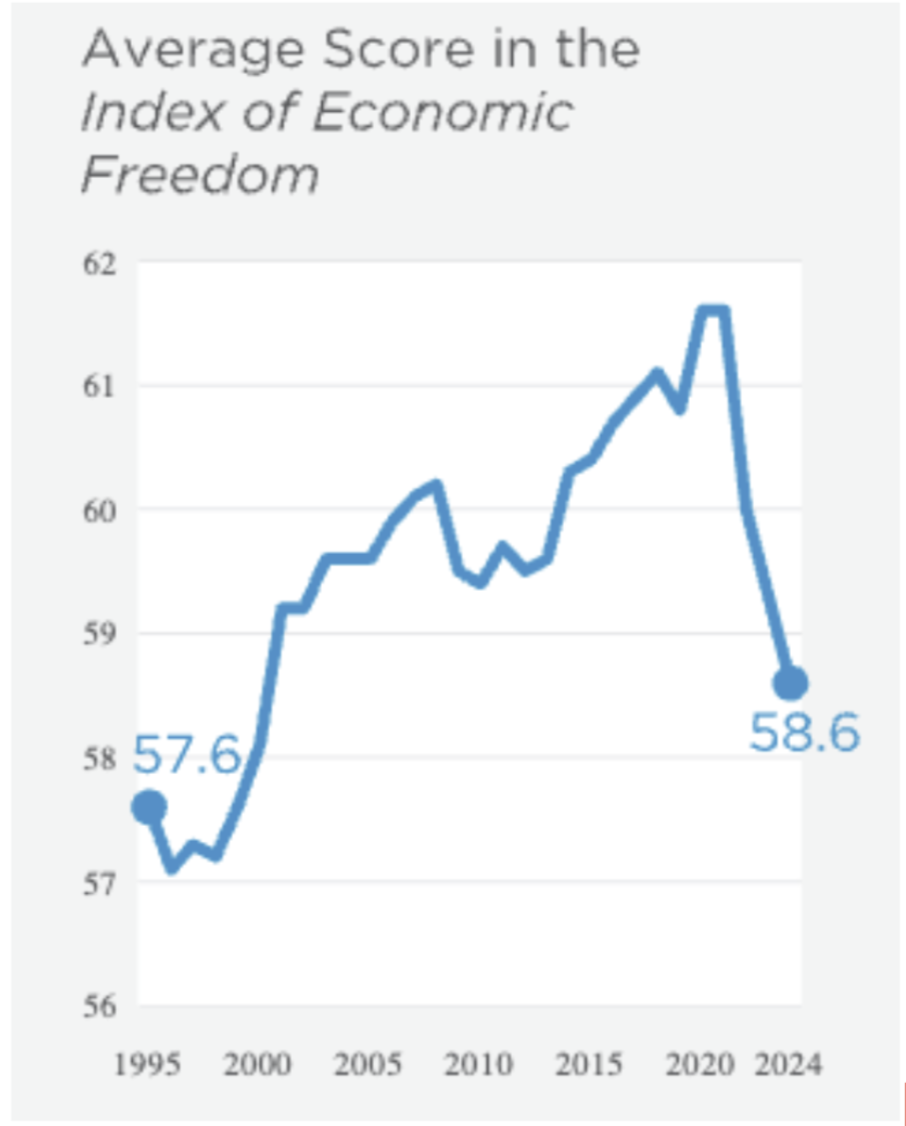

Yet economic freedom is declining globally, with many economies remaining restricted.

Over the past 100 years, economic freedom rose steadily—until it reversed course in the early 21st century. Today, average global economic freedom scores have fallen to their lowest level since 2001. As a result, most economies worldwide are now considered “mostly unfree” or even “repressed.”

In the U.S., this decline translates into falling living standards, with many feeling the “American Dream” is slipping out of reach. Data shows that only 14% of Americans feel optimistic about the future of the financial system. Globally, 70% of adults believe their children will be worse off economically than they were. Declining economic freedom is eroding trust in financial systems and institutions.

Why is socialism resurging recently? Why do societies keep trying this experiment? It seems human nature is easily drawn to socialism, and each generation must relearn its lessons the hard way. For some, this inclination may stem from genuine compassion—but without realizing these policies ultimately harm the very people they aim to help. Others may exploit public ignorance to gain power, or it may reflect a deeper pessimism about humanity or oneself.

