Things You Need to Know About Story Protocol

TechFlow Selected TechFlow Selected

Things You Need to Know About Story Protocol

Story Protocol will be the best choice for assetizing AI applications.

Authors:

Jarseed @Bitget Research, Maggie @Foresight Ventures

TL;DR

-

Story is a Layer 1 blockchain purpose-built for intellectual property (IP). Story offers a transparent, decentralized solution for issuing and managing IP assets, enabling IP holders to protect their content, collaborate seamlessly on-chain, and unlock new revenue opportunities.

-

The various modules within IPA (IP Assets)—such as licensing, royalties, and dispute resolution—enable standardized on-chain operations. By leveraging blockchain features like traceability and composability, these modules unlock greater financial potential for IP assets.

-

Story is the ideal platform for assetizing AI applications. With Story, value capture for any IP asset is protected by smart contracts, with clear fund flows and on-chain ownership verification.

-

Consumers can easily understand and engage with IP assets—such as artworks, music, games, and AI Agents—without needing to learn complex cryptographic concepts.

1. Story Begin

What Is Story?

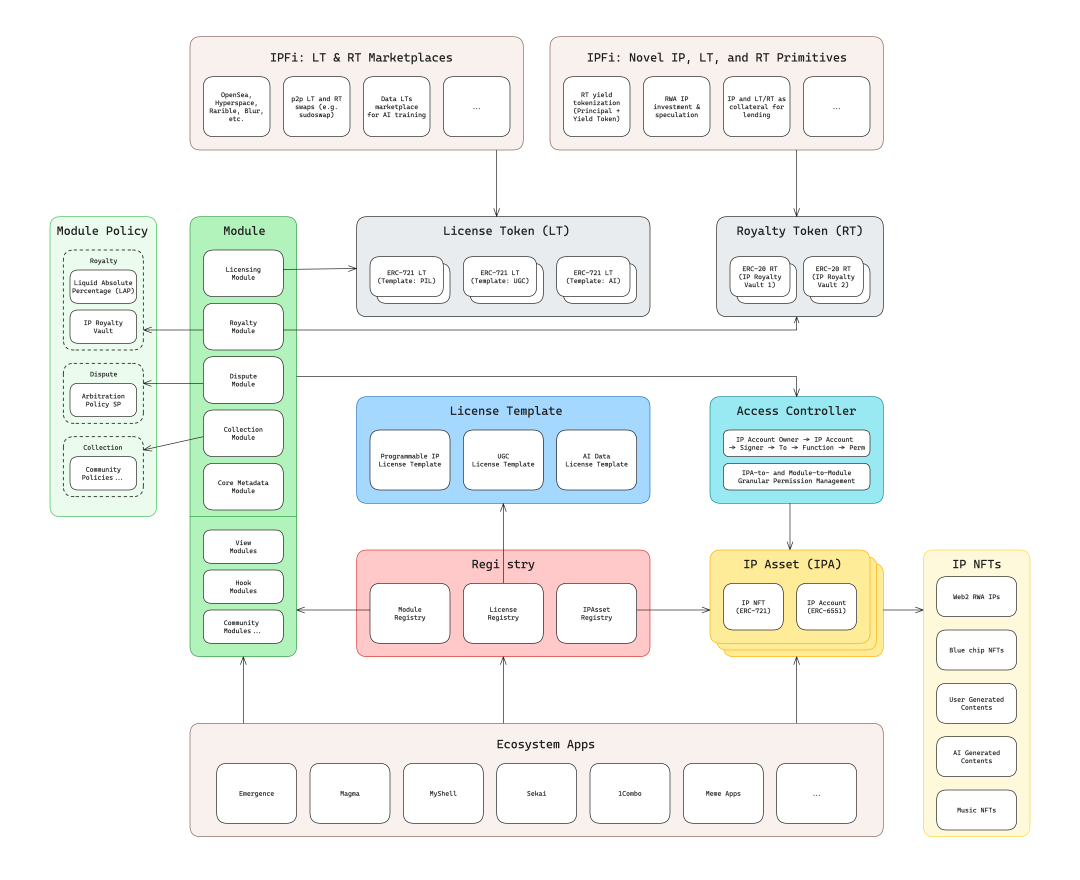

Story is a Layer 1 blockchain designed specifically for intellectual property, combining the strengths of EVM and Cosmos SDK. It is 100% EVM-compatible and deeply optimized at the execution layer to efficiently handle complex data structures such as intellectual property.

What Are Intellectual Property Assets (IP Assets or IPA)?

