IOSG Outlook 2025: Crypto's Schrödinger's Cat

TechFlow Selected TechFlow Selected

IOSG Outlook 2025: Crypto's Schrödinger's Cat

The crypto market is driven not only by technology or utility, but also by belief, trust, and the stories that capture our imagination.

By Momir @IOSG

Schrödinger's cat is a fascinating thought experiment—the principle essentially states that in quantum mechanics, macroscopic objects can exist in multiple states simultaneously until observed. In the Schrödinger's cat scenario, a cat is placed in a sealed box; before opening it, the cat exists in a superposition of being both alive and dead. Only when the box is opened does this state "collapse" into one definite outcome: either alive or dead.

This experiment closely mirrors today’s cryptocurrency market. Just as the cat exists in two states at once inside the box, the crypto industry today is in a phase of uncertainty where many possible futures coexist. Only when market shifts or external forces intervene will these possibilities collapse into a single reality.

The Superposition of Top Assets

BTC

One: Survival

BTC could solidify its position as a global reserve asset, fully realizing its vision as “digital gold.” However, achieving this depends on several critical factors:

-

The U.S. government includes BTC in national reserves and begins purchasing it (low probability).

-

Multiple governments or central banks from among the top 20 economies adopt BTC as a reserve asset (low to medium probability).

-

An increasing number of global public companies, inspired by MicroStrategy’s success, begin converting substantial cash reserves into BTC (medium to high probability).

-

Systemic shocks—such as government or banking collapses—boost BTC’s appeal as a hedge, reinforcing its role as a "safe-haven asset."

Two: Death

If these key scenarios fail to materialize, BTC’s momentum may weaken:

-

Government indifference: If major economies remain uninterested in BTC, market sentiment could turn bearish, shifting focus from price highs to whether large holders like MicroStrategy might take profits—or even dump their holdings.

-

Risk from MicroStrategy: While currently a strong supporter, if MicroStrategy’s leveraged positions trigger massive sell-offs, it could become a burden to BTC. Recall how giants like Alameda Research and Three Arrows Capital (3AC) were swiftly wiped out? Once liquidation lines are breached, short-sellers pounce, triggering cascading sales. If MicroStrategy follows suit, the situation could spiral out of control.

-

Technical vulnerabilities: BTC’s ability to withstand quantum computing threats remains a major concern. If BTC cannot adapt to this emerging risk, it cannot serve as a secure, tamper-proof store of value.

BTC now exists in a quantum-like superposition—either becoming the cornerstone of the crypto economy or being deemed outdated technology—its fate determined by market perception and ultimately collapsing into one definitive state.

ETH

One: Survival:

ETH has the potential to dominate the blockchain landscape and strengthen its status as a programmable alternative to BTC. Why might institutional investors increasingly favor ETH? Several reasons:

-

Institutional appeal: ETH boasts extremely high decentralization. Aside from BTC, it may be the only blockchain asset acceptable to governments and institutions.

-

Quantum resistance: Long-term, ETH is more likely than BTC to smoothly transition to quantum-resistant technologies. We expect ETH’s upgrade path to be significantly smoother than BTC’s.

-

Sustainable economics: With abundant on-chain activity, ETH generates organic fees that provide validators and miners with stable income. Its flexible tokenomics allow adjustments between inflationary and deflationary modes based on demand, giving it far greater long-term economic sustainability compared to BTC.

-

Developer ecosystem: ETH attracts the most developers and has been the preferred ecosystem for development teams for seven consecutive years.

-

Diversified leadership: Multiple teams drive ETH adoption, including Base (arguably the most influential crypto entity in the U.S.), Arbitrum, ZkSync, Starknet, and others.

-

Resistance to centralization risks: Unlike BTC, ETH doesn’t face the risk of market narrative dominance by a single entity like MicroStrategy.

-

Blockchain trilemma: ETH is the only public chain that has successfully balanced the blockchain trilemma—decentralization, scalability, and security—through innovative solutions like Rollups. This makes ETH the most technologically advanced and versatile blockchain, suitable for both institutional and retail users.

-

Ecosystem growth: ETH enjoys a vast and active ecosystem. The momentum generated by such scale allows ETH to benefit maximally from favorable policy developments and clear regulatory frameworks.

