Arthur Hayes' new article: The best investment under Trump's policies is holding Bitcoin; investors should buy the dip during the bull market to seize the opportunity.

TechFlow Selected TechFlow Selected

Arthur Hayes' new article: The best investment under Trump's policies is holding Bitcoin; investors should buy the dip during the bull market to seize the opportunity.

The future is here, the choice is yours.

Author: Arthur Hayes

Translation: TechFlow

All views expressed in this article are the author's personal opinions and for informational purposes only. They do not constitute investment advice or any recommendation to engage in trading activities.

More Content

Four steps away from the wall, a wooden board is vertically fixed onto a movable stand. My yoga instructor asked me to align the heels of my palms with the junction between the board and its stand, then bend forward like a cat, ensuring the back of my head pressed firmly against the board. If properly positioned, I could walk my feet up the wall into an L-shape, keeping the back of my head, spine, and sacrum flush against the board. To prevent rib flaring, I had to tighten my abdominal muscles and tuck my tailbone inward. Ouch—just maintaining this posture already left me drenched in sweat. Yet the real challenge lay ahead: lifting one leg fully vertical while maintaining alignment.

This wooden board acts as a “mirror of truth,” instantly exposing flaws in body alignment. If your posture is off, you immediately feel certain parts of your back or hips lose contact with the board. When I lifted my left foot while the right remained on the wall, my musculoskeletal imbalances became glaringly obvious: my left lat flared outward, my left shoulder rolled inward, making my entire body resemble a twisted ball of yarn. I’ve long known about these issues—my strength coach and spinal therapist both noted that my left-side back muscles are weaker than the right, causing my left shoulder to sit higher and tilt forward. Using the board to practice inversions simply makes these asymmetries more visible. There’s no shortcut to fixing them—only slow progress through a series of often painful exercises.

If this board is a "truth mirror" for bodily alignment, then U.S. President-elect Donald Trump is the "truth catalyst" for today’s geopolitical and economic realities. The global elite’s disdain for Trump stems precisely from the truths he reveals. By “Trump truth,” I don’t mean personal facts he might disclose—his height, net worth, or golf score—but rather the genuine relationships between nations and the authentic thoughts of ordinary Americans when freed from political correctness.

As a macroeconomic analyst, I use public data and current events to make predictions guiding my investment portfolio. I appreciate the “Trump truth” because it acts as a catalyst, forcing leaders to confront problems and take action. These actions will ultimately shape the future world order—and I aim to profit from it. Even before Trump formally takes office, countries have already begun acting in ways I anticipated, reinforcing my views on future monetary policy and financial repression. This year-end piece analyzes major shifts underway within and among the four largest economies: the U.S., EU, China, and Japan. In particular, I need to assess whether monetary policy will remain loose—or even accelerate—after Trump’s official inauguration on January 20, 2025. This judgment is critical to my short-term investment strategy.

However, I believe the crypto market currently overestimates Trump’s ability to quickly change the status quo. In reality, Trump has almost no politically feasible quick fixes. The market may wake up around January 20, 2025, realizing Trump has at most one year to drive any meaningful policy changes. This reality check could trigger sharp sell-offs in cryptocurrencies and other “Trump 2.0”-linked assets.

Trump has only one year to act because most U.S. lawmakers will begin campaigning by late 2025 for the November 2026 midterm elections. At that time, all House seats and many Senate seats will be up for re-election. With Republicans holding only a slim majority in Congress, they are likely to lose control after November 2026. While American frustration is understandable, solving deep-rooted domestic and international problems—even for the most capable politician—takes more than a decade, not just one year. Thus, many investors may face severe “buyer’s remorse.” Still, can money printing and financial repression targeting savers sustain a crypto bull run into 2025 and beyond? I believe yes—but this article is also my attempt to convince myself of that possibility.

Phases of Monetary Evolution

I’ll borrow Russell Napier’s framework to simplify the timeline of post-WWII monetary structures.

-

1944–1971: Bretton Woods System

Countries pegged their currencies to the U.S. dollar, which was convertible to gold at $35 per ounce.

-

1971–1994: Petrodollar System

When President Nixon ended the gold standard, the dollar began floating freely against other currencies. This shift occurred because the U.S. could no longer maintain the gold peg while expanding the welfare state and funding the Vietnam War. Nixon struck a deal with Gulf oil producers like Saudi Arabia: price oil in dollars, pump as much as demanded, and recycle trade surpluses into U.S. financial assets. As some reports suggest, the U.S. manipulated some Gulf states to raise oil prices, providing support for this new monetary structure.

