Crypto's Year: Crossing the 2025 Regulatory Hills, Heading into the 2026 Value Deep Waters

TechFlow Selected TechFlow Selected

Crypto's Year: Crossing the 2025 Regulatory Hills, Heading into the 2026 Value Deep Waters

For investors, the key is no longer betting on the arrival of the "next full bull market," but rather making more pragmatic assessments of which assets and sectors to focus on.

Author: K1 Research & Klein Labs

Looking back at 2025, it was not simply a bull or bear market, but rather a repositioning of the crypto industry across political, financial, and technological coordinates—laying the foundation for a more mature and institutionalized cycle in 2026.

Monthly event timeline for 2025 source: Klein Labs

At the beginning of the year, Trump’s inauguration and the Executive Order on Digital Assets significantly shifted regulatory expectations. Meanwhile, the launch of the $TRUMP token brought cryptocurrency into mainstream attention, rapidly increasing market risk appetite. Bitcoin broke through $100,000 for the first time, completing its initial leap from a "speculative asset" to a "political and macro asset."

Soon after, the market faced a sharp reality check. The retreat of celebrity tokens, Ethereum's flash crash, and Bybit's historic hack collectively exposed issues around high leverage, weak risk controls, and narrative overextension. From February to April, the crypto market gradually cooled down from its frenzy. Macroeconomic tariff policies and traditional risk assets moved in tandem, prompting investors to reassess the weight of security, liquidity, and fundamental value in asset pricing.

During this phase, Ethereum stood out as particularly representative: ETH underperformed relative to Bitcoin, but this weakness did not stem from any degradation in technology or infrastructure. On the contrary, throughout the first half of 2025, Ethereum made steady progress on key roadmap items such as gas limits, Blob capacity, node stability, zkEVM, and PeerDAS, with infrastructure capabilities steadily improving. Yet, the market failed to price in these long-term developments accordingly.

By mid-year, structural recovery and institutionalization advanced simultaneously. Ethereum's Pectra upgrade and the Bitcoin 2025 Conference provided technical and narrative support, while Circle’s IPO marked a deep integration between stablecoins and compliant finance. The formal enactment of the GENIUS Act in July became the most symbolic turning point of the year—the crypto industry received clear, systematic legislative backing in the U.S. for the first time. Against this backdrop, Bitcoin hit a new annual high. At the same time, on-chain derivatives platforms like Hyperliquid grew rapidly, and new forms such as tokenized stocks and Equity Perps began entering the market landscape.

In the second half of the year, capital flows and narratives diverged markedly. Accelerated ETF approvals, growing expectations of pension fund participation, and the start of a rate-cutting cycle collectively lifted valuations of mainstream assets. In contrast, celebrity tokens, memecoins, and highly leveraged structures frequently underwent cleansing. The large-scale liquidation event in October became the concentrated release of risks for the entire year. Meanwhile, privacy-focused projects saw temporary strength, while emerging narratives such as AI payments and Perp DEXs quietly took shape within niche sectors.

As the year ended, the market closed with sideways declines amid low liquidity. Bitcoin fell below $90,000, while traditional safe-haven assets like gold and silver performed strongly, indicating that crypto had become deeply embedded within global asset allocation systems. At this juncture, major crypto assets entered a phase of consolidation at lower levels: Will 2026 follow the traditional four-year cycle, rebounding before sliding into a bear market? Or will sustained institutional inflows and improved compliance frameworks break the cycle, pushing prices to new highs? This question will be the core research focus for the next stage of market dynamics.

Macro Environment and Policy: Structural Shifts in 2025

1. A Shift in Policy Direction: The Fundamental Difference Between 2025 and Previous Cycles

Reviewing past cycles in the crypto industry, policy and regulation have always been significant exogenous factors shaping market expectations—but their role fundamentally changed in 2025. Unlike the hands-off growth seen in 2017, the loose permissiveness of 2021, or the broad suppression during 2022–2024, what emerged in 2025 was a systemic shift—from suppression toward permission, from ambiguity toward clarity and structure.

