Old coins keep hitting the circuit breaker? Maybe you should understand ISO 20022 behind it

TechFlow Selected TechFlow Selected

Old coins keep hitting the circuit breaker? Maybe you should understand ISO 20022 behind it

ISO 20022, the common language of the financial industry.

By: TechFlow

This bull market has felt a bit uneasy. It was just dubbed the "Meme Bull Run," but not long after, the market erupted with waves of complaints—yes, veteran players rushed into memes and got rekt again. But the worst part isn't getting rekt on memes; it's realizing that the old tokens they sold—long-held assets that had been stagnant for years—are now surging wildly.

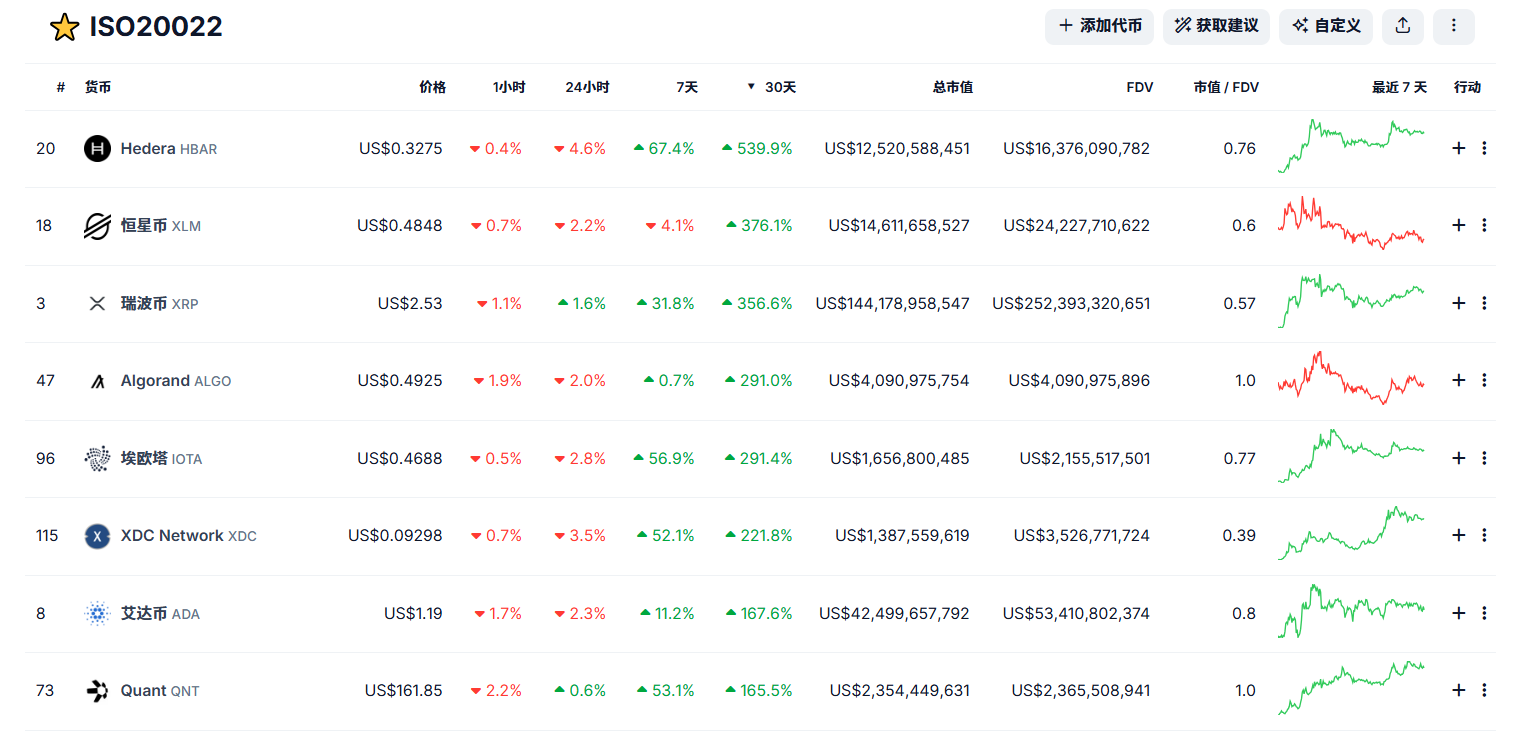

XRP, XLM, HBAR, XVG... These names, familiar yet strangely unfamiliar to old-time degens, are appearing daily at the top of exchange gain charts. In less than a month, XRP surged 400%, surpassing SOL in market cap. Old group members keep exclaiming: What year is this?

The so-called "old junk" coins, long plagued by FUD, have suddenly flipped the script and exploded upward. While this may seem like simple sector rotation, at its core, it might be another round of market-driven "value discovery" in these assets.