Two: Death:

In the worst-case scenario, ETH could miss the entire cycle due to internal and external risks:

-

Leadership, leadership, leadership:

-

Leadership vacuum: Due to ETH’s large and fragmented community, certain influencers continuously create confusion and spread contradictory messages, further fragmenting the ecosystem.

-

Cultural challenges: The new U.S. administration promotes a cultural shift—from "woke culture" toward practicality and groundedness. This means moving away from political correctness and moral discourse toward direct, results-oriented communication. ETH’s culture is often seen as more "woke" than other ecosystems, emphasizing inclusivity, political correctness, and community-led ethical debates. While these values support diversity, they can also bring inefficiencies—poor communication, moral policing, hesitation in making bold decisions. Loud voices within the community often act as moral courts, restricting open dialogue and creating friction around stronger leadership styles.

-

Competitive pressure: Competitors like Solana continue challenging ETH’s dominance. Many non-ETH public chains have already achieved significant growth. If this trend continues, ETH’s status as the top choice for elite developers will face mounting pressure.

In the future, ETH may be hailed as an upgraded version of BTC, the king of blockchains—or it may struggle due to inherent cultural and structural traits.

Solana

One: Survival:

Solana can shine through its agility and vibrant community:

-

Meme + AI convergence: In 2025, memes will still dominate crypto’s economic attention. Solana is leading this meme-driven trend—responding proactively to the rapid rise of AI agents by introducing an Agent SDK.

-

DePIN: Years of strategic investment in DePIN are finally paying off. As numerous DePIN solutions go live, Solana has the opportunity to lead in integrating blockchain with real-world infrastructure.

-

Developer leadership: By focusing on cutting-edge verticals and fast innovation, Solana challenges ETH’s dominance among developers. Solana’s intense focus on developer communities positions it as a breakout contender among ETH challengers.

-

Institutional validation: If a Solana ETF is approved, it would mark a pivotal milestone—signaling institutional recognition and elevating Solana’s standing among both institutional and retail investors.

Two: Death:

-

From hunter to hunted: Over the past 18 months, Solana staged a dramatic comeback. Its unconventional roadmap and resilience during the FTX collapse allowed it to reclaim a top spot among leading blockchains. But Solana is no longer the underdog—it now carries the aura of an established leader. As a result, speculative capital is beginning to shift toward its rivals, such as Sui, Hyperliquid, Aptos, and Monad. These emerging chains claim to offer faster, integrated alternatives, each threatening Solana’s position.

-

Overreliance on memes: Solana’s rise was fueled by memes and speculation. While effective in capturing attention, this strategy carries the risk of fading enthusiasm. Without sustainable on-chain activity—such as a thriving DeFi ecosystem or enduring narratives—a decline in meme popularity could severely damage Solana’s on-chain economy. Attention economies are inherently fleeting; long-term growth cannot depend solely on market attention.

-

Developer stickiness: In 2022, Solana experienced the largest developer exodus in blockchain history, fueling ongoing concerns about its long-term viability. While Solana’s recent success stems largely from speculators, we remain skeptical about whether it has cultivated a loyal, resilient developer community over the past 18 months. In the coming years, as competition intensifies, a strong developer base will be Solana’s essential moat for maintaining leadership.

Solana stands at a crossroads between survival and collapse: its flexibility, active community, and innovation give it the potential to challenge ETH. Yet amid rising competition, speculative dependence, and developer retention issues, Solana’s ability to sustain momentum will determine whether it continues to lead or fades from relevance.

Investment Outlook by Sector

2.1 Crypto x AI

Crypto x AI is currently the most innovative and dynamic sector in the industry, attracting widespread attention beyond crypto circles and offering vast imaginative potential. Sovereign AI—AI systems powered by decentralized crypto infrastructure—represents a revolutionary opportunity (though granting AI such power also introduces significant risks). These systems can achieve true autonomy, using non-custodial wallets to interact on-chain with other agents and humans. In the future, we may even see AI agents purchasing human services to complete off-chain tasks.

