Inside the Solana Foundation Marketing Memo: A Perfect Triumph of Internet Capital and the F.A.T. Principle

TechFlow Selected TechFlow Selected

Inside the Solana Foundation Marketing Memo: A Perfect Triumph of Internet Capital and the F.A.T. Principle

Solana's promise is to enable anyone with internet access to participate in capital markets.

Author: akshaybd

Translation: zhouzhou, BlockBeats

Editor's Note: Solana has stood out in this market cycle, with explosive meme trading activity and rising token prices on its chain. This momentum stems from the Solana Foundation’s focus on enhancing infrastructure performance and reducing latency to meet growing market demand, supporting the growth of founders, applications, and tokenized projects.

Below is the original content (slightly edited for clarity and readability):

The Internet Capital Market and F.A.T. Protocol Engineering

Solana promises to enable anyone with an internet connection to participate in capital markets. Today, all you need is to download a wallet or app and click a few buttons to join the internet capital market—a globally accessible ledger capable of tokenizing entities, currencies, and culture.

Why does this matter?

It helps us build a world where anyone, anywhere, can own assets simply by being online. These assets could be shares in global companies, real estate, commodities, or even cultural expressions. This lays the foundation for "universal basic ownership." The race among high-performance L1s isn't just about creating a decentralized NASDAQ—it's about building a native internet successor to NASDAQ: a capital market with greater accessibility, lower latency, and shared global liquidity.

