With an initial surge of over 5,000%, why is SONIC SVM dubbed the next Web3 mass-user growth engine?

TechFlow Selected TechFlow Selected

With an initial surge of over 5,000%, why is SONIC SVM dubbed the next Web3 mass-user growth engine?

This article takes you deep into the ecosystem highlights and development logic of $SONIC, fully unveiling this red-hot star project and analyzing the future growth roadmap of $SONIC.

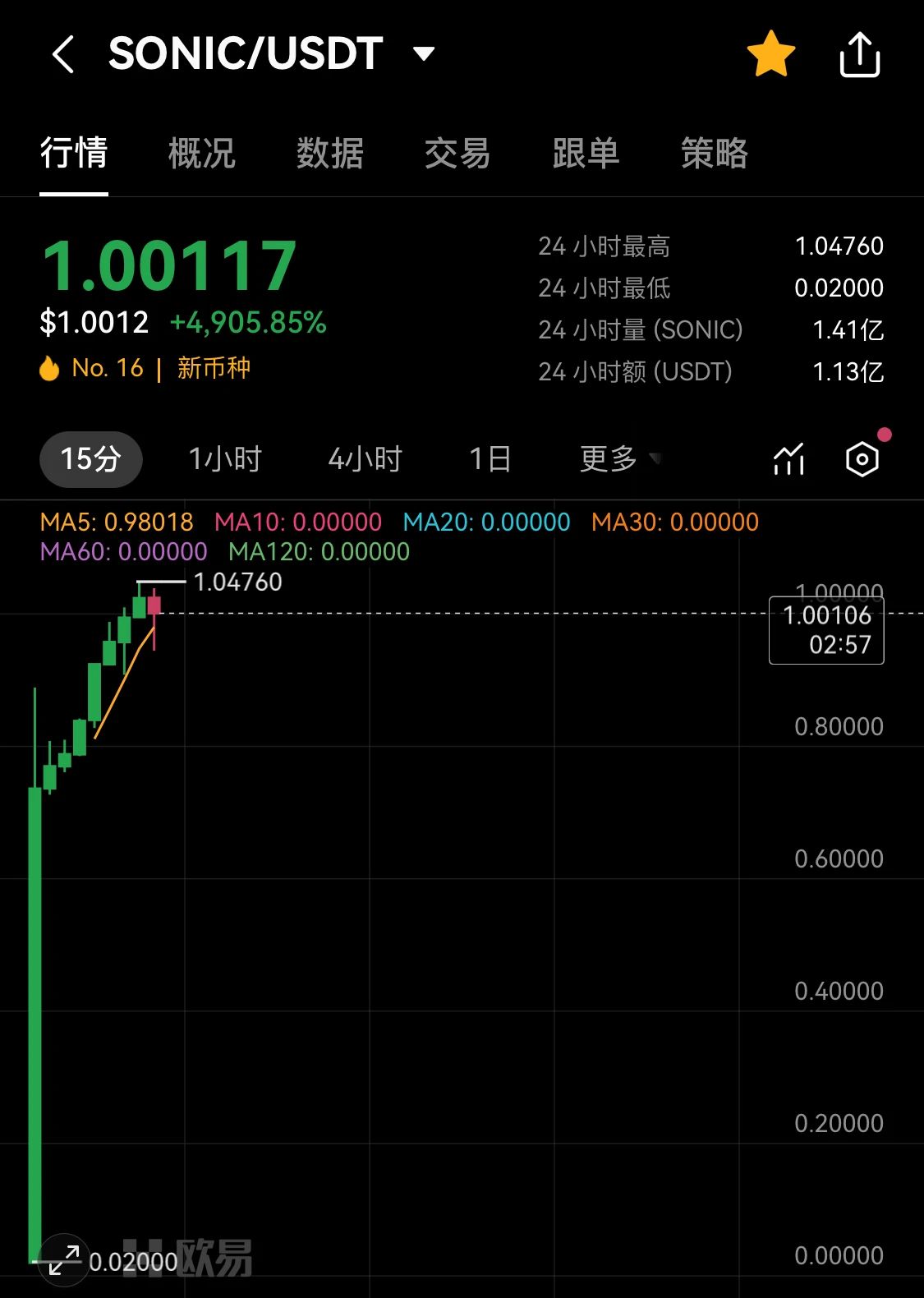

On January 7 at 20:00 Beijing time, SONIC SVM's token $SONIC officially launched on leading global exchanges including OKX, BYBIT, and BITGET, and is set to list on South Korea’s top-tier exchange Upbit tomorrow.

