DeFi Yield Data Special: veCRV Market Share Surpasses 45%, Pendle TVL Nears $4 Billion

TechFlow Selected TechFlow Selected

DeFi Yield Data Special: veCRV Market Share Surpasses 45%, Pendle TVL Nears $4 Billion

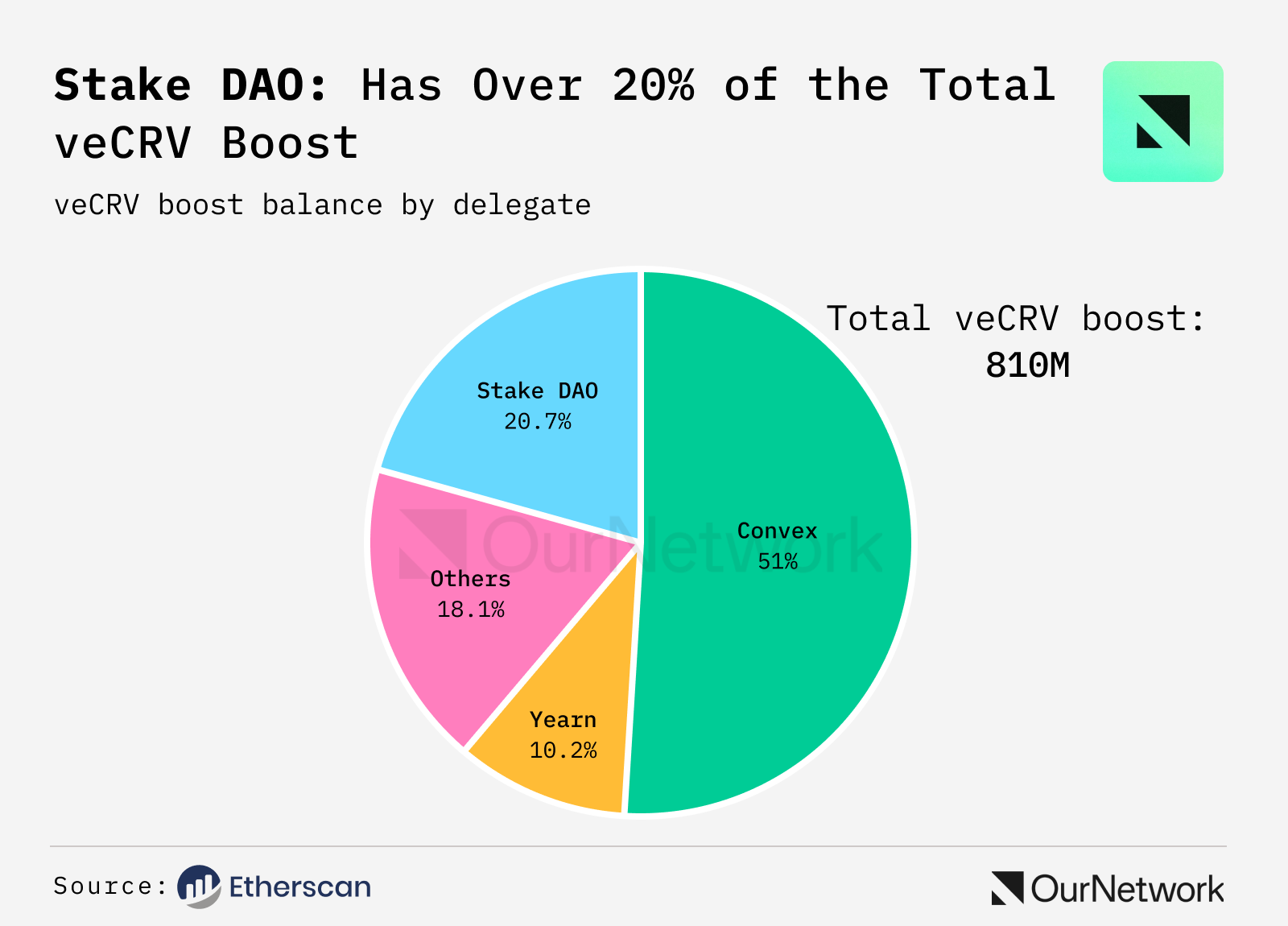

Stake DAO accounts for 20% of Curve’s boosted weight, delivering optimal returns for liquidity providers (LPs).

