a16z: Behind the Palantir-ification of Everything, a Doomed Imitation

TechFlow Selected TechFlow Selected

a16z: Behind the Palantir-ification of Everything, a Doomed Imitation

Deconstructing the Replicable Aspects of Palantir's Model

Author: Marc Andrusko

Translation: TechFlow

TechFlow Editorial: Silicon Valley is caught in a "Palantir-ization" frenzy—AI startups are emulating Palantir by sending engineers to client sites, delivering highly customized services, and closing seven-figure deals.

Marc Andrusko, partner at a16z, offers a reality check: most companies are merely copying surface-level tactics and will ultimately become consulting firms in SaaS clothing. This article breaks down which parts of the Palantir model are truly replicable—and which are just illusions.

Main Content:

These days, it's common to hear a line in startup pitch decks: "We’re basically Palantir for X."

Founders love talking about deploying “Forward-Deployed Engineers” (FDEs) onsite with clients, building deeply customized workflows, and operating like special forces rather than traditional software vendors. Job postings for “forward-deployed engineers” have surged by hundreds of percentage points this year, as everyone rushes to replicate the model Palantir pioneered in the early 2010s.

I understand why this approach is appealing. Enterprise buyers today are overwhelmed when deciding what software to purchase—everything claims to be AI, and distinguishing signal from noise has never been harder. Palantir’s sales proposition is seductive: drop a small team into a chaotic environment, integrate disparate, siloed systems, and deliver a custom operational platform within months. For a startup aiming to land its first seven-figure deal, promising, “We’ll send engineers into your organization and get it done,” is an incredibly powerful pitch.

