With Trump's inauguration approaching, crypto companies have donated over ten million dollars to the inaugural committee—how will the market react?

TechFlow Selected TechFlow Selected

With Trump's inauguration approaching, crypto companies have donated over ten million dollars to the inaugural committee—how will the market react?

Will the market rally brought by Trump appear again?

By Weilin, PANews

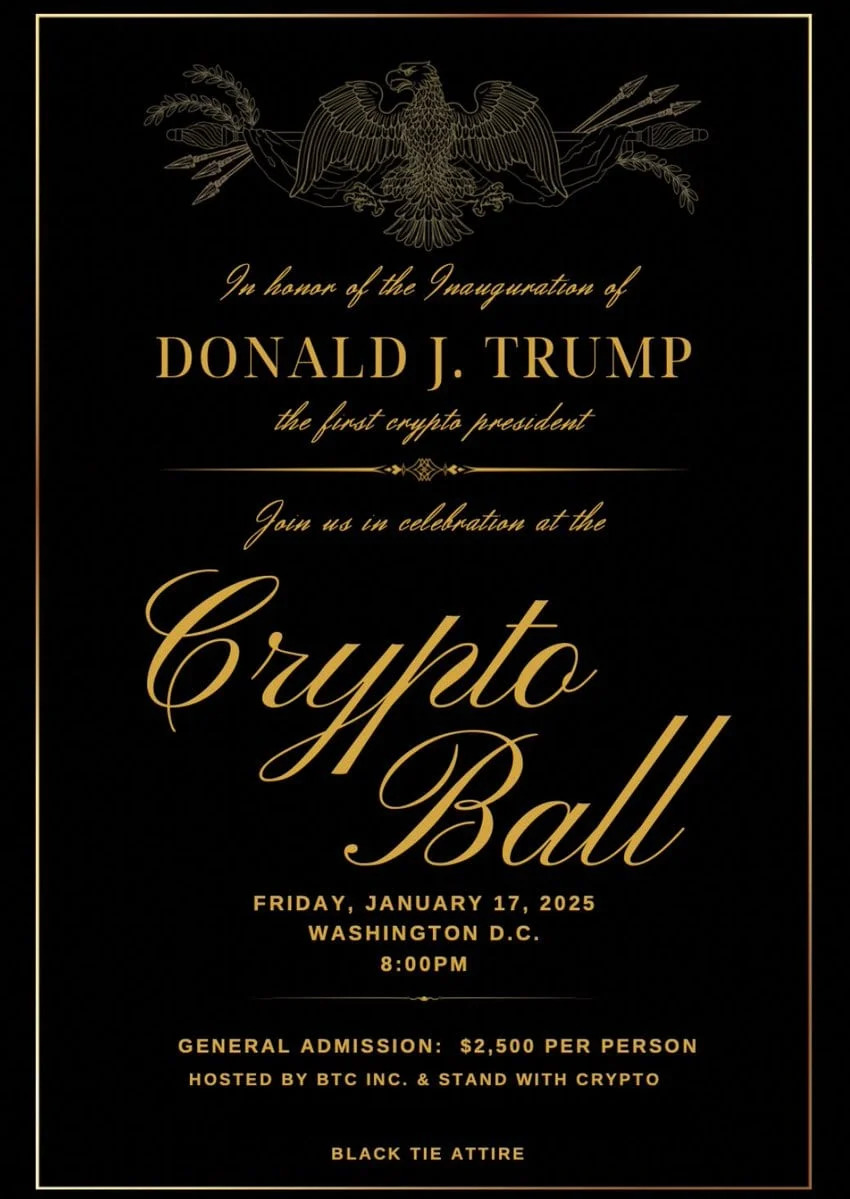

As U.S. President-elect Trump’s inauguration on January 20 draws near, leaders from the crypto and tech industries are preparing to participate in a grand celebration. On January 17, a crypto-themed ball will be held in Washington, D.C., with David Sacks, the White House’s AI and cryptocurrency chief, hosting the VIP reception. While Trump himself will not attend, top companies and leaders in the crypto sector have actively raised funds for the ball and related festivities, setting new records.

Will the so-called "Trump rally" boost the market again in January? Bitcoin's price trajectory faces several critical junctures, and analysts have shared their forecasts on how policy changes may impact prices.

Celebrating Trump’s Inauguration: “Crypto Czar” David Sacks to Host Crypto Ball

On January 20, Donald Trump will be sworn in for his second term as U.S. president—an event destined to become a significant moment in American history. The crypto ball scheduled for January 17 has already drawn widespread attention. Beyond standard tickets, a VIP reception is being hosted by Trump’s super PAC, MAGA Inc. Although Trump will not attend, David Sacks, the White House’s AI and cryptocurrency lead, will headline the VIP event.

Ticket prices are steep: general admission starts at $2,500, but the real draw lies in VIP and private packages. For $100,000, VIP guests gain networking access with key figures in the crypto world. A $1 million package includes four tickets plus a dinner with Trump at a later date.