Author: OurNetwork

Translation: TechFlow

Yield

Convex Finance | Stake DAO | Pendle

Convex Finance

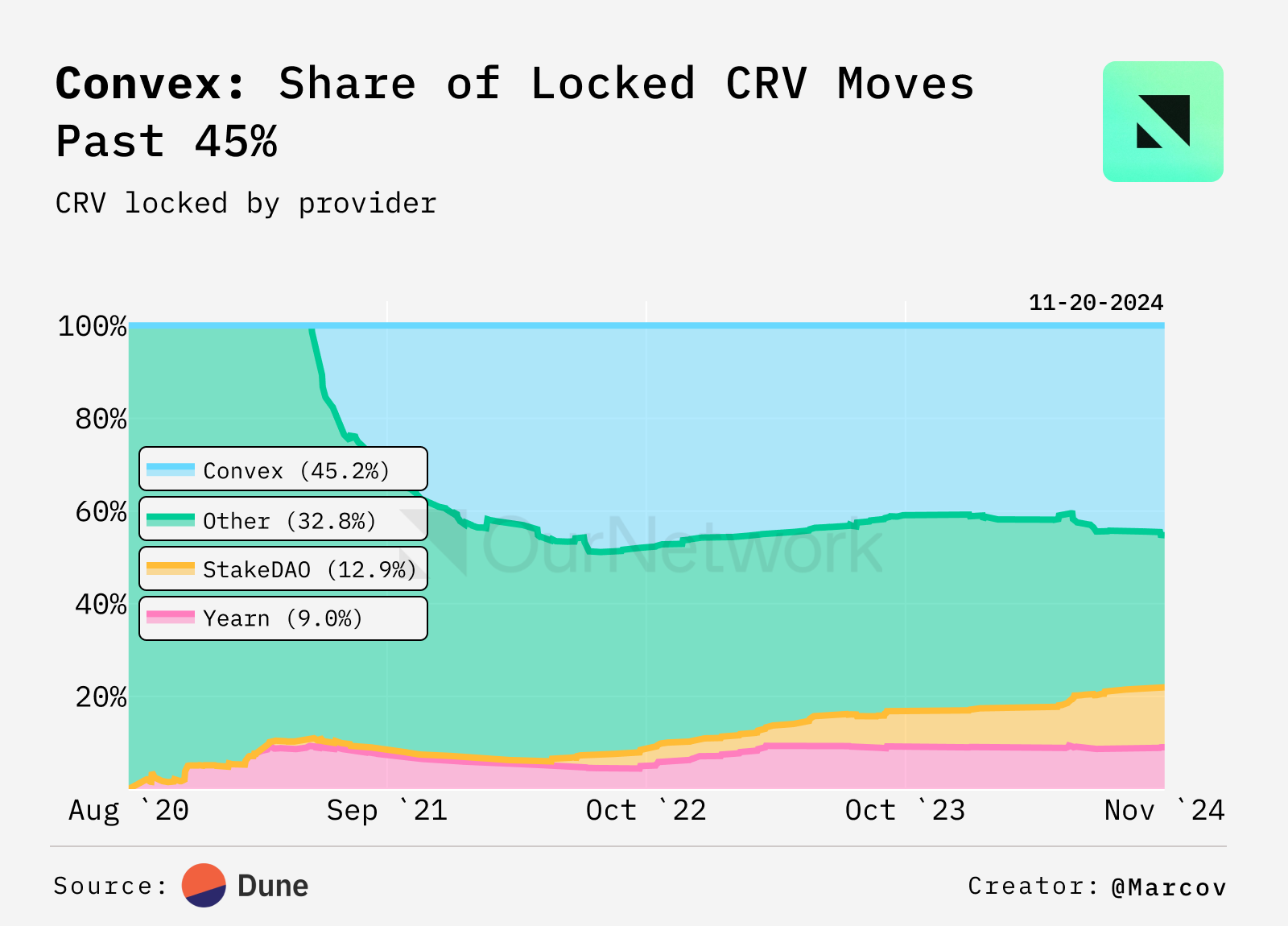

Convex Finance’s veCRV Market Share Breaks 45%

-

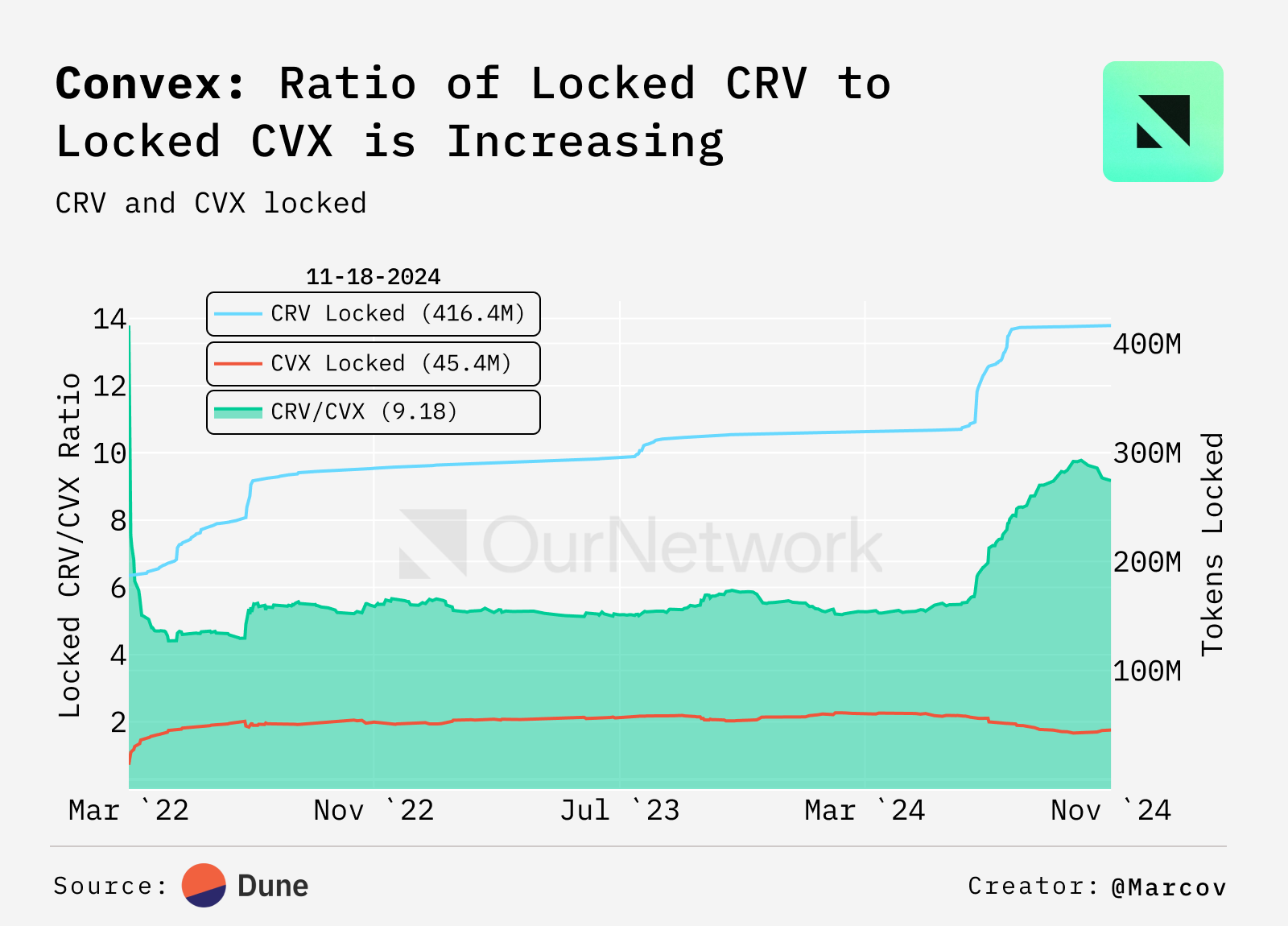

Convex Finance is a yield optimization platform designed for users of Curve Finance, one of the largest decentralized exchanges (DEX) in DeFi. On Curve, users can lock CRV (Curve's native token) to earn protocol fees, participate in governance voting, and boost rewards in liquidity pools. In July, the amount of CRV locked on Convex surged significantly, but over recent months this figure has stabilized at around 416 million. Despite limited growth in total locked CRV, Convex’s market share of locked CRV continues to rise—because the overall amount of CRV locked across the ecosystem has declined, pushing Convex’s share up to 45.6%, approaching its August 2022 peak of 48.9%.

-

Similar to locking CRV, Convex’s native token CVX can also be locked to earn enhanced rewards. However, recently the amount of locked CVX has decreased as some users have shifted toward staking CVX instead. Unlike locking, staking CVX offers lower rewards but allows users to unstake at any time, providing greater flexibility. This shift has increased the CRV-to-locked-CVX ratio per unit, reaching a high of 9.8. Recently, the amount of locked CVX appears to be rising again, with the current ratio at 9.18.