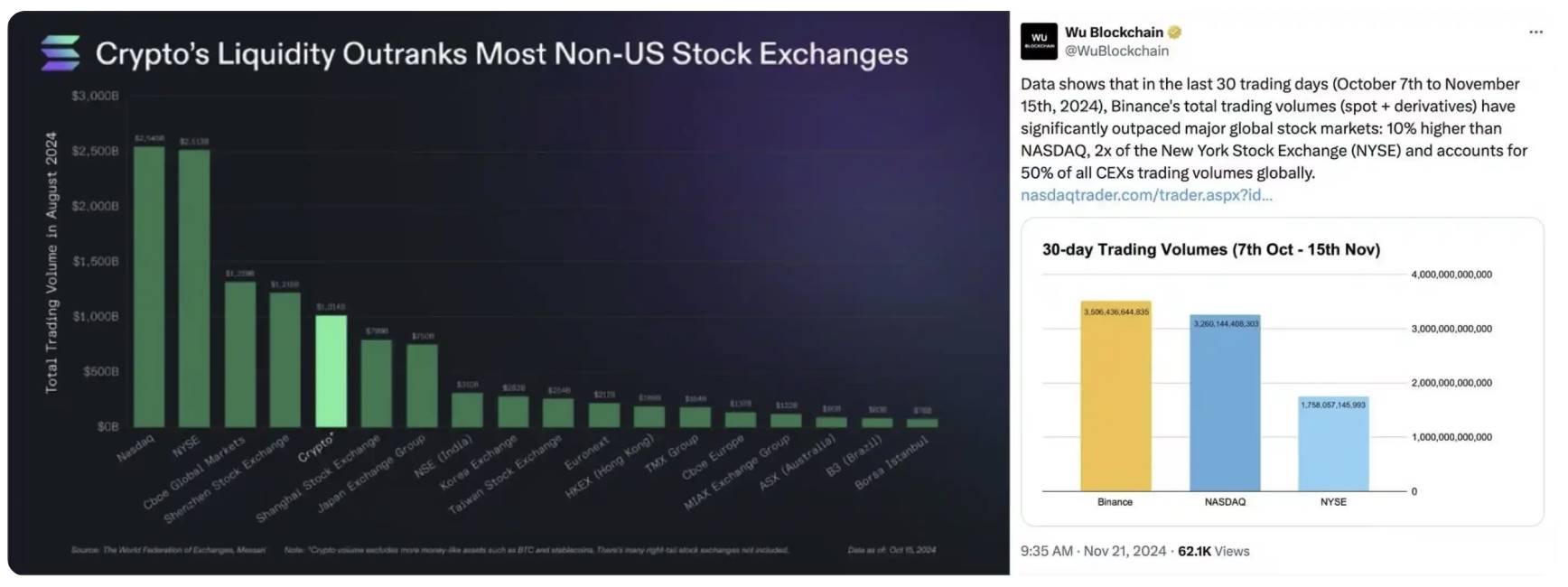

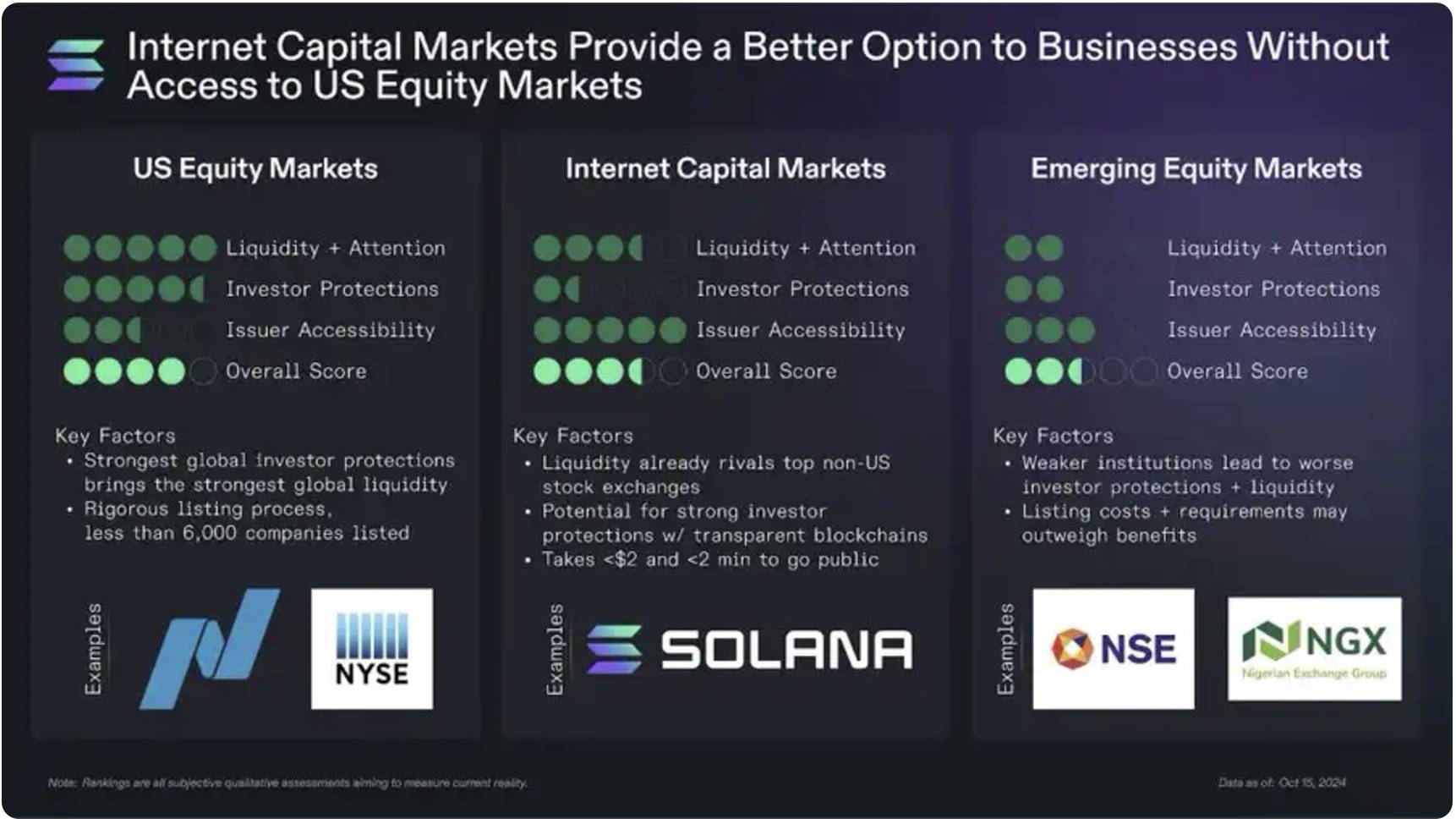

The opportunity is both simple and massive: currently, only about 15% of the world’s population can access the U.S. capital markets—the most liquid markets globally. Many other national capital markets suffer from poor liquidity, high entry barriers, and inefficient settlement. In contrast, crypto markets are far more accessible and liquid. At peak times, their trading volumes have exceeded those of NASDAQ and NYSE. We now have the chance to build the best capital market on the internet.

