Analyzing Hyperliquid's Product Landscape, Economic Model, and Valuation

TechFlow Selected TechFlow Selected

Analyzing Hyperliquid's Product Landscape, Economic Model, and Valuation

Answer to the question "Is HYPE really expensive?"

Author: Lawrence Lee

1. Introduction

Hyperliquid has emerged as one of the brightest spots in the recent crypto market, aside from AI and Meme trends. Its strategy—rejecting VC investment, allocating 70% of tokens to the community, and returning all revenue directly to platform users—has captured significant market attention. The protocol’s approach of using its income to repurchase HYPE has rapidly propelled HYPE’s circulating market cap beyond UNI into the top 25 cryptocurrencies, while simultaneously driving explosive growth across all platform metrics.

This article aims to describe the current state of Hyperliquid's development, analyze its economic model, and assess the valuation of HYPE, ultimately answering the question: "Is HYPE expensive or not?"

The views expressed herein represent the author’s interim thoughts as of publication and may change over time. These opinions are highly subjective and may contain factual, data, or logical errors. Feedback and discussion from peers and readers are welcome. However, this article does not constitute any investment advice.

A substantial portion of this article draws from ASXN’s research report on Hyperliquid released in September, which is the most comprehensive and in-depth analysis of Hyperliquid the author has read. Readers seeking further details on Hyperliquid’s mechanisms are encouraged to refer to that report.

Below is the main body of the article.

2. Hyperliquid Business Overview

Hyperliquid currently operates two core businesses: a derivatives exchange and a spot exchange. They also plan to launch a general-purpose EVM—HyperEVM—in the future.

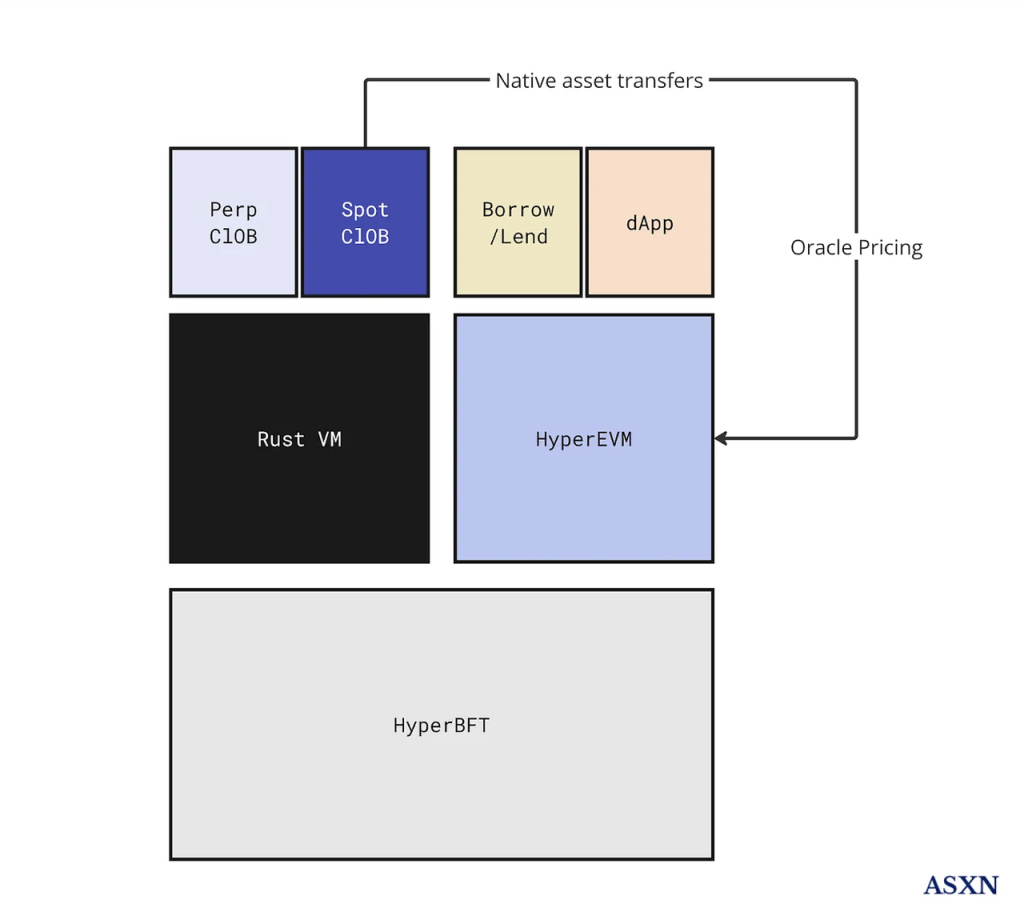

Hyperliquid Architecture Source: ASXN

2.1 Derivatives Exchange

The derivatives exchange was Hyperliquid’s first product and remains its flagship offering, serving as the centerpiece of its entire ecosystem.

In terms of core product design, rather than adopting alternative innovative models (such as those used by GMX or SNX) due to blockchain performance limitations, Hyperliquid chose the Central Limit Order Book (CLOB)—the most widely used mechanism across global exchanges and the one most familiar to traders and market makers—and focused instead on optimizing performance.

Their decentralized derivatives exchange runs on Hyperliquid L1, a PoS chain composed of the consensus layer HyperBFT and execution layer RustVM.

HyperBFT is a consensus algorithm modified by the Hyperliquid team based on Meta’s former blockchain team’s LibraBFT, capable of supporting up to 2 million TPS. Backed by this high-performance infrastructure, Hyperliquid has fully on-boarded key components such as the order book and clearinghouse onto the blockchain, forming its decentralized derivatives exchange architecture.

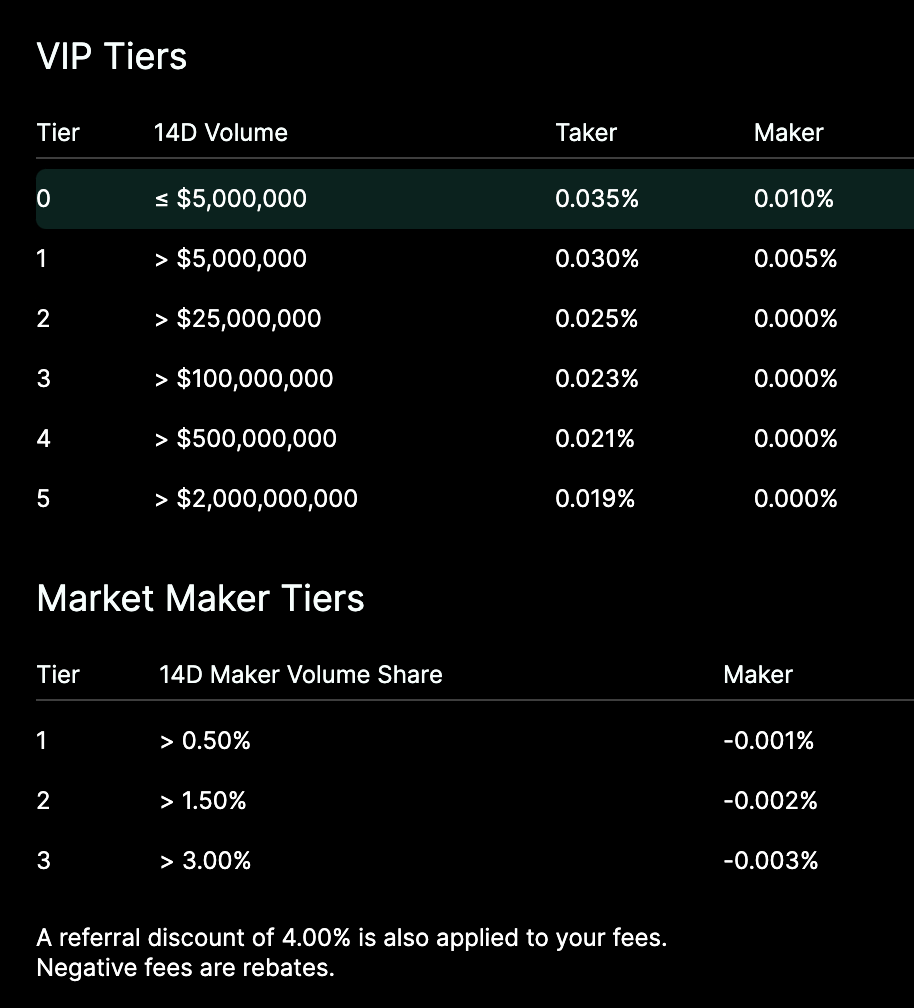

From an end-user perspective, the experience on Hyperliquid closely mirrors that of centralized exchanges like Binance—not only in trading interface and product structure but also in fee schedules and discount rules. The only major difference is that Hyperliquid requires no KYC.