-

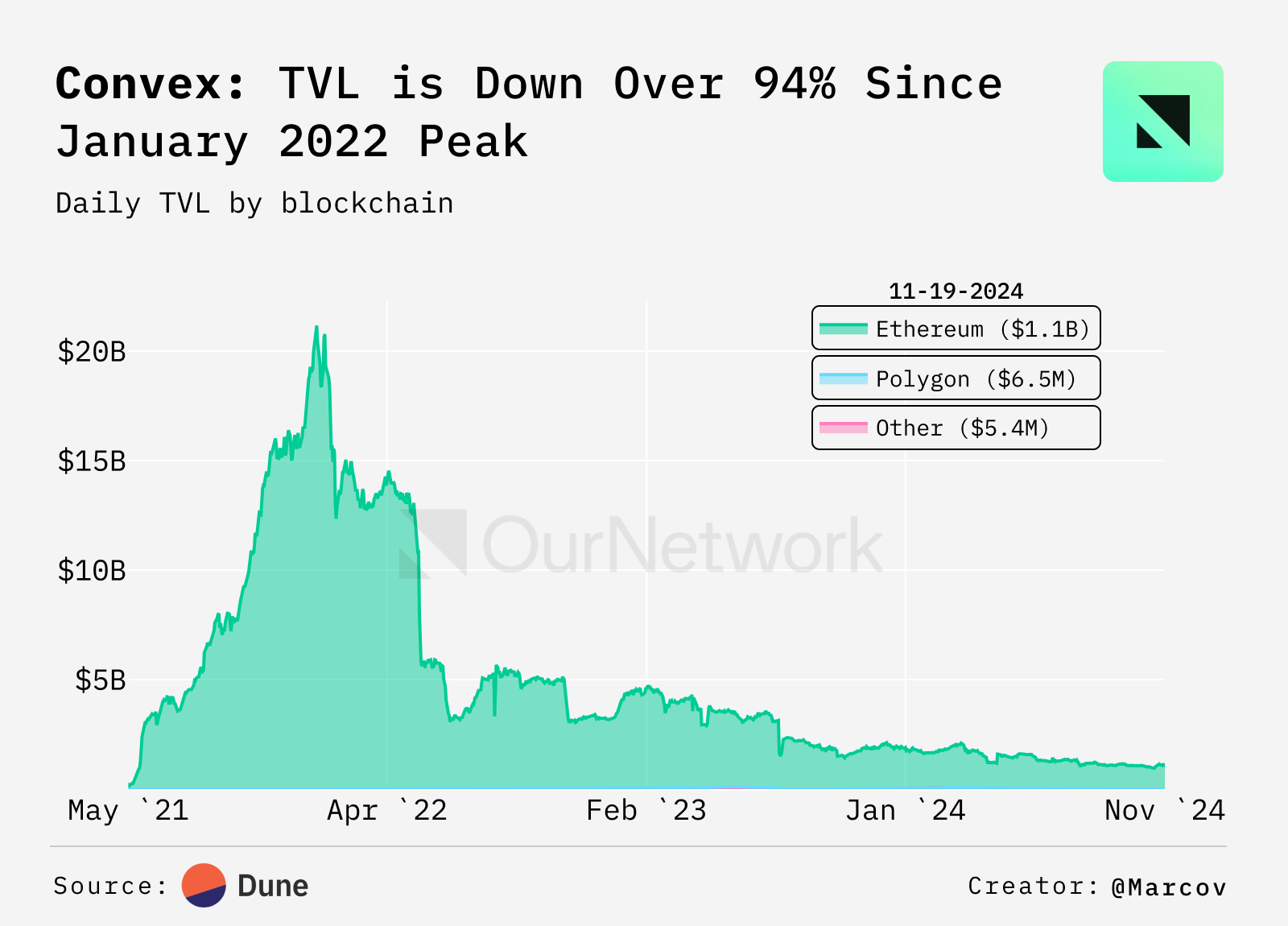

In terms of total value locked (TVL), although Convex Finance’s TVL has dropped significantly from its 2022 peak of $20 billion, the protocol currently maintains $1.16 billion in TVL across multiple blockchains. According to DeFi analytics platform DefiLlama, Convex remains one of the top-tier DeFi protocols in the Ethereum ecosystem.