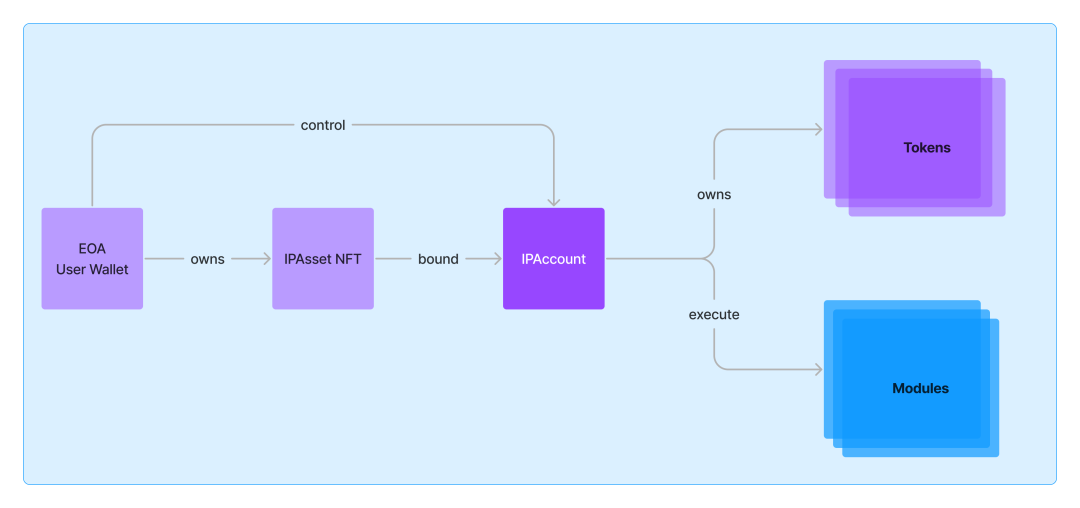

IPA refers to programmable core metadata for intellectual property on Story. Simply put, an IPA consists of an ERC-721 standard NFT representing the IP, and an ERC-6551 standard Token Bound Account (TBA) linked to that IP. The TBA is a standalone contract bound to the IP asset, used to manage permissions for interacting with Story’s modules or storing IP-related data.

Although IP assets use the ERC-721 NFT standard, their metadata follows a robust, purpose-built data structure tailored for IP assets.

