The Crossroads of DeSci: Returning to Value or Chasing Memes?

TechFlow Selected TechFlow Selected

The Crossroads of DeSci: Returning to Value or Chasing Memes?

The consensus around DeSci has just begun.

Author: Kevin, the Researcher from BlockBooster

On November 26, Paul Kohlhaas, founder of BIO Protocol, replied to a post by CZ on social media, stating that "Decentralized Science (DeSci) has successfully channeled meme coin liquidity into universities and laboratories worldwide, supporting genuine scientific research." This phenomenon raises an important question: Why can scientific research—especially medical research, which is inherently rigorous and requires long-term investment—successfully integrate with the fast-moving crypto market?

Scientific research, particularly in medicine, objectively demands significant time commitments, often measured in years or even decades. This stands in stark contrast to today's market obsession with "get-rich-quick" schemes. Why did DeSci spark widespread discussion in November? Is it due to a peak in meme sentiment leading to market correction? Or is DeSci merely a new breed of meme project disguised as humanitarian science? This article will examine the business models and development directions of Bio Protocol and Pump.Science to explore what DeSci truly needs; under what conditions it can align with market demand and achieve sustainable growth.

Bio Protocol Business Model Breakdown

The narrative around DeSci was initially sparked by Bio Protocol. On November 8, Binance completed a strategic investment in BIO, although the round and amount were not disclosed. Following this news, the BIO Genesis community fundraising campaign raised $33 million.

