Dual-Pool Liquidity Integration for Unified DeFi: Analyzing Perena, Backed by Binance Labs

TechFlow Selected TechFlow Selected

Dual-Pool Liquidity Integration for Unified DeFi: Analyzing Perena, Backed by Binance Labs

Spoke-and-hub architecture to solve inefficient DeFi capital utilization.

Text: TechFlow

Previously, CZ tweeted about his emphasis on blockchain applications, sparking market reactions and keeping investors' eyes on Binance Labs’ next moves.

Yesterday, Binance Labs announced its investment in Perena, a decentralized stablecoin protocol within the Solana ecosystem, putting into practice its focus on infrastructure-level applications. According to Coindesk, Perena raised approximately $3 million in its seed round.

What exactly is Perena—a fusion of Solana and DeFi infrastructure, doubling down with two powerful advantages—and why has it gained recognition from Binance Labs?

We took a close look at Perena and bring you this lightweight project overview.

Hub-and-Spoke Architecture: Solving Inefficient Capital Flow in DeFi

As Perena explains, the current oversaturation of stablecoin solutions leads to fragmented liquidity. A large number of isolated liquidity pools result in inefficient capital utilization and poor user experience. The project aims to solve these issues by working toward "unified liquidity."

Core Product: Numéraire

To achieve unified liquidity, Perena launched its core product, Numéraire—a swap protocol specifically designed for stablecoins. With a composable and scalable pool design, it significantly reduces idle capital issues common in traditional AMMs. It's also the first stablecoin swap protocol natively integrating Interest-Bearing Tokens (IBTs) in the Solana ecosystem.

