Everything You Need to Know Quickly About Usual's Launch on Binance

TechFlow Selected TechFlow Selected

Everything You Need to Know Quickly About Usual's Launch on Binance

Usual represents an important exploration direction of the DeFi 2.0 era.

Written by: TechFlow

The value of Binance's listing effect continues to rise.

In recent days, Binance’s sudden listings of ACT and PNUT have sparked multiple rounds of discussion and generated significant wealth effects for participants.

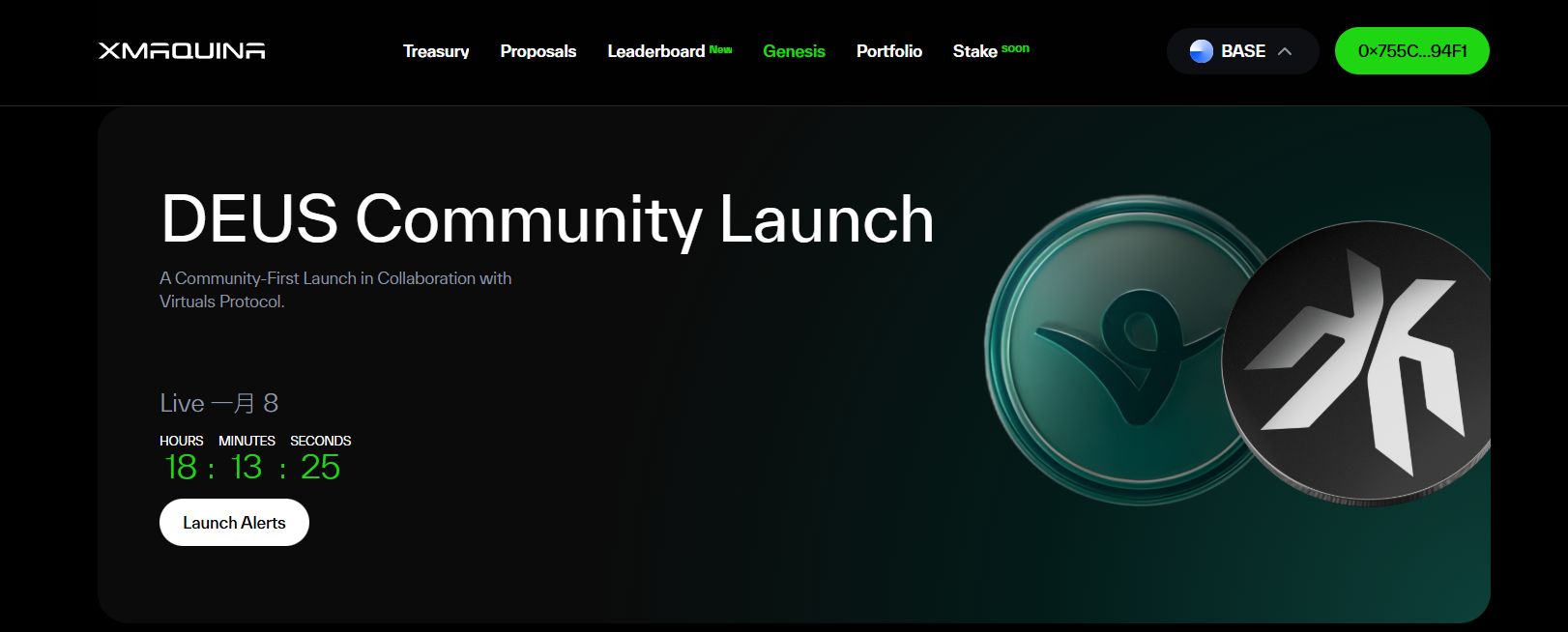

Today, according to an official announcement, Binance will list Usual (USUAL) on both Launchpool and Pre-Market. The Pre-Market trading for USUAL will go live at 10:00 (UTC) on November 19, 2024. Launchpool mining will begin earlier, starting at 00:00 (UTC) on November 15, 2024.

USUAL has a total supply of 4 billion tokens, with an initial circulating supply of 12.37%. The Launchpool allocation amounts to 300,000,000 USUAL, representing 7.5% of the maximum token supply.

Unlike volatile meme coins, Usual is actually a stablecoin protocol.

You might ask: isn’t the current market trend all about memes? What makes this token special? Could it end up like another VC-backed project that failed to deliver?

Top-tier CEXs don't only list meme coins. Ultimately, any token with a compelling narrative and strong secondary market potential can earn their favor.

If you’re considering participating in Usual, read on. This breakdown will quickly bring you up to speed on everything you need to know about the protocol.

Why Do We Need Another Stablecoin?