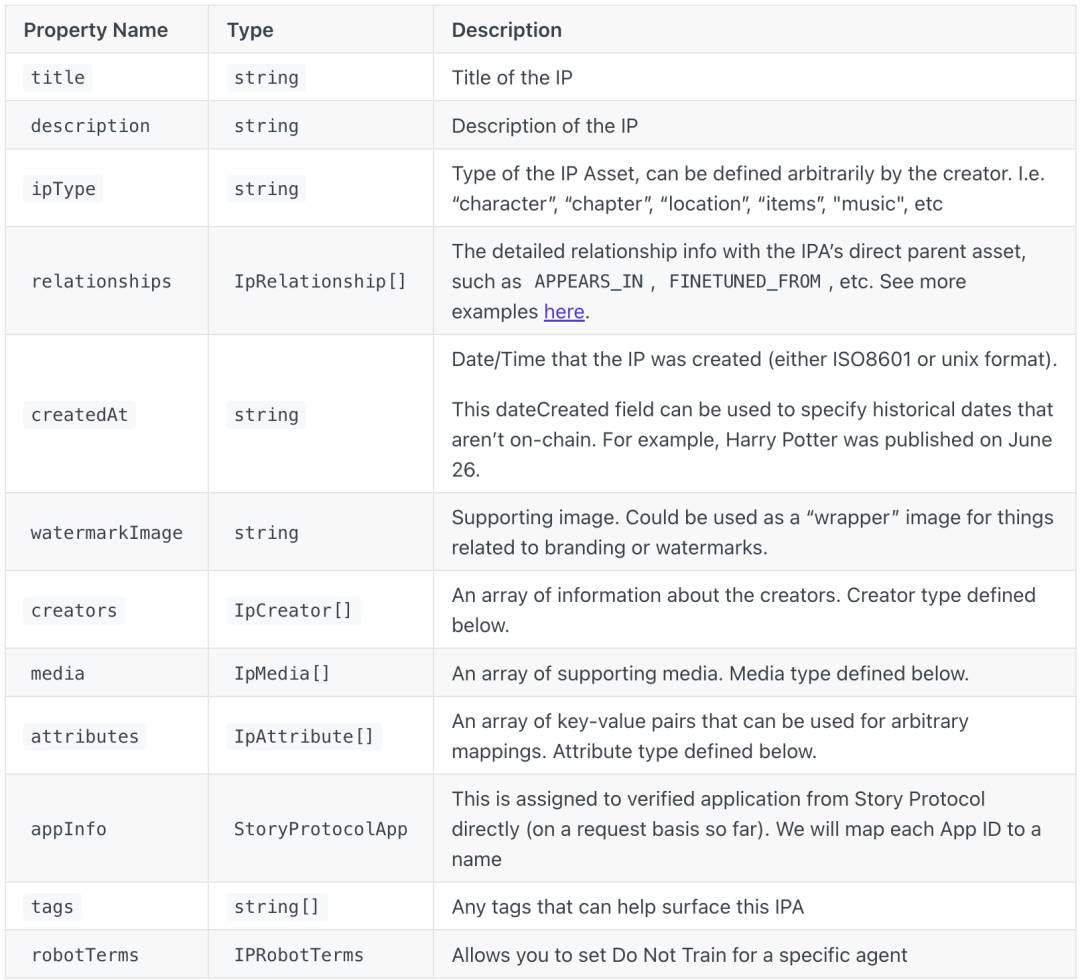

IPA Metadata Standard

IPA includes predefined attributes such as "relationships," which has 40 distinct types defined in Story to represent various IP ownership and dependency scenarios.

What Is an IP Account?

An IP Account is an EOA-like account implemented via the ERC-6551 standard, bound directly to an IP asset. For technical details, refer to EIP-6551.

IP Account Structure

IP Accounts serve two main functions:

-

Store IP-related data: including metadata and ownership information of associated assets (e.g., derivative license tokens or royalty tokens).

-

Support module interactions: modules interact with the IP Account to add and retrieve data. Features such as licensing, revenue/royalty distribution, remixing, and dispute resolution rely on the programmability of the IP Account.

Module Design for IPA and Core Modules

Thanks to the IP Account, IP assets can store data and interact with various modules via the ERC-165 interface. While users can develop custom modules, Story defines four core modules:

-

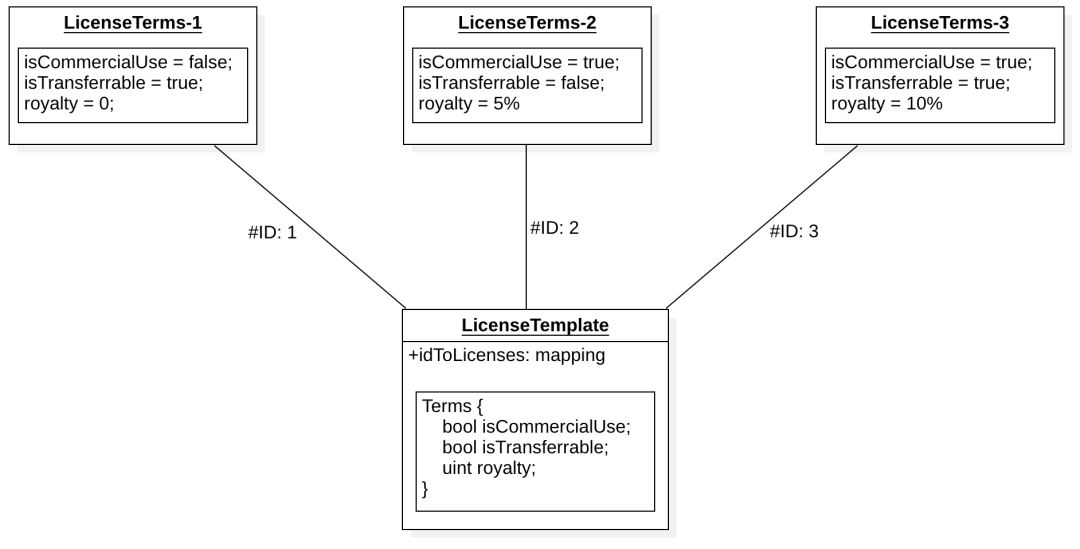

Licensing Module: This module allows users to create licenses from license templates (Programmable IP License, PIL) and attach them to IP assets. These licenses define terms governing how others may commercially use or co-create with your IP. Once licensed, anyone can mint a license token—a permission token bound by those terms—enabling parent-child relationships between IP assets and activating features like automated royalty flows.