In the future, companies will list directly “on the internet” and gain access to over a billion investors holding private keys—voting with their capital for the future they want. It won’t just be stocks, but every valuable asset class, culture, and idea.

How do we accelerate toward this future?

This is where F.A.T. protocol engineering comes in. For years, the industry was largely built on the idea that "value will primarily accrue at the infrastructure layer" (Fat Protocols, 2016). Eight years later, we’re still mostly building infrastructure because it tends to command higher valuations.

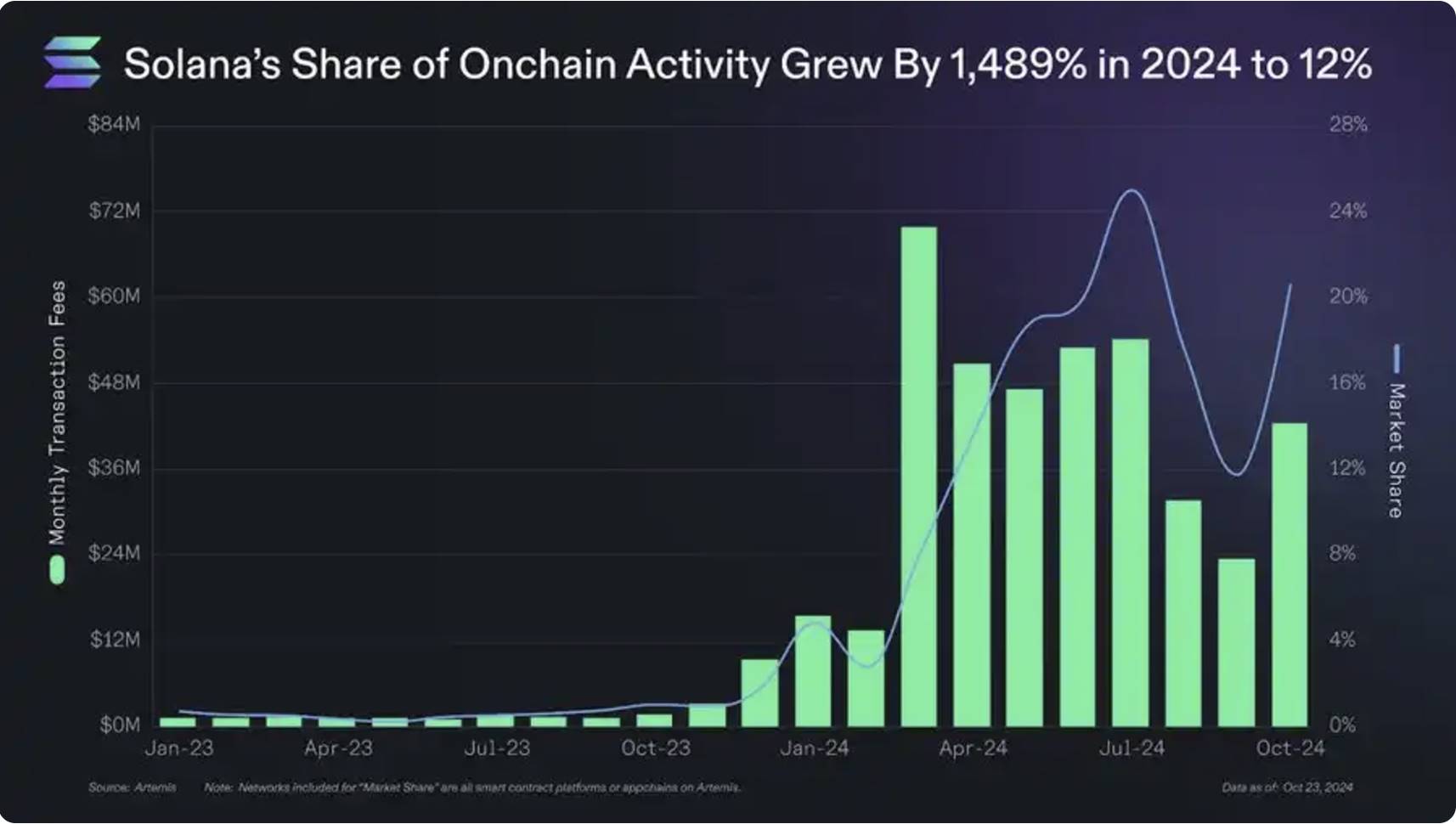

In contrast, Solana’s ecosystem has chosen to bet on products—a shift clearly demonstrated at Breakpoint 2024. By focusing on founders, applications, and tokenization, Solana grew its share of the transaction fee market—a strong indicator of ecosystem activity and health—by 1,489% in 2024, reaching 12%.