-

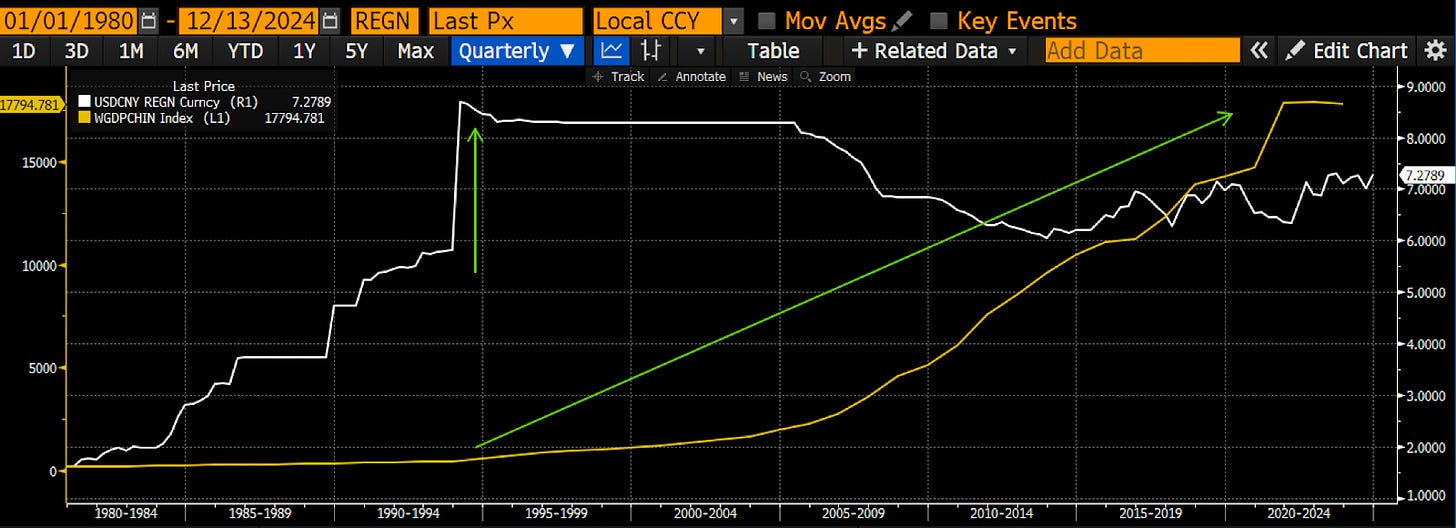

1994–2024: Petro-Yuan System

In 1994, China sharply devalued the yuan to combat inflation, banking crises, and weak exports. Simultaneously, China and other Asian economies adopted mercantilist policies, accumulating dollar reserves through cheap exports to pay for energy and high-end manufactured imports. This policy fueled globalization and introduced one billion low-wage workers into global markets, suppressing inflation in developed nations and allowing Western central banks to maintain low interest rates for extended periods.

The white line represents the USD/CNY exchange rate; the yellow line shows China’s GDP in constant U.S. dollars.

2024 – Present?

I haven’t yet named the emerging system. However, Trump’s election is the catalyst transforming the global monetary order. To clarify: Trump isn't the root cause of this restructuring—he bluntly identifies existing imbalances and is willing to pursue highly disruptive policies to rapidly achieve what he believes is best for Americans. These changes will end the petro-yuan system. As I argue in this article, they will lead to increased fiat money supply and intensified financial repression globally. Both outcomes are inevitable because leaders in the U.S., EU, China, and Japan refuse to achieve sustainable balance through deleveraging. Instead, they will print money and destroy the real purchasing power of long-term government bonds and bank deposits to ensure elite control in the new system.

I will begin with an overview of Trump’s goals, then evaluate responses from each economy or nation.