The event is organized by BTC Inc., with co-hosts including Stand With Crypto, Exodus, Anchorage Digital, and Kraken. Sponsorship packages for co-hosting cost $5 million. Other sponsorship tiers range from $150,000 to $1 million. Current sponsors include major crypto firms such as Coinbase, Sui, MetaMask, Galaxy Digital, Ondo, Solana, Metaplanet, MARA, Satoshi Action Fund, and MicroStrategy.

Multiple Crypto Firms Donate to Trump’s Inaugural Committee, Ripple Leads with Largest Contribution

As part of the presidential inauguration, fundraising efforts by Trump’s inaugural committee have attracted significant participation from crypto industry companies. By donating to the committee, crypto firms aim to secure influence within the incoming administration.

Trump’s inaugural fundraising has set a record, surpassing $170 million. Donors began receiving notifications last week (as of January 10) that seating for certain Washington events was full. Inaugural activities kick off on January 17. Those who donate $1 million or raise $2 million receive six tickets to various events, including the January 20 swearing-in ceremony and a “candlelight dinner” with Trump and his wife Melania on January 19—described as the weekend’s “highlight event.” They also receive two tickets to dine with Vice President-elect JD Vance and his wife.

Among crypto firms, Ripple stands out as the top donor, contributing XRP worth $5 million to Trump’s inaugural fund. Since Trump’s re-election victory on November 5, the value of Ripple’s escrowed XRP reserves has surged by over $85 billion. Ripple CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty recently met with Trump.

Other companies, including Robinhood, Coinbase, Circle, and Kraken, have also donated—$2 million, $1 million, $1 million USDC, and $1 million, respectively.

Circle CEO Jeremy Allaire said in a post on X: “We’re proud to build a great American company. The committee accepting USDC payments shows how far we’ve come and highlights the potential and strength of digital dollars.”

In addition, a company spokesperson confirmed that Moonpay recently contributed to support the president-elect’s inauguration, though the amount was not disclosed. New York-based Ondo Finance also donated $1 million to Trump’s inauguration in late December last year.

Trump May Announce Crypto Policies on First Day, But Implementation Will Take Time

According to Reuters, Trump is expected to issue at least 25 executive orders on his first day in office, some of which could relate to cryptocurrency policy. The Washington Post reported that Trump may move to repeal the controversial crypto accounting rule SAB 121 on his first day. That rule requires banks to treat held digital assets as liabilities on their balance sheets.

However, while the crypto industry eagerly anticipates Trump’s return, policy implementation may not happen immediately.

NYDIG, an institutional provider of Bitcoin financial services, noted that fulfilling campaign promises will take time. “There won’t be immediate changes in crypto policy after the inauguration, especially since many senior government positions remain unfilled,” NYDIG stated. “We advise against expecting rapid changes. Key officials still need to be appointed, confirmed, and then build their teams.”

Trump has yet to announce who will lead agencies such as the Commodity Futures Trading Commission (CFTC), the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC). However, NYDIG expects these appointees “will be supportive of Bitcoin and cryptocurrencies.”

Meanwhile, it remains unclear whether markets have already priced in Trump’s policy shifts. Analysts Dan Gambardello and Hoeem believe the market has not yet factored in Trump’s inauguration.

“Many think that a pro-crypto Trump administration and governments racing to buy Bitcoin are already priced in. But clearly, they are not,” Gambardello posted on X.

Crypto expert Hoeem echoed this view: “Trump’s inauguration is not priced in.” He added, “Trump will reverse any policies negatively impacting the crypto market and double down on those that are positive. From day one, he wants the market to keep rising—not only because his team and family are closely tied to it, but also due to his personal pride.”

Bitcoin Price Outlook: Mixed Signals from Rate Cut Expectations and New Policies

As markets anticipate potential policy shifts under Trump, analysts are closely watching Bitcoin’s price movement.

At the start of 2025, the crypto trading environment shows mixed trends following the December FOMC meeting and holiday season. According to 10x Research, Q1 2025 may not replicate the strong momentum seen in late January to March 2024 or late September to mid-December 2024.

The Consumer Price Index (CPI) data released on January 15 is a key focal point. Markets may pull back ahead of the CPI release, but could rebound if the data is favorable.

“Positive inflation data could reignite optimism, pushing the market higher ahead of Trump’s January 20 inauguration,” said Mark Thielen, founder of 10x Research. However, he cautioned that any rally might be short-lived. Thielen added that markets could retreat ahead of the FOMC meeting on January 29, forecasting Bitcoin to trade between $96,000 and $98,000 by the end of the month.

Singapore-based crypto investment firm QCP Capital noted on January 13 that despite unfavorable macro conditions and lingering Silk Road rumors, the crypto market appears resilient, with support levels at $91,000 for Bitcoin and $3,100 for Ethereum holding firm. Implied volatility remains relatively low and continues to decline, with only a slight bearish skew in the front-end market just before Trump’s inauguration.

While volatility markets show muted reactions, crypto is not yet out of the woods. Macroeconomic risks persist. Upcoming data releases—including Producer Price Index (January 14), Consumer Price Index (January 15), and Initial Jobless Claims (January 16)—could further fuel market volatility. As the U.S. economy heats up, this week will be a true test of whether cryptocurrencies can function effectively as a hedge against inflation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News