F = Founders, Not Just Developers

Today, it has never been easier or faster for a determined group of founders with just an internet connection to go from garage startups to billion-dollar companies.

1. tensor: Two founders from Canada, company valued at $445 million

2. pump.fun: A UK team that generated $155 million in fees within eight months

3. birdeye: Headquartered in Vietnam, reached 24 million users in 2024

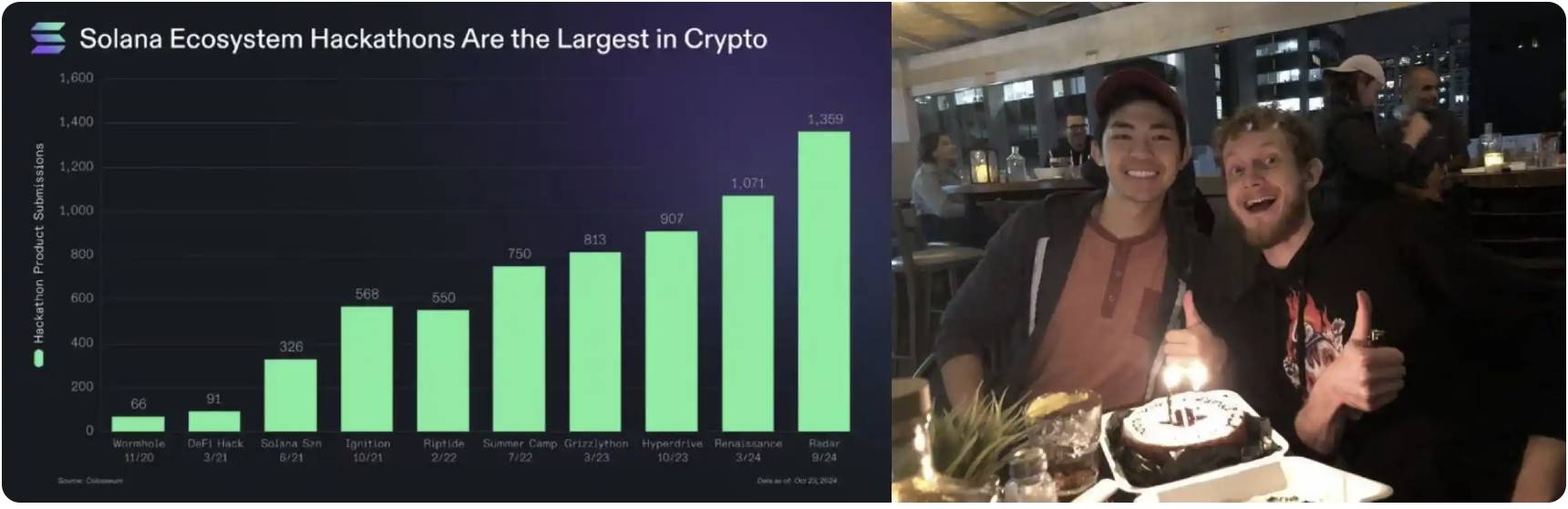

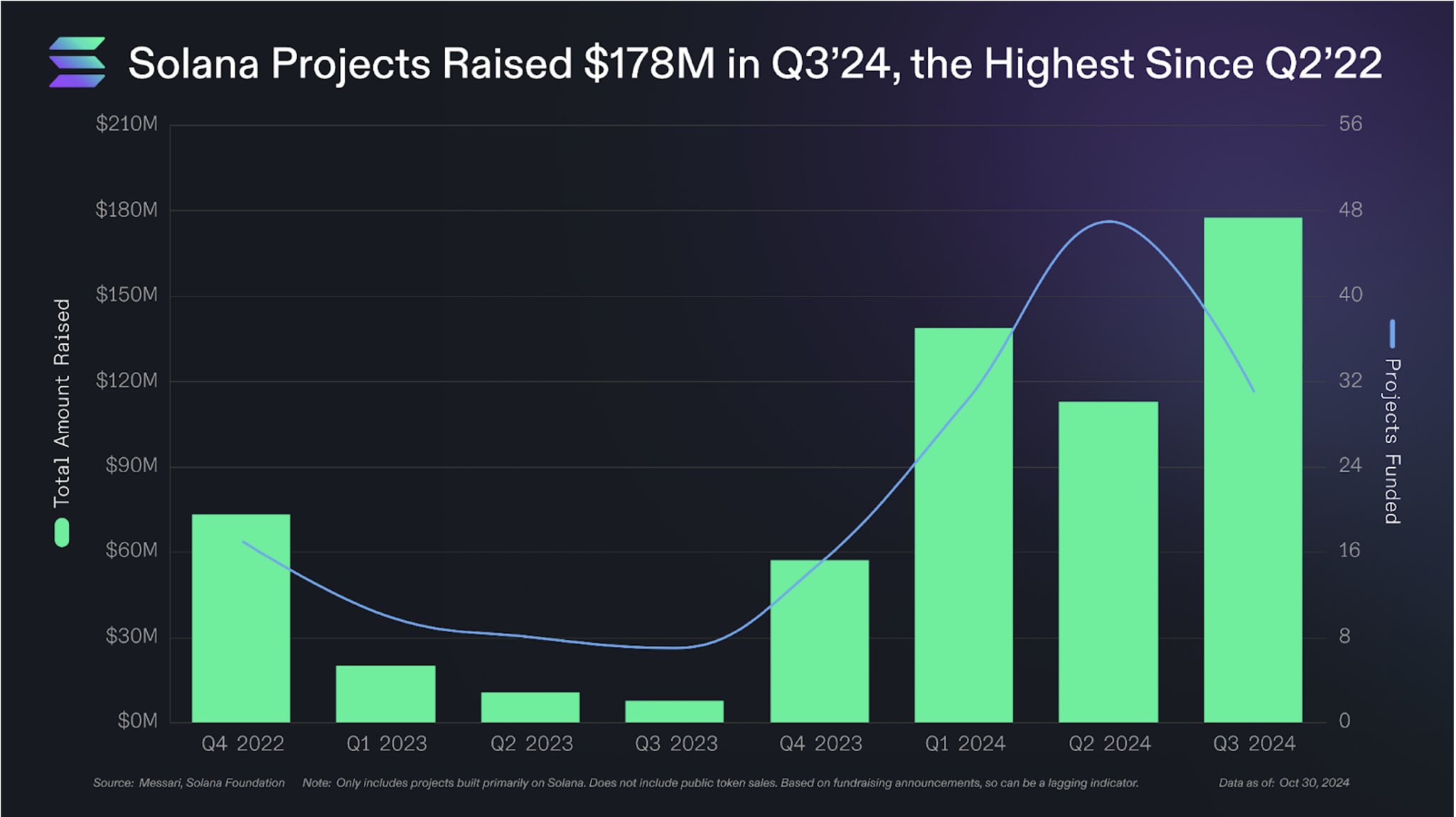

The startup flywheel will continue spinning rapidly into 2025. Colosseum Hackathon (Solana’s hackathon) is the largest talent discovery and development program in crypto, with past participants collectively raising $650 million in funding.

This flywheel is powered by a scale-ready ecosystem: from Superteam hubs and Shipyard workspaces to the Solana Turbine accelerator, community-driven infrastructure further accelerates founder growth.

A = Applications, Not Just Infrastructure

Infrastructure represents uncertain optimism, while applications represent certain optimism. The Solana ecosystem prioritizes building products people actually need. What’s the result?