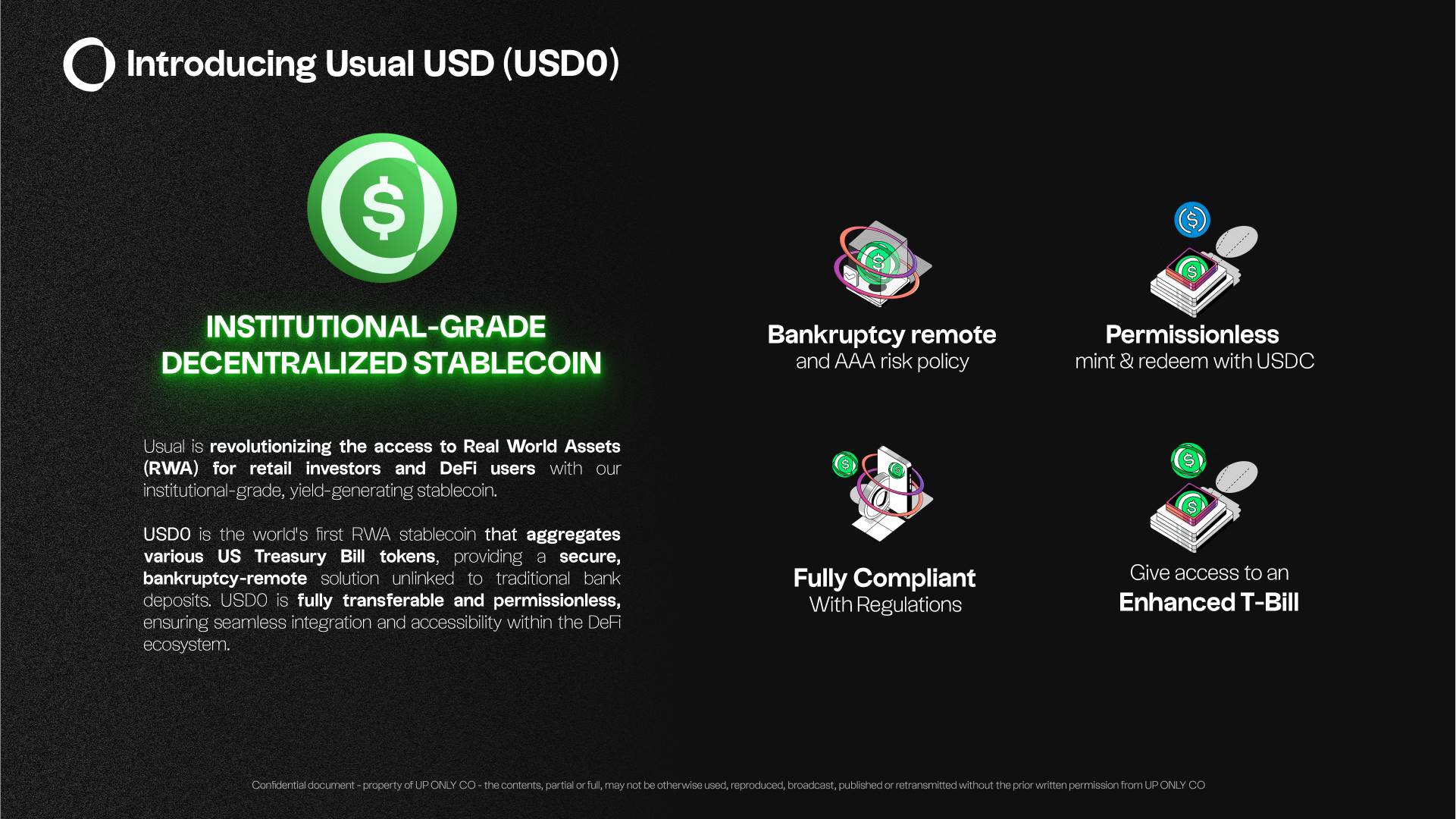

First, let’s clarify two key points: Usual is a stablecoin protocol, and its USD0 is a permissionless, fully compliant stablecoin backed 1:1 by real-world assets (RWA).

The USUAL token itself serves as the project’s governance token, allowing the community to guide the network’s future development.

With these two roles in mind, let’s understand what Usual is really doing.

As most people know, the stablecoin market is already quite mature, with Tether and Circle firmly entrenched. So, what justifies the existence of a new stablecoin?

Or more precisely, what is the compelling narrative for a credible new entrant? The answer lies in three key observations.

