Behind Base's疯狂 cash grab, what is the real "lever" driving value growth?

TechFlow Selected TechFlow Selected

Behind Base's疯狂 cash grab, what is the real "lever" driving value growth?

Providing more institutions with technological "leverage" to position themselves in Web3.

Producer|OKG Research

Author|Jason Jiang

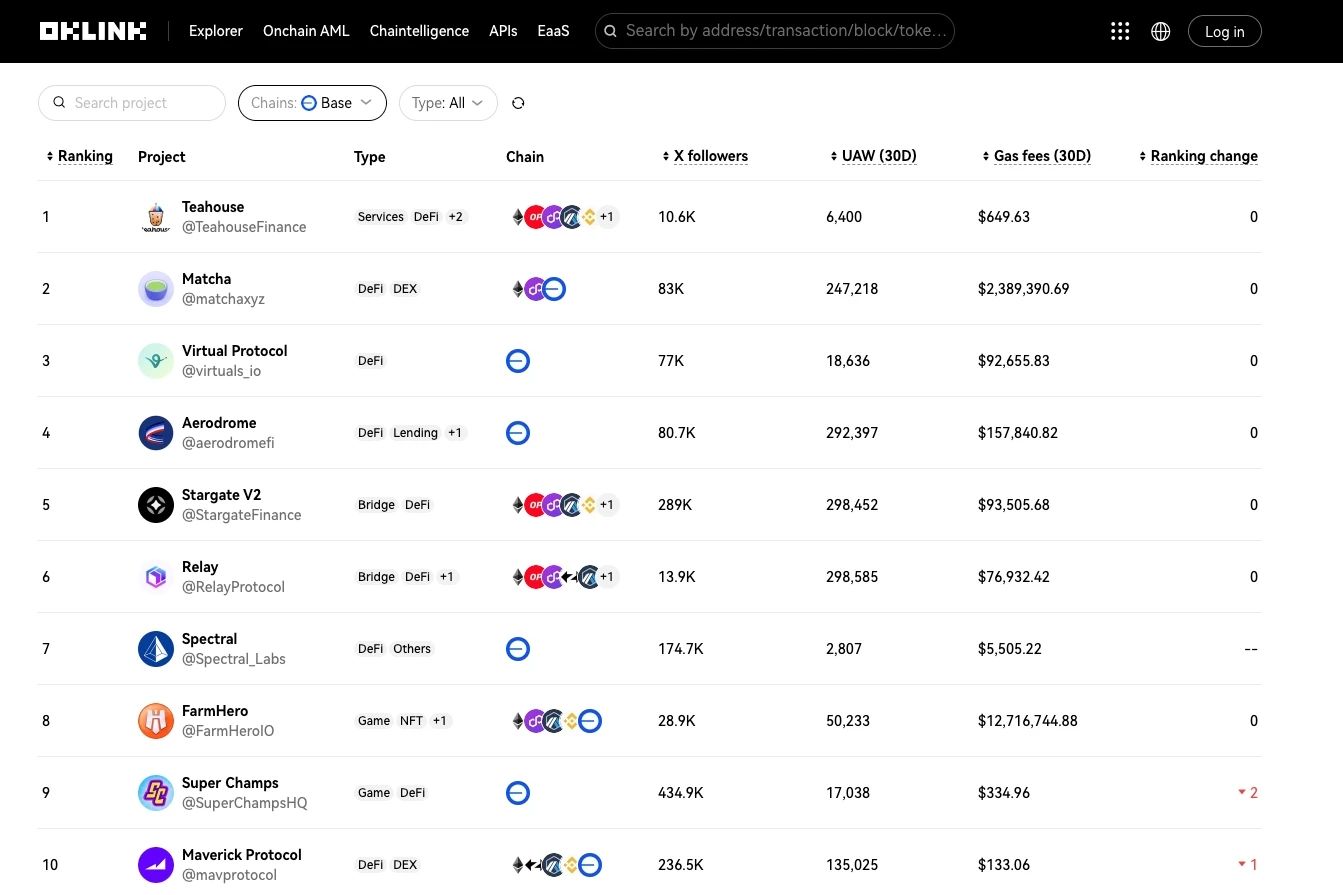

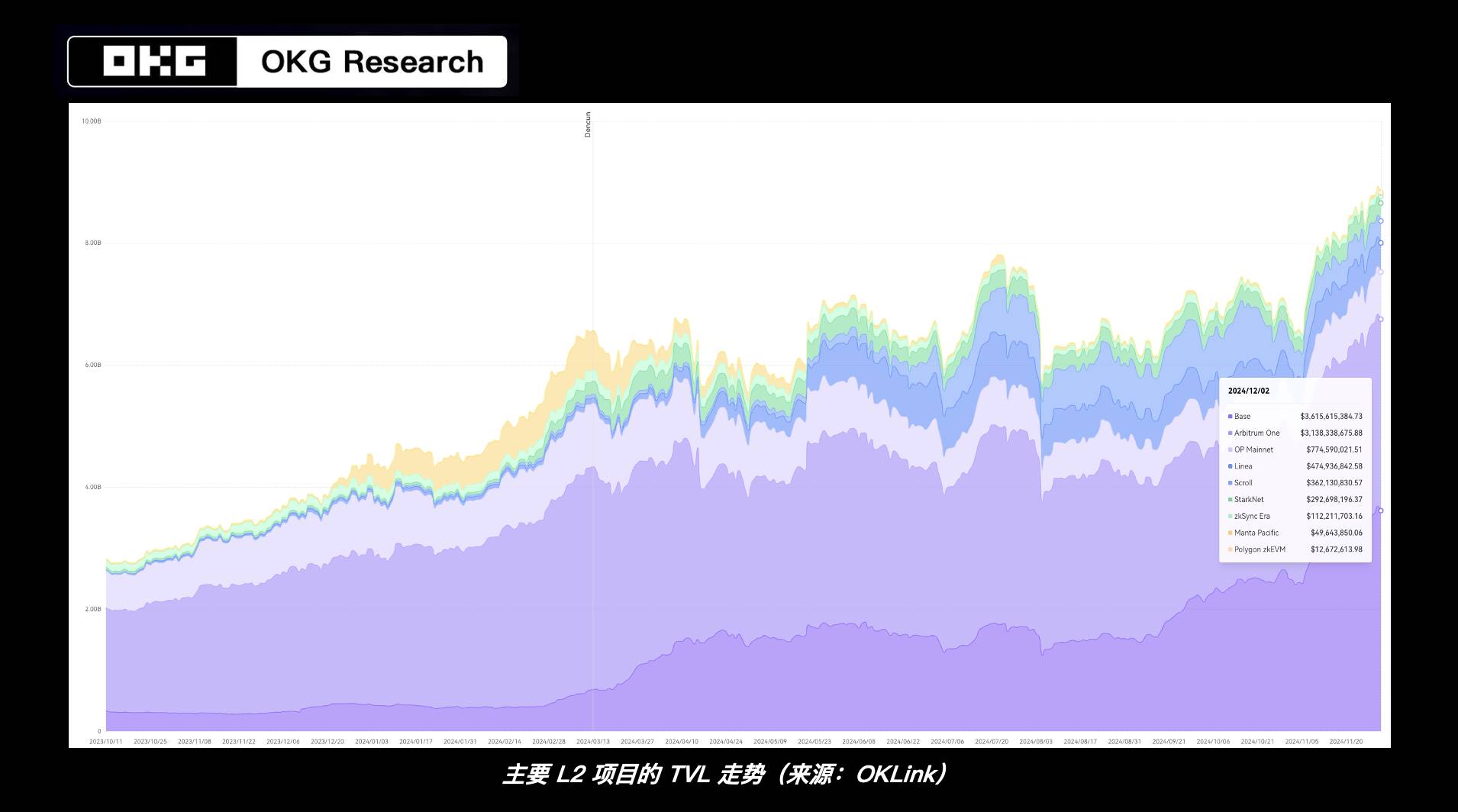

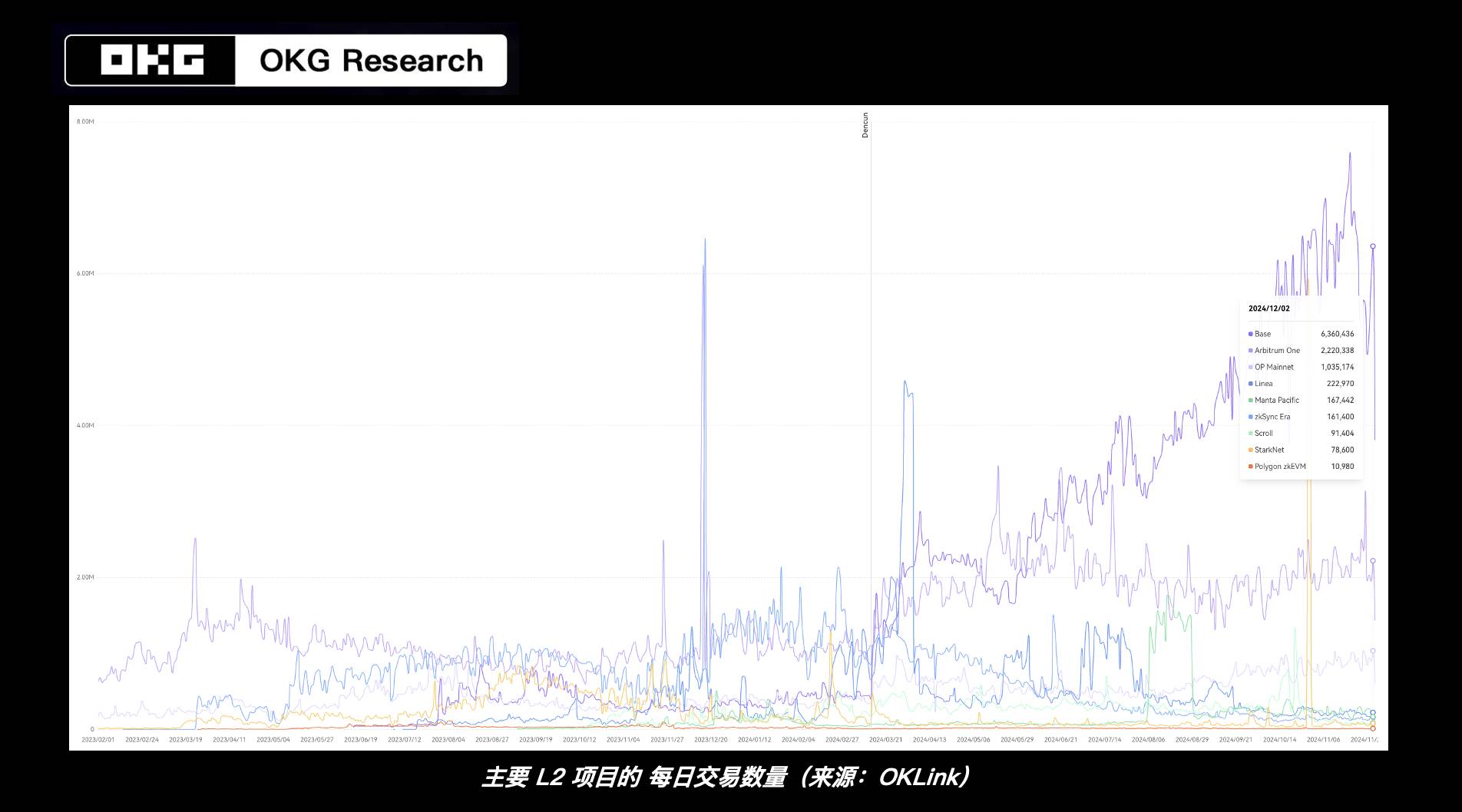

Massive capital is flooding into Base. On-chain data shows that over the past month, Base has been the ecosystem with the highest net inflow of funds, reaching $750 million—far exceeding Solana’s approximately $300 million during the same period. At the same time, other metrics are also surging: daily transactions on Base have peaked above 11 million, accumulating over 1 billion on-chain transactions to date, while weekly active addresses have grown 20-fold since the beginning of the year, surpassing Arbitrum to become the L2 project with the highest TVL.

Popular projects on Base (Source: OKLink)

Base’s success stems from its ability to capitalize on trends and create viral hits, but it also heavily benefits from Coinbase’s backing: Base seamlessly integrates various products, users, and tools within the Coinbase ecosystem, enabling developers to rapidly build on-chain applications and access over 100 million users and substantial assets. This allows for smooth migration of users and assets alike. This forms Base’s foundational advantage—and a natural edge compared to other L2s. Today, an increasing number of well-backed projects like Base are entering the L2 arena.

Will one of these well-supported L2s become the next Base?