Hyperliquid Fee Structure

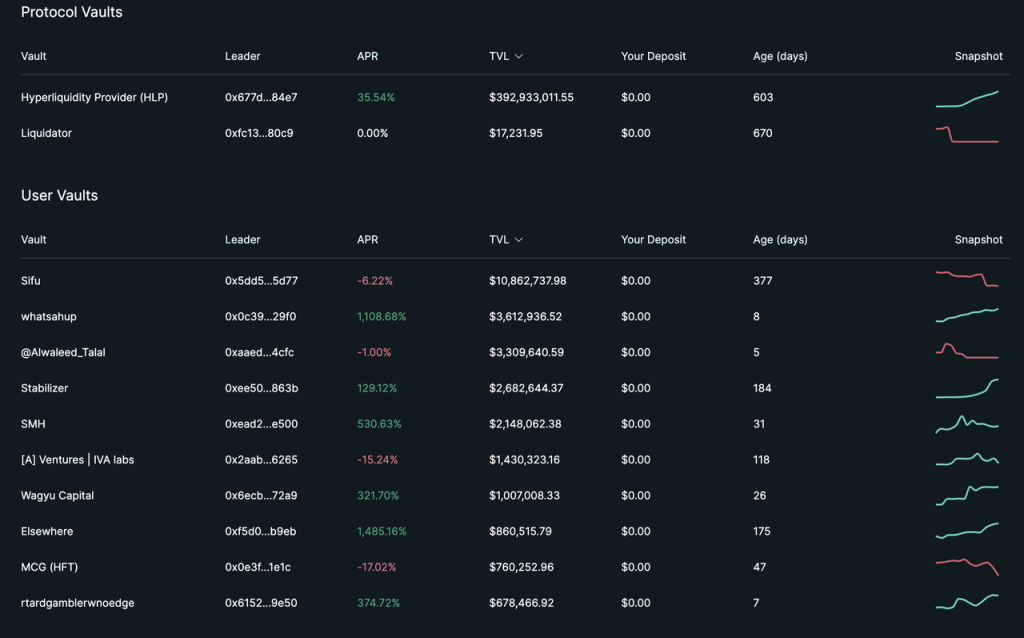

Beyond trading products, Hyperliquid introduced Vault functionality from day one. Vaults function similarly to “copy trading” features on centralized exchanges—anyone can deposit funds into a Vault managed by a designated operator, who receives 10% of profits generated. To align incentives, the operator must hold at least 5% of the Vault’s shares.

Source: hyperliquid official website

However, in terms of TVL distribution, 95% is currently concentrated in the official Vault, HLP.

Unlike typical Vaults, HLP—being operated officially—acts as a counterparty to many trades on the platform and thus earns a share of various fees (trading fees, funding fees, liquidation fees). In this sense, HLP is conceptually similar to GMX’s GLP, with key differences: GLP passively serves as the counterparty to all trades with transparent strategies, whereas HLP’s strategy is private, counterparties may be either HLP or other users, and HLP’s strategy can be adjusted dynamically.

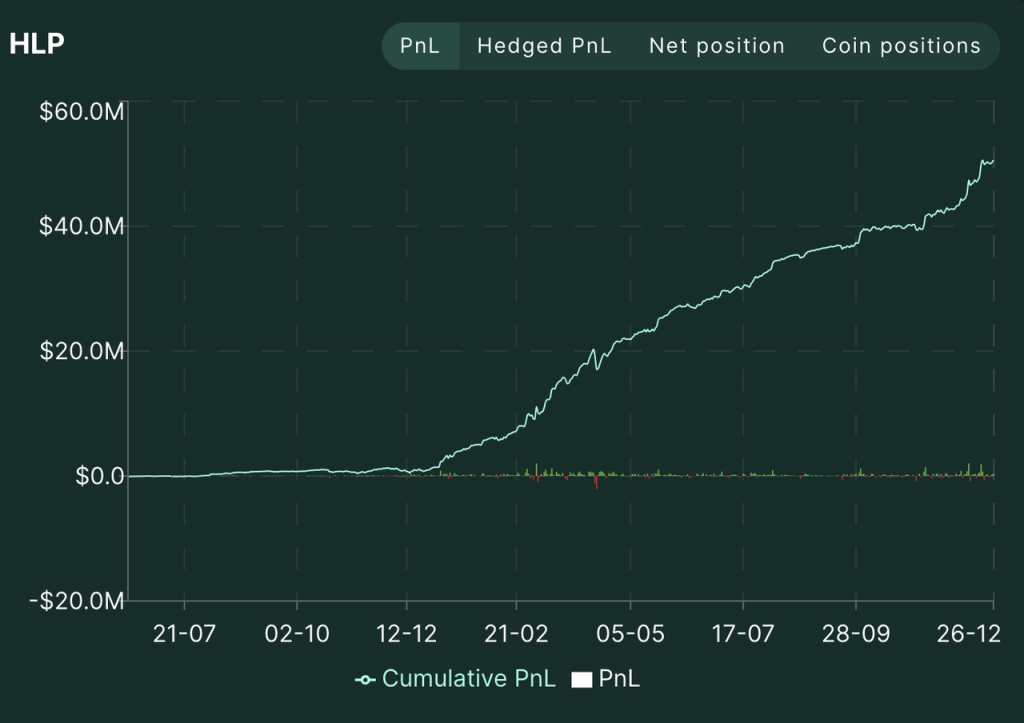

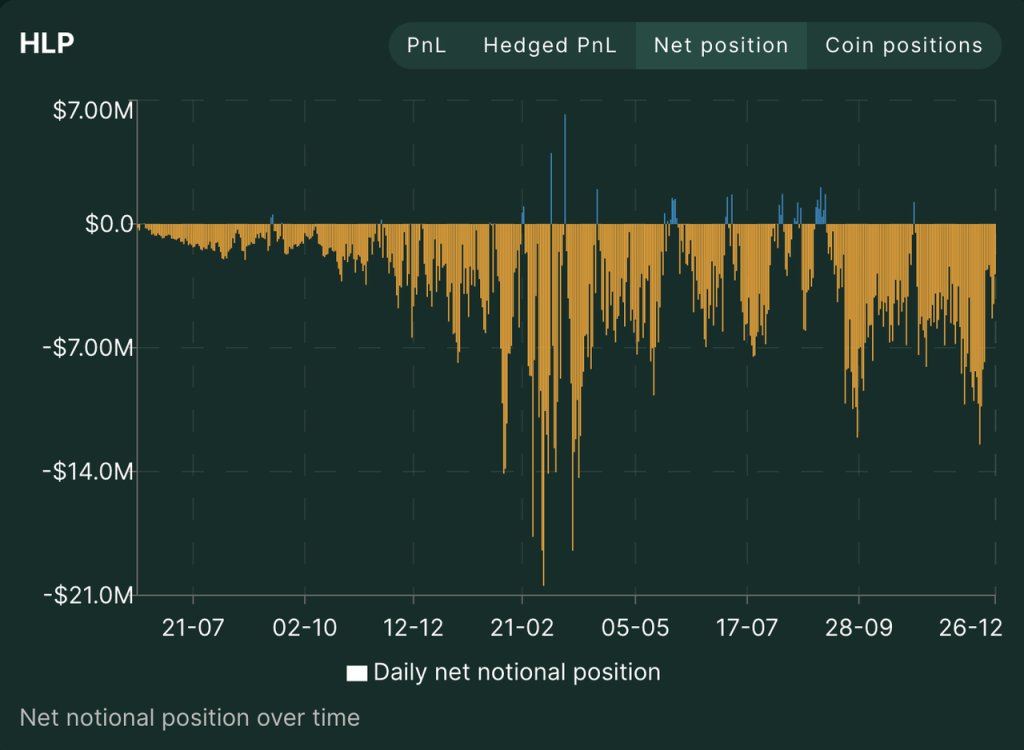

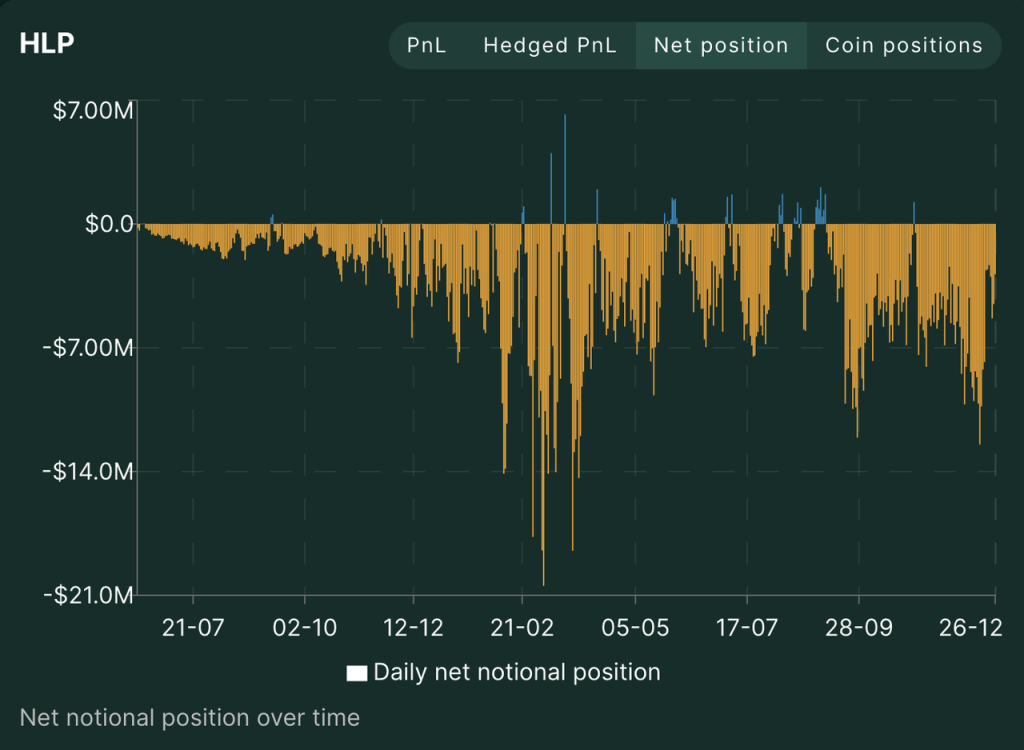

Since launching in July 2023, HLP has maintained a net short position almost continuously, providing liquidity to retail traders and profiting despite prolonged bull markets. Currently, HLP holds $350 million in TVL with a cumulative PNL of $50 million. Judging from the overall PNL curve of HLP and the PNL of its three strategy addresses, the Hyperliquid team appears to use fee subsidies to maintain a relatively positive APR for HLP.

