Base Behind the Spitfire: Net Inflows Exceed $2.5 Billion in Nearly 3 Months, TVL Surpasses $14.2 Billion, Overtaking Solana

TechFlow Selected TechFlow Selected

Base Behind the Spitfire: Net Inflows Exceed $2.5 Billion in Nearly 3 Months, TVL Surpasses $14.2 Billion, Overtaking Solana

Will Base's rise be a real threat at the gates, or just another "wolf cry"?

Author: Frank, PANews

For a long time, many public blockchains have liked to position themselves as competitors to Solana, yet none seem to have truly threatened it. However, recently, Solana co-founder Toly appears eager to debate with Jesse Pollak, the founder of Base. Meanwhile, Base's ecosystem has seen explosive growth across various metrics in recent months—leading among Layer 2 networks on multiple fronts, even surpassing Solana in key data such as Total Value Locked (TVL) and capital inflows.

Could Base actually be Solana’s most formidable potential rival? PANews reviewed Base’s latest data and compared it with Solana’s performance—does Base’s rise signal a real threat at the gates, or is this just another false alarm?

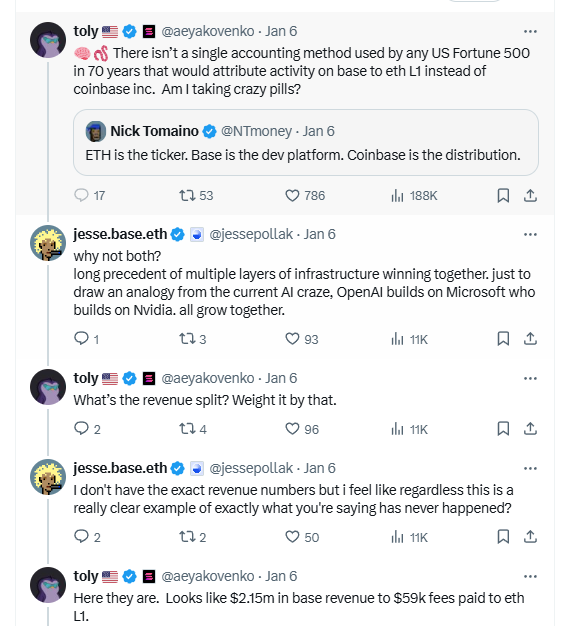

Founders Engage in Heated Public Debate

On January 6, Solana co-founder Toly commented on social media that Base isn't contributing genuine growth to the Ethereum ecosystem but instead siphoning off Ethereum's ecosystem value through Coinbase. In response, Base founder Jesse fired back, stating that Base does not compete with Ethereum in a zero-sum way. Rather, like other Layer 2 solutions, Base develops within Ethereum’s broader roadmap, and its growth contributes directly to Ethereum’s expansion.

Toly countered by drawing an analogy: Google and Microsoft both contribute to Linux, but their value capture remains separate. Similarly, no Fortune 500 company uses a single accounting method to attribute Base’s activity to Ethereum—the revenue flows into Coinbase. For example, while Base generated $2.15 million in revenue, only $59,000 was paid to Ethereum’s mainnet.

While Toly may appear to be advocating for Ethereum’s underrepresentation in value capture, the deeper context likely reflects not a Base-vs-Ethereum rivalry, but rather a growing competition between Solana and Base. Though numerous chains—including Sui, Aptos, and Hyperliquid—position themselves as rivals to Solana, the sentiment from Solana’s team suggests they see Base as their primary challenger.

As early as December, when Pudgy Penguins announced token issuance on Solana—spurring a record 66.9 million transactions in a single day on the network—Jesse publicly welcomed them, saying: “The Base community and I will welcome Pudgy Penguin and its PENGU token with open arms.” This move was widely interpreted by the community as a direct attempt to poach business from Solana.

Beyond that, tensions have flared repeatedly between the two camps. When Yuga Labs co-founder Garga.eth criticized the Ethereum ecosystem, Jesse expressed disapproval. Toly then chimed in sarcastically: “Bridge ETH to Solana—I absolutely don’t mind ETH becoming the best currency on Solana.” Previously, Jesse had also made several public comparisons positioning Base against Solana.