The Trump Truth

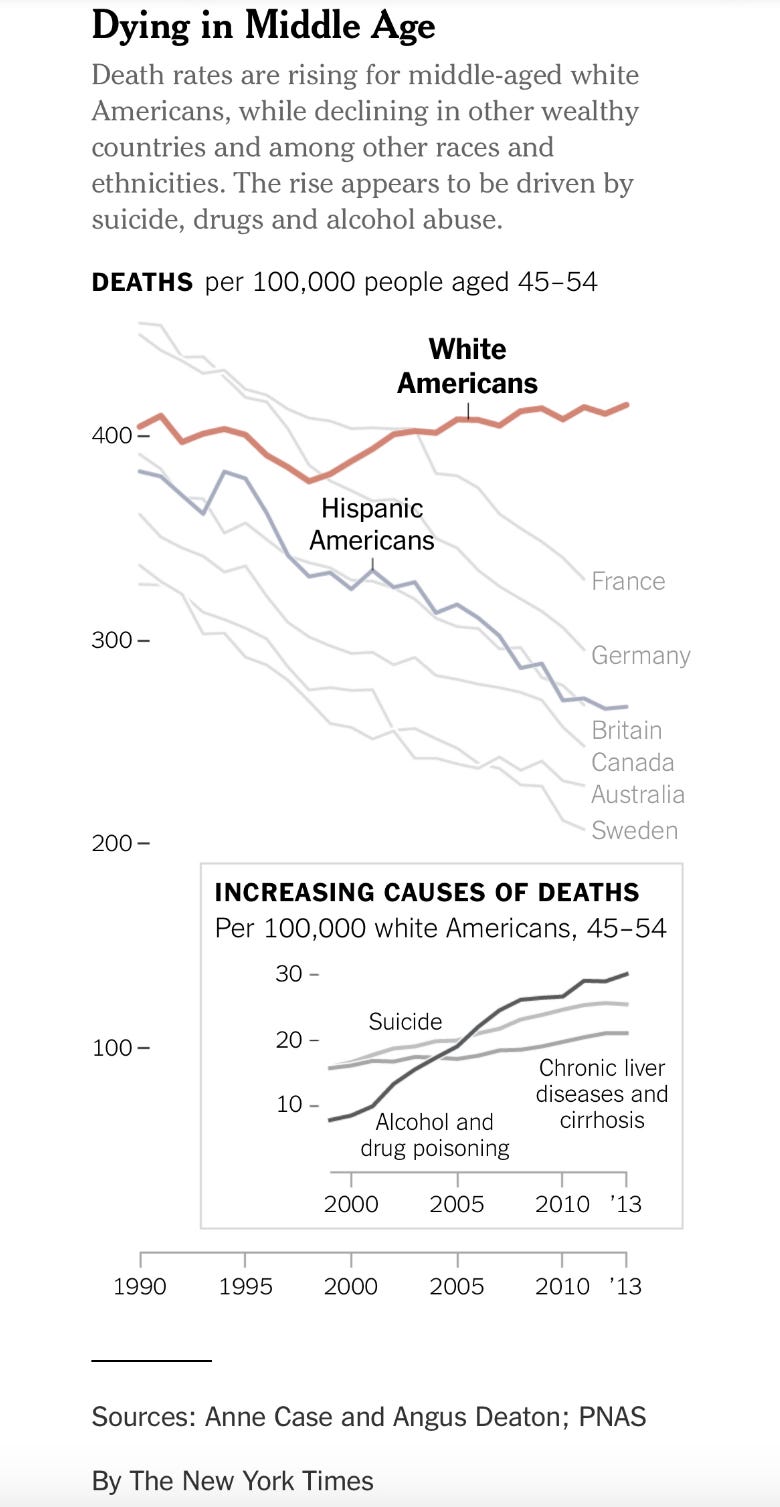

To sustain the petro-yuan system, the U.S. must maintain current account and trade deficits. This outcome led to the deindustrialization and financialization of the American economy. For a deeper understanding, I recommend reading Michael Pettis’s works. I’m not saying this is why the world should abandon the system, but since the 1970s, the average white American male clearly has lost much under so-called “Pax Americana.” The key word here is “average”—I’m not referring to top executives like Jamie Dimon of JPMorgan or David Solomon of Goldman Sachs, nor the white-collar workers employed by them. I mean those who once had jobs at Bethlehem Steel, owned homes and families, and now interact with women only at methadone clinics. This is evident—the group is slowly committing suicide via alcohol and prescription drugs. Compared to their high living standards and job satisfaction after WWII, their current condition is abysmal. It’s well known this demographic forms Trump’s base, and he speaks to them in ways other politicians dare not. Trump promises to bring industry back to America and restore meaning to their suffering lives.

For bloodthirsty Americans obsessed with “video game wars”—a powerful political bloc—the current state of the U.S. military is humiliating. The myth of U.S. military superiority over near or actual adversaries (currently only Russia and China qualify) originates from the narrative that America “liberated” the world from Hitler in WWII. But that’s false—the Soviet Union paid with tens of millions of lives to defeat Germany; the U.S. merely finished the job. Stalin was desperate over Roosevelt’s delay in launching a large-scale Western Front offensive against Hitler. President Roosevelt let the Soviets bleed to reduce American casualties. In the Pacific, though the U.S. defeated Japan, it never faced the full force of the Japanese Army, which committed most of its troops to mainland China. Hollywood would better serve history by depicting the Battle of Stalingrad and Zhukov’s heroism, honoring the millions of Russian soldiers who sacrificed, rather than glorifying D-Day landings.

After WWII, the U.S. military fought North Korea to a stalemate, lost to North Vietnam, suffered a chaotic withdrawal from Afghanistan in 2021, and is now losing to Russia in Ukraine. The only victories the U.S. military can claim are using overly complex, expensive weapons to defeat third-world nations like Iraq in two Gulf Wars.

Military success reflects industrial economic strength. If you care about war, the U.S. economy is built on “false prosperity.” Yes, Americans excel at leveraged buyouts, but their weapon systems are costly patchworks of Chinese-imported components, forcibly sold to “hostage clients” like Saudi Arabia under geopolitical agreements. Meanwhile, Russia—with an economy one-tenth the size of America’s—produces hypersonic missiles that cannot be intercepted at a fraction of the cost of U.S. conventional arms.

Trump is no “peace-at-all-costs” hippie; he fully believes in American military supremacy and exceptionalism and is eager to use it to slaughter enemies. Recall how during his first term, he assassinated Iranian General Qasem Soleimani on Iraqi soil—a move celebrated by many Americans. He didn’t care about violating Iraqi airspace or the fact that the U.S. wasn’t formally at war with Iran, unilaterally deciding to kill another nation’s general. Therefore, he wants to rearm this empire so its military power matches its propaganda.

Trump advocates reindustrializing the U.S. economy—not only to provide quality manufacturing jobs for those who want them but also to build a strong military. Achieving this requires reversing the imbalances created under the petro-yuan system. This will be done by weakening the dollar, offering tax subsidies and production incentives, and deregulating industries. All these measures will make it economically viable for companies to bring production back to the U.S.—currently still less attractive than China due to decades of pro-growth policies.

In my article Black or White, I discussed how quantitative easing (QE) for the poor could fund U.S. reindustrialization. I believe incoming Treasury Secretary Bessent will pursue such industrial policies. However, this takes time, and Trump needs immediate results to showcase in his first year to appeal to voters. Therefore, I think Trump and Bessent must immediately weaken the dollar. I want to explore how this is possible and why it must happen in the first half of 2025.