Stake DAO

Stake DAO Captures 20% of Curve Boosting Power, Delivering Best-in-Class Returns for LPs

-

In the competitive landscape among yield aggregators on Curve, platforms are vying to accumulate more veCRV boosting power. Recently, Stake DAO launched a key feature allowing veCRV holders to delegate their boost to Stake DAO in exchange for a share of generated yields. This move attracted Curve founder Michael Egorov, who delegated 50 million veCRV worth of boosting power to Stake DAO, pushing its market share above 20%. This development has significantly strengthened Stake DAO’s competitiveness in the veCRV boosting market and enhanced its ability to deliver high returns for users.

-

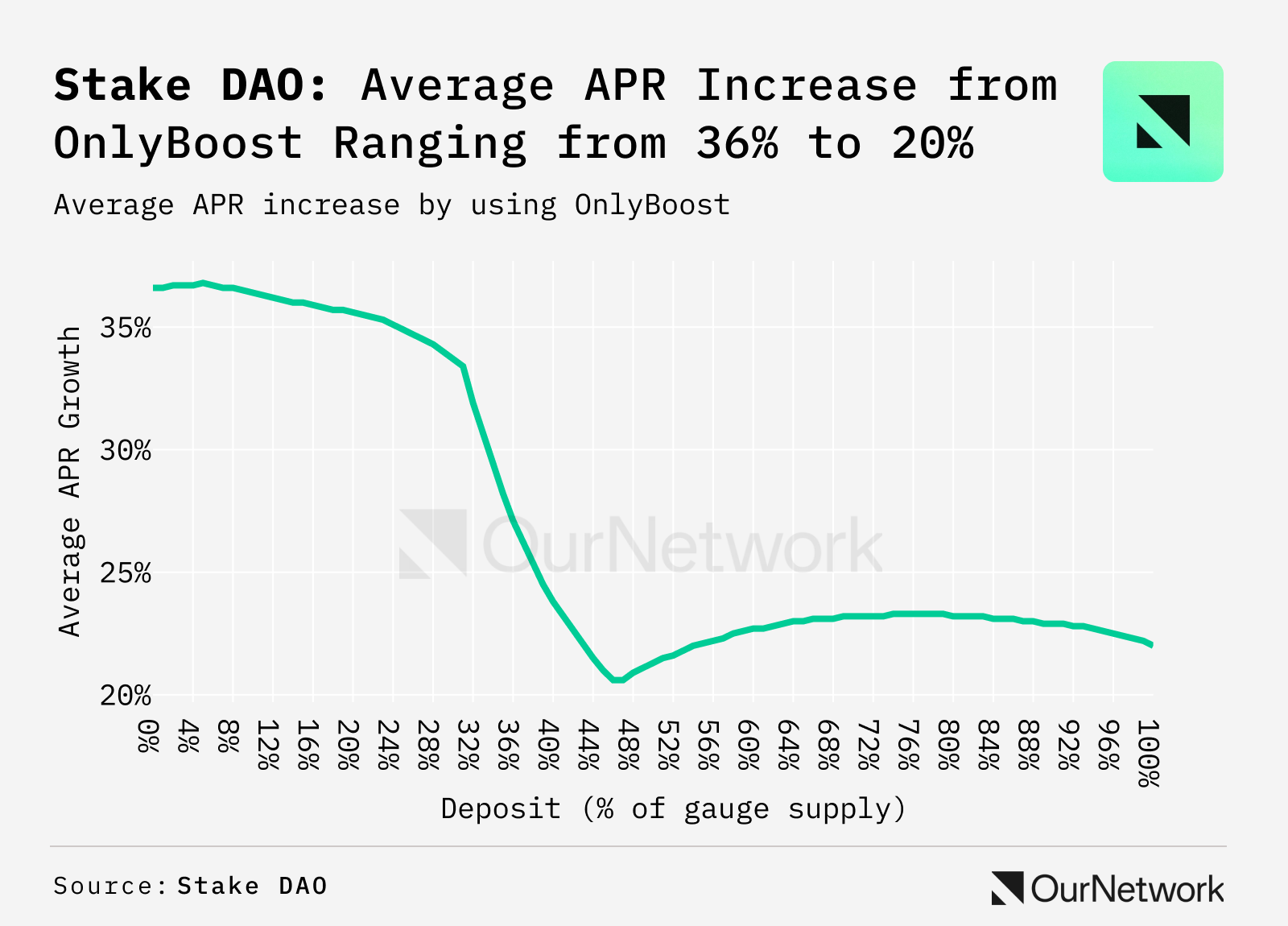