In previous cycles, regulation typically intervened negatively: either halting risk appetite at market peaks through bans, investigations, or enforcement actions, or releasing uncertainty en masse during bear markets via legal accountability. Under this model, regulation often failed both to protect investors effectively and to provide long-term development visibility for the industry, instead amplifying extreme volatility. But in 2025, governance began undergoing structural change: executive orders led the way, regulatory agencies aligned in tone, and legislative frameworks advanced progressively—replacing the prior case-by-case enforcement approach.

Crypto Regulation Development Timeline source: Messari

In this process, ETF approvals and stablecoin legislation played crucial roles as “expectation anchors.” The approval of spot ETFs allowed Bitcoin and Ethereum to enter traditional finance, gaining compliant access points suitable for long-term capital allocation. By the end of 2025, ETP/ETF products linked to Bitcoin and Ethereum reached a scale of several hundred billion dollars, becoming the primary vehicle for institutional capital investing in crypto. Meanwhile, stablecoin-related legislation (such as the GENIUS Act) established a tiered framework at the institutional level—defining which assets possess “financial infrastructure attributes” versus those remaining as high-risk speculative instruments. This distinction dismantled blanket valuation of “crypto as a whole,” driving differentiated pricing across assets and sectors.

It is important to note that the 2025 policy environment did not generate the kind of “policy-driven boom” seen in earlier cycles. Instead, its greater significance lies in establishing a relatively clear floor: defining permissible boundaries and distinguishing assets with long-term viability from those destined for marginalization. Within this framework, the role of policy shifted—from “driving rallies” to “constraining risk,” and from “creating volatility” to “stabilizing expectations.” Viewed this way, the policy shift in 2025 was less a direct engine for a bull market than an institutional foundation.