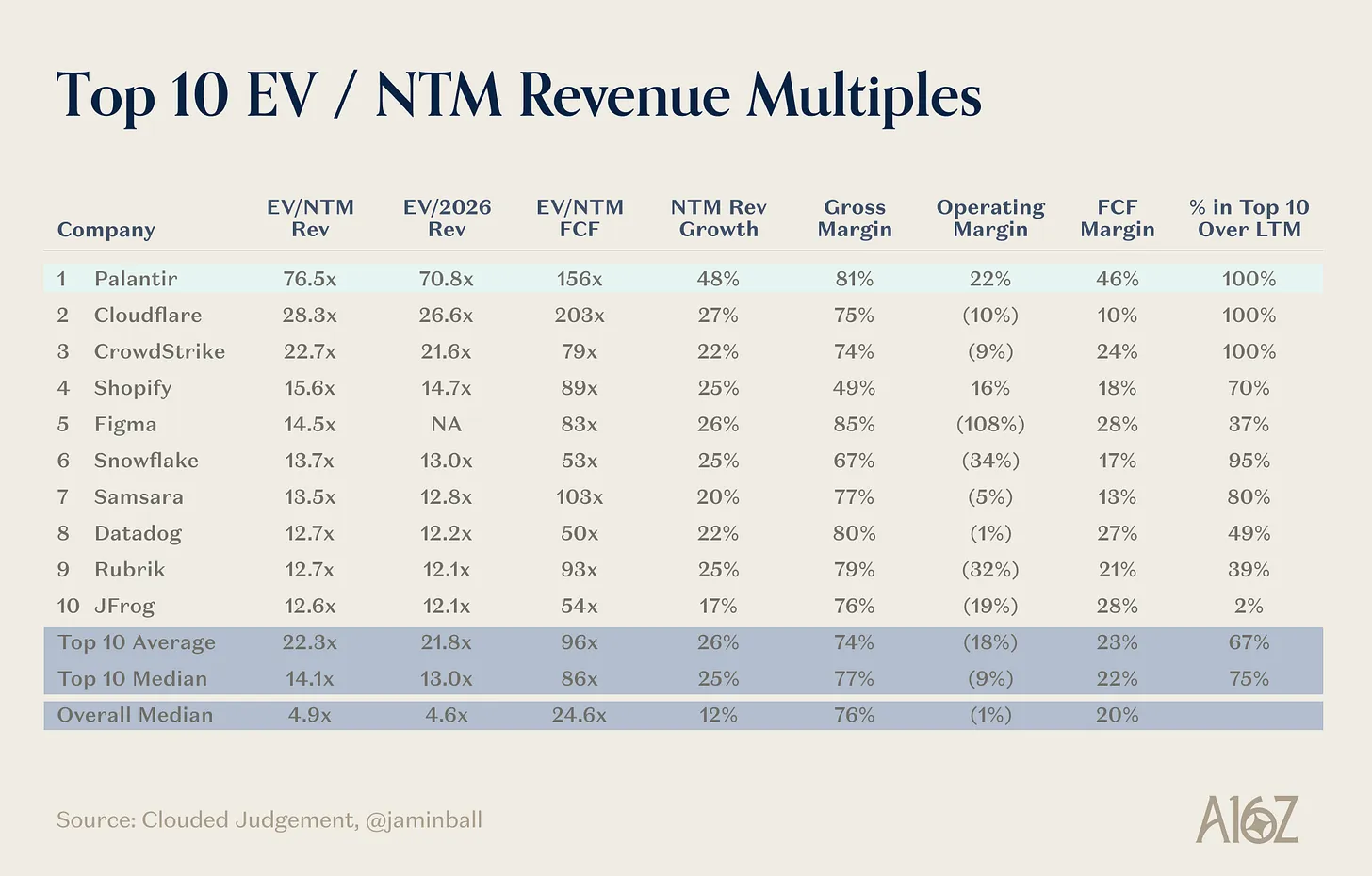

But I’m skeptical that “Palantir-ization” can be generalized as a playbook. Palantir is a “Category of One”—just look at how its stock trades! Most companies copying only the superficial aspects will end up as expensive service businesses trading on software valuation multiples, without any compounding competitive advantage. It reminds me of the 2010s, when every startup claimed to be a “platform,” but true platforms were extremely rare because they’re so hard to build.

This article aims to clarify which elements of the Palantir model are actually transferable and which are uniquely tied to its specific context, offering founders a more pragmatic roadmap for combining enterprise software with high-touch services.

What Does “Palantir-ization” Actually Mean?

“Palantir-ization” now refers to several interconnected practices:

Frontline Embedded Engineering

Forward-Deployed Engineers (called “Delta” and “Echo” inside Palantir) embed within client organizations—often for months—to understand business contexts, connect fragmented systems, and build custom workflows on the Foundry platform (or Gotham in high-security environments). Since pricing is typically fixed-fee with no traditional SKUs, these engineers are responsible for both building and maintaining those capabilities.

Highly Opinionated Integration Platform

Palantir’s product isn’t a loose toolkit but an opinionated platform for data integration, governance, and operational analytics—closer to an “operating system” for organizational data. The goal is to transform fragmented data into real-time, high-confidence decision-making.

Premium, High-Touch Sales Model

“Palantir-ization” also describes a sales style: long, deeply engaged sales cycles targeting mission-critical environments (defense, law enforcement, intelligence). Regulatory complexity and high-stakes industry bets aren’t bugs—they’re features.

Sell Outcomes, Not Licenses

Revenue comes from multi-year contracts tied to outcomes, bundling software, services, and ongoing optimization. Individual customer contracts can reach tens of millions per year.

A recent analysis defines Palantir as a “Category of One” because it excels simultaneously in three areas: (a) building an integrated product platform, (b) embedding elite engineers into client operations, and (c) proving itself in mission-critical government and defense settings. Most companies can achieve one or two of these—but not all three together.

Yet by 2025, everyone wants a piece of this model.

Why Everyone Wants to Copy Palantir Now

Three forces are converging:

1. Enterprise AI Has a “Last Mile” Problem

A large portion of AI initiatives stall before reaching production, usually due to messy data, integration headaches, and lack of internal champions. While procurement appetite remains strong (with real top-down pressure from boards and C-suites to “buy AI”), actual deployment and ROI often require extensive hands-on work.

2. Forward-Deployed Engineers Appear to Be the Missing Bridge

Media coverage and job market data show explosive growth in FDE roles this year—up 800% to 1000% across various sources—as AI startups use embedded engineers to make deployments stick.

3. Rapid Growth Is Expected (Seven-Figure Deals Scale Faster Than Five-Figure Ones)

If flying engineers onsite is the price of winning $1M+ deals from Fortune 500 or government clients, many early-stage companies are willing to trade gross margin for momentum. Investors are increasingly tolerant of lower margins, especially since new AI experiences often involve heavy inference costs. The bet is: win executive trust, deliver results, and then price accordingly.

So the narrative becomes: “We’ll do what Palantir did. We’ll send in an elite team, build something magical, and gradually turn it into a platform over time.”

This story works in very specific circumstances. But there are hard constraints that founders often gloss over.

Where the Analogy Breaks Down

Selling Outcomes from Day One

Palantir’s flagship product, Foundry, is a composition of hundreds of microservices—all aligned toward delivering outcomes. These microservices form productized, opinionated solutions to common enterprise problems across domains. Having met hundreds of AI application founders over the past two years, I can tell you where the analogy fractures: startups come in pitching grand outcome-based visions, while Palantir deliberately built microservices first—these became the foundational blocks of its core capabilities. This is exactly what distinguishes Palantir from typical consulting firms (and why it trades at ~77x next year’s revenue).