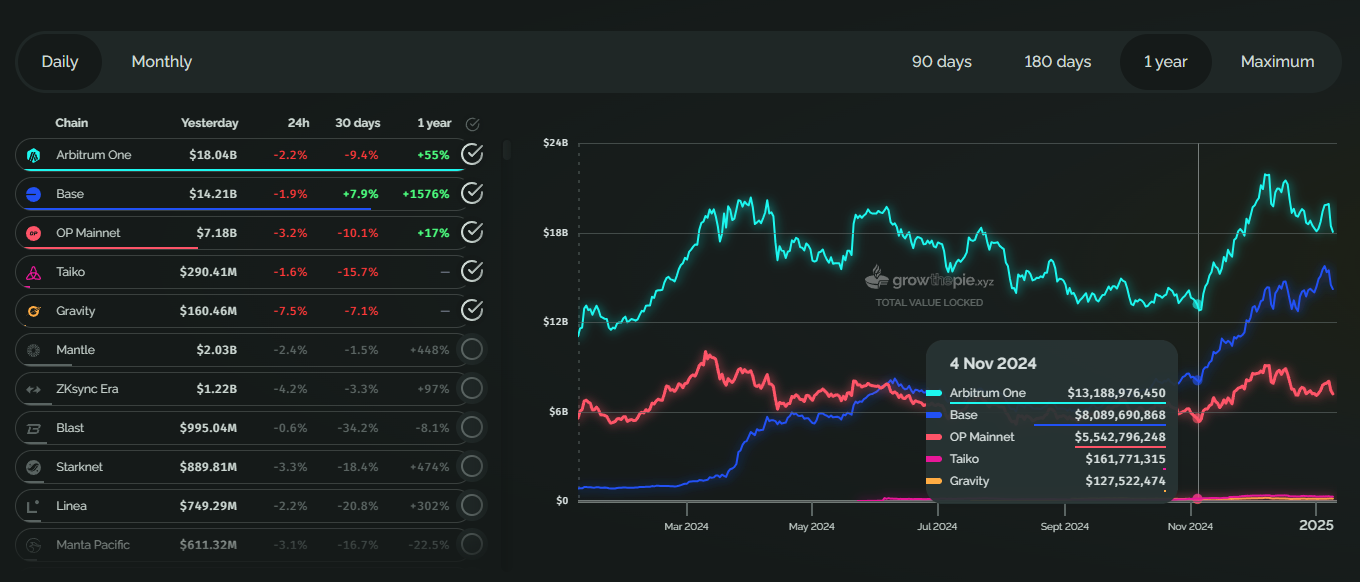

Base Overtakes Solana in TVL and Capital Inflows

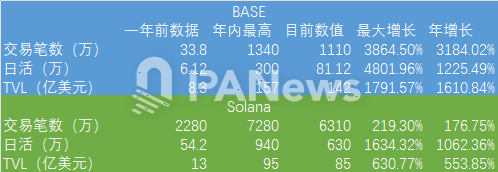

Underlying these verbal spats lies a quiet but significant shift in on-chain data between Base and Solana. PANews compared several key metrics over the past year between the two networks. While Base still lags behind Solana in overall scale, its growth rate now outpaces Solana across all major indicators. At this pace, Base could potentially surpass Solana in data terms within one to two years.

PANews selected common blockchain comparison metrics—daily active addresses, transaction count, and TVL—using data from one year ago up to January 10, 2025.

Looking first at Base: one year ago, it recorded approximately 338,000 daily transactions, 61,200 daily active addresses, and $830 million in TVL. These figures represented just 1.48%, 11.29%, and 63.85% of Solana’s respective values at the time.

By January 10, 2025, Base had grown to about 11.1 million daily transactions, 811,200 daily active addresses, and $14.2 billion in TVL. Now, these numbers stand at 17.59%, 12.88%, and 167.06% of Solana’s current levels, respectively.

Year-over-year growth rates for Base were 3,184.02% for transactions, 1,225.49% for daily active addresses, and 1,610.84% for TVL. In contrast, Solana’s growth during the same period was 176.75%, 1,062.36%, and 553.85%, respectively.

Clearly, after one year of development, Base still trails Solana significantly in transaction volume and user activity. However, in TVL, Base has already overtaken Solana. Interestingly, to celebrate this milestone, Jesse and other core team members shaved their heads live on stream on January 9.

Moreover, Base shows more aggressive momentum across other growth metrics. If both chains maintain their current growth trajectories, Base could surpass Solana in transaction volume within a year.