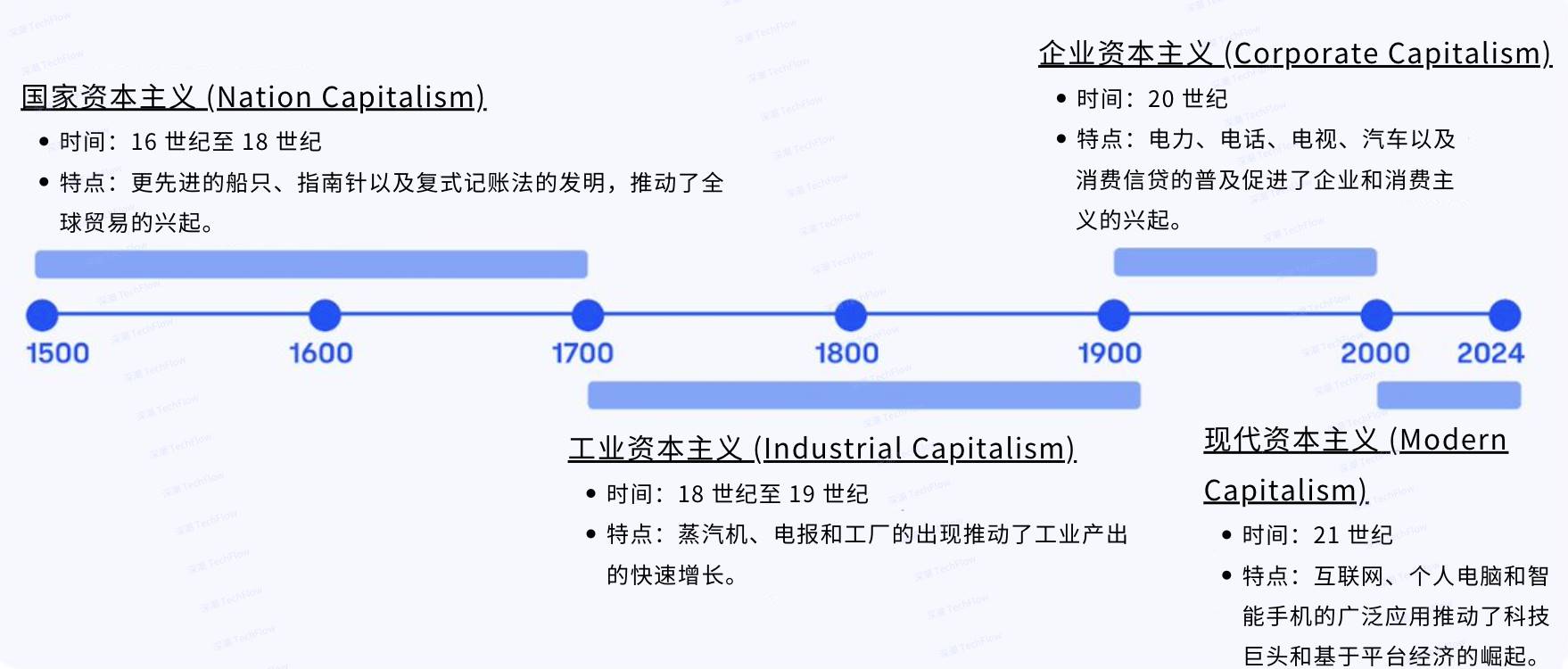

Regardless, history shows that whenever humanity faces challenges, innovation delivers solutions. From the printing press to the steam engine, electricity to the internet—each breakthrough has revitalized economies, expanded individual choice, and propelled civilization forward. Cryptocurrency will be the next chapter in this story.

Original image by Brian Armstrong, translated by TechFlow

Cryptocurrency can usher in a new era of capitalism: the age of economic freedom.

