Tech companies' journey with Bitcoin: Microsoft declines, Tesla holds, MicroStrategy reaches milestone

TechFlow Selected TechFlow Selected

Tech companies' journey with Bitcoin: Microsoft declines, Tesla holds, MicroStrategy reaches milestone

Tech companies show divided attitudes toward Bitcoin.

Author: Tuoluo Finance

Last week's market was volatile.

On the policy front, everything looked promising—expectations for rate cuts intensified and Trump’s pro-crypto stance continued. However, on the news front, reactions were mixed. First came panic sparked by Google's quantum computer announcement, followed by Microsoft voting down a proposal to invest in Bitcoin, briefly cooling off market FOMO. Major cryptocurrencies dipped, and altcoins suffered sharp declines. On the other hand, MicroStrategy’s successful inclusion into the Nasdaq-100 index reignited bullish sentiment.

Currently, with a December rate cut anticipated, market sentiment remains strong and price support levels are gradually rising. Yet among tech companies, divergence in Bitcoin adoption strategies continues.

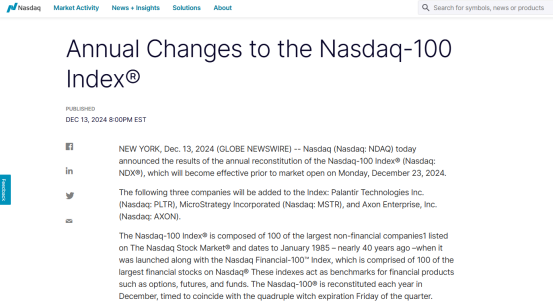

On December 14, according to Nasdaq’s official announcement, MicroStrategy (MSTR) has officially been added to the Nasdaq-100 Index, ranking as the 40th largest company in the index with a market cap exceeding $98 billion. Also joining the index are data analytics firm Palantir Technologies and Taser manufacturer Axon Enterprise, while gene sequencing equipment maker Illumina, AI server manufacturer Super Micro Computer, and vaccine developer Moderna were removed. The updated index will take effect prior to market open on December 23.

In fact, several days before the official announcement, Crypto Briefing had already reported the news, which later triggered Polymarket betting on whether the inclusion would be confirmed. As a result, when the news was officially confirmed, the market did not rally significantly—in fact, "sell the news" behavior caused minor volatility in major cryptocurrencies.

However, as of today, combined with the high likelihood of an upcoming rate cut, the market predictably resumed its upward momentum. Bitcoin briefly surged past $106,000 to a new all-time high, Ethereum broke above $4,000, and the entire crypto sector rallied across the board. RWA tokens led the gains with a 7.23% increase, while the long-dormant NFT sector also rose 7.06%.

Why does the Nasdaq-100 Index carry such significance? Launched in 1985, it has a long history and consists of the top 100 listed companies on the Nasdaq based on market capitalization and influence. These stocks primarily come from technology, consumer goods, healthcare, industrial, and communications sectors, with a heavy emphasis on tech. Unlike the S&P 500 or the Nasdaq Composite Index, the Nasdaq-100 excludes financial institutions and only includes non-financial firms.

To date, the index encompasses many well-known tech giants such as Apple, Microsoft, Google, Amazon, Tesla, Meta, Nvidia, and Intel. In performance, over the past decade the Nasdaq-100 has delivered roughly double the returns of the S&P 500, exhibiting clear characteristics of high return and high volatility. This year alone, driven by strength in the tech sector, the Nasdaq-100 has gained over 30%.

Over time, the index has attracted substantial interest from large investors. Notably, the Invesco QQQ Trust Fund tracks the Nasdaq-100 and now manages $320 billion in assets. According to Bloomberg analyst James Seyffart, approximately $451 billion in ETFs globally directly track the Nasdaq-100. When the index rebalances, global ETFs are expected to purchase at least $22 billion worth of shares across 19 different stocks. Based on this calculation, around $2.1 billion in fresh capital could flow into MicroStrategy.

While not as universally recognized as the S&P 500, the Nasdaq-100 still holds considerable prestige and credibility within traditional finance. MicroStrategy’s inclusion as the first crypto-native company in the index undoubtedly reflects the growing influence of the crypto space. It broadens investor access and marks a watershed moment for crypto enterprises entering mainstream finance. Regardless of individual stock or sector impact, this inclusion carries profound implications.