Bitcoin Strategic Reserve

“Gold is money; everything else is credit.” — J.P. Morgan

Trump and Bessent have repeatedly emphasized that weakening the dollar is necessary to achieve U.S. economic goals. But against what should the dollar depreciate, and when should this occur?

Major global exporters besides the U.S. are China (yuan), the EU (euro), the UK (pound), and Japan (yen). To attract more companies to relocate production to the U.S., the dollar must depreciate against these currencies. Companies don’t necessarily need to be U.S.-registered—Trump accepts Chinese manufacturers building factories in the U.S. and selling locally. But crucially, American consumers must buy “Made in America” goods.

International coordination for exchange rate adjustments is outdated. Today, the U.S. lacks the economic and military dominance it held in the 1980s. Thus, Bessent cannot unilaterally demand others adjust their exchange rates against the dollar. Of course, he can pressure via tariffs or other tools, but that requires significant time and diplomacy. In practice, there’s a more direct way.

The U.S. holds the world’s largest gold reserves—approximately 8,133.46 tons—giving it a unique advantage in weakening the dollar. Gold remains the true currency of global trade. Though the U.S. abandoned the gold standard 50 years ago, historically, the gold standard was the norm, and today’s fiat system is the exception. Thus, the simplest path is depreciating the dollar against gold.

Currently, the U.S. Treasury values gold on its balance sheet at $42.22 per ounce. If Bessent convinces Congress to raise the statutory price of gold, the depreciation of the dollar against gold would directly credit the Treasury’s account at the Federal Reserve. These newly created funds could be spent directly into the economy. Every $3,824 per ounce increase in gold’s price generates $1 trillion in additional Treasury funding. For example, adjusting gold to its current spot price would add roughly $695 billion to fiscal reserves.

In this way, the U.S. government could “create” dollars out of thin air by revaluing gold and spend them on goods and services. This is essentially fiat currency depreciation. Since other fiat currencies are implicitly linked to gold, they would automatically appreciate against the dollar. Without negotiating with other nations, the U.S. could swiftly achieve a sharp depreciation of the dollar against its major trading partners.

One might ask: couldn’t other exporting nations respond by depreciating their currencies more aggressively against gold to regain competitiveness? Theoretically, yes—but due to the dollar’s role as the global reserve currency, they cannot replicate America’s gold-devaluation strategy without risking hyperinflation. Especially since these countries lack self-sufficiency in energy and food like the U.S., such inflation would trigger severe social unrest, threatening incumbent regimes.

How much dollar depreciation is needed to drive U.S. reindustrialization? The answer lies in the new gold price. If I were Bessent, I’d act boldly—say, revalue gold to $10,000–$20,000 per ounce. According to Luke Gromen’s estimate, restoring the 1980s ratio of gold to Fed liabilities would require gold to rise 14-fold—to about $40,000 per ounce. That’s not my prediction, but it illustrates how overvalued the dollar is against gold today.

As a gold supporter, I hold physical gold bars and invest in gold mining ETFs because the easiest way for the dollar to depreciate is against gold. And this move will profoundly impact the cryptocurrency market.

The concept of a Bitcoin Strategic Reserve (BSR) builds on this logic. Senator Lummis proposed legislation requiring the Treasury to purchase 200,000 bitcoins annually over five years, funded by raising the gold price on the government’s balance sheet. The core idea is that bitcoin, as the “hardest money,” can help the U.S. maintain financial dominance in both digital and real economies.

If government economic policy becomes closely tied to bitcoin’s price, it will naturally favor expanding the bitcoin and crypto ecosystem. This mirrors how governments support domestic gold mining and trading markets. For instance, China encourages domestic gold ownership via the Shanghai Gold Futures Exchange as part of national gold accumulation policy.

If the U.S. government creates more dollars by depreciating gold and uses some of that money to buy bitcoin, the fiat price of bitcoin will rise. This could trigger competitive sovereign purchases by other nations trying to keep pace. In such a scenario, bitcoin’s price could grow exponentially. After all, in a context of active fiat devaluation, who would willingly sell bitcoin for depreciating paper money? Long-term holders will eventually sell at some price point—but certainly not at $100,000. While this logic is sound, I still don’t believe the BSR will actually be implemented. Politicians will likely prefer spending newly created dollars on social programs to secure electoral victories. Nevertheless, even the mere possibility of BSR creates upward pressure in the market.

I don’t expect the U.S. government to buy bitcoin, but that doesn’t diminish my bullish outlook on its price. Gold revaluation will create vast new dollar supplies, which will flow into real goods, services, and financial assets. Historically, bitcoin’s price has grown far faster than the expansion of the global dollar supply, due to its fixed supply and decreasing circulation.