Source: Hyperliquid official website

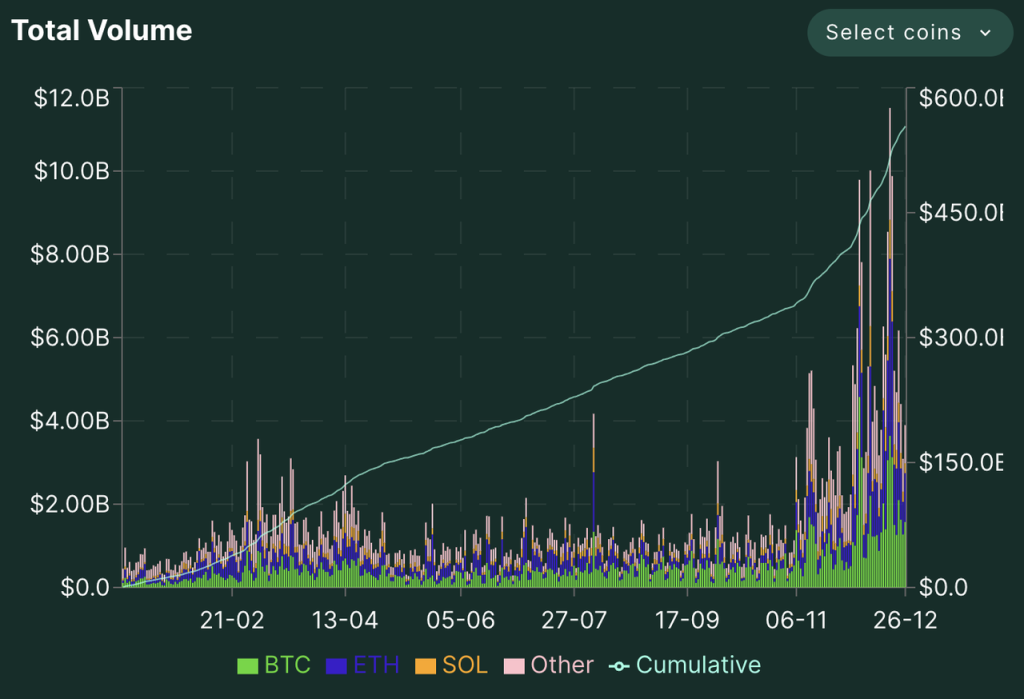

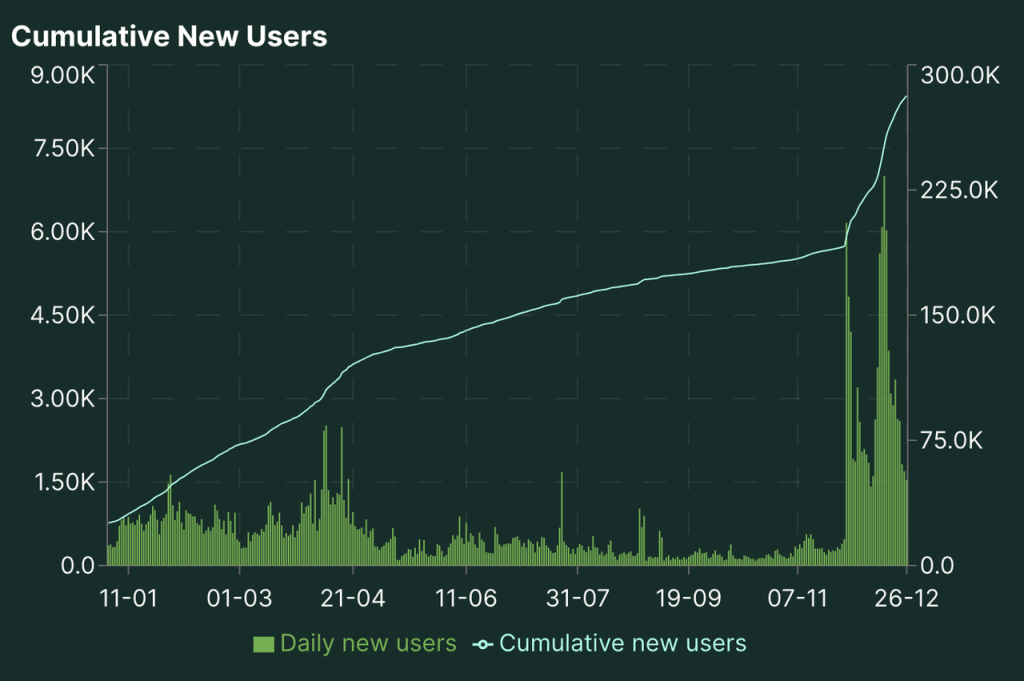

In terms of trading volume and open interest, Hyperliquid has grown rapidly, especially over the past two months. As $HYPE airdrops and prices continued to rise, nearly all platform metrics peaked between December 17–20.

Hyperliquid Trading Volume, Open Interest, and Number of Traders Since 2024 Source: Hyperliquid Official Website

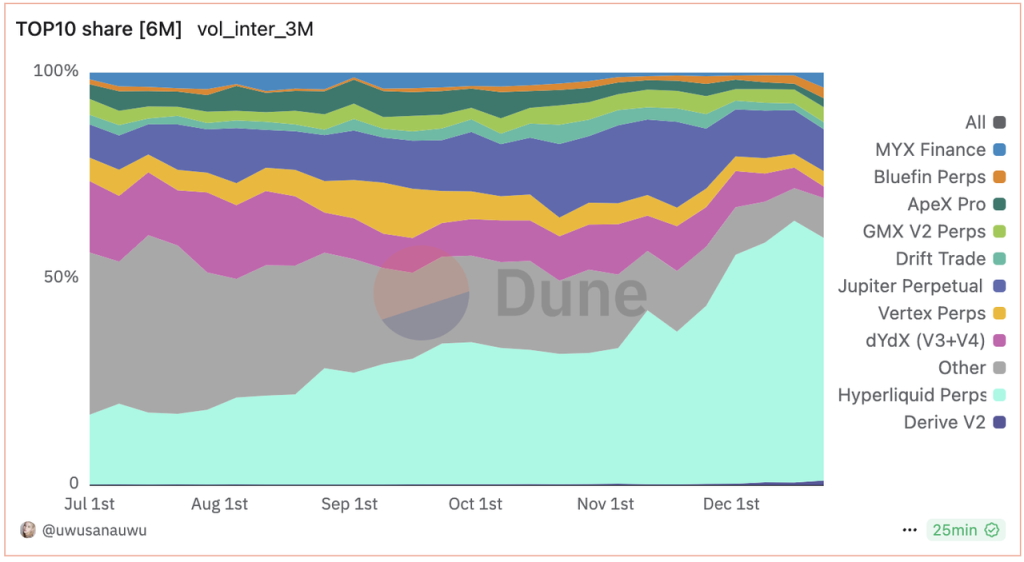

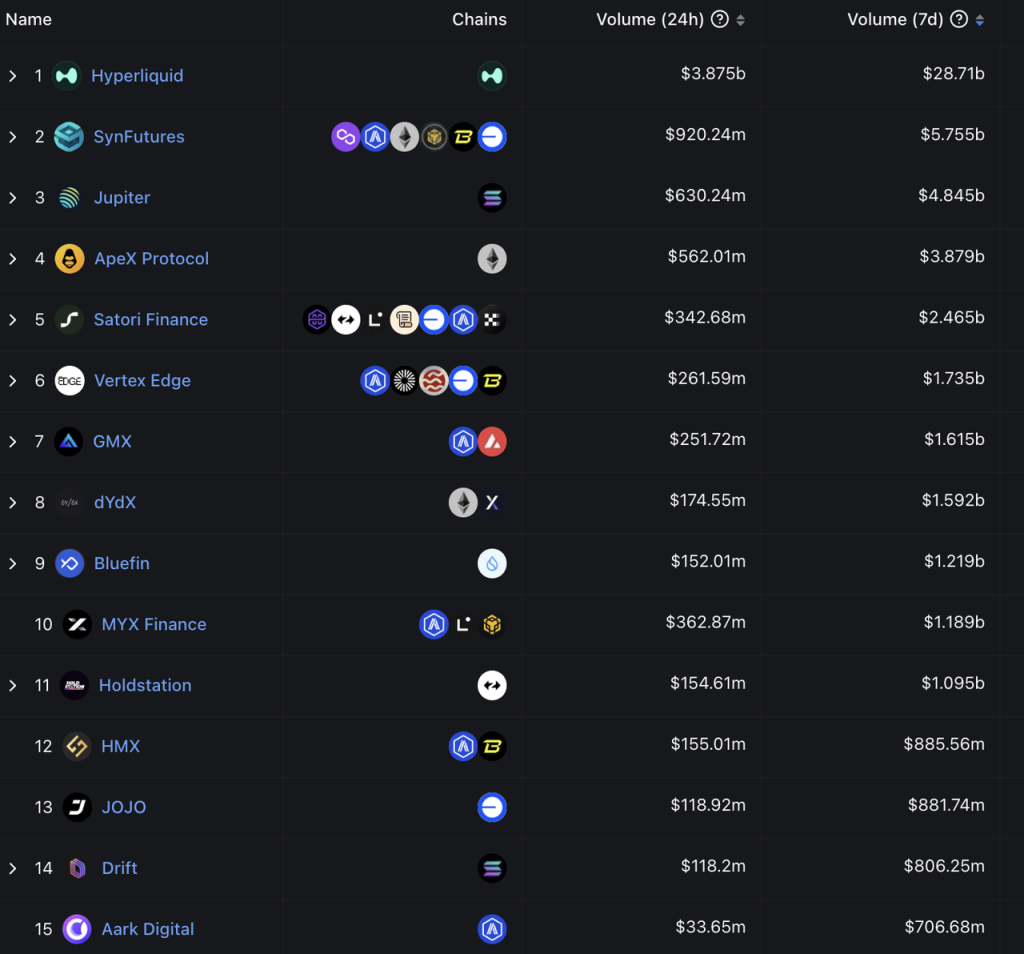

In the decentralized derivatives space, Hyperliquid has led in trading volume since June. Over the past two months, the gap between Hyperliquid and other DEXs has widened significantly, now reaching an order-of-magnitude difference.