Trump’s election victory has undeniably boosted crypto—Bitcoin’s meteoric rise speaks volumes. Just one month post-election, Bitcoin smashed through the $100,000 mark. Trump’s repeated pro-crypto statements have also prompted Wall Street to reassess the broader “payment utility” of cryptocurrencies. Many of the recent gainers—XRP, XLM, etc.—not only tie directly into the payments narrative but share another key trait: they belong to the 「ISO 20022」 concept.

ISO 20022: The Universal Language of Finance

Is ISO 20022 a sudden new narrative? Not at all. In fact, ISO 20022 originated as early as 2004—long before the first Bitcoin block was mined.

ISO 20022 (full name: Financial Services - Universal Financial Industry message scheme) is an international financial messaging standard developed by ISO Technical Committee TC68 (Financial Services). After years of evolution, it has become the unified global standard for financial messaging, covering areas such as payments, securities, trade, cards, and foreign exchange.

From a technical perspective, ISO 20022 is:

A globally unified financial communication standard

A standardized set of data formats and rules

A framework for transmitting financial messages

An analogy might help clarify this.

Imagine you’re sending $1,000 to a friend abroad. This transaction must pass through multiple intermediaries:

Your bank sends the payment instruction in its own format

SWIFT translates it into its own format

Intermediate banks may process it using yet another format

The recipient bank then translates it into a format it understands

It's like a game of telephone—each relay risks losing information. Critical details (such as payment purpose or invoice number) can vanish during translation. Despite seeming straightforward, cross-border payments involve countless conversions—because each financial institution speaks its own financial "dialect."

Thus, ISO 20022 can be seen as the "Mandarin of global finance." Just as Mandarin enables communication across China’s diverse regions, ISO 20022 allows different global financial institutions to exchange information using a common language.

With ISO 20022, all financial institutions speak the same "language." Payment information becomes richer (expanding from 140 characters to 9,000), data structures more standardized (like using a universal template), and processing smarter (machines can automatically read and act on data). Legacy cross-border transfers were like sending Morse code telegrams; today, it’s akin to sending a structured email—with attachments and automated categorization.

Cryptocurrencies Embracing ISO 20022

If a cryptocurrency complies with ISO 20022 standards, it can receive an official ISO code. This makes it significantly easier for financial institutions to use the crypto for cross-border payments. Moreover, regulators may apply looser oversight to ISO 20022-compliant tokens. Such tokens could see widespread adoption—essentially being "adopted" into the global financial payment system and gaining legitimate payment utility.