This multi-platform simultaneous listing has made $SONIC a market focal point, with its post-launch performance drawing significant attention—its price surged over 5000% in a short period, triggering widespread interest across the industry.

What drove such explosive market performance for $SONIC on its launch day? Behind this impressive achievement lies a unique combination of technological strengths, ecosystem potential, and strategic positioning. This article (January 6, 137Labs' "The Next Mass User Growth Engine in Web3 —— SONIC SVM" X SPACE transcript) will dive deep into the ecological highlights and development logic of $SONIC—from technical capabilities to community operations, from project positioning to market strategy—offering a comprehensive breakdown of this rising star and analyzing its future growth blueprint.

Q1

Could you elaborate on why 137Labs identified and became bullish on Sonic SVM during your research?

Ivan mentioned that 137Labs first noticed Sonic SVM as early as June and considered it a project worth watching. At that time, Sonic SVM had just completed fundraising and launched its Odyssey campaign, aiming to attract new users through this user acquisition initiative. As the first Rollup project within the Solana ecosystem, Sonic SVM holds significant market potential. Any core project pioneering in an ecosystem gains first-mover advantage, capturing more users, traffic, and ultimately increasing TVL.

By November, when Sonic SVM announced it had successfully attracted one million users via TikTok, 137Labs decided to elevate the project to high-priority status. Ivan emphasized that projects capable of acquiring traffic through TikTok deserve serious attention due to TikTok’s massive user base and powerful viral content distribution, making any traffic gained from this platform highly valuable.

For example, Telegram managed to convert users into Ton chain users, then further into token holders via mini-games on the Ton blockchain. Despite the complex conversion process, it successfully boosted Ton’s market cap. Therefore, any Web3 project capable of attracting mass users through similar platforms possesses enormous market potential.

Ivan believes that the current user scale in Web3 and crypto remains relatively small, while TikTok can bring hundreds of millions of users into these fields. If a platform can successfully onboard so many users, its prospects and valuation would be extremely promising.

OneOne noted that when hunting for alpha projects, he typically focuses on those offering innovative technologies, narratives, or gameplay mechanics. He believes Sonic SVM perfectly fits this criterion. While researching new projects, he discovered Light Protocol—a novel technology built on Solana. This caught his attention, and upon deeper investigation, he found that Sonic SVM leveraged not only Light Protocol but also introduced other technical innovations, meeting his standards for technological depth and uniqueness. OneOne emphasized that his primary focus is on technical innovation, particularly the depth and distinctiveness of implementation, which is precisely why Sonic SVM piqued his interest.

Q2

Sonic SVM is referred to as the “TikTok App Layer.” How should we understand this positioning? Why is it considered comparable to TON? Where does Sonic hold advantages or disadvantages compared to TON, and what makes its business model attractive?

Ningning mentioned that 2025 could mark the era of “fat apps,” where Web3’s “mass adoption” enters a new phase. Previously, efforts to popularize Web3 often relied on abstract infrastructure like DID or account abstraction, which failed to directly drive user conversion. The issue lies in the fact that average users do not prioritize decentralization or privacy as much as the industry assumes—they care more about seamless access to Web3 and enjoying high-yield opportunities on-chain. Thus, Web3 user acquisition must not only overcome technical barriers but also simplify onboarding processes.

In this context, Ningning highlighted Sonic SVM’s successful user acquisition via TikTok as a key strategic move. TikTok boasts a vast and high-quality young user base, especially in North America and Europe, who are particularly receptive to Web3 and cryptocurrency. Compared to Telegram, TikTok’s user base is superior in quality and more open to adopting Web3 applications. By targeting TikTok users, Sonic SVM has seized a sharp market opportunity, making its positioning as the “TikTok Chain” highly appropriate—it enables precise targeting of ideal users within the largest traffic pool available.

Technically, Sonic SVM functions as a Layer 2 based on Solana, inheriting Solana’s high TPS and concurrency features while maintaining efficient performance. Although Sonic SVM faces some degree of centralization as an L2, Ningning argues this isn’t critical for end-users, who primarily care about chain security, data transparency, and verifiability—all of which Sonic SVM delivers. Users are more concerned with entering the Web3 world easily (e.g., one-click connection via TikTok account) and participating in high-yield DeFi applications.