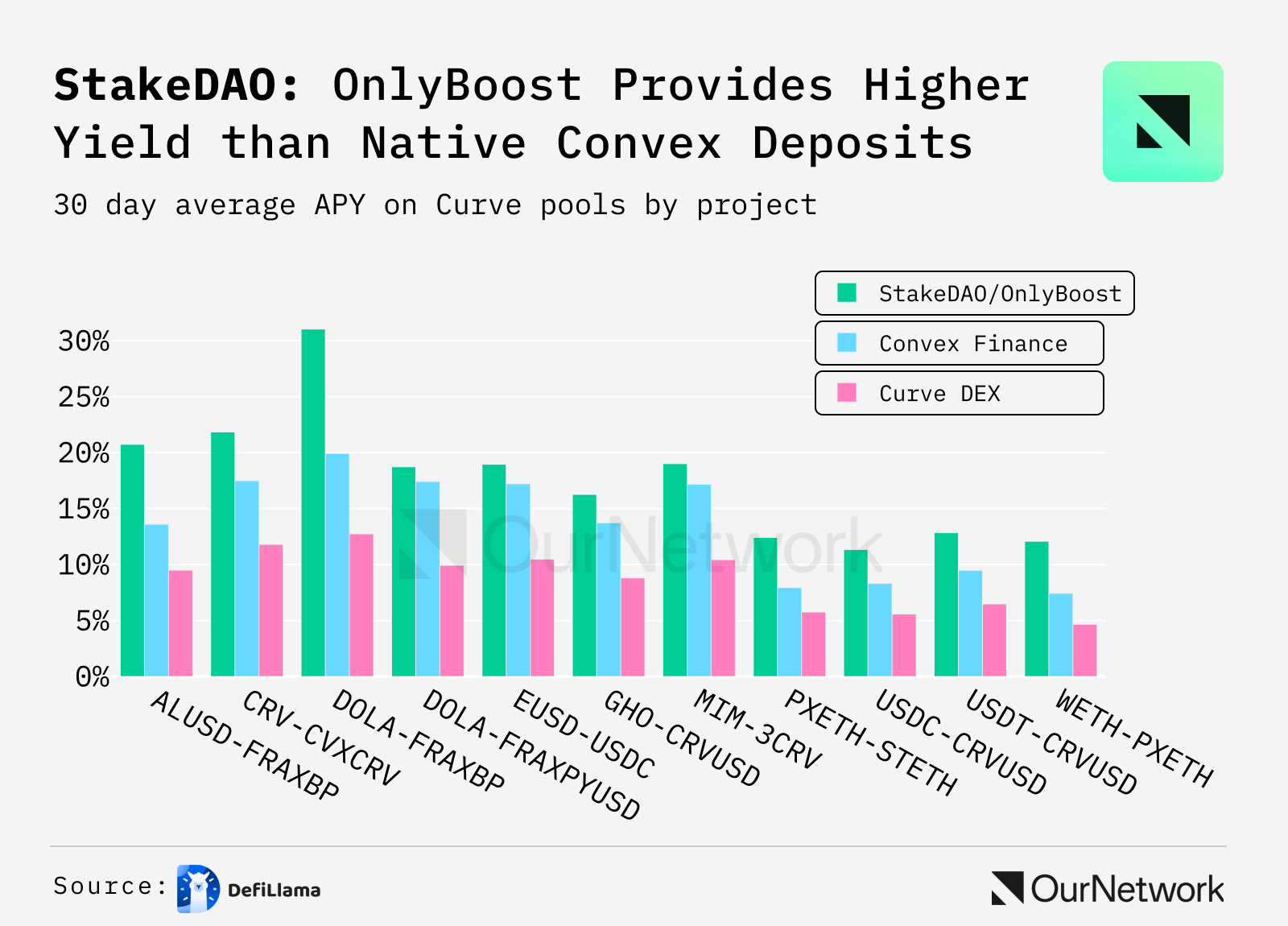

To adapt to new market conditions, Stake DAO subsequently updated its OnlyBoost feature. With this update, OnlyBoost pools now aggregate boosting power from Stake DAO, Convex, and Egorov, covering 70% of the available boost supply in the market. As a result, Stake DAO is now able to offer Curve liquidity providers (LPs) average returns that are 20%-40% higher than those on competing platforms.

-

Thanks to this update, the OnlyBoost feature has successfully achieved best-in-class annual percentage yields (APY) across Curve pools. The design leverages smart contracts that dynamically allocate deposits between Stake DAO and Michael Egorov’s boost or Convex, depending on which option provides the highest efficiency.