Months before AI agents became mainstream, we published insights on this space: The Agent Wars: Silicon Valley Titans vs. Crypto Challengers (Link: https://x.com/momir_amidzic/status/1825895123315458281)

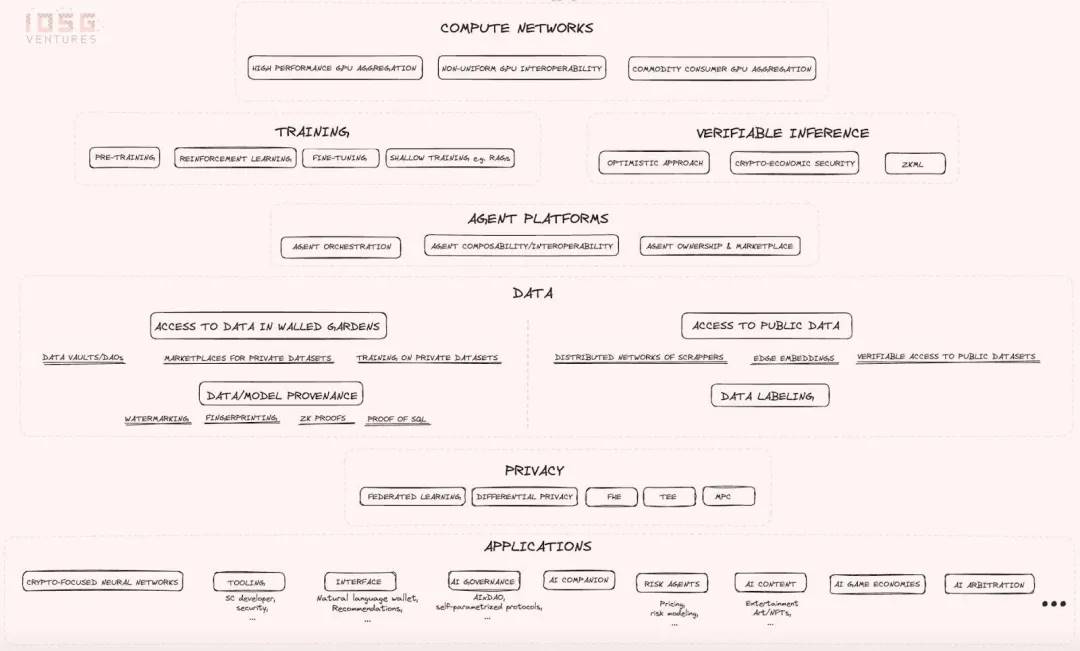

Beyond AI agents, other segments within Crypto x AI also deserve attention, as outlined in our June 2024 Crypto x AI industry map:

2.2 DePIN

DePIN is a highly innovative and diverse field, combining crypto-economic models with off-chain hardware to solve longstanding challenges in traditional industries.

Core Target Industries and Use Cases

DePIN projects span multiple sectors:

-

Edge computing: DePIN provides distributed processing power for latency-sensitive applications.

-

Energy and power infrastructure: DePIN incentivizes adoption of renewable energy sources.

-

Wireless networks: DePIN enables community-driven 5G and IoT connectivity, bypassing limitations of traditional telecom providers.

-

DePIN supports decentralized crowdfunding solutions for critical services such as mapping and high-precision positioning.

-

Computing and storage: DePIN offers decentralized alternatives to traditional cloud services, enabling secure data storage and processing.

-

CDN: DePIN enables cost-effective, scalable digital content distribution.

-

Data scraping projects like Grass use token incentives to build million-node networks, leveraging participants’ internet bandwidth to collect massive datasets.

While DePIN holds immense promise, not all projects are equally viable—success hinges heavily on individual project fundamentals.

We are optimistic about DePIN projects that deliver clear, measurable value—such as cost reduction, efficiency gains, or access to untapped markets. DePIN success typically arises from novel business models impossible under centralized systems, enabling superior market penetration, distribution, and accessibility. Additionally, DePIN improves cost efficiency and unit economics by lowering operational costs or optimizing resource utilization, making decentralized models more competitive and sustainable. Capital expenditure optimization is another key advantage: by using token incentives to distribute infrastructure costs across the community, DePIN projects achieve faster scaling and broader participation.