Ningning also emphasized that Sonic SVM’s business model demonstrates a strong product-market fit. By simplifying user onboarding and offering high-value assets on-chain, Sonic SVM provides a compelling value proposition. Compared to traditional financial products, this approach offers clear advantages—Web3 enables higher yields and unparalleled asset types. Ningning believes Sonic SVM’s positioning and user acquisition strategy fully showcase the attractiveness of its business model.

From a commercial perspective, Ivan provided an in-depth analysis of why Sonic SVM is called the “TikTok App Layer” and how it compares to TON.

Similarities between Sonic SVM and TON:

First, both share a common foundation: massive social media user bases. Sonic SVM is backed by TikTok, while TON relies on Telegram. According to 2024 data, TikTok has 1.58 billion monthly active users (MAUs), versus 950 million for Telegram. Both platforms offer immense potential for promoting Web3 and cryptocurrency. Additionally, both teams maintain close ties with their respective parent platforms—TON is led by Telegram’s founding team, while Sonic SVM’s founders have backgrounds at ByteDance (TikTok’s parent company). Moreover, Sonic SVM maintains deep collaboration with the Solana Foundation and broader Solana ecosystem.

Second, both use mini-games as a user acquisition tool. TON previously attracted users through “Tap to Earn” games, and Sonic SVM employs a similar strategy using mini-games and interactive content to onboard users into Web3.

Third, both integrate social identity verification and wallet recovery mechanisms, allowing users to generate login credentials and recover wallets via their social media accounts, greatly simplifying onboarding and improving usability.

Differences between Sonic SVM and TON:

First, short-form video content on TikTok exhibits far stronger virality than Telegram’s messaging format. Studies show that short-video content achieves conversion rates up to 2.2 times higher than text-based content, giving TikTok a significantly greater reach and engagement potential.

Second, there’s a notable difference in user value. TikTok’s user base is concentrated in North America, Europe, and Asia-Pacific regions, where users generally possess stronger spending power. In contrast, Telegram’s user base skews toward Eastern Europe, Southeast Asia, and Africa—developing markets with lower purchasing capacity. TikTok’s younger demographic also shows higher conversion efficiency, reaching up to 70% in marketing campaigns, whereas Telegram’s youth segment accounts for only 19%, resulting in lower conversion rates. ARPU (Average Revenue Per User) on TikTok stands at $11.7, compared to just $1 on Telegram—a tenfold difference. The gap in ARPPU (Average Revenue Per Paying User) is even wider, highlighting TikTok’s superior commercial value. Furthermore, TikTok requires KYC verification, enhancing data authenticity, while Telegram allows non-KYC usage.

Third, differences in引流 platforms matter. While Telegram currently dominates early-stage crypto project promotion, TikTok as a promotional channel is still nascent, offering substantial room for growth. TikTok’s massive traffic pool and affluent, young user base present Sonic SVM with a huge untapped market. Meanwhile, although TON is a rising player, its ecosystem activity and number of live projects remain under development. In contrast, Solana’s ecosystem is already mature. As a Layer 2 solution on Solana, Sonic SVM seamlessly integrates into the existing Solana ecosystem, benefiting from robust technical support and abundant project resources.

Thus, Sonic SVM’s business model is highly attractive. For crypto projects, user acquisition and monetization capability are crucial. Leveraging TikTok’s vast user base—especially its young, high-spending audience—Sonic SVM holds tremendous user conversion potential. TikTok users’ willingness and ability to spend enable Sonic SVM to attract substantial capital inflows, driving on-chain activity and TVL growth.

Moreover, users need not only to join but also bring funds—creating deposit liquidity—to generate real value for Sonic SVM. Through TikTok, a high-conversion platform, Sonic SVM is poised to attract large volumes of capital, fueling prosperity in its DeFi, GameFi, and broader ecosystem.

Compared to TON, Sonic SVM’s integration with TikTok better aligns Web3 technology with user needs, especially in terms of user conversion and spending power. Therefore, Sonic SVM is well-positioned not only for user growth but also for accelerating Web3 application adoption.

Q3

If a social media account linked to a wallet gets hacked, does the wallet face theft risks?

