5 Major Crypto Predictions for Trump's Presidency After the TRUMP Token Rollercoaster

TechFlow Selected TechFlow Selected

5 Major Crypto Predictions for Trump's Presidency After the TRUMP Token Rollercoaster

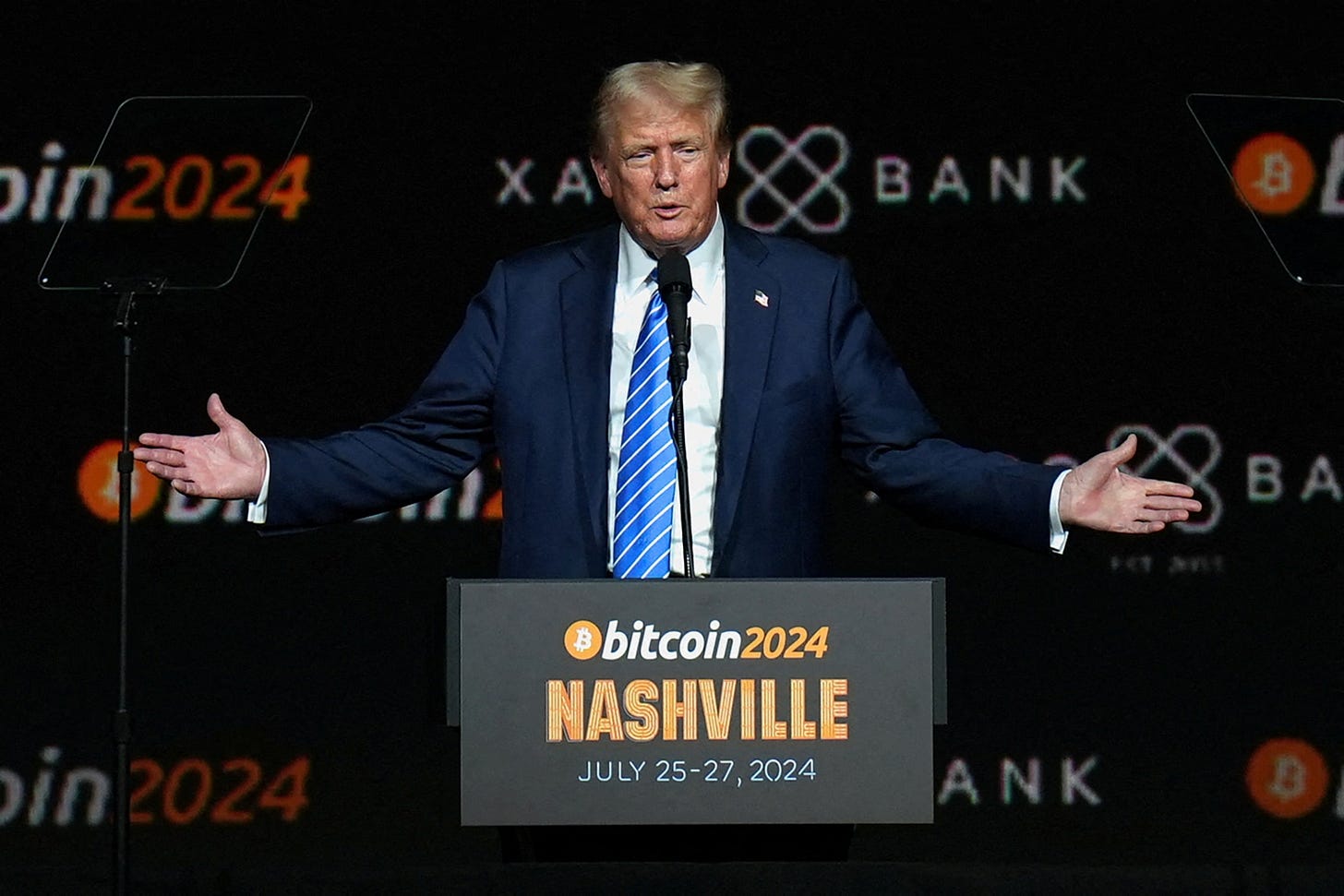

Trump promised that cryptocurrency would become a key issue during his presidency.

Author: Duo Nine⚡YCC

Translation: TechFlow

Earlier today, Trump posted the contract address of a Meme Token named after him on his official X account. Whether or not this is a scam no longer matters.

The TRUMP token surged to a market cap of $24 billion just hours after its creation! (Though as of today, prices have sharply pulled back from their peak.)

Love it or hate it, the Meme craze has made a powerful comeback.

Trump has also pledged that cryptocurrency will be a key agenda item during his presidency. Things are about to heat up.

Keep reading for my predictions on the top 5 crypto trends under President Trump:

1. Memes Will Dominate Crypto Narratives

I mean, just look at this phenomenon—it speaks for itself.

In less than 24 hours since Trump's post on X, the TRUMP token’s market cap soared to $24 billion, driven by widespread fear of missing out (FOMO). We can't blame investors—but this feels more like a quick cash grab before he officially takes office.

With presidential immunity, Trump could repeat such moves multiple times. I’m not sure if his X account was hacked or whether this behavior will become the norm. If it’s the latter, then a Meme supercycle may be upon us.

Who benefits?

First, Solana. While most other cryptocurrencies declined today, Solana rose 10%, with the TRUMP token being the only major exception. This single token nearly drained all liquidity from the broader crypto market within hours.