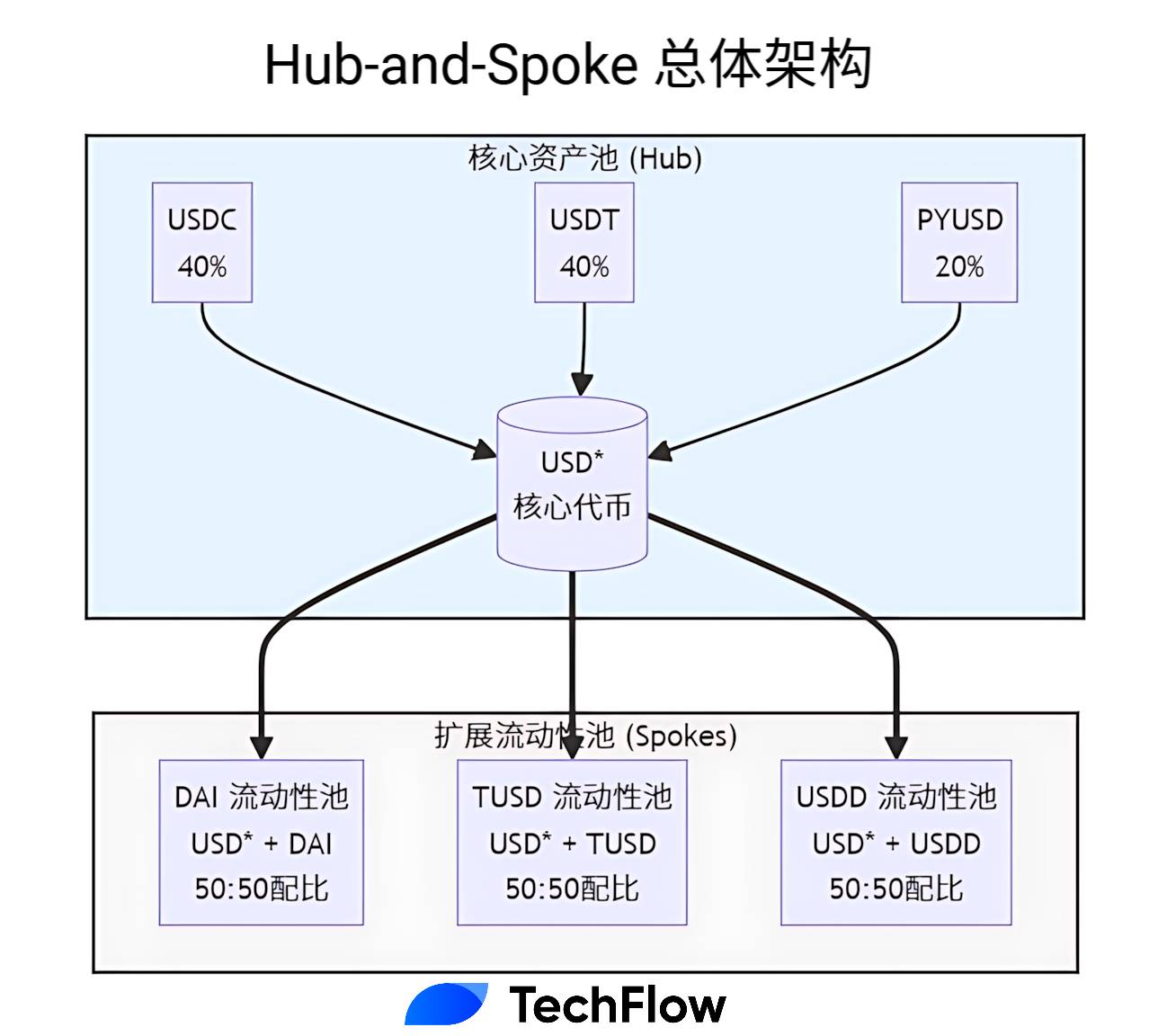

Hub-and-Spoke Architecture

The key innovation of Numéraire lies in its Hub-and-Spoke architecture. This dual-pool system, consisting of a Seed Pool (central pool) and multiple Growth Pools (expansion pools), balances capital efficiency with risk management.

In this model, the Seed Pool acts as the central liquidity hub, composed of major stablecoins such as USDC, USDT, and PYUSD, and issues Perena’s own liquidity token—USD* (USD Star). USD* not only earns swap fees but also grows in value through an automatic compounding mechanism.

Growth Pools provide liquidity support for emerging stablecoins by pairing them with USD*. All trades must be routed through USD*, creating a two-hop swapping mechanism that:

-

Effectively isolates risks in the Seed Pool

-

Maximizes protocol TVL utilization

-

Enables USD* holders to earn yields from both Seed and Growth Pools

Thus, Perena’s concept of “unified liquidity” does not mean physically pooling all assets into one single pool, but rather achieving logical unification through the Hub-and-Spoke structure.