Ivan pointed out that wallets linked to social media accounts are typically known as Account Abstraction (AA) wallets. While they simplify user experience, they may introduce certain risks. Users don't directly control their private keys—these are instead managed by the social platform or third parties. This means that even if a social media account is compromised, attackers cannot directly extract the private key. The only action possible for an attacker would be transferring assets within the account. However, if the user promptly resets their social media password and enables two-factor authentication (2FA), quick response measures can protect the account.

Ivan added that if a user hasn’t enabled 2FA and their social media account is stolen, the best course is immediately resetting the password and logging out all other devices. This prevents attackers from continuing unauthorized access. Enabling 2FA is one of the most effective preventive measures, significantly raising the barrier to account compromise—even if passwords are leaked, login attempts will fail without secondary verification.

Of course, such risks are closely tied to the platform’s own security. If the platform fails to adequately safeguard user accounts, large-scale breaches could occur. But if the platform prioritizes security and strengthens defenses, these risks can be effectively controlled.

Q4

What are the key technical innovations in SonicSVM’s architecture? What are the core features of HyperGrid and HSSN? How does Sonic’s technical solution differ from Ethereum Rollups? Can you summarize the essence of HyperGrid in one sentence?

OneOne explained that SonicSVM’s technical architecture can be understood by analogy with Ethereum’s Layer 2 solutions, though it is not technically a Layer 2 of Solana. Unlike Ethereum’s Layer 2s (such as Optimism and Arbitrum), SonicSVM’s innovation lies in its bidirectional synchronization mechanism. Ethereum’s Layer 2 performs unidirectional state sync—pushing state updates to the mainnet without receiving back state changes from the mainnet. In contrast, HyperGrid’s core component—the HyperGrid Shared State Network (HSSN)—enables bidirectional synchronization: Solana’s state can be synchronized to Sonic chains, and vice versa, enabling tighter coordination between chains.

Another innovative feature of HyperGrid is its grid structure. This grid allows multiple nodes to perform state synchronization in parallel, boosting system throughput via state compression and Byzantine fault tolerance. Specifically, increasing the number of grid nodes enables SonicSVM to handle more state sync requests, significantly enhancing processing capacity—an essential factor for scalability.

Beyond grid architecture and improved throughput, HyperGrid’s framework is compatible with the Solana Virtual Machine (SVM), enabling seamless migration of Solana-native dApps to Sonic chains. This ensures interoperability between applications on both chains, achieving Ethereum Layer 2-style equivalence—Solana dApps can run natively on Sonic without code modifications.

Finally, OneOne emphasized that SonicSVM’s grid design enables faster speeds than Solana itself, giving it a performance edge. This combination of bidirectional sync and high throughput gives SonicSVM a distinct technological advantage over Ethereum Rollups. In summary, the essence of HyperGrid can be stated as: *A high-efficiency state synchronization and grid architecture enabling cross-chain interoperability and superior throughput.*

Ivan began by explaining the similarities between Hypergrid and Ethereum Rollups. The term “Grid” comes from its composition of multiple grids—each functioning as a Rollup, akin to Ethereum Rollups or Solana L2s. Each Grid operates at the same level, serving as a Layer 2. Like Ethereum’s L2s (e.g., Optimism, Arbitrum), which rely on Ethereum mainnet for consensus, data availability, and settlement, Hypergrid similarly offloads these functions to the Solana mainnet.

In this regard, Hypergrid uses the HyperGrid Shared State Network (HSSN) for state management and validation. Similar to Ethereum Rollups, transaction ordering and state hash generation happen within each Grid before being submitted to HSSN. HSSN centrally manages these ordered transactions and states, then submits them to Solana for finality confirmation. Once confirmed by Solana, transactions become immutable.

To illustrate HSSN’s operation, Ivan offered a simple analogy: Solana is like a busy “club” overwhelmed with demand. To reduce congestion, HSSN proposes opening several “branch clubs”—each Grid acts as a branch handling local transactions and state ordering. Each branch (Grid) generates a state hash and sends it to HSSN, which performs global ordering and consolidated accounting before submitting everything to Solana for final confirmation. This mechanism alleviates pressure on Solana while improving overall system efficiency through distributed processing.

