The Historical Inevitability Behind New DeFi Tax Regulations: Reflections on America's New Financial Colonialism and Decision-Making Frameworks for Industry Practitioners

TechFlow Selected TechFlow Selected

The Historical Inevitability Behind New DeFi Tax Regulations: Reflections on America's New Financial Colonialism and Decision-Making Frameworks for Industry Practitioners

The new DeFi tax regulations are precisely the continuation of this model in the digital asset space, with the core being the use of technological means and rules to enforce global capital transparency.

By Aiying Ai Ying Pony

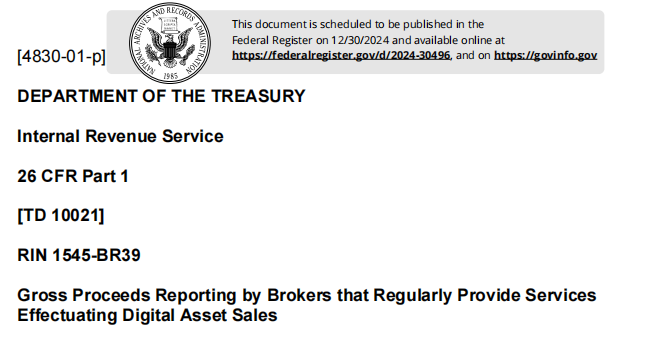

Regulatory document: https://public-inspection.federalregister.gov/2024-30496.pdf

The U.S. Department of the Treasury and Internal Revenue Service (IRS) have recently issued a significant new regulation (RIN 1545-BR39), expanding the scope of existing tax laws to include DeFi front-end service providers within the definition of "brokers." These providers—including any platforms that directly interact with users, such as Uniswap’s front-end interface—will be required to collect user transaction data starting in 2026 and submit reports to the IRS via Form 1099 beginning in 2027, including users’ total gains, transaction details, and taxpayer identification information.

We all know Trump's political stage is never short of drama, and his stance on cryptocurrency is no exception. From early criticism of Bitcoin as a “scam based on air” to later experimenting with NFT projects and launching the DeFi project WorldLibertyFinancial (WLF), he has boldly proposed incorporating Bitcoin into national strategic reserves (From Historical Land Acquisitions to Bitcoin Reserves: A Forward-Looking Proposal for the 2025 Bitcoin Strategic Reserve Draft). His actions reflect personal interests while also symbolizing the complex position of the crypto industry within the American political system.

Although the new rule still has one or two years before taking effect—and there remains considerable controversy over the definition of “broker,” since old regulatory frameworks cannot be rigidly applied to crypto projects—it could potentially be overturned. Nevertheless, Aiying Ai Ying wishes to explore today, from multiple angles, the historical inevitability behind this regulatory move and how industry participants should make strategic choices.

Part One: The Evolution from Traditional to New Financial Colonialism

1.1 Resource Logic of Traditional Colonialism

The core of the traditional colonial era was resource extraction through military force and territorial occupation. Britain controlled Indian cotton and tea via the East India Company; Spain plundered gold from Latin America—classic examples of wealth transfer achieved through direct resource seizure.

1.2 Modern Patterns of Financial Colonialism

Modern colonialism centers on economic rules, using capital flows and tax control to achieve wealth transfer. The U.S. Foreign Account Tax Compliance Act (FATCA) exemplifies this logic, requiring global financial institutions to disclose asset information about U.S. citizens, thereby compelling other nations to participate in U.S. tax governance. The DeFi tax regulation is precisely an extension of this model into digital assets—the core being the use of technology and regulatory mandates to enforce global capital transparency, enabling the United States to increase tax revenue and strengthen its grip on the global economy.

Part Two: America's New Colonial Tools

2.1 Tax Rules: From FATCA to DeFi Regulations

Tax regulations form the foundation of America’s new colonial model. FATCA forced global financial institutions to report on U.S. citizen accounts, setting a precedent for weaponized taxation. The new DeFi tax rules further extend this logic by mandating that DeFi platforms collect and report user transaction data, broadening U.S. oversight into the digital economy. As these rules take effect, the U.S. will gain increasingly precise visibility into global capital movements, enhancing its economic dominance.

