Deep Dive into MicroStrategy's Opportunities and Risks: The Double Whammy and Double Benefit of the Davis Effect

TechFlow Selected TechFlow Selected

Deep Dive into MicroStrategy's Opportunities and Risks: The Double Whammy and Double Benefit of the Davis Effect

MicroStrategy's business model significantly increases BTC price volatility, acting as an amplifier of fluctuations.

Author: @Web3_Mario

Summary: Last week, we explored the potential for Lido to benefit from regulatory changes, hoping to help readers capitalize on the "buy the rumor" trading opportunity. This week, an intriguing topic has emerged: the growing attention around MicroStrategy (MSTR). Many seasoned observers have shared their views on the company's operational model. After digesting and conducting deeper research into it, I’d like to share my own perspective. I believe the key driver behind MSTR’s stock price appreciation is the so-called “Davis Double Play.” Through a business design centered on raising capital to purchase BTC, MicroStrategy links Bitcoin’s appreciation directly to corporate profitability. By leveraging innovative access to traditional financial market funding channels—and thus gaining financial leverage—the company achieves earnings growth that exceeds even the direct gains from BTC holdings. Moreover, as its BTC holdings grow larger, MSTR gains increasing influence over BTC pricing, further reinforcing market expectations of continued profit growth. However, this strength also represents its core risk. When BTC enters a period of volatility or trend reversal, profit growth stalls. Meanwhile, due to fixed operating expenses and debt obligations, MSTR’s ability to raise additional capital diminishes, undermining future earnings expectations. Unless new catalysts emerge to push BTC prices higher again, the premium of MSTR stock over its underlying BTC holdings will rapidly contract—a process known as the “Davis Double Whammy.”

What Are the Davis Double Play and Davis Double Whammy?

Regular readers know I aim to make complex financial dynamics accessible to non-professionals by walking through my reasoning step-by-step. So let’s start with some foundational knowledge: what exactly are the “Davis Double Play” and “Davis Double Whammy”?

The term “Davis Double Play” was popularized by investment expert Shelby Cullom Davis (note: not Clifford Davis, as sometimes misattributed). It describes a scenario in which a stock surges due to two simultaneous positive factors:

- Earnings Growth: The company delivers strong earnings growth—driven by improved operations, management, revenue expansion, cost control, etc.

- Valuation Expansion: As investor confidence rises, they assign a higher valuation multiple (e.g., P/E ratio) to the stock, reflecting greater optimism about future prospects.

The mechanism works as follows: when a company beats earnings expectations—say, through rising sales, market share gains, or margin improvements—its profits increase. This performance fuels stronger belief in its long-term trajectory, prompting investors to pay more per dollar of earnings. The combination of rising earnings and expanding multiples creates a powerful feedback loop, often accelerating stock price gains—this is the “Davis Double Play.”

To illustrate, suppose a company currently trades at a P/E of 15x, with projected earnings growth of 30%. If market sentiment improves and investors now accept a P/E of 18x, the stock can surge even if fundamentals remain unchanged:

- Current share price: $100

- Earnings per share (EPS) rise 30%, from $5 to $6.50

- P/E expands from 15x to 18x

- New share price: $6.50 × 18 = $117

The stock climbs from $100 to $117—not just from earnings growth, but amplified by valuation expansion.

In contrast, the “Davis Double Whammy” occurs when two negative forces converge, causing a sharp decline in stock price:

- Earnings Decline: Profitability drops due to falling revenues, rising costs, or poor execution.

- Valuation Contraction: Diminished outlook leads investors to apply lower valuation multiples, further depressing the stock.

Here’s how it unfolds: disappointing results erode confidence, leading investors to question future growth. They then demand a lower price for each dollar of earnings, shrinking the P/E ratio. This dual hit—declining earnings and compressing valuations—can cause steep declines.

Example:

- Current share price: $100

- EPS falls 20%, from $5 to $4

- P/E contracts from 15x to 12x

- New share price: $4 × 12 = $48

The stock plunges from $100 to $48—a dramatic fall driven by both weaker fundamentals and reduced investor appetite.

This dynamic is especially pronounced in high-growth stocks, such as tech companies, where valuations rely heavily on forward-looking assumptions. These expectations, while optimistic, are inherently fragile and subject to large swings based on sentiment shifts.