2. Capital First: Stablecoins, RWA, ETFs, and DAT Building 'Low-Risk Channels'

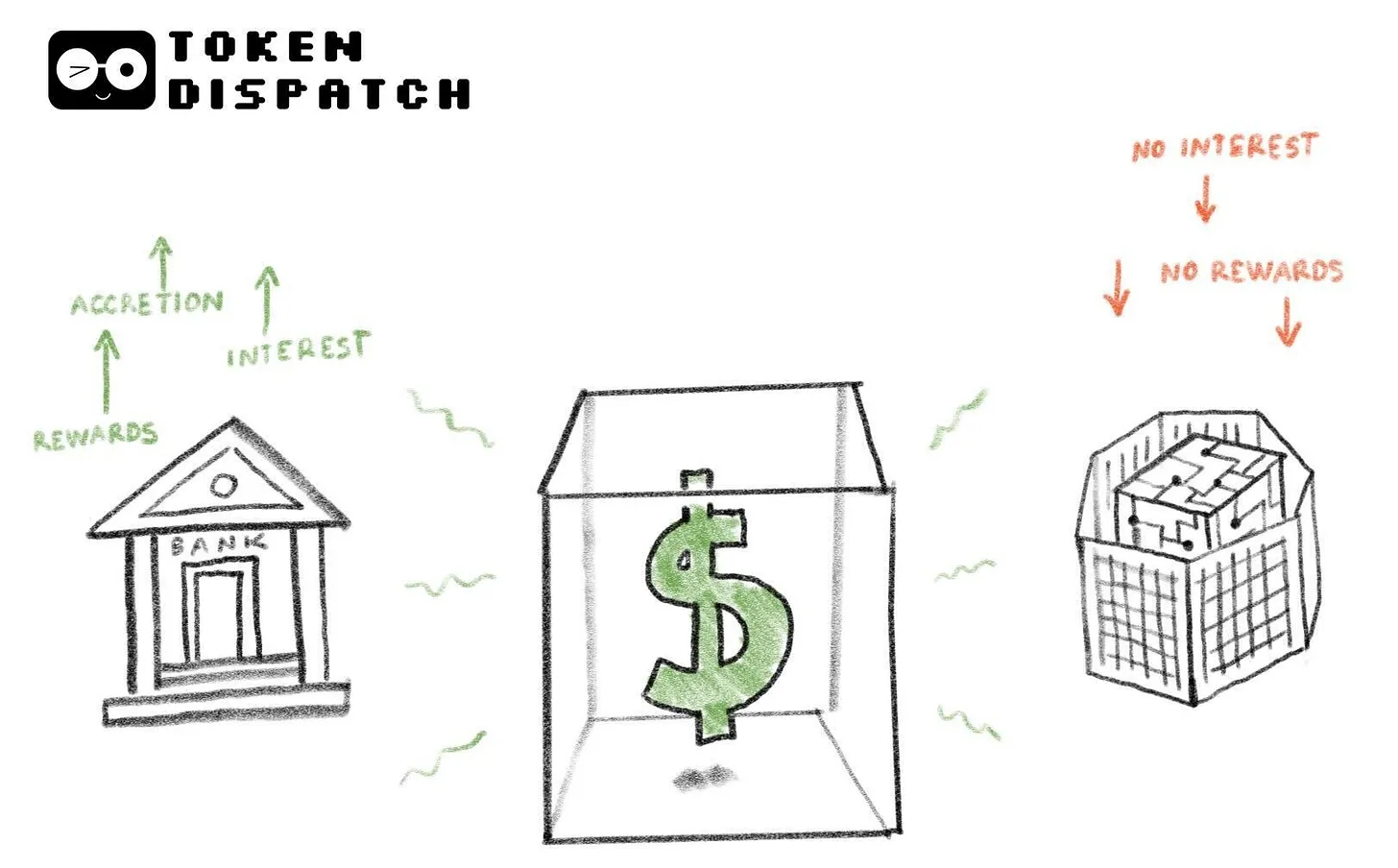

In the 2025 crypto market, a counterintuitive yet critical phenomenon became increasingly evident: capital did not disappear, but prices did not respond. Stablecoin market cap and on-chain transfer volumes remained consistently high, spot ETFs recorded net inflows across multiple windows, yet apart from a few blue-chip assets, most altcoins remained under prolonged pressure. This divergence between capital activity and price performance constitutes the central lens for understanding the 2025 market structure.

Stablecoins played a fundamentally different role in 2025 compared to previous cycles. Historically, stablecoins were mainly viewed as internal exchange “intermediary currencies” or leverage fuel during bull runs, with growth closely tied to speculation. In 2025, however, stablecoins evolved into tools for holding and settlement. Total stablecoin market cap grew from approximately $200 billion at the start of the year to over $300 billion by year-end—an increase of nearly $1 trillion—while the overall market cap of alt assets did not expand proportionally. Simultaneously, annual on-chain settlement volume reached multi-trillion-dollar levels, even exceeding the nominal transaction volume of traditional card networks. Clearly, the growth of stablecoins in 2025 stemmed primarily from payment, clearing, and cash management demand—not speculative leverage.

The development of RWA further reinforced this trend. Real-world assets deployed in 2025 were largely limited to low-risk categories such as government bonds, money market fund shares, and short-duration notes. Their primary significance wasn’t generating new price elasticity, but proving the feasibility of compliant assets existing on-chain. On-chain data shows TVL in RWA protocols accelerated in 2024 and continued rising in 2025—by October 2025, RWA protocol TVL approached $18 billion, up several-fold from early 2024.

While this scale remains insufficient to directly impact crypto asset prices at the macro level, its structural implications are clear: RWA offers on-chain capital a near-risk-free parking option, allowing some funds to “stay on-chain without participating in crypto price volatility.” Against a backdrop of attractive interest rates and clearer regulatory boundaries, this choice marginally weakened the traditional positive correlation between on-chain activity and token prices, further explaining the 2025 phenomenon of “capital growth with reduced price elasticity.”