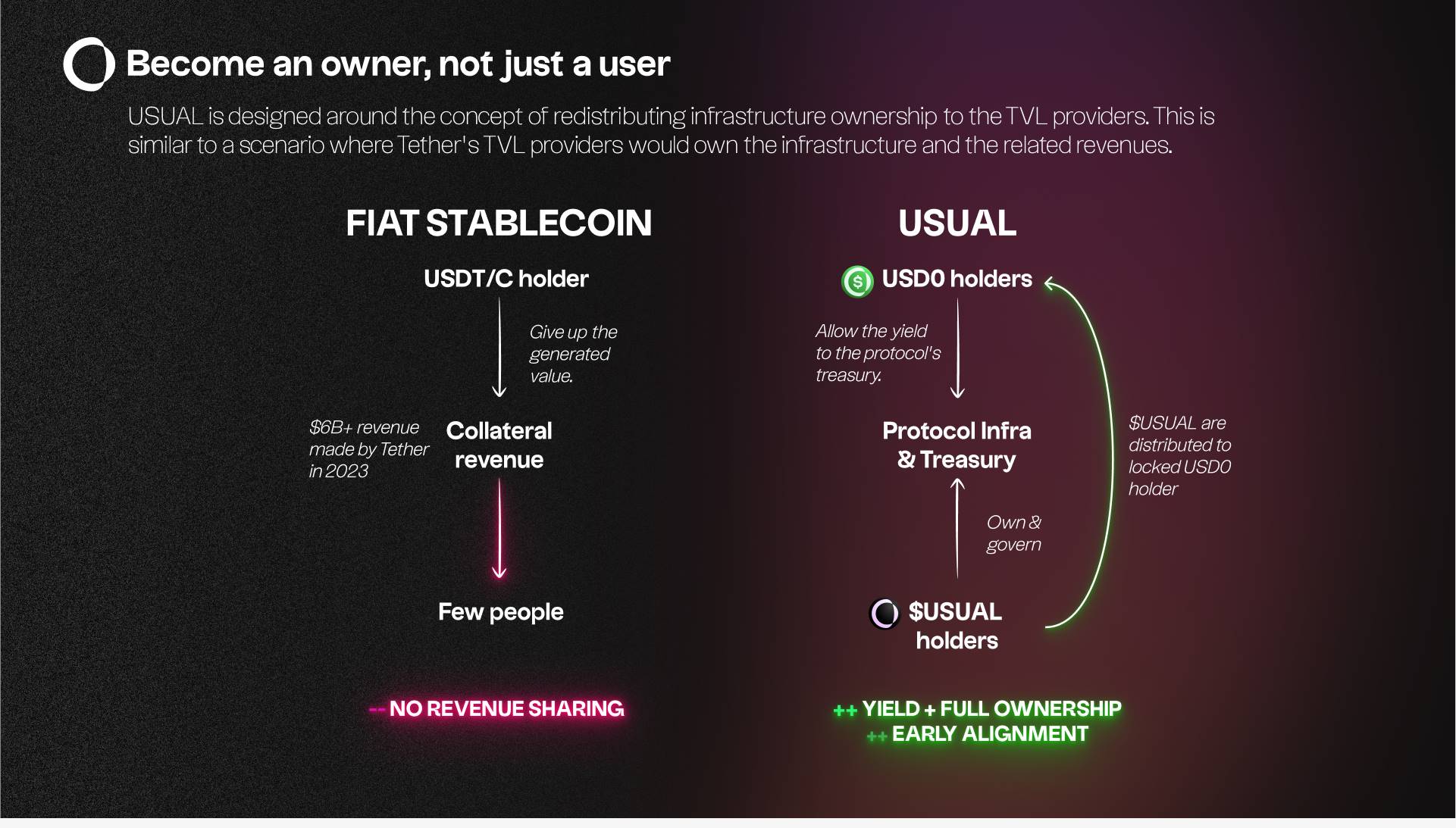

First, in 2023 alone, Tether and Circle generated over $10 billion in revenue, with valuations surpassing $200 billion. Yet, users who provided liquidity to these platforms received none of these massive profits. This model—where centralized institutions privatize profits while socializing risks—contradicts the core principles of decentralized finance.

Second, although real-world assets (RWA) are gaining attention in the crypto space, even products like on-chain U.S. Treasuries have fewer than 5,000 holders on mainnet. This shows that deep integration between RWA and DeFi still faces major hurdles.

Third, DeFi users increasingly want to share in the success of the projects they support. However, existing reward models often fail to compensate early adopters for taking on greater risk or adequately incentivize contributors to the project’s growth.

So the narrative here centers on democratization and financial equity.

Based on these insights, Usual presents three key selling points:

