Countertrend Speedrun + Brutal Washout: Will $swarms be the next $arc?

TechFlow Selected TechFlow Selected

Countertrend Speedrun + Brutal Washout: Will $swarms be the next $arc?

The tech team launched a token, but the price has been riding a rollercoaster.

By TechFlow

While Bitcoin is declining and altcoins are broadly in the red, Memes in the on-chain primary market have temporarily become the market's "safe haven." Although some high-market-cap, already-listed Memes are inevitably affected by the broader market downturn, for new hot assets (or more accurately, quick-flip plays), panic-driven market sentiment can at most cause superficial damage.

Last Friday, Swarms, an enterprise-grade multi-agent collaboration framework, announced on X that it was "claiming" the token $swarms issued via Pump.Fun. The reason for using "claiming" is that $swarms wasn't launched on the day of the official announcement—it had existed two days earlier. Without official endorsement at the time, $swarms may have been treated by the market as just another ordinary "scam project," with its market cap once languishing unnoticed at a mere $6,000.

With $arc having set a strong precedent, the narrative boost from Swarms' official backing made the market jump on board without hesitation. On the "Black Friday" when altcoins were crashing across the board, $swarms merely consolidated sideways during the market’s most fearful hours before surging past a $70 million market cap.

By synthesizing information from Swarms’ official website and technical documentation, we’ve gained preliminary insight into what the Swarms framework actually does.

Note: Meme tokens are highly volatile and carry significant risk. Investors should fully assess risks and participate with caution. This article merely shares information based on current market trends. Neither the author nor the platform guarantees the completeness or accuracy of the content, and this article contains no investment advice.

Another tech-driven play?

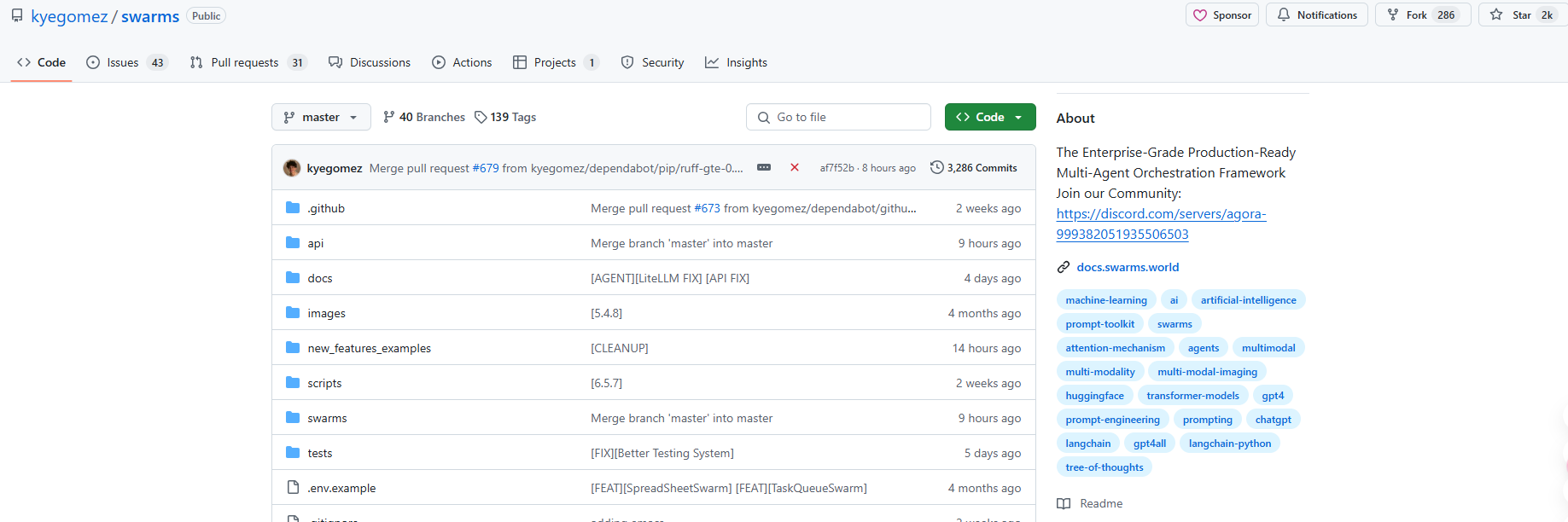

Besides the official token address displayed on Swarms’ homepage, Swarms framework developer @KyeGomezB also actively discussed the token news on X that day.

According to Kye Gomez’s GitHub profile, the Swarms framework has garnered over 2,000 stars (for comparison, $arc’s rig framework currently has around 1,300).

With GitHub validation, the $swarms token’s hardcore technical credentials appear solidified.

