BofA's Hartnett: "New global order = new global bull market = bull market in gold and silver," with the biggest risk to the bull market being the appreciation of East Asian currencies

TechFlow Selected TechFlow Selected

BofA's Hartnett: "New global order = new global bull market = bull market in gold and silver," with the biggest risk to the bull market being the appreciation of East Asian currencies

For asset allocation, Hartnett suggests going long on international equities and "economic recovery"-related assets, while also favoring the long-term outlook for gold.

Source: Wall Street Insights

Hartnett, Chief Investment Strategist at Bank of America, believes Trump is driving global fiscal expansion, creating a "New World Order = New World Bull Market" framework. Under this scenario, the bull markets in gold and silver will persist, while the biggest current risk lies in the potential for rapid appreciation of the yen, won, and new Taiwan dollar to trigger a global liquidity crunch.

The yen is currently near 160, approaching its weakest historical level, with its exchange rate against the renminbi hitting the lowest since 1992. Hartnett warns that if these extremely weak East Asian currencies experience a sharp rebound, it could reverse capital outflows from Asia, threatening the global market's liquidity environment.

In terms of asset allocation, Hartnett recommends going long on international equities and assets linked to "economic recovery," while maintaining a positive long-term outlook on gold. He views China as his top preferred market, as the end of deflation in China could act as a catalyst for bull markets in Japan and Europe.

Gold could break through $6,000 to reach a historic high, while small-cap and mid-cap stocks are expected to benefit from reductions in interest rates, taxes, and tariffs. However, the sustainability of this optimistic outlook depends on whether the U.S. unemployment rate can remain low and whether Trump can boost his approval ratings by lowering the cost of living.

01 New World Order Fuels Global Bull Market

Assuming the yen does not collapse in the short term, Hartnett believes the market is entering a phase of "New World Order = New World Bull Market." Trump is pushing forward global fiscal expansion, succeeding Biden’s previous approach.

Under this framework, Hartnett recommends increasing exposure to international equities, as positioning favoring American exceptionalism is undergoing a rebalancing toward global markets. Data shows that in the 2020s, U.S. equity funds attracted $1.6 trillion in inflows, compared to only $0.4 trillion for global funds—an imbalance that is expected to correct.

China is Hartnett’s most favored market. He argues that the end of deflation in China will serve as a catalyst for bull markets in Japan and Europe.

From a geopolitical perspective, the Tehran Stock Exchange has risen 65% since last August, while Saudi Arabia and Dubai markets have remained stable, suggesting no revolution will occur in the region. This is good news for markets, given Iran accounts for 5% of global oil supply and 12% of oil reserves.

02 Gold Bull Market Is Far From Over

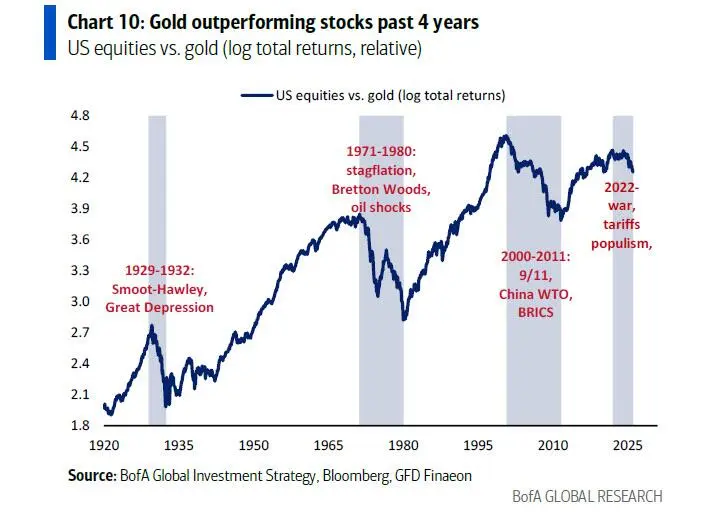

Hartnett emphasizes that the New World Order is fueling not only an equity bull market but also a bull market in gold.

Although gold—and especially silver—are currently overbought in the short term—silver prices are 104% above their 200-day moving average, the most overbought level since 1980—the fundamental case for gold’s long-term rise remains intact.

Gold was the best-performing asset of the 2020s, driven by factors such as war, populism, the end of globalization, excessive fiscal expansion, and debt devaluation.

The Federal Reserve and the Trump administration are expected to inject $600 billion in quantitative easing liquidity in 2026 through purchases of Treasuries and mortgage-backed securities.

Over the past four years, gold has outperformed both bonds and U.S. equities, and there are no signs of this trend reversing. While overheated bull markets often face strong pullbacks, a higher allocation to gold still makes sense.