How Is MSTR’s Premium Created, and Why Is It Central to Its Business Model?

With this background, we can now understand how MicroStrategy sustains a market valuation above the value of its BTC holdings—and why this premium is essential to its strategy.

MSTR has shifted from its legacy software business to one focused almost entirely on raising capital to buy Bitcoin. While asset management revenue may come later, today’s profits stem primarily from capital gains on BTC purchased via equity dilution and debt issuance. As BTC appreciates, shareholder equity grows proportionally—similar to a BTC ETF.

The critical difference lies in **leverage through financing**. Investor expectations for MSTR’s future earnings depend not only on BTC price moves but crucially on the company’s ability to keep raising capital at favorable terms. As long as MSTR’s market cap remains *above* the total value of its BTC stack (i.e., a positive premium), every round of financing—whether equity or convertible bonds—increases per-share intrinsic value when proceeds are used to buy more BTC.

This gives MSTR a structural advantage over passive ETFs: its ability to compound shareholder value via strategic capital raises.

Let’s demonstrate with a simplified example:

- BTC holdings: $40 billion

- Total shares outstanding: X

- Market cap: Y (where Y > $40B)

- Per-share equity: $40B / X

Now suppose MSTR issues new shares equal to fraction a of existing shares. Post-dilution:

- Total shares: X(1 + a)

- Funds raised: a × Y (at current market valuation)

- New BTC purchases: a × Y

- Total BTC value: $40B + aY

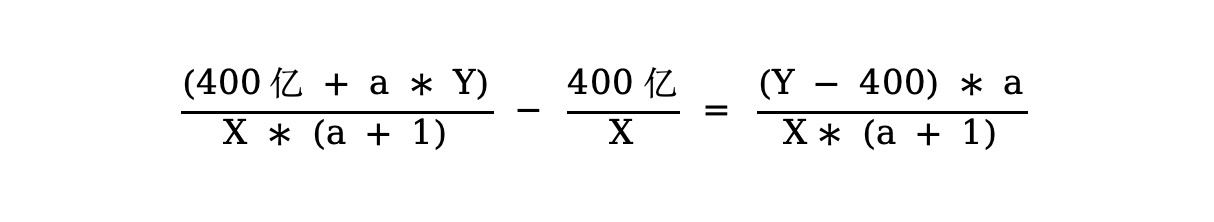

- New per-share equity: (40B + aY) / [X(1+a)]

Difference from original per-share equity:

This shows that whenever Y > $40B (i.e., there is a premium), the change in per-share equity after financing is **positive**, regardless of dilution level. Furthermore:

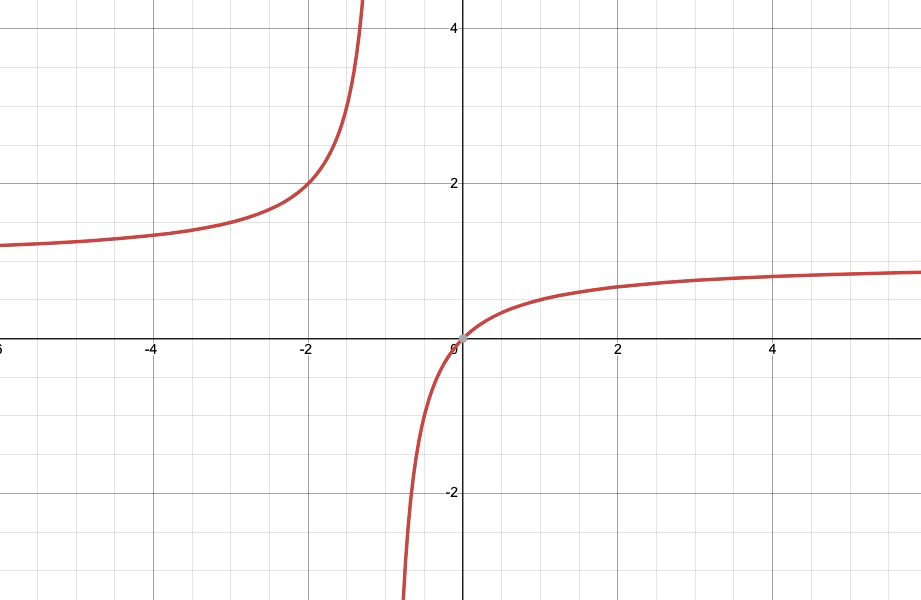

- The larger the premium (Y – 40B), the greater the boost to per-share value.