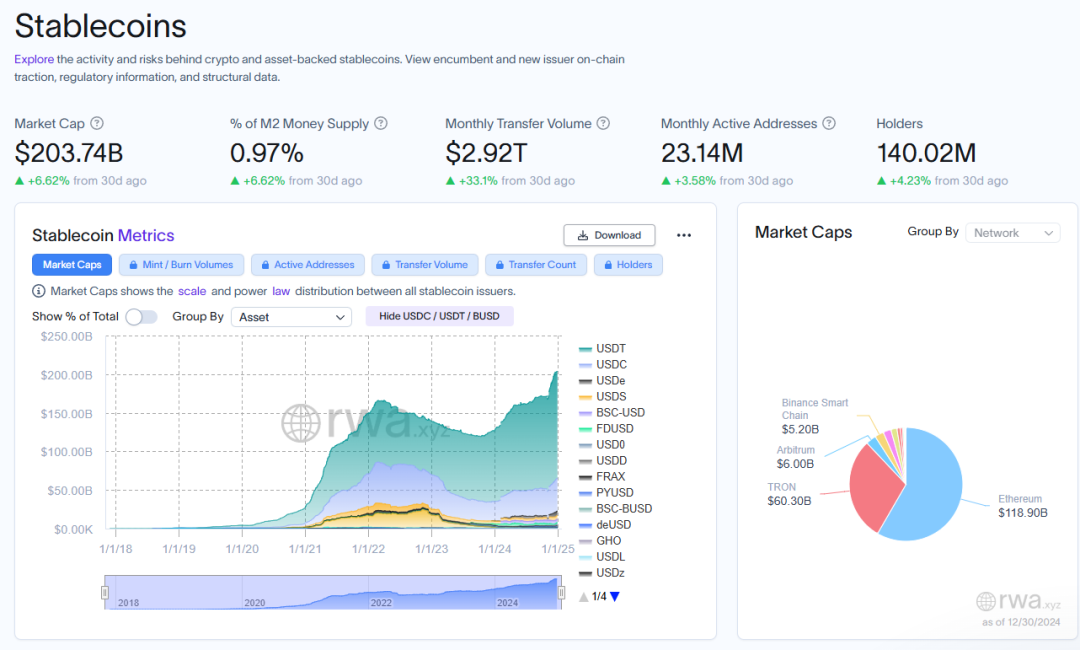

2.2 Technology Meets the Dollar: The Dominance of Stablecoins

In the $200 billion stablecoin market, dollar-backed stablecoins account for over 95%, with underlying collateral primarily composed of U.S. Treasuries and dollar reserves. Dollar stablecoins like USDT and USDC reinforce the global status of the U.S. dollar and lock more international capital into the U.S. financial system through their integration into global payment networks—an emerging form of dollar hegemony in the digital age.

2.3 Appeal of Financial Products: Bitcoin ETFs and Trust Instruments

Bitcoin ETFs and trust products launched by Wall Street giants like BlackRock have attracted massive international capital into U.S. markets through institutionalization and legalization. These financial instruments not only expand the reach of U.S. tax enforcement but also integrate global investors deeper into the American economic ecosystem. The current market size stands at $100 billion.