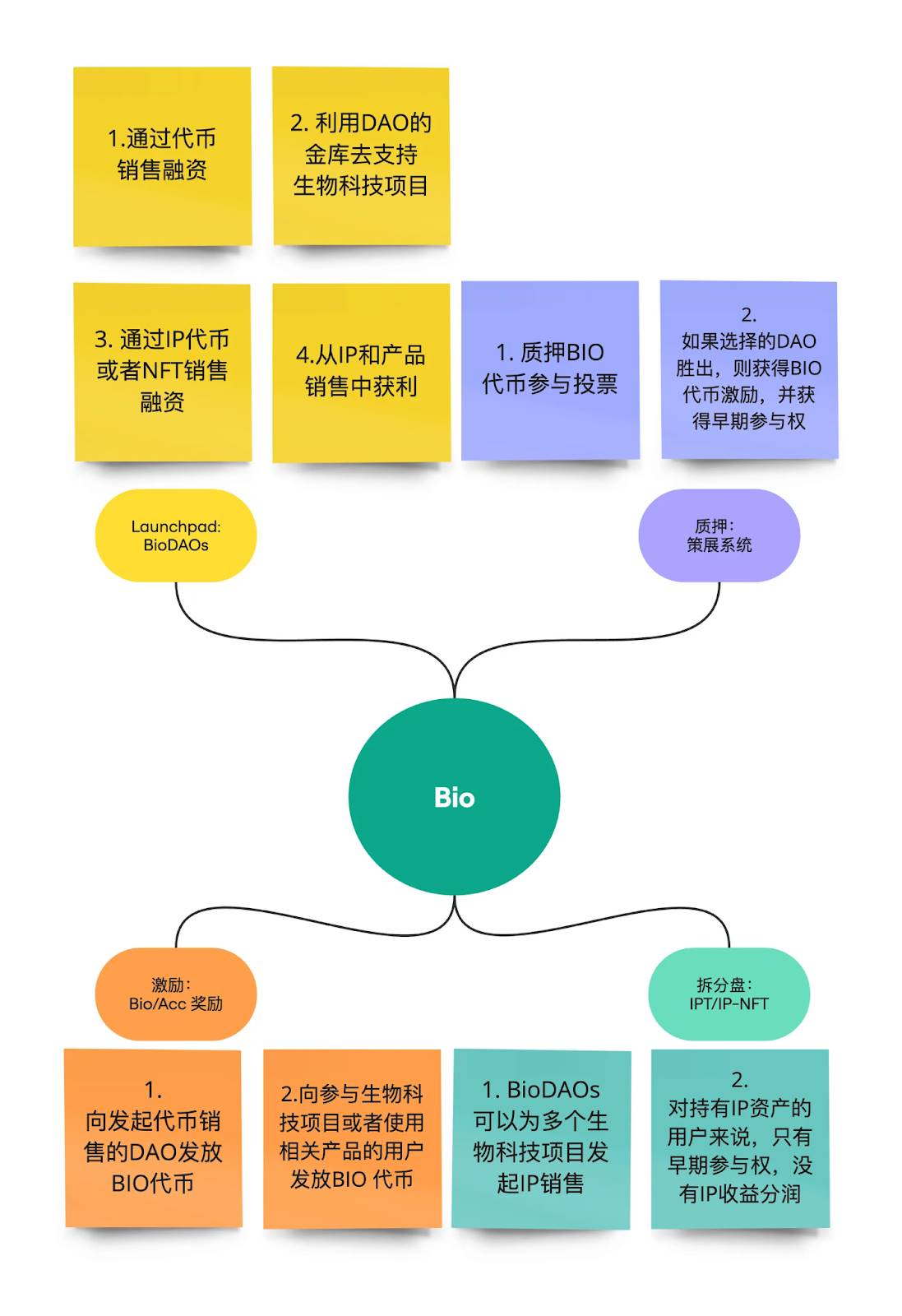

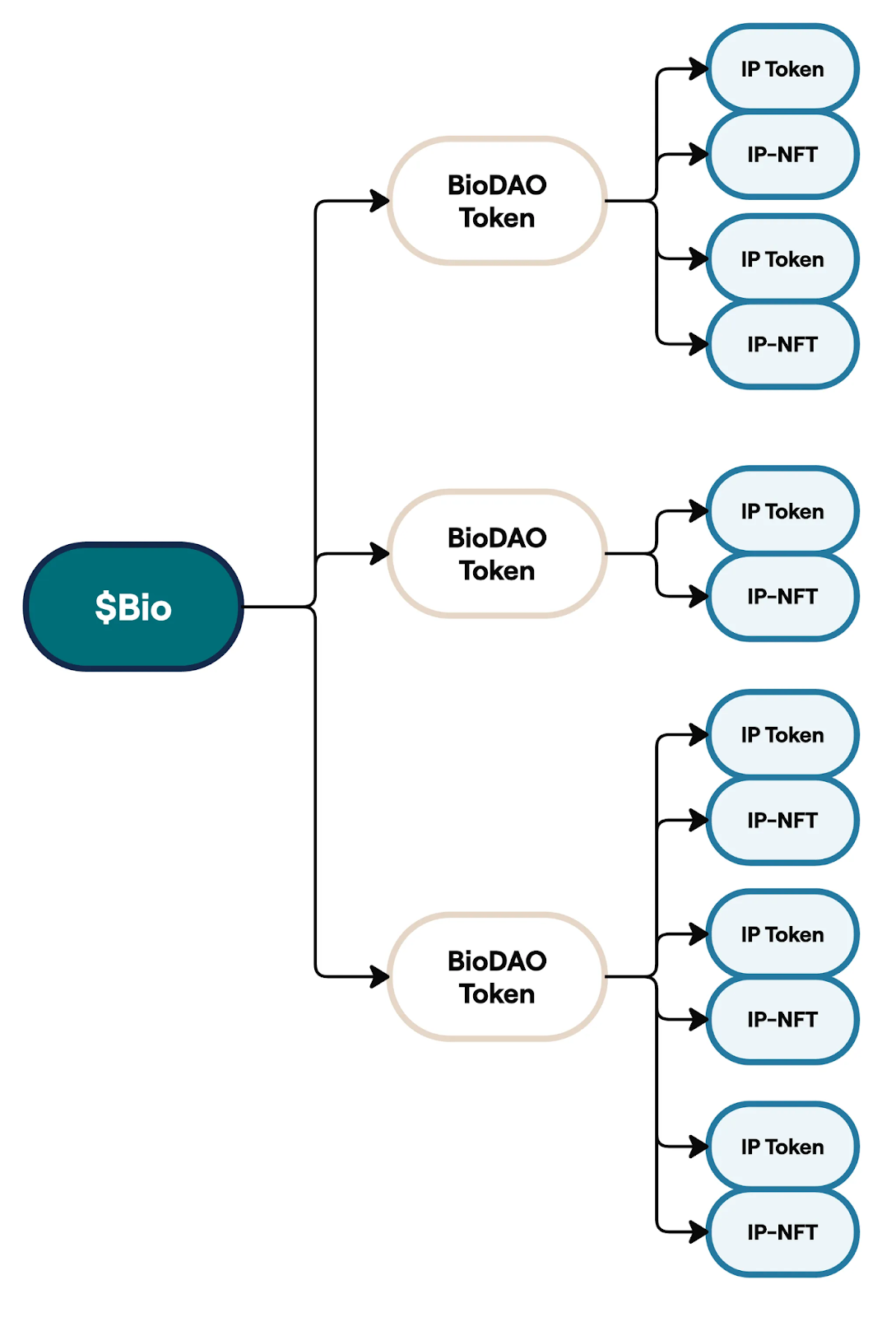

BIO currently operates seven active DAOs focusing on areas such as longevity, hair loss treatment, and brain health. It’s important to note that a BioDAO does not refer to a single research team working within one domain like longevity—it should instead be understood as a concrete implementation of the BIO Protocol. Why do I say this? Refer to the BIO Protocol business model diagram above. In simple terms, BIO consists of four components: a nested launchpad structure, non-yielding staking, incentive mechanisms, and an embedded launchpad enabling infinite fractal spin-offs.

First, Launchpad BioDAOs: Each BioDAO raises funds through token sales and uses those funds to support related biotech projects. Moreover, each BioDAO itself functions as a sub-launchpad—a point I’ll elaborate on later.

Second, BIO’s staking mechanism, branded as “curation,” locks user tokens. Governance and proposal pages show that regular staking rates hover around 15%, rising above 20% during votes for new BioDAO creation. Staking yields no direct returns. Instead, users who vote for a winning BioDAO receive BIO token rewards; those backing unsuccessful proposals receive nothing. Curation serves as a powerful tool for locking up BIO tokens. The value generated for the BIO ecosystem during new BioDAO launches far exceeds the cost of distributed rewards.