ETFs impacted the market more through capital stratification than broad diffusion. Spot ETFs offered compliant, low-friction access to mainstream crypto assets like Bitcoin and Ethereum, but this entry path was highly selective. In practice, by early 2026, leading BTC/ETH spot ETFs held close to 6% and 4% of the respective circulating supplies, forming a clear institutional absorption layer for major assets. However, this incremental capital did not spill over into broader asset tiers. During the ETF rollout, BTC Dominance (Bitcoin’s share of total crypto market cap) did not experience the rapid decline typical of historical bull markets, instead staying elevated—indicating institutional capital did not flow into long-tail assets (typically tokens ranked beyond #100 by market cap). As a result, ETFs strengthened capital concentration in top-tier assets while objectively intensifying structural fragmentation within the market.

Equally noteworthy alongside ETFs was the rapid rise in 2025 of Digital Asset Treasury Companies (DATs)—publicly traded firms incorporating digital assets like BTC, ETH, and even SOL onto their balance sheets, using equity financing, convertible debt issuance, buybacks, and staking yields to turn stocks into “funded, leveragable exposure vehicles to crypto.” In scale, nearly 200 companies disclosed adopting similar DAT strategies, collectively holding over $130 billion in digital assets. DATs evolved from isolated cases into a trackable capital market structure. Structurally, DATs reinforce capital concentration in mainstream assets just like ETFs—but through a more “equity-based” mechanism: capital enters stock valuations and funding loops, rather than directly boosting secondary liquidity in long-tail tokens—thereby further deepening the capital divide between mainstream and alt assets.

In summary, incremental capital in 2025 was not absent—it systematically flowed into channels that are compliant, low-volatility, and suitable for long-term holding.

3. Market Outcome: Structural Stratification Between Mainstream and Alt Markets

From a final price perspective, the 2025 crypto market displayed a highly counterintuitive yet logically consistent state: the market did not collapse, yet the vast majority of projects experienced continuous declines. According to Memento Research’s analysis of 118 token launches in 2025, about 85% of tokens traded below their TGE price, with median FDV drawdowns exceeding 70%, and this underperformance did not significantly improve during subsequent market rebounds.

Token Launches in 2025 source: MEMENTO RESEARCH

This phenomenon was not confined to fringe projects, but extended across most mid- and small-cap assets—even affecting some high-profile, well-valued launches that significantly underperformed Bitcoin and Ethereum. Notably, even when weighted by FDV, aggregate performance remained clearly negative, suggesting larger, higher-valuation projects actually dragged the market down more. This outcome clearly indicates that the issue in 2025 was not “disappearing demand,” but rather directional migration of demand.

With policy and regulatory environments becoming clearer, the capital structure of the crypto market is evolving. However, this transformation has not yet fully replaced the short-term dominance of narratives and sentiment in price formation. Compared to past cycles, long-term and institutional capital now selectively enters compliant, liquid assets and channels—such as blue-chips, ETFs, stablecoins, and select low-risk RWAs. Yet these funds act more as “foundational supporters” than short-term price catalysts.

Meanwhile, dominant trading behavior remains driven by high-frequency capital and sentiment, while the token supply side continues operating under old-cycle logic—expanding supply based on assumptions of broad-based bull markets. As a result, the much-anticipated systemic “alt season” never materialized. New narratives can still trigger short-term price reactions amid emotional surges, but lack durable capital backing across volatility cycles. Prices tend to fall faster than narratives can be realized, resulting in recurring mismatches between supply and demand—both cyclical and structural.

It is precisely within this dual-layered structure that 2025 revealed a new market condition: at the macro level, allocation logic increasingly concentrates on blue-chips and assets with institutional anchoring; at the micro level, the crypto market remains a narrative- and sentiment-driven trading arena. Narratives have not died—they’ve just been significantly constrained in scope. They are better suited for capturing emotional swings than serving as foundations for long-term valuation.