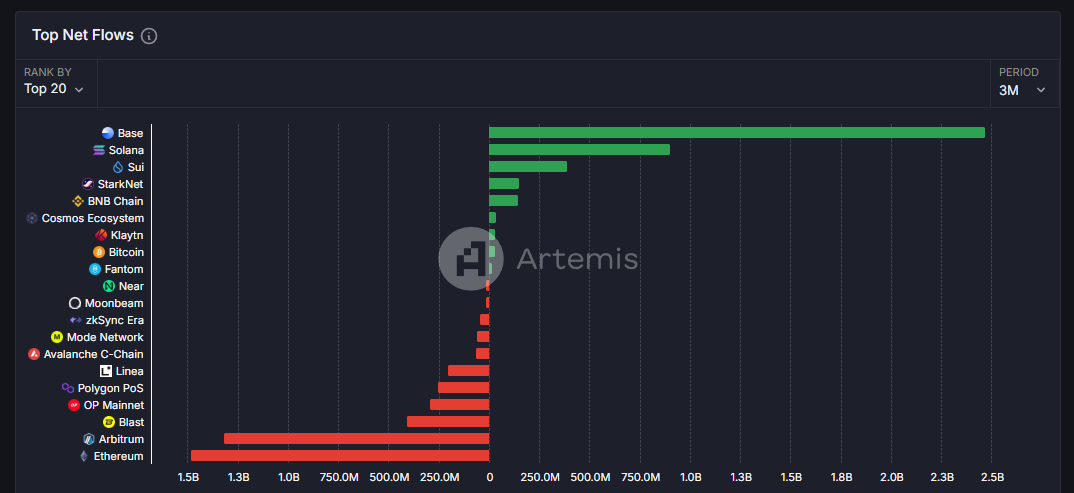

Another critical metric has also shifted quietly. For most of the past year, Solana led all blockchains in total capital inflows. But over the last three months, Base has taken the lead with a net inflow of $2.5 billion, while Solana ranks second with $900 million.

This shift is particularly striking—the net inflow over the past three months ($2.5 billion) accounts for roughly 65% of Base’s total annual inflow (~$3.8 billion), indicating a sharp acceleration in capital accumulation recently.

From U.S. Election to Virtuals: AI Fuels Base’s Rise

A closer look reveals this surge began around November 3. Notably, this wasn’t unique to Base—Arbitrum also experienced rapid growth during the same period.

The broader market rally following Donald Trump’s U.S. election victory likely contributed to this growth. More recently, however, Base has gained attention due to Virtuals Protocol—an emerging competitor in the meme coin space, where Solana has long dominated.

After various networks launched clones of Pump.fun with little success, Virtuals Protocol successfully capitalized on the AI agent trend, becoming the hottest platform for one-click AI agent deployment. It has spawned several high-market-cap AI agent tokens, including aixbt and G.A.M.E., each exceeding a $100 million valuation.

According to DexScreener data, on January 11, Solana’s DEX trading volume reached $6.88 billion, with 5,324 new pools created in 24 hours. On Base, trading volume stood at $2.12 billion, with 2,673 new pairs launched in the same period. The gap between the two in the meme sector is narrowing steadily. Base now stands as the only blockchain approaching Solana’s level of热度 in meme-related activity.

Previously, Sui saw a brief surge in popularity, but eventually faded. Base’s advantage lies in stronger capital retention—its TVL remains robust. As long as there’s no cliff-like drop in TVL, this momentum may be sustainable.

Data comparisons clearly show Base emerging as Solana’s strongest competitor. Yet one persistent issue remains: Base lacks a native governance token, making it difficult to price within the market. The absence of a chain-specific token also allows protocols like Virtuals to absorb much of the capital that might otherwise flow into a Base token.

To address this, on January 4, Base developer Jesse Pollak tweeted that Coinbase is considering offering tokenized COIN stock to U.S. users on the Base network.

If realized, the significance may extend beyond adding another asset to the RWA narrative. Instead, the value generated by Base could be more directly reflected in Coinbase’s stock price. For investors limited to traditional financial markets, this would offer indirect exposure to Base’s growth and benefits. Given Base’s current performance, such a tokenized entity could command a valuation well above $10 billion. On January 11, Coinbase’s market cap was approximately $64.7 billion—ranking behind BNB and SOL in the crypto space. With Base’s growing on-chain inflows factored in, could Coinbase eventually surpass both BNB and SOL in market capitalization?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News