Additionally, HSSN incorporates ZK verification (zero-knowledge proofs) to further optimize performance. Using Light Protocol’s ZK proofs, Hypergrid reduces Solana’s computational load and mitigates risks like DoS attacks. ZK proofs also accelerate finality, ensuring irreversible transactions.

Regarding interoperability, Ivan stressed Hypergrid’s compatibility with Solana. Not only can Solana-based projects migrate seamlessly to Hypergrid, but all assets and data on Solana can also flow natively to Sonic SVM without relying on third-party bridges. This enables frictionless transfer of assets and data across chains.

Moreover, seamless connectivity exists between Grids themselves, allowing assets and data to move freely between different Grids. This means assets on one Grid can be instantly transferred to another part of the Sonic network, ensuring smooth and consistent cross-Grid and cross-chain operations.

Ivan further explained that HSSN’s global ordering mechanism ensures system-wide consistency, preventing state conflicts or forks. The introduction of global ordering guarantees uniform transaction sequencing across Hypergrid, avoiding common issues in distributed systems and thereby enhancing reliability and stability.

Lastly, Ivan summarized Hypergrid’s technical characteristics. At the technical level, Hypergrid shares similarities with Ethereum Rollups in terms of sequencing, ZK proofs, and finality confirmation. Transaction ordering at the Rollup/Grid layer follows similar principles—each Grid orders transactions and generates corresponding states. ZK proof generation methods are also comparable. For finality, both Hypergrid and Ethereum Rollups depend on their respective mainnets (Solana and Ethereum) to finalize transactions and ensure immutability.

However, Hypergrid differs significantly from Ethereum Rollups in global ordering and interoperability. Ethereum Rollups rely on the Ethereum mainnet for transaction ordering, whereas Hypergrid uses the HSSN system for global ordering, with Solana only responsible for finality confirmation. Unlike Ethereum Rollups, Hypergrid doesn’t depend on Solana for ordering—only for final confirmation—reducing reliance on the mainnet and increasing flexibility.

Second, interoperability differs. Cross-Rollup communication on Ethereum (e.g., between OP, Arbitrum, Base) is often complex and imperfect, requiring third-party bridges for asset and data transfers. In contrast, Hypergrid enables native interoperability—assets and data can move seamlessly between Grids without external bridges—giving it a clear edge in cross-chain functionality.

Finally, Ivan concluded with one sentence: *It’s a ZK-powered, OP Superchain-equivalent, modular SVM execution layer with a decentralized ordering network.*

Q5

Beyond technology, what other highlights make SonicSVM stand out? For instance, ecosystem development, backing investors, latest operational metrics, or recent activities?

Ningning first highlighted that one of SonicSVM’s biggest strengths is its success in attracting a large number of real users, particularly through TikTok and similar platforms. This strategy, involving collaborations with TikTok, successfully funneled millions of TikTok users onto its platform. While many were initially drawn by airdrops or reward programs, the key question now is whether these users can be converted into deep Web3 participants—how to transition from “shallow” Web2 users to “heavy” Web3 users. Ningning believes this transformation process warrants close observation.

Next, Ningning noted SonicSVM’s innovative approaches to user incentives. It took inspiration from last year’s Telegram mini-game trends and enhanced them. Developers and projects can now build mini-games on SonicSVM’s framework. Since most TikTok users are interested in entertainment, cultural consumption, and IP merchandise—not necessarily financial investments typical of Web3 natives—SonicSVM’s ecosystem may lean more toward entertainment-focused offerings like casual mini-games and IP-driven NFT consumption.

Ningning further observed that SonicSVM’s ecosystem may diverge significantly from traditional Web3 ecosystems, especially when compared to DeFi or standard Layer 2 solutions. Its user base leans toward entertainment and culture, specifically catering to Gen Z’s preferences. This trend is already evident in China, where young people enthusiastically consume anime and gaming merchandise. Hence, SonicSVM may explore merging Web3 IPs with traditional Web2 IPs for commercialization and branding, appealing to youth-driven spending.

Finally, Ningning concluded that SonicSVM’s approach differs markedly from conventional Layer 2s. Traditional L2s usually aim to enhance economic opportunities in Web3 to attract traders and investors. In contrast, SonicSVM focuses on shifting Web3’s growth toward younger demographics by promoting entertainment and cultural consumption as gateways to on-chain participation.