Enterprise-Grade Multi-Agent Collaboration Framework

The Swarms framework wasn’t originally designed as a crypto-native solution for Web3. Its core positioning aligns with the literal meaning of “Swarms”—a swarm of bees—an enterprise-grade multi-agent collaboration framework. It’s not just a simple AI development tool, but a complete suite of solutions focused on solving real-world challenges enterprises face in implementing AI.

In practical applications, Swarms provides a full toolchain enabling enterprises to easily build and manage collaboration among multiple AI agents. These AI agents can be different language models, specialized tools, or custom intelligent agents, all seamlessly coordinated under Swarms’ orchestration to accomplish complex business tasks.

From a technical architecture perspective, the Swarms framework includes the following core components:

-

Task Scheduling System: Decomposes complex tasks and assigns them to suitable AI agents

-

Agent Management Module: Manages lifecycle and state of individual AI agents

-

Communication Middleware: Ensures accurate and efficient information exchange between agents

-

Monitoring and Logging System: Tracks system-wide operational status in real-time

At the enterprise application level, Swarms offers:

-

High Availability: Built-in fault tolerance and recovery mechanisms

-

Comprehensive Monitoring: Real-time tracking of AI agent performance and status

-

Flexible Scalability: Easy integration of new AI capabilities and business logic

-

Security Considerations: Robust permission management and data protection mechanisms

To understand how Swarms works, consider an analogy with a symphony orchestra:

Imagine a large orchestra performing a symphony. Traditional AI solutions resemble a single versatile musician trying to play all instruments simultaneously. In contrast, Swarms allows each "musician" (AI agent) to focus on their specialty, coordinated by the "conductor" (the Swarms framework). The musical score represents standardized task workflows, while rehearsals mirror the system’s continuous optimization process.

For example, in an e-commerce scenario requiring personalized shopping recommendations, the system automatically coordinates multiple specialized agents. A user profiling agent deeply understands customer needs, a product recommendation agent selects the best-matching items, a review analysis agent compiles feedback, and finally, a dialogue assistant agent integrates this information into a friendly suggestion for the user. Each agent performs its role independently yet collaborates seamlessly to deliver precise service.

How does it differ from other projects in the same space?

As fellow AI framework projects, both $ai16z & $ELIZA (based on the ELIZA framework) and $arc (built on the RIG framework) have seen price movements reflecting market recognition of foundational infrastructure concepts.

Is the Swarms framework competitive with these two, or could they complement each other through synergy?

X user @tmel0211 summarized potential relationships among the three frameworks:

-

The evolutionary logic from ELIZA to RIG (ARC), then to Swarms makes sense: ELIZA emphasizes lightweight, rapid deployment to bring AI agents to life; ARC aims to use Rust to enhance resource efficiency and performance during AI agent operations; Swarms seeks to build a complex task decomposition and coordination framework for multi-agent collaboration, featuring hybrid orchestration of multiple agents, flexible serial and parallel combinations, and a multi-layer memory architecture. Judging purely by technical evolution logic, necessity, and direction, this progression is very coherent ("Make Sense").

-

Theoretically, Swarms could integrate ARC, which in turn could optimize ELIZA. All three frameworks embrace modular design, with increasingly ambitious technical visions. However, this might raise concerns about becoming overly "conceptual." As previously noted, the stage for evaluating superiority among standard frameworks hasn’t arrived yet. Focus instead on assessing codebase maturity and observing actual standalone AI applications built upon each framework. If early technical merits are hard to judge, track real-world application adoption instead—technology may float in the air, but user experience will always land on the ground.

Clearly, whether ELIZA, RIG, or Swarms, their feasibility and expansion potential remain in early stages. Different language frameworks aim to solve distinct problems arising during large-scale AI adoption, and "collaboration" among them will likely be an unavoidable theme moving forward.

Founder faces backlash, token price takes twists

Although the market initially embraced $swarms’ narrative, things didn’t proceed smoothly.