Third, the primary utility of the BIO token lies in incentives. These are split into two parts: one directed at participating BioDAOs, which receive incentive payouts upon their initial token offerings; the other aimed at users, who may earn BIO tokens when using BioDAO products or contributing to them. Currently, these user incentives are minimal in quantity. Compared to traditional research industries where clinical trial participation is extremely costly, BIO drastically reduces costs by issuing its own tokens as rewards.

Fourth is the fractal spin-off model. BioDAOs act as sub-launchpads, selecting specific teams or research topics, raising capital, and issuing IP tokens or IP NFTs. Holders of these assets are promised early participation rights but no guaranteed financial returns.

From a business model perspective, BIO operates using familiar industry practices, but with key distinctions. Its nested launchpad architecture means that potential liquidity issues first impact individual BioDAO tokens. The BIO token acts as a buffer layer—its value is only questioned if multiple BioDAO tokens fail. Conversely, successful project-level asset launches feed directly back into BIO’s value by attracting more users to buy and stake BIO tokens. Another distinctive feature is leveraging participation in scientific R&D as justification for requiring users to stake tokens without offering yield. Potential returns are instead borne by the individual BioDAO or research project, allowing BIO to lock up user capital at near-zero cost over the long term. Effectively, BIO serves as an index token across all underlying DAO tokens.

How Pump.Science Blurs the Line Between DeSci and Memecoins

Molecule is a protocol that puts intellectual property (IP) on-chain, enabling Bio Protocol to issue IP-NFTs and IPTs. Pump.Science is Molecule’s launchpad, representing ownership of a compound’s intellectual property via tokens.