Ivan elaborated on SonicSVM’s strengths in user growth, institutional backing, ecosystem building, and future outlook. First, he emphasized that SonicSVM attracted nearly 8.7 million registered wallet users before mainnet launch and without any incentive programs—2 million of whom came from TikTok—demonstrating its ability to draw Web2 platform users into Web3. Additionally, the largest of SonicSVM’s four mini-games reached 2.1 million monthly active users on TikTok, showcasing the platform’s appeal and potential.

On funding, Ivan noted SonicSVM received backing from major institutions, including Bitkraft—the leading North American gaming investment fund managing nearly $1 billion in assets—validating SonicSVM’s potential in the gaming space. Galaxy Digital, a key infrastructure provider in the Solana ecosystem, also supports SonicSVM, reinforcing its alignment with Solana. Additionally, SonicSVM secured investments from OKX and Mirana Ventures (affiliated with Bybit), providing solid financial footing for future development.

On individual angel investments, SonicSVM received backing from Lily Liu, President of the Solana Foundation, along with other core members of the Solana ecosystem, strengthening its ties and securing additional resources and support.

Ivan further analyzed SonicSVM’s future potential. He believes SonicSVM is not merely a GameFi or DeFi chain—the key highlight is SVM equivalence, meaning any Solana-based project can migrate seamlessly to SonicSVM, greatly facilitating ecosystem convergence. This will attract developers and users from Solana, powering SonicSVM’s ecosystem expansion.

Furthermore, Ivan suggested that SonicSVM might eventually host a platform akin to pump.fun, featuring decentralized exchanges, lending protocols, and perpetual contracts. Such developments would enrich SonicSVM’s ecosystem beyond traditional gaming and finance.

Finally, Ivan highlighted that as TikTok-born IPs and meme projects like MooDeng approach near-billion-dollar valuations, SonicSVM could become the ideal platform for hosting them. He believes SonicSVM can transform TikTok users into Web3 participants, creating an ecosystem where users enjoy entertainment while engaging in high-yield DeFi activities. This platform offers users greater profit-making opportunities, holding immense market potential and innovation upside.

Q6

What are the highlights of SonicSVM’s tokenomics design? Which aspects of token allocation and circulation models might attract investor attention?

OneOne mentioned SonicSVM’s partnership with TikTok, which directly impacts tokenomics design. He noted that during its TGE, SonicSVM allocated a portion of tokens to TikTok users—an approach designed to ensure ongoing participation from TikTok users, boosting platform activity and token circulation. If TikTok users remain engaged, SonicSVM could offer sustained participation mechanisms reflected in future token distributions, encouraging broader involvement in the Web3 ecosystem.

Second, OneOne drew a comparison with Pump.fun, pointing to new user engagement possibilities. Pump.fun, as a Web3 platform, suffered from lack of regulatory oversight, leading to non-compliant live streams. In contrast, TikTok enforces strict content moderation, effectively preventing such issues. OneOne believes SonicSVM can leverage TikTok’s livestreaming capabilities to host content that would otherwise be unregulated on platforms like Pump.fun—ensuring compliance while enhancing platform credibility and user experience.

Third, OneOne analyzed the unique advantages stemming from SonicSVM’s TikTok collaboration. He argued that this partnership lowers the barrier to entry—for example, users could conduct on-chain transactions directly within TikTok. Moreover, the collaboration creates positive externalities: as massive TikTok user inflows occur, the platform naturally gains traffic. This network effect attracts exchange attention—exchanges favor projects with user traction because they promise higher trading volume and fee revenue. For example, TON chain, with its large user base, enjoys greater visibility on exchanges and easier listings. Such externalities play a vital role in securing exchange support and enhancing token liquidity.

Q7

What is your view on SonicSVM’s future market cap potential? Any valuation expectations to share?

Ningning believes the concept of consumer chains could see a major market cap uplift in 2024. Traditionally, projects backed by advanced tech like ZK Rollups or top-tier VCs are expected to achieve billion- or even multi-billion-dollar valuations. However, Ningning notes that despite initial hype, many ZK-based projects haven’t delivered as expected. Instead, consumer chains once undervalued in primary markets—like SonicSVM and Pengu’s Abstract—may surprise in secondary markets. This shift could expand awareness of consumer chains from early investors to broader retail audiences. As recognition grows, SonicSVM’s market cap could rise substantially.