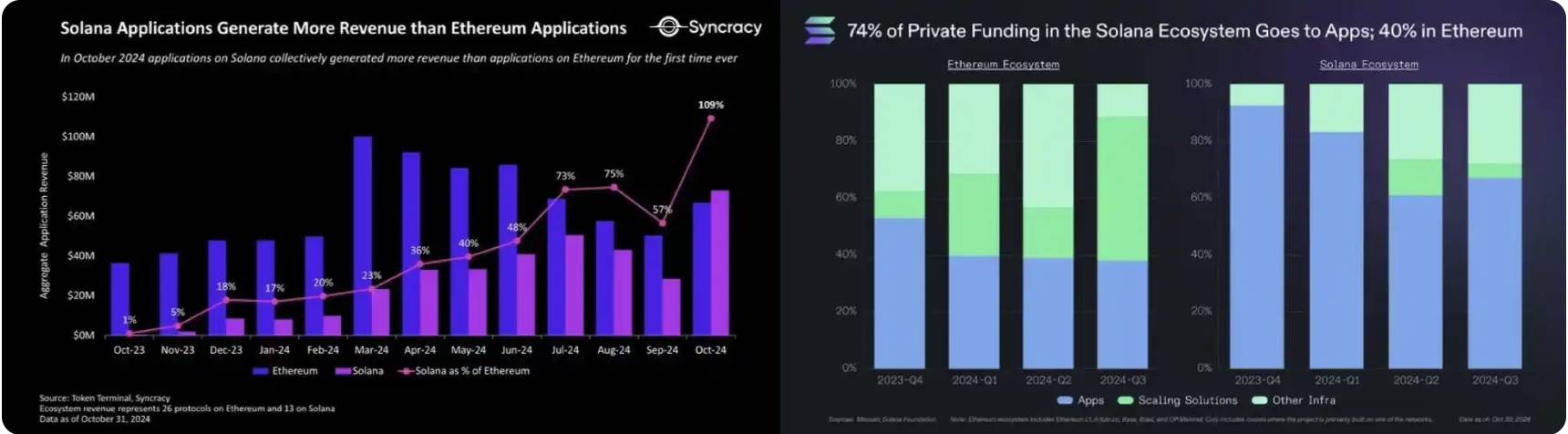

In October alone, application revenue reached $73 million—an 185x year-over-year increase—putting Solana ahead of all other networks. Moreover, 74% of capital within the ecosystem flows into applications (compared to 40% on Ethereum), as founders follow user demand.

Solana has long held the belief that what matters isn’t TVL, but where economic activity concentrates. Chain GDP—revenue generated by applications—is the key metric for measuring a protocol’s long-term success. When application revenue exceeds that of the base layer, the protocol has achieved product-market fit. If your base layer is extractive, applications will leave—either building their own chains or migrating elsewhere.

Study the Laffer Curve.

T = Tokenization, Not Just TVL

TVL is a passive, self-referential metric. Active metrics like capital efficiency and trading volume are more instructive. The ultimate goal is clearer: Solana is the best platform for internet-native asset issuance. Over the past six months, 2.6 million tokens have been launched on Solana—78% of the total across all chains. While memes dominate public attention, they aren’t the only thing growing.

Treasury balances have doubled to $134 million, stablecoins have grown 120% to ~$4 billion, along with 4,200 physical assets from BAXUSco and dvinlabs, 190 million digital collectibles from Drip Haus, and over one million hotspots from Helium—just a few examples.

As adoption, tooling, and regulation catch up, hyper-tokenization will accelerate—creating a globally accessible ledger where all assets are tokenized.

Each component of F.A.T. reinforces the others: more founders launch products, more products attract users, more users drive more capital into tokenization, and more capital attracts more founders. In Q3 2024 alone, Solana-native teams raised $178 million.

The "Protocol" in F.A.T. Protocol Engineering

Teams focused on the core protocol (such as Anza, Jump, Jito, etc.) work daily to improve performance and optimize user experience. By pushing the limits of hardware and software, they enhance Solana’s performance and capacity at the base layer. Increasing bandwidth and reducing latency are key strategies, reflecting Solana’s ongoing commitment to building infrastructure for real-world use—not just valuation.

Finally, I call it engineering—not theory—because it highlights an important inherent value in the ecosystem: a strong yet pragmatic product culture that consistently makes tough trade-offs, launches in the real world, and iterates to achieve product-market fit (PMF). This culture attracts builders, not just academics.

As the ecosystem grows, we must preserve this culture rather than becoming dogmatic—or worse—complacent due to any temporary success. Crypto moves fast, and we will remain agile and adaptive.

Going forward, the Foundation expects its marketing efforts to support these core pillars through events and content, celebrating the most outstanding founders, applications, and tokenization projects, while teams continue improving Solana’s speed and performance. Additionally, given signs of an innovation renaissance emerging in the United States, we will also refocus efforts on the U.S. market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News