A Strategic Battleground: Stablecoins

TechFlow Selected TechFlow Selected

A Strategic Battleground: Stablecoins

In this fiercely competitive billion-dollar赛道, who can still grab the next piece of the pie?

Author: Zeke, Researcher at YBB Capital

Preface

According to CoinGecko data, the total market capitalization of stablecoins has now surpassed $200 billion. Compared to when we last discussed this sector a year ago, the overall market cap has nearly doubled and reached an all-time high. Previously, I described stablecoins as a critical component in the crypto ecosystem—a key entry point for various on-chain activities due to their role as stable value storage. Today, stablecoins are beginning to extend into the real world, demonstrating financial efficiency beyond traditional banking in retail payments, business-to-business (B2B) transactions, and international remittances. In emerging markets across Asia, Africa, and Latin America, the practical value of stablecoins is becoming increasingly evident. Their strong financial inclusivity enables residents of developing countries to effectively combat hyperinflation caused by unstable governments and participate in global financial activities or subscribe to cutting-edge digital services such as online education, entertainment, cloud computing, and AI products.

Entering emerging markets and challenging traditional payment systems represent the next frontier for stablecoins. In the foreseeable future, regulatory compliance and accelerated adoption of stablecoins will become inevitable. The rapid development of AI will further intensify demand for stablecoins—especially for purchasing computing power and subscribing to services. Compared to developments over the past two years, one thing remains unchanged: Tether and Circle still dominate this space with overwhelming control. More startups are shifting focus toward upstream and downstream aspects of stablecoins. However, today we’ll continue focusing on stablecoin issuers—within this fiercely competitive, multi-billion-dollar industry, who else can claim the next piece of the pie?

1. Evolution of Trends

In the past, we typically categorized stablecoins into three types:

1. **Fiat-collateralized stablecoins**: These are backed 1:1 by fiat currencies like the US dollar or euro. For example, each USDT or USDC corresponds directly to one dollar held in the issuer’s bank account. This model is straightforward and theoretically ensures high price stability;

2. **Over-collateralized stablecoins**: These are created by locking up volatile but liquid crypto assets (e.g., ETH, BTC) as collateral at ratios exceeding 100%. To mitigate volatility risk, these systems require higher collateralization levels. Prominent examples include Dai and Frax;

3. **Algorithmic stablecoins**: These rely entirely on algorithms to regulate supply and maintain a peg to a reference currency (usually USD). When prices rise above parity, the algorithm mints new coins; when they fall below, it buys back tokens from the market. A notable example was UST (Luna's stablecoin).

In the years following the UST collapse, most innovation in stablecoins revolved around Ethereum-based Liquid Staking Tokens (LST), creating variations of over-collateralized models through different risk-balancing mechanisms. The term "algorithmic stablecoin" became taboo—until early this year, when Ethena emerged, redefining the trajectory of stablecoin development. The new direction combines high-quality assets with low-risk yield generation, attracting users through competitive returns and carving out opportunities in an otherwise consolidated market. All three projects discussed below follow this emerging trend.

2. Ethena

Ethena is the fastest-growing non-fiat-collateralized stablecoin project since the Terra-Luna crash. Its native stablecoin, USDe, has grown to $5.5 billion in market size, surpassing Dai to rank third globally. The core mechanism relies on delta hedging using Ethereum and Bitcoin as collateral. Specifically, Ethena maintains a short position on centralized exchanges (Cex) equivalent in value to its collateral (ETH/BTC), aiming to neutralize price fluctuations affecting USDe’s stability. If ETH/BTC prices rise, losses from the short positions are offset by gains in collateral value—and vice versa. This process depends on off-chain settlement providers, meaning protocol assets are custodied by multiple external entities.

Ethena generates revenue from three primary sources:

1. **Ethereum staking rewards**: Users deposit LSTs which earn staking yields;

2. **Hedging trading income**: Ethena Labs may generate funding rate profits or basis spread returns from its hedging operations;

3. **Fixed income from liquid stables**: Interest earned by holding USDC on Coinbase or other stablecoins on various exchanges.