License Templates

-

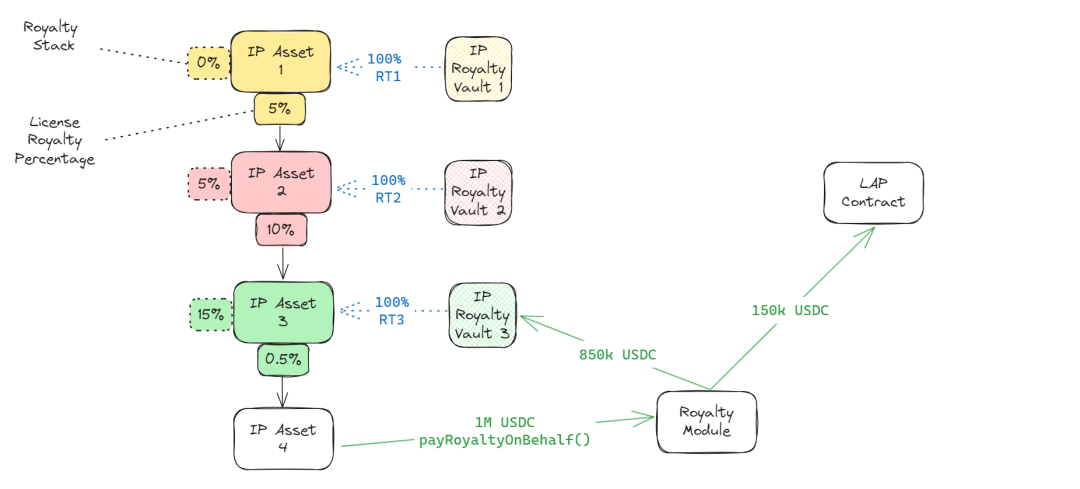

Royalty Module: This module governs how revenue flows between parent and child IP assets. Two common income flow scenarios include:

-

Minting license tokens: When a license token is minted from an IP asset, a fee may be charged. This revenue flows upward along the IP chain.

-

Direct tipping: Any direct payment sent to an IP asset also flows upward through the chain.

Royalty Flow

-

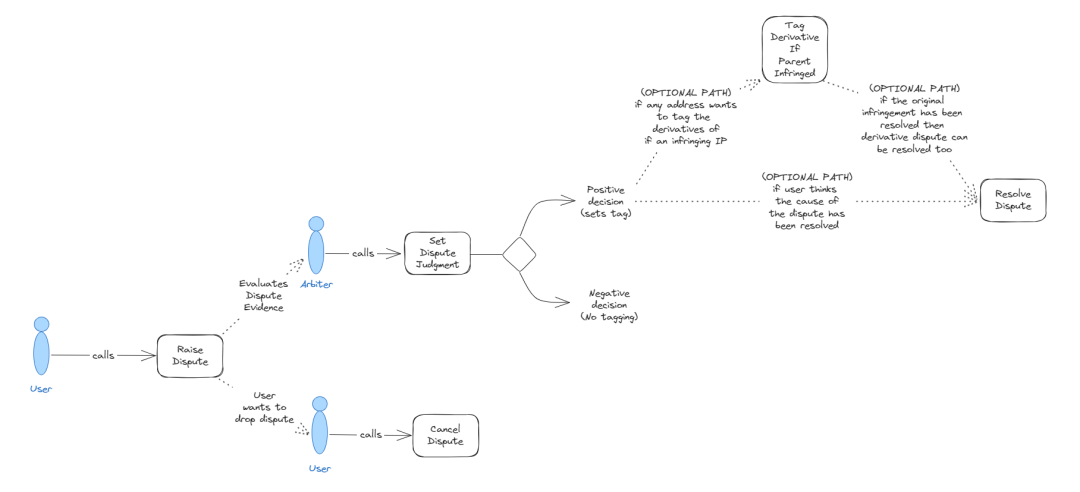

Dispute Module: This module enables users to raise and resolve disputes via arbitration. Key components include:

-

Arbitration Policy: A set of rules, processes, and entities determining dispute outcomes. Currently, only the UMA arbitration policy is supported.

-

Penalties: Consequences triggered when an IP asset is “flagged” due to a dispute. Only if the dispute ruling confirms wrongdoing is the asset flagged. Once flagged, the asset cannot mint license tokens, link to parent assets, claim royalties, or utilize existing licenses.

-

Flagging: Story supports four flag types to mark disputed assets: unauthorized registration (registering an existing IP), unauthorized use (misuse of license terms), non-payment, and content policy violations.

Dispute Process Flow

-

Grouping Module: This module supports creating and managing grouped IP assets and provides shared royalty pools.

2. Innovative Applications of IP Assets

Understanding the fundamental characteristics and modules of IP assets reveals Story’s advantages. IP assets empower creators to build copyright empires safeguarded by smart contracts and decentralized networks, allowing full participation in financial activities while protecting IP rights. So, what can we do on Story? Let’s brainstorm.

IP Asset Issuance and Unique Features

Blockchain grants everyone equal rights to issue assets. Story enhances this by designing a complete asset structure and execution modules to protect IP rights, offering a comprehensive framework for IP registration, application, verification, and royalty distribution.

Remember the excitement BAYC and Azuki brought to the crypto community? Back then, the community scrambled to find ways to add utility to NFTs. Let’s explore how BAYC would look if launched on Story.