Despite persistent criticism and skepticism toward L2s due to excessive infrastructure leading to fragmented liquidity and intensified competition for market share, new entrants remain undeterred. Numerous institutions continue joining the L2 race: legacy DeFi giant Uniswap launched its own L2, Unichain; Web2 tech titan Sony announced its L2 network Soneium… Just as the battle for liquidity continues, a fresh wave of high-profile, well-connected competitors has arrived.

Compared to early L2 projects, these newcomers are different.

Early native L2s like Arbitrum and Optimism were built primarily to address Ethereum’s technical and performance limitations—not application needs. These projects aimed to meet demand for mainnet usage by offering lower gas fees and higher TPS. Their success depends on a highly active main chain: only when the mainnet sees frequent use can the advantages of L2s be realized and their value unlocked. However, despite Ethereum maintaining leadership in absolute figures, its growth has significantly lagged behind chains like Solana amid internal and external challenges. As a result, even though these L2s possess strong technical foundations, they’ve had little room to demonstrate their potential.

In contrast, newer L2 entrants—whether Base launched in August last year, or Uniswap and Sony this year—either already have existing applications and traffic, or offer significant potential for integrating Web2 use cases. They rely less on Ethereum for traffic, scenarios, and ecosystems, and do not aim to replace Ethereum. Instead, they focus more on monetizing existing L2 technology to optimize and expand their own application landscapes and gain competitive advantages.

Why are these projects choosing L2? On one hand, modular rollup infrastructure has matured, with platforms like OP Stack drastically lowering the technical barriers to deploying an L2. One-click chain deployment is becoming a reality, without needing to bootstrap a new consensus network—making it a more cost-effective technical choice. On the other hand, Base’s success has proven that L2 projects can operate healthily without relying on token-based financial incentives, offering clear regulatory compliance advantages that may attract even more institutional interest.

The second half of the L2 race has begun—how will value leverage be unlocked?

Criticism and pessimism around L2s today stem not just from underwhelming market performance, but fundamentally from a visible mismatch between technological advancement and application innovation in this cycle. It's like building a highway with great effort, only to realize there are barely any cars on the road—most people are still riding bicycles. In such a scenario, the highway’s value naturally remains unrealized.

How can this be solved? The most effective way is to accelerate application development within the L2 ecosystem, narrowing or even eliminating this timing gap, thereby reigniting infrastructure demand and pushing the market into a virtuous cycle of “infrastructure → applications → infrastructure,” unlocking the true leverage of L2 value.

As Sota Watanabe, SBL Director at Sony and founder of Astar Network, put it, “Due to the lack of touchpoints with general users and their feedback, the Web3 industry has historically been building products for itself.” But with institutions like Sony bringing real-world business operations and resources, Web3 infrastructure and applications could finally break free from the echo chamber, evolving into solutions that solve real problems and meet genuine needs—delivering the benefits of Web3 technology to a broader Web2 audience.

At Ethereum’s developer conference in July this year, Vitalik also stated that “the biggest theme for Ethereum’s ecosystem in the next decade will be applications.” These new L2 entrants are arriving precisely with applications in mind—and driven by them. While most native L2 projects continue competing on technical narratives, the newcomers are already building toll booths on the existing L2 highways and guiding more vehicles onto the roads.

As L2 technology advances and matures, L1 blockchains may grow increasingly distant from everyday users, while L2s become the primary hubs for on-chain users and applications. According to OKG Research, over 90% of Ethereum transaction activity already occurs on L2 networks. More institutions—especially Web2 companies—are likely to adopt L2s as their preferred platform for building on-chain applications and participating in the Web3 ecosystem.

In this process, a new phase of the L2 battle centered on applications may soon unfold—one that will require not just technical prowess, but also strategic resources and real-world use cases. These new L2 players, backed by powerful institutions and armed with built-in traffic and scenario advantages, might outperform long-standing projects entrenched in technical battles, delivering surprises on the application front and unlocking the full value leverage of L2 innovation.

If spot ETFs for digital assets give more investors access to Web3-era portfolio options, then L2s may provide more institutions with a Web3 technology 'lever,' enabling Web3 to serve not only itself but also amplify the Web2 market, sparking new waves of application innovation.

*The content described in this article is solely for market observation and trend analysis, and should not be considered as specific investment advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News