Decentralized Derivatives Exchange Trading Volume Share Source: Dune

7-Day Trading Volume Ranking of Decentralized Derivatives Exchanges Source: DeFiLlama

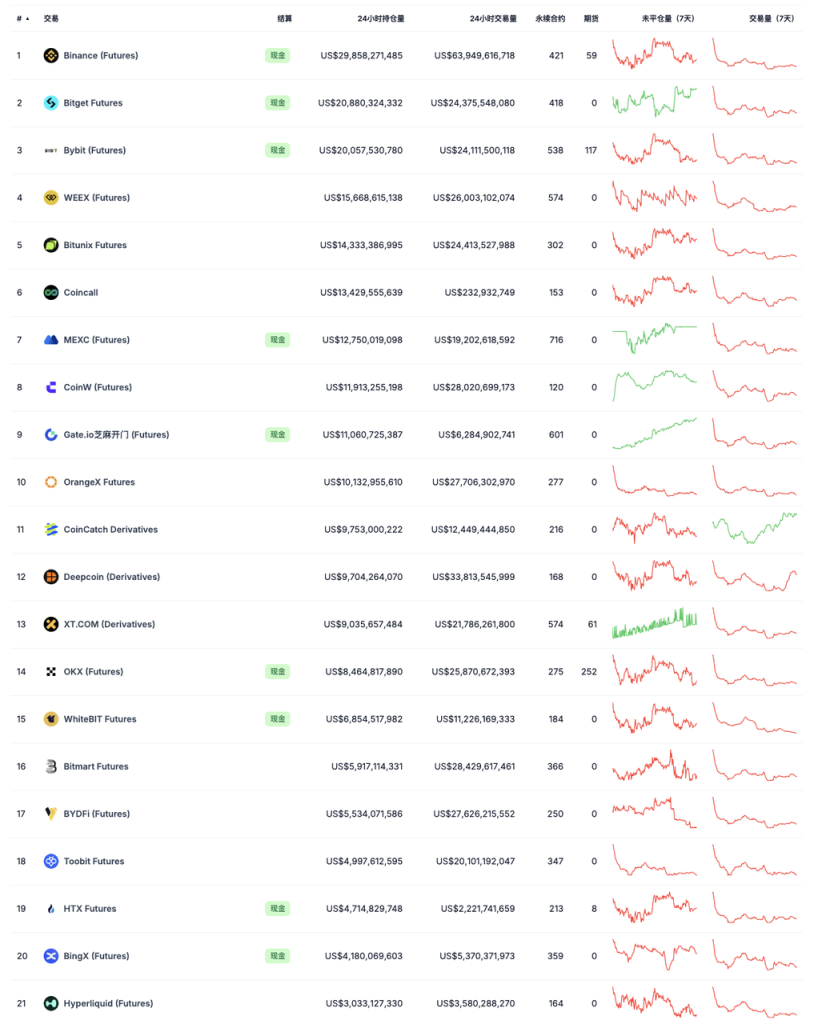

In terms of valuation and trading volume, Hyperliquid is more comparable to centralized exchanges today.

Screenshot Date: 2024-12-28 Source: Coingecko

Hyperliquid’s recent metrics have declined noticeably (peak daily trading volume reached $10.4 billion, recently below $5 billion), yet its open interest remains around 10% of Binance’s, and trading volume about 6%. Both figures are roughly equivalent to 15% of Bitget and Bybit’s levels. At its peak (December 17–20), Hyperliquid achieved 12% of Binance’s open interest and 9% of its trading volume—approaching 20% of Bybit and Bitget’s levels in both metrics.

Overall, Hyperliquid’s derivatives exchange has grown rapidly, establishing a solid lead in the decentralized derivatives sector. Compared to leading centralized exchanges, the gap has narrowed to within tenfold.

2.2 Spot Exchange

Hyperliquid’s spot exchange also uses a CLOB model, with identical product architecture and fee standards as its derivatives exchange.

Currently, the spot exchange only lists native assets compliant with HIP-1 standard and does not support tokens from other chains.

Top Market Cap Spot Tokens on Hyperliquid

HIP-1 (Decentralized Listing)

HIP-1 is analogous to ERC-20 or SPL-20—it is Hyperliquid’s token standard. However, unlike ERC-20 and SPL-20, creating a HIP-1 token is costly because successful creation grants listing eligibility on Hyperliquid’s spot exchange.

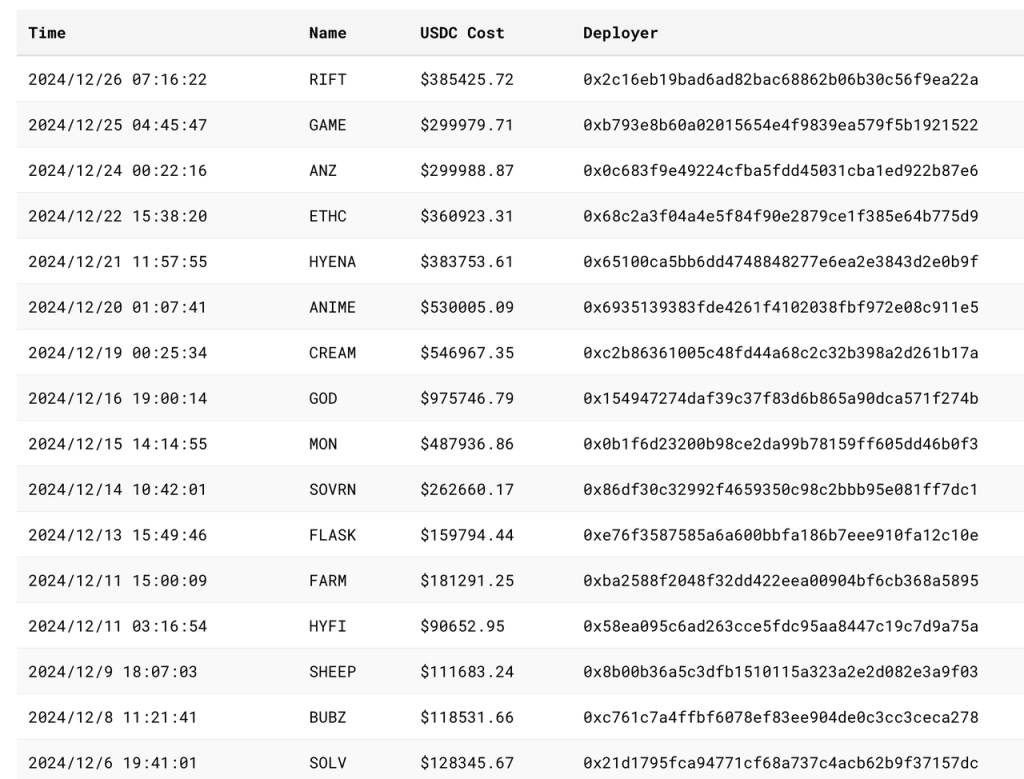

HIP-1 listings are auctioned publicly via Dutch auctions:

Anyone can participate. The auction starts at twice the previous winning price and linearly decreases over 31 hours down to 10,000 USDC (adjustable; previously lower, recently raised to 10,000 USDC). The first developer to successfully bid gains the right to create a TICKER, which becomes tradable on Hyperliquid’s spot exchange. Bids are paid in USDC.

Recent auctions and final prices:

Source: asxn

Notable created tickers (by auction price descending):

-

GOD: A game backed by Pantera

-

CREAM: A legacy lending project plagued by hacks, associated with Machibigbrother

-

ANIME: Azuki’s token ticker; rumored to be acquired by the AZUKI team, though unconfirmed

-

MON: Issuer of the game Pixelmoon

-

SWELL: An Ethereum-based staking & restaking protocol

-

RIFT: A gaming protocol on Virtual by J3ff

-

GAME: Rumored to be secured by GAME on Virtual, unconfirmed

-

ANZ: A stablecoin protocol on Base chain

-

SOVRN: Formerly BreederDAO (a gaming asset platform invested by a16z and Delphi), planning to launch a game on Hyperliquid

-

FARM: Hyperliquid’s native AI pet game launched via the Hyperfun platform

-

ETHC: A mining project linked to Machibigbrother

-

SOLV: A Bitcoin ecosystem staking protocol backed by BN Labs, yet to issue a token

SOLV marks a turning point in HIP-1 auctions. Prior auctions largely followed meme or domain-name logic, where tickers carried symbolic value and speculation centered on uniqueness within the ecosystem.

After SOLV, projects began actively bidding for strategic positioning and listing rights, pushing prices upward—with GOD fetching nearly $1 million. Most bidders focus on entertainment, particularly games and NFTs, though some DeFi protocols like Solv, Swell, and Cream are also present.

Additionally, Hyperliquid has recently maintained a consistent “spot listing fee” above $100,000 per month—comparable to second-tier centralized exchanges.

Through HIP-1, Hyperliquid has established a public, decentralized listing mechanism. Listing fees are determined by market participants, avoiding centralization risks, while collected fees are used to buy back and burn HYPE, supporting HYPE’s price and valuation metrics.