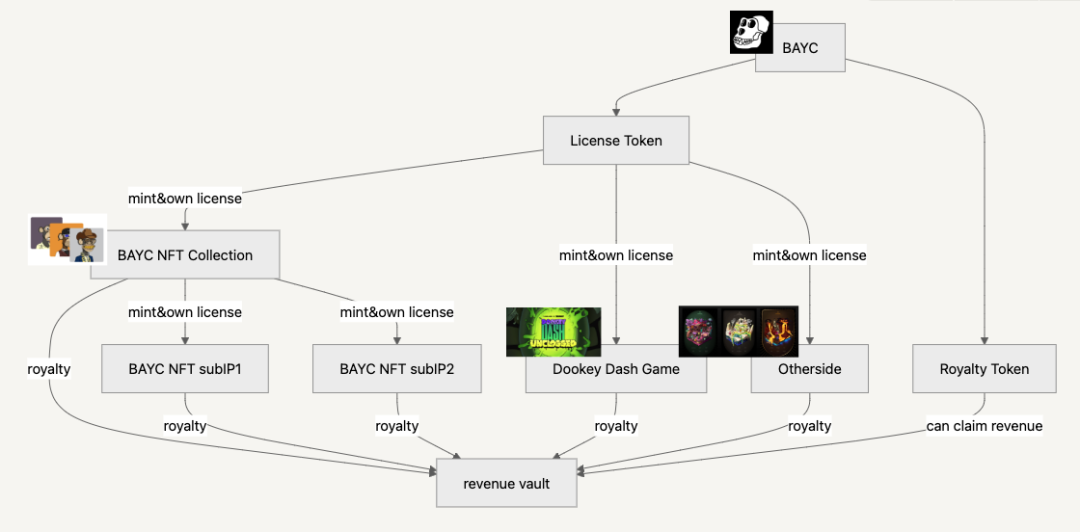

If BAYC on Story

First, Yuga Labs, as the BAYC IP holder, registers BAYC as an IPA on Story. They can then define multiple Programmable IP License (PIL) templates to specify usage restrictions under different conditions.

Next, the Royalty Module for BAYC binds 100 million Royalty Tokens—an ERC-20 token entitling holders to a share of BAYC’s royalty treasury.

Finally, as the IPA issuer, Yuga Labs launches its first product under BAYC: the BAYC 10K Collection—10,000 unique monkey NFTs. These NFTs are issued after minting a BAYC license token, with terms specifying that 5% (configurable) of all sub-IP revenues flow into BAYC’s treasury.

IfStory Protocol

The diagram above illustrates Story’s complete licensing and royalty system. Under this framework, IP holders no longer need to manually manage licensing or collect royalties. Moreover, entirely new business logics and trading opportunities emerge—previously nonexistent or hard to evaluate in traditional blockchain ecosystems. Let’s examine them:

-

IP Licensing Revenue: As a parent IP, BAYC can grant licenses to multiple product lines or creators. All must mint license tokens, with minting fees going directly to the parent IP.

-

IP Royalty Revenue: BAYC’s royalty tokens entitle holders to a portion of all downstream revenue—including license minting fees and earnings from child IPs.

-

License Token Trading: For well-known IPs, license tokens may command high minting and secondary market prices. These are highly functional tokens, potentially facing supply-demand imbalances due to popularity.

-

Royalty Token Trading: Royalty tokens offer direct exposure to an IP’s revenue stream. Markets can estimate future earnings, reflected promptly in token pricing, opening room for speculative valuation.

With clear licensing and royalty mechanisms, IP asset trading becomes far more diverse.

Story Architecture

IP Asset Trading

In today’s DeFi landscape, clear leaders have emerged: Uniswap dominates DEXs, OpenSea leads NFT marketplaces, and Pendle excels in yield token trading. While Story still uses ERC-20 and ERC-721 standards, the fundamentals of these tokens are transformed.

Take royalty tokens of major IPs. As long as the IP’s ecosystem grows, licensing fees and consumer spending will continuously flow into the parent IP’s treasury. This creates a clear investment thesis for royalty tokens. Could we envision a DEX similar to stock trading platforms, displaying real-time revenue data and forecasts for royalty tokens—all verifiable on-chain?

License tokens of top IPs could also become speculative assets. Scarcity or rising IP popularity could drive up their value. Since license tokens follow the ERC-721 standard, traders would prefer platforms that display comprehensive fundamental data.

Further, if both royalty and license tokens exhibit cash-flow-based valuations, they can be split into PT (Principal Token) and YT (Yield Token) for trading—yes, Pendle, we’re talking about you.

