Besides TON, which public blockchains are competing for Telegram users? How do they perform in terms of data?

TechFlow Selected TechFlow Selected

Besides TON, which public blockchains are competing for Telegram users? How do they perform in terms of data?

What insights can be gained by analyzing data on how major public blockchains use Telegram games for user acquisition?

Author: Stella L

In 2024, mass adoption of blockchain gaming found an unexpected catalyst: Telegram. As major blockchains race to establish a presence on this instant messaging platform with its vast user base, a critical question has emerged: Can this user acquisition strategy drive truly sustainable growth, or is it merely creating a short-lived data bubble?

The Rise of the Telegram Gaming Wave

The Telegram gaming revolution began with Notcoin’s simple "tap-to-earn" mechanism, which quickly demonstrated the platform's immense potential as a Web3 gateway. This success triggered a ripple effect across the entire blockchain ecosystem.

What started as a simple game experiment on TON has evolved into a full-scale competition. Aptos took an early lead, with its Telegram game Tapos pushing daily on-chain transaction volume past the 50 million mark in August. This breakthrough sparked a chain reaction, with Sui, Core, Starknet, and Matchain among others entering the fray by launching their own Telegram-based gaming initiatives.

This wave soon captured the attention of mainstream crypto exchanges. Binance led the charge by listing multiple Telegram-based gaming tokens, including Hamster Kombat and Catizen. Other exchanges swiftly followed, scrambling to capture market share in this emerging sector.

Since the second half of 2024, institutional capital has also begun flowing in at scale. Notably, Binance Labs made a strategic investment in Pluto Studio, the publisher behind Catizen. Meanwhile, GAMEE—the mobile gaming subsidiary under Animoca Brands and developer of WatBird—completed two funding rounds in August alone, underscoring rising institutional confidence in Telegram-linked gaming projects.

Blockchain Strategies and Their Outcomes

In 2024, multiple blockchain networks launched Telegram games, achieving varying degrees of success in user acquisition and retention. By analyzing specific data from Core, Sui, and Matchain, we can better understand both the immediate impact and long-term sustainability of this strategy.

Core: A New Experiment in the Bitcoin Ecosystem

Core Blockchain is a Bitcoin-driven, EVM-compatible Layer 1 network. At the end of September 2024, the social game TomTalk launched on Core, allowing users to earn points through chat activities within its Telegram mini-app.

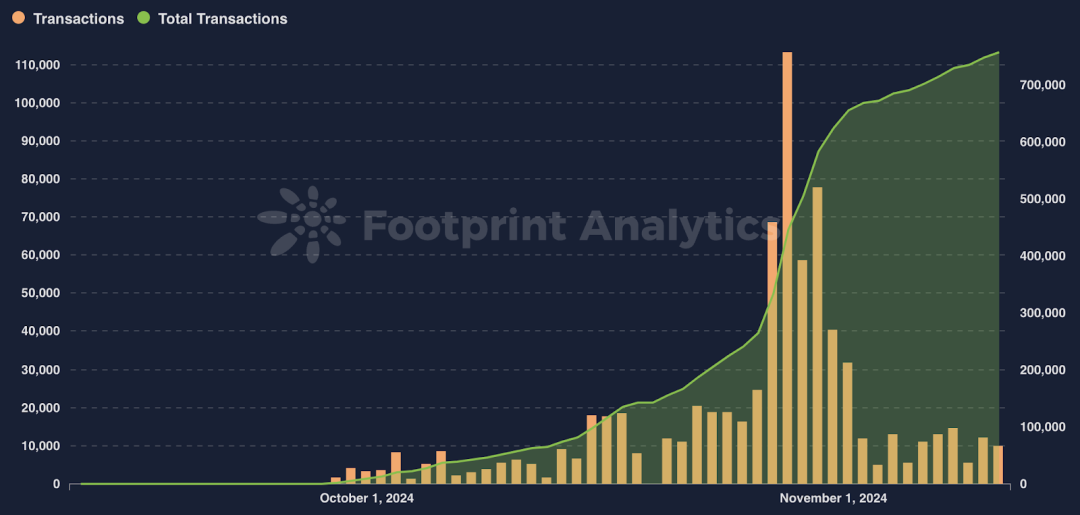

According to data from Footprint Analytics, TomTalk had a significant impact on Core. As of November 12, the platform accumulated 729,000 users (unique wallet addresses) and generated 757,000 on-chain transactions. During its peak period from October 28 to 31, DAU (daily active users) reached 80,000, accounting for 14.3% of Core’s total DAU, while daily transactions represented 7.6% of the network’s total volume.

Data source: TomTalk Daily and Cumulative Transaction Count

However, after an initial surge, TomTalk’s metrics showed a clear cooldown. By November 12, daily active users stabilized around 14,000, with daily transaction volumes remaining similar. The Telegram mini-app reported a monthly active user count of 16,000. This cooling trend highlights the challenge of maintaining sustained user engagement.