In essence, USDe functions as a packaged low-risk quantitative hedging product offered via centralized platforms. Under favorable market conditions with ample liquidity, Ethena can deliver double-digit floating annualized yields—reaching up to 27% currently—surpassing even Anchor Protocol’s peak APY of 20% during the Terra era. While not offering fixed returns, such yields remain exceptionally high for a stablecoin project. But does Ethena carry risks comparable to Luna?

Theoretically, Ethena’s biggest risk stems from potential exchange or custodian failure—black swan events that are inherently unpredictable. Another concern is mass redemption (a run on USDe), which would require sufficient counterparty liquidity. Given Ethena’s explosive growth, such a scenario isn’t impossible. Rapid selling could depeg USDe in secondary markets. To restore the peg, the protocol would need to unwind hedges and sell spot collateral, potentially turning unrealized losses into realized ones and triggering a negative feedback loop.1 That said, this risk is far lower than UST’s single-layer failure mode, and consequences would be less catastrophic—though risks still exist.

Ethena experienced a prolonged downturn mid-year, amid declining yields and skepticism about its design. Yet no systemic failures occurred. As a pivotal innovation in this cycle, Ethena introduces a hybrid on-chain/Cex architectural logic, channeling large volumes of post-merge LST assets into exchanges, providing scarce bearish liquidity during bull markets while boosting exchange fees and user activity. It represents a pragmatic yet intriguing compromise—achieving high yields without sacrificing too much security. Looking ahead, could a fully decentralized version emerge as order-book DEXs mature alongside advanced chain abstraction?

3. Usual

Usual is an RWA-based stablecoin project founded by Pierre PERSON, former French parliament member and advisor to President Macron. Fueled by news of a Binance Launchpool listing, the project recently gained significant traction, with TVL surging from tens of millions to approximately $700 million. Its native stablecoin, USD0, operates under a 1:1 reserve model—but unlike USDT or USDC, users don’t exchange fiat for digital tokens directly. Instead, their fiat funds are converted into ultra-short-term U.S. Treasury bonds—the project’s core value proposition: sharing the yield previously captured solely by Tether.