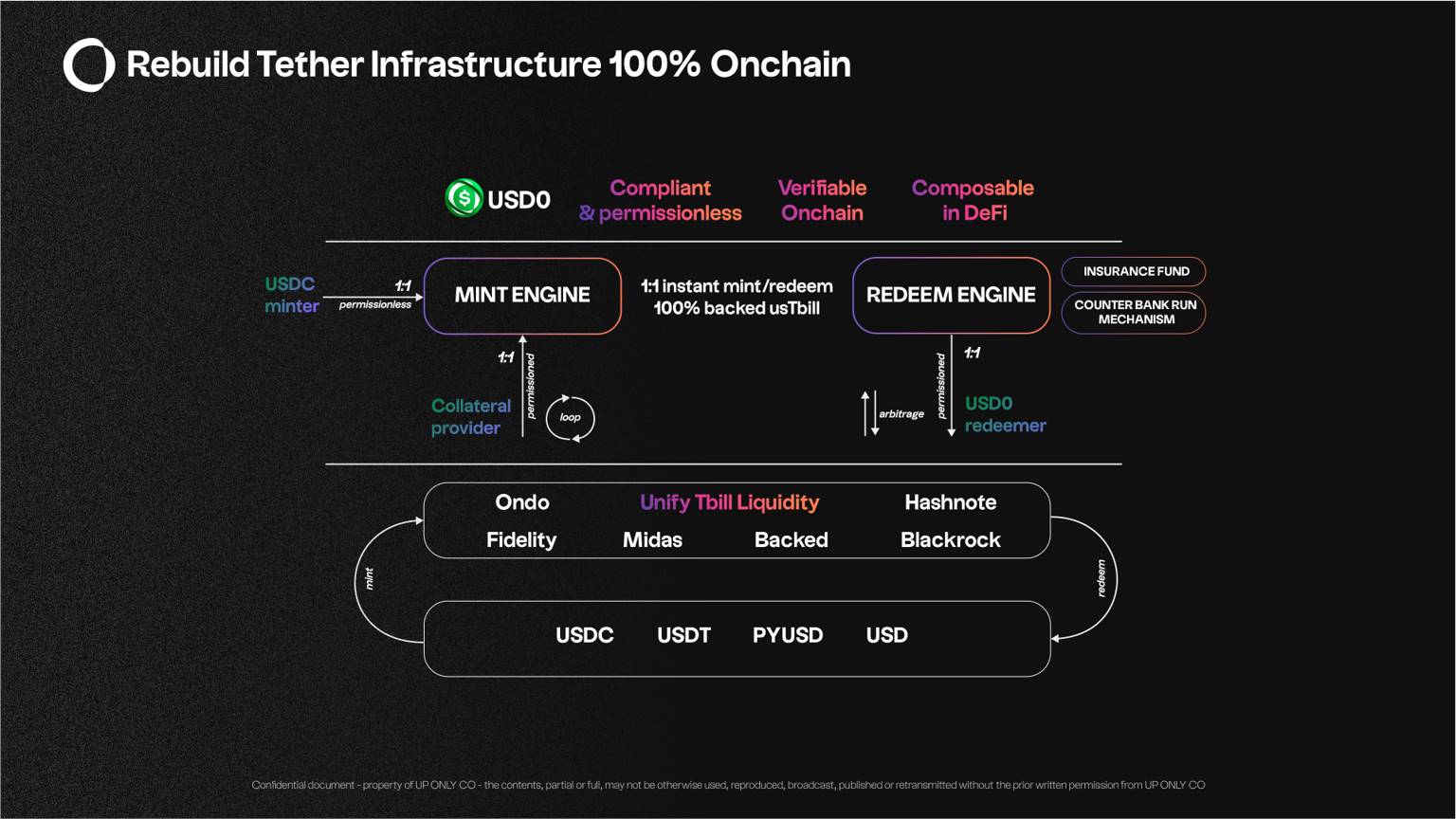

First, bringing stablecoins fully on-chain. Unlike traditional stablecoins, Usual’s issuance is entirely governed by a community of governance token holders, who make critical decisions on risk policies, collateral types, and liquidity incentives. This decentralized control ensures neutrality and transparency.