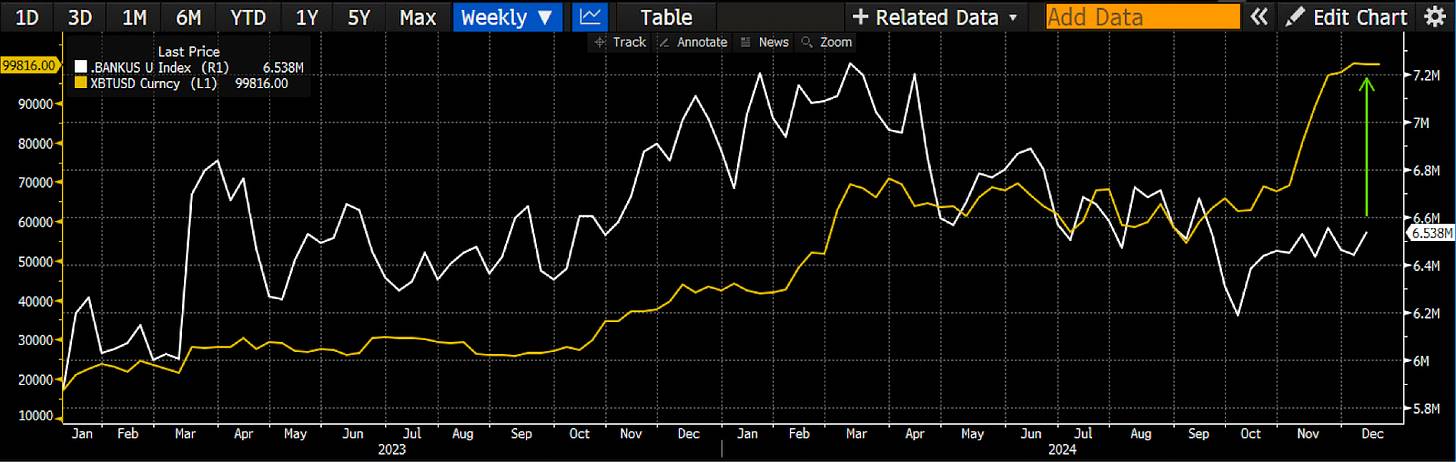

The white line shows the Fed’s balance sheet; the yellow line shows bitcoin’s price, both indexed to 100 on January 1, 2011. The Fed’s balance sheet grew 2.83x, while bitcoin’s price surged 317,500x.

In summary, rapidly and significantly weakening the dollar is the first step for Trump and Bessent to achieve their economic goals. This can be done swiftly without negotiating with domestic legislators or foreign finance ministries. Given Trump’s need to demonstrate results within one year to help Republicans retain control of Congress, I expect the dollar/gold devaluation to occur in the first half of 2025.

Next, let’s focus on China and examine how they will respond to Trump’s core policies.

China’s Response

China currently faces two major challenges: employment and real estate. Trump’s policies undoubtedly intensify these issues, as the U.S. also seeks to create higher-paying jobs and boost productive investment for its people. Trump and his team’s main weapons are a weak dollar and tariffs—so what tools does China have in response?

I believe China has clearly signaled it must ideologically accept quantitative easing (QE) and further allow the yuan to float freely. Until now, China has barely used central bank money printing for fiscal stimulus, mainly to avoid worsening domestic imbalances. Additionally, China has been waiting, observing the policy direction of the new U.S. administration. However, recent signs indicate China will launch large-scale economic stimulus through traditional QE channels and allow the yuan to trade according to market demand.

To understand why QE leads to yuan depreciation: QE increases yuan supply. If yuan growth outpaces other currencies, the yuan will naturally depreciate against them. Moreover, yuan holders may preemptively convert their holdings into fixed-supply assets like bitcoin, gold, or U.S. stocks to protect purchasing power—further accelerating yuan depreciation.

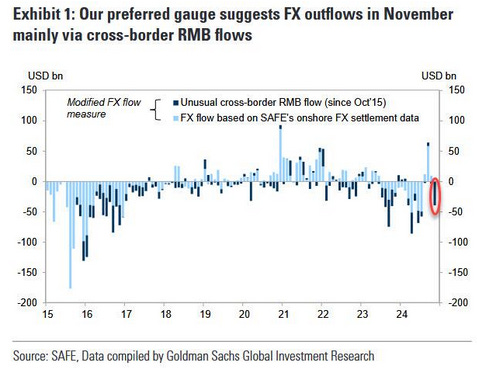

This chart shows the trend of investors beginning to withdraw capital from China.

As previously mentioned, China cannot counter the U.S. by depreciating the yuan against gold—doing so would trigger hyperinflation due to its dependence on imported food and energy, ultimately threatening the CCP’s rule. However, China can significantly increase yuan supply to ease its real estate crisis and avoid deflation. Recent news indicates the People’s Bank of China (PBOC) is preparing to allow yuan depreciation in response to Trump’s tariff threats—signaling a potential full-scale QE launch.

“With Trump returning to the White House, China’s top leaders and policymakers are considering allowing the yuan to weaken further in 2025 to counter higher U.S. trade tariffs.” — Reuters, December 11, 2024

The PBOC hasn’t openly stated its true reason for allowing yuan flexibility—it may want to avoid accelerating capital flight. Directly telling the wealthy class that policy will focus on printing money and buying government bonds could spark panic and rapid capital outflows. Funds might first flow to Hong Kong, then to the rest of the world. Hence, the PBOC prefers subtle signals to guide investors toward domestic stocks and real estate instead of overseas assets.

As I predicted in my article Let's Go Bitcoin, the PBOC will use massive QE and monetary stimulus to fight deflation. We can gauge policy effectiveness by watching whether yields on Chinese Government Bonds (CGB) rise. Currently, CGB yields are at historic lows because investors prefer principal-protected government bonds over volatile stocks and real estate. This reflects pessimism about China’s medium-term economic outlook. Reversing this isn’t complicated: just print money and have the central bank repurchase government bonds from investors via open market operations—that’s the definition of QE. See my diagram analysis in Black and White for details.