As for why it qualified, the reason is straightforward: market capitalization trumps all. The criteria for Nasdaq-100 inclusion are relatively lenient—companies must rank within the top 100 by market cap and maintain an average daily trading volume of at least 200,000 shares—but there is no requirement for profitability.

Since beginning Bitcoin purchases in 2020 under the leadership of fervent crypto advocate Michael Saylor, MicroStrategy has become a Wall Street celebrity among crypto firms. From a business model perspective, originally a BI software company, MicroStrategy now centers entirely around Bitcoin. Its valuation relies on a premium-based model, using equity dilution to raise funds, increasing BTC holdings, boosting BTC per share, and thereby driving up market capitalization. Simply put, it designs allocation ratios between equity and Bitcoin, raising capital through bonds and share sales to buy Bitcoin, then leveraging Bitcoin appreciation for capital growth.

This year alone, MicroStrategy issued over $6 billion in convertible notes to fund Bitcoin purchases. As of December 8, 2024, it had acquired 423,650 BTC at an average price of approximately $60,324 per coin, totaling about $25.6 billion—making it the publicly traded company with the largest Bitcoin holdings globally.

Against the backdrop of rising Bitcoin value, MicroStrategy’s stock has soared. Its share price has risen over 500% this year, peaking at $543, with trading volume reaching staggering levels—on certain days surpassing even Nvidia and Tesla. Currently, MicroStrategy’s market cap stands near $98 billion, placing it among the top 100 U.S. public companies by market value.

The extraordinary returns have stirred significant controversy. Even prominent short-seller Citron Research targeted the company, arguing that its valuation is excessively inflated. Nevertheless, MicroStrategy has sparked a wave of copycat strategies. This year, Bitcoin miners including Marathon Digital, Riot Platforms, Core Scientific, Terawulf, and Bitdeer have all emulated MicroStrategy’s approach, using similar convertible debt financing to acquire Bitcoin.

Given its massive influence, strong profit appeal, high valuation, and large market cap, MicroStrategy’s inclusion in the Nasdaq-100 is hardly surprising. With increased exposure to traditional investors, further stock appreciation remains possible—meaning more capital available for additional Bitcoin purchases. On December 13, the founder even hinted via social media at plans to buy more Bitcoin.

Notably, the inclusion has also drawn greater scrutiny. Nasdaq explicitly requires member companies to be non-financial, yet while MicroStrategy nominally operates as a tech firm, its core activity is effectively hoarding and speculating on Bitcoin—functioning more like a Bitcoin investment vehicle or even a de facto Bitcoin ETF. The founder has even declared that MicroStrategy will become a “Bitcoin bank.”

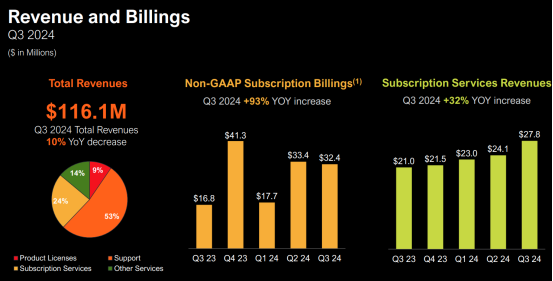

Michael Lebowitz, portfolio manager at RIA Advisors, bluntly stated: “This is essentially a company that would die without Bitcoin.” Financial reports support this view. According to its Q3 earnings, MicroStrategy recorded cumulative revenue of $343 million in the first three quarters of fiscal 2024, down 7.81% year-on-year from $372 million. Over the same period, it incurred a net loss of $496 million. Software business revenue in Q3 totaled just $116.1 million, a 10.3% decline year-on-year.

On a positive note, the FASB fair value accounting rule officially took effect today. Under the new standard, companies can now record Bitcoin at current market value rather than acquisition cost, giving crypto firms like MicroStrategy greater financial flexibility. It is foreseeable that during next February’s earnings season, most crypto companies will report significantly stronger financial results.