2.4 Real-World Asset Tokenization (RWA)

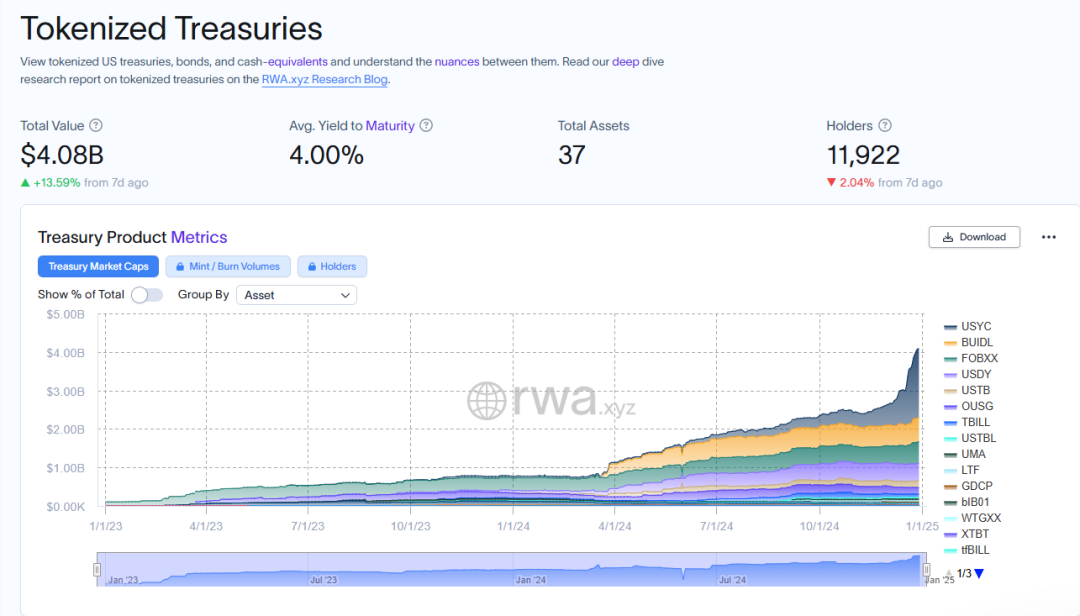

Real-world asset tokenization is becoming a key trend in DeFi. According to Aiying Ai Ying, the tokenized U.S. Treasury market has already reached $4 billion. This model enhances liquidity for traditional assets via blockchain technology while creating new sources of influence for the U.S. in global capital markets. By controlling the RWA ecosystem, the U.S. can further promote the global circulation of Treasuries.

Part Three: Economics and Finance – Deficit Pressures and Tax Equity

3.1 America’s Deficit Crisis and Tax Loopholes

America’s federal deficit has never been more alarming. In fiscal year 2023, it approached $1.7 trillion, exacerbated by post-pandemic stimulus measures and infrastructure spending. Meanwhile, the global cryptocurrency market cap has exceeded $3 trillion—yet most of it operates outside the tax net. For a modern state reliant on taxation, this is clearly unacceptable.

Taxation is the cornerstone of state power. Historically, the U.S. has responded to deficit pressures by expanding its tax base. The hedge fund regulatory reforms of the 1980s successfully expanded capital gains tax coverage to fill fiscal gaps—a model now being repeated with cryptocurrency as the new target.

3.2 Financial Sovereignty and the Defense of the Dollar

But this isn’t just about taxes. The rise of DeFi and stablecoins challenges the dollar’s dominance in the global payment system. While stablecoins extend the dollar’s reach by pegging to it, they simultaneously create a parallel “private money” system that bypasses the Federal Reserve and traditional banks. The U.S. government recognizes that such decentralized monetary forms may pose long-term threats to its financial sovereignty.

Through tax regulation, the U.S. seeks not only fiscal benefits but also aims to reassert control over capital flows and defend the dollar’s hegemonic position.

Part Four: Industry Perspective – Strategic Choices for Practitioners

4.1 Assessing the Importance of the U.S. Market

For DeFi project operators, the first step is a rational assessment of the strategic value of the U.S. market. If a platform derives most of its trading volume and user base from the U.S., exiting would entail significant losses. However, if U.S. users represent a small share, full withdrawal becomes a viable option.

4.2 Three Key Response Strategies

Partial Compliance: A Middle Ground

-

Establish a U.S.-based subsidiary (e.g., Uniswap.US) focused on meeting compliance needs for American users.

-

Separate protocol from front-end, reducing legal risk through DAO or community-based governance models.

-

Implement KYC procedures and report only essential information for U.S. users.

Full Exit: Focus on Global Markets

-

Apply geo-blocking to restrict access from U.S. IP addresses.

-

Redirect resources toward Asia-Pacific, Middle East, and European markets that are more crypto-friendly.

Full Decentralization: Upholding Technological and Ideological Principles

-

Abandon front-end services entirely, transitioning the platform to fully protocol-governed operations.

-

Develop trustless compliance tools (e.g., on-chain tax reporting systems) to technically circumvent regulation.

You may also refer to previous articles by Aiying Ai Ying:

Part Five: Broader Reflections – The Future Battle Between Regulation and Freedom

5.1 Regulatory Evolution and Long-Term Trends

In the short term, the industry may delay implementation through litigation. But in the long run, the trend toward compliance is irreversible. Regulation will likely polarize the DeFi sector: one end comprising large, fully compliant platforms, the other consisting of smaller, stealth-operating decentralized projects.

U.S. policy may also evolve under global competitive pressure. If countries like Singapore or the UAE adopt more permissive crypto regulations, the U.S. might loosen certain restrictions to attract innovators.

5.2 Philosophical Reflections on Freedom vs. Control

The essence of DeFi is freedom; the essence of government is control. This struggle has no final resolution. Perhaps the future of crypto will take the form of “compliant decentralization”—where technological innovation coexists with regulatory compromise, and privacy alternates with transparency.

Aiying’s Conclusion: Historical Inevitability and Industry Crossroads

This regulation is not an isolated event but the inevitable outcome of America’s political, economic, and cultural trajectory. For the DeFi industry, it represents both a challenge and an opportunity for transformation. At this historical juncture, balancing compliance with innovation, protecting freedom while assuming responsibility, is a question every practitioner must answer.

The future of the crypto industry depends not only on technological advancement but more critically on how it finds its place between freedom and regulation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News