Macroscopically, the main issue with printing is the yuan’s external value. While a strong yuan has benefits—cheaper imports for Chinese consumers, greater RMB settlement adoption by trade partners, lower borrowing costs for firms—under Trump’s policy pressure, these advantages are negligible. The U.S. can print far more boldly than China without triggering hyperinflation, a fact Trump and Bessent have made clear. Thus, the USD/CNY exchange rate may float, meaning short-term yuan depreciation.

Before Bessent pushes for a sharp dollar/gold devaluation, yuan depreciation will help Chinese exporters sell more goods abroad. This short-term edge could help China negotiate better terms with Trump’s team—such as easier market access for Chinese firms in the U.S.

For crypto investors, the key question is: how will Chinese investors react to rising yuan supply? Will legal capital outflow channels like Macau gambling and Hong Kong enterprises remain open or be shut down to curb capital flight? Given the U.S. is restricting certain funds (e.g., Texas public university endowments) from investing in Chinese assets, China may similarly block newly printed yuan from flowing to the U.S. via Hong Kong. These yuan must be channeled into domestic stocks and real estate. Thus, capital outflows from yuan to dollar may accelerate before policy windows close.

Short-term, Chinese capital may flow via Hong Kong to the dollar zone and purchase bitcoin and other cryptos. Mid-term, once China bans obvious offshore channels, the question becomes whether Hong Kong crypto ETFs will be allowed to accept mainland capital. If controlling crypto via Hong Kong’s state-owned asset managers enhances China’s competitiveness—or at least puts it on par with the U.S. in crypto—these ETFs could rapidly attract massive inflows. This would fuel the crypto market, as ETFs would need to buy spot crypto globally.

Japan: The Sunset Empire’s Choice

Though Japan’s political elite take pride in their culture and history, they remain heavily dependent on U.S. support. After WWII, Japan rebuilt rapidly with U.S. dollar loans and tariff-free access to American markets, becoming the world’s second-largest economy by the early 1990s. Meanwhile, Japan built more ski resorts than anywhere else—critical to my lifestyle.

Yet, as in the 1980s, trade and financial imbalances between Japan and the U.S. are once again central. The currency accord then caused a weak dollar and strong yen, culminating in the 1989 collapse of Japan’s stock and real estate bubbles. To strengthen the yen, the BOJ tightened monetary policy—directly bursting the bubble. This shows loose policy inflates asset bubbles, and tightening bursts them. Today, Japanese politicians may again perform “financial seppuku” to appease U.S. demands.

Currently, Japan is the largest holder of U.S. Treasuries and has pursued aggressive QE, evolving into Yield Curve Control (YCC), resulting in an extremely weak USD/JPY rate. I explored the importance of USD/JPY in detail in my articles Shikata Ga Nai and Spirited Away.

Trump’s economic strategy clearly demands the dollar appreciate against the yen. Trump and Bessent have made this adjustment inevitable. Unlike with China, Japan’s adjustment won’t be adversarial—Bessent will effectively set the USD/JPY rate, and Japan will comply.

But the key to yen appreciation lies in the BOJ raising interest rates. Without intervention, the following may occur:

-

As rates rise, Japanese Government Bonds (JGBs) become more attractive, prompting Japanese corporations, households, and pension funds to sell foreign assets (mainly U.S. Treasuries and stocks), convert proceeds to yen, and buy JGBs.

-

Rising JGB yields mean falling prices, severely impacting the BOJ’s balance sheet. Additionally, the BOJ holds vast U.S. Treasuries and stocks; as Japanese investors sell these to repatriate funds, their prices may fall. The BOJ would also need to pay higher interest on yen bank reserves. These factors could jeopardize the BOJ’s solvency.

