Every time cryptocurrencies go crazy, humanity moves one step further away from AGI?

TechFlow Selected TechFlow Selected

Every time cryptocurrencies go crazy, humanity moves one step further away from AGI?

Some people are investing, while others are speculating.

By Zhou Yixiao, TechFlow Pro

After Donald Trump won the U.S. presidential election, market expectations rose that he would ease regulatory pressure on cryptocurrency. Trump has previously expressed support for bringing Bitcoin mining operations to the United States—a policy that could indirectly impact the AI industry. In the early hours of November 23, Bitcoin's price surged to $99,660, hitting a new all-time high and inching closer toward the $100,000 mark.

This is significant because both Bitcoin mining and AI training require massive amounts of energy and computing power. As both sectors grow simultaneously, they will inevitably compete for electricity and hardware resources. This means AI training operations could be affected by Bitcoin price volatility, especially when miners compete for limited hardware. In other words, rising Bitcoin prices may lead to higher AI training costs.

AI VS BTC

Following ChatGPT’s breakthrough success, AI companies have rushed to train and deploy their own models in hopes of surpassing OpenAI’s flagship offerings. This has created enormous demand: AI model inference is far more complex than traditional search engine indexing and retrieval—each ChatGPT query consumes roughly ten times more energy than a Google search.

As a result, AI firms are urgently seeking cheap energy and large tracts of land to house equipment. In North America, some regions have implemented queuing systems for large data centers waiting to connect to the power grid. Even after securing initial approval, building a data center from scratch can take years, cost millions of dollars, and involve lengthy regulatory and administrative processes.

Internationally, large-scale Bitcoin mining has long been an extremely profitable business—but one heavily impacted by the volatile crypto market. After the 2022 cryptocurrency market crash, many miners were forced into bankruptcy or had to shut down operations entirely.

In 2023 and early 2024, mining companies that survived the downturn enjoyed strong profits. However, this year’s Bitcoin halving—where miner rewards were cut in half—did not trigger the usual sharp rise in Bitcoin’s price as seen in previous cycles, failing to offset reduced block rewards. Since April, Bitcoin’s prolonged sideways price movement has squeezed miner margins, pushing some to diversify their business models to hedge against crypto price volatility.

Four years ago, when data center and Bitcoin mining company IREN considered entering the AI training space, they found the business volume insufficient from a commercial standpoint. Today, however, an increasing number of major Bitcoin mining firms are replacing part of their mining hardware with equipment designed for running and training AI systems. These companies believe providing compute power to AI firms offers a safer, more stable revenue stream than mining alone.

Now, collaboration between the artificial intelligence and Bitcoin mining industries appears natural and mutually beneficial. AI companies need the existing sites, low-cost energy access, and infrastructure already established by miners, while miners seek the stable income and potential profits brought by the current AI boom.

Some Bitcoin mining firms have begun leasing their facilities to AI clients. In June, Core Scientific—a Bitcoin mining company that nearly went bankrupt in 2022—announced it would host over 200 megawatts of GPUs for AI startup CoreWeave. Core Scientific stated that AI companies are already purchasing mining sites at prices exceeding those in the mining market, referring to Bitcoin mining facilities as “electrical shells” within the data center industry.

Other mining companies are operating GPU clusters themselves. Hut 8, a Bitcoin mining firm, secured a $150 million investment from Coatue Management to build AI infrastructure. At some facilities of Australia-based IREN, GPUs used for AI and ASICs used for Bitcoin mining coexist in the same space. Bitcoin provides immediate but highly volatile income, while AI relies on customer contracts, which offer greater stability once secured. Nasdaq-listed Bitdeer is also building its own AI data center in Singapore.

A Business That Looks Too Good to Be True

However, only a small fraction of overseas mining companies can successfully make this transition. Moreover, the equipment used for Bitcoin mining—called ASICs (Application-Specific Integrated Circuits)—is designed specifically for one task. The term “application-specific” means these devices cannot be repurposed for other uses. Miners cannot seamlessly shift their mining rigs into AI applications.

An AI infrastructure industry professional told TechFlow, “For example, we typically use H100s to train models, while mining usually relies on 4090s.”

In other words, to serve the AI sector, Bitcoin miners must purchase entirely new equipment. Furthermore, AI and Bitcoin mining have different data center requirements. Entering a completely new and highly complex field is inherently difficult, let alone competing against well-funded tech giants like Google, Amazon, and Microsoft.