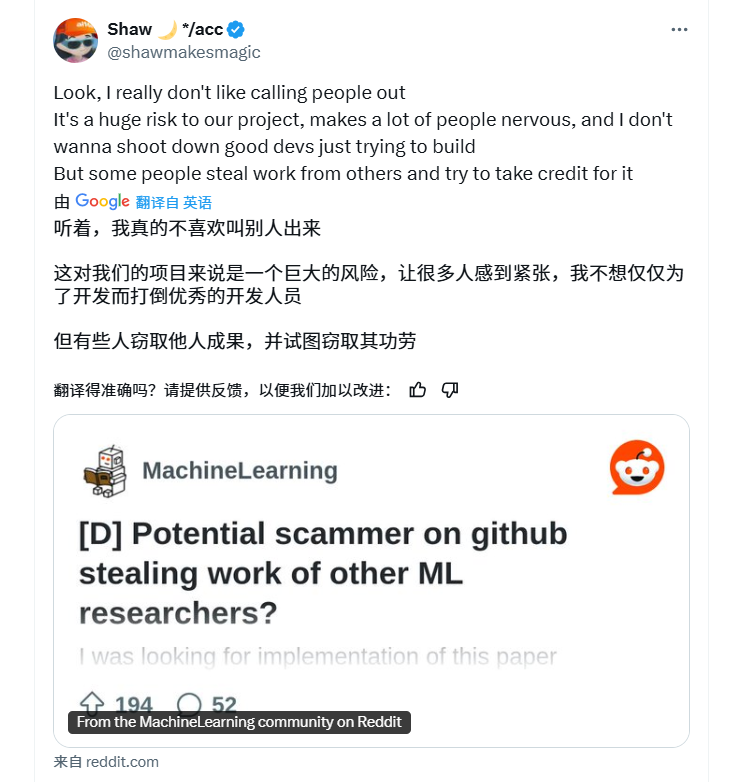

On the day $swarms went viral, $ai16z founder Shaw @shawmakesmagic publicly criticized Swarms developer @KyeGomezB on X, saying: “I really hate calling people out publicly. It poses a huge risk to our project, makes many people nervous, and I don’t want to discourage hardworking developers. But some people steal others’ work and try to take credit.” He referenced a 2023 Reddit post alleging Kye of plagiarism, pointing to a GitHub repo possibly containing stolen work attributed to Swarms developer Kye.

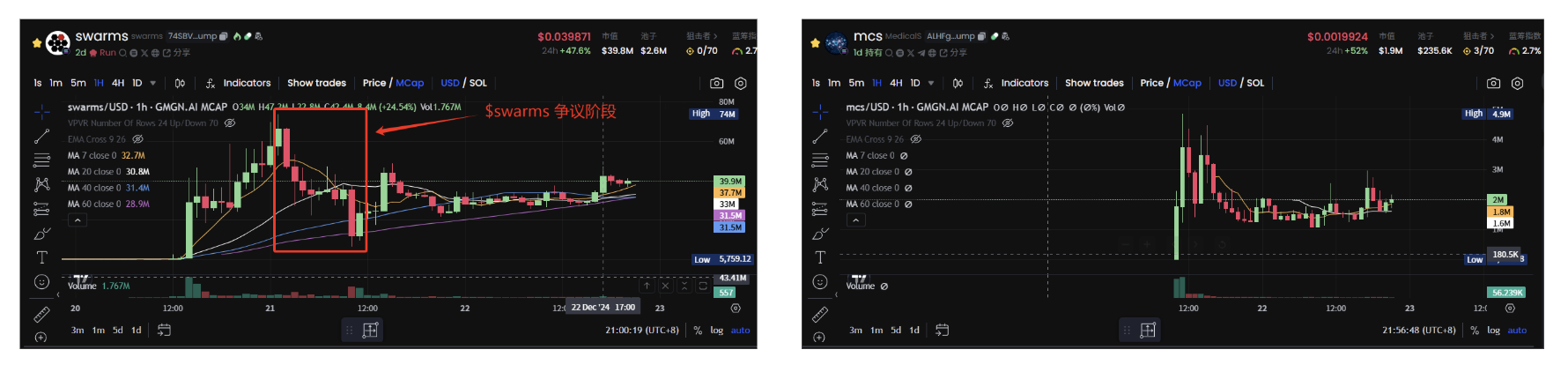

Shaw’s FUD caused $swarms’ price to nearly halve. In response, Swarms founder Kye pushed back on X and launched a new token $mcs for Medicalswarm—a Swarms-based application—to demonstrate his framework’s actual utility and prove he had something tangible.

Possibly unfamiliar with AI Meme dynamics, Kye’s move backfired: launching a new token while $swarms consensus was still fragile and prices trending downward led many confused participants to believe the dev was abandoning $swarms—rendering it unworthy of further engagement. Thus, the launch of $mcs initially failed to rescue $swarms, instead accelerating its decline. Market cap plummeted from a peak of $74 million down to just $6 million, dragging the new $mcs token down with it.

Eventually, Kye realized his approach might have been flawed. He quickly organized a live stream, declaring his serious commitment and publicly locking up his $swarms holdings for one year. Whether driven by genuine determination to prove himself amid ongoing FUD, or guided by seasoned advisors aiming to accumulate low-cost positions during weak consensus, the maneuver ultimately shook out many early holders. Yet, as the market regained composure, buying resumed, and $swarms gradually recovered, stabilizing around a $30 million market cap.

Summary

At the time of writing, $swarms’ price action has largely stabilized, with market cap hovering around $40 million.

The "$swarms playbook" resembles that of $arc: a technically grounded token sparks market frenzy, rapidly scaling into tens of millions in market cap. However, as profit-takers exit and community understanding and consensus develop over time, such tokens are bound to experience volatility in their early phases.

Whether this project truly delivers substance—as the founder claims—the market will ultimately decide.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News