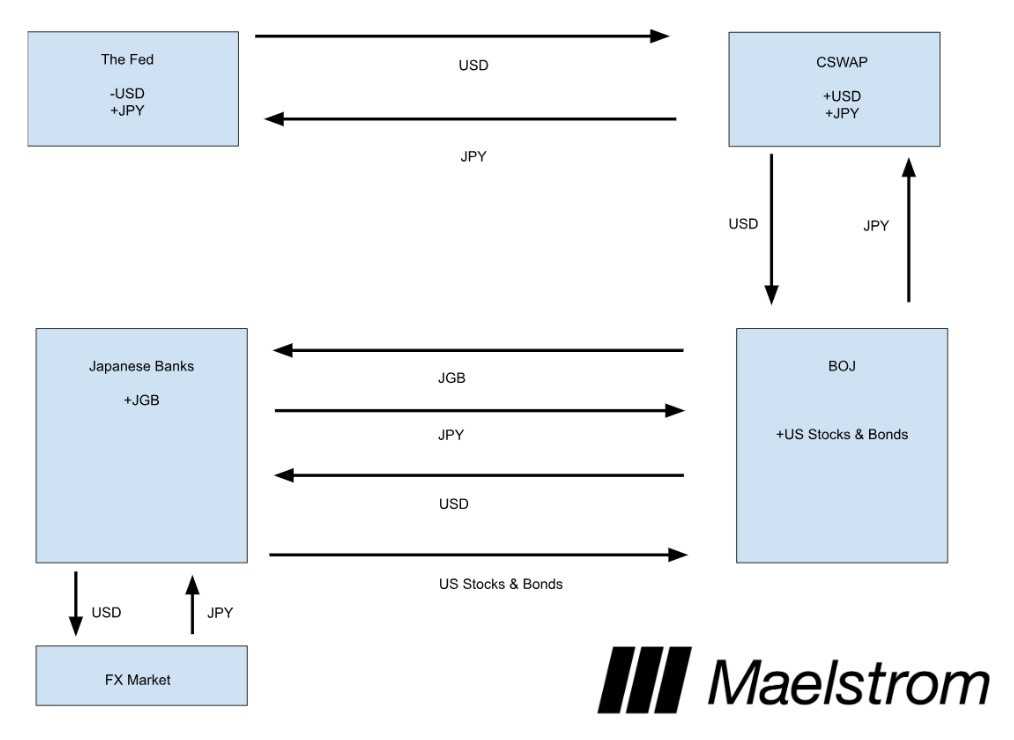

Trump clearly doesn’t want Japan’s financial system to collapse. U.S. naval bases in Japan are vital to containing China’s maritime expansion, and Japanese semiconductor production ensures stable supply chains for the U.S. Thus, Trump may instruct Bessent to take all necessary measures to stabilize Japan’s financial system. For example, Bessent could use Treasury authority to conduct USD/JPY currency swaps (CSWAP) with the BOJ, absorbing off-market sales of U.S. Treasuries and stocks by Japanese investors. The mechanism is detailed in my article Spirited Away:

-

Federal Reserve expands dollar supply to absorb yen accumulated from unwind of carry trades.

-

Currency Swap: Fed provides dollars to BOJ; BOJ provides yen to Fed.

-

Bank of Japan ends up holding more U.S. stocks and bonds; as dollar supply grows, these asset prices rise.

-

Japanese banks hold more Japanese Government Bonds (JGBs).

This mechanism is crucial for crypto markets: resolving the unwinding of yen-dollar carry trades will massively expand dollar supply. Though gradual, stabilizing Japan’s financial system may require trillions in new dollars.

Resolving U.S.-Japan trade and financial imbalances isn’t complicated—Japan has little say. Its political position is extremely fragile: the ruling LDP has lost its parliamentary majority, plunging governance into turmoil. Though Japan’s elites inwardly resent American brashness, they lack the political power to resist Trump’s economic strategy.

EU: The Last Shall Forever Be Last

Though many Europeans (at least not those named Muhammad) retain some Christian traditions, the biblical phrase “the last shall be first” clearly doesn’t apply economically to the EU. The last shall forever be last. For some reason, Europe’s elite politicians seem content enduring relentless U.S. pressure.

In fact, Europe should have done everything to strengthen cooperation with Russia and China. Russia could supply cheap pipeline energy and abundant grain. China offers high-quality, low-cost manufactured goods and eagerly buys European luxury products in huge volumes. Yet, the continent remains subservient to two island nations—Britain and America—missing out on a vast, unstoppable Eurasian prosperity bloc.

Because Europe refuses cheap Russian gas, clings to false green energy promises, and shuns mutually beneficial trade with China, Germany and France’s economies are faltering. As Europe’s two economic engines, their decline weakens the entire continent, reducing it nearly to a vacation playground for Arabs, Russians (though perhaps less now), and Americans. The irony is rich—European elites often harbor deep prejudices against people from these very regions.

This year, Super Mario Draghi (September 2024 “Future of European Competitiveness”) and Emmanuel Macron (April 2024 “Europe Speech”) delivered two pivotal speeches. For Europeans, these are depressing—they accurately identify core problems: high energy costs and insufficient domestic investment—but their solutions boil down to “print more money to fund green transition and impose more financial repression.”

A more effective solution would be: abandon blind support for U.S. policy, reconcile with Russia for cheap gas, develop nuclear energy, deepen trade with China, and fully deregulate financial markets. Yet disappointingly, despite many European voters recognizing current policies don’t serve their interests and voting for parties pushing change, ruling elites use undemocratic means to suppress majority will. Political instability persists—France and Germany effectively lack stable governments.

Trump’s strategic intent is clear: the U.S. needs Europe to keep distancing itself from Russia, limit trade with China, and buy American-made weapons to defend against Russia and China—blocking the emergence of a powerful, integrated Eurasian economy. But these policies harm Europe’s economy, forcing the EU to rely on financial repression and massive money printing to survive. I’ll quote Macron to illustrate Europe’s future financial policy and explain why if you hold capital in Europe, you should be concerned. Beware: you may soon lose freedom to move capital out of Europe, and your retirement accounts or bank deposits may be forced into poorly performing long-term EU government bonds.