Since TRUMP and the vast majority (99%) of Meme Tokens are built on the Solana ecosystem, demand for SOL will increase. Other Solana-based Meme Tokens will also benefit as capital rotates between them.

Investors who profit from TRUMP will seek the next promising Meme Token, repeating the cycle endlessly. The arrival of a Meme supercycle will attract massive new inflows. However, this could hurt most non-Meme altcoins.

If you haven’t entered the Meme space yet, now is the time to reconsider. Even the 47th President of the United States is fully embracing the Meme wave. But if Memes aren’t your thing, here’s some good news!

2. Bitcoin Is Core

An increasing number of countries are disclosing strategic Bitcoin reserves. Under Trump’s administration, it’s only a matter of time before the U.S. announces a similar plan.

Currently, 13 U.S. states are actively considering or have proposed legislation to establish Bitcoin reserves. If Memes don’t interest you, make sure you’re fully invested in Bitcoin. This is currently the clearest trend in crypto.

I’m bullish on Bitcoin and expect it to potentially surpass $150,000 this year. I previously wrote about this here. If you're torn between altcoins and Bitcoin, go with Bitcoin. From a risk-reward perspective, it's the smartest choice in crypto.

If you want to try altcoins, focus on the hottest current trends: Meme Tokens, AI Tokens, and select DeFi protocols like Hyperliquid. Bet on winners—and Bitcoin has always been the biggest winner.

3. Trump Is Ushering In A New Crypto Era

Everyone influential in crypto will rush to align with Trump, as he drives forward a new crypto policy. This will spawn countless new coins, tokens, and DeFi protocols, making the market extremely active—and complex.

This also means abundant profit opportunities—many of them. His TRUMP token is merely the beginning; many more such projects will follow. However, scams will surge too. Anything linked to Trump will be exploited and abused by fraudsters.

Therefore, ensure you only engage with reputable projects and platforms. Anything below that standard risks leaving you scammed, rug-pulled, hacked, or drained. I’ve seen this play out too many times over the years.

To sum up simply:

Get involved and position yourself wisely. If you’ve never bought Bitcoin, buy some now. With full government support for crypto, the space is poised for an explosion bigger than anything we've seen before. Remember, Trump controls the White House, Senate, and House—unprecedented momentum for crypto.

Starting January 20, 2025 (next Monday), when Trump is officially sworn in, the crypto market may rapidly enter an extremely active phase.

4. Crypto Could Peak in 2025

Trump’s presidency will inject massive optimism into the crypto market, along with huge waves of new capital. Consider this: a single tweet from an incoming president pushed a Meme token to a $24 billion market cap in 24 hours.

I believe Elon Musk’s leadership in crypto has been overtaken. Now, the U.S. President is the new king of crypto. That one tweet alone moved markets—an incredible feat.

This is undoubtedly a positive signal for Bitcoin and the entire crypto market. Yet, this frenzy or FOMO won’t last forever. At some point—perhaps when people widely believe Bitcoin will hit $250,000 or even $1 million—the market will top out.

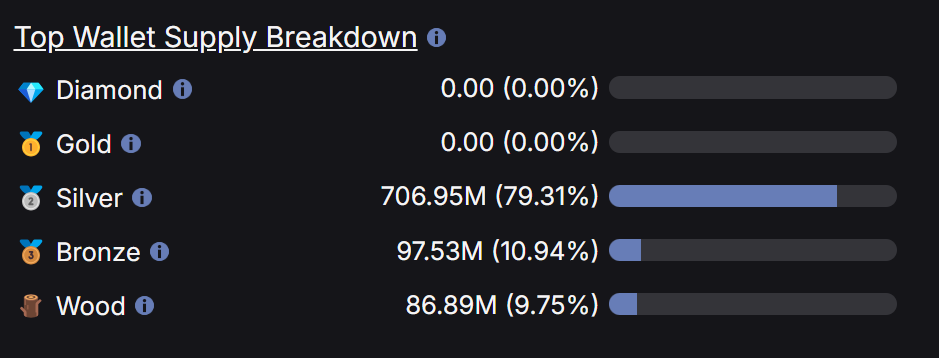

I expect this could happen by late 2025, when Trump must confront reality and tackle pressing economic issues, possibly shifting market sentiment negatively. Until then, however, the trend remains bullish, as total crypto market cap hits new highs (see chart above).

Ride this coming FOMO wave and lock in substantial profits. You’ll need that capital in the next bear market.

5. A Bear Market Will Return During Trump’s Presidency

Trump is still just one man. Even as U.S. President, he cannot stop the natural forces of the market.

Markets always move in cycles, and Trump’s term begins near the end of a bull run. I’m unsure how his presidency will conclude, but I believe the next major bear market will occur during his second four-year term—if he wins re-election.

I’d be surprised if the next crypto bear market didn’t begin in 2025. Perhaps Trump can extend the FOMO slightly, but a bear market will come nonetheless. When it does, ensure you have ample cash ready—you’ll need it to buy Bitcoin at low prices.

When the bear market arrives, I’ll be here.

Since 2014, I’ve lived through three bear markets. You must prepare while your funds are strong. Bear markets rapidly drain liquidity, cause protocols to collapse, and plunge the market into stagnation. It’s painful—but part of the game.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News