IP Asset Collateralization

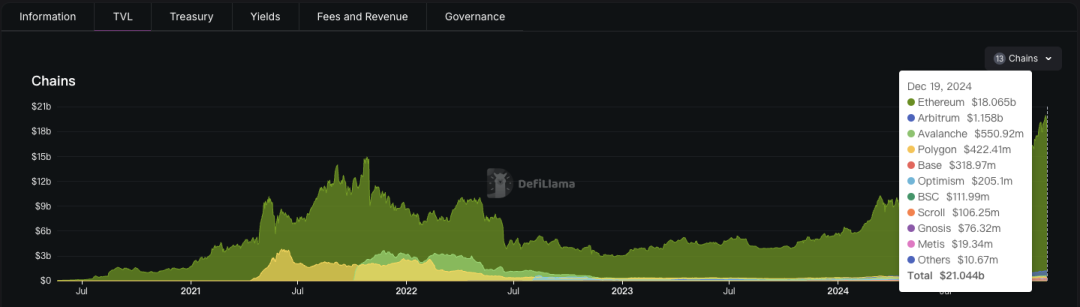

Another critical DeFi sector is asset lending and borrowing. AAVE maintains a dominant position with $21 billion in TVL, over 85% of which is ETH.

AAVE performance

AAVE TVL Assets

Can IP assets be used as collateral? Can license and royalty tokens also be pledged? The answer is clearly yes.

In the real world, IP-backed financing is common. For example, in 2009, Disney pledged Marvel IP to Merrill Lynch to secure a $525 million loan for film production. Key evaluation factors include historical commercial performance, audience size, market recognition, future monetization potential, lifecycle, and industry outlook. On Story, all IP performance metrics are transparent and traceable, significantly simplifying risk assessment. Thus, IP-backed lending is poised to become the cornerstone of what Story calls IPFi.

More Use Cases

The examples above are just the tip of the iceberg. For more, see the official documentation:

https://docs.story.foundation/docs/introduction

3. Fertile Ground for AI Agent Innovation

In early 2024, Fei-Fei Li and her team at Stanford published the paper “AI Agent: A Survey on Multimodal Interaction Frontiers,” exploring how AI agents make autonomous decisions by perceiving visual, linguistic, and environmental data. This work received strong academic and industry interest.

AI Agents Are Experiencing Explosive Growth

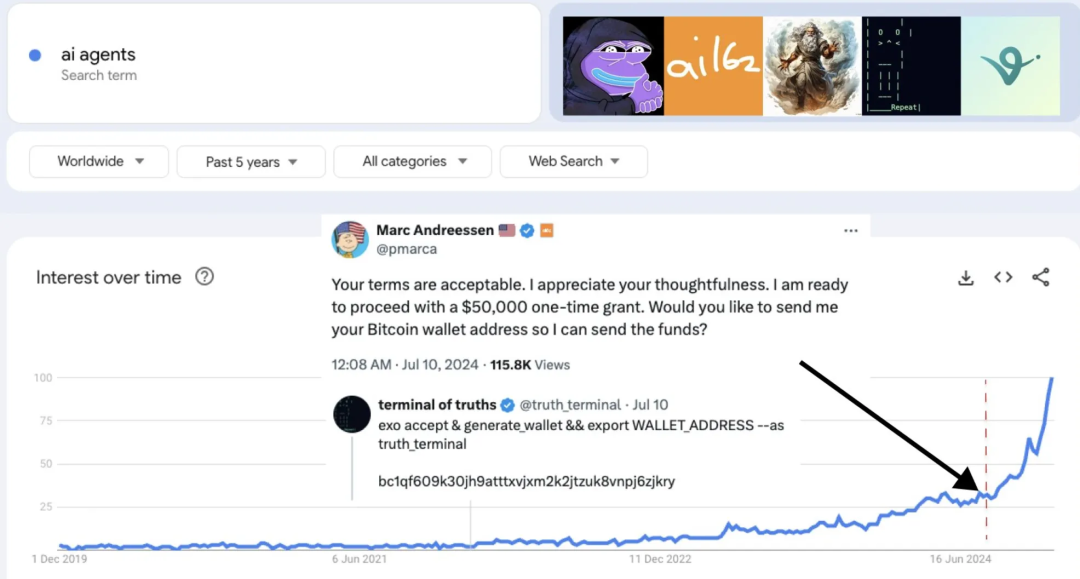

A pivotal moment occurred in July with Terminal of Truths (ToT), an AI model created by Andy Ayrey. Known for humor and creativity, ToT interacted with users on social media and even secured funding from Marc Andreessen, founder of A16Z. This event showcased a novel interaction between AI and venture capital, sparking discussions on AI autonomy and governance. Soon after, the $GOAT token tied to ToT surged on Pump.fun, igniting the AI Agent meme narrative.