-

Transaction Focus: To illustrate how OnlyBoost delivers optimal returns for Curve pools, consider this recent “rebalancing” transaction. A user optimized their alETH/pxETH liquidity position by reallocating deposits between Convex and Stake DAO to maximize yield.

Pendle

Delleon McGlone | Website | Dashboard

Implied APY Drops from 36% Earlier in 2024 to 12%

-

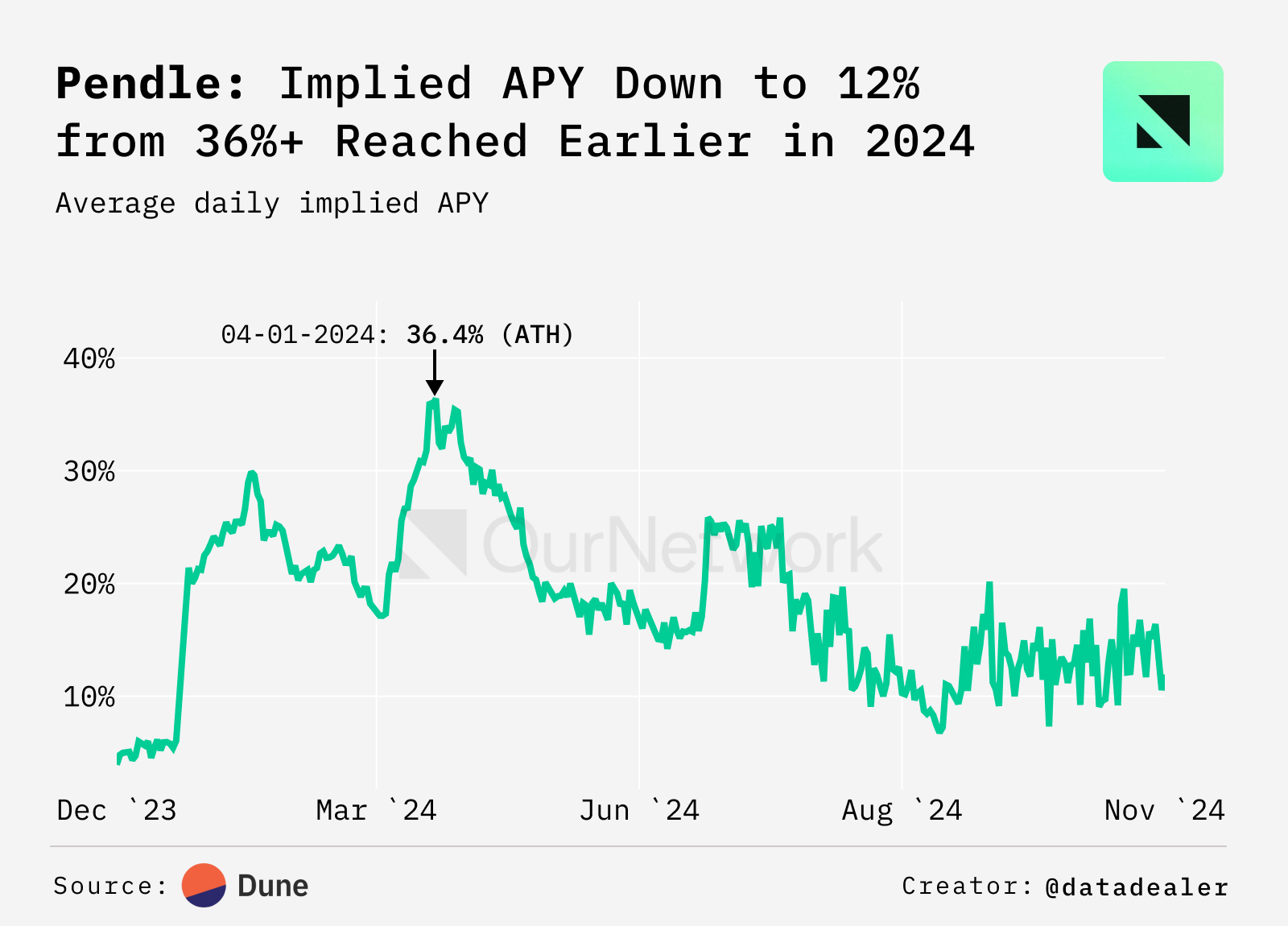

Pendle is a yield-focused protocol whose core functionality involves tokenizing future yield streams and enabling users to trade them. Currently, Pendle’s total value locked (TVL) is close to $4 billion, ranking it first among yield protocols on DeFi analytics platform DeFiLlama. However, Pendle’s yields on Ethereum have been highly volatile, averaging between 4% and 36% implied annual percentage yield (APY) over the past year. Over the last 12 days, yields have dropped by 13%, settling around 12%.