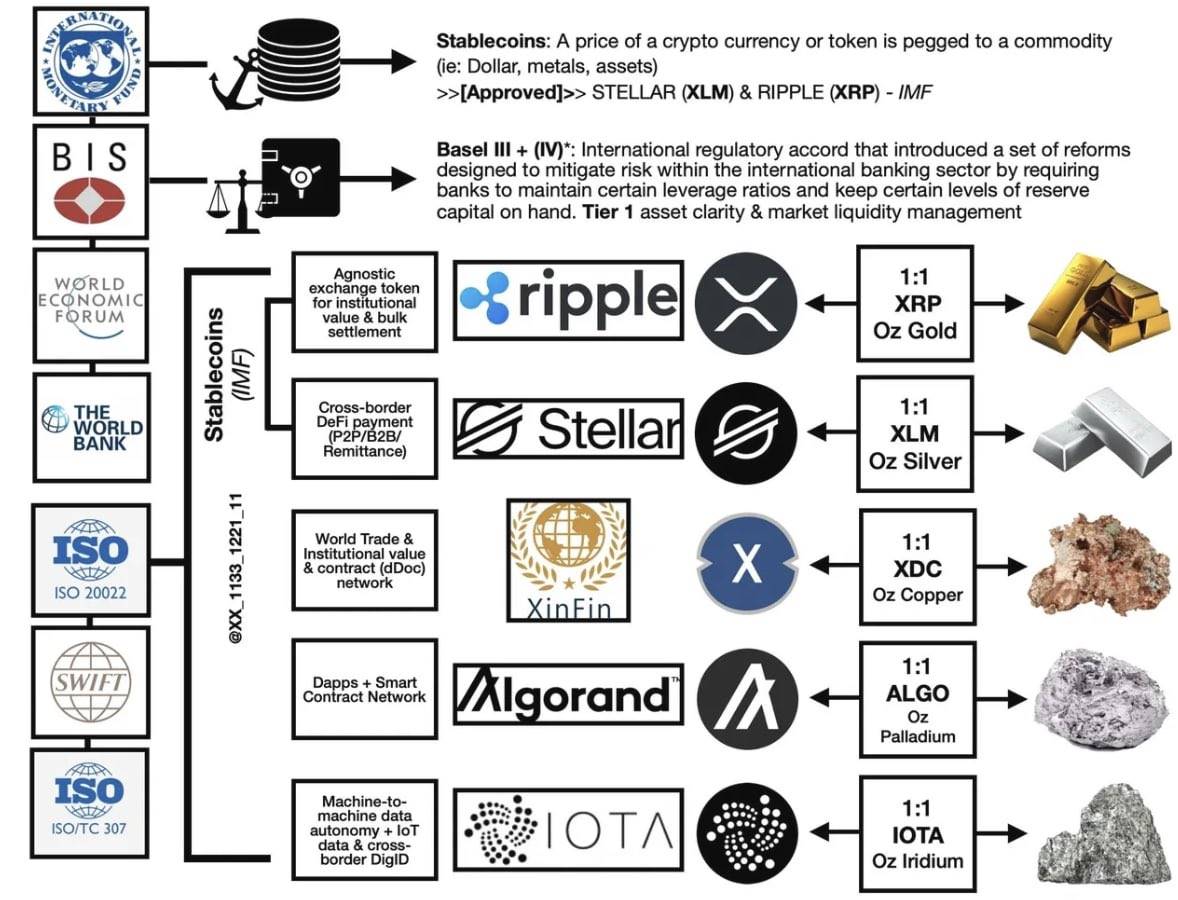

Note: A widely circulated chart on Twitter, for reference only

Which cryptocurrencies are currently recognized by the market as ISO 20022 candidates?

XRP (Ripple)

Official Certification Status: The only cryptocurrency project officially certified under ISO 20022

Implementation Details:

RippleNet fully integrates ISO 20022 messaging standards

Provides Real-Time Gross Settlement (RTGS) systems

Enables end-to-end tracking for cross-border payments

Has established partnerships with over 200 financial institutions

Key Collaborations:

Interoperability testing with SWIFT

CBDC projects with multiple central banks

Direct payment channel integrations with major banks

XLM (Stellar)

Official Certification Status: Not officially certified, but technically supports the standard

Implementation Details:

Uses messaging formats compatible with ISO 20022

Offers cross-border payment and remittance services

Supports asset tokenization

Key Collaborations:

Strategic partnership with MoneyGram

Collaboration with over 350 banks in Argentina and other countries

Partnership with Circle for USDC issuance

ADA (Cardano)

Official Certification Status: Not officially certified

Implementation Details:

Atala PRISM identity solution supports ISO 20022

Implements the standard via academic research-driven development

Supports smart contracts and tokenized assets

Key Collaborations:

Partnership with Ethiopia’s Ministry of Education

Government-level collaborations with multiple African nations

Working with financial institutions on identity verification solutions

QNT (Quant)

Official Certification Status: Not officially certified

Implementation Details:

Overledger platform enables ISO 20022 compatibility

Provides cross-chain interoperability solutions

Supports multi-chain CBDC implementations

Key Collaborations:

Strategic partnership with LCX exchange

Participation in CBDC project development

Collaborating with enterprises and financial institutions on blockchain interoperability

ALGO (Algorand)

Official Certification Status: Not officially certified

Implementation Details:

Supports ISO 20022 standard message transmission

Delivers high-performance Layer-1 blockchain solutions

Supports smart contracts and asset tokenization

Key Collaborations:

Collaboration with multiple CBDC initiatives

Payment network partnerships with financial institutions

Support for stablecoin issuance and cross-border payments

HBAR (Hedera)

Official Certification Status: Not officially certified

Implementation Details:

Employs ISO 20022-compatible messaging formats

Offers high-throughput distributed ledger technology

Supports smart contracts and token services

Key Features:

Strong performance in implementing ISO 20022 standards

Provides enterprise-grade solutions

Supports cross-border payments and settlements

IOTA (MIOTA)

Official Certification Status: Not officially certified

Implementation Details:

Tangle technology supports ISO 20022 integration

Focused on IoT payments and data transfer

Enables zero-fee transactions

Key Collaborations:

Cooperation with EU institutions

Involvement in smart city projects

Development of IoT payment solutions

XDC (XDC Network)

Official Certification Status: Not officially certified

Implementation Details:

Supports ISO 20022 standards for trade finance

Provides enterprise-grade blockchain solutions

Supports smart contracts and tokenization

Key Collaborations:

Partnerships with trade finance platforms

Supports supply chain finance applications

Established relationships with financial institutions

Does "Legitimacy" Really Matter?

Debate around ISO 20022 has always been divided. Some insist that only XRP—having received official certification—is the true ISO 20022 coin. Others argue that ISO 20022 is fundamentally an open technical standard with no formal "certification" mechanism. Projects like Ripple, Stellar, and Cardano simply support the standard at various technical levels—much like how HTTP underpins the internet.

More importantly, we should focus on real-world adoption. Ripple, despite its official status, has made tangible progress in cross-border payments. At the same time, Stellar’s collaboration with MoneyGram and Cardano’s deployments in Africa demonstrate meaningful practical achievements. From this perspective, whether a project is "officially certified" appears unrelated to its actual market potential.

Instead of obsessing over whether a project has received some "official stamp," it’s far more valuable to understand what problems it solves, whether its solutions are viable, and whether it holds competitive advantages in the current market landscape.

After all, when facing a long-term narrative, entering with a short-term speculation mindset—hoping to cash in quickly—is more likely to result in punishment from the market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News