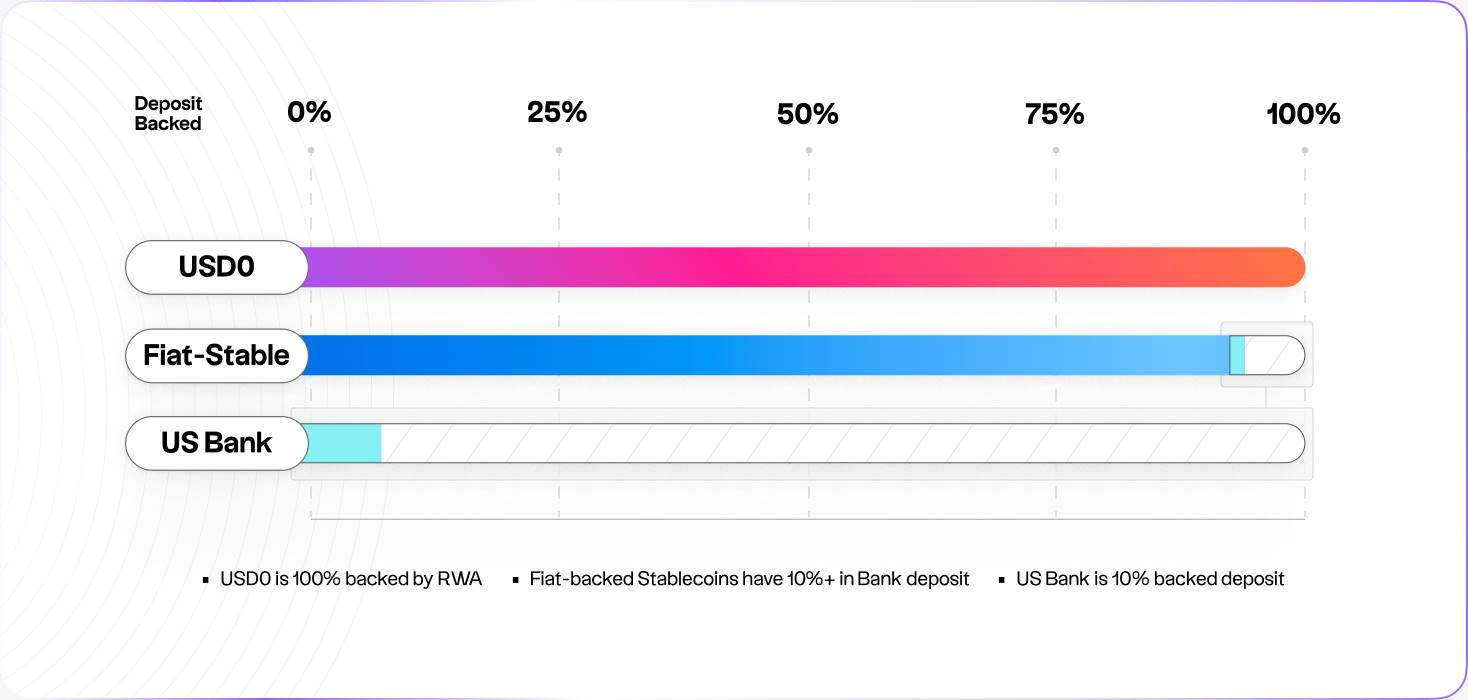

Second, solving the bankruptcy remoteness issue. Traditional stablecoins typically keep reserves in commercial banks, exposing them to fractional reserve risks within the banking system. As seen in the collapse of Silicon Valley Bank, this model carries systemic vulnerabilities. Usual takes a different path—directly linking to ultra-short-term bonds, supported by strict risk policies and an insurance fund, ensuring 100% collateralization.

Third, redefining ownership and revenue distribution in stablecoins. Users not only earn yield from the underlying collateral but, more importantly, gain full control over the protocol, treasury, and future revenues through governance tokens.

In essence, Usual isn’t merely trying to compete with existing stablecoins. It aims to solve a deeper problem: how to transform stablecoins into users’ own financial infrastructure, rather than tools for centralized profit extraction.

Understanding USD0 in Seconds: A RWA-Backed Stablecoin

The Usual Protocol ecosystem consists of three core products: USD0, USD0++, and the USUAL governance token. Each product offers unique functionality and value, together forming a complete financial ecosystem.

-

USD0: The Secure and Stable Foundation

USD0 is the cornerstone of the Usual ecosystem. It is the world’s first RWA-backed stablecoin aggregating multiple tokenized U.S. Treasury bonds. This design makes USD0 a secure, bankruptcy-remote solution that doesn’t rely on traditional bank deposits, thus avoiding systemic risks inherent in conventional finance.

The “0” in USD0 signifies its ambition to serve as the equivalent of central bank money (M0) within a monetary protocol.

Key features of USD0 include:

-

Full transferability and permissionless access: Ensures seamless integration and broad accessibility across DeFi ecosystems.

-

Versatility: Can be used as a payment method, counterparty, and collateral.

-

Transparency: Provides real-time updates on collateral holdings, enhancing user trust.

-

Scalability: Backed by the deeply liquid U.S. Treasury market, theoretically scalable to trillions of dollars.