Thus, 2025 did not mark the end of narrative-based pricing, but rather the beginning of narratives being filtered by capital structure. Prices still react to sentiment and stories, but only assets capable of attracting long-term capital retention after volatility can achieve genuine value accumulation. In this sense, 2025 resembled a “transition period of pricing power”—not an endpoint.

Industry and Narratives: Key Directions Under Structural Stratification

1. Tokens with Real Yield: The First Sector to Adapt to Changing Capital Structures

1.1 2025 Review: Yield-Bearing Assets Became Capital Sinks

In an environment where narratives still dominate short-term prices, but long-term capital begins setting thresholds for engagement, tokens offering real yield were the first to adapt to shifting capital structures. This sector demonstrated relative resilience in 2025 not because its narrative was more compelling, but because it offered capital a participation path independent of perpetual sentiment growth—even if prices stagnated, holding itself carried a clear return logic. This shift was first evident in the market acceptance of yield-bearing stablecoins. Take USDe, for example: it gained rapid capital recognition not through complex storytelling, but via a transparent and explainable yield structure. In 2025, USDe’s market cap briefly surpassed $10 billion, making it the third-largest stablecoin after USDT and USDC. Its growth rate and scale far outpaced most risk assets during the same period. This suggests that part of the capital now views stablecoins as cash management tools rather than mere trading intermediaries. In a high-interest-rate environment with increasingly defined regulations, such capital chooses to remain on-chain in stablecoin form. Consequently, its pricing logic shifted from “does it have narrative flexibility?” to “is the yield real and sustainable?” This does not mean the crypto market has fully transitioned to cash-flow-based valuation, but it clearly shows: when narrative space shrinks, capital gravitates toward asset forms that work without needing stories.

1.2 2026 Outlook: Capital Will Further Concentrate Around Core Value Assets

When markets enter sharp downturns or liquidity contractions, the assets worth watching are not those telling the best stories, but those possessing two types of resilience: first, whether the protocol can genuinely continue generating fees/income in low-risk-appetite environments; second, whether that income can create a “weak support” for the token through buybacks, burns, fee switches, or staking rewards. Therefore, assets like BNB, SKY, HYPE, PUMP, ASTER, and RAY—with more direct value capture mechanisms—tend to be prioritized for recovery during panic periods. Meanwhile, assets like ENA, PENDLE, ONDO, and VIRTUAL—clear in function but varying widely in strength and stability of value capture—are better suited for structural screening during post-crash sentiment recovery: whoever can convert functional usage into sustained revenue and verifiable token absorption earns the right to evolve from “trading narrative” to “allocatable asset.”

DePIN represents a longer-term extension of the real-yield logic. Unlike yield-bearing stablecoins or mature DeFi, DePIN’s core isn’t financial engineering, but whether tokenized incentives can transform real-world, capital-intensive, or inefficient infrastructure demands—compute, storage, communication, AI inference—into sustainable decentralized supply networks. The market completed initial filtering in 2025: projects unable to prove cost advantages or overly reliant on subsidies quickly lost capital patience. DePIN projects addressing real demand began to be seen as potential “income-generating infrastructure.” Currently, DePIN resembles a direction under intense observation due to accelerating AI demand, yet not broadly priced in. Whether it enters mainstream valuation in 2026 hinges on whether real demand can translate into scalable, sustainable on-chain revenue.

Overall, real-yield tokens became the first preserved sector not because they've reached maturity in value investing, but because—in a context where narratives are filtered by capital structure and alt seasons fail to materialize—they were the first to meet a simple, practical condition: providing capital with a reason to stay, even without continuous price appreciation. This also defines the key challenge for the sector in 2026—not “do we have a narrative?” but “after scaling, does the yield still hold?”