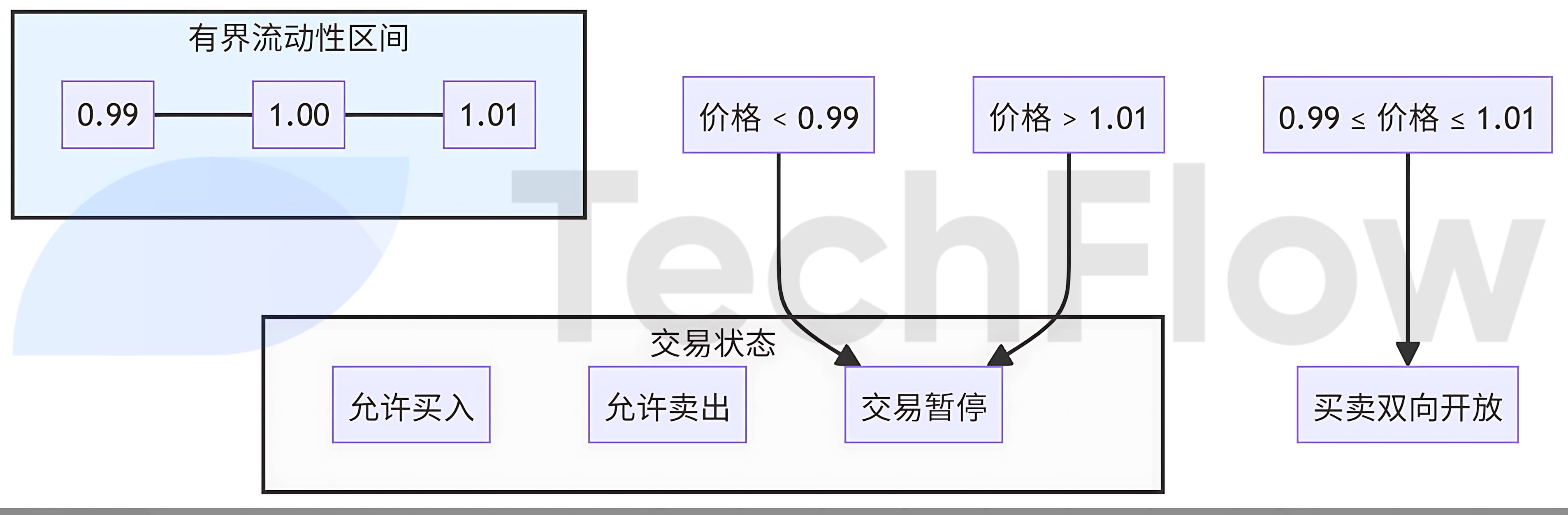

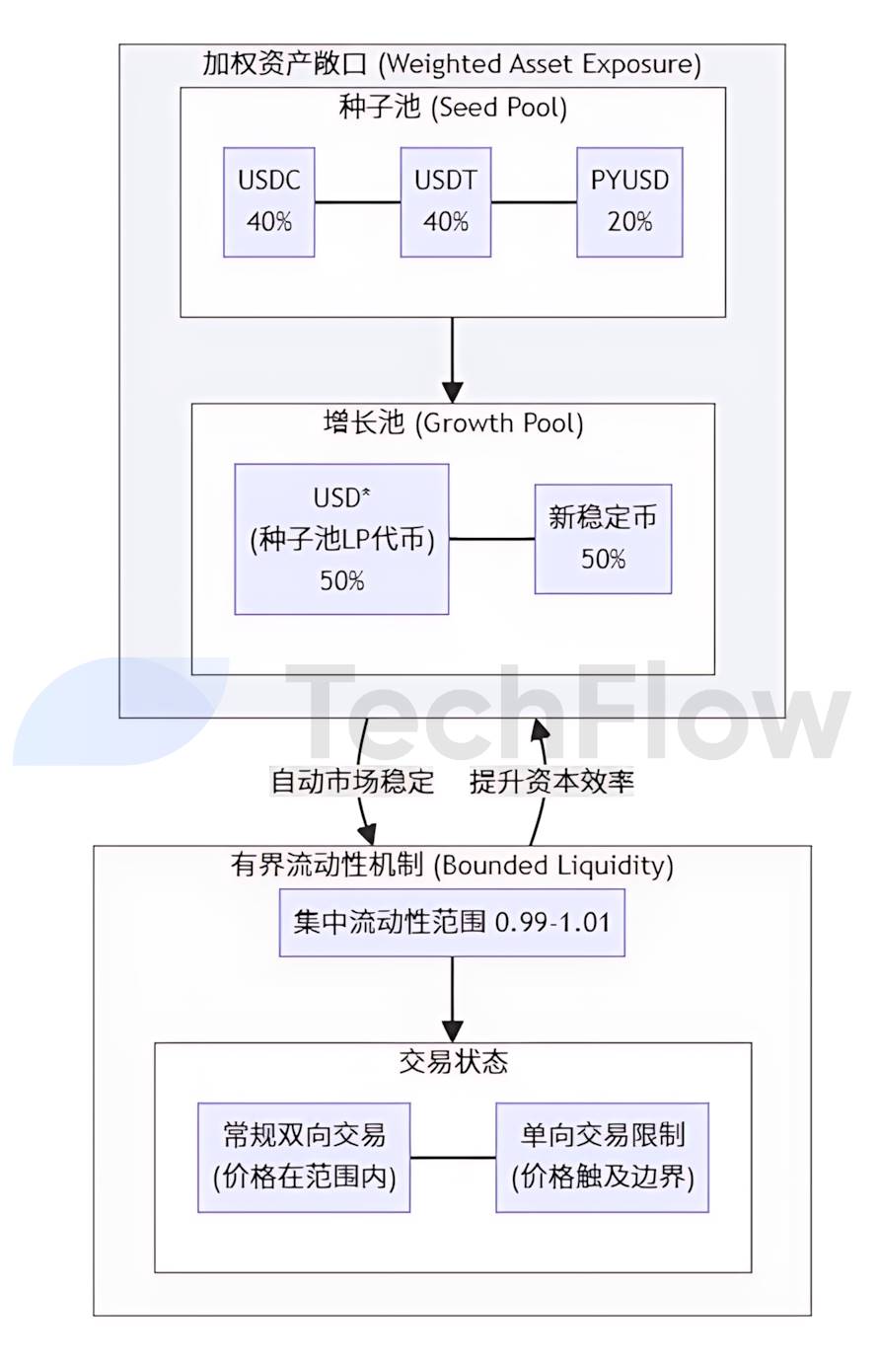

To ensure USD* remains stable and supports this coordinated architecture, the protocol introduces two mechanisms: Bounded Liquidity and Weighted Assets.

The Bounded Liquidity mechanism concentrates funds within a narrow price range suitable for stablecoin trading—specifically between 0.99 and 1.01. When prices reach these boundaries, the system restricts trading directions until prices return to a healthy range.

The Weighted Assets mechanism uses invariant equations to establish price anchors, allocating liquidity via configurable asset weights. When asset ratios deviate from target weights, the system automatically adjusts exchange rates to create price spreads, generating arbitrage opportunities that incentivize market participants to rebalance the pool back to its intended ratio. In simple terms, by setting target proportions and leveraging price adjustments and arbitrage incentives, the market self-corrects without manual intervention.

For example, the Seed Pool targets a composition of 40% USDC, 40% USDT, and 20% PYUSD, while Growth Pools use a 50/50 weight between USD* and new stablecoins.

How to Participate

Perena is currently in testing phase and accessible via Solana wallets.