Palantir has a suite of core products:

- Palantir Gotham: A defense and intelligence platform helping military, intelligence, and law enforcement agencies integrate and analyze scattered data for mission planning and investigations.

- Palantir Apollo: A software deployment and management platform that autonomously and securely delivers updates and new features to any environment (multi-cloud, on-prem, air-gapped).

- Palantir Foundry: A cross-industry data operations platform integrating data, models, and analytics to drive enterprise decisions.

- Palantir Ontology: A dynamic, actionable digital model organizing real-world entities, relationships, and logic, powering applications and decisions within Foundry.

- Palantir AIP (Artificial Intelligence Platform): Connects AI models (like LLMs) to organizational data and operations via Ontology, creating production-ready AI-driven workflows and agents.

As one Everest report notes: “Palantir engagements start small. Initial collaboration might be a short training session and limited license. If value is proven, additional use cases, workflows, and data domains are layered on. Over time, revenue shifts from services toward software subscriptions. Unlike consulting firms, services are a means to drive product adoption, not the primary revenue source. Unlike most software vendors, Palantir is willing to invest its own engineering time upfront to win meaningful clients.”

On one hand, I now see AI app companies jumping straight to seven-figure contracts. On the other, this is largely because they operate in full customization mode—solving whatever problem early customers throw at them, hoping themes will emerge later to shape core capabilities or “SKUs.”

Not Every Problem Is a “Palantir-Level” Problem

Palantir’s early domains had no viable alternatives: counterterrorism, fraud detection, battlefield logistics, high-risk medical operations. The value of solving these problems was measured in billions of dollars, lives saved, or geopolitical consequences—not incremental efficiency gains.

If you're selling to a mid-sized SaaS company to optimize its sales process by 8%, you can't afford the same level of custom deployment. The ROI simply doesn’t justify months of embedded engineering effort.

Most Customers Don’t Want to Be Your Permanent R&D Lab

Palantir’s clients default to co-evolving the product with the company; they tolerate ambiguity because stakes are high and alternatives are scarce.

Most enterprises—especially outside defense and regulated sectors—don’t want to feel like they’re part of an ongoing consulting engagement. They want predictable implementations, interoperability with existing tools, and fast time-to-value.

Talent Density and Culture Can’t Be Generalized

Palantir spent over a decade recruiting and training exceptionally capable generalist engineers who can write production-grade code, navigate bureaucracy, and sit comfortably in meetings with colonels, CIOs, and regulators. Former employees have spawned an entire “Palantir mafia” of founders and executives—many leading unicorn companies because they combine deep technical skill with exceptional client effectiveness.

Most startups cannot assume they’ll hire hundreds of such people. In practice, “we’ll build a Palantir-style FDE team” often devolves into:

- Rename pre-sales solution engineers as “FDEs”

- Ask junior generalists to handle product, implementation, and account management simultaneously

- Leadership that’s never seen a real Palantir deployment but likes the vibe

To be fair, there are many talented individuals outside Palantir, and tools like Cursor are enabling non-engineers to code. But scaling the Palantir model at volume requires an extremely rare blend of business and technical talent—experience at Palantir helps precisely because it’s such a unique company. And that pool of people is finite!

The Services Trap Is Real

Palantir works because there’s a genuine platform underneath the customization. If you only copy the embedded engineer component, you’ll end up with thousands of bespoke deployments that can’t be maintained or upgraded. Even in a world where AI tools allow such models to reach software-like gross margins, companies overly reliant on frontline deployment without a strong product backbone may fail to achieve increasing returns to scale or durable moats.

Undiscerning investors might see hockey-stick contract value growth—from $0 to $10M—and rush in. But my question is: what happens when dozens (or hundreds) of these $10M startups start pitching the exact same thing and collide?

At that point, you’re not “Palantir for X.” You’re “Accenture for X,” with a prettier frontend.

What Palantir Actually Got Right

Beneath the myth, several elements deserve close attention:

1. Platform-First, Not Project-First

Palantir’s forward-deployed teams build using a small set of reusable primitives—data models, access controls, workflow engines, visualization components—rather than writing entirely custom systems for each client.

2. Strong Opinions About How Work Should Be Done

The company doesn’t just automate existing processes—it often pushes clients toward new ways of working, with the software embodying those opinions. This kind of supplier assertiveness is rare and enables reuse.

3. Long Time Horizon and Patient Capital

Becoming Palantir-like requires enduring years of negative sentiment, political controversy, and uncertain near-term monetization while the platform and sales model mature.