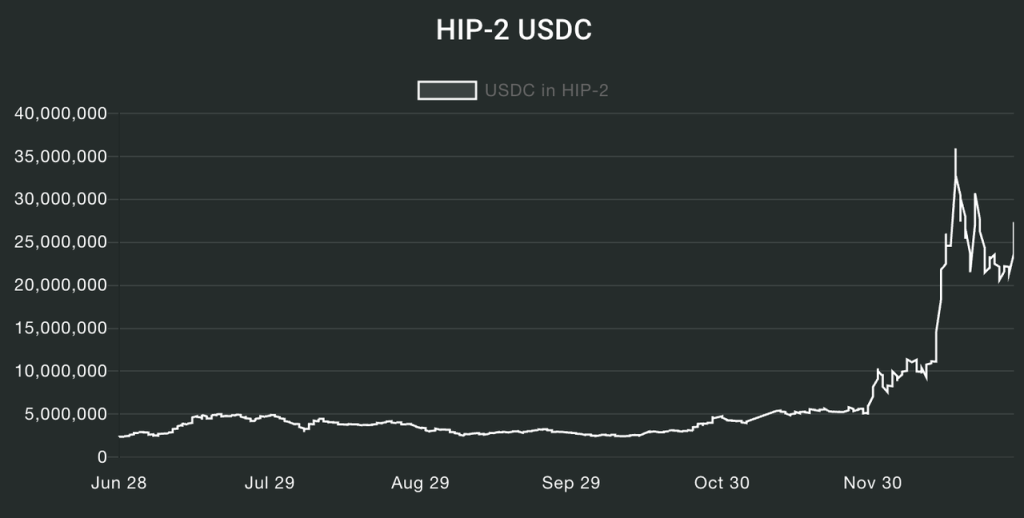

HIP-2 (Hyperliquid’s AMM)

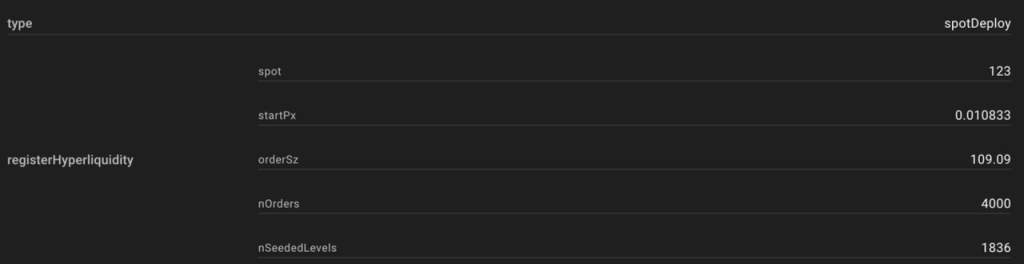

Given that Hyperliquid’s spot trading relies on order books, new tokens often face liquidity challenges. To address this, Hyperliquid introduced HIP-2 to provide initial liquidity for tokens created via HIP-1.

In simple terms, HIP-2 offers an automated market-making system allowing developers to automatically provide liquidity for HIP-1 tokens. The mechanism uses linear market making within a defined price range, where developers set upper and lower bounds and a midpoint. The system then automatically creates market-making grids every 0.3% price interval within the range.

Below is an example of a HIP-2 order book and its parameter settings:

Since its launch, many newly created Hyperliquid-native tokens have adopted this AMM mechanism. Total USDC locked in HIP-2 now exceeds $25 million.

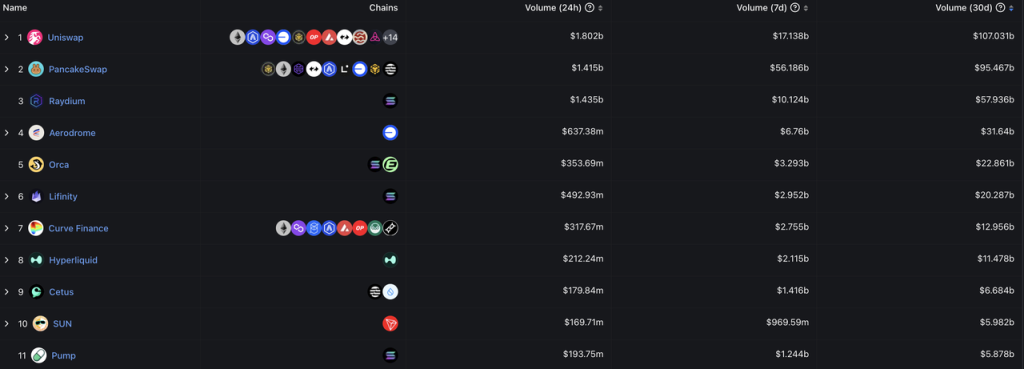

Hyperliquid’s average daily spot trading volume over the last 30 days is approximately $400 million, placing it among the top ten DEXs, comparable to Curve, Lifinity, and Orca.

Source: DeFillama

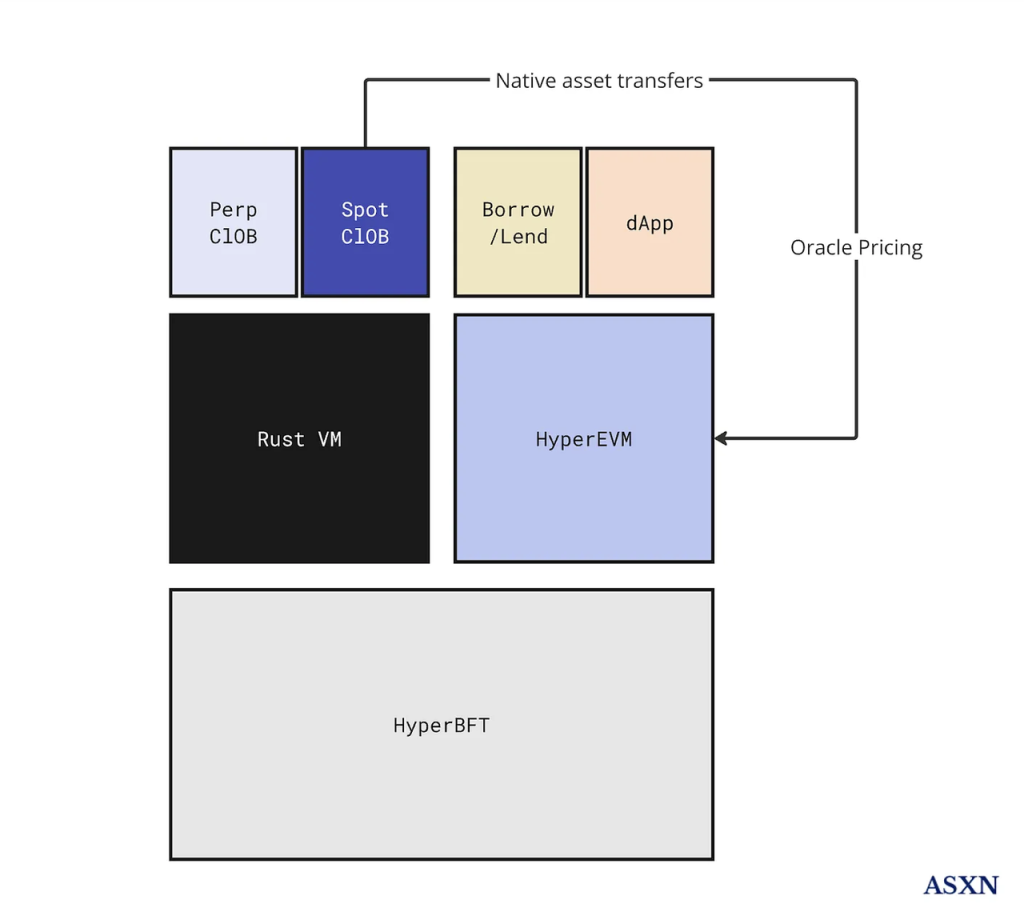

2.3 HyperEVM

HyperEVM has not yet launched. In Hyperliquid’s official documentation, the current derivatives and spot exchanges run on RustVM, referred to as Hyperliquid L1, while HyperEVM is called simply “EVM.” According to their definition, HyperEVM is not an independent chain:

Hyperliquid L1 includes a general-purpose EVM as part of its blockchain state. Importantly, HyperEVM is not a standalone chain but, like other parts of L1, secured by the same HyperBFT consensus mechanism. This allows the EVM to interact directly with native L1 components such as spot and perpetual order books.

ASXN’s report illustrates Hyperliquid’s architecture as follows:

Hyperliquid runs two execution layers (RustVM and HyperEVM) under one consensus layer (HyperBFT). Core functions like contracts and spot trading operate on RustVM, which will remain focused on these primary dApps. Other dApps will be built on HyperEVM.

About HyperEVM, we know from the team’s documentation:

-

Unlike RustVM, which hosts Hyperliquid’s current spot and derivatives exchanges, HyperEVM is permissionless—any developer can build applications or issue assets (FTs or NFTs) on it

-

HyperEVM is interoperable with Hyperliquid L1—for example, L1 oracles can be used by HyperEVM, and certain token transfers can occur between the two VMs (though not all, since L1 assets are “permissioned,” limited to USDC and HIP-1 tokens, while HyperEVM supports far more)

-

HyperEVM will use Hyperliquid’s native token $HYPE as gas, while the current L1 does not require users to pay gas fees

The author is unaware of any similar architectural designs in the crypto world. It remains unclear how classic composability use cases on Ethereum—such as depositing ETH into Lido to receive stETH, borrowing USDC against stETH on Aave, then buying a meme token like PEPE—would work across HyperEVM and Hyperliquid L1 (this might help define whether they are one chain or two). Based on current understanding, the relationship between HyperEVM and Hyperliquid L1 may resemble that of an L2 and L1 with partial interoperability, or that of a centralized exchange and its proprietary EVM chain (e.g., Binance and BNB Chain, or Coinbase and Base Chain).