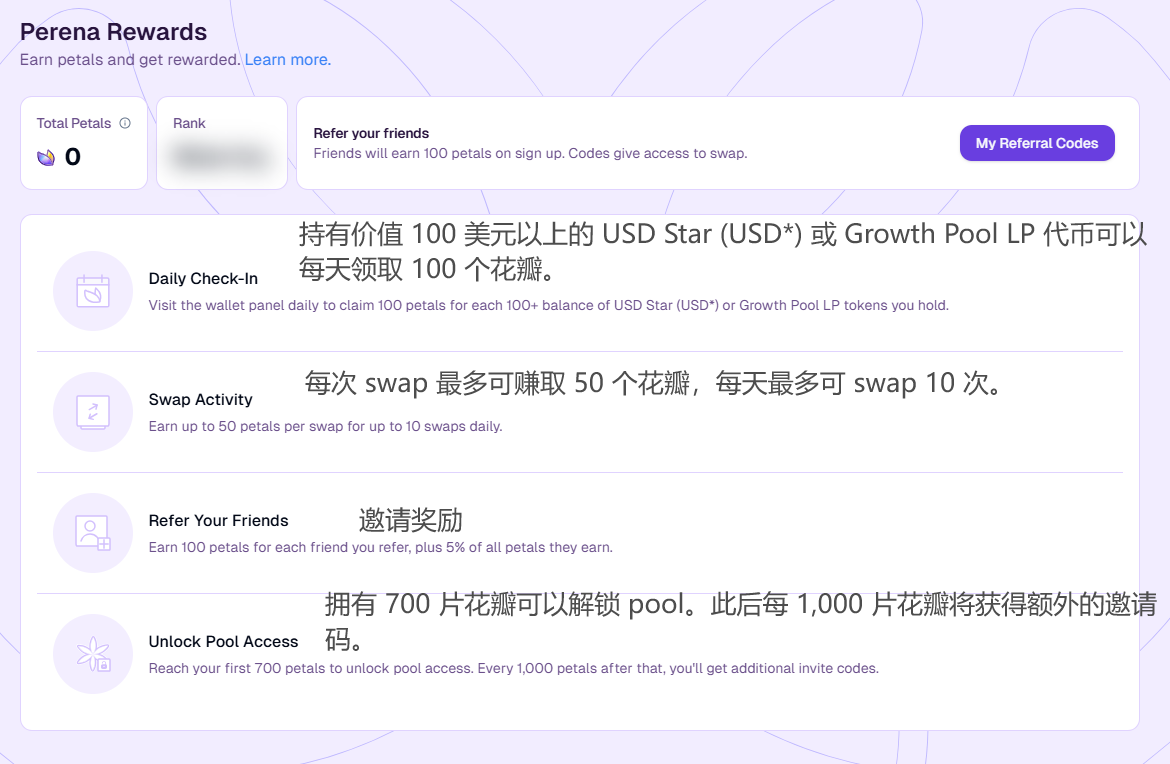

New users without a special invitation code can initially only access basic swap functionality. Accumulating 700 points unlocks access to Perena Pools for providing liquidity.

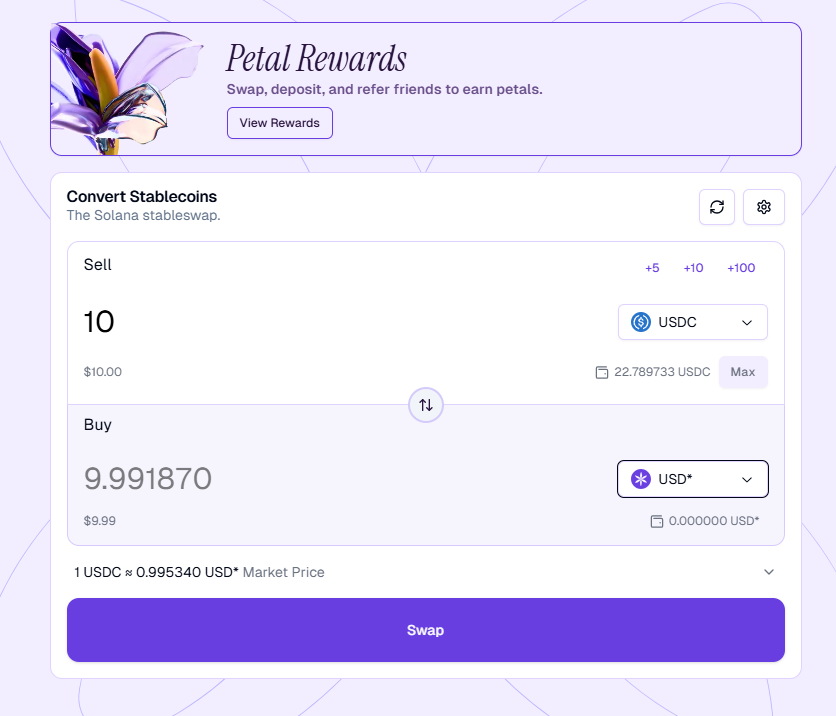

Users earn 0.1 point per dollar traded, with a maximum of 50 points per swap, and up to 10 swaps per day. For instance, swapping 10 USDC for 9.99 USD* earns 1 point.

Besides swaps, users can also earn points through daily check-ins and referral rewards.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News