Therefore, not all mining companies can replicate the high-value partnership between Core Scientific and CoreWeave. Smaller miners, in particular, often lack meaningful resources to offer the AI industry.

In China, cryptocurrency mining is banned, so miners have no option to pivot to AI. Nevertheless, companies from other sectors are trying to capture a share of the AI wave—either by directly entering the field or establishing computing power subsidiaries to engage in “compute leasing” businesses. According to statistics, there are now over 100 listed A-share companies under the “compute leasing” concept, including Hongbo Shares—the so-called “king of lottery printing”—and Lotus Holding, known as the “monosodium glutamate king.” On video platforms, content such as “sold a house back home, bought 800 graphics cards, and started a compute leasing business with my middle school classmate” has emerged.

In an ideal scenario, the compute leasing business model involves an upfront investment in GPU servers, hosting hardware in professional intelligent computing centers, and leasing computing power to end users, with both hardware maintenance and software services handled by the computing center.

In reality, however, this may not be a profitable venture. Demand for compute leasing stems from the development of large AI models, yet rental prices for high-end AI hardware are plummeting. Eugene Cheah, CEO of Featherless.Ai, wrote that overseas H100 rental prices once reached $8 per hour but have now dropped below $2 per hour. This is mainly due to early lease agreements made by some companies, who are now reselling reserved compute capacity to avoid idle resources. Meanwhile, most market players are opting for open-source models, reducing demand for newly trained proprietary models.

The domestic compute leasing market is experiencing a similar phenomenon of “compute surplus,” yet “leasing prices likely won’t drop, because most hardware was purchased at high prices earlier,” a professional in the intelligent computing industry told TechFlow.

“Still Faster This Way”

There’s a famous saying in the crypto world: “computing is power.” This phrase has now spread to the AI community.

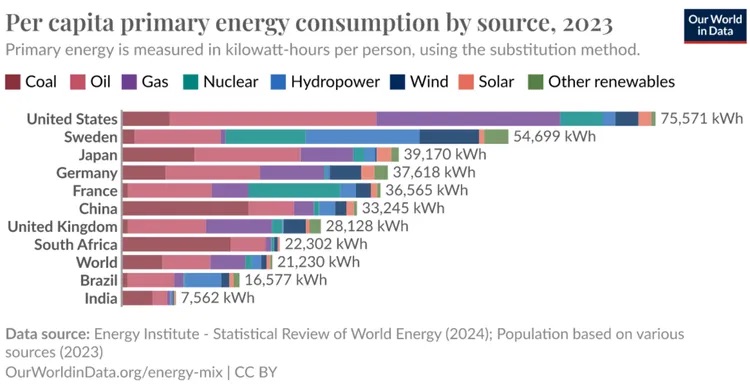

Underlying computing power is energy. There is a close correlation between developed nations and high energy consumption. If we compare countries by per capita electricity generation (measured in kilowatt-hours, kWh), the pattern becomes clear. In essence, energy surplus is a necessary condition for civilizational advancement. After all, layers such as manufacturing, transportation, public services, urbanization, and computing built atop basic survival needs like agriculture all depend on abundant energy.

From this perspective, the infrastructure originally built for cryptocurrencies is now helping meet the computing demands of the AI era. For overseas cryptocurrency mining industries that have long sought to shed their speculative image, this presents a valuable opportunity to demonstrate real-world utility. As long as this boom continues, leading players will benefit from the enthusiasm and liquidity driven by AI.

During every technological revolution, a “gold rush” inevitably follows. For speculators involved, the pursuit is always profit itself—whether the object of speculation is digital currency, artificial intelligence, or tulips from three centuries ago seems irrelevant.

After the latest Bitcoin halving, some miners face a dilemma: either continue mining and holding coins, betting on future price increases; or pivot to building AI data centers, hoping to ride the AI wave and make quick profits. Now that prices have hit record highs, some are once again exclaiming: “Still faster this way.” But there’s another well-known saying in crypto circles: “Holding crypto is harder than being a widow.”

As people swing back and forth between the crypto and AI worlds, this recurring cycle echoes Keynes’ observation: Speculators don’t care who is the most beautiful—they only care who will win the beauty contest.

And this “beauty contest” will continue endlessly.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News