2. AI and Robotics × Crypto: The Key Variable in Productivity Transformation

2.1 2025 Review: Cooling Down of AI and Robotics Narratives

If there was one sector that “failed” in price terms in 2025 but became more important in the long run, AI and Robotics × Crypto stands out. Over the past year, DeAI investment热度明显降温,相关代币整体跑输主流资产,叙事溢价被快速压缩。但这一降温并非源于方向本身失效,而是因为 AI 将带来的生产力变革更多体现在生产效率的系统提升,其定价逻辑与加密市场定价机制出现了阶段性错位。

2024–2025 年,AI 产业内部发生了一系列结构性变化:推理需求相较训练需求快速上升,后训练(post-training)与数据质量的重要性显著提高,开源模型之间的竞争加剧,以及 Agent 经济开始从概念走向实际应用。这些变化共同指向一个事实——AI 正在从「模型能力竞赛」进入「算力、数据、协作与结算效率」的系统工程阶段。而这些恰恰是区块链在长期维度上可能发挥作用的领域:去中心化算力与数据市场、可组合的激励机制、以及原生的价值结算与权限管理。

2.2 2026 年展望:生产力革命仍是打开叙事上限的关键

展望 2026 年,AI × Crypto 的意义正在发生转移。它不再是「AI 项目发币」的短期叙事,而是为 AI 产业提供补充性基础设施与协调工具。Robotics × Crypto 亦是如此,其真正价值并不在于机器人本身,而在于多主体系统中如何实现身份、权限、激励与结算的自动化管理。当 AI Agent 与机器人系统逐渐具备自主执行与协作能力时,传统中心化系统在权限分配与跨主体结算上的摩擦开始显现,而链上机制提供了一种潜在的解决路径。

然而,这一赛道在 2025 年并未获得系统性定价,也正源于其生产力价值的兑现周期过长。与 DeFi 或交易类协议不同,AI 与 Robotics 的商业闭环尚未完全形成,真实需求虽在增长,但难以在短期内转化为可规模化、可预测的链上收入。因此,在当前「叙事被压缩、资金更偏好可承接资产」的市场结构下,AI × Crypto 更像是一个被持续跟踪、但尚未进入主流配置区间的方向。

AI、Robotics × Crypto 更应被理解为一个分层叙事:在长期维度上,DeAI 是潜在的生产力变革基础设施;在中短期维度上,以 x402 为代表的协议级创新,可能率先成为情绪与资金反复验证的高弹性叙事。这一赛道的核心价值,不在于是否立即被定价,而在于其一旦进入定价区间,所能打开的上限明显高于传统应用型叙事。

3. 预测市场与 Perp DEX:投机需求被制度与技术重新塑形

3.1 2025 年复盘:投机需求持续稳定

在叙事被压缩、长期资金趋于谨慎的背景下,预测市场与去中心化永续合约(Perp DEX)成为 2025 年少数实现逆势增长的赛道,其原因并不复杂:它们承接的是加密市场最原生、也最难被消灭的需求——对不确定性的定价与对杠杆交易的需求。与多数应用型叙事不同,这类产品并非「创造新需求」,而是对既有需求进行迁移。

预测市场的本质是信息聚合,资金通过下注行为对未来事件进行「投票」,价格则在不断修正中逼近集体共识。从结构上看,这是一种天然存在、且相对更合规的「赌场形态」:没有庄家操控赔率,结果由现实世界事件决定,平台仅通过抽取手续费获利。这一赛道的第一次高调亮相,出现在美国总统大选期间。围绕选举结果的预测市场在链上迅速聚集流动性与公众注意力,使其从边缘 DeFi 产品跃升为具备现实影响力的叙事方向。2025 年,该叙事并未退潮,而是随着基础设施成熟度提升、多个协议发币预期下而持续发酵。从数据层面看,2025 年预测市场已不再是小众实验。预测市场累计成交额已超过 24 亿美元,与此同时,全市场未平仓合约(Open Interest)维持在约 2.7 亿美元水平,显示这并非短期博弈流量,而是真正有资金在持续承担事件结果风险。