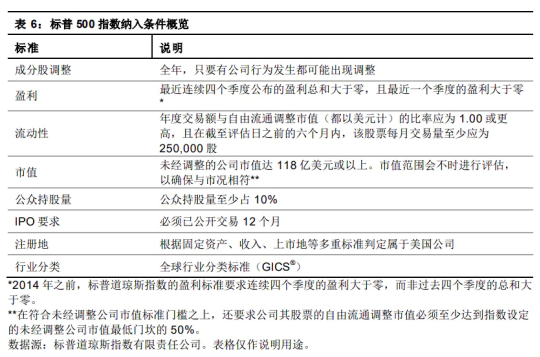

Criticism persists, but market expectations stretch further ahead. Due to its corporate classification, MicroStrategy’s tenure in the Nasdaq-100 may not last long. Bloomberg analyst James Seyffart suggests ICB might reclassify MicroStrategy as a financial stock during the next review in March. But having achieved this milestone on Nasdaq, broader recognition via inclusion in the S&P 500 has become the next market aspiration. While the S&P 500 is more flexible regarding corporate classification, it imposes stricter profitability requirements—specifically, a company must have positive net income over the most recent four consecutive quarters. Although this currently conflicts with MicroStrategy’s financial reality, hopes remain due to the incoming administration and the new accounting standards.

Just as one story resolves the issue of high valuation premiums, another brings cold water—Microsoft.

Prior to MicroStrategy’s Nasdaq-100 announcement, on December 11, Microsoft held its final vote on a shareholder proposal to add Bitcoin to its balance sheet. As predicted, despite a passionate three-minute pitch by Michael Saylor urging shareholders to support the move, experts maintained that investing in crypto cannot guarantee improved portfolio returns. True to the board’s earlier stance, Keith Dolliver, Microsoft’s Deputy General Counsel, announced during the live shareholder meeting that the proposal was officially rejected.

Based on this precedent, Amazon’s similar proposal in April is also likely to be rejected. Following the news, Bitcoin temporarily dropped below $95,000. As always, for large tech giants holding vast cash reserves, volatility remains a key concern. Most prefer conservative and stable financial strategies over high-risk, high-volatility investments. Strategic acquisitions and sustained R&D spending align better with their long-term values than speculative returns. Moreover, tech giants care deeply about public image, and the high energy consumption associated with Bitcoin mining contradicts their promoted green initiatives, potentially inviting regulatory backlash—one more reason they hesitate to enter the space.

Undeniably, tech companies holding Bitcoin has become a trend. According to DL News, around 144 companies now hold Bitcoin on their balance sheets. Yet attitudes among tech firms show clear divergence, falling into three main paths: First, aggressive adopters like MicroStrategy, which have built their entire business around Bitcoin—mostly mirrored by other crypto-native firms. Second, conservative giants like Microsoft and Amazon, prioritizing stability and caution, remaining on the sidelines. Third, a middle ground where companies hold Bitcoin while maintaining core operations,though with nuanced differences—some view Bitcoin as part of asset diversification, such as Tesla and SpaceX under Elon Musk, with Tesla currently holding9,720 BTC;others use Bitcoin for promotional synergy, typically firms facing stagnant growth.

Still, this divergence among tech firms hasn’t dampened overall market enthusiasm. While giants remain cautious, other return-seeking companies won’t slow down—Bitcoin strategies are simple to implement and offer rare growth opportunities. Broadly speaking, under a Trump-led pro-crypto administration, Bitcoin is likely to gain speculative momentum on par with AI in the U.S. stock market, representing a new avenue for value creation. Whether for brand marketing, asset allocation, or stock price stabilization, amid potential growth spirals, numerous companies—especially those facing operational bottlenecks—will be reluctant to abandon this strategy. Therefore, as crypto continues to go mainstream, corporate adoption will only grow. Even if not led by giants, these moves still represent vast inflows of institutional capital.

Meanwhile, the Trump effect continues. On December 15, Trump reiterated in an interview his plan to establish a strategic Bitcoin reserve akin to the oil reserve and pledged to “do some great things” in the cryptocurrency space. As expected, with strong policy tailwinds, bullish sentiment in the crypto market remains robust. The market has already responded—the dense concentration of Bitcoin holder prices is shifting from $95,000 toward $100,500.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News