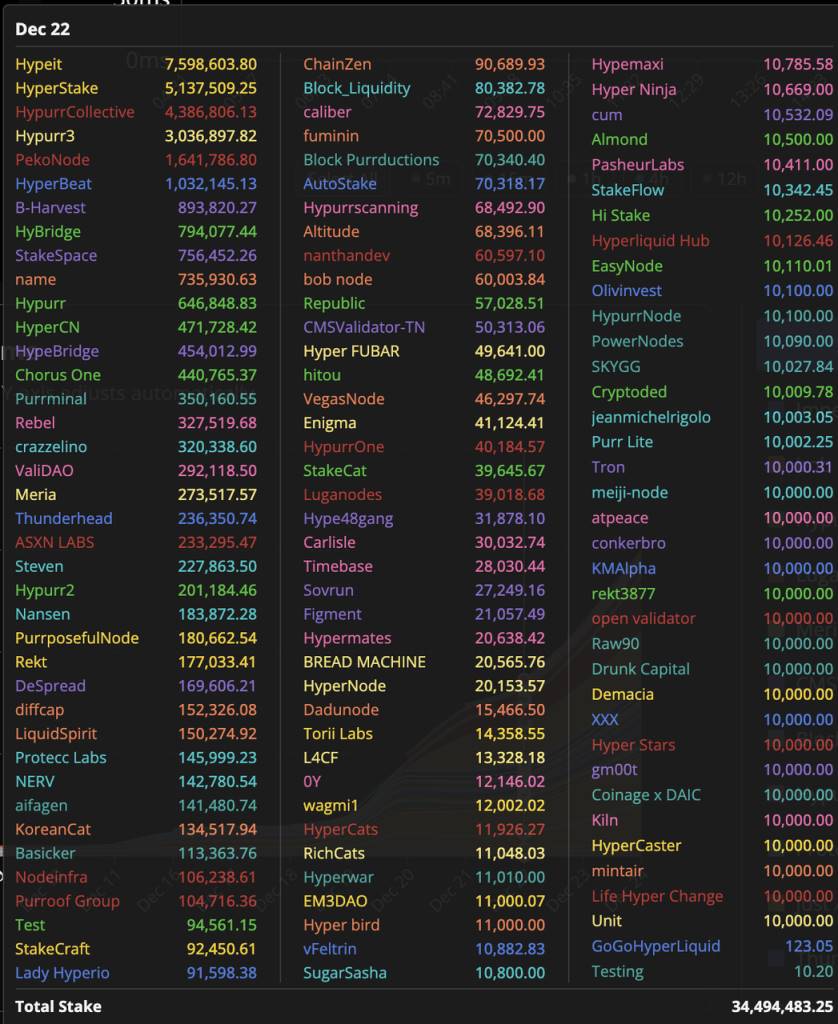

HyperEVM testnet is already operational, with notable validators including Chorus One, Figment, B Harvest, and Nansen participating in testing.

HyperEVM Testnet Validator List Source: ASXN

Since RustVM is not open to all developers, few applications are currently built on it, mostly trading tools:

Such as the Telegram trading bot Hyperfun (token HFUN), Telegram social trading bot pvp.trade, trading terminals tealstreet and Insilico, and derivatives aggregator Ragetrade.

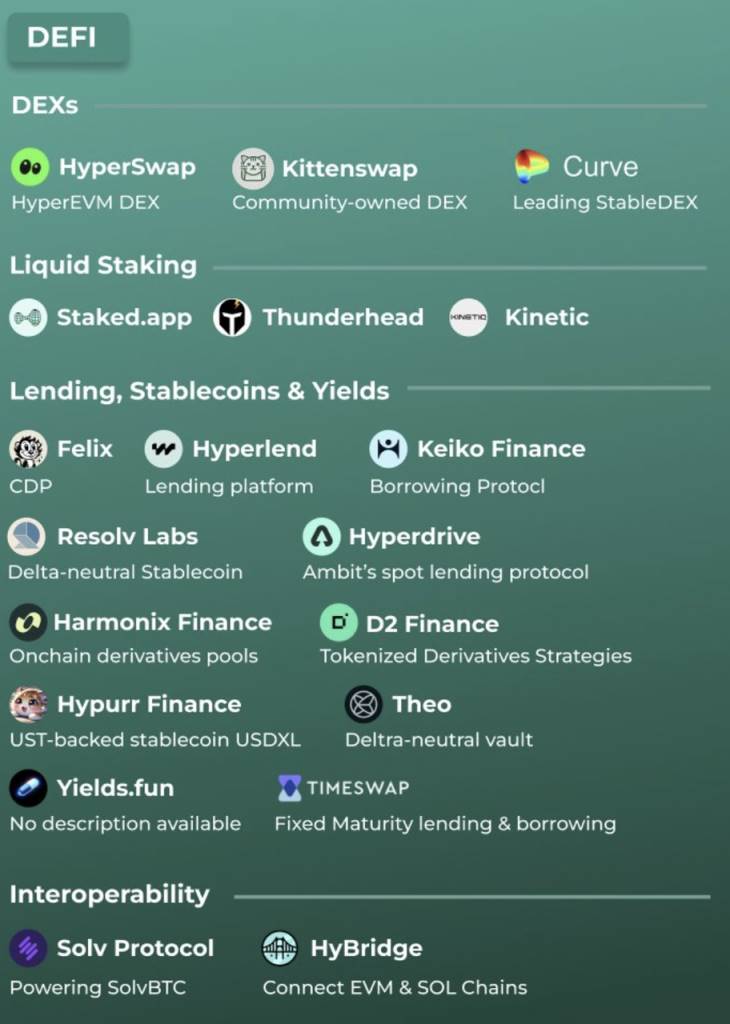

HyperEVM, being fully open to developers, will host numerous upcoming projects. Besides some HIP-1 token holders mentioned earlier, many others are listed on the image below and on Hypurr.co.

The exact mechanics of HyperEVM and its relationship with Hyperliquid L1 will only become clear upon full launch. No official launch timeline has been announced yet.

Summary: Hyperliquid’s overall business positioning resembles that of a top-tier exchange group, with core operations in trading and L1 infrastructure, making it a direct competitor to major exchange groups. While sharing similar business models, Hyperliquid differentiates itself by building its trading operations on-chain. Compared to permissioned and opaque CEXs, Hyperliquid’s advantages include permissionless access (no KYC), transparent and verifiable data, better composability, and lower overall operating costs—enabling it to return more revenue and profit to its token $HYPE.

3. Team, Tokenomics, and Valuation

3.1 Team

Hyperliquid has two co-founders, Jeff Yan and iliensinc, both Harvard alumni. Before entering crypto, Jeff worked at Google and Hudson River Trading. The team is extremely lean—according to ASXN’s September report, there are only 10 members, five of whom are engineers. This is striking for a derivatives exchange with daily trading volumes exceeding $10 billion.

Throughout Hyperliquid’s product development—from self-funding R&D, building a high-performance chain for a fully on-chain order book, to the innovative HIP-1 mechanism—the team’s ability to solve problems from first principles, despite its small size, is impressive.

3.2 $HYPE Tokenomics

$HYPE has a total supply of 1 billion, officially launched on November 29, 2024. With no prior fundraising, there is no investor allocation. Distribution is as follows:

-

31.0%: Genesis airdrop to early users, fully circulating

-

38.888%: Future emissions and community rewards

-

23.8%: Team allocation, unlocking after 1-year cliff, mostly vesting between 2027–2028, with some extending beyond 2028

-

6.0%: Hyper Foundation

-

0.3%: Community grants

-

0.012%: HIP-2

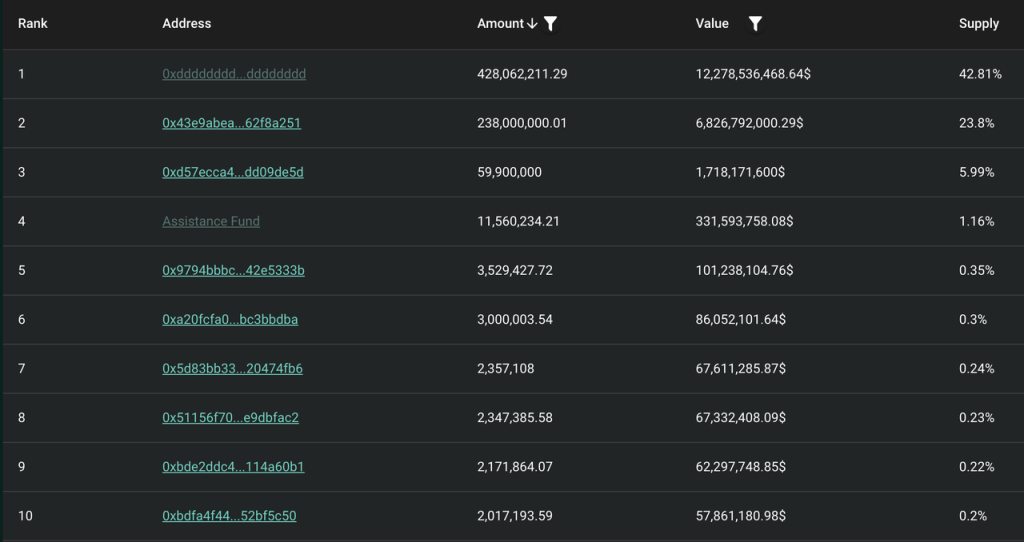

The overall team-to-community split is approximately 3:7. Current holder distribution:

Excluding community, team, and foundation addresses, the largest holder is the Assistance Fund (AF), holding 1.16% of total supply and 3.74% of circulating supply.

Currently, Hyperliquid generates revenue from two sources: trading fees and HIP-1 auction proceeds. Trading fees include spot and futures trading fees, funding fees, and liquidation fees. Since Hyperliquid L1 charges no gas fees and HyperEVM is not live, current revenue excludes gas fees.

According to the team’s documentation:

"On most other protocols, the team or insiders are the main beneficiaries of fees. On Hyperliquid, fees are entirely directed to the community (HLP and the assistance fund). For security, the assistance fund holds a majority of its assets in HYPE, which is the most liquid native asset on the Hyperliquid L1."

All fees go to HLP and AF. However, the exact split between them hasn’t been disclosed.

Luckily, Hyperliquid L1 data is public. Based on @stevenyuntcap’s analysis, as of early December, Hyperliquid had subsidized HLP by $44 million, while the initial AF fund used $52 million to buy HYPE. This implies total protocol revenue since launch until early December was $96 million, yielding an approximate HLP:AF revenue split of 46%:54%. (We can also estimate Hyperliquid’s average perpetual contract fee rate at ~0.0225%, based on $428 billion in cumulative trading volume during that period.)