Before quoting Macron, consider Enrico Letta, former Italian PM and current president of Jacques Delors Institute: “The EU has up to €33 trillion in private savings, with 34.1% held in current accounts. Yet these funds aren’t being effectively used to meet the EU’s strategic needs. Alarmingly, vast amounts of European capital flow annually into the U.S. economy and American asset managers. This reflects inefficiency in how the EU deploys savings. If these resources were efficiently redistributed within the EU economy, they could significantly advance its strategic goals.” — From “Much More Than a Market”

Letta’s message is clear: European capital shouldn’t fuel American businesses but serve Europe’s own development. EU authorities have multiple tools to force investors into underperforming European assets. For pension or retirement accounts, regulators could define “suitable investment universes,” legally restricting fund managers to EU stocks and bonds. For bank deposits, regulators could ban non-EU investment options, claiming they’re “unsuitable” for depositors. Any capital in EU-regulated institutions may fall under control of policymakers like Christine Lagarde. As ECB President, her primary duty is ensuring the survival of the EU financial system—not protecting your savings from inflation.

If you thought only Davos World Economic Forum elites supported such policies, here’s Marine Le Pen: “Europe must wake up… because America will more aggressively defend its own interests.”

Trump’s policies provoke strong reactions across Europe’s political spectrum—from left to right.

Returning to EU politicians’ refusal to adopt simpler, less destructive solutions, here’s Macron’s direct message to ordinary citizens: “Yes, the days of Europe depending on Russian energy and fertilizers, outsourcing production to China, and relying on America for security are over.”

Macron stresses EU capital should stop flowing to top-performing financial products and instead serve internal development. He says: “Third, every year we send about €300 billion in savings to fund America—whether buying U.S. Treasuries or venture capital. That’s utterly absurd.”

Moreover, Macron proposes suspending Basel III banking rules. This would let banks use infinite leverage to buy expensive, low-yield EU government bonds—ultimately hurting euro-denominated investors as it implies unlimited euro supply. He adds: “Second, we need to reconsider how Basel and Solvency rules are applied. We can’t be the only economy strictly adhering to these. America, originator of the 2008–2010 financial crisis, chose not to follow them.”

Macron argues that if America ignores global banking rules, Europe needn’t either. But such policies may trigger fiat system collapse and accelerate bitcoin and gold adoption.

Draghi’s recent report notes that to sustain massive welfare systems (e.g., France’s government spending at 57% of GDP—the highest among developed nations), the EU needs an additional €800 billion in annual investment. This will come from ECB money printing and financial repression forcing savers to buy long-term EU government bonds.

I’m not fabricating this. These statements come directly from across the EU political spectrum. They claim to know best how to invest EU savings. They tell you banks should be allowed infinite leverage to buy bonds of EU member states—and eventually, unified eurobonds issued by the ECB. Their justification? The so-called “Trump strategic intent.” If Trump-led America weakens the dollar, suspends banking regulations, and forces Europe to cut ties with Russia and China, then EU savers must accept low returns and financial repression. Europe’s “good citizens” must sacrifice capital and living standards to preserve the EU project.

I trust you’ve noticed the sarcasm. But if you’re willing to lower your living standards for “Europe™,” I won’t blame you. I bet many of you proudly wave the EU flag publicly, yet privately rush to your computers seeking escape routes. You know the way out: buy and self-custody bitcoin before it’s banned. But EU readers, that choice is yours alone.

Globally, as euro supply grows and EU capital controls tighten, bitcoin’s price will surge relentlessly. This is the inevitable result of current policies. Yet I believe it will be a case of “do as I say, not as I do.” Those in power may quietly move assets to Switzerland or Liechtenstein and frantically buy crypto. Meanwhile, ordinary people who fail to protect their savings will suffer under state-backed inflation. This is Europe’s current tragic reality.

Crypto’s Truth Terminal

Our Truth Terminal is a 24/7 crypto free market. Bitcoin’s rise after Trump’s victory in early November has already become a leading indicator of accelerating fiat money supply growth. In response to “Trump policies,” every major economy must react swiftly—typically through currency depreciation and intensified financial repression.

Bitcoin (yellow line) is driving growth in U.S. bank credit (white line).

Does this mean bitcoin will rise straight to $1 million without major pullbacks? Certainly not.

I believe the market fails to realize Trump has very limited time to deliver results. Current expectations for Trump and his team are too high—they’re expected to perform economic and political miracles overnight. But the problems behind Trump’s popularity have accumulated over decades and can’t be solved quickly. No matter how Elon Musk promotes on X, there are no instant fixes. Thus, Trump is unlikely to fully satisfy his supporters’ expectations or prevent Democrats from regaining control of Congress in 2026. Impatience stems from despair, and Trump, a shrewd politician, knows this. In my view, this means he must make bold moves early—hence my bet that he’ll push for a sharp dollar/gold devaluation within his first 100 days. It’s a simple way to quickly boost U.S. production cost competitiveness. This policy would rapidly bring manufacturing back, delivering immediate job growth—not waiting five years.

Before this crypto bull run enters a “blow-off top” phase, I expect a sharp market drop around January 20, 2025—Trump’s inauguration day. The Maelstrom team plans to reduce positions early and hopes to rebuy core assets at lower prices in the first half of 2025. Of course, every trader says this and believes they can time the market perfectly. But usually, they sell too early, then lack confidence to re-enter at higher prices—missing most of the bull run. Aware of this, we commit: if the bull market continues strongly after January 20, we’ll quickly adjust strategy, accept short-term losses, and re-enter the market.

“Trump policies” have clarified structural flaws in the global economic order and shown me that the best way to maximize investment returns in this environment is holding bitcoin and crypto. Thus, I’ll continue buying the dips and rallies, seizing opportunities in this bull market.

The future is here. The choice is yours.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News