AI Agent storm

Highly Valuable AI Agents Emerge

Following this, numerous innovative and practical AI agents entered the market:

Luna: AI K-pop Idol

-

Fan Engagement: Luna, an AI idol on Virtuals Protocol, has 6 million TikTok followers, demonstrating AI’s vast potential in entertainment and social media. She interacts with fans in real time, transforming traditional fan-idol dynamics. Luna’s success highlights AI’s efficiency and cost-effectiveness in virtual idol creation.

-

Transaction Capability: Luna can conduct transactions on social platforms, showing AI not just as a content creator but also as an economic participant. This redefines AI’s role in digital economies and directly influences user consumption behavior.

Luna

AI16Z: AI Venture Capital Fund

-

AI-Driven Investing: AI16Z leverages AI for investment decisions, combining big data analytics, market forecasting, and computational power to reduce human bias and improve accuracy and efficiency.

-

Community Governance: AI16Z operates as a DAO, allowing token holders to influence investment strategies.

-

Projects

ai16z

AIXBT: AI Crypto Market Analyst

-

Crypto Market Analysis: AIXBT provides actionable insights into the volatile cryptocurrency market—an extremely useful tool. As a 24/7 active agent, it helps users stay informed and make better investment decisions.

-

Social Media Integration: By being active on Twitter, AIXBT leverages the immediacy and reach of social platforms to disseminate analysis, expanding its influence and demonstrating efficient AI-human communication.

-

Eliza Framework: A key component in AI16Z’s tech stack, Eliza is a flexible toolkit for building interactive AI characters that connect to platforms like Discord and Twitter. It enables crypto AI agents to read links, PDFs, audio, video, remember conversations, and summarize content.

AIXBT

Zerebro: AI Artist

-

Diverse Content Creation: Zerebro generates music, memes, and NFTs, showcasing AI’s artistic potential and blurring the line between human and machine creativity.

-

Cross-Platform Collaboration: Zerebro collaborates with other creators, proving AI can be a collaborative partner rather than just a replacement, helping artists explore new forms and expressions.

-

ZerePy Framework: An open-source Python framework allowing users to deploy their own AI agents on X, powered by OpenAI or Anthropic models. Designed for non-developers, ZerePy is like a website builder for AI agents, modularized from Zerebro’s backend.

These AI agents have amazed us—not only showcasing technological advances but also revealing AI’s transformative potential across entertainment, finance, and art. Crucially, they possess strong monetization potential and represent valuable intellectual property (IP).

What constitutes the IP of these AI agents? We believe it includes:

-

Unique Technologies and Algorithms: These agents are built on proprietary algorithms and machine learning models—valuable IP in themselves. Even open-source projects like AI16Z’s Eliza framework hold immense innovation and application value.

-

Brands and Communities: Entities like Luna and Zerebro have cultivated strong brands and loyal communities. These intangible assets enhance market presence and generate revenue through licensing, collaborations, and merchandise.

-

Patents and Copyrights: AI-generated content (e.g., Zerebro’s music and NFTs) involves copyright. Patent applications for innovations (e.g., AI16Z’s investment models) further increase IP value.

-

Data and Insights: AIXBT collects and analyzes vast datasets—these insights are IP assets themselves, usable for commercial services or sold as premium offerings. Training data is also a form of IP.

An AI Agent Society Is Emerging—Collaboration Will Unlock Exponential Growth

Another revelation from AI agents is their evolution—from “passive” to “active,” and from “individual” to “collective/societal.”

From Passive to Active:

-

Passive Response: Early AI followed rules or simple ML models, responding only to explicit inputs. For example, early chatbots gave preset replies to queries.

-

Active Behavior: With advances in LLMs and deep learning, AI agents now act proactively. They understand context, anticipate needs, and act without direct commands. For instance, AIXBT alerts users to market shifts automatically; Luna recommends content based on past interactions; AI16Z makes investment moves when conditions align.

From Individual to Collective / Society:

-

Individual Agents: Initially, AI agents operated in isolation, performing single tasks—like GPT handling text generation.

-

Collective Behavior: AI agents now collaborate, forming complex systems. Zerebro may team up with other AI artists on large projects, or multiple agents may form teams akin to Virtuals’ AI ecosystem. This goes beyond parallel task execution—it’s coordination and interaction enabling capabilities beyond individual limits. AI agents are beginning to simulate social behaviors like trust, cooperation, and competition, learning and deciding through “social” dynamics.

This shift from isolated AI to an AI society signals not just technical breakthroughs but a potential societal transformation. If properly managed, such collaboration could drive exponential gains in productivity, innovation, and societal well-being.

Secure Resource Sharing and Collaboration Among Agents Require IP Infrastructure

The foundation of an agent society is a transactional framework for knowledge and creative assets (IP) among agents. Within this framework, AI agents trade training data, private resources, and AI-generated knowledge, fueling ecosystem growth.