Since AF has converted all its USDC into HYPE, we can simplify: 46% of Hyperliquid’s perpetual trading income goes to suppliers (HLP holders), and 54% is used to repurchase $HYPE.

Besides perpetual trading fees, two additional revenue streams benefit HYPE holders: HIP-1 auction proceeds and the USDC portion of spot trading fees—both currently flow entirely into AF for HYPE buybacks. Additionally, the HYPE portion of HYPE-USDC trading fees is directly burned (totaling 110,000 HYPE so far).

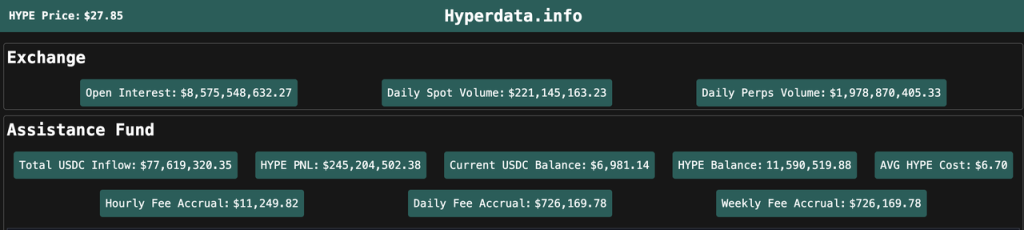

AF’s current strategy involves regularly converting accumulated USDC into HYPE. Thus, tracking AF’s USDC inflow provides insight into Hyperliquid’s profitability and HYPE buyback strength. According to hyperdata.info, AF has received over $77 million in USDC cumulatively, more than $25 million in the past month alone—equating to ~$1 million in daily HYPE buybacks.

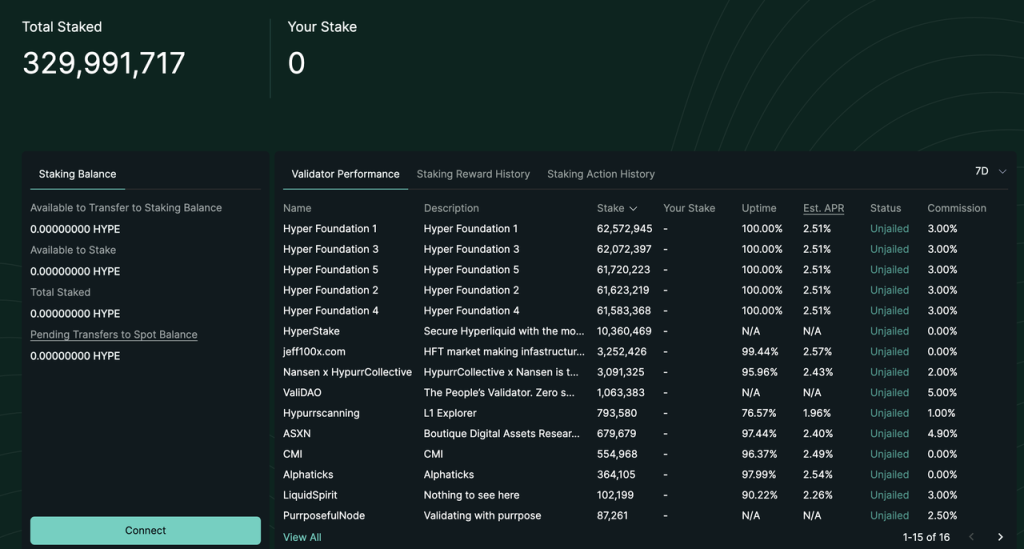

On December 30, 2024, Hyperliquid officially launched HYPE staking, with current yields around 2.5%. This yield comes solely from fixed PoS consensus rewards, modeled after Ethereum’s consensus layer (yield inversely proportional to the square of staked HYPE). Besides the team and foundation’s 300 million tokens, nearly 30 million user-held tokens are also staked.

Looking ahead, several adjustments to HYPE’s economic model are possible:

-

HyperEVM launch

-

$HYPE used as gas on HyperEVM

-

Execution layer revenues distributed to HYPE stakers (currently only PoS rewards)

-

Fee redistribution to $HYPE holders

-

$HYPE staking enables fee discounts

3.3 Valuation

We will now explore two valuation frameworks for Hyperliquid. Before proceeding, note the following:

-

Hyperliquid’s data is extremely volatile—its market cap, TVL, revenue, and user metrics have increased several- to tens-of-fold in the past month, followed by ~50% drawdowns. The volatility of these metrics far exceeds what the valuation comparisons below suggest. These frameworks are better suited for long-term reference.

-

HYPE’s price is currently Hyperliquid’s biggest fundamental driver. The surge in metrics is more a result of rising HYPE prices, not the other way around (“Hyperliquid’s strong metrics caused the price”)—rather, it’s the reverse.

Framework 1: Comparison with BNB

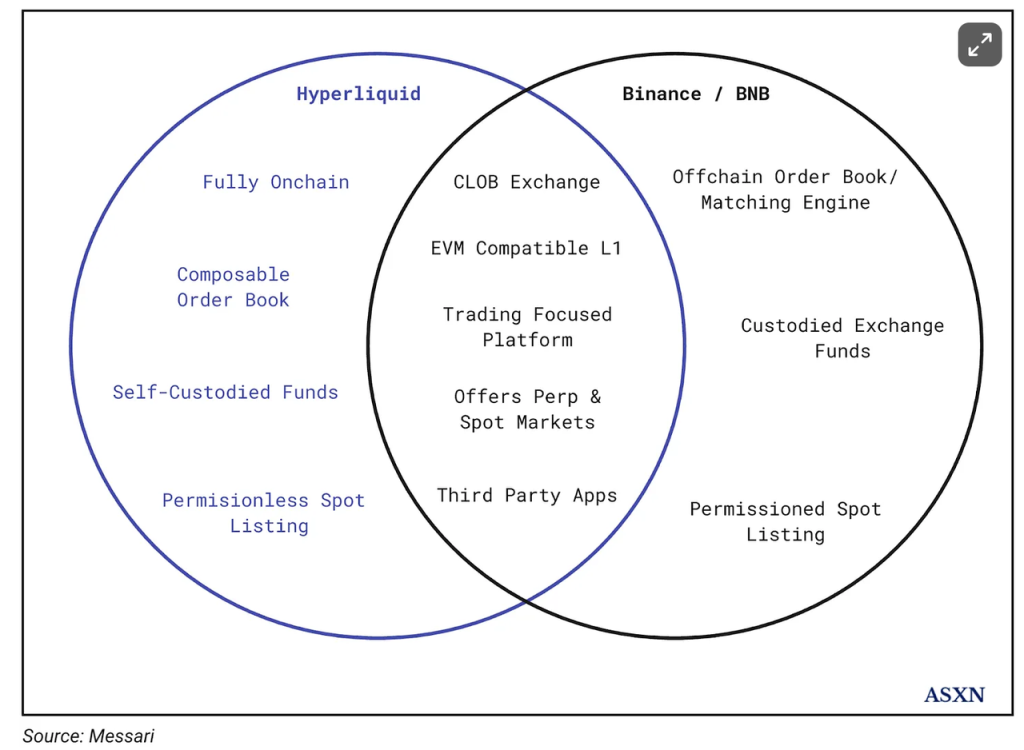

Hyperliquid’s core thesis, popularized by Messari, is that of an “on-chain Binance”:

This analogy is generally reasonable and possibly the best framework. Binance/BNB may indeed be the most appropriate comparison for Hyperliquid/HYPE:

-

Hyperliquid’s core business—derivatives and spot exchanges—aligns with Binance’s main operations;

-

HyperEVM can be compared to BNB Chain. Though not yet live, both HYPE and BNB are designed to serve as gas on EVM chains and offer staking rewards;

-

Both HYPE and BNB directly benefit from platform trading fees;

We’ll now compare Hyperliquid’s architecture—divided into derivatives exchange, spot exchange, and EVM—with Binance.

-

Derivatives Exchange:

As noted earlier, Hyperliquid’s recent open interest and trading volume are roughly 10% of Binance’s. Thus, we roughly equate HYPE = 10% of BNB in this segment.

-

Spot Exchange:

Hyperliquid’s 30-day average daily spot trading volume is ~$400 million. After excluding Binance’s zero-fee FDUSD pairs, Binance’s average daily spot volume is ~$2.6 billion. Hence, HYPE = 1.5% of BNB here.

-

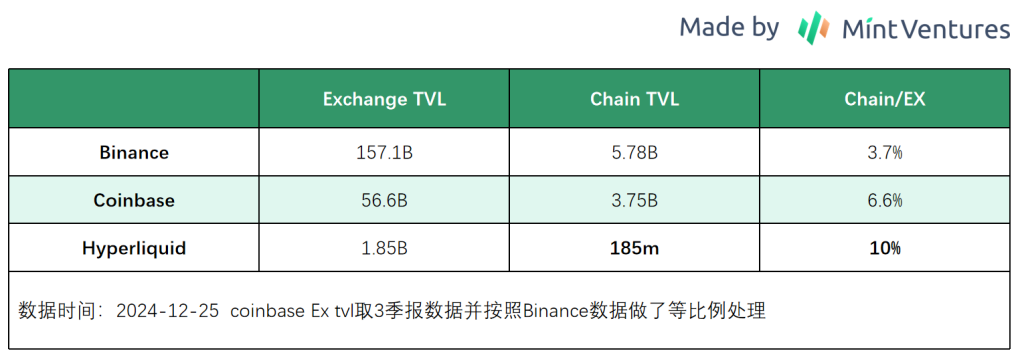

EVM:

Following earlier logic, HyperEVM’s relationship with Hyperliquid L1 resembles that of Binance Exchange and BNB Chain.