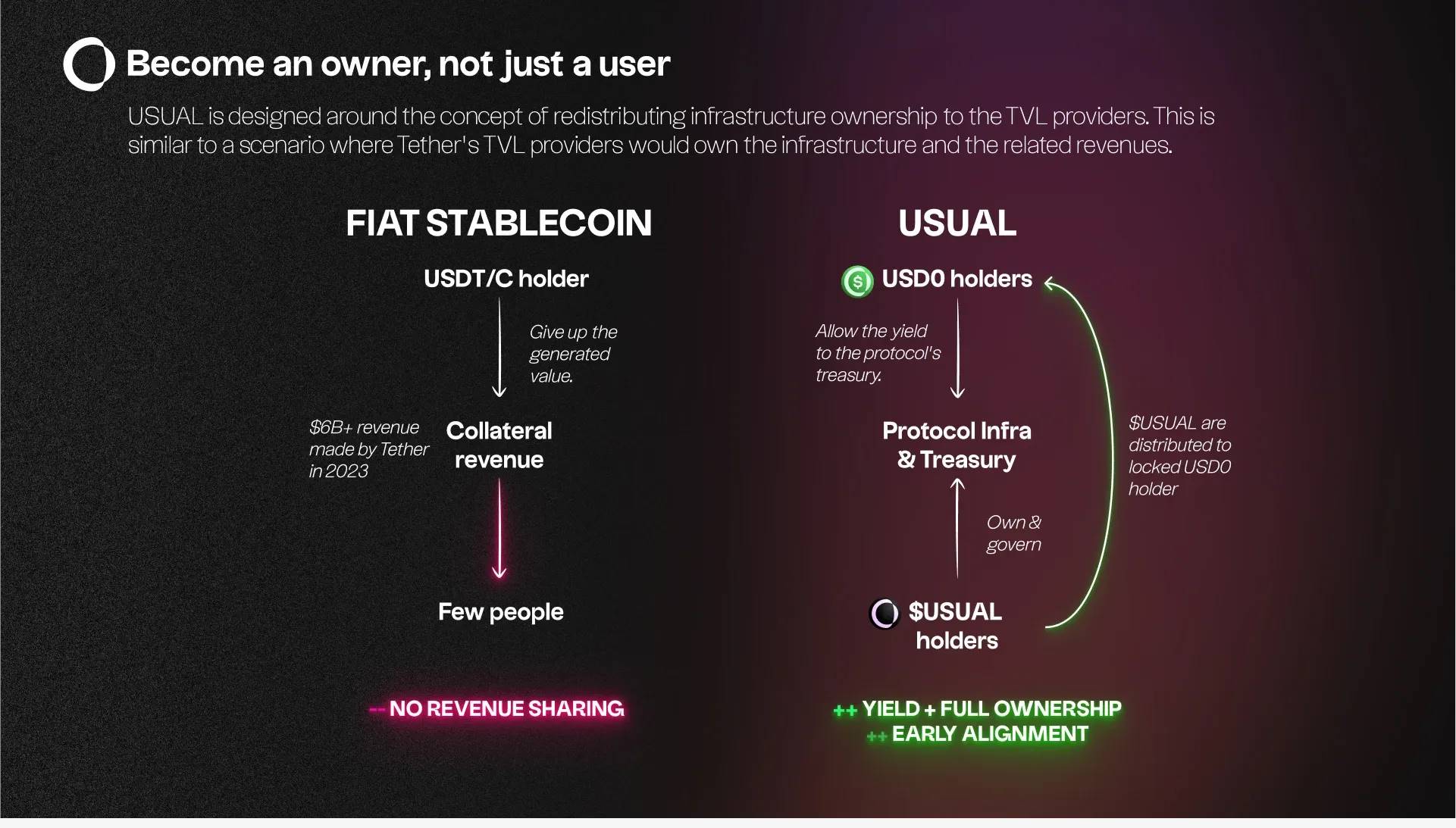

As shown in the diagram above, the left side illustrates traditional fiat-backed stablecoins. With Tether, for instance, users receive no interest when converting fiat into USDT. Effectively, Tether acquires free capital, deploying it into low-risk instruments (primarily U.S. Treasuries)—earning $6.2 billion in profit last year alone—then reinvesting those gains into higher-return ventures, essentially “earning while sleeping.”

The right side shows Usual’s model, built around the principle: *Become An Owner, Not Just A User.* Infrastructure ownership is redistributed to TVL contributors—users’ fiat is transformed into real-world assets (RWA) in the form of short-dated U.S. Treasuries. This conversion is facilitated via USYC, operated by Hashnote, a leading on-chain institutional asset manager backed by DRW partners. Generated yields flow into the protocol treasury and are governed collectively by token holders.

The protocol token, USUAL, is distributed to users who lock USD0 (which becomes USD0++), enabling shared yield distribution and aligning early incentives. Notably, the lock-up period lasts four years—matching the maturity window of certain U.S. intermediate-term Treasuries (typically 2–10 years).

Usual’s advantage lies in maintaining capital efficiency while breaking the centralized control held by Tether and Circle, redistributing profits more equitably. However, the long lock-up duration and relatively modest yields (compared to crypto-native options) may hinder short-term viral growth akin to Ethena. Retail appeal might center more on the potential appreciation of the USUAL token itself. Over the long term, however, USD0 holds distinct advantages: enabling non-U.S. citizens without American bank accounts to access U.S. Treasury portfolios; superior underlying assets allowing for much larger scale than Ethena; and decentralized governance making the stablecoin resistant to freezing—making it a preferable option for non-trading users.