Pump.Science argues that buying stock in a biotech company indirectly gives you exposure to all its drugs. On Pump.Science, however, investors can choose to fund a single drug candidate. Tokens issued on Pump.Science comply with legal frameworks, but only synthetically created compounds are eligible for tokenization—not naturally occurring substances like nicotine. However, combinations—such as nicotine mixed with caffeine—can be patented, and thus tokenized. Pump.Science tokenizes these patents or datasets and tests their efficacy.

Two tokens have been launched so far: $RIF and $URO, with $RIF reaching a $100 million market cap. The underlying compounds can be developed into supplements, potentially generating revenue through future sales or patent licensing. To attract more investors, Molecule develops data packages demonstrating compound effectiveness—for example, showing significant lifespan extension in animal trials.

But is Pump.Science genuinely committed to scientific research? Increasingly, that seems unlikely. Ahead of Christmas, Pump.Science announced a "Rif Christmas" event, launching two new tokens per day for ten days—meaning 20 synthetic compound tokens will be released intensively throughout December. While the platform claims it plans to gradually advance these projects toward human trials and eventually commercialize supplements, it's foreseeable that the vast majority of these 20 tokens will collapse to zero long before any corresponding supplement reaches market.

From a market-timing perspective, Pump.Science is also pushing forward AI-related product development. Plans include creating an AI trading bot trained on compound experiment data, capable of executing trades based on milestone events at various stages of development.

Returning to our central theme: Should DeSci return to value creation or continue chasing memes? From the business models and trajectories of Bio Protocol and Pump.Science, it’s clear neither has fully committed to real scientific research while still capitalizing on memecoin opportunities. This hybrid approach might represent one viable path for future DeSci protocols. However, several points must be recognized clearly:

- Scientific research must return to fundamentals and objective laws. Biomedical research requires sustained, substantial funding—short-term memecoin speculation cannot last.

- A single memecoin is not a sustainable model for DeSci protocols.

- Investing in DeSci tokens requires tolerance for prolonged periods of low visibility and narrative dormancy.

- DeSci projects need to inflate valuations using VC-style hype, boost expectations around flagship projects, and consistently signal through iconic figures. Given that DeSci awareness lags far behind AI, stronger authoritative signals are needed to build market confidence and consensus.

- In terms of go-to-market strategy, DeSci encompasses several verticals: fundraising, research, data, peer review, publishing, infrastructure & services, art, open science ecosystems, and community. Projects should select niches aligned with their expertise or lower technical barriers.

- The DeSci model is inherently fractal—each research topic becomes a sub-token. It relies on large-cap tokens pulling smaller ones ("big vehicles towing small carts"), using Web3-style crowdfunding to finance real-world research initiatives and showcase practical applications. Several existing protocols are pursuing this model. However, given the high uncertainty and failure rate inherent in scientific research, execution remains extremely challenging.

The market needs to witness numerous real-world examples of DeSci making tangible impacts before broad consensus forms. This process will take longer than the AI narrative—ChatGPT launched at the end of 2022, and crypto speculation began in 2023. DeSci will require even more time. Yet paradoxically, AI’s rapid progress has subtly conditioned people’s minds to accept once-unimaginable possibilities as realistic. VitaDAO’s longevity research no longer seems like science fiction. Overall, I believe DeSci consensus is only just beginning. It requires long-term cultivation and should be viewed as a narrative poised to explode in the next bull market.

About BlockBooster: BlockBooster is an Asia-based Web3 venture studio backed by OKX Ventures and other top-tier institutions, dedicated to becoming a trusted partner for exceptional founders. Through strategic investments and deep incubation, we bridge Web3 projects with the real world, empowering high-potential startups to grow.

Disclaimer: This article/blog is for informational purposes only and represents the author’s personal views, not necessarily those of BlockBooster. It does not constitute: (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets—including stablecoins and NFTs—carries high risk, with significant price volatility and the potential for total loss. You should carefully consider whether trading or holding digital assets is suitable for your financial situation. For specific questions, please consult your legal, tax, or investment advisor. Information provided herein (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in preparing such data and charts, but no responsibility is accepted for any factual errors or omissions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News