Conversely, we should avoid DePIN projects that misuse tokenization. Poor tokenomics often lead to unsustainable ecosystems. Some projects fail to deliver real efficiency improvements or meaningful advantages over traditional methods, instead relying solely on token incentives to mask inefficiencies and subsidize usage in the short term. Tokenization alone does not justify decentralization—and in some cases, outcomes are worse than existing centralized models.

2.3 Payments

Stablecoins have become the dominant payment medium in crypto. Thanks to their programmability, cross-border utility, and increasingly clear regulatory frameworks, stablecoins are poised to become the standard settlement currency for global payments.

Although stablecoins offer clear advantages over fiat in programmability and cross-border liquidity, broader adoption is still hindered by regulatory uncertainty and inefficient on/off-ramp mechanisms. However, a crypto-friendly U.S. administration may bring regulatory clarity, fostering a healthier environment for efficient, liquid, low-cost crypto-fiat transactions.

Short Term (1–3 years): Remittances and Consumer Applications

Stablecoins will first dominate cross-border remittances, offering a faster, cheaper alternative to SWIFT. Crypto-linked debit/credit cards (Visa/MasterCard) will simplify spending and bridge on-chain wealth with real-world transactions. This benefits individuals outside the U.S. banking system, those lacking access to traditional payment cards, and crypto holders seeking convenient ways to spend their assets.

Medium Term (3–7 years): Business Adoption

Businesses will increasingly adopt stablecoins due to their low fees, instant settlement, and programmability. Companies will seamlessly convert between crypto and fiat, offering customers both payment options. This dual-track approach will boost efficiency and further integrate stablecoins into mainstream commerce.

Long Term (7+ years): Paying Taxes with Stablecoins

Stablecoins will become widely accepted legal tender, used even for tax payments, eliminating the need to convert to fiat. At that point, stablecoins will disrupt traditional financial infrastructure, enabling low-cost P2P transactions between consumers and merchants, significantly reducing reliance on banks and credit card companies.

2.4 Consumer Applications

The consumer applications space is highly experimental and difficult to define, often overlapping with AI, DePIN, and payments. It encompasses a broad range of use cases, including AI-powered consumer tools, consumer-facing DeIN projects, and user-centric payment solutions.

Beyond practical utility, consumer apps in crypto also carry strong elements of speculation and gamification. A key category here is blockchain gaming. Games that blend speculative economies with memes remain among the most successful consumer engagement experiments in the industry. These speculative applications blur the lines between entertainment, finance, and functionality, creating unique opportunities for innovation.

Looking ahead, new experiments combining crypto with consumer applications will unlock further potential. Game mechanics enhanced by economic incentives show great promise, offering novel ways to attract users and drive adoption. The design space is vast, and we expect breakthrough innovations in this area by 2025.

IOSG Portfolio Highlights

1. Usual

2024 was a breakout year for Usual, reaching $1.5 billion in TVL within six months and ranking among the top five stablecoins. Its governance token is now listed on Binance, the world’s largest CEX. Their momentum shows no signs of slowing—Usual aims to break into the top three stablecoins within the next 12 months, competing directly with giants like Circle and Tether. With scalability on par with competitors, this ambitious goal seems well within reach.

In DeFi, strategic partnerships with Ethena, Ondo, and M0 will drive the next phase of growth. Notably, Ethena and Usual’s yield products are designed to perform across market cycles—delivering high crypto-native yields in bull markets and stable RWA-backed returns in bear markets. On the CeFi front, integration of Usual as collateral is just beginning. Usual assets will become deeply embedded in both CeFi and DeFi ecosystems. As integrations expand, powerful network effects will accelerate adoption and utility.

Looking forward, the Usual team remains focused on building a vibrant ecosystem around the Usual asset. Given their exceptional execution, we have full confidence that groundbreaking innovation is just around the corner.