4. Very Specific Market Mix

Early focus on intelligence and defense wasn’t accidental: high willingness to pay, high switching costs, enormous stakes, and a tiny number of massive clients. Not to mention decades-old competitors who rarely faced competition.

In short, Palantir isn’t just “software + consulting.” It’s “software + consulting + political project + extremely patient capital.”

This isn’t something you can casually graft onto a vertical SaaS product.

A More Realistic Framework: When Does “Palantir-ization” Make Sense?

Instead of asking “How do we become like Palantir?”, ask a series of threshold questions:

1. Problem Criticality

Is the problem “mission-critical” (human lives, national security, billions of dollars at stake), or “nice-to-have” (10–20% efficiency gain)? The higher the stakes, the more justified the frontline deployment model.

2. Customer Concentration

Are you selling to dozens of massive clients, or thousands of small ones? Embedded engineering scales better with concentrated, high-ACV (Annual Contract Value) customer bases.

3. Degree of Domain Fragmentation

Are workflows similar across clients and tooling consistent—or does every deployment differ fundamentally? If every customer is a snowflake, building a coherent platform is nearly impossible. Some homogeneity helps.

4. Regulation and Data Gravity

Are you operating in highly regulated domains with acute data integration pain points (defense, healthcare, financial crime, critical infrastructure)? That’s where Palantir-style integration creates real value.

If you fall mostly into the bottom-left quadrant of these dimensions (low criticality, fragmented customers, relatively simple integrations), full “Palantir-ization” is almost certainly the wrong model. In such cases, a bottoms-up PLG (Product-Led Growth) strategy is more appropriate.

What’s Worth Learning

While I doubt every early-stage company can successfully adopt the Palantir model, there are several valuable takeaways:

1. Use Frontline Deployment as Scaffolding, Not the Building

The following approaches can make sense:

- Embed engineers with early design partners

- Do whatever it takes to get the first 3–5 customers into production

- Use these collaborations to stress-test your primitives and abstractions

But clear guardrails are essential:

- Time-bound deployments (e.g., “90-day sprint to production”)

- Clear ratios (e.g., “maximum number of engineering heads per $1M ARR per customer”)

- Quarterly goals to convert custom code into reusable configurations or templates

Otherwise, “we’ll productize later” becomes “we never got around to it.”

2. Build on Strong Primitives, Not Custom Workflows

Palantir’s real lesson lies in product architecture:

- Unified data model and permissions layer

- Generic workflow engine and UI primitives

- Configuration over code wherever possible

Forward-deployed teams should spend time selecting and validating combinations of primitives—not building entirely new things for each client. Leave greenfield development to engineers.

3. Make FDEs Part of Product, Not Just Delivery

In Palantir’s world, FDEs are deeply involved in product discovery and iteration, not just implementation. Strong product and platform teams feed on insights gathered by FDEs in the field.

If your FDEs sit in a separate “professional services” silo, you lose this feedback loop—and slide toward becoming a pure service firm.