On valuation, Ningning boldly predicts that by the end of Q1 2024, SonicSVM’s market cap will reach at least $3 billion, reflecting his optimistic outlook on the project’s potential.

Ivan proposed a detailed valuation model centered on fund sedimentation and activation. His method starts with TikTok’s MAU, combines it with current crypto penetration rates, and estimates the number of users yet to enter crypto. Multiplying this by SonicSVM’s high conversion rate and average user deposit amount, Ivan believes SonicSVM can accumulate significant capital from TikTok users, effectively converting them via mini-games and other mechanisms.

Formula: Sedimented Funds = TikTok MAU × (1 - Crypto Penetration Rate) × Conversion Rate × Average Entry Capital

Ivan noted that SonicSVM’s mini-games boast much higher conversion rates than other platforms (e.g., Telegram mini-games or exchange referral programs), enabling rapid Web3 user acquisition and substantial fund accumulation. These sedimented funds exceed TVL since not every user deposits into DEXs or ecosystem apps. Beyond fund accumulation, SonicSVM excels at converting these funds into active capital—driving on-chain economic activity. Ivan used gas fee consumption as an example: active users increase transactions and protocol usage, generating ecosystem vitality.

Further, Ivan introduced a Return on Equity (ROE)-like metric, drawing parallels with Solana’s performance. When sedimented funds turn into active capital, they generate higher transaction volumes and activity, ultimately reflected in market cap growth. Final valuation formula: Sedimented Funds × ROE = Generated Fees, minus costs, multiplied by PE. Ivan believes SonicSVM holds enormous upside potential.

Ivan also stressed SonicSVM’s uniqueness. While many KOLs may attempt comparisons, such benchmarks lack meaning—SonicSVM is the only Web3 project operating at scale on TikTok. This TikTok + Web3 synergy gives SonicSVM an irreplaceable position among peers, serving as a core driver of market cap growth.

Lastly, Ivan highlighted SonicSVM’s technical advantages, particularly its gasless and approval-free operations. This design eliminates cumbersome blockchain actions like paying gas fees or confirming wallet approvals, making Web3 feel as smooth as Web2—greatly lowering barriers and increasing user stickiness.

OneOne, addressing SonicSVM’s market cap potential, first asserted that TVL is not suitable for evaluating all project types—especially public chains. He explained that as a platform, a public chain hosts diverse applications beyond DeFi, so assessing value solely by TVL is inadequate. A better approach is PEG valuation, which forecasts market cap based on projected on-chain growth rate over a given period. This considers not just TVL, but also user growth and on-chain activity—providing a more holistic view of a platform project’s multi-dimensional growth potential.

Furthermore, OneOne discussed the distinction between FDV and circulating market cap, emphasizing their respective roles. FDV forecasts full issuance market cap, reflecting total potential value. Circulating market cap reflects current market sentiment and investor confidence in future prospects. He noted that circulating market cap often correlates with “market dream ratios”—some projects gain high valuations due to compelling narratives, though actual performance may lag.

OneOne stressed that valuation methods must be flexible across stages and project types. Short-term, Fisher’s Equation can help estimate token velocity and market expectations. For projects like SonicSVM, short-term valuation should consider liquidity and market reactions. He recommended combining PEG with dynamic market sentiment adjustments for more accurate predictions.

In conclusion, OneOne believes the most appropriate valuation method for SonicSVM is PEG, adjusted for market growth expectations. He suggests setting upper and lower bounds for more precise forecasting. He also noted that as SonicSVM launches more meme-culture content, its valuation model may require recalibration to account for cultural volatility. Overall, OneOne emphasized the importance of adaptive, context-sensitive valuation strategies—especially for public chains and platform projects, where comprehensive, market-responsive models are essential.

Conclusion

With $SONIC’s stellar launch performance and the upcoming listing on Korean exchanges, we believe more entrepreneurs, developers, and ecosystem projects will join SONIC SVM. Going forward, as Sonic SVM continues expanding its ecosystem, refining its technical architecture, and unlocking user value, we have every reason to expect it to spark further waves of innovation in the Web3 space. Whether through its unique positioning as the “TikTok Chain” or breakthroughs in technology and business model, Sonic SVM has already left an indelible mark on the industry. Let us look forward together to how this shining new star will continue writing its legendary journey in the future of crypto.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News