Perp DEX 的崛起则更加直接地指向加密行业的核心产品形态——合约交易。其意义并不在于「链上是否比链下更快」,而在于将不透明、高对手方风险的合约市场,引入一个可验证、可清算、无信任依赖的环境中。透明的仓位、清算规则与资金池结构,使 Perp DEX 展现出不同于中心化交易所的安全属性。然而,必须承认的是,2025 年绝大多数合约交易量仍集中在 CEX,这并非信任问题,而是效率与体验问题的结果。

3.2 2026 年展望:制度与技术决定其能否成为跨周期产品

展望 2026 年,Polymarket 与 Parcl 合作推出房地产预测市场,预测市场有机会触达更广泛的非加密用户群体,成为破圈应用。此外,世界杯这一全球性天然存在博弈的事件,极有可能成为预测市场的下一次流量拐点。此外,更重要的变量在于基础设施层面的成熟度提升:流动性深度的持续改善,包括做市机制、跨事件资金复用能力以及大额订单的价格承载能力;结果裁决与争议解决机制的完善。这两者将决定预测市场能否从「事件型博彩产品」,进化为一种可长期承载宏观、政治、金融与社会不确定性的概率定价基础设施。若上述条件逐步成熟,预测市场的上限将不止于短期流量,而在于其是否能成为加密体系中少数具备跨周期生命力的核心应用形态之一。

Perp DEX 能否持续扩展,关键不在于「是否去中心化」,而在于是否能在需求侧提供中心化平台暂时无法给出的增量价值。比如资金使用效率的再提升:通过将未被占用的合约保证金与 DeFi 协议深度结合,使其在不显著增加清算风险的前提下,参与借贷、做市或收益策略,从而提升整体资金使用率。如果 Perp DEX 能在安全、透明的基础上,进一步解锁这类结构性创新,其竞争力将不再只是「更安全」,而是「更高效」。

从更宏观的视角看,预测市场与 Perp DEX 的共同点在于:它们并不依赖长期叙事溢价,而是依赖可重复、可规模化的投机与交易需求。在叙事被筛选、山寨季缺席的环境中,这类赛道反而更容易获得持续关注。它们或许不是长期配置型资金的首选,但极有可能成为 2026 年内,情绪资金、交易资金与技术创新反复交汇的核心舞台。

Conclusion

In summary, 2025 was not a “failed bull market,” but a profound restructuring centered on pricing power, participant composition, and sources of value in the crypto market. On the policy front, regulatory logic shifted from highly uncertain suppression toward clearly defined boundaries and functional categorization. On the capital side, long-term investors did not directly return to high-volatility assets, but instead used structural instruments like ETFs, DATs, stablecoins, and low-risk RWAs to first establish compliant, auditable, low-volatility on-ramps. On the market level, the pricing mechanism underwent substantive change: narrative diffusion no longer automatically triggered linear price increases, broad-based alt seasons gradually faded, and structural divergence became the norm.

But this does not mean narratives have exited the market. Quite the opposite—in shorter timeframes and specific niches, narratives and sentiment remain the dominant trading drivers. The recurring vibrancy of prediction markets, Perp DEXs, AI payments, and memes shows that crypto remains a highly speculative, decentralized arena for information and risk博弈. The difference is that these narratives increasingly struggle to survive across cycles and solidify into long-term valuation foundations. They are now more like transient opportunities—continuously filtered by capital structure, rapidly tested, and swiftly eliminated—revolving around real use cases, trading needs, or risk expression.

Therefore, entering 2026, a more realistic and actionable framework is emerging: at the macro level, the market will continue consolidating around mainstream assets and infrastructure with real utility, distribution capability, and institutional anchoring; at the micro level, narratives are still worth engaging—but no longer worth believing in. For investors, the key is no longer betting on the arrival of the “next full bull market,” but pragmatically assessing which assets and sectors can not only survive shrinking markets, regulatory constraints, and intensified competition, but also regain momentum and pricing power when sentiment recovers and risk appetite temporarily returns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News