We previously published our thesis on Usual: Link, and shared our story with the Usual team: Link

2. BTC Ecosystem

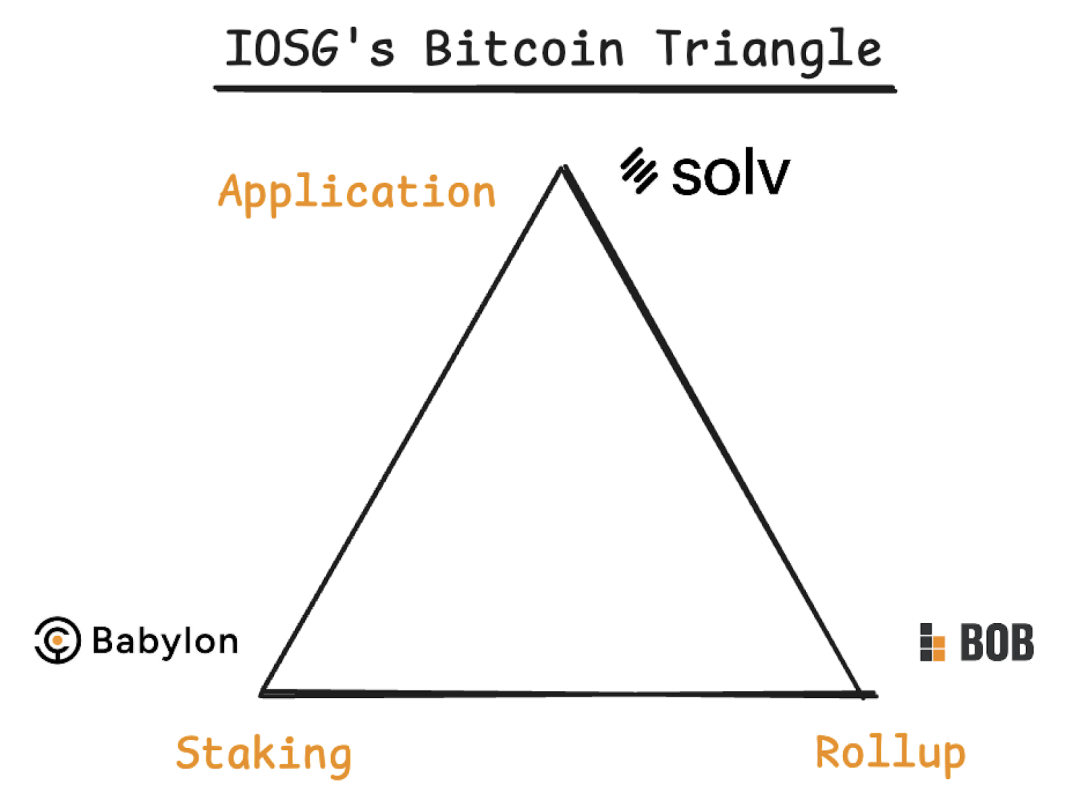

Despite being the oldest and most mature cryptocurrency, the BTC ecosystem remains in its early stages. We back a suite of pioneering projects shaping BTC’s next frontier:

-

Babylon: A cryptographic breakthrough enabling trustless BTC staking, allowing BTC holders to secure external networks and earn rewards without intermediaries.

-

BoB: A hybrid rollup using BitVM v2 for trustless BTC bridging. BoB combines Babylon’s fast finality with Ethereum’s data availability to create a secure hub, enabling BTC to freely integrate with ETH’s DeFi ecosystem.

-

Solv: The largest BTCfi application, redefining BTC’s role in DeFi by unlocking yield for BTC holders and advancing foundational financial products.

2025 is a pivotal year—years of BTC ecosystem innovation will transition into real-world deployment. This will be a crucial test of genuine demand for a thriving BTC-based on-chain economy. We are confident in BTC’s evolution from a store of value to an ecosystem supporting trustless staking, DeFi, and cross-chain interoperability.

3. AI Sector: Theoriq, Phala, Hyperbolic

Theoriq is an AI DePIN project redefining the future of AI collaboration. Within Theoriq’s framework, AI agents don’t operate in isolation—they form dynamic collectives. This forward-looking architecture enables agents to collaboratively solve complex problems beyond the reach of standalone systems. Theoriq introduces memory-equipped agents, advanced evaluators, and user-friendly tools, ensuring human feedback remains central to agent development—driving compounding value creation. This forms a virtuous cycle: agents learn, adapt, and self-organize through effective collaboration, continuously improving the ecosystem.