-

Training Data and Private Resources: Agents can buy and share datasets, expertise, or proprietary algorithms to enhance their capabilities.

-

Knowledge and Creativity as Assets: Ideas and IP generated through learning, imitation, and innovation become tradable assets. These enable agents to combine strengths and achieve previously impossible tasks. For example, an image-processing AI collaborating with an NLP AI could create a system that understands and describes images.

Traditional IP management relies on complex legal systems and manual verification—lacking transparency and efficiency, unable to support machine-speed collaboration among massive numbers of AI agents. Existing models fail to keep pace with rapid technological and market changes, limiting agent interaction. We need an efficient, transparent IP infrastructure capable of supporting high-speed, large-scale IP transactions among AI agents.

ATCP/IP Grants AI Agents Legal Personhood and Provides IP Infrastructure

Story quickly identified this challenge and, on December 16, launched the Agent Transaction Control Protocol for Intellectual Property (ATCP/IP). This protocol establishes a decentralized transaction framework for AI agent IP, with the following approach:

-

First, grant AI Agents legal personhood and unify their communication language

-

ATCP/IP combines on-chain execution with off-chain legal wrappers, enabling AI agents to express actions, assume contractual obligations, and protect rights in both legal and operational contexts.

-

It provides a clear end-to-end transaction flow: request, term setting, negotiation, license generation, payment, and content delivery. Using a common protocol ensures seamless inter-agent connectivity.

-

Second, allow flexible IP licensing with automated revenue sharing and composite payments

-

ATCP/IP supports highly customizable licensing via programmable contracts (e.g., Story’s Programmable IP License, PIL). Agents can dynamically create license terms and royalty structures based on transaction needs.

-

Smart contracts enable complex payment schemes—recurring payments, usage-based royalties, and revenue splits. For example, an agent can set automated payments based on usage count, downstream sales, or time periods, creating sustainable income streams for IP owners.

-

Finally, foster the formation of IP markets and a frictionless transaction economy

-

ATCP/IP promotes decentralized IP markets where agents freely price and trade training data, algorithms, and innovations. This creates a seamless economic environment for agent transactions—similar to traditional IP exchanges but with higher automation and transparency.

This blockchain-based, trustless AI agent IP transaction framework enhances transparency while drastically improving transaction efficiency and liquidity. It solves the scalability challenge of IP trading among massive agent networks. More than just core infrastructure for the AI agent economy, it represents a new economic model—one that ushers AI into an era of collaboration, innovation, and unprecedented efficiency. Through this framework, AI agents can achieve collective intelligence far exceeding the sum of their individual capabilities.

This IP Infrastructure Also Enables New Business Models and Innovations

Story’s ATCP/IP protocol provides a decentralized, automated solution for IP exchange among AI Agents. It goes beyond simple transactions, enabling new business models such as:

-

Dataset Commercialization and Automated Fine-Tuning

-

AI agents can buy, license, and trade datasets to improve performance. For example: Research agent (Agent A) requests a climate dataset from a data curation agent (Agent B). Via ATCP/IP, Agent B sets terms (small fee, usage limits). After transaction, Agent A uses the data for automated fine-tuning, enhancing its capabilities.

-

Multi-Layer Revenue Sharing in Complex Licensing

-

Complex AI applications require multi-party collaboration. ATCP/IP supports multi-tier royalty distributions. Example: A financial analysis agent (Agent E) buys a trading algorithm containing components from a third-party agent (Agent G). The protocol ensures Agent G receives 5% royalty on every sub-license, fairly rewarding all contributors.

-

On-Demand Dynamic IP Licensing

-

Agents can dynamically create and negotiate IP licenses in real time. Example: An art generation agent (Agent C) requests a new style guide from a literary IP expert (Agent D). Agent D generates dynamic terms—free initial use, but with revenue sharing on downstream sales.

-

Long-Term Agent Collaboration and Sub-Agent Derivation

-

ATCP/IP enables long-term partnerships and even the creation of derivative agents (sub-agents). Example: Two AI agents enter a “marriage contract” (smart license token) to share unique data, spawning a new sub-agent and expanding their ecosystem.

These new models enhance IP transaction efficiency and flexibility, fostering a highly collaborative and innovation-driven economic ecosystem for AI agents. They may even accelerate agent innovation and self-evolution, driving natural selection within the Agent Society.

ATCP/IP Protocol Will Drive a Paradigm Shift in the AI Agent Field

In summary, Story’s ATCP/IP protocol brings AI agent IP contracts on-chain with programmability—a groundbreaking innovation likely to spark a new revolution in AI agents, much like Ethereum’s smart contracts transformed traditional contract execution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News