4. f(x)Protocol V2

f(x)Protocol is the flagship product of AladdinDAO, which we covered in detail in last year’s article. Less prominent than the two aforementioned projects, f(x)Protocol also suffers from complex architecture introducing several drawbacks: susceptibility to attacks, low capital efficiency, high transaction costs, and complicated user experience. Nevertheless, I believe it stands as the most noteworthy stablecoin project born during the 2023 bear market. Below is a brief overview (for full details, refer to the f(x)Protocol v1 whitepaper).

In version V1, f(x)Protocol introduced the concept of a “floating stablecoin,” splitting stETH into fETH and xETH. fETH is a “floating stablecoin” whose value tracks ETH with minimal deviation, while xETH absorbs most of ETH’s price volatility as a leveraged long position. Thus, xETH holders assume greater market risk and reward, helping stabilize fETH’s value. Early this year, building on this idea, the team introduced a rebalancing pool framework featuring only one liquid, USD-pegged stablecoin: fxUSD. All other leveraged stable pairs no longer have independent liquidity but exist solely within the rebalancing pool or as backing for fxUSD.

● Basket of LSDs: fxUSD is backed by multiple liquid staking derivatives (LSDs) such as stETH and sfrxETH. Each LSD has its own stability/leverage pairing mechanism;

● Minting and Redemption: Users mint fxUSD by depositing LSDs or withdrawing stablecoins from corresponding rebalancing pools. The deposited LSD first mints its associated stable derivative, which is then added to the fxUSD reserve. Conversely, users can redeem LSDs using fxUSD.

In simple terms, f(x)Protocol resembles an ultra-complex version of Ethena or earlier hedged stablecoins. On-chain, the balancing and hedging processes are extremely intricate—first separating volatility, then managing numerous balance mechanisms and margin requirements for leverage. The resulting complexity significantly undermines user accessibility, outweighing its benefits. In V2, the design shifts focus to eliminating the complications introduced by leverage and strengthening support for fxUSD. The key innovation is xPOSITION—an NFT-like, high-beta (highly sensitive to market movements) leveraged long product enabling users to engage in high-leverage trading on-chain without worrying about individual liquidations or paying funding fees. Benefits are clear:

● Fixed Leverage Ratio: xPOSITION offers a constant leverage ratio. Initial margins aren't subject to margin calls due to market swings, nor do unexpected liquidations occur from fluctuating leverage;

● No Liquidation Risk: Unlike traditional leveraged platforms where extreme volatility leads to forced closures, f(x) Protocol V2 eliminates this risk;

● No Funding Fees: Typically, leveraged trading incurs borrowing costs (e.g., interest). xPOSITION removes these fees, reducing overall trading expenses.

The new Stability Pool allows users to deposit USDC or fxUSD with one click, supporting protocol stability. Unlike V1, the V2 Stability Pool anchors the relationship between USDC and fxUSD. Participants can arbitrage price differences in the fxUSD–USDC AMM pool, helping maintain fxUSD’s peg. Protocol revenue comes from position opening/closing fees, liquidations, rebalancing, funding rates, and collateral yield.

This project remains one of the few non-overcollateralized, fully decentralized stablecoin initiatives. However, its complexity contradicts the minimalist design ideal of stablecoins, requiring users to possess technical knowledge before safe participation. During extreme market conditions, the layered defense mechanisms against bank runs could paradoxically harm users. Nonetheless, its vision aligns closely with the ultimate dream of every crypto native: a truly decentralized, natively-built stablecoin backed by top-tier cryptographic assets.

Conclusion

Stablecoins remain a battleground for dominance—a high-barrier sector within crypto. In last year’s article titled *“On the Brink of Collapse, But Algorithmic Innovation Never Died,”* we briefly reviewed the history of stablecoins and expressed hope for more interesting, decentralized, non-overcollateralized alternatives. Now, a year and a half later, aside from f(x)Protocol, few new entrants have pursued this path. Fortunately, Ethena and Usual offer promising middle-ground solutions, giving us choices for more ideal, more Web3-aligned stablecoins.

References

1. Mario on Web3:Deep Dive Into Ethena: Success Drivers and Risks of a Death Spiral

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News