- The smaller the issuance size (a), the higher the relative gain—due to inverse proportionality in the first quadrant.

Thus, maintaining a healthy market premium is central to Michael Saylor’s strategy. His optimal path is clear: preserve the premium while continuously raising capital to scale BTC accumulation, thereby increasing MSTR’s influence over BTC pricing. Greater perceived pricing power reinforces investor confidence in sustained growth—even at elevated valuations—enabling further fundraising.

In summary, the magic of MicroStrategy’s model lies in the self-reinforcing cycle: BTC appreciation drives earnings growth → positive sentiment expands valuation multiples → higher premiums enable more leveraged buying → increased BTC holdings enhance pricing influence → reinforcing growth expectations. Under the “Davis Double Play,” this loop amplifies returns. The market isn’t just betting on BTC—it’s speculating on how high a premium MSTR can sustain to fund future BTC purchases.

What Risks Does MicroStrategy Pose to the Market?

Now let’s examine the risks MSTR introduces to the broader ecosystem. In my view, the core danger lies in its role as a **volatility amplifier** for BTC prices—especially under the “Davis Double Whammy” scenario. The domino effect begins when BTC enters a prolonged consolidation or downtrend.

Consider what happens when BTC’s upward momentum slows. MSTR’s earnings growth inevitably decelerates. Some observers focus on MSTR’s average BTC cost basis or unrealized gains—but this is irrelevant. Unlike traditional firms whose quarterly reports reveal delayed profit updates, MSTR’s earnings are effectively **real-time and fully transparent**. Since both BTC prices and MSTR’s holdings are public, investors can calculate per-share equity instantly. There’s no lag between actual performance and market perception. Therefore, focusing on historical cost bases adds no insight—the stock already reflects all available information.

Back to the breakdown: as BTC stalls, MSTR’s profit growth flattens or reverses. Fixed operating and financing costs begin to weigh on net income, possibly pushing the company into losses. Prolonged stagnation erodes confidence in BTC’s future trajectory, which translates into skepticism about MSTR’s ability to continue raising capital. This undermines expectations of future earnings growth. The result? A rapid contraction of MSTR’s valuation premium—the beginning of the “Davis Double Whammy.”

To protect his business model, Michael Saylor must defend the premium. That means taking action—specifically, selling BTC to raise cash for share buybacks. This marks the moment MSTR sells its **first Bitcoin** since inception.

You might ask: why not just hold BTC and let the stock fall freely?

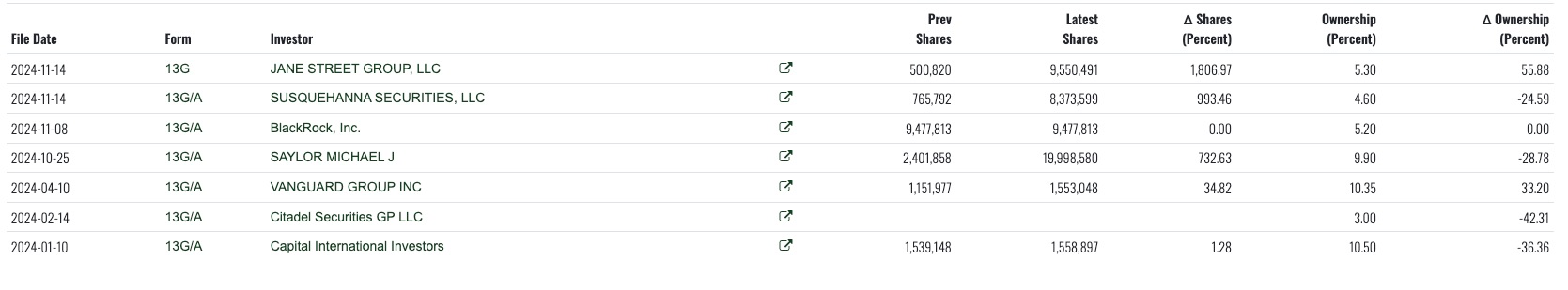

The answer: because doing so risks losing control—not just financially, but strategically. While Saylor maintains voting control via dual-class shares (Class B shares carry 10x voting power vs. Class A), his economic ownership is less than 10%. Major institutional holders include elite trading firms like Jane Street and BlackRock.