-

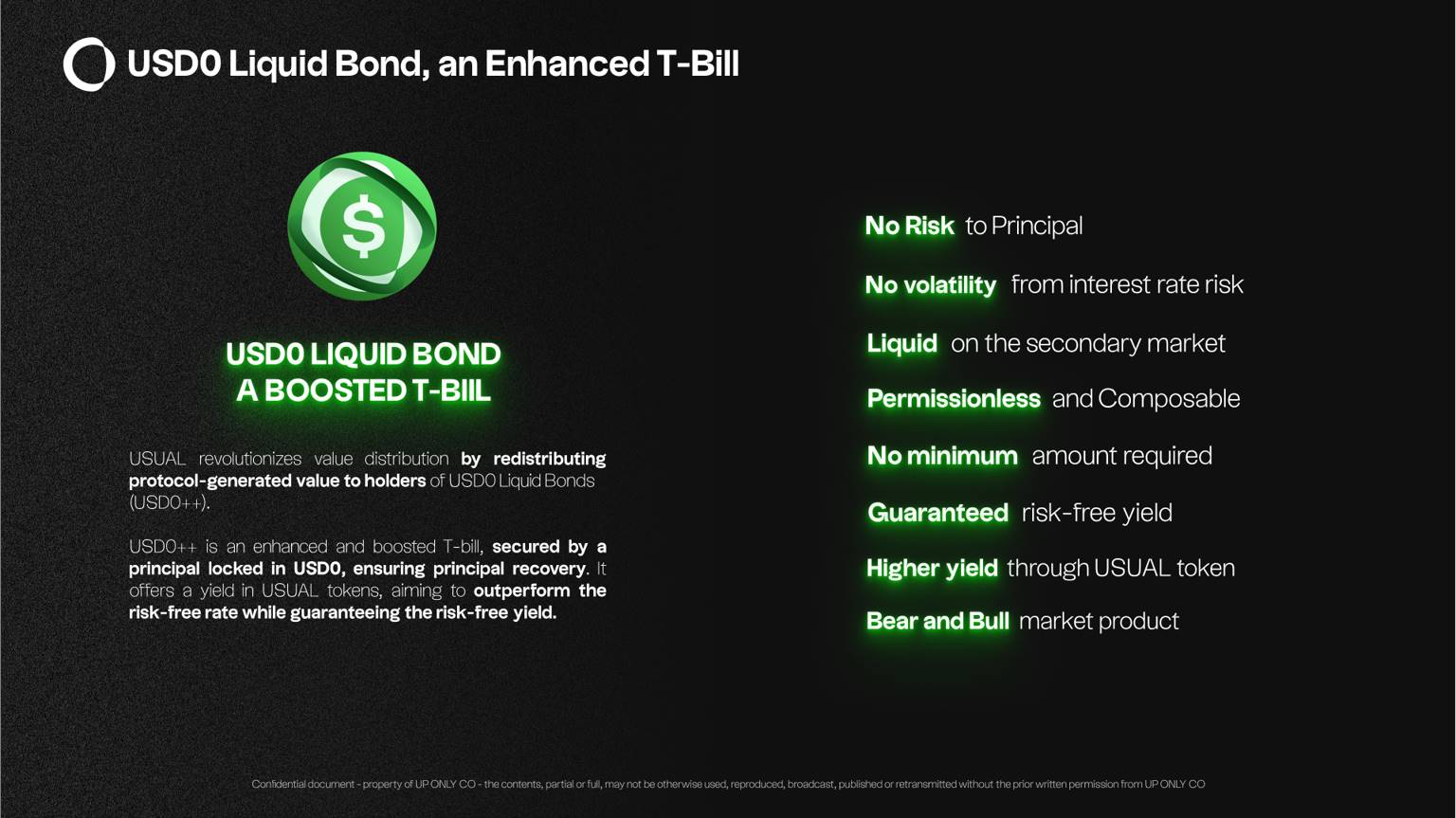

USD0++: An Innovative Product That Doubles Treasury Yields

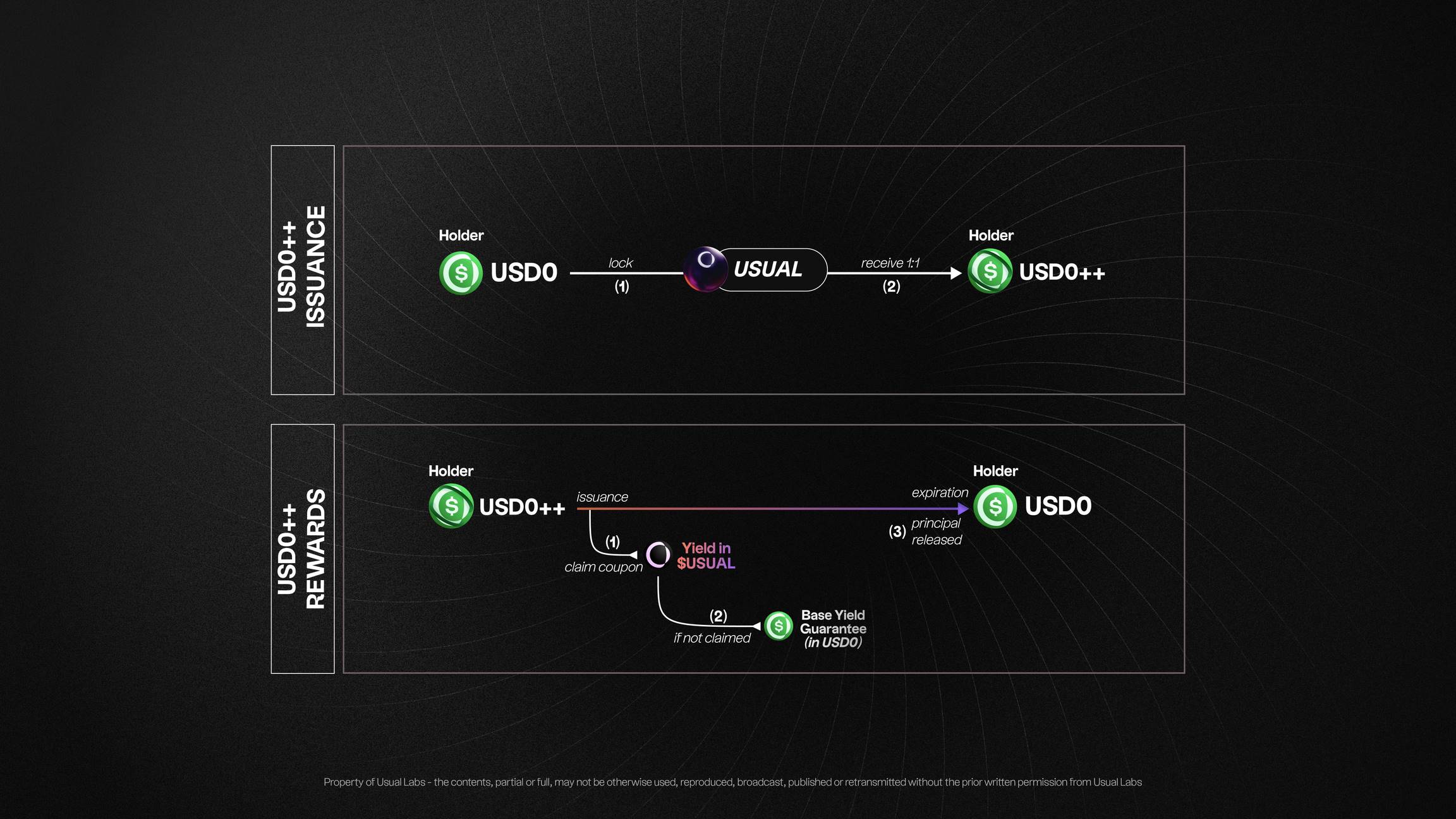

USD0++ is an innovative product within the Usual ecosystem—an enhanced version of Treasury bonds. Through a 4-year DeFi Treasury Bill, USD0++ is backed by principal locked in USD0, guaranteeing capital return. It enables users to benefit from the protocol’s growth and success. Unlike traditional models, USD0++ not only shares protocol income but also distributes ownership via its innovative rewards mechanism.

This innovative design reflects deep financial insight. When users convert USD0 into USD0++, they enter a carefully engineered two-layer yield structure. The first layer is base yield from U.S. Treasuries, guaranteed through the Base Interest Guarantee (BIG) mechanism, ensuring investors receive returns comparable to regular Treasuries even in worst-case scenarios. The second layer is enhanced yield derived from protocol growth, distributed in the form of USUAL tokens.

Notably, the 4-year lock-up period is no accident. It aligns with the duration of mid-term U.S. Treasuries and gives the protocol sufficient time to grow and generate value. During this period, USD0++ holders become long-term partners whose interests are tightly aligned with the protocol’s success.

From a technical standpoint, USD0++ uses smart contracts for automated management. When users deposit USD0, the contract automatically allocates funds into optimal Treasury portfolios while initiating a token emission plan. This process is fully transparent and tamper-proof, allowing users to monitor investment status and expected returns in real time. More importantly, the system uses a modular design, enabling flexible parameter adjustments or new feature additions based on market demand and regulatory requirements.

Compared to traditional finance, USD0++ transforms passive Treasury investing into active protocol participation. Investors are no longer just waiting for interest payments—they can use USUAL tokens to participate in governance, share growth dividends, and even trade these rights on secondary markets. This design essentially creates a new category of financial product: one that retains Treasury-level safety while unlocking the growth potential of crypto economies.

From a risk management perspective, USD0++ offers a unique hedging strategy. In highly volatile crypto markets, investors gain stable cash flows from Treasuries while using USUAL tokens to capture upside from sector growth. This combination effectively balances risk and return. During market downturns, the base interest guarantee provides crucial downside protection; during bull runs, USUAL tokens offer substantial appreciation potential.