Sui: The Rising Dark Horse

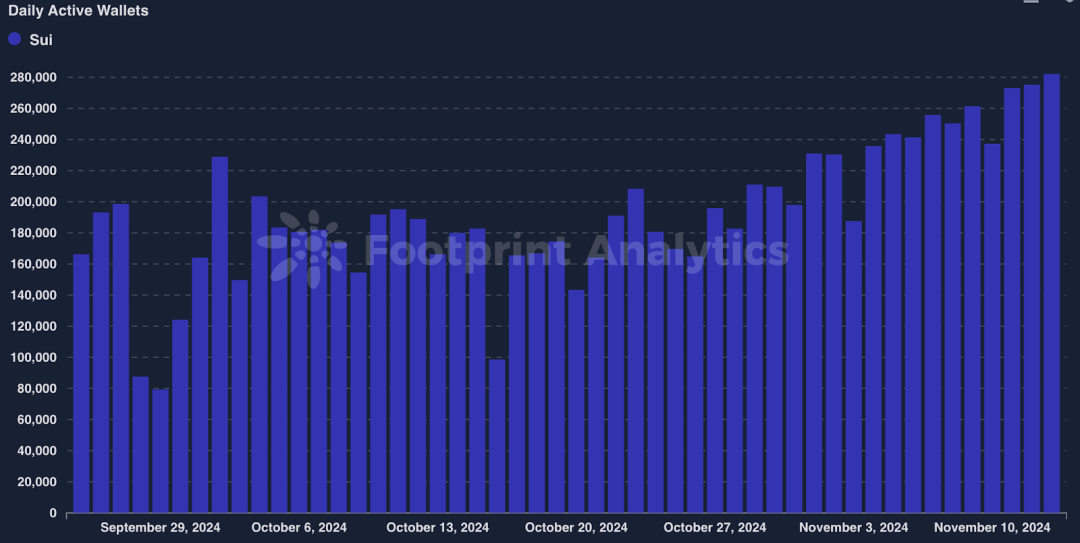

Sui is a high-performance Move-based blockchain known for its fast transaction processing. On September 25, BIRDS launched on Sui, skillfully combining memecoin elements with GameFi features.

BIRDS’ performance has been impressive. As of November 12, it had attracted 751,000 unique wallet users and generated 17.7 million transactions on the platform. Even more strikingly, BIRDS’ influence within the Sui ecosystem continues to grow—its share of daily active users increased from 9.1% to 34.0% (as of November 12), while its share of transaction volume rose from 4.3% to 13.5%.

Source: BIRDS Daily Active Users

Most notably, unlike the typical post-launch decline seen in other Telegram games, BIRDS has maintained a steady upward trajectory. Its Telegram mini-app boasts 6.2 million monthly active users, while its average daily active users on the Sui chain reached 243,000 in November. This gap reveals substantial user conversion potential, offering ample room for future growth.

Matchain: A Dramatic Ascent

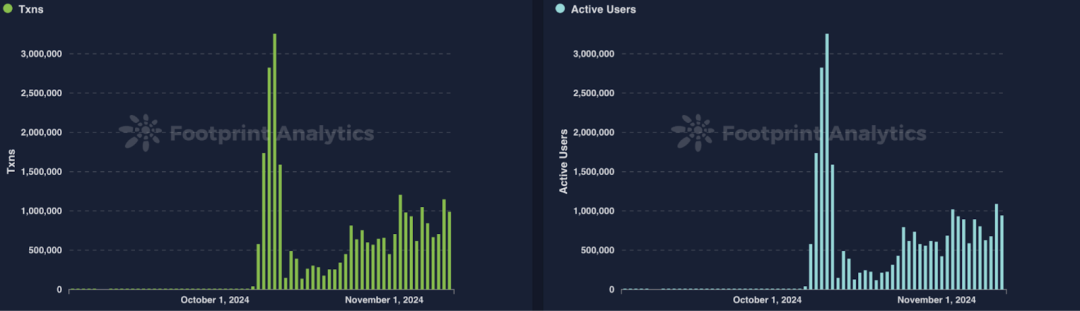

Matchain, a decentralized AI blockchain focused on data and identity sovereignty, has shown the most dramatic results from Telegram game integration since its mainnet launch in August 2024.

Starting from a mere 78 daily active users in September, Matchain’s gaming segment surged to an average of 550,000 daily active users in October, driven by Telegram games like LOL, Jumper, and Digiverse. Daily transaction volume skyrocketed from 127 to 565,000 during the same period.

From October 9 to 13, Matchain reached its peak moment, surpassing 2 million daily active users in its gaming segment and hitting a record high of 3.3 million users on October 12. Although activity subsequently declined, it stabilized at 615,000 users by the end of October and resumed growth in November, reaching 769,000 daily active users. This trajectory illustrates the immense user acquisition potential of Telegram-based blockchain games.

Data source: Matchain Gaming Segment Data

Matchain’s journey may be the best example of how Telegram games can catalyze blockchain adoption—rising from negligible activity to consistently maintaining hundreds of thousands of daily users within just two months. However, its stabilization after rapid growth also underscores the challenge projects face in sustaining momentum after initial user acquisition.

Advantages and Challenges of Telegram Games

Telegram games have proven remarkably efficient as a blockchain user acquisition channel. Compared to traditional Web3 channels where customer acquisition costs often exceed $10—and centralized exchanges spending as much as $40–$50 per user—Telegram games reduce acquisition costs to less than $0.10. More importantly, these users generally possess foundational knowledge of cryptocurrency, making it easier to convert them into active Web3 participants.

Yet, this seemingly ideal acquisition strategy still faces several key challenges. First, the current user base is highly concentrated in Telegram’s strong markets, such as Eastern Europe, Africa, and South Asia. Second, most projects struggle with sharp declines in user retention after the initial launch phase. Additionally, widespread bot and studio activity requires significant effort from project teams to ensure the long-term health and sustainability of their ecosystems.

Future Outlook

As the early红利 (bonanza) period comes to an end, blockchain networks must adopt more strategic approaches to building within the Telegram ecosystem. Success will depend on crafting viral marketing toolkits, designing sustainable growth mechanisms, establishing robust user behavior analytics systems, and continuously optimizing acquisition funnels and retention strategies.

The Telegram gaming phenomenon is not just a short-term trend, but a paradigm shift in blockchain user acquisition. Public chains and other Web3 projects that effectively solve retention challenges while preserving their cost-efficient user acquisition edge will gain a decisive advantage in the next phase of Web3 mass adoption.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News