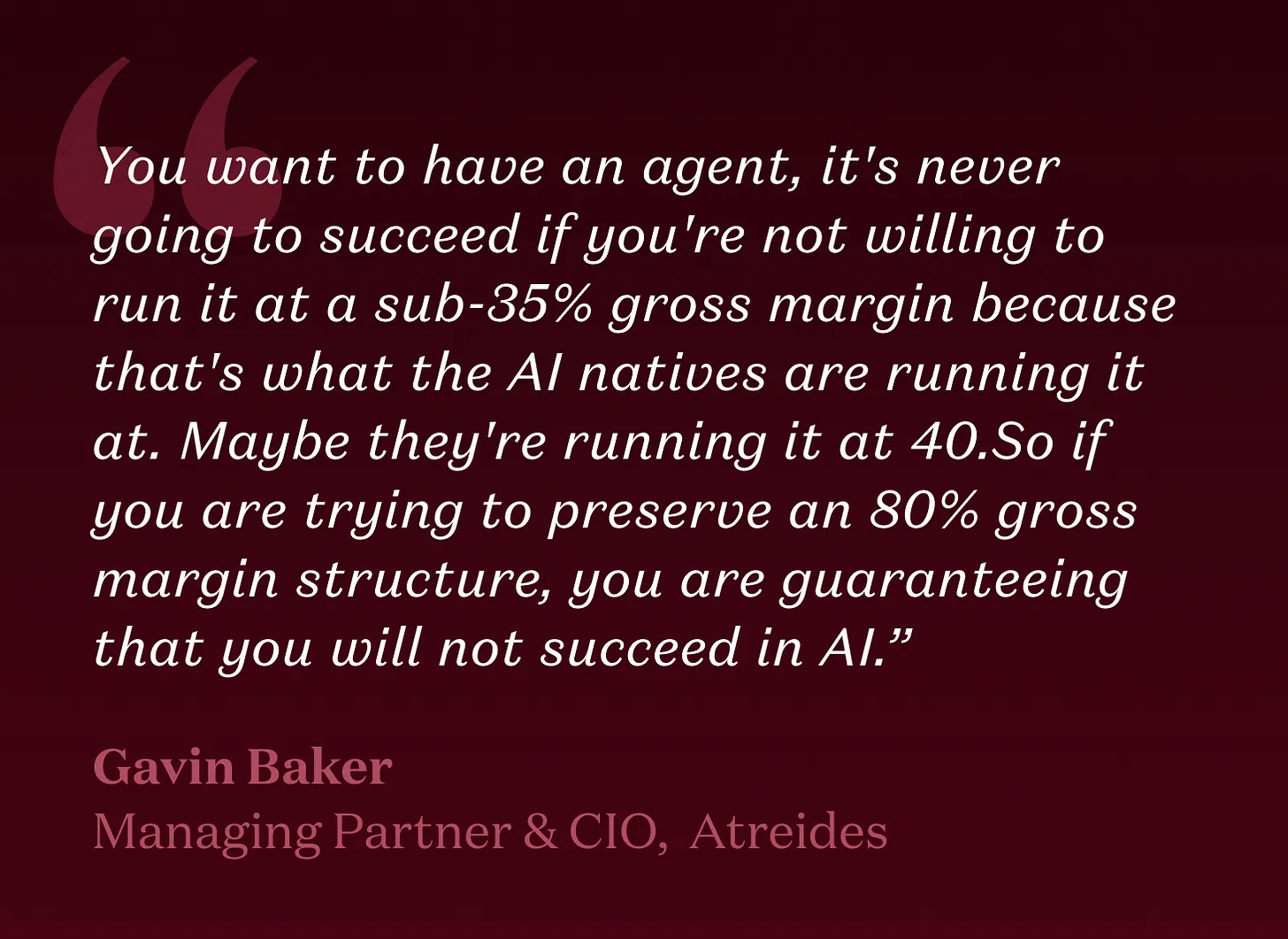

4. Be Honest About Your Gross Margin Structure

If your pitch assumes >80% software gross margins and 150% net dollar retention, but your go-to-market relies on long-term onsite projects, be transparent about the trade-offs—at least internally.

For certain categories, structurally lower gross margins with higher ACV can be perfectly rational. The danger lies in pretending to be a SaaS company while operating as a service business with a platform veneer. Investors often care about the path to maximum absolute gross profit, which can sometimes come from larger contracts with higher COGS (Cost of Goods Sold).

How I’d Stress-Test a “Palantir-ized” Startup

When a founder tells me “We’re Palantir for X,” here are the questions in my notebook:

- Show me the boundary of your opinionated platform. Where does shared product end and client-specific code begin? How quickly does that boundary move?

- Walk me through your deployment timeline. How many engineer-months from contract to first production use? What absolutely must be custom?

- What’s the gross margin on a mature customer in Year 3? Does frontline deployment effort decline significantly over time? If not, why?

- If you signed 50 customers next year, where would it break? Hiring? Onboarding? Product? Support? I want to see where the model cracks.

- How do you decide NOT to customize? The willingness to say “no” to customization is often what separates real product companies from “service firms with a nice demo.”

If the answers are clear, grounded in real deployments, and architecturally coherent, some degree of Palantir-style frontline deployment could indeed be a real advantage.

If the answers are vague, or if every engagement is clearly unique, it’s hard to vouch for repeatability or true scalability potential.

Conclusion

Palantir’s success has created a powerful aura that dominates the psyche of risk-taking entrepreneurs and venture capitalists: elite engineering squads drop into complex environments, untangle chaos, and deliver systems that transform organizational decision-making.

It’s easy to believe every AI or data startup should look like this. But for most categories, full “Palantir-ization” is a dangerous fantasy:

- Problems aren’t critical enough

- Customers are too fragmented

- Talent models don’t scale

- Economics quietly collapse into a services business

For founders, a more useful question isn’t “How do we become Palantir?” but:

“To bridge the AI adoption gap in our category, how much Palantir-style frontline deployment do we need—and how quickly can we turn it into a real platform business?”

Get that right, and you can borrow the most important parts of this playbook—without inheriting the burdens that could crush you.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News