HyperEVM isn’t live yet, so we don’t know how much TVL will migrate from RustVM. But given the product architecture and user experience, migration would likely come from existing exchange users. Using Binance and Coinbase as references and considering the current market enthusiasm for Hype, we assume 10% of Exchange TVL will migrate to the chain (optimistic, though most TVL-based valuation articles assume 100% of Hyperliquid TVL migrates to HyperEVM). Under this assumption, HYPE = 3% of BNB.

-

Economic Model

Beyond structural comparisons, we must consider differences in economic models between HYPE and BNB.

As analyzed earlier, HYPE currently converts 54% of platform gross profit and 100% of net profit into HYPE buybacks or burns.

BNB historically used 20% of Binance’s net profit for buybacks per its whitepaper. After 2021, when buybacks were decoupled from net profit, the exact proportion became unclear. However, judging from burn trends and Binance’s market position, the burn ratio likely remained around similar levels.

From a (holder-centric) economic model standpoint, HYPE clearly outperforms BNB.

BNB Historical Burn Data

Notably, the current 54% of revenue flowing to HYPE holders could increase further. Due to its mechanism, HLP has held large short positions in crypto (using USDC as collateral) throughout the bull market since July 2023—a period during which BTC rose over 200%. Despite prudent management, HLP has maintained breakeven performance but required paying over 30% APR to retain capital.

HLP Historical Net Position Source: Hyperliquid Official Website

In the future, as markets potentially peak, the trend of crypto users being net long in derivatives will persist. The likelihood of HLP generating higher strategy returns increases in sideways or bear markets (as seen in historical returns of GMX’s GLP and GNS’s Vault). Hyperliquid may no longer need to allocate such a large portion of revenue as rent to HLP, potentially improving its net margin further.

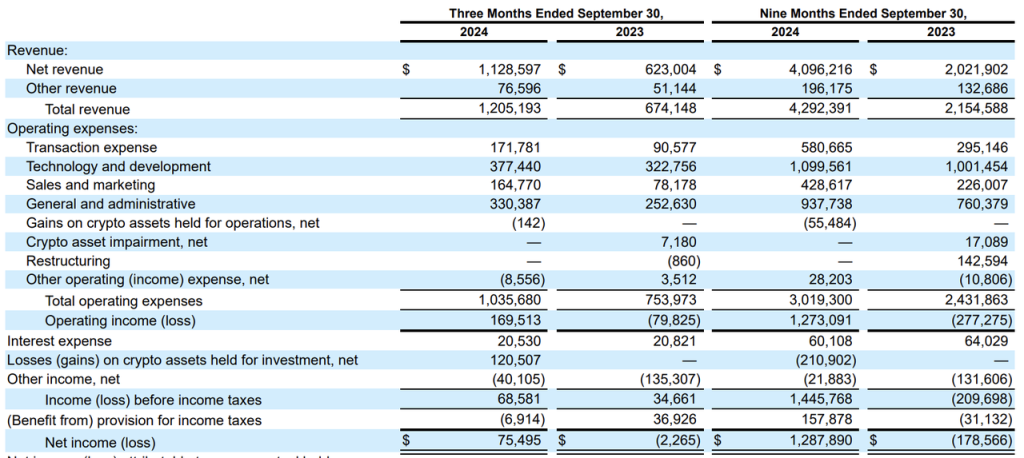

Regarding net margins, we don’t know Binance’s exact figure, but we can gain insights from Coinbase’s financial reports as a public company.

Coinbase Quarterly Report 24Q3

In 2023, Coinbase’s operating expenses (R&D, admin, sales, and transfer fees) averaged over $600 million per quarter—nearly equal to total revenue, resulting in near-zero net margin. In 2024, with the market rally, margins improved but still remain below 30%.

This comparison clearly highlights Hyperliquid’s advantage in net margin (economic model) over centralized exchanges. We can illustrate this advantage through a specific example: listing procedures.

CEXs typically have dedicated listing teams responsible for tracking trends, negotiating with projects, and collecting listing fees or tokens. These teams command high salaries and bonuses, and internal control teams are needed to monitor potential conflicts of interest.

In contrast, Hyperliquid’s HIP-1 listing process, as described, runs automatically via pre-coded rules. Operational costs for new listings approach zero, allowing all “listing fees” to be directed entirely to HYPE holders.

In summary, as of late December 2024, we have the following comparisons:

-

Derivatives Trading: HYPE = 10% of BNB

-

Spot Trading: HYPE = 1.5% of BNB

-

EVM (estimated): HYPE = 3% of BNB

-

Economic Model: HYPE significantly superior to BNB

-

Circulating Market Cap: HYPE = 9% of BNB

-

Full Diluted Market Cap: HYPE = 27% of BNB

Derivatives trading is Hyperliquid’s primary business and should carry significant weight in valuation. In the author’s view, while HYPE’s current market cap isn’t cheap, it isn’t overly expensive either.

Framework 2: PS Ratio

HYPE has buyback and burn mechanisms directly benefiting the token, making the Price-to-Sales (PS) ratio a useful valuation metric:

-

Derivatives Trading Fees:

Assuming an average fee rate of 0.0225% and a 46:54 HLP:AF revenue split.

Last month’s derivatives revenue = $15.47 billion × 0.0225% = $34.8 million. About 54% ($18.79 million) went to AF for HYPE buybacks, implying an annualized net profit of $225.5 million.

-

HIP-1 Auction Fees:

Last month’s revenue: $6.1 million. Applying the 46:54 split, this implies an annualized net profit of $39.5 million.

-

Spot Trading Fees:

Hyperliquid’s spot trading fees mirror those of derivatives. The USDC portion follows the same 46:54 HLP:AF split. For other tokens (e.g., in HYPE-USDC pairs, buyers pay USDC fees, sellers pay HYPE fees), the HYPE portion is directly burned.

Thus, spot fee contributions to HYPE’s net profit consist of two parts:

-

HYPE portion: Directly queryable via block explorer. Since HYPE’s TGE, exactly 30 days ago, 110,490 HYPE have been burned—annualized to 1,325,880 HYPE, worth ~$37 million at current prices.

-

USDC portion: Last 30-day spot volume: $11.5 billion. Amount used for HYPE buybacks = $11.5B × 0.0225% × 54% = $1.397 million, annualized to $16.77 million.

Combining all three revenue streams and annualizing last month’s data, total amount allocated to HYPE buybacks is $318.77 million.

Using circulating market cap, HYPE’s P/S is 29.4; using fully diluted market cap, it’s 88.

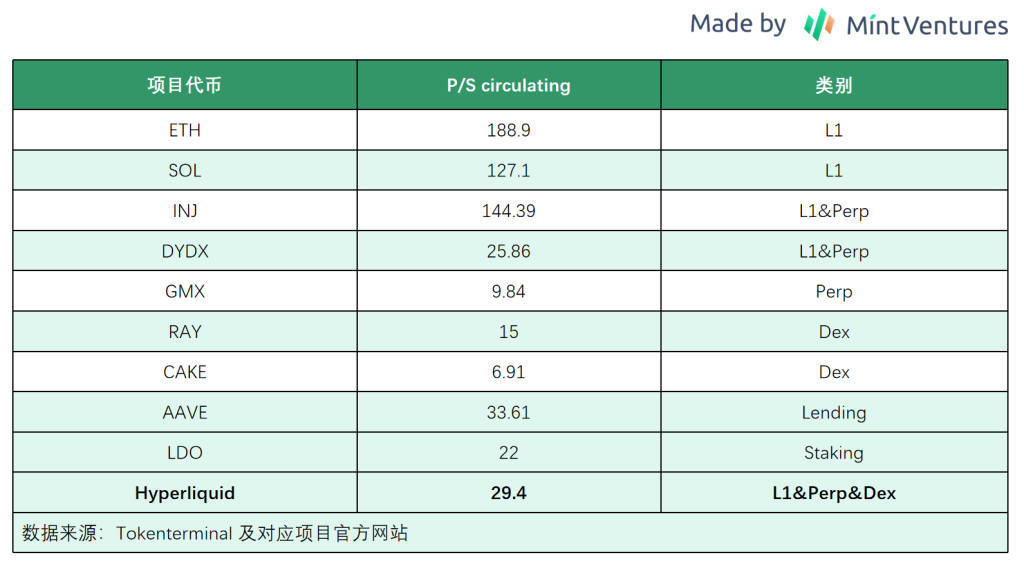

Below are circulating P/S ratios of some crypto projects comparable to Hyperliquid:

L1s show significantly higher P/S valuations than apps. Hyperliquid’s P/S is notably lower than comparable L1s.

These are two valuation frameworks for HYPE. Again, it bears repeating:

Hyperliquid’s data is extremely volatile—market cap, TVL, revenue, and user metrics have surged multiple times over the past month, followed by ~50% pullbacks. The volatility far exceeds what these valuation metrics suggest. These frameworks are best used for long-term reference.

HYPE’s price is currently Hyperliquid’s biggest fundamental—metric surges are more a result of rising HYPE prices, not the cause.

4. Risks

Key risks facing Hyperliquid include:

-

Fund Risk: All of Hyperliquid’s funds are currently stored in its bridge smart contract on Arbitrum. The security of this contract and the 3/4 multi-sig controlled by the core team are critical.

-

Code Risk: Includes risks from the current L1 and HyperEVM. Hyperliquid uses novel architecture and consensus. While keeping the L1 closed-source reduces attack surface, as Hyperliquid grows in scale and influence—and especially after HyperEVM launches—the risk of exploits or code vulnerabilities increases.

-

Oracle Risk: An inherent risk for all derivatives exchanges.

-

Regulatory Risk: Loss of comparative advantage. No KYC is currently Hyperliquid’s main edge over CEXs. As Hyperliquid continues to grow, regulatory pressure—particularly anti-money laundering requirements—may emerge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News