-

USUAL: The Core of Governance and Incentives

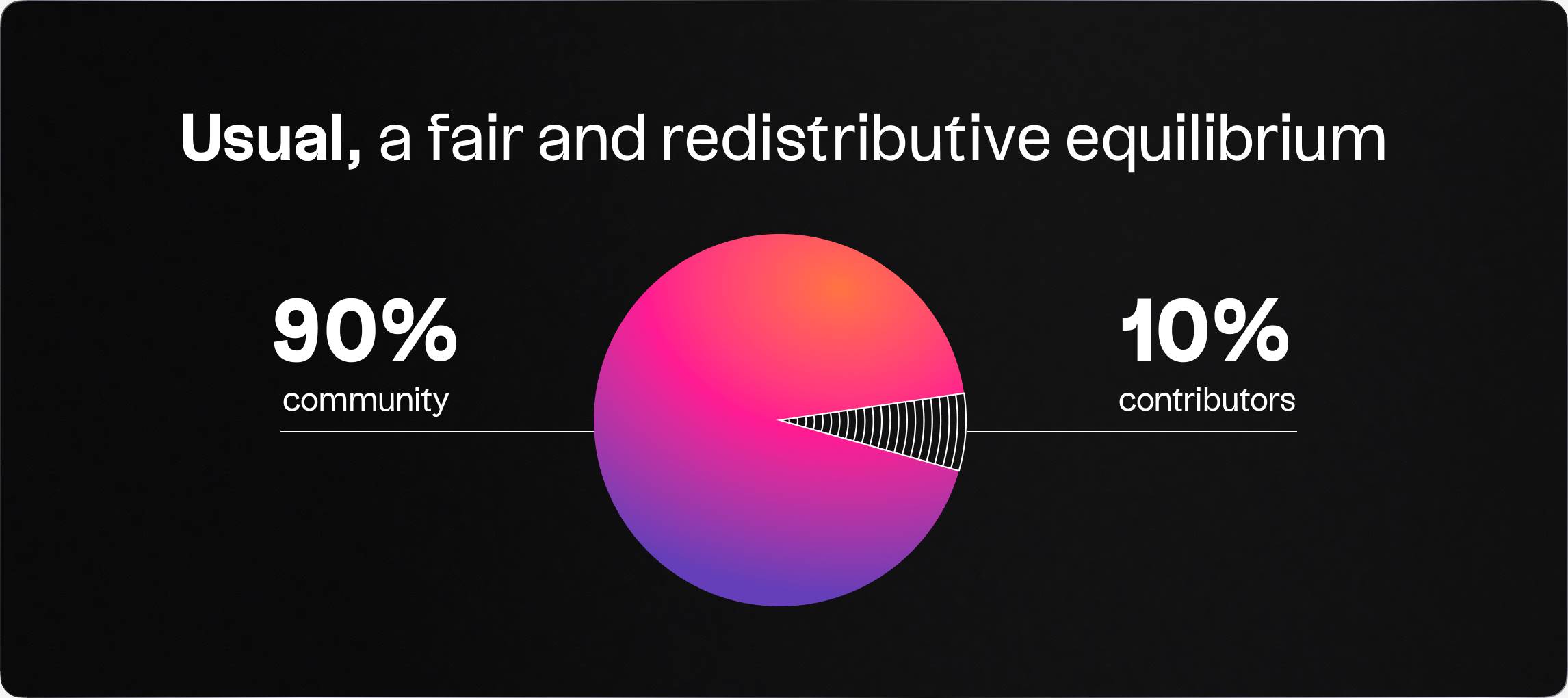

As the governance token of Usual Protocol, USUAL goes far beyond simple voting rights. It is the central mechanism for value capture and distribution across the ecosystem. Its thoughtfully designed tokenomics ensure sustainable growth and maximum user benefit.

In governance, USUAL employs an innovative "value-driven governance" model. Holders not only vote on key decisions—such as risk parameter adjustments and new product launches—but their voting power is directly tied to their contribution to the protocol. This ensures that long-term holders and active ecosystem contributors have greater influence.

USUAL’s value capture operates on multiple levels. First, all protocol revenues—including minting and redemption fees—support the token’s value. Second, staking allows USUAL holders to earn ongoing revenue shares. Most importantly, as the protocol’s managed asset size grows, the rate of USUAL issuance gradually decreases. This deflationary design enhances long-term value appreciation.

In practice, USUAL’s utility extends well beyond governance. It serves as a reward token for liquidity mining, participates in pricing various financial products within the ecosystem, and can even act as a cross-chain bridging medium. This multi-dimensional utility increases token demand and strengthens the ecosystem’s network effects.

Through this holistic design, USUAL seamlessly connects all components of the protocol, creating a self-reinforcing positive feedback loop. As more users join and more assets accumulate, USUAL’s value proposition becomes increasingly clear and powerful.

Outlook

Given the current market environment, Usual’s launch timing could not be better. As the crypto market recovers from a bear phase, demand for high-quality projects is rising. Unlike purely speculative meme coins, Usual offers a full-stack financial infrastructure—a differentiated positioning that may prove to be its key advantage.

From a valuation perspective, several dimensions are worth watching:

First, the overall size of the stablecoin market. Currently, USDT and USDC combined have a market cap exceeding $100 billion and generate over $10 billion in annual revenue. If Usual captures just 5% of this market, its stablecoin business alone could support a substantial valuation.

Second, the growth potential of the RWA sector. As traditional financial institutions increasingly enter crypto, demand for compliant, on-chain Treasury products will surge. As the first protocol to tokenize Treasury yields, Usual is well-positioned to become a major player in this emerging market.

Looking at Binance listing performance recently, market enthusiasm for high-quality projects remains strong—regardless of whether they’re memes or not, unique narratives stand out. Usual’s complete product suite, clear value capture model, and vast market opportunity align closely with the traits of successful Binance listings.

However, investors should also be aware of key risks:

First, regulatory risk. Although Usual uses compliant Treasuries as backing, any innovative financial product may face policy uncertainty amid tightening global financial regulation.

Second, user education costs. While the integration of stablecoins, Treasury yields, and governance tokens is innovative, it also raises the complexity barrier for users. The team will need to invest heavily in market education.

Third, competition. Once Usual proves the viability of this model, other teams will likely rush in. Maintaining first-mover advantage will be an ongoing challenge.

In summary, Usual represents a significant direction in the DeFi 2.0 era. Rather than copying existing models, it seeks to solve real problems through technological innovation. For investors seeking long-term value, this is undoubtedly a project worth watching. At the same time, investors should prudently allocate positions based on their risk tolerance and investment horizon, with proper risk management in place.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News