Theoriq operates in a self-regulating environment powered by crypto-economic incentives. Agents are rewarded for good behavior and penalized for errors, maximizing reliability and accountability. We led Theoriq’s seed round in 2022, when Crypto x AI was still a contrarian idea. Two years later, we’re thrilled to see Theoriq entering production.

Phala has long been a core holding in our portfolio. Recognizing its immense potential in shaping the future of Crypto x AI, we recently increased our investment. As a pioneer in TEE technology, Phala holds a unique advantage in meeting AI agents’ demand for secure infrastructure.

AI agents rely on TEE to securely manage critical assets—like wallets and social accounts—ensuring privacy, trust, and performance without compromise. In an era where nearly every infra project is exploring TEE integration, Phala’s solution stands out for its reliability and scalability, making it the preferred choice for many developers.

Hyperbolic is revolutionizing AI infrastructure. As a leading GPU network, Hyperbolic specializes in inference and offers verifiable inference tools. It has pioneered a GPU layer allowing AI agents to rent GPU resources via SDK. This innovation enables AI agents with computational needs to easily access required resources, enabling more complex and efficient workflows.

Hyperbolic’s Inference Cloud is a platform where anyone can contribute GPU resources. It fully abstracts hardware heterogeneity, making GPUs truly interchangeable. With outstanding execution, Hyperbolic has become the first project to host some of the most advanced open-source AI models on its platform.

4. Gelato

Five years ago, we recognized Gelato’s immense potential early. We led its seed round and have participated in every subsequent funding round. Over time, Gelato has quietly evolved into the AWS of Web3. Today, if you name any three crypto projects, at least one likely relies on Gelato’s tech stack in the backend. Gelato has achieved product-market fit, offering a robust and multifunctional suite including RaaS, Functions, Relay, VRF, account abstraction, RPCs, bridges, and oracles. Its solutions span payments, DeFi, infrastructure, consumer apps, and AI agents.

2025 will be the year Gelato transitions from silent infrastructure enabler to actively telling its story, marketing effectively, and building compelling token utility. It is poised not only to be recognized as a critical infrastructure layer but also to emerge as a pillar of reliability and innovation in the Web3 landscape.

5. Staking and Restaking

We have consistently invested in two major themes within the ETH ecosystem—"The Merge" and the "Shanghai Upgrade"—specifically in staking and restaking. Our portfolio includes EigenLayer, ether.fi, Kiln, Renzo, Babylon, and AltLayer—four of which are now listed on Binance. EigenLayer and ether.fi rank third and fourth among all DeFi protocols by TVL, at $15.7 billion and $8.4 billion respectively. Additionally, ether.fi and Kiln are the fourth and fifth largest ETH staking providers, with Kiln managing $13 billion in assets.

Reviewing the evolution of the ETH staking and restaking ecosystem, it’s clear that ETH’s value as a multi-functional asset continues to grow and expand.

As ETH’s roadmap progresses and the staking ecosystem matures, its importance in the blockchain industry grows. Through staking and restaking, ETH not only strengthens network security and decentralization but also demonstrates its unique attributes—as capital, a consumable asset, and a store of value—by expanding economic security and ecosystem richness.

Final Thoughts

The fate of the crypto industry in 2025 is like Schrödinger’s cat. Its success isn’t determined by intrinsic qualities alone, but by how it is perceived from the outside. On many levels, value is a construct shaped by collective consensus. BTC may be “digital gold,” ETH the backbone of decentralized innovation, and Solana the agile disruptor—but their ultimate destinies depend on the narratives we choose to embrace and the meanings we assign to them.

In crypto—a world of infinite possibility but finite attention—market perception becomes the ultimate currency. The market is driven not only by technology or utility, but also by belief, trust, and the stories that capture our imagination. What we pay attention to determines what survives and thrives, just as observation collapses Schrödinger’s paradoxical cat into a single state. The collective gaze of markets, institutions, and individuals will decide which futures prevail in crypto, and which fade into oblivion. Ultimately, it is our perception, our beliefs, and the stories we tell ourselves that will shape the foundation of the future digital economy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News