Coinbase’s core belief is that widespread adoption and use of cryptocurrency can significantly advance global economic freedom. This stems from crypto’s unique potential: to build a global economy driven by technology and individuals—not governments. In this system, anyone with internet access can participate, property rights are strongly protected, and monetary value can be preserved over time. This is not a distant dream—cryptocurrency is already delivering greater economic freedom today:

-

Stablecoins: Stablecoins have become a revolutionary application within crypto, with transaction volumes growing over threefold year-on-year to approximately $27 trillion. Their use has expanded beyond trading into everyday financial life, particularly in emerging markets—which lead the world in stablecoin adoption. For example, in Argentina, 5 million people actively use cryptocurrency for daily payments, while saving in USD has become the second most popular use case for stablecoins in emerging markets.

-

Free Trade: Built on a global network, cryptocurrency eliminates intermediaries and national borders, greatly enhancing free trade. Layer 2 networks can now settle global transactions in under one second, with fees below one cent—making crypto the only payment method that simultaneously offers “speed, low cost, and global reach.” This technology unlocks unprecedented trade freedom for individuals and businesses. Compared to traditional payment services, crypto transfers are faster, cheaper, and come with no limits on frequency or amount. According to a Visa study, one of the main reasons people choose crypto in Australia, Brazil, Germany, Hong Kong, South Africa, the U.S., and the UK is for transactional freedom and lower fees.

-

Property Rights: By replacing courts and intermediaries with code and cryptography, cryptocurrency is providing secure, enforceable property rights on a global scale. Currently, over 5 billion people—about two-thirds of the world’s population—lack formal ownership documentation for homes or land. Governments are now exploring how crypto can solve this. On blockchains, ownership records are tamper-proof, and smart contracts can automatically enforce ownership-related rights. For instance, Georgia has begun migrating land registries to blockchain, and Sweden is testing a blockchain-based land registration system.

-

Open Access: Cryptocurrency is breaking down barriers and building a more inclusive global financial system. It allows people to retain and make fuller use of their hard-earned wealth. Decentralized Finance (DeFi) is transforming access to financial services, offering equal opportunity to anyone with an internet connection—whether entrepreneurs in remote areas or the roughly 1.4 billion unbanked people worldwide—to participate in the global economy.

Today, cryptocurrency adoption and usage have reached a critical inflection point. Nearly 7% of the world’s population now owns cryptocurrency—a trend driven by real-world economic needs.

Original image by Brian Armstrong, translated by TechFlow

How to Advance Economic Freedom in 2025

To world leaders and policymakers: It’s time to embrace cryptocurrency and technological optimism to drive economic freedom and human progress. Here are four concrete actions you can take this year:

-

Enact laws that allow cryptocurrency to thrive locally. Cryptocurrency is a novel and distinct technology that shouldn’t be constrained by outdated regulations. Policymakers must focus on creating clear, forward-looking regulatory frameworks that encourage innovation at home—rather than pushing it overseas. Otherwise, your country risks being left behind.

-

Establish a strategic Bitcoin reserve. Bitcoin is the top-performing asset class since its inception and has emerged as a powerful hedge against inflation. The future global competition will center on digital economies, not space exploration. Bitcoin could become a foundational asset of the global economy—like gold—and play a key role in shifting geopolitical power balances. In a world where national strength is influenced by Bitcoin holdings, governments will race to build strategic reserves. Doing so would strengthen domestic economies and secure leadership in the digital age. Those who delay risk losing competitiveness and relevance.

-

Support economic zones that give innovators the freedom to test bold ideas. Experimental models such as regulatory sandboxes provide innovators with safe environments to learn and grow through practice. We’ve seen this succeed in cities like Shenzhen and Hong Kong. New initiatives like Prospera, which embrace cryptocurrency, could accelerate innovation even further.

-

Improve government efficiency. As demonstrated by Argentine presidential candidate Milei and the exploration of cryptocurrency by DOGE, we’re rediscovering that excessive government intervention often fails to solve problems—and frequently becomes the problem itself. No matter who you are or where you live, cryptocurrency brings benefits. Even if you don’t directly use crypto-based financial services, you still benefit indirectly. Cryptocurrency is becoming a grassroots “check and balance” against authoritarianism, overregulation, legal abuse, rising fiscal deficits, and stifled innovation.

Our shared responsibility: Each of us has a role in shaping a new path—one where innovators, technological advancement, and free markets drive economic growth, rather than government intervention. We should actively embrace economic freedom and advocate for more open policy environments. Progress and prosperity depend on our collective effort.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News