-

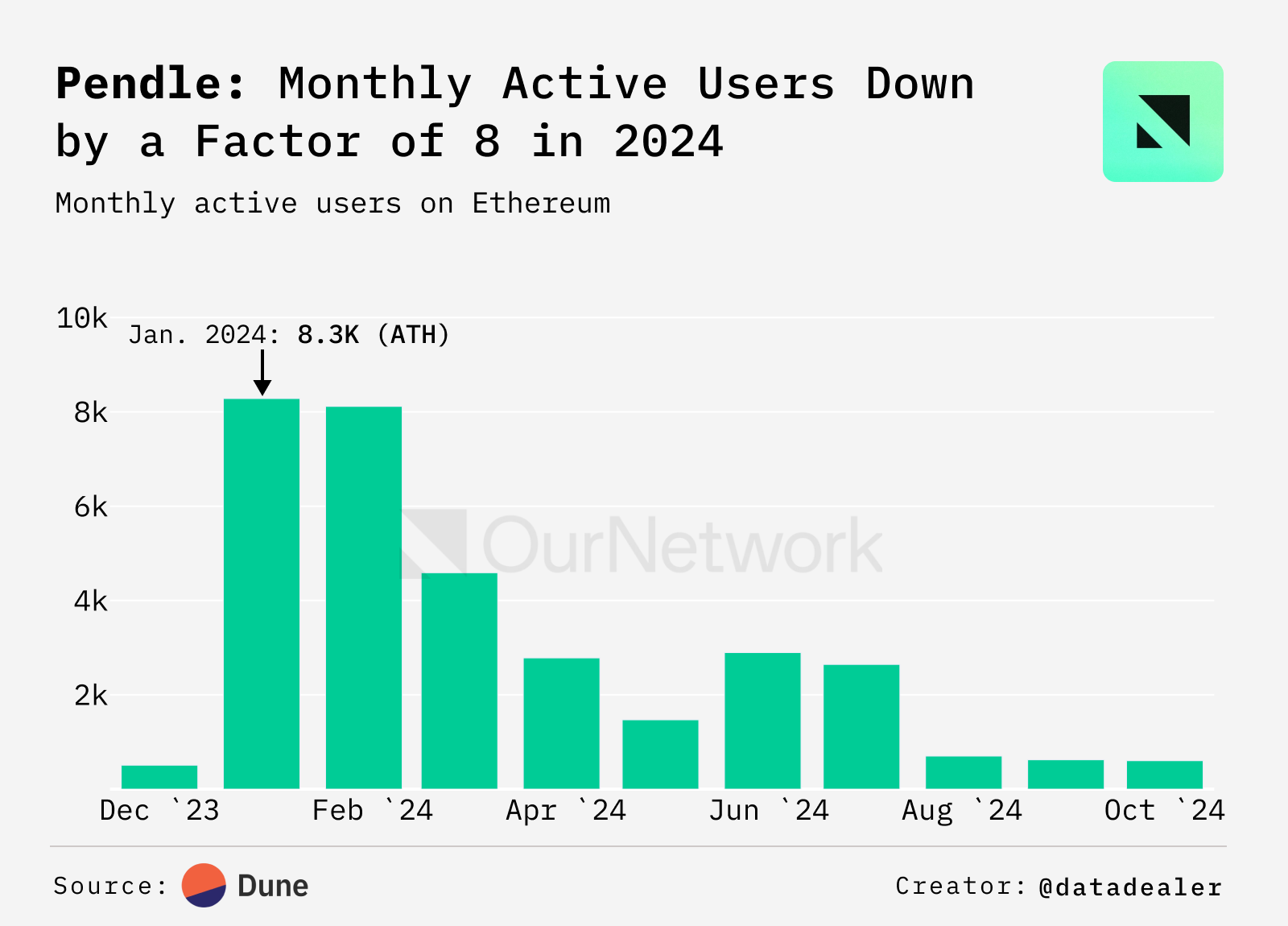

Earlier this year, Pendle reached a peak of 8,300 monthly active users on Ethereum, but user numbers have since trended downward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News