Currently, gold allocations among Bank of America’s high-net-worth clients stand at just 0.6%. Considering that the average gain during the four gold bull markets over the past century was about 300%, gold prices could surpass $6,000.

03 Small-Caps and Economic Recovery Assets to Benefit

Beyond gold, other assets are also benefiting from the New World bull market.

Hartnett believes that rate cuts, tax reductions, tariff reductions, and the "put option protection" provided by the Fed, the Trump administration, and Generation Z explain the market rotation into "devaluation" trades (such as gold and the Nikkei) and "liquidity" trades (such as space and robotics) following the Fed’s rate cut on October 29 and Trump’s election victory on November 4.

Hartnett recommends going long on assets tied to "economic recovery," including mid-cap and small-cap stocks, homebuilders, retailers, and transportation, while shorting large-cap tech stocks—unless one of the following occurs:

First, U.S. unemployment rises to 5%. This could be driven by corporate cost-cutting, AI adoption, and immigration restrictions failing to prevent rising joblessness. Notably, youth unemployment has increased from 4.5% to 8%, and despite a significant drop in Canadian immigration, unemployment has still risen from 4.8% to 6.8% over the past three years. If tax cuts are saved rather than spent, it would hurt cyclical sectors.

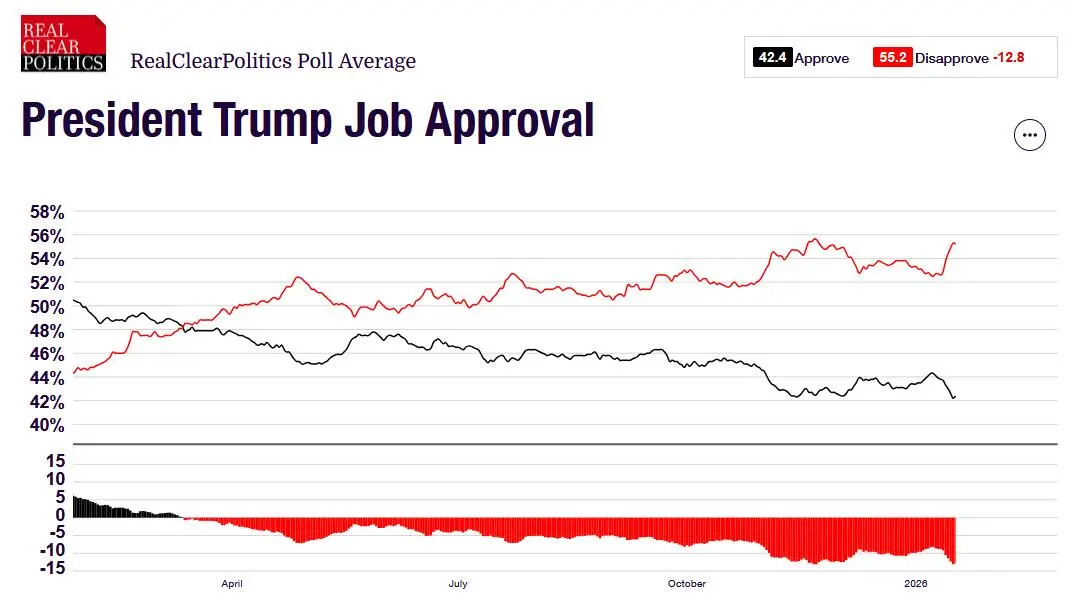

Second, Trump’s policies fail to significantly lower the cost of living through large-scale intervention. Main Street interest rates remain high, and unless energy, insurance, healthcare, and AI-driven electricity prices fall, Trump’s low approval ratings will be difficult to improve. Currently, Trump’s overall approval stands at 42%, economic policy approval at 41%, and inflation policy approval at just 36%.

Historically, Nixon’s move in August 1971 to freeze prices and wages successfully improved the cost of living—his approval rose from 49% in August 1971 to 62% at re-election in November 1972.

But if Trump’s approval fails to improve by the end of Q1, midterm election risks will rise, making it harder for investors to continue betting on "Trump prosperity" cyclical assets.

04 Rising East Asian Currencies Pose Biggest Risk

Hartnett points out that market consensus in Q1 is extremely bullish, but the greatest risk comes from a rapid appreciation of the yen, won, and new Taiwan dollar. The yen is currently trading near 160, its weakest level against the renminbi since 1992.

Such a rapid rebound could be triggered by factors including a Bank of Japan rate hike, U.S. quantitative easing, Sino-Japanese geopolitical tensions, or hedging failures.

If it happens, it could trigger a global liquidity squeeze, as the $1.2 trillion in capital flows from Asia—used to recycle current account surpluses into the U.S., Europe, and emerging markets—would reverse.

Hartnett’s warning signal is the risk-off combination of "yen rising, MOVE index rising." Investors should closely monitor this indicator to determine when to exit the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News