For Saylor, the long-term value of the *company* far exceeds his personal BTC stake. If MSTR collapses, he gets little in liquidation. Hence, preserving the corporate vehicle is paramount.

So what’s the benefit of selling BTC to repurchase shares during a dip?

Simple: if Saylor believes MSTR is temporarily undervalued (e.g., low P/E due to panic), buying back shares increases per-share equity more than selling BTC reduces it. For instance, removing shares from circulation boosts EPS faster than reducing BTC reserves drags it down. Once sentiment recovers, the rebound is stronger. This logic becomes even clearer in extreme cases—such as when MSTR trades at a *discount* to its BTC value.

But here’s the catch: when MSTR starts selling BTC, downward pressure intensifies. Given Saylor’s significant position and limited liquidity during downturns, any BTC sale could accelerate price declines. Falling BTC prices further hurt MSTR’s earnings outlook, shrink the premium, and force more BTC sales to fund buybacks—triggering a vicious cycle.

Another factor pressures Saylor: major stakeholders—what some call “Deep State” capital—are unlikely to tolerate a collapsing stock price. They’ll demand active stewardship. Reports suggest Saylor’s voting power has dipped below 50% amid ongoing dilution (though unconfirmed). Regardless, the trend threatens his control unless he acts decisively.

Are MicroStrategy’s Convertible Notes Really Risk-Free Before Maturity?

Having laid out the full picture, I want to address one final point: whether MSTR faces near-term debt risk. Experts have already explained the nature of its convertible notes—I won’t repeat that. Yes, maturities are distant, and contractual repayment obligations aren’t imminent. But I argue that **debt risk can still manifest early—through stock price dynamics.**

MSTR’s convertible notes are essentially bonds with embedded call options. At maturity, creditors can choose conversion into shares at a pre-set rate. However, MSTR retains flexibility: it can repay in cash, stock, or a mix—giving it discretion to minimize dilution if cash is available. The notes are unsecured, but given the company’s ability to manage redemption form, default risk appears low. Additionally, if MSTR’s stock trades above 130% of the conversion price, the company may opt to redeem the notes in cash—providing refinancing negotiation leverage.

Still, these notes carry indirect market risks. Their primary buyers—hedge funds—often use them for **delta-neutral hedging strategies**, aiming to capture volatility rather than directional exposure.

A typical delta hedge involves:

- Buying MSTR convertible notes (long optionality)

- Selling short an equivalent amount of MSTR stock (to offset price sensitivity)

Hedge funds continuously adjust this hedge as the stock price moves:

- If MSTR stock falls: The note’s delta decreases (conversion becomes less likely), requiring the fund to sell more shares short to maintain neutrality.

- If MSTR stock rises: Delta increases (conversion more likely), so the fund buys back shares to reduce short exposure.

This rebalancing occurs frequently—especially during:

- Sharp BTC/MSTR price swings

- Changes in volatility, interest rates, or credit spreads

- Delta threshold breaches (e.g., every 0.01 change triggers adjustment)

Let’s walk through an example:

- Hedge fund holds $10M in MSTR convertibles (initial delta: 0.6)

- Sells $6M worth of MSTR stock short

Scenario 1: Stock rises from $100 to $110 → delta increases to 0.65 → Must cover short by buying back: (0.65 – 0.6) × $10M = $50,000 in stock → Supports the stock price

Scenario 2: Stock drops from $100 to $95 → delta falls to 0.55 → Must increase short by: (0.6 – 0.55) × $10M = $50,000 in additional short sales → Exerts further downward pressure on MSTR stock

In other words, during a sell-off, delta hedging forces hedge funds to **sell more MSTR shares**, exacerbating the decline. This weakens the valuation premium and threatens the entire financing model. Conversely, in rising markets, hedgers buy shares, providing tailwinds—making this mechanism a double-edged sword.

Ultimately, while MSTR’s debt may not require immediate repayment, the market impact of its convertible note structure can still transmit stress early—via stock price volatility. In a crisis, this hidden feedback loop could accelerate the “Davis Double Whammy” before any formal default occurs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News